You know how the age-old adage goes - When life serves you lemons, make lemonades, sell lemonades, buy more lemons, make more lemonades, sell more lemonades, and make a big lemonade stand, etc.

Warren Buffett, a financier, philanthropist, and one of the wealthiest businessmen in the world generates sustainable and long-term growth year on year by following one secret – to reinvest profits in business. This requires dedication, concentration, and a clear plan.

Reinvesting profits is like planting a tree and enjoying its fruit, shades, and flowers in the long run. Like Buffett, your innovative ideas have led you to start a business and become your boss. To grow your business in the next few years, you need a strategy to make it happen. If your business is making more money than you need to spend, you must reinvest profits after paying off all expenses, including yourself.

Table of Contents

- Why Reinvest Profits

- Reinvest Profits – How to Maintain a Balance

- Factors to Consider Before You Reinvest Profits

- How to Reinvest Profits?

- Conclusion

- Key Takeaways

Why Reinvest Profits

This is undoubtedly true, tried and tested - You must spend money to make money. Reinvest profits to bring your business closer to bigger goals.

Some have suggested that, with conventional knowledge, you must reinvest 30% or even 50% of the profit you earn from your business. The actual amount varies, but the secret is to reinvest profits based on the actual strategy, not the set amount/percentage. All areas of your business require money, but you must strike a delicate balance.

The decision to reinvest profits should be made strategically and intentionally. You may feel the urge to spend money when your business makes money, but it's important to reinvest profits in your biggest assets, yourself, and your business.

Reinvest Profits – How to Maintain a Balance

While considering reinvestment of your hard-earned money, consider your financial security and the risk involved in the investment. Unless you have an accounting background, managing your company's finances may not be intuitive.

The Bureau of Labor Statistics reports that about 20% of new businesses will be closed within two years. Only about 65% of new companies have existed for more than 5 years. This means, that the same strategy of running your business doesn’t apply to all.

If revenue exceeds the cost, your business is profitable. Profitable companies have a positive number at the bottom of the income statement. You can calculate your operating profit after deducting money spent on taxes, interest, and other expenses that are not related to the core business from the total income.

Making a profit is an impressive achievement for any small business.

Factors to Consider Before You Reinvest Profits

Ask yourself these five questions before reinvesting your profits

1. What should you reinvest profits in?

Think about your business goals and where you want to see your business in the next three years before answering this question.

- Do you want to expand your team, or do you want to work on your sales?

- Would you like to try a new marketing campaign, or do you need new software for your business operations?

2. What is the timeline to reinvest profits?

Clarify the ideal future of your business and the changes needed to reach it. Next, think about the challenges you are currently facing. With a clear vision of your objectives and trials, identify potential investments you can make in your business.

- Prioritize each item on the investment list by urgency

- Consider the potential rate of return on each option and how quickly those results will be displayed

- You can invest in a fast ROI spending first

For example, if your investment list includes both YouTube Ads and Newspaper articles for business promotion, you can invest in YouTube ads first and direct additional revenue to newspaper marketing.

Many businesses follow the profit-first model pioneered by Mike Mikhailovich which encourages business owners to profit a percentage of every dollar that goes into their business. Similarly, percentages are used for taxes, expenses, and so on. According to Mikhailovich, this method increases the profitability of the enterprise.

However, entrepreneurs must consider that sticking to a given budget that focuses on profits first can come at the expense of growth.

Let us look at an example:

You deduct $1 million in salary each year from your profitable business, and after 7 years, you will leave with $ 7 million.

But what if instead you receive $500,000 each year and reinvest profits of the remaining $500,000 in your business?

You may be worth $50 million in 7 years.

3. Reinvest profits based on the profit you earn

Many get stuck in reinvestment when they have a surplus or profit in cash. You can also use your profits to repay your business debt, pay taxes, and pay for yourself. Calculate your average monthly profit by running a profit and loss report in your accounting program

Revenue – Operating Cost = Profit

Next, let's calculate the profit that can be used to reinvest in the business.

- First, deduct the long-term debt payments and liabilities

- Next, make sure you have allocated some of your profits to taxes

- Finally, keep some amount for yourself

You can use the remaining to reinvest profits in the growth of your business.

For example,

- Revenue $10,000

- Expenses-$3,000

- Loan payment – $500

- Tax Savings-$1,000

- Personal Expense-$1500

Available profit =

$10,000 – ($3,000+$500+$1000+$1500) = $4,000

4. Before you reinvest profits, decide how much you need to pay

It is completely your decision, how much you need to pay for business expenses or personal expenses out of the profits you make. Using 100% of your profits is not a sensible decision.

