Agencies deliver training, employment, career, and business services, in addition to administering the unemployment insurance, veteran reemployment, and labor market information programs.

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

What is ETA 9061 form?

This form is used along with Form 8850 in order to help state workforce agencies (SWAs) determine eligibility for the WOTC program. The form has to be completed on behalf of the applicant by

(a) employer, a participating agency, the SWA

(b) the applicant directly

The form has to be signed by the individual completing the form. The form has to be used by the employers seeking WOTC certification.

Table of Contents

- What is ETA 9061 form?

- What is WOTC?

- Types of workers who are eligible for WOTC

- Required Certification Forms For the WOTC

- IRS form 8850

- IRS form 9061

- What are the instructions to file form 9061?

- What are the Pros and Cons of the WOTC?

- Claiming the Work Opportunity Tax Credit (WOTC)

- Key Takeaways

What is WOTC?

The Work Opportunity Tax Credit is a federal tax credit available to employers in case they hire individuals from specific targeted groups. The employee groups are those who face difficulty in finding employment. The tax credit aims to make jobs easily accessible to specific segments of the workforce.

Types of workers who are eligible for WOTC

According to the IRS, targeted groups are as follows:

- There are individuals who get temporary assistance for needy families (TANF) benefits under Part A, Title IV of the Social Security Act. Such individuals are included in targeted groups

- Qualified veterans, including those receiving SNAP (supplemental nutrition assistance program) benefits, those who are unemployed, and those who are unemployed and entitled to compensation from a service-connected disability

- Qualified ex-felons

- Community residents with at least 18 age and under 40 and live in an empowerment zone, renewal community, or enterprise community,

- People with physical or mental disabilities who have completed their rehabilitative services and have been referred for work

- Summer youth employees

- Supplemental nutrition assistance program (SNAP) recipients

- Supplemental Security Income (SSI) recipients

- Long-term family assistance recipients

- Qualified long-term unemployment recipients

Required Certification Forms For the WOTC

Certification forms are required to verify that a potential employee is a member of a targeted group to claim the work opportunity tax credit. For this, you need to fill out forms with information from both the employee and the employer.

IRS form 8850

Form 8850 is one such form that is required for the certification request for the work opportunity credit. Page 1 needs to be filled out by the employee by providing details such as name, address, social security number, age, and certification status. Page 2 needs to be filled out by the employer and details such as contact information, the date employee was offered the job, the hiring date of the employee, and the working date of the employee.

Form 8850 needs to be signed by both the employer and the employee before the employer files the form with the employer’s state workforce agency. This needs to be done within 28 days after the employee starts working.

IRS form 9061

There is another form 9061 that needs to be completed by the employee and needs to be verified by the employer that the information mentioned is correct using supporting documents. The documents that may be required include a copy of the employee’s birth certificate, military discharge papers, records of receiving SNAP, or SSI benefits, depending on the targeted group they belong to.

In case the employee has already been conditionally certified, which implies that they have been tentatively identified as belonging to a target group, then the employer can complete DOL Form 9062 instead. The employer’s state workforce agency is required to make conditional certification decisions, and Form 9062 acts as an official record of pre-certification. Form 9061 or 9062 needs to be submitted by the employer after they send in Form 8850.

What are the instructions to file form 9061?

Let’s take a look at the instructions to file form 9061:

Boxes 1 and 2 are for agency use only.

Boxes 3-5. You are required to enter employer information including the name, address including ZIP code, telephone number, and employer Federal ID number (EIN) of the employer requesting the certification for the WOTC. You are not supposed to enter information related to the employer’s representative if any.

Boxes 6-11. Here you are required to enter the information about the applicant including the applicant’s name and social security number as displayed on the applicant’s social security card. In Box 8, you are required to specify whether the applicant previously worked for the employer and if yes, you need to mention the last date or approximate last date of employment. Through this information, ‘48-hour’ reviewer can easily eliminate requests for former employees and issue denials to these requests.

Boxes 12-23. Here you are required to enter applicant characteristics. You need to go through the questions carefully, and answer each question, and provide additional information where required.

Box 24 Sources to Document Eligibility. Here the applicant or employer is requested to provide documentary evidence to support the YES answers in Boxes 12 - 23. You need to list or describe the documentary evidence pertaining to the ICF that will be provided to the SWA. You need to list or describe the documentary evidence that is related to the ICF that will be provided to the SWA. Specify in parentheses next to each document listed whether the document is attached(A) or forthcoming(F).

Box 25 (a) Signature. The person who completes the form has to sign the signature block.

