Formerly known as the Bombay Shops and Establishment Act 1948, Gujarat Shops and Establishment Act came into effect on 11th January, 1949. It is based on the report provided by Shantilal Shah’s Committee.

The purpose of this Act as mentioned in the Preamble is to amend and regulate the laws related to work conditions and employment in shops, residential hotels, commercial establishments, restaurants, theatres, eating houses, and other establishments.

Table of Contents

- Registration of Establishment

- Application for renewal of certificate

- Change in particulars submitted

- Detailed Provisions on Shops and Establishments

- Provisions related to Employees

- Enforcement and Inspections and Penalties

- Few Miscellaneous Provisions

- How Can Deskera Assist You?

- Key Takeaways

Registration of Establishment

According to section 2 (8), an establishment is defined as a shop, residential hotel, commercial establishment, restaurant, eating house, theatre, or other places of public amusement or entertainment to which this act applies. It also includes other establishments which are declared by the state government.

Section 7 of the act is related to the registration of establishment, while Section 7(1) is related to the application format and content.

Section 7(1) stresses the fact that every employer of the establishment shall within 30 days of commencement of the act, commencement of the section, or commencement of the work of the establishment, will have to send to the Inspector of the local area concerned a statement, in a prescribed form, along with the prescribed fees containing:

- The name of the employer and the manager, if any;

- The postal address of the establishment;

- The name, if any, of the establishment;

- The category of the establishment, i.e., whether it is a shop, commercial establishment, residential hotel, restaurant, eating house, theatre, or other places of public amusement or entertainment; and

- Any other particulars that may be prescribed

If the inspector is satisfied with the accuracy of the statement, he will register the establishment and issue a registration certificate to the employer.

In case there is any discrepancy in the opinion of the Inspector and the employer related to the category of the establishment, section 7 (3) of the act deals with this.

Application for renewal of certificate

For provisions pertaining to the renewal of the certificate, section 7(6) deals with it. On receiving the application for the renewal, the inspector needs to confirm the details mentioned in the application. If the details are correct, the inspector will have to renew the registration certificate in the prescribed form. The certificate will be valid for the period for which it has been renewed unless it gets cancelled before the period gets expired.

Change in particulars submitted

Section 8 of the act is related to the procedure of notifying any change in the particulars submitted to the inspector

Section 8 of the act deals with the procedure of notifying any change in the particulars of the application submitted to the inspector. The section says that –

“It shall be the duty of an employer to notify the Inspector, in the prescribed form. (Any change in the particulars contained in the statement submitted under section 7 within such period, after the change has taken place, as the State Government may be prescribed in respect of any establishment or class of establishments). The Inspector shall, on receiving such notice and the prescribed fees and on being satisfied about its correctness, make the change in the register of establishments in accordance with such notice and shall amend the registration certificate or issue a fresh registration certificate, if necessary”

Detailed Provisions on Shops and Establishments

Besides providing a procedure for registration, renewal and closure, the Gujarat Shops and Establishment act also depicts provisions related to the operations of such establishments.

That is why the act depicts the timing for opening, closing, and interval periods for shops and commercial establishments. According to this act, shops dealing wholly with milk, eggs, meat, and other farm and dairy products should not be opened before 5 am, while shops other than those wholly dealing with farm and dairy products should not be opened before 7:30 am.

The closing timing of the shops has also been specified. It depicts that no shops except the ones dealing with paan and beedi will remain open after 8:30 pm, while paan-beedi shops are allowed to remain open till 11 at the night.

According to this act, hawking is prohibited before and after closing hours of shops. Commercial establishments can remain open from 8:30 in the morning to 8:30 at the night.

Provisions related to Employees

According to this act, provisions on the cleanliness of premises and health and safety of the employees have been laid down, taking a cue from the Factories Act.

Identity cards need to be provided to the employees in major establishments such as restaurants and hotels.

According to the section 25 of the act, the identity cards need to have the following particulars prescribed:

- The name of the employer;

- The name, if any, and the postal address, of the establishment;

- The name and age of the employee;

- The hours of work, the interval for rest and holiday of the employee;

- The signature (with date) of the employer or manager.

Section 35 to Section 38C of the act deals with the provisions related to Payment of Wages and Paid Leaves to the employees.

