Do you know which form is used to pay income tax in quarterly installments? Well, it is Form 1040 ES. While Form 1040 is used to report income tax for the entire year, Form 1040 ES is used for quarterly tax payments. Read on to get answers to all your questions related to Form 1040-ES.

Table of Contents

- What is Form 1040-ES?

- What are estimated taxes?

- How to fill out Form 1040-ES?

- What is the procedure to fill out the Form 1040-ES worksheet?

- Who all are exempted from paying estimated taxes?

- How to calculate estimated taxes?

- Steps to calculate your estimated taxes

- Step 1: You need to estimate taxable income for the year

- Step 2: Calculate income tax

- Step 3: Calculate self-employment tax

- Step 4: Add all and divide by four

- When are estimated taxes due?

- How to make estimated tax payments?

- Tax Penalties

- What is the safe harbor rule?

- How Can Deskera Assist You?

- Key Takeaways

What is Form 1040-ES?

Form 1040-ES is a tax form that needs to be filed for estimated tax which refers to the income taxes on the income that cannot be withheld. The income can be earnings from self-employment, interest, rent, dividend, and alimony.

What are estimated taxes?

Estimated tax is a method to pay tax quarterly on income that cannot be withheld. It is basically a quarterly payment of taxes for the year based on the income for that particular period. Mostly small business owners, freelancers, independent contractors, etc. are required to pay estimated taxes. The income on which this tax is applicable can be earned income, rental income, dividend income, interest income, and capital gains.

Whether you own an LLC, S corporation, partnership, or sole proprietorship, that pays over $1000 in income tax for a year is required to pay that amount in four parts. That amount will be distributed evenly in four parts over the entire year. However, for C corporations, the amount is $500.

Form 1040-ES is segregated into 4 different slips, one for each payment period. Whenever you send the payment to the IRS, you will have to submit one of those slips.

How to fill out Form 1040-ES?

To file quarterly estimated taxes for your business, you will have to fill out Form 1040-ES. For this, you will have to provide your personal info and the amount of the quarterly payment. Every slip has its deadline printed on it. The slips are numbered one to four so that you get to know the order in which they need to be filed.

If you are filing jointly with your spouse, you need to only fill in your spouse’s info.

If you want to track the payments you have made, and your due payments, you can track them through this table.

What is the procedure to fill out the Form 1040-ES worksheet?

Let’s take a look at the steps to fill out the Form 1040-ES worksheet:

Make sure you have all the financial information for the previous year. If you face any difficulty, you can even contact a professional bookkeeper. Your tax payments can be calculated using the Form 1040-ES worksheet.

You need to take note of the following:

Line 2a helps you enter deductions. In case you want to list deductions, then you may have to estimate the amount based on the last year’s total amount. If you don’t want to do that, you will have to use a standard deduction then.

Line 4 is the place where you have to provide the details of the estimated taxes of the year, before deductions or credits. You can check the tax rate schedule for the year to figure this out.

Line 9: You will have to provide details regarding the self-employment tax in line 9. This is generally 15.3% of the gross income.

Line 14 (a and b): Here you will have to provide details regarding the total tax of the year, taking into account deductions and credits. In case this is your first year where you have to file estimated quarterly taxes, then it depends on what you calculate for this line. It may be possible that you won’t have to pay the quarterly tax this year depending on your calculation.

Line 15: Here you can see your quarterly payment amount. This is the amount on Line 14, multiplied by 0.25.

Who all are exempted from paying estimated taxes?

You are not required to pay estimated taxes if you meet the following conditions:

- You are an employee:

For employees, employers need to do the quarterly tax withholding on their behalf. That is why employees need to fill out Form W-4 so that the employers deduct the correct amount.

- Special cases: in case you meet the three specific conditions, you won’t have to pay quarterly estimated taxes:

- In case you didn’t owe any taxes in the previous year and didn’t file an income tax return

- In case you were a US citizen or resident for the entire year

- If your tax year was 12 months long

In case you don’t meet the above-mentioned criteria, you will have to pay estimated quarterly taxes.

How to calculate estimated taxes?

If you want to calculate your estimated taxes, you need to add up your total tax liability for the current year such as self-employment tax, individual income tax, and any other taxes. Once this is done, you need to divide that number by four.

The estimated taxes can be calculated through the IRS Estimated Tax Worksheet present in Form 1040-ES for individual filers. Corporations need to use Form 1120-W for their calculation. Through this worksheet, you will get to know about the calculations in detail and you will get payment vouchers.

Steps to calculate your estimated taxes

Here we are going to understand how to calculate your estimated taxes with the help of an example. John is a small business owner of a sole proprietorship. Let us calculate his estimated quarterly tax payments based on his income tax and self-employment tax that he owes.

Step 1: You need to estimate taxable income for the year

Firstly, we will have to start with the income tax of John. John will have to estimate his income for the year to estimate the income tax for the year. For example, he expects to make 90k this year, then he will have to subtract any above-line deductions from this.

$90000-$15000 (above-line deductions) =$75,000 This is adjusted gross income of John. Then, the standard deduction has to be subtracted which is $12, 950.

John can also deduct 50% of his self-employment tax of $12,716.59 which has been calculated below. He can deduct $6,358. So, the total estimated taxable income becomes $55,692

Step 2: Calculate income tax

The next step is to multiply his adjusted gross income by the income tax rate in order to find out the tax due. As tax brackets vary every year, you will have to check out the recent ones.

