According to the American Payroll Association, about 65% of the workers live paycheck to paycheck. This means that the paycheck errors make employees more likely to leave the company, which according to Kronos is 49% of workers who start looking for new jobs after two paycheck errors.

Additionally, these errors also put the employees in actual financial distress, due to which employees are more likely to have trouble focusing and producing high-quality work.

This, in turn, can negatively affect your customer’s feedback, proactive customer service, customer loyalty, customer retention, gross profit margin, net profit ratio, and revenue.

Hence, being well-versed with all the payroll forms will help your company financially as well as administratively. By understanding your payroll forms and along with it the complicated employment laws and confusing tax rules, you would be able to better prepare yourself to meet all your payroll obligations and avoid penalties, as well as retain top talents in your company, boost employee morale and reduce the overall hassle.

The topics covered in this article are:

- What are Payroll Forms?

- What are the Contents of Payroll Forms?

- Importance of Payroll Forms and Taxes

- What are the Penalties for Incorrect Payroll Forms?

- 15 Payroll Forms Needed by Every Employer

- Non-Tax Payroll Forms You Should Consider Using

- Tips to Avoid Payroll Mistakes

- How can Deskera Help your Business with Payroll Forms?

- Key Takeaways

- Related Articles

What are Payroll Forms?

Payroll forms are also called payroll reports. Payroll forms are basically means of accruing and organizing accounting information about a business's employees.

Typically, payroll forms have comprehensive details of payroll transactions in a quarter; however, they may be generated for longer or shorter periods of time, depending on the needs of the company as well as the rules of the USA federal government.

However, through these payroll forms, you would be able to ensure that you are accurately calculating payroll taxes and also that your employee is eligible to work legally. Thus, the two main purposes served by payroll forms are:

- To collect information related to employee compensation

- To report employment tax payments to governments

Running payroll involves withholding and paying employment taxes, including federal income tax withholding and Federal Insurance Contributions Act (FICA) taxes. Thus, checking their accuracy regularly, and having all the data on the basis of which the payroll gets determined, is a must.

What are the Contents of Payroll Forms?

Some of the most important information that is included in payroll forms are:

- Paycheck distribution

- Direct deposits

- Bonuses paid

- Deductions or withholdings like employer taxes and deposits to Social Security and Medicare

- Holiday or sick-leave pay

And so on, as applicable.

Typically, these figures will be broken down by the employees while also including the overall figures that will show your company’s transactions over time.

Importance of Payroll Forms and Taxes

- For each of the persons that are employed by your company, you would be liable to pay taxes for them and then report this information to the Internal Revenue Service (IRS).

- Payroll forms are especially useful in the filing of IRS Form 941- Employer’s Quarterly Federal Tax Return.

- Comprehensive payroll forms will ensure timely and accurate filing for your business.

- Payroll forms will also help in guaranteeing correct accounting of project performance when contractors are involved.

What are the Penalties for Incorrect Payroll Forms?

In case of incorrectly reported and/or paid employment taxes, your company will accrue severe penalties. At the federal level, a fine of two to ten percent would be automatically levied, with additional penalties for the same error at the state and local government levels, as applicable. What needs to be noted here is that these penalties are applicable to businesses of all sizes in every industry.

Especially in case of incorrect or fraudulent Social Security payments, the IRS harshly penalizes the company as well as the individual involved in the specific accounting for Social Security payments. These penalties can be up to a hundred percent of the total amount owed under the same category.

15 Payroll Forms Needed by Every Employer

As an employer, it is mandatory for you to have up-to-date payroll forms, regardless of how many employees you have. For instance, to maintain a good reputation with the IRS, you will need regulated payroll tax forms like W-4 for new hires and W-2 for wage and tax statements. Additionally, you can also have other less structured forms which will be helpful to you in organizing your company’s processes, like, for example, direct deposit.

While the forms that will be discussed in this section are federal forms, many of them do have their state and local equivalents that you should check for. In fact, you can contact your state and local tax authorities to get a list of required payroll filings.

The top 15 payroll forms needed by every employer are:

