The American Payroll Association shows an error rate of 1-8% of overall payroll in organizations that utilize conventional time cards, and generally, 40% of small businesses cause an average of $845 every year in IRS penalties because of disorganized payroll processes.

As a Small Business Owner, nonetheless, you're wondering precisely how much payroll mistakes are costing you back. The answer relies upon the kinds of payroll mistakes you're making. Thus, here's a rundown of the 7 most costly mistakes made in payroll and best practices to stay away from them. The topics covered are topics covered are as follows:

- Misclassifying Employees

- Being late in depositing business taxes

- Miscalculating pay

- Neglecting to Keep Complete Records

- Processing payroll utilizing some wrong state

- Choosing some wrong payroll service provider

- Regulation, Law, and Order

- Best Practices to avoid these errors

- Key takeaways

1. Misclassifying Employees

Before you set a specialist on your payroll, you'll have to classify the sort of work relationship your business has with them. You could have to present an alternate sort of payroll contingent upon this foreordained relationship.

The Fair Labor Standards Act (FLSA) gives advantages and securities, similar to overtime pay and the minimum pay permitted by law, for most workers under the law. A self-employed entity (1099) doesn't get these securities, as managers who recruit them don't pay a part of their taxes.

Similarly, exempt and nonexempt workers additionally have different legal rights. A few associations goof up and misclassify their workers as self-employed entities or as exempt.

Misclassifying workers as self-employed entities rather than workers lessens work costs up to 30 percent for certain organizations, yet, it is unfair to both the workers and different organizations and can prompt a heavy fine.

Not only can misclassification be able to deny a worker a few significant advantages and wages, but it might also likewise mean the government misses out on important tax dollars. Whenever left unchecked, the next underpayment or overpayment can transform into an expensive payroll blunder.

Inaccurately identifying workers as exempt or non-exempt

Exempt workers are not qualified for overtime and are relied upon to complete their task, regardless of how long it takes, without additional compensation. These workers are exempt assuming they perform specific somewhat significant level work obligations, are paid on a compensation premise and earn no less than $23,660 each year.

On the off chance that a non-exempt worker is treated as an exempt worker, they pass up overtime or a time-based compensation, which will bring about wage theft. In this way, except if a worker consents to be paid a compensation which is common for high-ranking positions, most non-exempt workers ought to be paid hourly.

Ways to avoid this mistake:

Misclassifying workers can turn out to be one of the most exorbitant payroll botches a retail business can make-so it's essential to ensure you see every classification and group each individual you recruit accurately straight out of the door.

As the name proposes, self employed entities have more freedom than employees. As per the IRS definition, the overall guideline is that an individual is a self employed entity assuming the payer has the right to control or direct only the result of the work and not what will be done and the way in which it will be finished.

Classifying a worker as exempt or non-exempt will rely upon their job, work obligations, and responsibilities. By and large yet not generally, salaried workers are viewed as exempt while hourly workers are non-exempt. Non-exempt workers are safeguarded under the Fair Labor Standards Act (FLSA) and qualified for overtime pay, while exempt workers are not.

2. Being late in depositing business taxes

While you're dealing with a retail business or offline chances are, you're paying workers various sums at various times. For instance, assuming that you maintain a brick-and-mortar business, you could make some part-time cashier who works hourly and a worker who works full time with benefits.

A few payrolls are firmly attached to specific tax forms. Failing to present these when you recruit a worker or contractor is a serious payroll botch you ought to never make. There are a ton of essential government forms you'll have to submit, and some of them may be totally unique in relation to what you're utilized to.

For instance, the tax responsibilities while recruiting self-employed entities will be really not the same as while recruiting standard workers. Ensure you're educated with regards to what forms you want to have for recently recruited team members and when you really need to submit them.

