Do you know how the information of each employee reaches the concerned authorities regarding the Employees’ State Insurance Act, 1948?

This act ensures that each insured employee and their immediate family gets medical benefits as assured by the law. The primary employer should fill the Form 01(A) - Form Of Annual Information to provide relevant information about each employee on an annual basis, confirming personal and professional details for the law to act upon.

This is to be diligently maintained by each employer and submitted to the Regional Office/Sub-Regional Office, ESI Corporation, every year. The employer must submit the company declaration in the specified format once a year.

Table of Contents

- About The Employees’ State Insurance Act, 1948

- Applicability

- Sample Of Form 01(A) - Form Of Annual Information

- About The Constituents Of Form 01(A) - Form Of Annual Information

- Other Compliance Forms Besides Form 01(A) - Form Of Annual Information, To Be Filled By The Employer

- About The ESI Act

- Prices Revised From Time To Time

- Collection of Contributions

- Contribution Period and Benefit Period

- Benefits For Employees Covered Under Form 01(A) - Form Of Annual Information As Prescribed Under The ESI Act

- Medical Benefits To Be Provided To Employees As Specified In Form 01(A) - Form Of Annual Information

- Sickness Allowance (SB)

- Maternity Benefits Or Birth Allowance (MB)

- Disability pension

- Other Benefits

- Conclusion

- Key Takeaways

About The Employees’ State Insurance Act, 1948

The Employees’ State Insurance Act, 1948 stipulates Form 01(A) - Form Of Annual Information is an integrated measure of social insurance as set out in the state employee insurance law.

It protects workers from the effects of illness, childbirth, disability, and death from occupational accidents and provides medical care to insureds and their families, as defined by the Employees’ State Insurance Act, 1948.

Applicability

The Employees’ State Insurance Act, 1948 and the Form 01(A) - Form Of Annual Information are applicable in:

- All states of India except Manipur, Nagaland, Sikkim, Mizoram, and Arunachal Pradesh

- Delhi, Chandigarh, and Pondicherry

- Non-seasonal factories with ten or more employees

- Restaurants, hotels, shops, cinemas (including previews), road transport companies, and newspaper companies with more than 20 employees

- Private health and educational institutions that employ more than 20 people in certain States/UTs

The existing wage limit for legal compensation is Rs 21,000 per month as of January 1, 2017

Sample Of Form 01(A) - Form Of Annual Information

About The Constituents Of Form 01(A) - Form Of Annual Information

Form 01(A) - Form Of Annual Information is covered under the ESI act (Regulation 10C)

Form 01(A) - Form Of Annual Information incorporates the following information:

- Employer’s Code

- Name of the Factory/Establishment

- Complete Postal address of the Factory/Establishment to be mentioned in Form 01(A) - Form Of Annual Information along with the following address related details

- PIN

- Telephone No

- Fax No

- E-mail address

- Location of Factory/Establishment

(a) State

(b) District

(c) Municipality/Ward

(d) Name of Town/Revenue Village and (Taluk/Tahsil)

(e) Police Station

(f) Revenue Demarcation/Hudbast No.

- Details of Bank A/c should be mentioned in Form 01(A) - Form Of Annual Information along with the below-mentioned details:

(a) Account No

(b) Name of Bank and Branch

- Income Tax PAN/GIR No

- Income Tax Ward/Circle/Area

(a) In the case of a factory whether a Licence is issued Under Section 2(m) (i) or 2(m) (ii) of the Factories Act, 1948, it should be clarified by the employer in Form 01(A) - Form Of Annual Information

(b) Power connection No

- No. Sanctioned power load Issuing Authority to be clarified in Form 01(A) - Form Of Annual Information

a) Whether it is Public or Private Ltd/Proprietorship/Partnership/Cooperative Society/Company/Ownership (attach copy of Memorandum & Articles of Association/Partnership Deed/Resolution)

(b) State name, present and permanent residential address of current Proprietor/Managing Directors, Director/Managing Partners, Partners/Secretary of the Co-operative Society in Form 01(A) - Form Of Annual Information

- Name Designation Address i) ii) iii) iv) v) vi) vii)

- Address(es) of the Registered Office/Head Office/Branch Office/Administrative Office/Sales Office/other offices if any, with number of employees attached with each office and the individual responsible for them

- Address No. of employee Phone No./Function Person responsible as on date, Fax No. for the everyday functioning of the enterprise or employee

- a) Whether any work/business carried out through a contractor/immediate employer

- b) If yes, give the nature of such work/business

- A declaration and undertaking by the Principal Employer to be given on Form 01(A) - Form Of Annual Information

- An undertaking to intimate changes, submitted promptly to the Regional Office/Sub-Regional Office, ESI Corporation as soon as such changes take place

- Date Name & Signature of the Primary employer on Form 01(A) - Form Of Annual Information

- Place Designation with seal

- U/s 2(17) of ESI Act, the Form 01(A) - Form Of Annual Information should be signed by the principal employer.