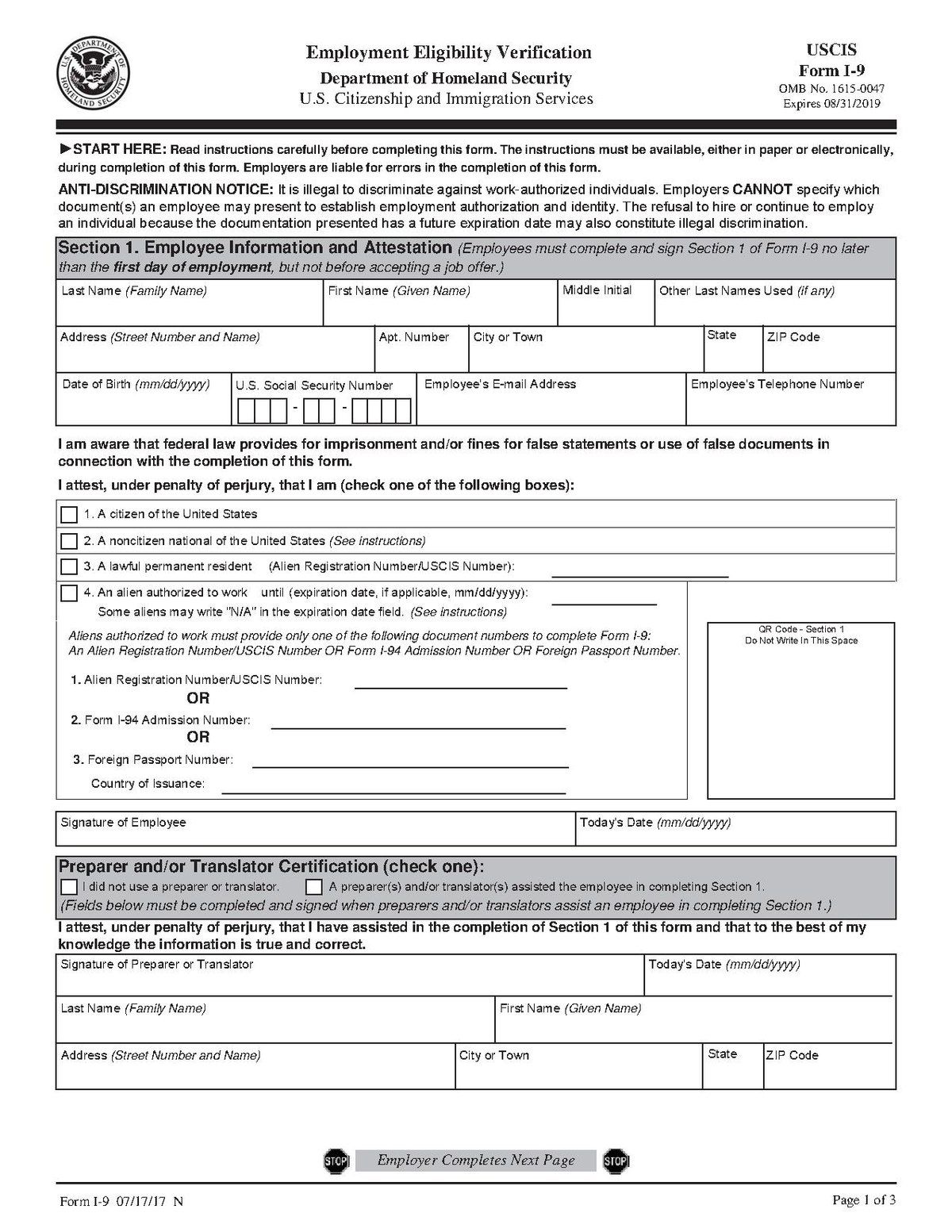

Form I-9

Payroll Form I-9 is one that will verify your employees’ identities and assess whether they can legally work in the country or not. For every employee that you hire, you would be required to complete an I-9 form irrespective of that employee’s citizen status. Payroll Form I-9 will have to be filled out by you and your employee. The deadline for filing this payroll form is three days after the hire date.

Note: Always keep a copy of the Payroll Form I-9 in case they are ever requested by the government. The rule of thumb for the same is to keep a copy for either three years after the date of hire or for one year after the date on which the employment ended, whichever time frame is longer.

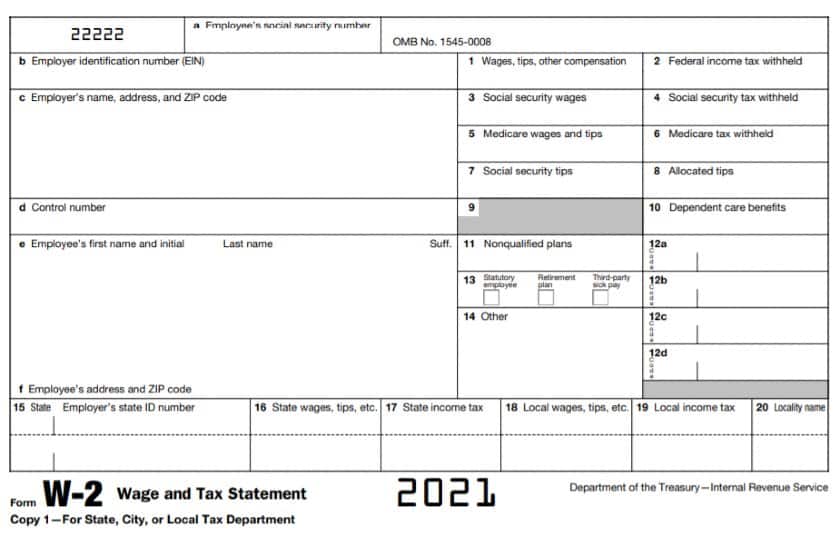

Form W-2

Payroll form W-2 is for reporting your team’s annual compensation and the withheld payroll taxes. In this form, all the earnings, deductions, and withholding for each of your employees is tallied every calendar year.

At the end of the year, you would be required to give a copy of this form to your employees and then also send it to the Social Security Administration by January 31. Additionally, depending upon the state your company is based in, you might also be required to file state copies of this form for your employees. The deadline for filing payroll form W-2 is January 31.

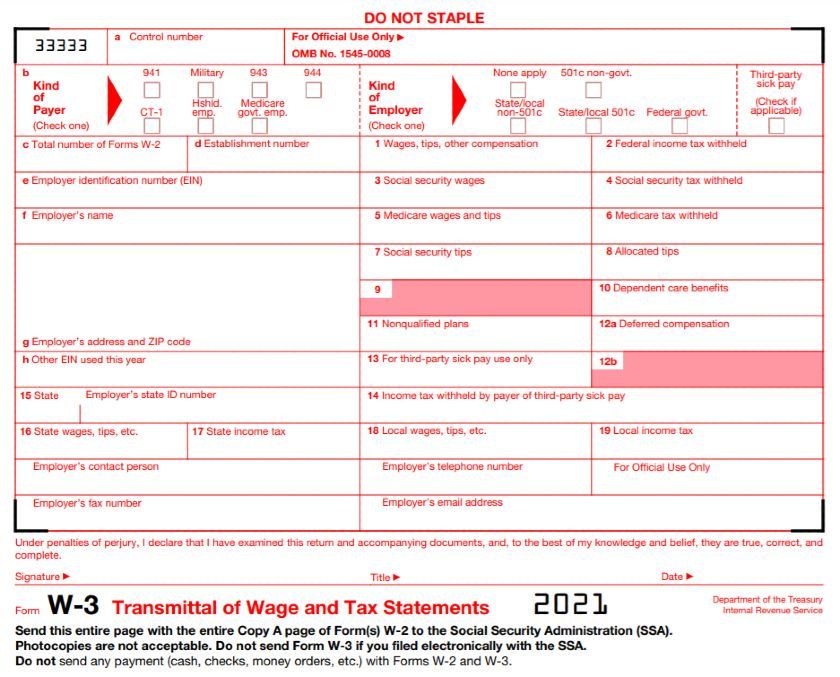

Form W-3

Once you have issued payroll form W-2, payroll form W-3 is essential to be completed and submitted to the SSA with the applicable W-2 copies. Form W-3 is essentially a summary of all the individual W-2 forms that you had distributed for the year.

Through this form, you will be able to report the sum of salary and wage payments made by you to all your employees. In addition to this, you would also be able to report total taxes and other benefit information. The deadline for filing payroll form W-3 is January 31.

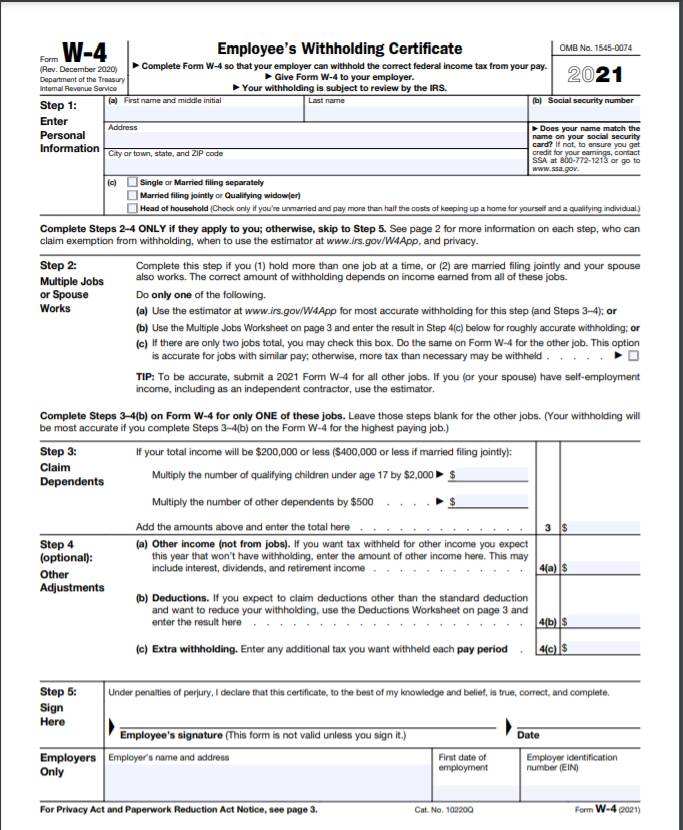

Form W-4

Payroll form W-4 is associated with calculating your employee’s withholding allowances, which will then tell you how much withholding taxes you have to deduct from their paychecks.

