Being an employer of a small or large business leads to tons of responsibilities. And, one of those crucial responsibilities includes Payroll Taxes.

Moreover, it is important for employers to handle payroll, and file tax returns, employers must first create the necessary accounts.

Today, we’ll discuss Michigan Payroll Taxes. If you own your business in Michigan— you must continue reading further.

We'll focus on and learn everything there is to know about Michigan Payroll Taxes and related concepts in today's guide. Let's take a look at what we'll be talking about next:

- Payroll Forms

- Step-by-Step Details on Payroll Procedures

- Michigan Laws (Wages & Hours)

- Employer Payroll in Michigan

- Paycheck Deduction in Michigan

- Unemployment Tax

- Income Tax

- Withholding on Michigan Income Tax

- Worker Compensation

- Overtime

- Pay Stub Regulations

- Minimum Pay Period

- Laws Regarding Final Paychecks

- Michigan Benefits

- Frequently Asked Questions (FAQs) on Michigan Payroll Taxes

- Payroll Tax Resources and Sources in Michigan

- How Deskera Can Assist You?

Payroll Forms

The federal and state forms listed below are required to produce proper pay for employees, as well as compliance with payroll reporting and tax remittance for businesses.

Payroll Forms in Michigan

- Michigan W-4 Form: This form aids employers in computing employee tax withholding.

- UIA 1020, Michigan Quarterly Tax Report: This is the form that is used to file unemployment taxes in Michigan.

- Form 5080 is used to file sales/use and withholding tax returns on a monthly or quarterly basis.

- Form 5081 is used to file annual sales/use and withholding tax returns.

Forms for Federal Payroll

- W-4 Form: This form assists employers in calculating tax withholding for their employees.

- W-2 Form: Shows total annual earnings (one per employee)

- W-3 Form: Reports all employees' total pay and taxes.

- Form 940 calculates and reports unemployment taxes to the IRS. Form 941 calculates and reports quarterly income and FICA taxes withheld from paychecks.

- Annual income and FICA taxes withheld from paychecks are reported on Form 944.

- 1099 Forms: These forms give contractors pay information that they can use to figure out how much tax they owe the IRS.

Step-by-Step Details on Payroll Procedures

Following we have discussed a step-by-step guide on payroll procedures. Make sure you read that carefully so that you don’t miss out on any information. Let’s check:

Step 1: Establish your Company as an Employer

You'll need your Employer Identification Number (EIN) and an account with the Electronic Federal Tax Payment System (EFTPS) at the federal level.

Step 2: Register with the Michigan State

State Registration: Complete Form 518 and send it or submit it online to the Michigan Department of Treasury. Use the Michigan Business Tax Registration Guide, which also includes Form 518, if you need help.

The Liability Questionnaire (UIA Schedule A) and the Successorship Questionnaire must be completed by all employers.

Local Registration: Michigan is one of 17 states that mandate local taxes to be paid. Each time you need to register for a business or pay taxes in one of the following 24 cities: Albion, Battle Creek, Benton Harbor, Big Rapids, East Lansing, Flint, Grayling, Hamtramck, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Springfield, Walker, Detroit, Grand Rapids, Highland Park, and Saginaw, contact the local city office.

If any of the following applies to you in these locations, you must register:

- You recruit someone new, or one of your current employees leaves

- You've moved your office to a new location

- In a new location, you conduct business

Please keep in mind that any local legal changes in the 24 municipalities will require you to stay current.

Step 3: Setting up with Payroll Process

You can perform your own payroll, which is the most time-consuming alternative and has the largest risk of a payroll error.

- Create a payroll template in Excel. Although using a template is still a manual procedure (albeit one that is less so than doing it by hand), it does provide you with more structure, which will help you avoid frequent payroll mistakes.

- Enroll in a payroll service. We strongly advise using a payroll provider because it is the quickest of all processes. It also provides you with a support system to turn to if you require more assistance.

Step 4: Collect Payroll Forms

Onboarding is the optimum time to gather payroll forms. W-4, I-9, and Direct Deposit information are all included on payroll forms. You must also submit a Michigan W-4 form.

This would be a great moment to look up which Michigan locality you need to send taxes to using your employee's address.