Other Compliance Forms Besides Form 01(A) - Form Of Annual Information, To Be Filled By The Employer

ESIC Forms for Employers:

- Form 01 Employer's Registration Form

- Form- 01A Annual information of factory/establishment submission form

- Form 3 Return of Declaration forms

- Form 5 Return of contributions

- Form 5a Statement of advance payment of contributions

- Form 6 Register of employees

- Form 10 Abstention verification

- Form 11 Accident Register

- ESIC 37 Certificate of Re-employment/continuing employment

About The ESI Act

As this is a defined contribution plan, all workers in a factory or facility to which the law applies must be insured in the manner prescribed by law. The information of all such insured employees must be properly noted and registered in Form 01(A) - Form Of Annual Information by the primary employer.

Contributions paid to employees are based on employer contributions and employee contributions. A report of the same is submitted to the concerned ESI authorities each year in the form of Form 01(A) - Form Of Annual Information

Prices Revised From Time To Time

Currently, the employee contribution rate (w.e.f. 1/1/97) is 1.75% of the wages of the employee, and the employer contribution at 4.75% of the wage paid/paid for the employee in each payment period.

For newly established regions, the contribution rate is 1% of the employee's salary and the employer must pay 3% for the first 24 months (from June 10, 2016).

Workers earning an average daily salary of up to Rs. 137 are exempt from paying contributions. However, employers make their contributions in connection with these workers. This should be clearly stated in Form 01(A) - Form Of Annual Information

Collection of Contributions

The employer needs to maintain Form 01(A) - Form Of Annual Information and maintain a record of his contributions. He pays each employee's contributions and other such contributions at the above rates within 15 days of the last day of the calendar month in which the contributions are paid.

The company allows certain branches of the State Bank of India and several other banks to accept payments on their behalf.

Contribution Period and Benefit Period

There are two contribution periods of 6 months each and two corresponding benefit periods of 6 months, respectively, as shown below.

|

Contribution Period |

Cash Benefit Period |

|

April 1 to Sept 30 |

Jan 1 of the following year to June 30 |

|

Oct 1 to March 31 of the following year |

July 1 to December 31 |

Benefits For Employees Covered Under Form 01(A) - Form Of Annual Information As Prescribed Under The ESI Act

The information given in Form 01(A) - Form Of Annual Information by the Principal employer makes the employees eligible for certain benefits throughout the year. Let us take a look at these benefits that the employees can take advantage of:

Section 46 of the ESI law provides the following benefits:

Medical Benefits To Be Provided To Employees As Specified In Form 01(A) - Form Of Annual Information

The insured and their dependents will receive comprehensive medical care covered by compulsory Insurance from the day they start employment. There is no limit to the cost of treatment for the insured or her family.

This benefit is also extended to retired members with permanent disabilities and their spouses. Medical care is provided with a premium of Rs. 120/year

Sickness Allowance (SB)

A sickness allowance in the form of cash compensation equivalent to 70% of wages is paid to the insured employee during the certified illness period for up to 91 days per year. The insured must contribute 78 days with a 6-month contribution period to qualify for illness.

Form 01(A) - Form Of Annual Information includes information about all employees eligible for this benefit.

Extended Illness Benefits (ESB)

Sickness Benefits can be extended for up to 2 years for 34 malignant and long-term illnesses with an 80% increase in wages.

Increased sick leave

An increase in sick leave equal to total wages is paid to male and female workers registered in Form 01(A) - Form Of Annual Information who have been sterilized for 7 and 14 days.

Maternity Benefits Or Birth Allowance (MB)

The Birth or Pregnancy Birth Allowance is paid for 26 weeks and is a full wage contributed over the 70 days of the previous two contribution periods. It can be renewed for an additional month based on medical advice based on details specified in Form 01(A) - Form Of Annual Information.

Disability pension

Temporary Disability Benefits or Pension (TDB)

From the first day of Insurance, regardless of whether contributions have been paid in the event of an occupational accident, as long as the disability persists, the employee will be paid a temporary disability pension of 90% of his salary.

Permanent Disability Benefits or Pension (PDB)

The pension is paid at 90% of wages in the form of a monthly salary, depending on the degree of disability certified by the Medical Association.

Dependents Benefits or Survivor's Pension (DB)

In the event of an occupational accident or death due to an occupational accident, 90% of the wage will be paid to the survivor of the deceased insured in the form of a monthly salary as per information stated by the employer in Form 01(A) - Form Of Annual Information.