The Penalty for this is Up to 15% of taxes due still neglected over 10 days after the date of the first notice. You'll need to file income tax returns forms on the following dates:

1. April 15: Default cutoff time for calendar year-end for corporations.

2. June 15: Default cutoff time for calendar year-end for foreign corporations.

3. October 15: Extended cutoff time from April 15 cutoff time.

4. December 15: Extended cutoff time from June 15 cutoff time.

Contingent upon your conditions, you might require additional time to record, or you'll have to document all the more routinely on the off chance that your business income exceeds a specific amount. Research your Federal and State regulations prior to filing your documents for the IRS, or you could face fees regardless of documenting on schedule.

Or then again, on the off chance that you deal with a Shopify store, you could have a group of support staff who work a few shifts week support tickets, an inbound marketing manager who works 20 hours in a week creating new leads, and a web-based business manager who works all day in your corporate office running your shop's activities.

With so many different compensation structures, it tends to be difficult to stay aware of what taxes should be paid, for who, and when. In any case, except if you need to wind up managing some really extreme payroll tax penalties, you're most certainly going to need to keep steady over when your payments are due.

As a business, you're expected to deposit employment taxes, including government income tax kept and FICA tax, both on the business and worker side, on an ordinary timetable either month to month or semi-week-by week and assuming you neglect to set aside those deposits on schedule, you could end up facing hefty payroll tax penalties that increase in light of how late your record.

Ways to avoid this mistake:

To abstain from suffering consequences for late filing, it's vital to be perfectly clear on employment tax due dates and set those due dates on your schedule.

On the off chance that you set aside deposits on a month-to-month schedule, you would deposit employment taxes by the fifteenth of the next month. In the event that you set aside deposits on a semi-week-by-week schedule, you would deposit employment taxes for payments made Wednesday through Friday by the next Wednesday, and taxes for payments made Saturday through Tuesday by the next Friday.

Assuming you really do wind up filing late, there are two exemptions that could assist you with keeping away from a penalty. As indicated by the IRS, the law permits the IRS to eliminate the deposit penalty if: (1) the penalty applies to the first required deposit after a necessary change to your frequency of deposits, and (2) you record your employment tax by the due date.

3. Miscalculating pay

A wrong paycheck can be baffling for any worker, especially on the off chance that the mistake brings about missed payments. Errors likewise sit around idly, as you'll have to devote hours or even days to research and address blunders outside of the regular payroll cycle. Furnishing both your contractors and contractors with exact payroll is the premise of a good professional relationship.

Ensuring you get the perfect sum for every payroll is a task and a half, however, it should be finished. It for the most part includes looking through a lot of time sheets and guaranteeing that all of them are legitimate.

As per an American Productivity and Quality Center (APQC) study, associations take somewhere in the range of two and ten days to determine a payroll blunder. In the time it takes to fix those blunders, workers can become baffled or even experience difficulty taking care of their bills.

Pay errors can occur with salaried or hourly workers. Normal error situations incorporate the following:

• Missing the first paycheck for fresh recruits

• Overpaying or underpaying workers

• Inappropriately paying workers who are on disability or other leaves

• Making mistaken retroactive payments

• Deducting some wrong sum for benefits or other payroll allowances

For one thing, you can underpay your workers unintentionally. This implies that you'll be providing them with less revenue than they merited. Aside from being exceptionally amateurish, this can crush a worker's motivation.

Over payment is additionally a major issue with regards to misinterpreting payroll, which might be because of a basic data entry mistake. In any case, giving one of your workers more money than they've earned is a terrible plan of action. Also that it can truly harm your organization's funds assuming it continues unrestrained. This is particularly valid for smaller organizations.

Overtime or other Wages are Miscalculated

As an entrepreneur, you need to compute overtime compensation accurately overtime compensation are totally not the same as standard wages. You will owe wages, penalties, and interest on the off chance that you don't compensate the right overtime rate.

Fixing payroll mistakes implies investigating the overtime compensation. Assuming workers are non-exempt, they should be paid something extra for any hours worked over 40 every week. A few states have extra standards, e.g., in California, workers should be compensated overtime for working over eight hours in a typical working day, regardless of whether they surpass 40 hours out of each week.