Step 5: Timesheets for hourly and non-exempt employees should be collected, reviewed, and approved.

You can choose from three options:

- Make use of a timesheet on paper.

- Use time and attendance software that is either free or inexpensive.

- If you're utilizing a payroll service, request that their time and attendance system be added.

Step 6: Compute payroll, pay employees, and remit taxes

Employees can be paid in a variety of methods (cash, check, direct deposit), and federal taxes should be paid through the Electronic Federal Tax Payment System (EFTPS).

Step 7: Payroll taxes with local, state, and federal governments

For federal taxes, including unemployment taxes, follow the IRS instructions. The IRS allows you to order official tax forms.

Local Taxes in Michigan: You must maintain track of the municipalities to which you have contributed employer and employee taxes in Michigan. You'll need to contact the local government's business office for payment alternatives for each one.

Michigan State Taxes: You must submit an annual withholding tax report to Michigan. You must also file withholding tax reports on a regular or quarterly basis.

For monthly or quarterly filings, use Form 5080, and for annual filings, use Form 5081. You can file online for free or by mailing a cheque to the Michigan Department of Treasury.

You must make payments according to the following schedule:

Step 8: Keep track of your payroll records by documenting and archiving them

It is critical to retain records for all employees, including those who have been fired, for several years. Michigan has no special document storage standards or restrictions, please follow the federal recommendations.

Step 9: Prepare payroll tax reports at the end of the year

W-2s (for employees) and 1099s (for non-employees) are the government documents that must be completed (for contractors). By January 31 of the following year, these forms should be given to workers and contractors.

In Michigan, state W-2s are necessary, and these forms must be submitted by the final day of February the following year.

Michigan Laws (Wages & Hours)

Most occupations require you to pay your staff at least the minimum wage. Furthermore, the current minimum wage in Michigan is $9.65 per hour.

Except for the following, all workers of employers with two or more employees in a calendar year are covered:

Except for

- some domestic service employees who are excluded from the Fair Labor Standards Act,

- individuals under the age of 18, and those above the age of 64,

- Summer camp staff who labor for up to four months

- workers who work for fruit, pickle, or tomato growers, as well as

- additional agricultural laborers hired on a piecework basis for harvest

Moreover, it is likely to rise in the next years if the state's unemployment rate remains below 8.5 percent. The table below shows the predicted gains.

Michigan increases Minimum Wage Predicted Table:

The state of Michigan's minimum wage laws have a few exceptions. Employers can pay 16- and 17-year-olds 85 percent of the standard minimum wage if they do not replace an adult employee with a child.

Employers may additionally pay tipped workers a minimum wage of $3.67 per hour, as long as the wage plus tips equal the state's minimum wage of $9.65 per hour.

Employer Payroll in Michigan

Wage payment statutes in Michigan compel employers to pay wages at least twice a month.

Earnings earned during the first 15 days of the previous month are due on the first of the month, and wages earned from the 16th to the last day of the previous month are due on the 15th of the month. Each employee is safeguarded.

Paycheck Deduction in Michigan

The most common deductions in Michigan are payroll taxes, garnishments, and the employee's part of benefit payments (i.e., medical insurance).

If the following criteria are met, you may deduct overpayments from an employee's check without the employee's written consent:

- Within six months of the overpayment, a deduction is made.

- Human error or miscalculation resulted in an overpayment.

- At least one pay monthly in advance, the employee receives a written explanation of the deduction.

- The deduction is less than 15% of the employee's total earnings.

- The employee's hourly rate is not reduced below the minimum wage as a result of the overpayment.

Unemployment Tax

You must pay unemployment taxes if you are an employer. These taxes go towards benefit programs for employees who are laid off unwillingly.

For new employers in Michigan, the unemployment tax rate is 2.7 percent. The term "new employer" refers to a company that has been in operation for less than two years. The construction business is the one exception to the rate. For the first two years, their rate is comparable to that of construction employers.

The unemployment rate is calculated using your company's taxable payroll and benefits handed out to former employees in years three and four. Beginning in year five, your rate is mostly influenced by your wages and unemployment benefits, which are computed using a Michigan-developed algorithm.