What is recommended for this form is that your team should fill out a new form each year. Additionally, a new form will also have to be filled out when there is a change in any personal or financial situation of your employees. The deadline for this payroll form is February 15.

Note: Keep copies of the payroll form W-4 if in case it is requested by the IRS.

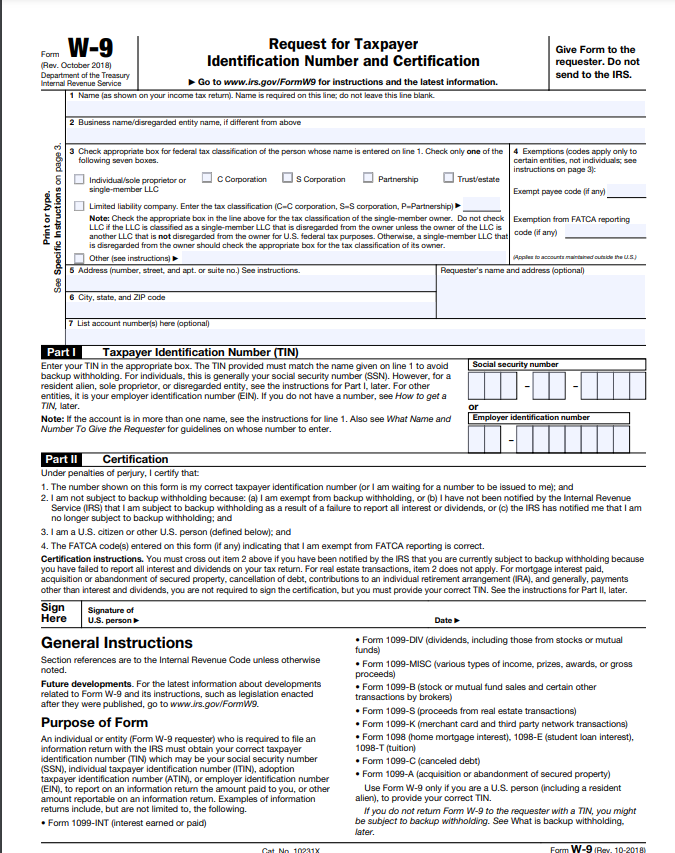

Form W-9

A payroll firm that focuses on your contractors rather than your employees is form W-9. This form needs to be completed by your contractors, through which they will provide you with their correct tax ID number so that you can report how much you pay them.

Note: Similar to forms W-4, forms W-9’s copies should also be stored for a few years.

