Before we get into the nuances of the form and its applications, it is significant to understand the business setup that requires such formalities.

First off, let’s not keep you waiting— if you want your business not to pay taxes as the traditional corporation, as C Corporation does, you will need to understand the nuances of 1120S.

Filing your business as an S Corporation allows you a special tax status with the IRS and benefits from certain tax benefits.

Along with the tax benefits come extended paperwork compared to a C corporation, and it is also heavily scrutinized by the IRS. That is because S Corporation status helps you enjoy tax benefits by cutting down double taxation— once at the corporate level and again as an individual shareholder.

Filing an 1120s is therefore crucial for the IRS to take a report of dividends, losses, and income of the shareholders of the company.

Read on to understand the intricacies of the form and the business type.

Table of Contents

- What is the 1120-S form?

- What is an S Corporation?

- Form 1120 and Form 1120-S

- How to Form an S Corporation?

- Is S Corporation best suited for your business?

- How to distinguish C and S Corporations?

- How to fill form 1120-S?

- Who needs to file 1120-S?

- Frequently asked questions on 1120-S and S Corporations?

- What does the S Corporations do with their surplus funds?

- Can I specifically allocate assets to a shareholder?

- Does S Corporation require the distribution of all profits?

- How to transfer Life Insurance without giving up the tax benefit?

- How Can Deskera Assist You?

- Key Takeaways

What is the 1120-S form?

The Form 1120-S in the United States is a tax form used to report S Corporation stakeholders' income, losses, and dividends. Precisely, it is the filing of an income tax return for an S Corporation.

This form is only used if the firm has already filed IRS Form 2553 and the IRS has accepted the company's S Corporation election.

Because S Corporations are pass-through organisations, they are not subject to federal income taxes. On the other hand, shareholders disclose the corporation's profits on their personal tax returns.

Even though S Corporations are exempt from corporate taxes, Form 1120-S is still required since it is submitted with an accompanying Schedule K-1 that tells the IRS how much of the corporation each shareholder owns.

The IRS uses the Schedule K-1 form to figure out what taxes each business owner must pay or receive a refund on their personal tax return. Certain tax benefits may not be available to the S Corporation and its stakeholders if the 1120-S and Schedule K-1 are not accurate.

What is an S Corporation?

An S Corporation chooses to be regarded as a pass-through organisation for federal tax purposes by filing an S Corporation election with the Internal Revenue Service (IRS). S Corporations are taxed under the Internal Revenue Code's (IRC) Subchapter S, which is where their name comes from (Subchapter S Corporation).

S Corporations are accounting entities, which means that before the money is distributed to individual shareholders, the S Corporation calculates income and deductions at the corporate level.

An S Corporation hands you legal safeguards for your personal assets that are separate from the company's assets. S Corporation ownership interests are simple to transfer to new owners without generating significant tax penalties or dissolving the firm.

As the owner/shareholder of an S Corporation, you can work for the company and receive a wage. You can pay yourself dividends from the S Corporation or distributions that usually are taxed at a lower rate than the employee's compensation in addition to your salary. As long as you characterise your wage and dividends/distributions in an acceptable manner, this helps you lower your self-employment tax liability.

Ownership shares in S Corporations are simple to transfer to new owners without incurring significant tax repercussions or causing the corporation to dissolve.

The stakeholders are protected from responsibility in the same way that shareholders in a C corporation are. Personal assets of S Corporation shareholders, such as personal bank accounts, cannot be confiscated to satisfy business debts.

Form 1120 and Form 1120-S

S Corporations must submit Form 1120-S for federal taxes, whereas C Corps must file Form 1120. Although both S Corporations and C Corps are categorised aS Corporations, they differ in various ways and offer significant benefits and drawbacks to business owners.

C Corporations, unlike S Corporations, are not pass-through entities. C Corporations must file Form 1120 with the Internal Revenue Service and pay federal income tax at the corporation level.

Shareholders in a C Corp must pay personal income tax on both the corporation's salary and dividends received.

The most crucial disadvantage of forming a C Corp rather than an S Corporation is frequently perceived as double taxation. Despite the double taxation, C Corporations provide stockholders with several benefits:

- C Corporations can include an unlimited number of shareholders.

- Shareholders do not have to be citizens or legal residents of the United States.

- C corporations can have multiple stock classes.

- C Corporations pay a lower minimum tax rate.

- C Corporations have an easier time obtaining outside capital.

How to Form an S Corporation?

Simply put, you can go either of the two ways:

- Form an LLC and elect S Corporation tax status from the IRS while requesting your employee identification number (EIN)

- Establish a corporation and choose S Corporation status from IRS.

However, starting with an S Corporation status may not be a wise choice as an S Corporation invalidates all privileges of a corporation.

