Accounting professionals and business owners all around the world may find it difficult to calculate overtime. Even though it could appear like a simple and straightforward approach. However, when applied to various team members, this simple technique becomes more complicated.

Furthermore, recognizing your rights in regard to overtime work will help you determine whether you are eligible for a bonus when you put in extra hours for your employer.

In today’s guide, we’ll learn everything associated with overtime pay and its related concepts. Let’s take a look on what we’ll cover ahead in this detailed guide:

- Understanding Overtime

- Eligibility for Overtime

- Working of Overtime

- Understanding Overtime Percentage

- Understanding Time-and-a-half or Double Time

- Who Qualifies for Overtime Pay?

- Different Types of Overtime Pay

- Things to Know Before Calculating Overtime Pay

- Calculating Overtime for Everyone on your Team

- Why Some Workers Are Exempt From Working Extra Hours?

- Overtime & Pay Regulations for Employees

- Keeping Track of Overtime

- How much overtime compensation are employees entitled to?

- How Deskera Can Assist You?

Let's Start!

Understanding Overtime

The number of hours a full-time employee works past their regularly planned shifts is referred to as overtime.

Furthermore, the number of overtime hours might vary based on the company and the country where employment and labor laws are in effect.

For instance, a 40-hour workweek is typically a common schedule, and any additional hours worked by employees are considered overtime.

Eligibility for Overtime

Some employees might not be entitled to overtime compensation depending on their individual job responsibilities. Employers must carefully assess if their staff members are exempt or nonexempt from overtime compensation because they are responsible for any unpaid overtime.

If an employee in the US satisfies the requirements outlined in the Fair Labor Standards Act (FLSA), they are deemed exempted from paying overtime:

- Receiving a wage

- Working as an executive, professional, or outside sales representative

- Receiving compensation that exceeds the minimal criteria of $35,568 per year or $684 per week

Exempt status is determined on a case-by-case basis and is not based only on the employee's job description or salary.

Working of Overtime

Overtime is defined as hours worked by an employee in a week that exceeds a certain quantity. Any extra time worked is paid for at a higher rate than usual.

Overtime pay is the extra pay rate given to hourly employees who work more than a set number of hours each week. The federal requirement for overtime pay for hourly workers is that they receive 1.5 times their usual hourly wage for labor over 40 hours per week.

For instance, a person who works 45 hours a week at an hourly rate of $10 would get paid $10 for the first 40 hours and $15 for each additional hour.

If a salaried employee's weekly income exceeds a certain threshold, they are often exempt from overtime requirements. As of January 1, 2020, the new laws mandate that exempt workers earning less than $684 per week receive overtime compensation. Non-discretionary compensation and incentive payments may still satisfy up to 10% of the salary requirement (including commissions).

Understanding Overtime Percentage

The ratio of an employee's overtime hours to their regular hours worked during a pay period is known as the overtime percentage.

This statistic, which offers information on employee productivity and performance, is used by human resources managers to target hiring and recruitment needs.

As employees' time spent working on projects outside of regular working hours is represented by extra hours, a higher percentage of overtime frequently signals lower employee productivity.

The following method can be used to determine the overtime percentage for both individual employees and your entire organization:

Understanding Time-and-a-half or Double Time

Standard Overtime Rate: 1.5 times the employee's regular hourly pay is the standard overtime rate. The term "time-and-a-half" is another name for this number.

For example, suppose the overtime rate for a worker earning $15 per hour ($15 x 1.5) is $22.50 per hour. The overtime rate for a different worker earning $25 per hour is $37.50 ($25 x 1.5).

The gross salary for the person earning $15 per hour and putting in 40 hours per week is $600 ($15 x 40). You must pay them at your overtime rate for any minutes or hours they put in over the required 40.

Note: A major exception is (again) the state of California, where workers are compensated at one and a half times their regular rate for hours above 8 but up to 12 each day, and at double that amount for hours over 12.

In California, an employee is entitled to double time compensation after the first eight hours of the seventh day if they work seven consecutive days.

Remember: There is no legal requirement that an employer pay employees double their ordinary rate of pay. It's merely an incentive that some companies use to encourage workers to come in on days when they would otherwise take off.