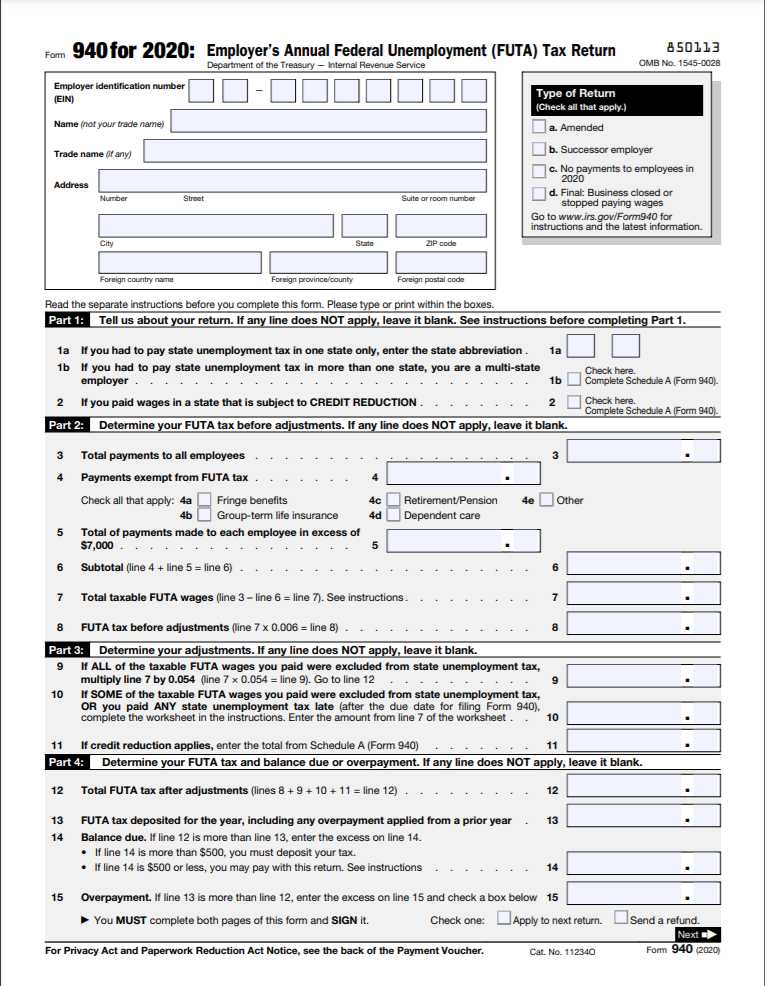

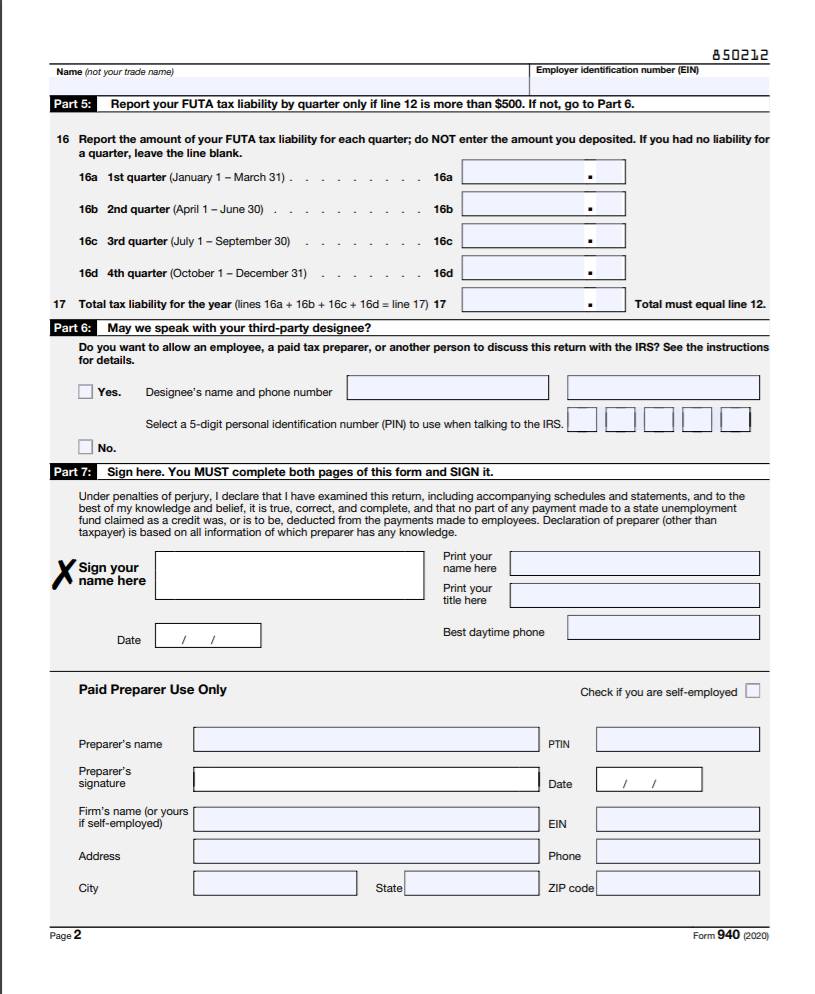

Form 940

Payroll form 940 is a form that reports the FUTA (Federal Unemployment Tax Act) tax payments to the IRS. FUTA and state unemployment tax payments are the funds that are collected from employers that give extra compensation to workers who have recently lost their jobs. The deadline for filing payroll form 940 is January 31.

Note: These taxes are to be paid by your company and cannot be collected from your team’s wages.

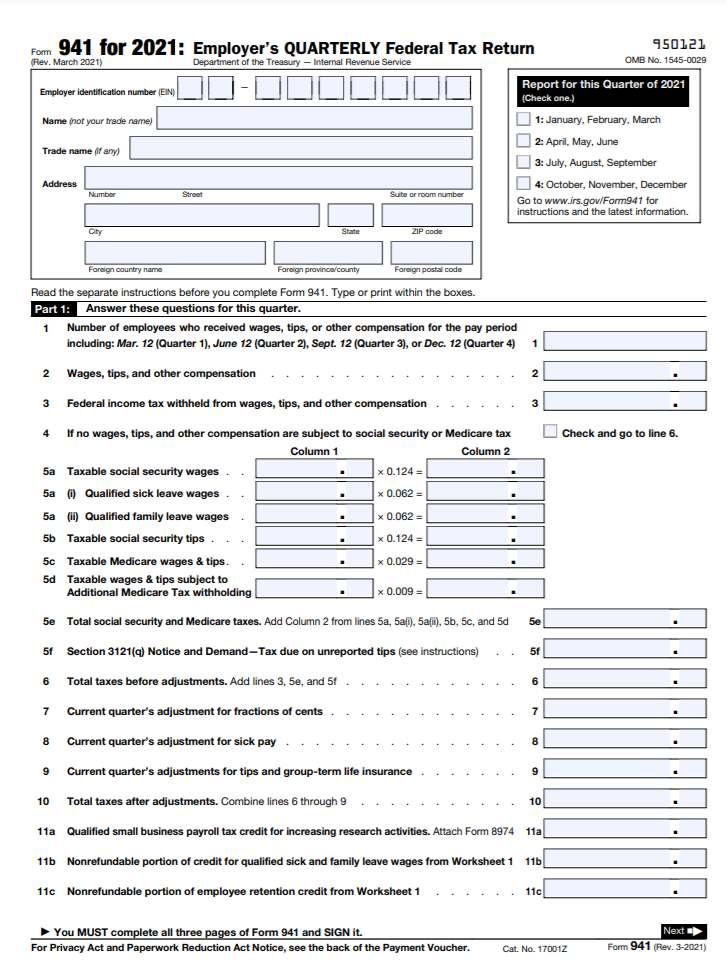

Form 941

This payroll form is also known as the Employer’s Quarterly Federal Tax Return. This hence means that as an employer, you would be required to file this form four times a year. The details to be mentioned in this form are the amount you withheld in your team’s income tax, Social Security, and Medicare, as well as what your portion will be in Social Security and Medicare Tax.

Note: You should also check your state’s labor law website to know what your state requires from you in these taxes, on top of the federal requirements.

The deadlines for payroll Form 941 are April 30, July 31, October 31, and January 31.

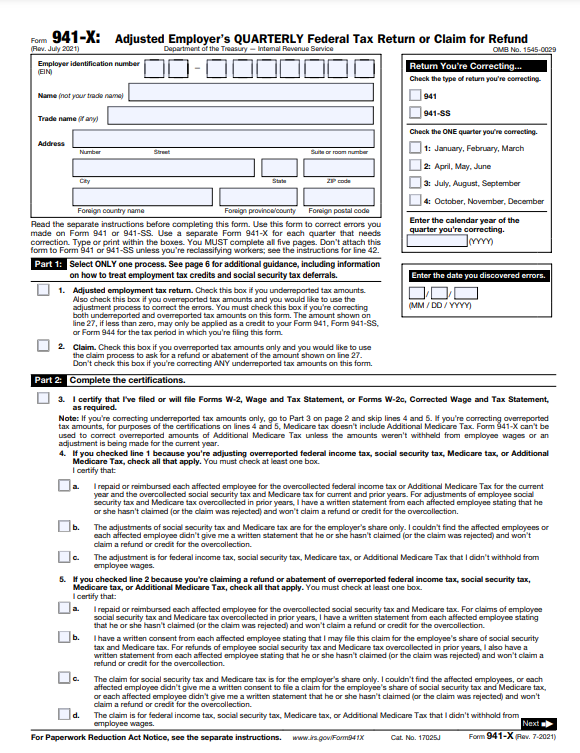

Form 941-X

This payroll form is specifically for correcting any mistakes that you might have made in payroll form 941. This is, therefore, a form of a form.