Prerequisites for being an S Corporation:

-Being a domestic company,

-Having no more than 100 shareholders, and

-Issuing only one class of stock

-Individuals, trusts, and estates are the only types of shareholders permitted; partnerships, companies, and foreign stockholders are not permitted.

As mentioned above, small businesS Corporations filling out Form 2553 to the Internal Revenue Service can make eligible businesses enjoy the S Corporation status.

Financial institutions and insurance companies are among the businesses that are not eligible.

Is S Corporation best suited for your business?

S Corporation has shared and is governed like a corporation, with the same directors, officials, and shareholders as its C corporation counterparts. Here are some parameters that could help you make an informed decision.

Flexible Ownership

If you want to have limited ownership, an S Corporation is the way. These companies are limited to 100 stockholders, all of whom must be citizens of the United States. There are no restrictions on the categories of shareholders who can own stock. If you want to avoid being ranked, an S Corporation is the way to go.

An S Corporation's shares can be freely transferred without incurring tax repercussions. When an ownership stake is transferred, the S Corporation does not need to make any adjustments to the property basis or follow any sophisticated accounting standards.

Heightened Credibility

Because the owners have made a formal commitment to their firm, operating as an S Corporation may assist a fledgling business build credibility with potential customers, workers, vendors, and partners.

Outside Investors Will Find It Less Attractive

Money is required to expand your business. The standard corporate structure will be better if you require venture financing. The pass-through tax structure and a 75-shareholder limit will turn off venture capitalists.

Meetings of the S Corporation are required

Your status remains that of a corporation, which means you must hold regular meetings and keep company minutes. Consider how much more time it takes to run an S Corporation. Today's small businesses prefer to form a Limited Liability Company (LLC) because they are easier to manage.

Restricted ownership of stocks

Although an S Corporation can have voting and non-voting shares, it can only have one class of stock. As a result, distinct classes of investors cannot be granted different dividends or distribution rights.

In addition, the number of stockholders is limited. Foreign ownership is forbidden, as is ownership by certain types of trusts and other entities (for example, a non-resident alien cannot be an owner).

No flexibility in fund allocation

In terms of allocating revenue and loss, there is less freedom. due to the one-class-of-stock constraint, an S Corporation cannot efficiently apportion losses or income to specific shareholders.

Unlike a partnership or LLC, where the allocation can be established in the operating agreement, the allocation of income and loss is governed by stock ownership.

In addition, maintaining the required accumulated adjustment account can be time-consuming, necessitating the assistance of an accountant. (Note: C corporation shareholders typically cannot deduct any losses unless their stock is worthless or sold at a loss.)

How to distinguish C and S Corporations?

Both S and C corporations must submit articles of formation and have regular meetings with complete minutes for directors and stockholders.

Shareholders must be able to vote on significant corporate decisions such as management restructuring, mergers and acquisitions, and new investments during these meetings.

- Finally, the legal and accounting costs of forming an S Corporation and a C corporation are similar.

- S Corporations issue one class of stock, whereas C corporations can issue multiple classes.

- It may be argued that this makes it more difficult for a corporation to raise finance.

How to fill form 1120-S?

S Corporations can usually file their Form 1120-S online and all associated forms, schedules, statements, and attachments. The following are examples of possible attachments:

- Form 7004 - Automatic extension of time to file

- Forms 940, 941, and 944- Employment tax returns

- Form 1099- Miscellaneous income

The 15th day of the third month after the tax year is usually the deadline for filing Form 1120-S. Any company that follows the traditional calendar year must file by March 15th.

To fill out Form 1120-S correctly, you'll need the following information:

- The foundation date of the corporation

- The list of products and services

- EIN, a business activity code

- Date of receiving the S Corporation status

- Balance sheet including profit and loss statement

- Methodology of accounting

- Any payments made under a separate contract

- Form 1120-S must be signed and dated by the president or another corporate officer authorized to sign tax returns for the IRS to accept it

Depending on the size of the organization and the type of the firm, IRS Form 1120-S might be quite difficult to complete. Before sending tax paperwork to the IRS, it is essential to contact a tax lawyer or a licensed accountant.

The Schedule K-1 is a supplement to Form 1120-S or Form 1065. The Schedule K-1 form, which must be completed for each shareholder, identifies the percentage of firm shares owned by each individual shareholder for the tax year. Form 1065 is used instead of Form 1120-S for partnerships.

Who needs to file 1120-S?

The S Corporation's tax return is Form 1120-S. S-Corp profits, losses, deductions, and credits must be reported to the IRS, even though they do not pay federal income tax. The IRS will look at the business tax return records to see how each shareholder will be taxed.

If a corporation elects to be an S Corporation by completing Form 2553 and the Internal Revenue Service (IRS) accepts the election, it must file Form 1120-S.

