The biggest thrill wasn't in winning on Sunday but in meeting the payroll on Monday - Art Rooney

Do you feel calculating payroll accurately is a challenge? Particularly when you are a small business owner in US. Payroll for your organization doesn't need to be an impossible errand. Your ability lies in a business venture - not really in monitoring the different labor and tax laws that apply to every one of your workers.

Do you feel calculating payroll accurately is a challenge? Particularly when you are a small business owner in US. Payroll for your organization doesn't need to be an impossible errand. Your ability lies in a business venture - not really in monitoring the different labor and tax laws that apply to every one of your workers.

This guide will disclose how to do payroll manually. We'll likewise uncover different options you have on the off chance that manual payroll isn't your thing. There are two methods for running payroll as a small business in US as given below:

- Do payroll yourself

- Utilize a payroll service

- Hire an accountant

Do Payroll Yourself

Payroll taxes are government, state, and local taxes kept from a worker's paycheck by the business. They incorporate Income Tax, Social Security, and Medicare. To appropriately work out what your payroll tax ought to be, you need to know the current tax rates.

Processing payroll manually:

Doing your organization's payroll on your own costs less, however is tedious and inclined to mistakes. Assuming you're tax-savvy, you might have the option to adopt a Do it yourself strategy to pay your workers. However, considering all the finance botches you can make (and dreadful fines you can bring about), ensure you're totally OK with all that you want to do before you make a plunge. Here’s how you can start:

Step 1: Have all workers complete a W-4 form. To get compensated, workers need to finish Form W-4 to report their filing status and monitor individual recompenses. The more remittances or dependents workers have, the fewer payroll taxes are deducted from their checks each payroll interval. For each new worker you employ, you need to file a recently added team member report. Note that there is another adaptation of Form W-4, so this is the form you ought to have recently added team members fill out.

Step 2: Sign up for Employer Identification Numbers. Before you do payroll yourself, ensure you have your Employer Identification Number (EIN) prepared. A federal employer identification number regularly called an EIN, is a number the IRS uses to recognize and follow your business' payroll tax installments and forms. It resembles a Social Security number for your business.

An EIN is similar to an SSN for your business and is utilized by the IRS to recognize a business entity and any other individual who pays workers. In the event that you don't have an EIN, you can apply for one on the IRS site. You may likewise have to get a state EIN number; take a look at your state’s employer resources for additional subtleties.

Step 3: Register with the Electronic Federal Tax Payment System (EFTPS). A major piece of running payroll includes paying payroll taxes on schedule. The EFTPS is a free installment framework that allows you to do precisely that, by permitting you to pay both your federal payroll taxes and federal unemployment taxes right from your PC.

On the off chance that you're utilizing a payroll service, you can avoid this stage since they'll send in your tax payments for you.

Step 4: Pick your payroll plan. After you register for your Employer Identification Numbers, get insured (remember laborers' pay), and show working environment banners, you really want to add three significant dates to your schedule: worker compensation dates, tax payment due dates, and tax filing deadlines.

Step 5: Compute and keep income taxes. Whenever it's time to pay your workers, you have to figure out which government and state taxes to withhold from your workers' compensation by utilizing the IRS Withholding Calculator and your state's resource or a reliable paycheck calculator. You should likewise monitor both the worker and business part of taxes as you go.

Stage 6: Pay payroll taxes. Whenever it's an ideal opportunity to settle taxes, you have to present your government, state, and local tax deposits, as applicable.

Step 7: Document tax forms and employee W-2s. At last, make certain to send in your employer's federal tax return (normally each quarter) and any state or local returns, as appropriate. What's more to wrap things up, remember about setting up your yearly filings and W-2s toward the year's end.

Run payroll:

1. Work out your workers' gross wages: Gross wages are the aggregate sum of wages that your worker earns, before payroll deductions like retirement contributions, medical advantages, and payroll tax withholdings. How you compute your worker's gross wages relies upon in the event that your worker is an hourly or salaried worker.

For hourly workers, duplicate the complete hours they worked in the payroll interval by their time-based compensation. For salaried workers, divide their total annual compensation by the number of payroll intervals you have consistently.

