Mr. Raghavendra was working for a textile unit for 12 years, and he resigned from the job to look for better opportunities. He had filed an application to his employer requesting him to clear his dues, including gratuity. After 15 days of applying, he received a Gratuity form L which he wasn’t very clear about.

The Gratuity form L was sent by his employer confirming the amount that is due towards the employee, containing relevant information about his employment, and the date when he can collect his gratuity amount. The filling and submission of the Gratuity form L come under the payment of Gratuity Act 1972. Here we will learn more about the Gratuity Form L.

Table of Contents:

- About the Gratuity Form L

- The Payment of Gratuity Act,1972

- Scope and purpose

- Payment of Gratuity under Gratuity form L

- Sample of the Gratuity Form L

- Other Compliance Forms other than Gratuity form L related to the Payment of Gratuity Act,1972

- Selection of Nominee

- Inspectors appointed for the purpose and authority of this Act

- Collection of Gratuity

- Penalties

- Exemption from liability of an employer

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

About the Gratuity Form L

The Gratuity form L is the acceptance and confirmation (notice) of payment of gratuity amount to the employee. If the claim made by the employee, his legal heir, or his nominee is approved as a result of the examination, the employer will specify the amount and setting of the tip to be paid and within the deadline for receiving the gratuity payment request through the Gratuity form L. He needs to send a notification and specify the payment date within 30 days of receiving the request.

The Payment of Gratuity Act,1972

A law that establishes a system for paying benefits to employees employed in factories, mines, oil fields, ports, plantations, stores and other facilities, and related facilities. The Payment of Gratuity Act,1972 is a general law, such as the Minimum Wages Act, Employment and Social Policy, etc., which is an extension of the Labor Law and stipulates the minimum amount of benefits given to workers. This is a social security regulation that provides social benefits to employees of industries, companies, and organizations.

Scope and purpose

The Payment of Gratuity Act,1972 was enacted with the sole purpose of providing Gratuity - a monetary award for services provided by employees.

Under the Payment of Gratuity Act, 1972, Section: 2A, the definition of an employee who is entitled to get the gratuity as specified in the Gratuity form L is as follows:

Employees within the meaning of this law who have served continuously without taking a break because of sickness, accidents, vacations, and long absenteeism.

There was no downtime under the rule, a strike, a lockout, or suspension of work, whether or not it was an employee's fault.

If a worker (not a seasonal worker) is continuously employed for one year or six months within the meaning of (1), and if the worker is continuously employed by the employer.

(A) One year if the worker (to whom the Gratuity form L is referred) worked with the employer for at least

(i) 190 days in the 12th calendar month before the date on which the calculation is concerned. Workers hired underground in mines or work less than 6 days a week

(Ii) 240 days in other cases

(B) If the employee worked for 95 days for the employer for at least 6 calendar months before the date associated with the calculation for the 6 months or someone employed in the basement of a company that works for 6 days a week.

(C) In other cases, 120 days

He should not have been laid off under the Industrial Employment (Standing Orders) Act, 1946 (20 of 1946), or under the Industrial Disputes Act, 1947 (14 of 1947), or under any other law applicab1c to the establishment;

- He earned full wages the previous year

- He should not have been absent due to employment and a temporary accidental disability during employment

- In the case of a woman, if she was on maternity leave, the total duration of her maternity leave should not exceed 12 weeks

- If the worker employed in the seasonal business is not continuously employed for one year or six months within the meaning of paragraph 1, he will not be entitled

- If he/she is 70 years old or older, he/she will not be entitled

Payment of Gratuity under Gratuity form L

- Employees are entitled to Gratuity pay as mentioned in the Gratuity form L if they continue to work for five years in the event of severance, retirement, death, or disability. However, in case of death or disability termination, 5 years of uninterrupted service is not required. In addition to his pension, the worker is also entitled to a bonus amount

- In the event of death or disability due to an accident or illness, the employer is obliged to pay Gratuity to the employee's agent or legal heir, (specified in the Gratuity form L) regardless of the number of years of continuous work. The law also provides for minors as legal heirs, and regulatory agencies must deposit the amount in such banks or other financial institutions until the minors are older