In other words, businesses with a big number of employees seeking unemployment benefits pay a higher unemployment tax rate than businesses with a small number of employees seeking benefits.

Income Tax

Michigan is a tax-free state. The state requires that you withhold 4.25 percent of each employee's gross salary.

In addition, there are local income taxes. The employee's tax rate is determined by the local jurisdiction in which he or she works.

**Please contact the local city authority for the most up-to-date pricing.

Withholding on Michigan Income Tax

Employers in Michigan are obligated to withhold state income tax from their employee's paychecks and remit the amounts withheld to the Michigan Department of Treasury.

Michigan has reciprocal agreements with Illinois, Indiana, Kentucky, Minnesota, Ohio, and Wisconsin. Employers in Michigan are not required to deduct Michigan income tax from earnings paid to non-Michigan residents.

Other out-of-state businesses with employees in Michigan must register with the Michigan Treasury Department and withhold Michigan income tax from all employees who work in the state.

Withholding from Social Security (FICA)

The Social Security FICA tax is calculated at a rate of 6.2 percent on the first $137,700 earned, with a maximum amount withheld of $8,537.40. The Medicare (Hospital Insurance) FICA tax is calculated at a rate of 1.45 percent on all wages.

Worker Compensation

Even public employers are almost always required by law to carry worker compensation insurance for their employees.

If any of the following happens to you as a private employer, you must carry workers' compensation insurance:

- Over the course of a year, you have at least one employee that works more than 35 hours per week for 13 weeks or longer. Homeowners who hire domestic workers are included in this category.

- At any given time, you have at least three employees.

The agricultural industry is the one exception. Workers' compensation insurance is necessary for businesses in this field if they have three employees who work more than 35 hours per week for 13 weeks or longer in a year.

Further, workers' compensation insurance costs about $.70 for each $100 of payroll you process. A company processing $500,000 in payroll, for example, can expect to spend roughly $3,500 in insurance.

Overtime

Any time worked over 40 in a workweek should be compensated at 1.5 times the employee's regular hourly rate, according to federal requirements.

In Michigan, however, there are extra requirements for companies to pay overtime. If an employer's gross income exceeds $500,000.00, the federal government mandates them to pay overtime (if applicable).

In Michigan, any employer with two or more employees is required to pay overtime despite gross income.

Pay Stub Regulations

In Michigan, you must present each employee with a wage statement that details the number of wages received, the pay period, and a complete list of deductions made.

Minimum Pay Period

Employees in Michigan might be paid weekly, bimonthly, semimonthly, or monthly. You can choose what works best for your business—consider industry standards—but regulations require that you maintain a constant frequency.

If you're going to change your pay frequency policy, it's a good idea to notify your employees ahead of time. Consider using a defined payroll calendar to keep track of payroll dates and determine the effects of changing pay frequency.

Laws Regarding Final Paychecks

In Michigan, you must pay dismissed employees' final earnings by the following scheduled payday.

In Michigan, you are not compelled to provide vacation days to employees or to pay for wasted vacation days. You must, however, adhere to your company's vacation payment policy.

Michigan Benefits

Frequently Asked Questions (FAQs) on Michigan Payroll Taxes

Following we have discussed some crucial frequently asked questions (FAQs) associated with Michigan Payroll Taxes. Let’s discuss

Que 1: Is it necessary for me to file Michigan payroll taxes?

Ans: The Michigan Department of Treasury and the Michigan Unemployment Insurance Agency require all persons and businesses conducting business in Michigan to register.

Que 2: What is the Unemployment Insurance Tax in Michigan?

Unemployment Insurance Tax (UIT) is a federally mandated, state-run program that provides temporary compensation to unemployed workers who are unable to find work due to circumstances beyond their control.

The Michigan Unemployment Insurance Agency requires employers to register.

Que 3: What Are the Payroll Taxes in Michigan?

Ans: The Michigan Department of Treasury is in charge of state payroll taxes.

- Michigan Income Taxes: Michigan has a flat income tax rate of 4.25%.