But allocating 100% of your profits to reinvestment with debts outstanding isn’t wise either. Decide how much you or your business need as mandatory expenses, subtract the amount from the income, and reinvest profits in business growth.

5. How will you reinvest profits?

This is a very difficult question for most entrepreneurs. What kind of investment do you want to make in the next 6-12 months? You can allocate your profit one of two ways:

This method is suitable for companies that have a constant monthly profit and prefer to slowly reinvest profits in their business over time - attributing a fixed amount to personal income and business expenses and reinvesting the rest (which can vary).

The second option is to reinvest profits in a certain percentage each month which can speed up the reinvestment schedule but also lowers the owner's rewards. This method is suitable for companies that have monthly earnings fluctuations and prefer to take advantage of cash flow fluctuations to accelerate reinvestment.

In both scenarios, the choice depends on your individual financial needs.

How to Reinvest Profits?

To reinvest profits for a business owner means reducing your monthly take-away, but that's how your business evolves. You may want to invest in upgrades and better materials, so let us consider the various options that you can reinvest profits in:

1. Reinvest Profits in Business improvement

You can reinvest profits in various segments of your business like enhancing the customer support section, strengthening infrastructure, improving marketing strategies, streamlining manufacturing, and adding value to your business.

2. Reinvest Profits in Marketing

Digital Marketing is thriving and has surpassed traditional marketing in every way. You can reinvest profits in Facebook and Twitter ads that can target demographics with accurate boundaries. You can invest in a good SEO strategy to raise your company's profile and reach the top of Google's search engine results. You may want to reinvest profits in your website that can increase sales and attract more attention to your products and services.

3. Reinvest Profits in Research and Development

It is wise to reinvest profits to further improve your products and services. R&D projects are not just for manufacturers, but also for businesses to improve their business functions.

4. Reinvest Profits in Inventory

Regular clearance sales of popular products indicate that you need to increase your order volume to get the sales you missed. But you must remember, too much inventory can jeopardize a company's operating cash flow and cost money for products that don't pop out of the shelves fast enough. You can use the Economic Order Quantity (EOQ) model before you reinvest profits in inventory.

5. Reinvest Profits in Training, Education, and Development

Reinvest profits in courses, educational material, best practices and techniques, and seminars to improve your skills and your employee’s knowledge.

Employers who enroll in a qualified education program related to their area of work and earn less than their income limit can use lifelong learning credits to reduce taxes by 20% of tuition fee, which is up to $2,000 a year, and $10,000 a lifetime.

6. Reinvest Profits in a Business Contingency Fund

Building emergency funding is essential for SMEs. Emergency funds can fund your business in emergencies like a temporary closure due to COVID 19. One of the J.P. Morgan reports says that small businesses have a cash maturity of only 27 days. Only 25% of small businesses have enough to last for two months when they run out of income.

7. Reinvest Profits in Employees

If your business is going well, you can reinvest profits in hiring additional employees or thanking existing employees for helping you succeed in your business. Forecast financial data before you hire new employees.

If your future profits are good and you think it's the right time, then you can start hiring talented people. Don’t forget to thank your efficient employees as happy employees not only perform the best; they also cost less. Offer them a bonus, or add a 401 (k) plan to their compensation.

8. Reinvest Profits in Software

By investing in software, you can spend less time on cumbersome tasks. By streamlining core functions like sales, marketing, accounting, hiring, payroll, project management, etc., you can spend more time on other revenue-generating reinvestment activities.

9. Reinvest Profits in Equipment

We recommend upgrading your business equipment to get the latest information on the industry. If your existing assets are aging and have high maintenance costs, it is advisable to reinvest profits in new machinery and equipment.

Depending on the equipment you purchase, you may be able to use bonus depreciation or the deductions in Section 179 to amortize the entire cost of the asset in the year of purchase.

10. Reinvest profits in yourself

You can support your education or hire employees so that they can solve less important issues and you can focus on the important ones.

11. Reinvest profits in External factors

You can reinvest profits in Real Estate, another business, new technology, or even in your target audience to achieve your long-term business growth goal.

Conclusion

To reinvest profits in your business is the most lucrative way to keep your business growing. You may want to increase the owner's draw, but as a proud parent, you must do whatever it takes to grow your business. Reinvest profits in areas that promise high ROI. This will strengthen your financial stability and will cover long-term risks.