Gross wages include:

- Overtime pay

- Sick and vacation pay

- Bonuses

- Commissions

- Tips

2. Compute your worker's pre-tax deductions and deduct them from gross wages. Pre-tax deductions are payroll deductions that your worker volunteers to keep from their check. General instances are as follows:

- Commuter benefits

- Medical advantages

- Disability protection

- Retirement contributions

These derivations are deducted from your worker's gross wages before payroll taxes are determined. That implies they bring down your worker's taxable pay.

3. Ascertain your workers ' federal tax withholdings and deduct them from their checks. Since you know your worker's taxable gross wages, the following stage is to ascertain and keep compulsory payroll taxes. These are the worker's part of payroll taxes. Afterward, you'll sort out your portion. There are two kinds of federal payroll taxes:

- Federal Insurance Contributions Act (FICA)

- Federal income tax (FIT)

4. State income tax and other state taxes. Contingent upon your state, you may likewise have to keep state or local income taxes from your worker's checks. A few states even expect that you keep extra state taxes. Check with your state's labor department to understand what you actually have to hold back.

5. Compute other voluntary and compulsory payroll deductions and deduct them from the paycheck. There are other voluntary and compulsory payroll deductions you might keep after taxes. An illustration of a voluntary post-tax payroll deduction is the worker's union fees, which they are choosing to pay. Compulsory payroll deductions are derivations you're expected to keep and that the worker doesn't pick into.

These are called wage garnishments and they're deducted from your worker's checks.

Garnishments can be for delinquent student loans, unpaid child support, credit card debt, unpaid medical bills, and unpaid taxes. The public authority will tell you in the event that your worker has a compensation garnishment. The notice will let you know when to begin and end the garnishments, the amount to keep, and where to send the funds.

Then, at that point, you'll deduct the pay garnishment from your worker's disposable earnings. Disposable income is your worker's income after obligatory payroll deductions yet before their voluntary deductions, similar to retirement commitments and health care coverage. The meaning of disposable earnings changes by state.

In certain states, medical coverage is important for dispensable earnings. Check with your state's payroll department for their meaning of dispensable earnings.

6. Pay workers and record payroll totals. After you've determined every worker's paycheck, it's an ideal opportunity to pay them. Assuming your state expects that you give a compensation stub (which most states do), make certain to incorporate a compensation stub with their paycheck. Additionally, make certain to keep an eye on your state's compensation stub prerequisites. A few states have severe compensation stub necessities.

This is additionally a fantastic opportunity to record the payroll totals for every worker. This proves to be useful some other time while you're covering payroll taxes and recording out your quarterly and yearly forms. For every worker record their:

- Wage garnishment totals

- Voluntary deductions

- FICA payroll taxes

- Federal, state, and local withholdings

- Gross pay

7. Compute federal employer payroll taxes. As a business, you pay two kinds of federal employer taxes:

- FUTA payroll tax

- FICA payroll taxes

You pay half of FICA payroll taxes, which is 7.65% of their gross compensation. The Social Security wage base applies to the two workers and employers. When your worker's wages surpass the compensation base, you don't have to make good on Social Security tax.

The Additional Medicare tax is just imposed on workers. That implies you're not liable for paying more Medicare tax after their wages surpass $200,000. All things considered, you'll keep on paying 1.45%. The other employer tax is FUTA tax, which goes towards government unemployment insurance. FUTA charge is 6% on every worker's first $7,000 in quite a while. After your worker earns $7,000, you never again settle FUTA tax.

Assuming you pay your state unemployment taxes on schedule, you'll get a 5.4% government tax break. This brings down the compelling FUTA tax rate to 0.6%. A few employers might need to pay more in FUTA tax assuming they are in a state with an outstanding federal loan balance. These businesses won't get the full 5.4% credit. Check with your state's finance organization to discover your FUTA tax rate.

8. Work out-state employer taxes. All states expect that you cover state unemployment tax (SUTA). This tax goes towards funding public unemployment programs. Each state has its own SUTA tax rate. In many states, the SUTA tax fluctuates in light of your worker's total wages and the number of workers you've laid off previously.

Ordinarily, when you register as another business in your state, you'll accept your SUTA tax rate. A few states expect that you cover additional employer taxes. Make certain to check with your state's labor department to discover what taxes are required.

9. Set money to the side to pay the public authority. After you've determined the worker's and employer's part of payroll taxes, it's an ideal opportunity to set those supports to the side. Afterward, you'll send the money to the IRS and state government, yet until further notice, move it to a reserve fund or payroll account for safekeeping.