- Michigan Local City Payroll Taxes: The following Michigan cities levy a local income tax of 1% on resident employees (R) and 0.5% on nonresident employees (NR): Albion, Battle Creek, Benton Harbor, Big Rapids, East Lansing, Flint, Grayling, Hamtramck, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Springfield, and Walker. Residents and nonresidents who work in Detroit, Grand Rapids, Highland Park, and Saginaw pay the following local taxes:

- Detroit 2.4% R, 1.2% NR

- Grand Rapids 1.5% R, 0.75% NR

- Highland Park 2% R, 1% NR

- Saginaw 1.5% R, 0.75% NR

Employer Contributions to Unemployment Insurance (UI): Employer contributions to unemployment insurance range from 0.06 percent to 10.3 percent.

Furthermore, employers who are new to the market pay a flat charge of 2.7 percent. Employers in the new construction industry pay a flat rate of 8.2 percent.

Que 4: What exactly is an Employer Identification Number (EIN)?

Ans: You will be given a 9-digit Michigan Withholding account number and a 10-digit Michigan Unemployment Insurance Agency number after registering your business with the Michigan Department of Treasury and the Michigan Unemployment Insurance Agency.

In all electronic and paper filings, you must supply your employer account numbers when filing returns and making deposits.

Que 5: What information do I need to register for payroll taxes?

Ans: Check the following information that you need to register yourself for payroll taxes. Let's learn:

- If relevant, the name and Social Security number of all responsible parties doing business as (DBA).

- Both a physical business address and a mailing address are required.

- Phone number for a business

- Email address that is valid (contact person and business)

- Employer Identification Number (EIN) is a nine-digit number assigned by the federal government (EIN)

- Description of the industry

Que 6: What should I do if I don't have an EIN?

Ans: The IRS issues an EIN, which is a federal tax identification number.

Que 7: Who is responsible for remitting withholding tax on the payroll?

Ans: Every Michigan employer who is required by the Internal Revenue Code to withhold federal income tax must also register for and withhold Michigan income tax.

My company is based outside of Michigan and has no ties to the state. Employees that are Michigan residents work both in and out of state for us. Which state's withholding tax would you be subject to?

Employers can willingly register with the Michigan Department of Treasury to withhold Michigan income tax, or employees can pay anticipated income tax payments to Michigan directly.

Wisconsin, Indiana, Kentucky, Illinois, Ohio, and Minnesota have reciprocal agreements with Michigan. Employers in these states should not withhold income taxes from Michigan residents who work in their jurisdictions.

Que 8: Is it mandatory for charitable organizations to withhold taxes from their employees?

Ans: Yes. Charitable, religious, and governmental organizations, for example, are required to withhold Michigan income tax.

Que 9: When is it necessary to register a home employer for withholding tax?

Ans: If the federal government mandates a household payer to withhold federal taxes, Michigan would be required to withhold Michigan taxes.

If the federal government did not impose withholding, Michigan would not be required to withhold. When not required, however, the home payer can always withhold.

Payroll Tax Resources and Sources in Michigan

Website for the State of Michigan's Business: Access and submit forms, view the most up-to-date laws and regulations, and learn about various taxes and employer/employee issues.

Michigan Department of Treasury: Payroll tax rates, tax returns, and other information

How Deskera Can Assist You?