Box 25 (b) Signature Options (a) Employer or Authorized Representative (b)SWA staff (c) Participating Agency staff (d) Applicant (if the applicant is a minor, the parent or guardian must sign)

Box 26 Date. You need to mention the month, day, and year when the form was completed.

What are the Pros and Cons of the WOTC?

With the help of tax credits, businesses can reduce their tax liability which can be quite helpful in the long run. This implies work opportunity tax credit or any other type of business tax credit.

One of the most important benefits of the credit is increasing diversity in hiring. With the help of this tax credit, finding work for certain groups becomes much easier.

On the other hand, the biggest difficulty for employers is meeting the certification and filing requirements. Although the paperwork is not complicated, employers need to make sure that they are filing forms correctly and on time in order to pre-screen and certify workers initially. Also, accurate records of the employee’s hours and wages earned in the first year of work need to be kept. All this is done to claim the credit.

Claiming the Work Opportunity Tax Credit (WOTC)

After an employee gets certified, employers can claim the work opportunity tax credit on their income tax returns. For this, you need to file IRS Form 5884, Work Opportunity Credit, IRS Form 3800, General Business Credit, IRS Form 1040, 1040-SR, 1041, 1120, etc.

In order to calculate the credit, employers need to determine the number of hours worked by the employee and their wages for the first year of employment. The limit of credit an employer can claim is based on the business income tax or Social Security tax owed.

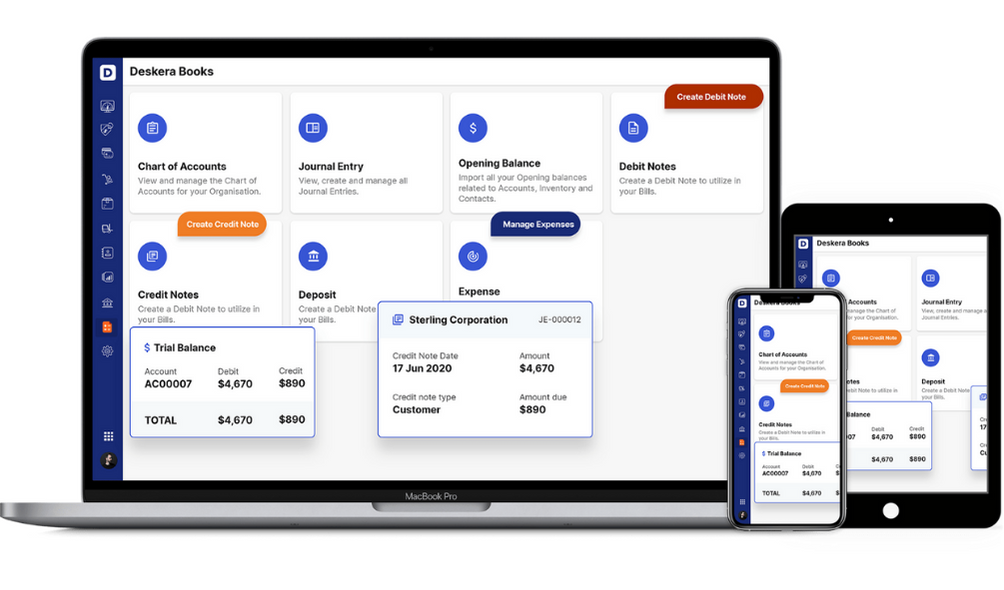

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- The Work Opportunity Tax Credit is a federal tax credit available to employers in case they hire individuals from specific targeted groups

- There are some specific targeted groups who are eligible for WOTC including qualified veterans, qualified ex-felons, summer youth employees, qualified long-term unemployed recipients

- Certification forms are required to verify that a potential employee is a member of a targeted group to claim the work opportunity tax credit

- IRS form 8850 and IRS form 9061 are required to verify that a potential employee is a member of a targeted group to claim the work opportunity tax credit

- Form 8850 needs to be signed by both the employer and the employee before the employer files the form with the employer’s state workforce agency

- IRS form 9061 is used along with Form 8850 in order to help state workforce agencies (SWAs determine eligibility for the WOTC program

- Form 9061 has to be used by the employers seeking WOTC certification

- There are various advantages and disadvantages of WOTC

- One of the major advantages of using tax credits is that it helps in reducing tax liability

- It becomes difficult for the employers to meet the certification and filing requirements

- After an employee gets certified, employers can claim the work opportunity tax credit on their income tax returns. For this, you need to file IRS Form 5884, Work Opportunity Credit, IRS Form 3800, General Business Credit, IRS Form 1040, 1040-SR, 1041, 1120, etc.

- In order to calculate the credit, employers need to determine the number of hours worked by the employee and their wages for the first year of employment

Related Articles