The IRS administers how much profit and loss should be attributed to an individual shareholder established on the ownership percentage detailed on Form 1120-S.

Profit and loss are reasonably simple to compute if the shareholder does not notice a change in this percentage during the year. However, profit and loss must be pro-rata per share if the individual purchases new shares, sells or transfers any holdings during the year.

Frequently asked questions on 1120-S and S Corporations?

What does the S Corporations do with their surplus funds?

Owners of S Corporations can withdraw money out of the company in various ways. Wages, distributions, loans, and reimbursement for company expenses are examples of these.

Can I specifically allocate assets to a shareholder?

In the case of an S Corporation, special allocations are not permissible. On the other hand, special allocations are authorised in the case of LLCs and other partnership-taxed businesses.

Ordinary income and loss and capital gain and loss can be assigned to LLC members who will profit from them (subject to certain conditions). All elements of income and deduction must be apportioned on a pro-rata basis in the case of an S Corporation.

Does S Corporation require the distribution of all profits?

An S Corporation's profits must be distributed to its stockholders for tax purposes. On the other hand, The S Corporation is free to do whatever it wants with its profits. As a result, the company can distribute gains to shareholders, keep them as retained earnings, or do both.

How to transfer Life Insurance without giving up the tax benefit?

Many companies buy life insurance for various reasons, including providing cash for buy-sell agreements and "key man" insurance. Most taxpayers are aware that life insurance proceeds to the beneficiary are tax-free. There is an exception when a life insurance policy has been transferred for value.

When the need for S Corporation-owned life insurance is no longer present, a distribution of the policy often constitutes a "transfer for value," effectively eliminating the tax-free nature of the proceeds. In most cases, this trap does not exist in the LLC. In most cases, an LLC can deliver a life insurance policy to the insured member without sacrificing this valuable tax benefit.

How Can Deskera Assist You?

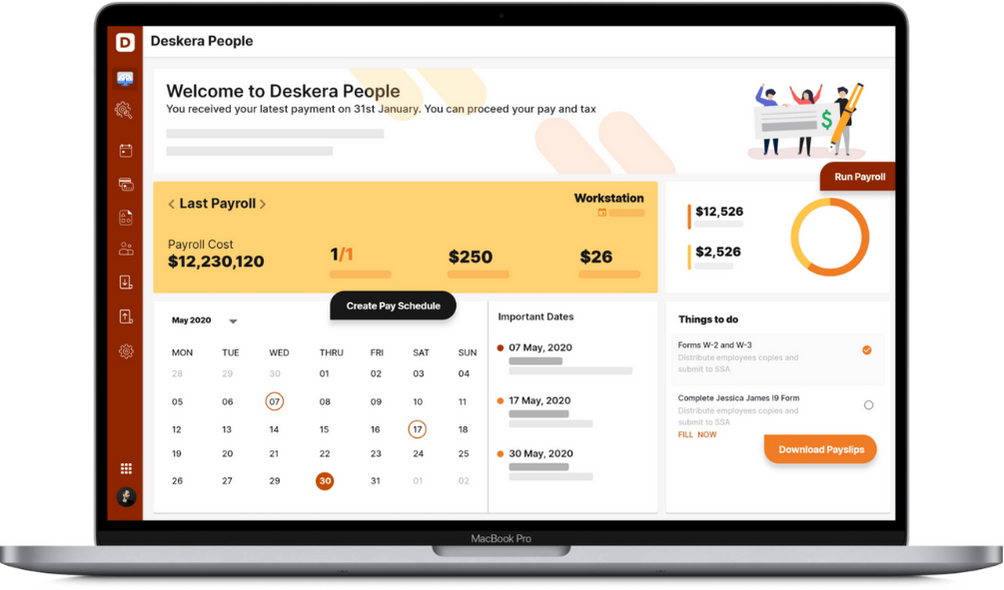

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- The IRS administers how much profit and loss should be attributed to an individual shareholder established on the ownership percentage detailed on Form 1120-S.

- An S Corporation chooses to be regarded as a pass-through organization for federal tax purposes by filing an S Corporation election with the Internal Revenue Service (IRS). S Corporations are taxed under the Internal Revenue Code's (IRC) Subchapter S, which is where their name comes from (Subchapter S Corporation).

- S Corporations must file Form 1120-S. This company structure permits a corporation to pass through corporate income, losses, deductions, and credits to shareholders for federal tax purposes.

- 1120-S can be filled out online and other schedules and attachments by visiting the IRS's official website. Depending on the size of the organization and the type of the firm, IRS Form 1120-S might be quite difficult to complete. Before sending tax paperwork to the IRS, it is essential to contact a tax lawyer or a licensed accountant

Related Articles