- In addition, the law states that for services provided for at least 6 months, the amount of Gratuity pay equivalent to the 15-day wage will be the final wage rate received by the workers involved

- The amount of Gratuity should not exceed Rs. 10 lakhs

- Employees are entitled to the benefits of the services, but their rights may be limited by two conditions

- If negligent dismissal leads to loss, damage, or destruction of the employer's property and the Gratuity form L will not be issued

- If the termination is based on immoral or chaotic acts or constitutes an essentially immoral crime

Sample of the Gratuity Form L

Inclusions of the Gratuity form L

- The employer fills the Gratuity form L with the below-mentioned information:

- The Gratuity form L must be addressed to the employee, the nominee who applied, or to the employee’s legal heir

- The Gratuity form L should contain the total amount due to the employee

- If it is given to the employee, his details, tenure, and ID number shall be mentioned, or if it is for the legal heir/nominee, the details of the employee on whose behalf the amount is given out to them, shall be specified in the Gratuity form L

- The employer must specify when (day and date) the concerned person can come and collect the amount from the office in the form of cash or cheque. He can also give an option of sending the amount through a postal order in the Gratuity form L

- Besides the information that needs to be mentioned in the Gratuity form L, the employer must give specifics about the employment of the worker like

- The total tenure of service of the employee in years and months

- The last drawn salary/wages to be mentioned in the Gratuity form L

- The proportion of the gratuity that is admissibly payable in terms of nomination

- The total amount that needs to be paid out should be mentioned in the Gratuity form L

- The Gratuity form L should be duly signed by the employer or his authorized representative along with details like date, place, name of established, and the stamp of the establishment

- A copy of the Gratuity form L should be submitted to the controlling authority as well

Other Compliance Forms other than Gratuity form L related to the Payment of Gratuity Act,1972

- Form A - Notice of Opening submitted by the employer to the controlling authority of the area within 30 days of the rules becoming applicable to an establishment

- Form B - Notice of Change to the controlling authority of the area within 30 days of any change in the name, address, employer, or nature of business

- Form C - Notice of Closure of business, to the controlling authority of the area at least 60 days before the intended closure

- Form F - Nomination to be submitted in the given format and submitted in duplicate by personal service by the employee, after taking proper receipt or by sending through registered post acknowledgment due to the employer

- Form G - Fresh Nomination within ninety days of acquiring a family to be submitted by the employee to the employer

- Form H - Modification of Nomination shall be submitted in duplicate in the format to the employer

- Form I - Application for gratuity by an employee

- Form J - Application for gratuity by a nominee

- Form K - Application for gratuity by a legal heir

- Form M - Notice rejecting a claim for payment of gratuity along with reasons

- Form N - Application for direction Before the Controlling Authority in the given format to the controlling authority for issuing a direction with as many extra copies as are the opposite party

- Form T - Application for recovery of gratuity

Selection of Nominee

The law requires employees to prescribe a candidate's name shortly after completing a year of work, whose name will be mentioned in the Gratuity Form L if it isn’t for the employee (especially in case of disability or death). For families, the candidate must be one of the employee's family and the other candidates are invalid. Changes or new nominations must be notified by the employee to the employer. The employer keeps it safe.

Inspectors appointed for the purpose and authority of this Act

The Government shall be deemed an officer under Article 21 of the Indian Criminal Code to determine whether it violates any of the provisions of this Act. For example, after issuing the Gratuity Form L, the employer fails to pay the stipulated amount to the employee on time. The act can appoint one or more inspectors. They will then take the necessary steps to ensure compliance with all provisions of this Act.

Collection of Gratuity

If after giving the Gratuity form L, the employer fails to pay the Gratuity pay within the specified period, the inspector will issue a certificate to the collector on behalf of the victim and collect the amount including the compound interest set by the central government. However, these provisions apply according to two conditions.

- Supervisors need to give employees a reasonable opportunity to explain the reasons for such behavior

- The amount of interest paid cannot exceed the amount of gratuity amount as specified in the Gratuity form L under this law

Penalties

If employers violate the provisions of the law or fail to abide by the confirmations as laid out in Gratuity Form L, they will be subject to certain penalties.