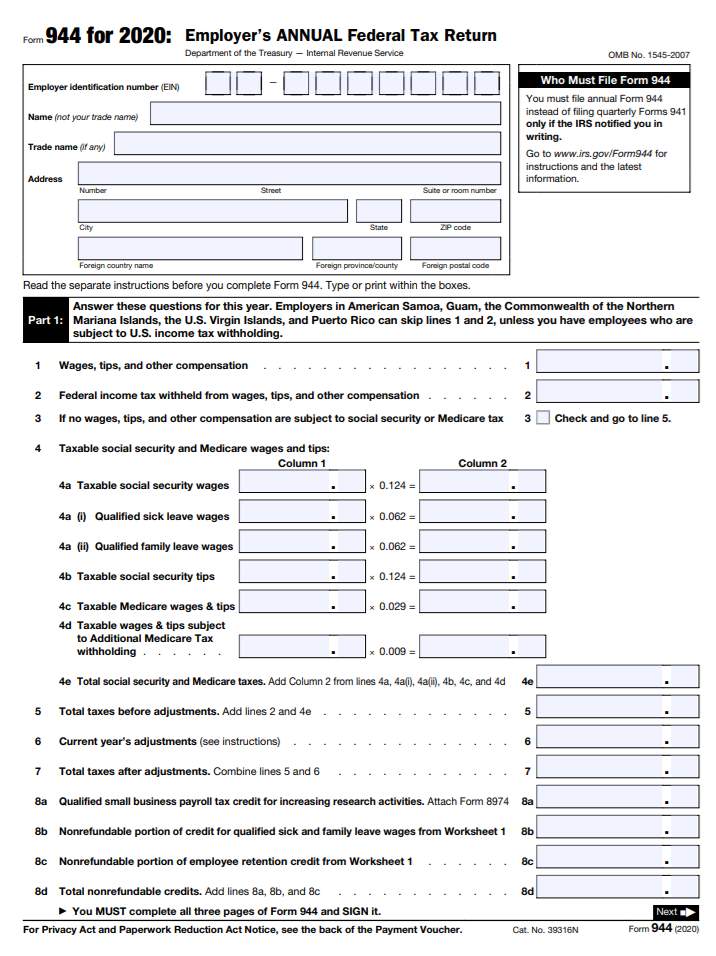

Form 944

Payroll form 944 is also known as the employer’s annual federal tax return and serves the same purpose as the payroll form 941. However, this form is used less frequently because it is to be filed by only those small businesses whose annual tax liability is less than $1,000. The deadline for filing this form is January 31.

This form reports total income and FICA taxes withheld and payable (employees’ as well as employer’s share) throughout the year. This form is applicable for those employers who are eligible to make one payment annually instead of the usual four quarterly payments.

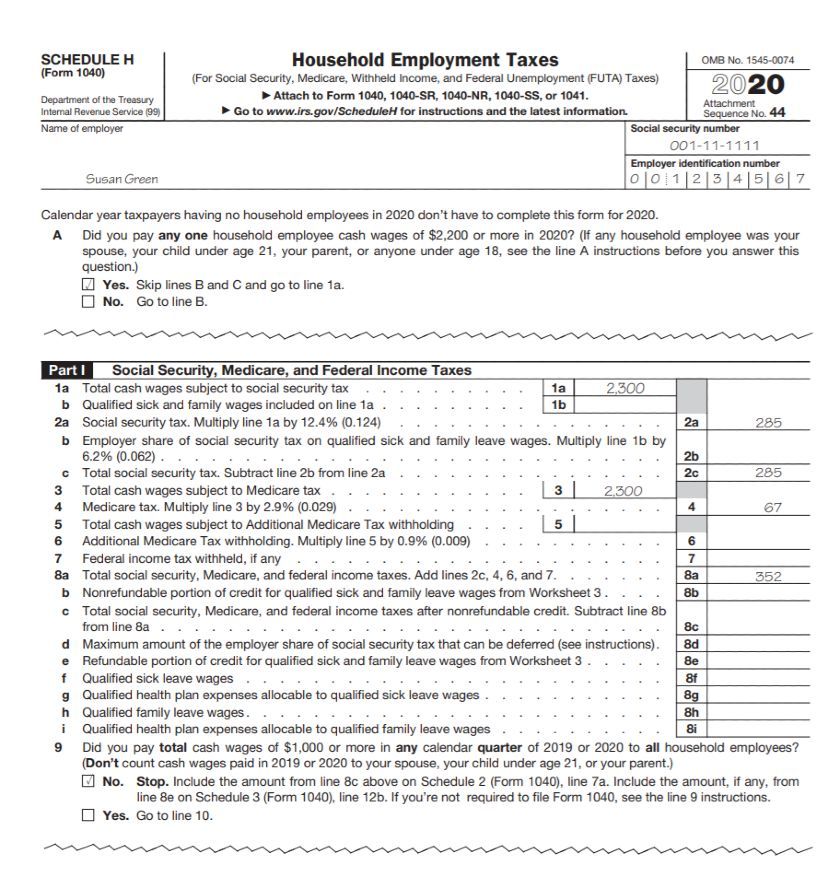

Schedule H (Form 1040)

This payroll form is needed only if you are paying cash wages to household employees like babysitters, nannies, or caregivers. Through this form, you would have to report the total wages paid along with taxes due (FICA, FUTA).

Note: The form comes with clear directions on how to calculate the amounts owed, and hence, you would not have to research that on your own.

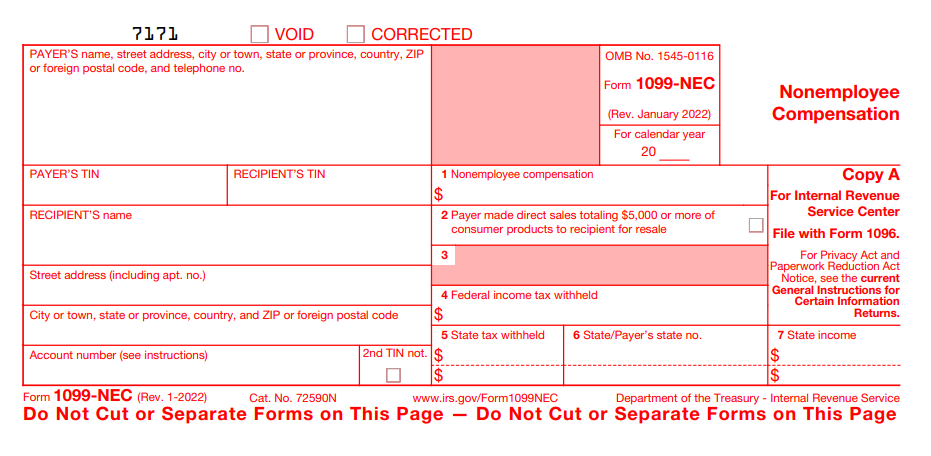

Form 1099

Payroll form 1099 is used to report any compensation that you have made to non-employees. For each contractor or individual, or freelancer, you would be required to file a Form 1099-NEC, which is due on January 31 each year. Form 1099-NEC is, therefore, a simplified way for you to report over $600 paid to such self-employed individuals. This form covers fees, benefits, commissions, prizes, awards, etc.