How Can Deskera Help you?

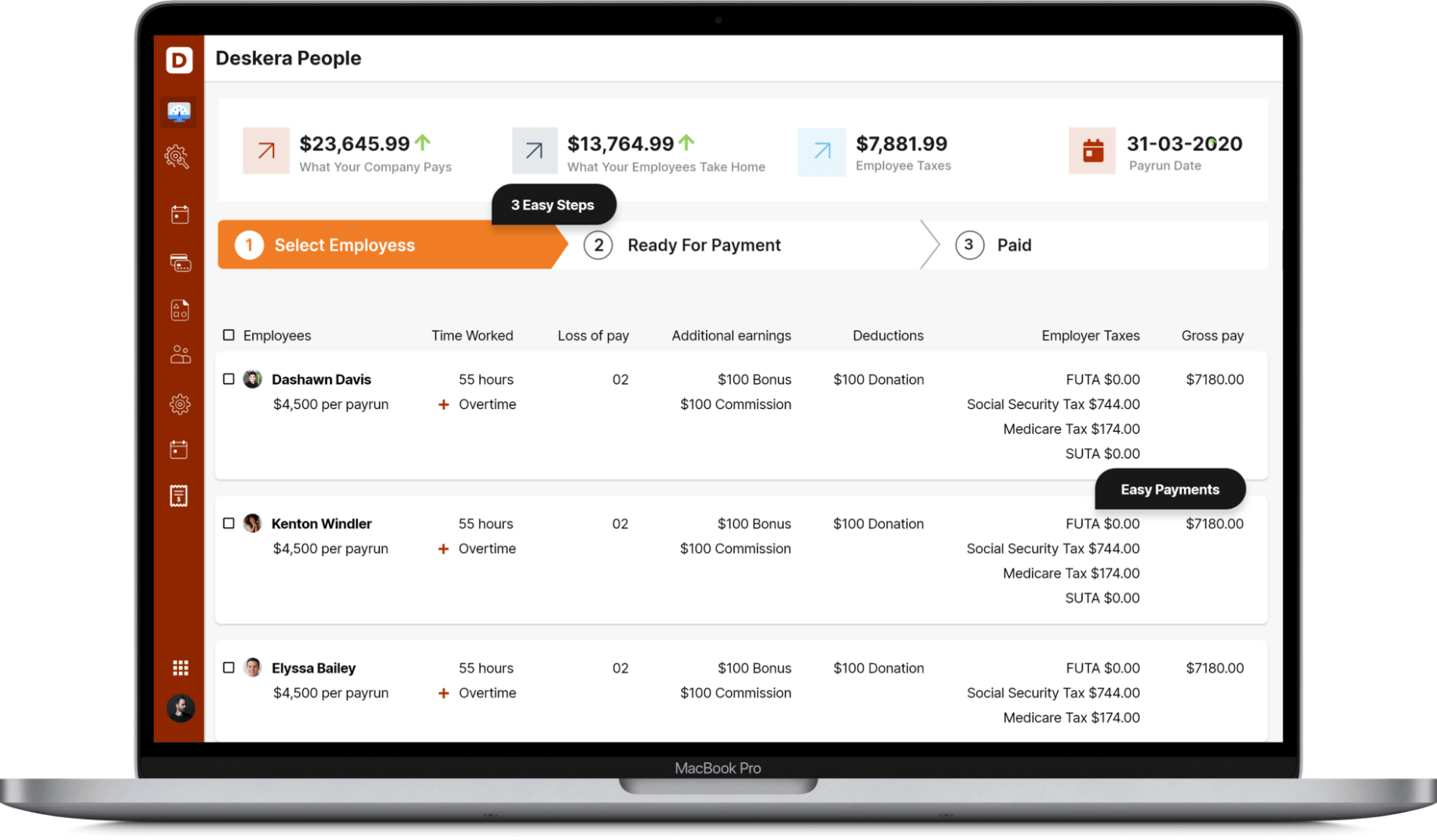

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Key Takeaways

- If you want to grow and develop the key areas and functions of your business, you must reinvest profits in the appropriate segments

- You can reinvest profits that are calculated after deducting operational and personal expenses from the income earned each month

- You can reinvest profits in equipment, technology, employee training, or marketing

- Consistency in reinvesting profits ensures long-term growth of the business and its continued success

Related Articles