Based on the tax bracket, John’s income tax comes out to be $7,869.24

Step 3: Calculate self-employment tax

As John earned more than $400 this year, he will have to pay self-employment tax. To calculate self-employment tax, total income needs to be multiplied by 92.35%. This refers to the self-employment taxable income. Then this number needs to be multiplied by 15.3% (self-employment rate). So, self-employment tax becomes $90000 X 92.35% X 15.3%= $12,716.59

John’s estimated quarterly taxes becomes 8,130.24 (estimated income tax owed) + $12,716.59 (estimated self-employment taxes) = $20,846.83

Step 4: Add all and divide by four

Finally, to calculate estimated quarterly tax payments for each quarter, you need to add income tax and self-employment tax and divide the result by 4.

So, John’s total estimated taxes become:

$8,130.24 + $12,716.59 = $20,846.83

Now, for quarterly tax payment, dividing this number by 4:

$20,846.83/4 = $5,211.71

You can even seek the help of a CPA to calculate quarterly tax payments.

When are estimated taxes due?

As per the name, estimated quarterly tax payments are due four times a year. It is due generally on the 15th of April, June, September, and January. In case, it is a weekend or a holiday, the next business day will be considered the due date.

For 2022, estimated quarterly tax deadlines are as follows:

For Jan 1 to March 31: April 18 is the due date

For April 1 to May 31: June 15 is the due date

For June 1 to August 31: September 15 is the due date

For September 1 to December 31: January 17 is the due date

Make sure you set these due dates in your calendar at the start of every tax year.

How to make estimated tax payments?

It is very easy to submit the payment to the IRS. All you need to do is to fill out the form 1040-ES and mail it along with the money order or check to the IRS office nearest to your place.

You can even transfer the money online through a credit card, by phone, or through the IRS payment gateway.

If you own a corporation, you need to file the payment through the Electronic Federal Tax Payment System.

Tax Penalties

Penalties can be imposed by the IRS on quarterly tax payments for a few reasons:

- When you don’t pay on time, a tax penalty can be imposed

- If you don’t pay enough tax for the year, a penalty can be imposed

If you want to avoid an overpayment or underpayment penalty, you can pay either at least 90% of this year’s tax bill, or pay the same amount (100%) as the taxes you owed the previous year, whichever is suitable for you.

What is the safe harbor rule?

When you pay 100% of the taxes you owed on the previous year’s federal tax return, it is known as the safe harbor rule. In case your income grew this year, you can still avoid penalties if you provide the payments that you owed in the previous year.

Note that if your annual income exceeds $150,000 per year, then you need to pay 110% of what you paid in taxes the previous year.

As an entrepreneur, it may not be easy to pay taxes four times a year. However, being prepared can help you sail through the process easily. You can even seek the help of a tax professional to make the tasks seamless for you.

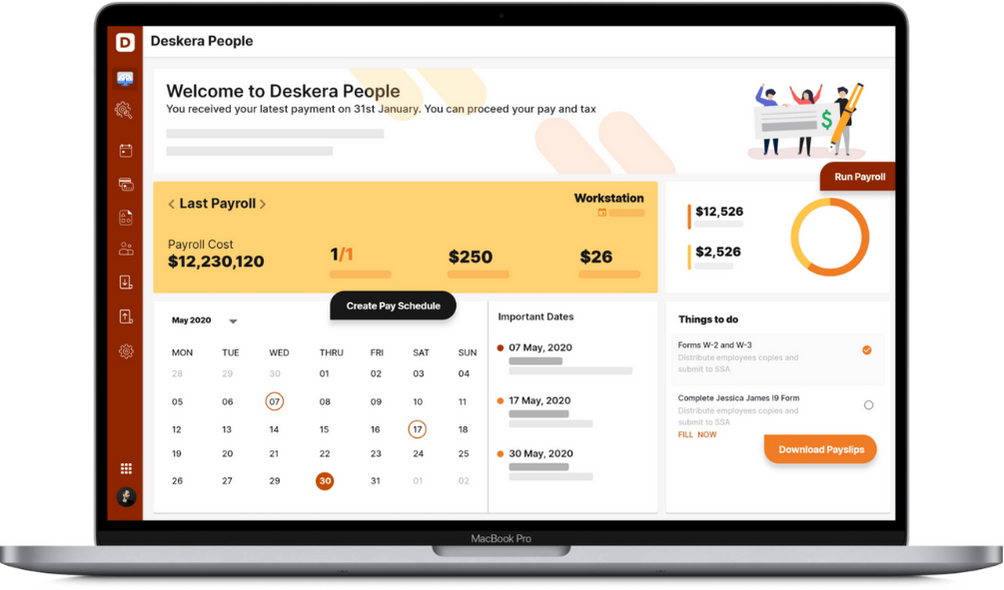

How Can Deskera Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Form 1040-ES is a tax form that has to be filed for estimated tax which refers to the income taxes on the income that cannot be withheld

- Estimated tax is a method to pay tax quarterly on income that cannot be withheld. It is a quarterly payment of taxes for the year based on the income for that particular period

- There are certain steps to filing Form 1040-ES

- You need to note various points filing the Form 1040-ES worksheet

- You are exempted from paying estimated taxes if you are an employee, in case you didn’t owe any taxes in the previous year and didn’t file an income tax return, you were a US citizen or resident for the entire year, if your tax year was 12 months long

- If you want to calculate your estimated taxes, you need to add up your total tax liability for the current year such as self-employment tax, individual income tax, and any other taxes. Once this is done, you need to divide that number by four

- Making estimated taxes payment is easy. You need to fill out the form 1040-ES and mail it along with the money order or check to the IRS office nearest to your place. The payment can even be made online through a credit card, by phone, or through the IRS payment gateway

- Estimated quarterly tax payments are due four times a year. It is due generally on the 15th of April, June, September, and January

- Penalties can be imposed by the IRS on quarterly tax payments when you don’t pay on time, tax penalty can be imposed, or you don’t pay enough tax for the year

- When you pay 100% of the taxes you owed on the previous year’s federal tax return, it is known as the safe harbor rule