However, if you have made a payment of $600 or more to an individual or LLC, then you need to file Form 1099-MISC, which will include attorney fees, awards, healthcare, royalties, and rent. Here, the due date is March 1 if filed by paper, and March 31 if filed electronically.

Note: Depending on your state, you might also be required to file state versions of payroll form 1099 for your independent contractors.

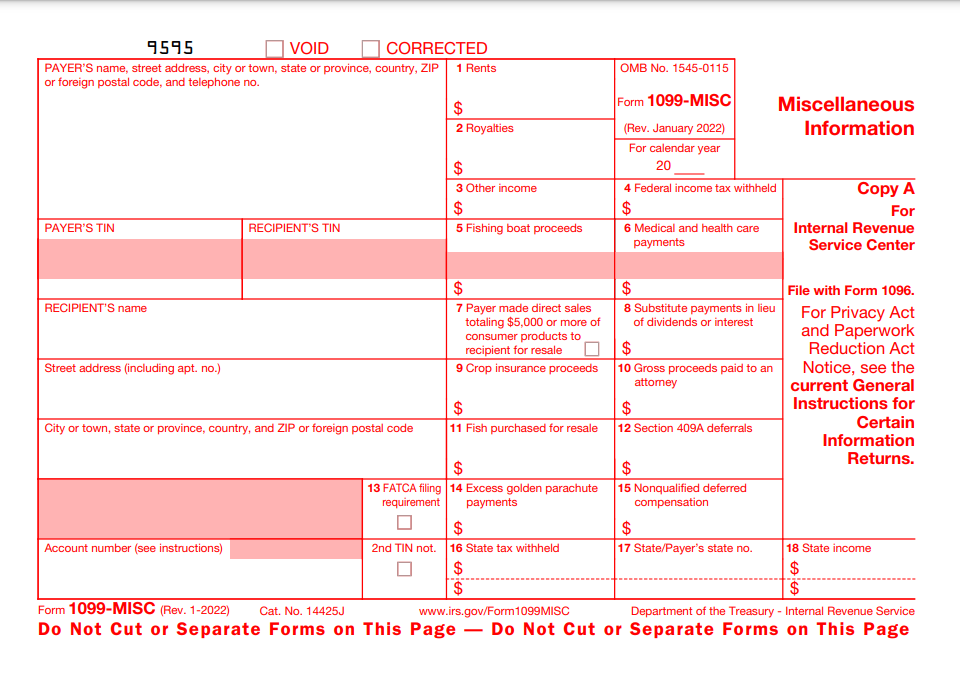

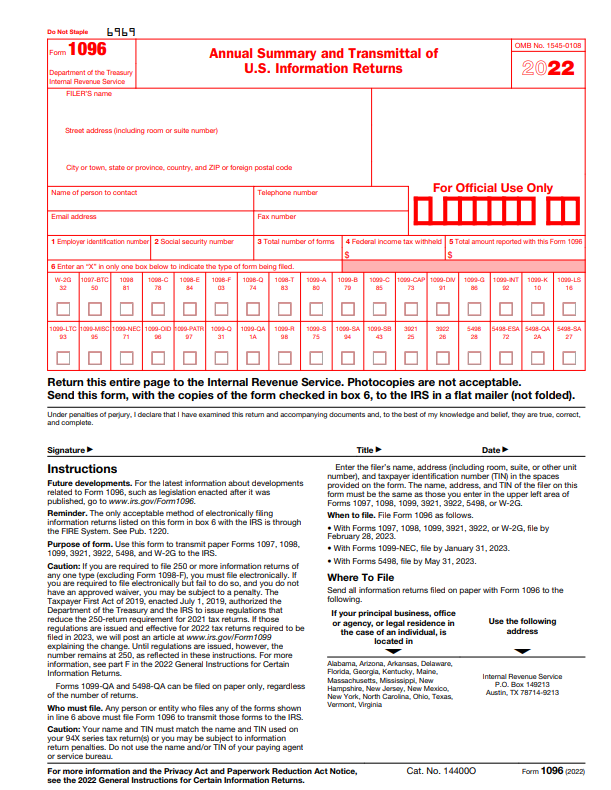

Form 1096

Payroll form 1096 is a summary of all the form 1099s that you have filled out. However, if in case you have filled only one Form 1099, then you would not be required to fill form 1096. Just like in the case of payroll form 1099, the due date for payroll form 1096 is January 31 each year.

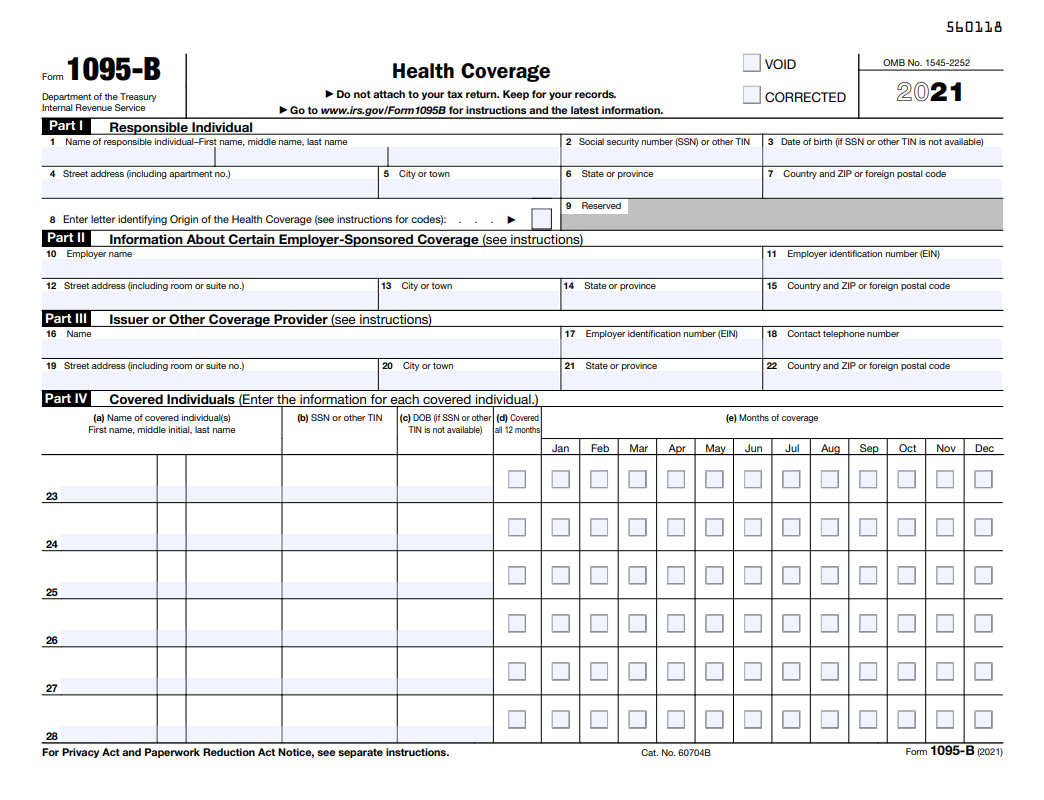

Form 1095-B

Payroll forms 1095 are not to be filled out by all the small business owners. This is because Form 1095-B is for the recipients of small business-sponsored health insurance whose coverage exceeds the Affordable Care Act’s definition of “minimum essential coverage.”