Non-exempt salaried workers may likewise be qualified for overtime except if they are exempt from overtime under the State Labor Code or on the other hand if an upheld or existing order like welfare or child support manages the worker's hours, wages, or working conditions. Businesses can involve a clock-in-time usage framework to guarantee they're precisely keeping up with worker hours.

There is no set overtime pay, yet most businesses choose to go with 150%-200% of the worker's standard hourly rate.

Compensating overtime wages to workers for hire is more troublesome. Since you will not be following time for most workers for hire, it will be more challenging to decide when they went above and beyond. You can give rewards when tasks have been finished rapidly or particularly well.

Inaccurately logged overtime hours can prompt inappropriate overtime pay, which prompts corrections conceivably across various fiscal years. Adjusting those blunders takes time and can be unimaginably disrupting for workers, regardless of whether they are underpaid or overpaid and need to return money to the organization.

Compensating overtime isn't simply an issue of paying workers the standard 1.5 times their ordinary compensation rate when they work more than 40 hours in seven days. Overtime payments mistakes can emerge assuming you miss a payment in any of the following situations:

• Whenever workers work during break times

• Whenever workers invest time going between work sites

• At the point when workers are expected to partake in exercises outside of typical hours, for instance, in preparing, teambuilding, or organization parties

Poor record-keeping can cause both in-house issues and issues while tax documenting or finishing other outside tasks. To have an effective business, you really need to track everything, particularly payroll records.

Neglecting to take away garnishments from a worker's payroll

While it might appear to be that taxes and contributions are the main things that you want to keep from your worker's compensation, this isn't true. Garnishments like credit installments, mortgages, and even home loans, at times, ought to be deducted from the net compensation prior to giving the worker a check. Garnishments are a method for guaranteeing the individual getting a check pays their own debts.

Neglecting to eliminate the garnishments from your worker's compensation can cause both you and them numerous issues.

Misfiling gross and net payroll

This is a basic error, taking everything into account. It is truly simple to try not to make it - it requires a touch of concentration and practice. Sometimes, it very well may be a test to work out the net worker's check from their gross payroll. Be that as it may, it is normally really clear. What is significant is that you don't get them stirred up.

Gross pay is the sum your worker is due before taxes, deductions, contributions, or commitments are held back. Net income is all that a worker earned minus the contributions, commitments, or some other kept costs.

Ways to avoid this mistake:

To compensate for overtime it's essential to plan likewise and ensure that no employees work past their planned shift times. It's additionally essential to keep meticulous time records so you know precisely when your workers timed in and out, how long they worked in a given week, and regardless of whether you'll have to handle overtime pay each payroll interval.

4. Neglecting to Keep Complete Records

A disorderly and inefficient payroll process can be a catastrophe waiting to happen. Depending on paper processes, manual information entry, or a mass of Excel bookkeeping spreadsheets prompts mistakes that might require weeks or months to uncover. Scattered records can likewise lead you to miss a worker's payment or circle back to things requiring critical consideration.

With regards to payroll records, you can never be excessively careful. The FLSA expects employers to keep three years of pay records. These records incorporate hours worked, payroll dates, payment rates, and the sky is the limit from there. While this could seem like a great deal of information, a few states require much more, with records dating considerably farther back.

Additionally, having a manual framework for overseeing payroll expands your dependence on one individual to deal with all finance activities. Without a coordinated and automated payroll framework, it's harder for somebody to fill in when the finance administrator is out of the workplace or leaves the organization. It can likewise set you up for issues in case of a review or process review.

Appropriate record keeping will safeguard you lawfully and permit you to see the upgrades or deterioration in every one of the perspectives connected with your business. Not only does this information guard your association in the event of future reviews, it likewise assists you with running payroll all the more easily at this very moment.

Not keeping payroll records for long enough

It's normal for new companies or new organizations to toss out or incorrectly record payroll, making them hard to find. Be that as it may, doing as such could put your business in danger of paying fines on accurately determined payroll essentially for not keeping records long enough to show proof.

