If you have been thinking of ways to pay your employees every week but are doubtful of it being of any help, then this post can guide you well. From the time one sets up a business and hires employees, payroll is one thing that takes the front seat. Employers must run through ways to make it a beneficial payroll procedure for the employees as well as for themselves.

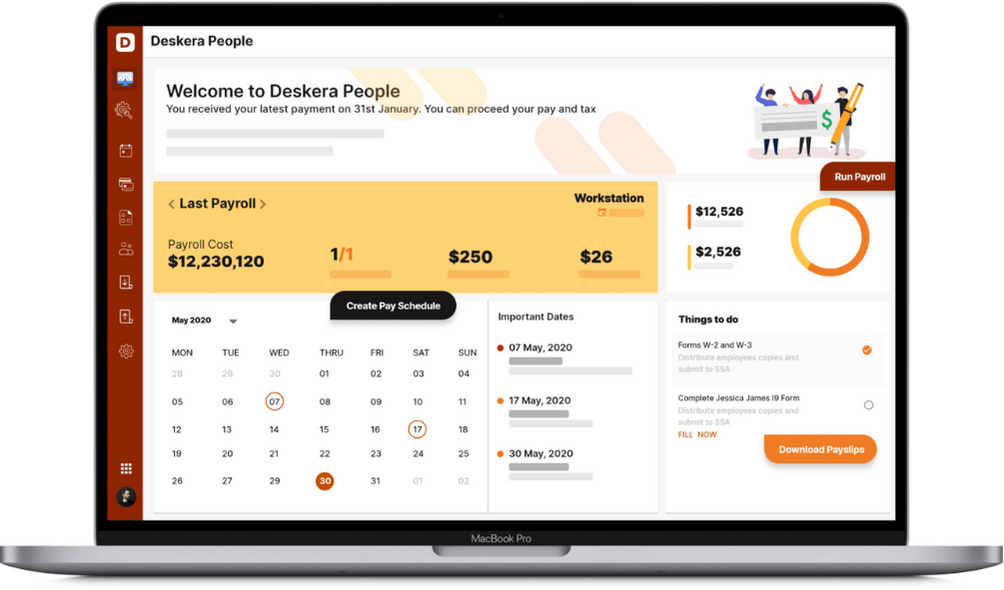

With Deskera’s Payroll system, you can always be sure of the timely payments owing to the system’s automation facility. With the built-in tax calculations, you can now process your payroll expeditiously.

Let us walk over the diverse advantages you shall experience while you begin to process your employees’ payroll on a weekly basis. Here's what we have for you:

Why should you pay Employees Every Week?

While most companies in the United States pay their employees biweekly or twice a month. Twice a month payment rolls out on the 15th and 30th of every month. The following paragraphs intend to convey why paying your employees every week can be fruitful.

Let’s check it here:

Retain the Existing talent pool

Your employees are your asset, and undoubtedly, you should seek measures to keep your staff’s morale high. Letting them feel valued and comfortable is your duty. Paying them every week will certainly boost their confidence and act as a motivating factor.

Do you want your employees to like working with you? Do you want to provide added value to those who work for you? Do you want to keep your finest employees working for the company with increased dedication? If that's the case, choosing weekly payroll is one of the simplest things you can do.

Employees will receive a weekly wage as a result of this. Consequently, individuals find it easier to plan their personal budgets and make bill payments. In a way, this irons out a lot of personal stuff for them. Taking care of the personal needs becomes much more easier for them when they know they will be receiving amounts soon.

Getting paid once a month can place a strain on many people's finances. You never know what kind of financial situation each employee has at home, so having the flexibility of money coming in each week could be more beneficial than you think. For some it could be paying school fees or caring for an ailing family member. Having financial stability can keep them hopeful in trying times.

In other words, paying more frequently goes a long way in retaining your pool of talented employees.