Usually, these forms are generated and filed by your insurer along with the summary form 1094-B. These forms are used by the employees to verify that they have health insurance when filing their taxes. It was used because, in case of insufficient coverage, the taxpayers had to pay penalties.

As of today's date, while the federal government does not require you to send Form 1095-B to every covered employee, they might still request it. In fact, some states and territories like the District of Columbia and New Jersey do require health coverage reporting, and thus, your employees need this form. The deadline for filing payroll form 1095-B is January 31.

Note: Employees of “Applicable Large Employers” will receive Form 1095-C instead, whereas those who receive health insurance through the healthcare marketplace will get a Form 1095-A.

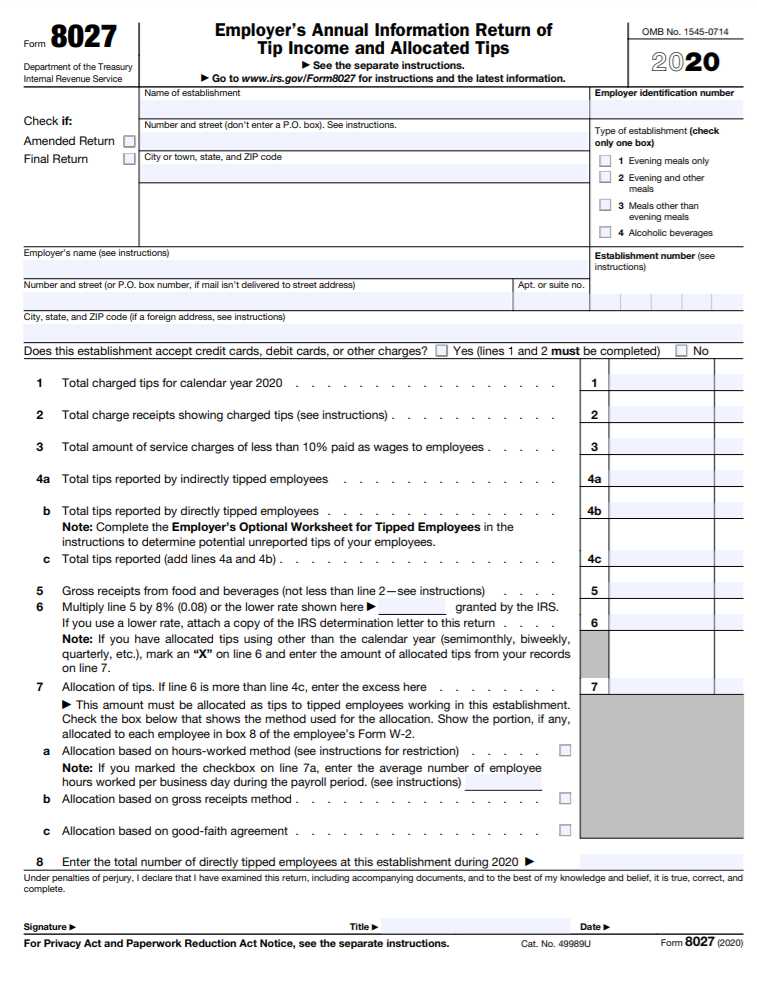

Form 8027

Payroll form 8027 is not used by all the employers but rather by only those large companies with workers who receive tips routinely like bars, restaurants, and other companies in the hospitality industry. If filed by paper, its due date is March 1, and if filed electronically, its due date is March 31.

For the purpose of this form, IRS has defined large companies as those that have more than ten employees working on a typical business day. The main purpose of payroll form 8027 is to report the total tip income received within the establishment and to calculate allocated tip amounts that employers are responsible for paying tipped employees.

Allocated tips are the additional amounts paid by some of the employers if their total reported tips are too low as compared to the size of their business. Through payroll form 8027, you would be able to calculate any additional amounts due.

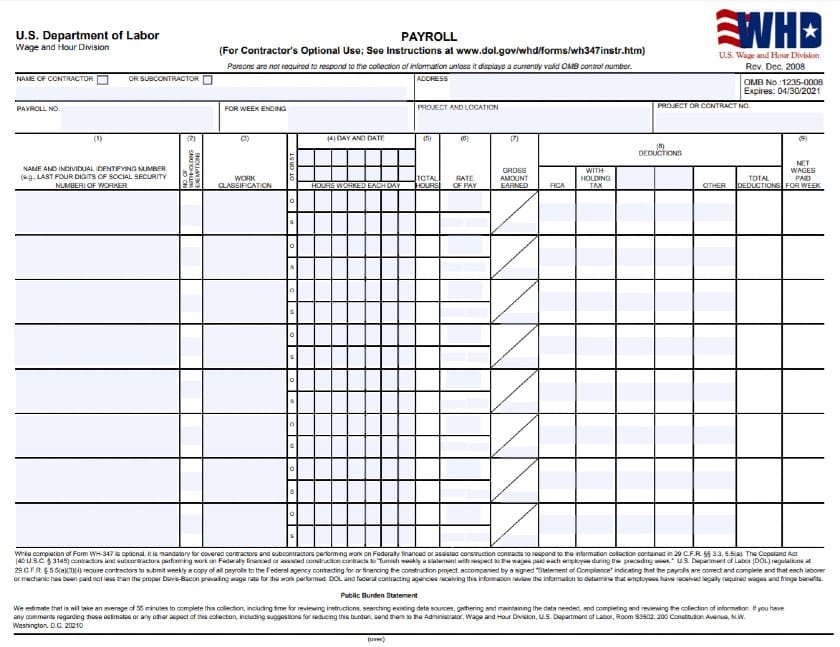

Form WH-347

This is the certified payroll form for employers who work on federal projects. This form is important as through this, your company would be able to ensure that the agency funding the project continues to pay.

In this payroll form, you would have to fill in every detail of each worker like their name, the number of hours worked, project name, wages earned, benefits paid, and so on.

Note: You would be required to submit an updated copy of this form to the agency each week.

Non-Tax Payroll Forms You Should Consider Using

In addition to the regulated and tax-related payroll forms that you would have to fill as employers, you should also use some of the non-tax-related payroll forms that will help you manage your internal processes better. Considering that these forms are not regulated, you can create your own non-tax payroll forms.