Payroll records ought to be held for no less than three years, and numerous specialists suggest saving them for quite a long time. It's preferred to keep records longer than the law-expressed least in light of the fact that the IRS might observe an inconsistency later down the line. Whenever the IRS could see a payroll blunder, it really depends on the business to show confirmation. If not, the organization could get a fine.

Not keeping up with confidentiality

All payroll data shouldn't be disclosed beyond the payroll division and senior supervisory team. This implies records should be dealt with cautiously - e.g., finance data shouldn't be left on a printer or left opened on a PC screen, in an overall vicinity of the workplace. Having records on display can influence your standing with clients and workers.

Regardless of whether you're outsourcing your payroll to an outsider specialist organization or you recruit self-employed entities to deal with projects, you really need to shield your private information from spilling. That includes your workers' very own information and payroll data. That is the reason it's crucial to sign a DPA with an outer partner.

Likewise, assuming you've chosen to depend on technology, remember that it's flawed. A server might go down, your PC might get harmed. Ensure sufficient backup for each one of your information and keep your payroll data in a solid surrounding and safeguarded from programmers or some other issues.

Ways to avoid this mistake:

You genuinely must keep exact, complete, and up-to-date payroll records for your workers as a whole, including W-2s, time sheets, and pay records. And don’t think you can simply throw your records in the dustbin once a worker leaves; the IRS expects you to keep most worker and payroll records for no less than four years-and the Small Business Administration (SBA) suggests keeping all payroll records for a long time since certain states have various necessities.

Keeping meticulous employee and payroll records might feel like a pain in the moment—but if the IRS comes knocking for an audit, you (and your business bank account!) will be grateful you did.

5. Processing payroll utilizing some wrong state

Assuming you maintain a bigger retail business, you could have a corporate office or lead store that is situated in one state yet, in addition, have retail tasks (and workers) in different states. On the off chance that you run a web-based business activity, you could have managers and workers for hire dispersed around the nation yet all placing in work on your Shopify store.

Each state has different compensation regulations and rules and, as a business, you're expected to maintain the regulations and rules for the state where your worker works, not the state where your organization is based.

Along these lines, for instance, suppose your online business activity is situated in Lansing -yet you just recruited a couple of full-time customer service representatives in Spokane.

Michigan and Washington have different the minimum wage permitted by law regulations and keeping in mind that you could pay your Lansing-based CSRs $10 each hour which is fine since the minimum pay permitted by law in Michigan is $9.65 each hour, to follow the state of Washington's minimum pay permitted by law regulations, you'd need to pay your Seattle group no less than $13.50 each hour.

Ways to avoid this mistake:

Assuming you have workers that work in various states, keep exact payroll records and sort out your documents in view of the state. In the event that you're computing your worker's wages and savings in light of the state where your business is based and not the state where the worker is effectively utilized, it could prompt pay mistakes which, thus, could prompt genuine penalties.

For instance, assuming you underpay a worker in view of their state's minimum pay permitted by law regulations, you would be on the snare for all back pay owed to that worker. Furthermore, in the event that your savings were erroneous and you didn't cover exact taxes, you could likewise be on the snare to the IRS for penalties and interest.

6. Choosing some wrong payroll service provider

While picking a payroll company, ensure that they can give excellent finance administrations, similar to the following:

- New-Hire Reporting: Deadlines are tight for fresh recruits, particularly for calculating authorized or existing orders. Reports will be filed with the appropriate organization and on schedule.

- Payroll Processing: Automates payrolls most work concentrated viewpoints, similar to tax withholding, estimations, and payment options, for example, computerized or paper checks.

- PTO-Management: Keeps track of workers' paid time off, including parental and clinical leave, time off, days off, and personal days without any issue.

- Compute, Withhold and Pay Taxes: Removes blunders in calculating and paying taxes, including the most costly and normal errors, similar to additional time.