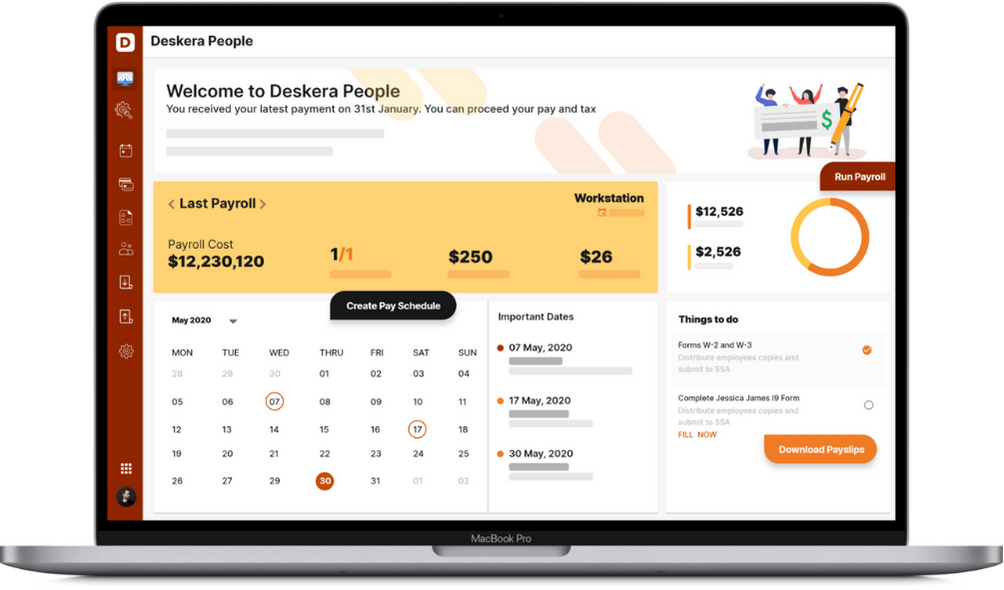

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Final Takeaways

Now that we've reached the end of this extensive guide, we've compiled a summary of crucial sections for your future reference. Let's get this started:

- You'll need your Employer Identification Number (EIN) and an account with the Electronic Federal Tax Payment System (EFTPS) at the federal level (EFTPS).

- Onboarding is the optimum time to gather payroll forms. W-4, I-9, and Direct Deposit information are all included on payroll forms. You must also submit a Michigan W-4 form. This would be a great moment to look up which Michigan locality you need to send taxes to using your employee's address.

- Employees can be paid in a variety of methods (cash, check, direct deposit), and federal taxes should be paid through the Electronic Federal Tax Payment System (EFTPS).

- You must submit an annual withholding tax report to Michigan. You must also file withholding tax reports on a regular or quarterly basis.

- W-2s (for employees) and 1099s (for non-employees) are the government documents that must be completed (for contractors). By January 31 of the following year, these forms should be given to workers and contractors.

- Most occupations require you to pay your staff at least the minimum wage. Furthermore, the current minimum wage in Michigan is $9.65 per hour.

- The state of Michigan's minimum wage laws has a few exceptions. Employers can pay 16- and 17-year-olds 85 percent of the standard minimum wage if they do not replace an adult employee with a child.

- The most common deductions in Michigan are payroll taxes, garnishments, and the employee's part of benefit payments (i.e., medical insurance).

- For new employers in Michigan, the unemployment tax rate is 2.7 percent. The term "new employer" refers to a company that has been in operation for less than two years.

- Michigan is a tax-free state. The state requires that you withhold 4.25 percent of each employee's gross salary. In addition, there are local income taxes. The employee's tax rate is determined by the local jurisdiction in which he or she works.

- Michigan has reciprocal agreements with Illinois, Indiana, Kentucky, Minnesota, Ohio, and Wisconsin. Employers in Michigan are not required to deduct Michigan income tax from earnings paid to non-Michigan residents.

- The Social Security FICA tax is calculated at a rate of 6.2 percent on the first $137,700 earned, with a maximum amount withheld of $8,537.40. The Medicare (Hospital Insurance) FICA tax is calculated at a rate of 1.45 percent on all wages. The agricultural industry is the one exception. Workers' compensation insurance is necessary for businesses in this field, if they have three employees who work more than 35 hours per week for 13 weeks or longer in a year.

- Any time worked over 40 in a workweek should be compensated at 1.5 times the employee's regular hourly rate, according to federal requirements.

- Employees in Michigan might be paid weekly, bimonthly, semimonthly, or monthly. You can choose what works best for your business—consider industry standards—but regulations require that you maintain a constant frequency.

- Unemployment Insurance Tax (UIT) is a federally mandated, state-run program that provides temporary compensation to unemployed workers who are unable to find work due to circumstances beyond their control.

- Employer contributions to unemployment insurance range from 0.06 percent to 10.3 percent. Employers who are new to the market pay a flat charge of 2.7 percent. Employers in the new construction industry pay a flat rate of 8.2 percent.

- Every Michigan employer who is required by the Internal Revenue Code to withhold federal income tax must also register for and withhold Michigan income tax.

Related Articles