Pay payroll tax

Payroll doesn't end when you hand your workers their checks. Recollect that money you set to the side for safekeeping? Presently it's an ideal opportunity to send those funds to the public authority.

Step 1: Cover government finance charges. As a business, you're expected to send both your worker's tax portions and your employer taxes to the IRS. Precisely when you pay your federal payroll taxes relies upon your deposit plan. There are four kinds of deposit plans:

- Quarterly

- Month to month

- Semi-week after week

- Next day

Your deposit plan depends on your payroll tax liability for the past quarter or look-back period. A look-back period is a 12-month period that closures on June 30. To cover your taxes, you should pay through EFT that you start through your bank or pay by means of the Electronic Federal Tax Payment System (EFTPS).

Month to month and semi-month to month investors are not generally permitted to mail in their tax payments.

There are penalties for paying late. For organizations on a semi-week-by-week or month-to-month deposit plan, penalties range somewhere in the range of 2% and 15% of the unpaid tax (contingent upon how late the deposit is). Assuming you're on a quarterly deposit schedule and fail to deposit payroll taxes or record form 941 by the cutoff time, you might face penalties of somewhere in the range of 5% and 25% of the absolute tax due.

For more data on late penalties, allude to IRS Notice 746.

Step 2: Settle FUTA tax. Luckily, the FUTA tax payment schedule is more direct. In the event that your FUTA tax is more than $500 in a quarter, you'll deposit the tax on the last day of the month after the quarter closes. In the event that your FUTA tax is under $500 in a quarter, you're not expected to put aside a tax deposit.

All things being equal, your unpaid tax liability turns over to the following quarter. When your total unpaid FUTA tax surpasses $500, you'll put aside a deposit for that quarter.

In the event that your FUTA tax never surpasses $500, you should pay the aggregate sum due by January 31 of every year. Once more, it's vital to pay your FUTA tax on schedule. For every month you’re late, the IRS will hit you with a penalty of 5% of the unpaid tax sum.

Step 3: Pay state, city, and local taxes. Very much like the IRS, each state has its own deposit plan for payroll taxes. Check with the appropriate state or local office in your city and state to discover when and how you're expected to deposit your state and local taxes. .Document quarterly and yearly tax forms

The last step to running payroll physically is to document the necessary tax forms with the bureaucratic and state government.

1. File Form 941: As a business, each quarter you're expected to finish IRS Form 941, Employer's Quarterly Federal Tax Return. This form lets the IRS know how much money you kept from your team’s paychecks and how much employer taxes you paid for the quarter. Most businesses are expected to document Form 941. The main exceptions are:

- Individuals who have gotten a notice that they're expected to file Form 944 rather than Form 941

- Organizations with occasional workers

- Individuals with household workers

- Organizations with farm workers

Form 941 is expected on the last day of the month following the finish of the quarter-so April 30, July 31, October 31, and January 31. Assuming you set aside online payroll tax deposits in full all through the quarter, then, at that point, you have 10 extra days to record the form. This changes the due date to the tenth of the subsequent month following the finish of the quarter. You can submit Form 941 on the web or download the form, finish it up carefully, and mail it to the IRS.

2. File Form 940: Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return is a yearly form that you use to report your FUTA tax payments to the IRS. You're expected to document Form 940 if both of these statements are valid:

- You paid no less than $1,500 in worker compensation during the year

- You had a worker work for at least 20 weeks during the year. (The 20 weeks don't need to be continuous.)

Form 940 is expected on January 31 and covers the past fiscal year. On the off chance that you made on-time FUTA tax payments, you have until February 10 to record the form. You can document Form 940 on the web or download the form and mail it to the proper location (see Form 940 guidelines for a list of postage information).

3. File Form W-2: The Form W-2 Wage and Tax Statement is a yearly form that you'll finish for every worker. It reports your worker's yearly wages, derivations, and tax withholdings. You send the copies to your workers, the Social Security Agency, and your state, city, or local tax department. Your W-2s should be put together by January 31 consistently.

There are a few options with regards to getting ready and recording your W-2s. You can buy the forms from an office supply store and complete, print, and mail them yourself.