- Compliance: Delegates the right forms to the right workers, similar to the W-2, 941, 1099, and W-9. Payroll service co-ops will ensure this information is precise.

Not using payroll software

We live in a digital age, and we can say with practically outright conviction that there is an application for everything.

While an application on your mobile maybe excessively basic or insecure for time tracking or assisting you with running payroll, there is payroll software designed particularly for that.

You should simply invest in some time to do data entry, for example, the worker's social security numbers or when they began working for you, and the product will wrap up.

• You won't have to double-check on everything constantly

• It will save you a great deal of time

• You could set aside cash by keeping a smaller payroll department

• No need to go to the bank or pay compensations from a computer. The payroll software calculates and pays every one of the sums

These are only a part of the advantages of automating your payroll system.

Ways to avoid this mistake:

It's fundamental to pick a payroll service provider that will suit your organization's requirements. This might mean switching suppliers as your organization develops.

7. Regulation, Law, and Order

Don't you simply cherish IRS audits? What about worker claims for unfair pay? You could feel that guidelines that demand you keep exact records of worker work hours is a regulatory drag, however, they're really there to safeguard you. As are state regulations directing payroll processes.

Certainly, you can in any case agree with guidelines while utilizing customary arrangements, or simply your past pen and paper. Yet, it's basically more straightforward with an application. Notwithstanding, regardless of whether you're paying a contractor or a worker for hire, you'll have to keep a few guidelines. These will vary contingent upon your circumstance, business scope, and a lot more factors.

Ways to avoid this mistake:

There are many existing regulations influencing how you manage representative compensation, and guidelines change after some time. As well as understanding the basic requirements of FLSA and tax withholding laws, you additionally need to see how to apply newer programs like the Payroll Protection Plan (PPP). By monitoring regulatory updates, you can make changes to payroll processes accordingly, rather than playing find each regulation change.