- If someone makes a misrepresentation or false statement to avoid payment or in the Gratuity form L, he/she shall be liable for 6 months imprisonment and/or a fine of up to 10,000 rupees

- At least 3 months (up to 1 year), punishment will be given, if you do not comply with the provisions of this law. You will be fined 10,000 (up to 20,000)

- Failure to pay benefits as specified by the Act or under the Gratuity form L is a criminal offense and the employer will be sentenced to a minimum of 6 months imprisonment and a maximum of 2 years imprisonment unless the court finds a good reason

Exemption from liability of an employer

An employer charged with violating this law has established a reasonable reason for his actions or for others who have committed actions without his knowledge. If so, he shall be free from all liability. If convicted, others are subject to the same penalties as their employer.

Conclusion

The Payment of Gratuity Act, 1927, is a philanthropic law aimed at the welfare of employees who form the backbone of an organization, company, or start-up. The amount of gratuity encourages employees to work efficiently and improve their productivity. However, this law is limited to large corporations or organizations and does not apply to organizations with less than 10 employees. However, the law is completely complete and supersedes any other law or statute regarding Gratuity.

The Gratuity Form L is a confirmation that is sent out by the employers to the employee, his legal heir, or his nominee, confirming the amount, day, and date of the gratuity pay-out. This Gratuity Form L is only finalized after a request has been made to the organization for the payment of gratuity. Other conditions also need to be met, which have been discussed above

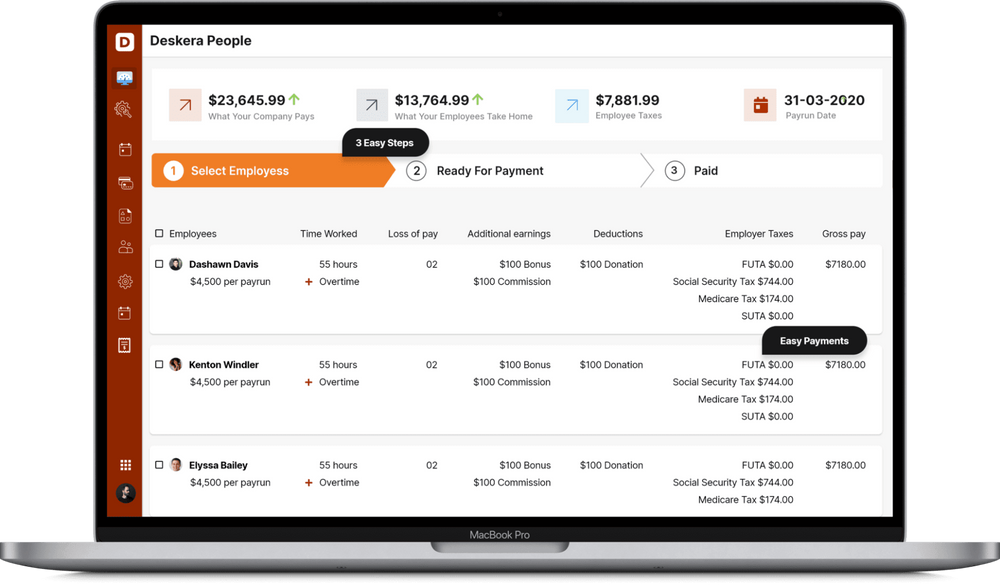

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The employee must submit a written application to the employer after which the employer must calculate the gratuity amount and notify the relevant employees and supervisors in writing using Gratuity Form L

- The payment as specified in the Gratuity Form L must be made within 30 days of the date the employee requested to be paid. If you do not pay within the specified limit, you will have to pay interest. However, if the payment delay is due to the employee, the employer is not entitled to pay simple interest

- Disputes between employees and employers are filed with the inspector, and the settlement procedure chaired by the inspector is considered through a court procedure

- Gratuity Form L is a formal confirmation to the employee regarding the collection of the amount that the organization owes to him

Related Articles