Or then again you can utilize a web-based documenting service, which electronically files the forms with the correct agencies and sends copies to your workers. It's essential to document your W2s by the January 31 cutoff time. Any other way, you could end up facing penalties of between $50 per W2 (for W2s not over 30 days late) to $270 per W2 (for W2 filed after August 1 or not submitted at all).

Step 4: Record state tax forms: Dependent upon your state, you could in the same manner need to record quarterly or yearly tax forms declaring your payroll tax saved parts and payments. Yet again check with the fitting state/local agency for the nuances. Keep precise payroll records.

Under the Fair Labor Standards Act (FLSA), you're expected to keep specific payroll records available for every single nonexempt laborer, including:

- The time and day of the week the worker's week's worth of work begins

- The hours the worker works every day

- The complete hours worked by the worker every week's worth of work

- The worker's complete name, social security number, and birthdate (if younger than 19)

- The worker's location, including postal district

- The worker's gender

- The worker's job title

- Total additional time profit for every week's worth of work

- All worker wage adjustments (counting additions to or deductions from)

- Total wages paid to the worker each payroll interval

- The date of the payment and the payroll interval said installment covers

- The premise on which the worker's wages are paid (for instance, "$10 each hour" or "$500 each week")

- The worker's ordinary time-based compensation rate

- Total straight-time earned every normal business day as well as week's worth of work

Under the FLSA, you'll have to save this large number of records for quite some time.

As well as clutching your payroll records for quite some time, the IRS likewise expects businesses to track all employment taxes for a long time so make a point to keep those convenient too.

Utilize a Payroll Service

Going with a small business payroll supplier is low-to-medium cost and dependable. You can definitely relax on the off chance that the Do it yourself strategy isn't for you, payroll services make it simpler for entrepreneurs to pay their workers and return to their center business capacities. Most payroll services work out worker compensation and taxes naturally and send your payroll taxes and filings to the IRS and your state's tax department for you.

Very much like with the Do it yourself option above, you need to have every one of your workers complete a Form W-4 and find or register for Employer Identification Numbers.

Step 1: Choose a full-service payroll supplier. In the event that you don't know how to do payroll yourself, use payroll programming that decreases the gamble of blunders or fines.

Step 2: Add your workers. You want to set up your workers before you process their payroll. Adding workers you're paying for the first time is for the most part faster; on the off chance that you're changing to another finance supplier, you likewise need to add your present workers' year-to-date payroll data. Regardless, you for the most part need to enter worker names, addresses, Social Security numbers, and expense keeping data.

Step 3: Track hours worked and import them. The U.S. Division of Labor expects businesses to monitor wage records, for example, timecards for as long as two years. Certain states might have longer retention requirements; make certain to really take a look at the particular prerequisites in your state.

Stage 4: Process your first payroll run. Click Send and you're finished.

Step 5: Monitor your duty tax and filings. The IRS requires tax forms to be saved for at least three years. Certain states might have longer retention requirements; make certain to really take a look at the particular prerequisites in your state.

Hire an accountant

Employing an accountant is the most costly choice, yet it's dependable. To figure out how to do payroll yourself for your organization or utilize a payroll software, consider employing an accountant. A decent accountant can deal with your finance and ensure your tax payments and filings are dealt with.

How Deskera Can help You?