Best Practices to avoid these errors

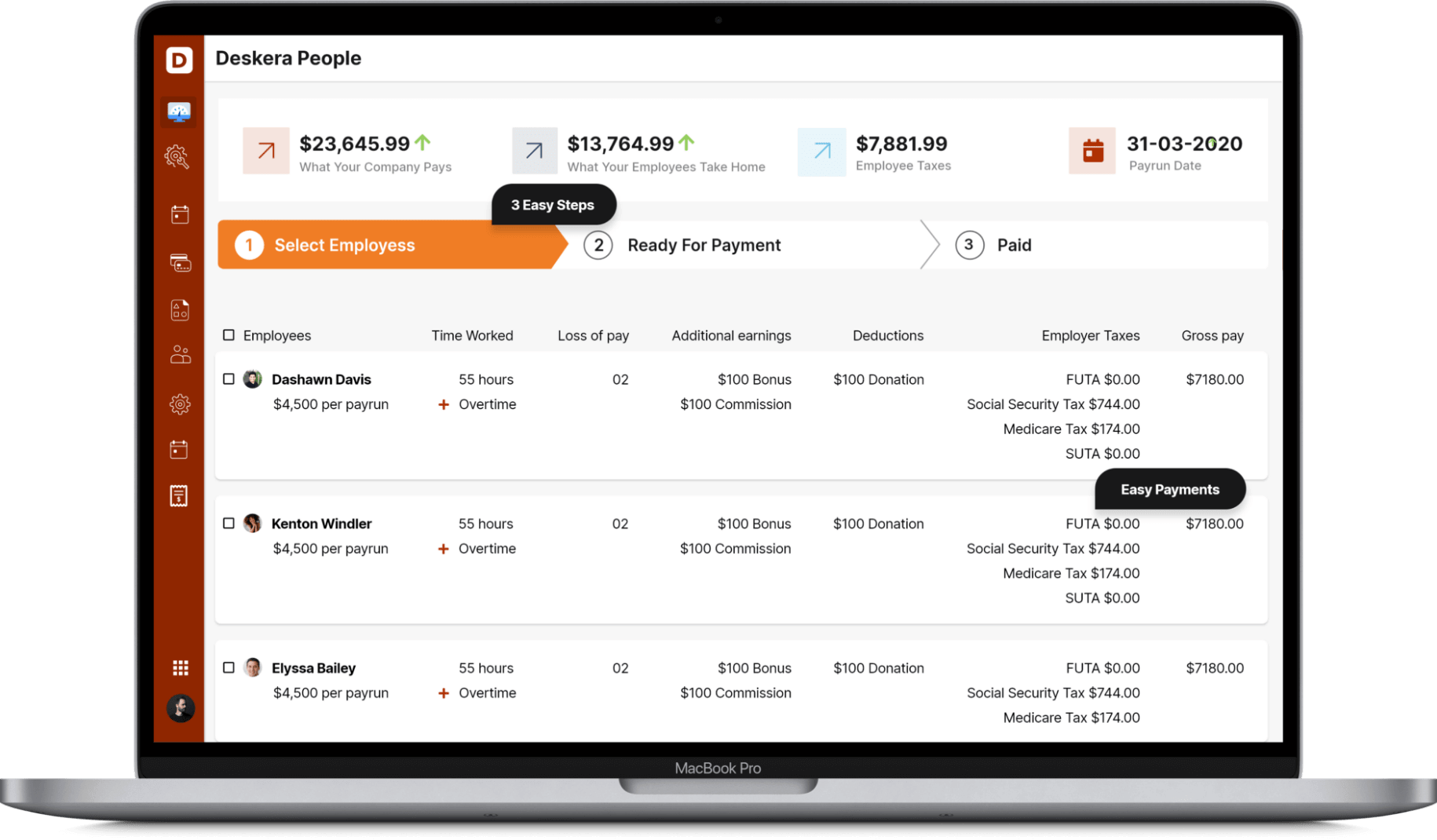

- The most ideal way to keep payroll botches from disrupting your organization? Invest in Deskera payroll software. The right software will manage and update important employee information, like wages, hours, account numbers, and withholdings, and then communicate those changes to your payroll system, eliminating the need for double entry.

- Manage any payroll blunders right away. Regardless of how on top of your finance game you are, slip-ups can occur. In any case, in the event that you notice a payroll botch, the key is to manage it right away.

The sooner you perceive and address any payroll blunders, the more uncertain you are to pay expanding interest and fines. Assuming you can demonstrate it was a regulatory oversight and not a purposeful demonstration, you might even have the option to get your penalty deferred. Along these lines, with regards to payroll blunders, the sooner you face and manage them, the better.

- You can never turn out wrong with the proven checklist. Payroll administrators have a great deal to monitor, regardless of whether they have software to help their processes. With a checklist, they can go through each progression of the step without fail, investigating each piece and ensuring everything is precise.

- Budget for tax payments. Business taxes are expected on a customary timetable. You need to realize you must compensate them-and planning for them will guarantee that you have the funds available to set aside your deposits when they're expected and stay away from any late penalties all the while.

How can Deskera Help you with Payroll Mistakes?

Generate payroll and payslips in minutes with Deskera People. Employees can view their payslips, apply for time off, and file their claims and expenses online.

Key Takeaways

- The additional time you give yourself to deal with your payroll, the additional time you need to recognize and address any blunders. Running reports well ahead of time and not the day preceding your run payroll will give you the time you really want to audit for errors and fix those mix-ups if essential.

- Whenever you process payroll physically, you're leaving a ton of space for a human blunder. Via automating your payroll process rather than attempting to handle things like withholdings, overtime, and PTO yourself you remove the human from the situation and altogether bring down your possibilities making a costly payroll error.

- Individuals don't change, so innovation needs to. Individuals will continuously observe a way to error cheat in attendance reporting. Nonetheless, by changing to a versatile mobile time clock, you can incredibly diminish the recurrence of blunders, set aside cash, and increment efficiency in your business.

Related Articles