Three of the most common non-tax payroll forms that you should consider using are:

Direct Deposit Authorization Form

This non-tax payroll form is issued to those employees who want their paychecks electronically rather than through a paper check. This form is thus proof of you having their permission to pay them via direct deposit. These forms usually include a space for a routing and account number.

Time Sheet

Employees record the hours they work during each period on this document, which can then be used by you to verify the work time before issuing them paychecks.

Pay-stub

Pay-stub is a document that can be issued with each paycheck to show the breakdown of total earnings, deductions, etc. Some of the states of the USA require you to issue them mandatorily, while others do not. Often, the states who have made it mandatory also give clear instructions on the information that should be included and that which should not be included.

Tips to Avoid Payroll Mistakes

The three main tips that will help you in avoiding common payroll mistakes are:

- Pay attention to the deadlines for tax payments and filing. Depending on your business, you might have payroll tax payments due annually or quarterly.

- Ensure that you do not miscalculate overtime. What also needs to be noted is that some of the USA’s states have their own overtime regulations, in which case the rule of employee higher pay prevails. This also highlights how you should check your state’s labor laws well in advance to ensure that you are paying your employees fairly.

- Set aside dedicated time for payroll processing. This will help in preventing costly mistakes as well as unhappy workers.

How can Deskera Help your Business with Payroll Forms?

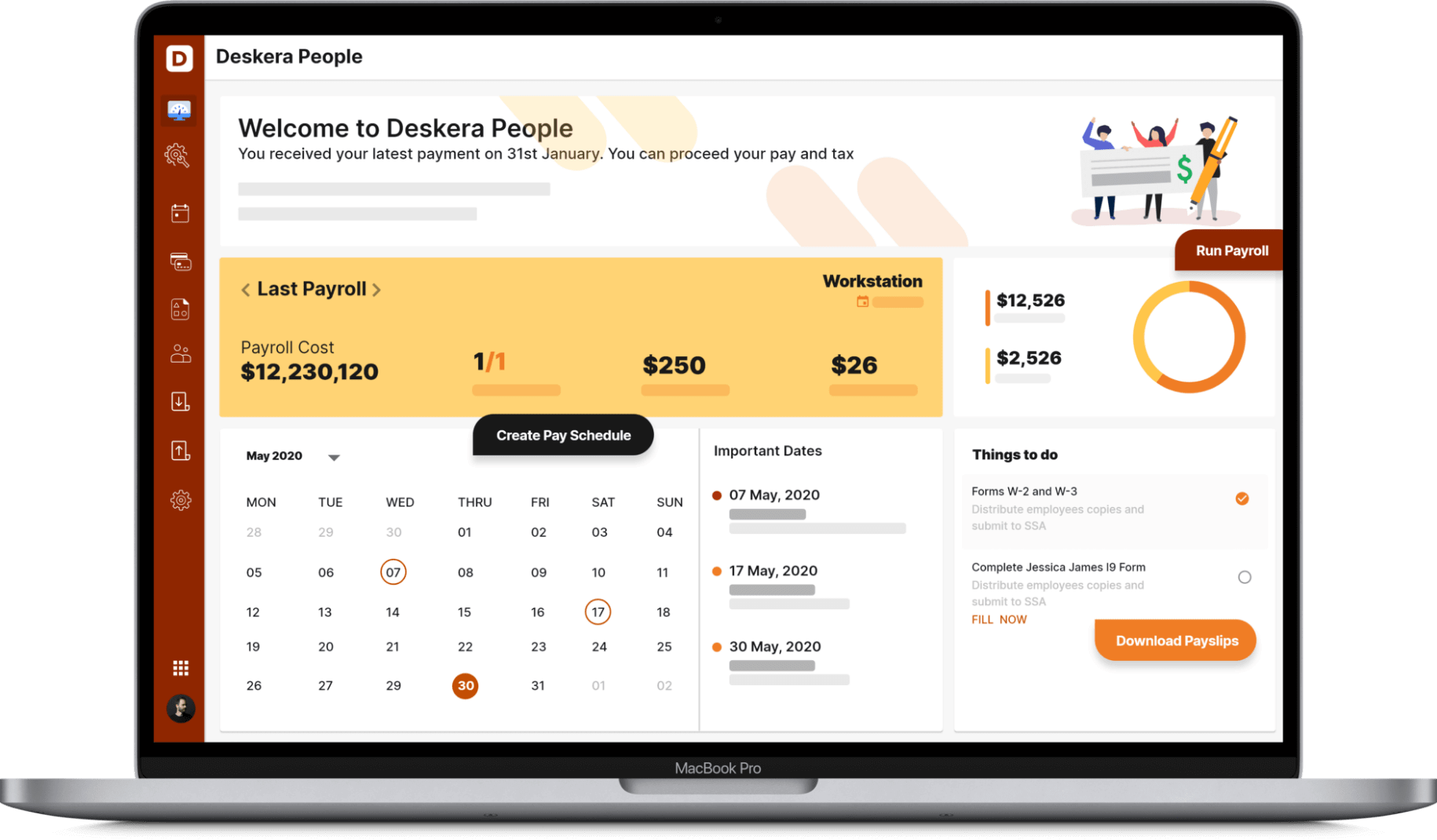

With Deskera People, you would be able to generate payroll and payslips within minutes and in compliance with the rules that apply to you as it comes with inbuilt statutory and tax compliances as well as payroll forms like W-2, W-4, 1099 of the USA.

Additionally, you would also be able to set up employee bonuses, voluntary deductions, and many such components with Deskera People. In fact, with the pay stub designer that uses the simple drag and drops mechanism for moving its shapes and sections, you would be able to custom design your pay stubs with your company’s logo, colors, and fonts.

Key Takeaways

While owning a business comes with several tasks as well as rewards on so many levels, one of the biggest tasks is ensuring that your employees are getting paid properly. However, this is where the pain also comes in the form of all the several necessary payroll forms that you would be required to fill out correctly.

If you make an error or fail to do so entirely, the IRS will penalize you with the federal charges typically being more expensive than the state ones. In fact, in the previous years, IRS implemented nearly 7 million payroll tax penalties, which amounted to $4.5 billion.

Thus, the 15 most important payroll forms that you should keep track of and file (as applicable) by their due dates are:

- Form I-9

- Form W-2

- Form W-3

- Form W-4

- Form W-9

- Form 940

- Form 941

- Form 941-X

- Form 944

- Schedule H (Form 1040)

- Form 1099

- Form 1096

- Form 1095-B

- Form 8027

- Form WH-347

In addition to these taxation based payroll forms, some of the non-tax payroll forms that should be filed by your company as applicable are:

- Direct deposit authorization form

- Time-sheet

- Pay-stub

By using cloud-based software like Deskera People, you would be able to automate several of your payroll processes, making them faster and more accurate while also helping you meet your due dates.

Related Articles