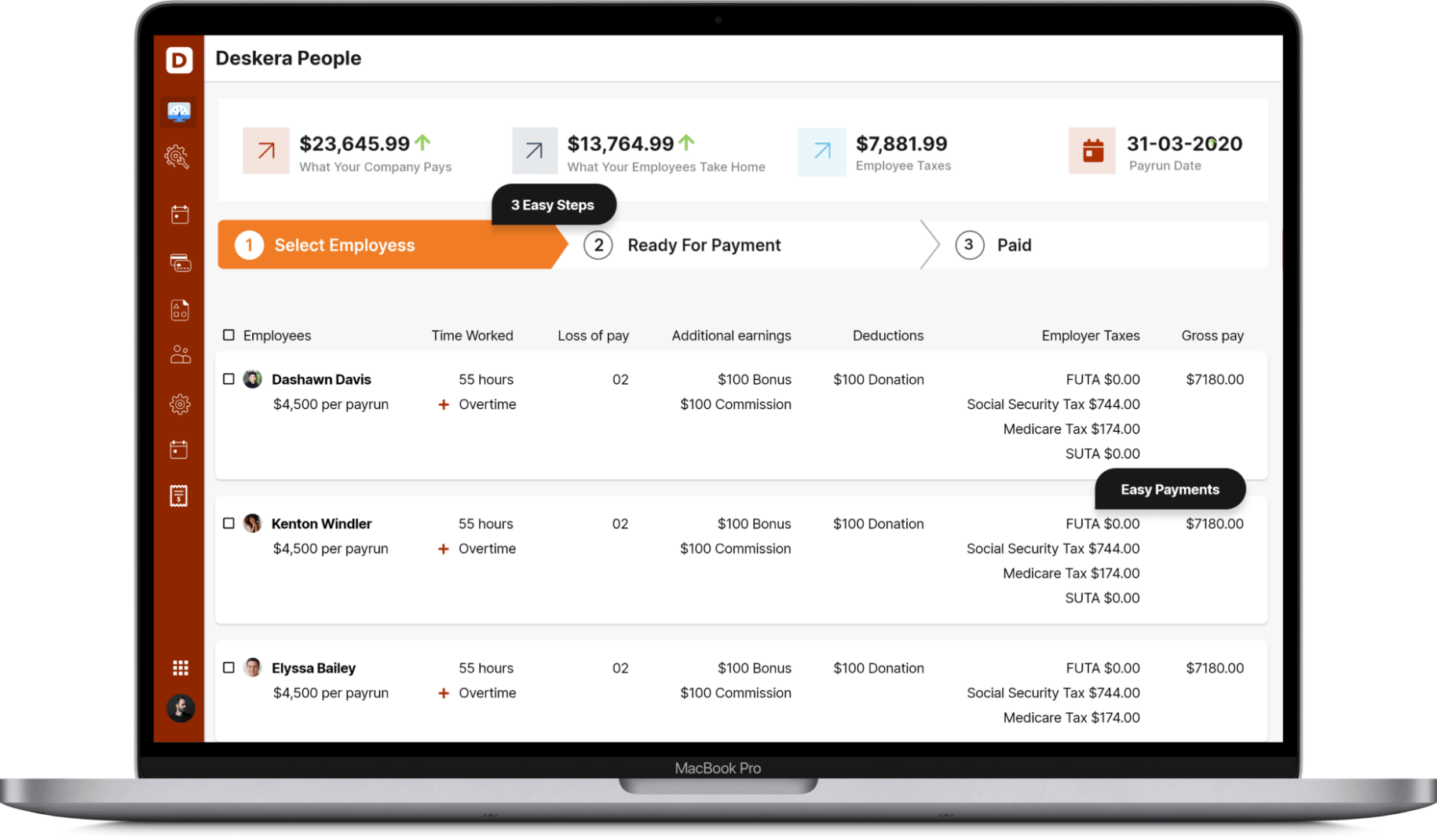

Deskera People helps digitize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements. Generate payroll and payslips in minutes with Deskera People. Employees can view their payslips, apply for time off, and file their claims and expenses online.

Conclusion

Regardless of whether you have a solitary worker or a huge staff, setting up an exact, solid payroll framework will forestall difficult issues for your workers and your business. As a business, you're legitimately expected to remember all workers for your payroll, regardless of whether they're assigned as full-time or part-time, excluded or nonexempt. You'll have to withhold all pertinent local, state, and government pay and finance charges from your workers' paychecks.

Key Takeaways

- Self-employed entities are answerable for settling their own taxes. Along these lines, assuming you utilize workers for hire, you don't have to run payroll or keep anything from their paychecks; all things considered, you would give them a paycheck for their full hourly or venture rate-and, from that point, they would deal with ascertaining how much tax they owe and paying those taxes to the appropriate authorities.

- The main free payroll handling arrangement is to do payroll manually. payroll programming, accountants, and clerks all charge an assistance cost. On the off chance that you don't have additional funds to spend on a finance service, the Do it yourself approach can set aside you some money.

Doing manual finance isn't the most direct undertaking, however, outfitted with the right information, time, and a strong number cruncher, you can do payroll for your independent venture yourself.

- A major piece of running payroll includes paying payroll taxes on schedule. The EFTPS is a free payment framework that allows you to do exactly that, by permitting you to pay both your government finance duties and bureaucratic unemployment taxes right from your PC.

Related articles