Leave provisions given to the employees according to the Gujarat Shops and Establishment Act 1948, are as follows:

Quantum per year: Out of 240 working days, 21 days are given as privileged leave or earned leave. There are no casual leaves or sick leaves.

Entitlement: You get 5 days as privileged or earned leave after 3 months on completion of 60 working days in that period

Accumulation: 42 days as privileged or earned leaves

Computation: Prefixed or suffixed holidays after the leave period will not be considered as leave. Holidays or Sundays falling between the leave period of leave will be counted as leave.

Enforcement and Inspections and Penalties

According to the act, the state has the power to enforce provisions and inspections of the shops and establishments. The state has the power to appoint an inspector under this act and this inspector has the power to inspect the shops and establishments occasionally in order to check if the rules are being obeyed by the employers or not.

If the rules are offended, then penalties will be provided to the offenders, according to this act.

Few Miscellaneous Provisions

Some miscellaneous provisions have also been provided to ensure the smooth functioning of the shops and establishments.

Section 62 deals with the maintenance of registers and records and the display of notices as per the prescribed rules. Section 63 deals with wages for overtime work in the different categories of establishments. It also determines the limit of hours of work for shops and commercial establishments, residential hotels, restaurants, eating-houses theatres or other places of public amusements or entertainments and also for any other establishment.

Section 65 restricts double employment on a holiday or during leave as per the Act. Section 66 is related to the notice of termination of service. Section 69 preserves the rights and privileges under other laws, contracts, customs, usage or any award, settlement, etc., if such rights and privileges are more favourable. Section 70 is related to the extensions of the Factories Act to all persons employed in and in connexion with a factory, although the Factories Act did not apply to those non-workers.

How Can Deskera Assist You?

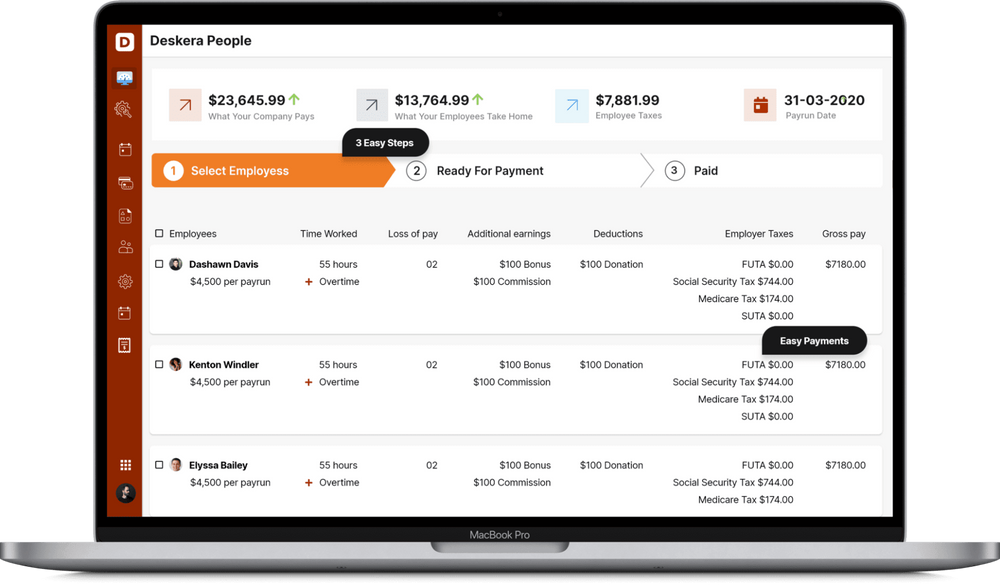

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- Gujarat Shops and Establishment Act came into effect on 11th January, 1949

- The aim of this act is to amend and regulate the laws related to work conditions and employment in all types of establishments

- According to the section 2 (8), an establishment is defined as a shop, commercial establishment, residential hotel, restaurant, eating house, theatre, or other places of public amusement or entertainment to which this Act applies

- Section 7 of the act is related to the registration of establishment, while Section 7(1) is related to the application format and content

- Section 7 (6) deals with provisions related to the renewal of the certificate

- Besides providing a procedure for registration, renewal and closure, the Gujarat Shops and Establishment act also depicts provisions related to the operations of such establishments

- According to the act, the state has the power to enforce provisions and inspections of the shops and establishments

Related Tasks