Simplify your budget

If you pay your employees every month, you have 12 or 13 paydays. Likewise, if you decide to pay them biweekly, you will have 26 paydays. This means you will have three pay periods in one month, twice a year. This twists net income on a monthly basis for organizations with payrolls that account for a substantial percentage of total expenses. Consequently, monthly financial statements are no longer as informative. One solution you may adopt to combat this is to make adjusting entries; however, wouldn’t you find that tedious?

You could pay your staff twice a month to avoid this problem entirely; the only hitch is the time-inefficient process of filling in the timesheets.

So, weekly payments will lead you to have 52 paydays a year. To sum up, you will have more frequent and smaller paydays. This increases the utility of monthly financial statements without requiring additional time for modifying entries.

Predictable Cash Flow

Having a weekly payment system has another advantage. You can cut your payroll debits in half by paying your staff every week rather than every other week. Cash flow is more predictable when smaller, more regular payments are made. Engaging in this process can be especially fruitful if your incoming cash flows are uneven.

Therefore, your weekly payments can make the process more regularized and help you organize cash flows.

Lets you have more Precise Timesheets

Your employees will certainly find it easy to submit weekly timesheets rather than biweekly or monthly ones. Additionally, it will be easier for you also to keep track of the hours spent working.

When your employees fill in the timesheets for a week, they are more likely to give a detailed and precise description of the work completed. This way, you can be sure of the recorded hours. Additionally, it can be beneficial to you in the case where you pay your contractors for the hours worked.

Become a Market Leader

If yours is a business that derives benefits and has greater cash flows weekly, then it becomes even more important to have weekly processing of the payments. Certain sectors like restaurant have cash flows that can be monitored weekly.

Such businesses can let you have a more frequent inflow of cash. With an increased cash flow, paying out weekly is certainly easier.

Employers who seek to enhance their employees' financial well-being produce stronger, longer-lasting businesses. So, rolling out weekly payments can help you ace the markets and keep your employees happy, too.

Cut Down Your Payroll Work with Automated Tool

With all the payroll hassles that tend to bother you, letting an automated system take over can do wonders. Deskera has one of the easiest payroll system for small businesses. Use it not only for your payroll processing but also when you want to have a built-in tax calculating system.

When your employees take leaves or go on vacation, you can be easily monitored through Deskera’s ‘Attendence’ tab, making it convenient for you to focus on your core activities.

How can Deskera Help You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible pay schedule, custom payroll components, detailed reports, customizable pay slip, and uploading expenses, creating new leave types, and more, it makes your work simple.

Key Takeaways

Payroll is one of the first things that comes to mind when starting a business and hiring staff. Employers must consider how to make payroll a worthwhile process for both their employees and themselves.

- Your workforce being the most valuable asset, you should take steps to keep their morale high. It is your responsibility to make them feel valued and at ease. Paying them weekly will undoubtedly enhance their confidence and serve as a motivator.

- Paying more frequently goes a long way in retaining your pool of talented employees

- You will be having more frequent and smaller paydays. This increases the utility of monthly financial statements without requiring additional time for modifying entries

- You can cut your payroll debits in half by paying your staff every week rather than every other week. Cash flow is more predictable when smaller, more regular payments are made

- When your employees fill in the timesheets for a week, they are more likely to give a detailed and precise description of the work completed. This way, you can be sure of the recorded hours

- Additionally, it can be beneficial to you in the case where you pay your contractors for hours worked

- Employers who seek to enhance their employees' financial well-being produce stronger, longer-lasting businesses. So, rolling out weekly payments can help you ace the markets and keep your employees happy, too

- Allowing an automated system to handle all of your payroll headaches can be extremely beneficial. Deskera's payroll system is one of the most user-friendly for small enterprises.

- It can be used not just for payroll processing but also for tax calculations.

- You may quickly manage your employees' absences or vacations with Deskera's 'Attendance' page, allowing you to concentrate on your primary responsibilities.

Related Articles