Other Benefits

- Funeral expenses: Rs. 15,000 will be paid to relatives or those who have performed the last rites from the first day of entry into related employment

- Childbirth costs: Delivery is made in a location where the required medical facilities are not available under the ESI program for the insured woman or IP his wife

- In addition, the Form 01(A) - Form Of Annual Information also provides information about the insured workers who are eligible for benefits that are based on several other needs

- Vocational Rehabilitation: For insured persons with permanent disabilities who are undergoing VR training at VRS

- Physical rehabilitation: In the case of physical disability caused by accident at work

- Health care for old age: Members who retire below retirement age or because of VRS/ERS, and those who retire from service due to permanent disability. These members and their spouses are covered on the premium payment of Rs 120 per year

- Rajiv Gandhi Shramik Kalyan Yojana: This unemployment allowance is w.e.f. January 4, 2005. An insured person who has been unemployed after more than three years of Insurance due to business/business closure, dismissal, or permanent disability has the following rights:

- Unemployment allowance of 50% of wages for up to 2 years

- Self and family health care through ESI Hospital/Pharmacy while the insured is receiving unemployment benefits

- Vocational training to improve skills

- Fees/travel allowances borne by ESIC

- Incentives for private sector employers, as noted under the Form 01(A) - Form Of Annual Information to provide regular employment for persons with disabilities

- The minimum wage limit for disabled people to use ESIC benefits is Rs 25,000

- Employer contributions are paid by the central government for employees specified under Form 01(A) - Form Of Annual Information for three years

Conclusion

Form 01(A) - Form Of Annual Information is an important record of being duly filled by the primary employer under the Employees' State Insurance Act, 1948. This form entails the information and vital details, both personal and professional, about each employee who is enrolled for the ESI benefits as stated above. Form 01(A) - Form Of Annual Information should be submitted by the employer to the concerned authorities every year.

In case of any changes or modifications, it should instantly percolate to the ESI registrar.

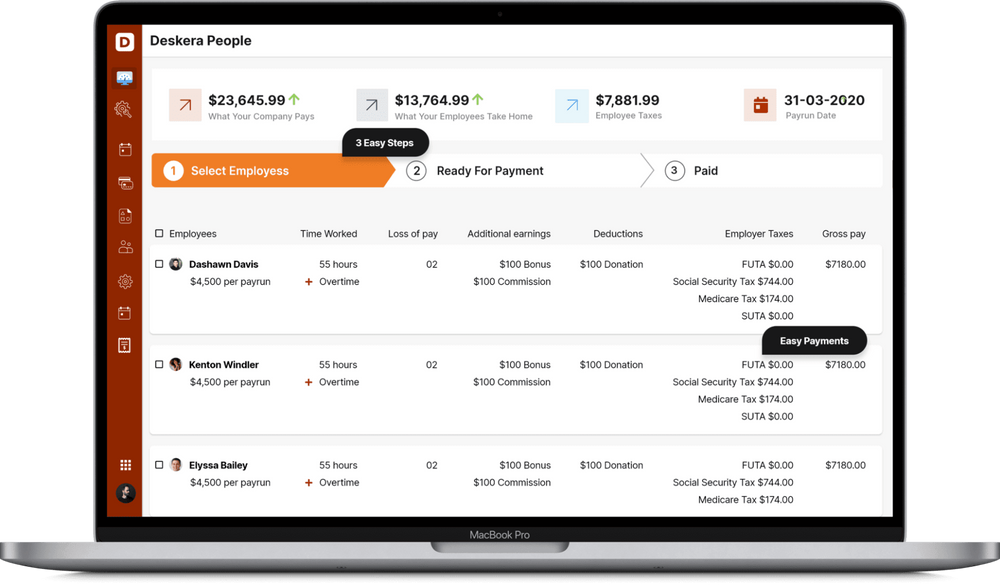

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- Form 01(A) - Form Of Annual Information is a vital part of the Employees' State Insurance Act, 1948

- Form 01(A) - Form Of Annual Information contains important information about employees who make contributions towards the ESI Act and are eligible for the benefits granted by the law

- The Form 01(A) - Form Of Annual Information is to be maintained by the principal employer and should be duly signed, stamped, and sealed by him

- In case of any change in the information about any employee, the same needs to be notified by the employer through the Form 01(A) - Form Of Annual Information

- Form 01(A) - Form Of Annual Information also includes employees who are eligible for the provision of social security in the unorganized sector or who have been unemployed

- The Insurance Inspected appointed under the ESI Act can check the Form 01(A) - Form Of Annual Information and ask for clarifications

Related Articles