Who Qualifies for Overtime Pay?

Whether a person is a full-time, part-time, or temporary employee may determine whether they are eligible for overtime. The following are the several employment options you can come across:

Full-time Employees

Full-time employees often have the right to overtime pay, unless their employment contract states otherwise. For full-time employees, a typical work week lasts between 38 and 40 hours. They might receive overtime pay if they are obliged to work more than this number of hours.

Temporary Employees

Temporary workers may be eligible for overtime pay benefits that are comparable to those received by other employees. They might need to satisfactorily complete a probationary term before they are paid for overtime.

Even while their contracts may provide these workers fewer rights, they are still entitled to the same pay as someone who holds a permanent position in the same role.

Part-time Employees

Part-time employees are entitled to overtime pay when they work past their regular work hours, unless their employment contract specifies something else. This can involve putting in longer hours than required or longer hours than full-time employees who are compensated with overtime.

Furthermore, when part-time employees are required to work overtime at unsociable times, such as late at night or on the weekend, they may also be paid for it.

Different Types of Overtime Pay

Depending on the requirements of the business and the desires of the employee, there are various sorts of overtime. You can encounter the following forms of overtime throughout your working life:

Overtime Pay

The payout for overtime hours is referred to as overtime compensation. It could be compensated at a rate that is higher or lower than the rate for regular hours. The overtime rates are outlined in the employment agreement or award. The employee is entitled to the overtime pay rates outlined in the employment contract if they apply.

Tipped Overtime

Tipped overtime is applicable to workers whose wages are less than the minimum wage and who get at least $30 in tips each week. If a tipped employee works overtime, their overtime compensation is calculated by increasing their hourly tip rate by 1.5 and deducting it from the minimum wage rate.

Compulsory Overtime

The duty to work overtime may be stated in a worker's employment contract. It might have a clause outlining the criteria and conditions for mandatory overtime. Employers must still adhere to Fair Labor's standards when demanding extra work, even if compulsory overtime is stipulated in an employment contract.

Voluntary Overtime

When an employer requests overtime from a staff member but it is not specified in the contract, it is known as voluntary overtime. In this circumstance, employees are allowed to accept or refuse the overtime work as they see fit. There is no consequence for the employee's unwillingness to accept overtime labour because it is not required of them.

Eight-and-eighty overtime

This sort of overtime is only applicable to specific personnel, such as healthcare professionals, and it is calculated by employers for workers who put in more than the industry norm of eight hours per day.

Time off in Lieu (TOIL)

Employees may be entitled to time off as compensation for overtime labour instead of earning more money (TOIL). This is often the same amount of time off as was worked, taken later as arranged with the employer.

Furthermore, TOIL agreements may be outlined in an employment contract or discussed in-person with an employer. They could specify the number of hours a worker can accumulate before taking time off, as well as the duration of the leave.

Non-Guaranteed Overtime

Non-guaranteed overtime refers to a specific circumstance in which an employee's employment agreement mandates that they work overtime upon request.

This further indicates that companies may or may not demand more work from their employees. Employees could be required to accept overtime if their employer asks it.

Things to Know Before Calculating Overtime Pay

There are particular ways to compute overtime pay, but before you can do so, you might need to be aware of the unique terms and rates between you and your employer. How to compute overtime compensation is outlined in the following steps:

1. Compute how many hours you put in within a specific week

You can keep note of your daily work hours and whether you had any irregular work schedules to calculate how many hours you put in. If you use them, you can also check your timesheet or payslips for this information. Review your contract at this point to ascertain your standard weekly hours of labour so you may compare them.

2. Figure out your hourly rate

If you are paid per hour, your wage is determined by your hourly rate. For salaried employees, dividing your pay into weeks and hours will allow you to determine your hourly rate.

Divide your pay by the number of weeks in a year (52), then by the amount of hours you typically work. For those who work full-time, this is often 40. You get your hourly wage as a result.

3. Estimate the overtime compensation rate for the company

From "time," which is equivalent to regular pay, to "time and a half," or even "double time," which are, respectively, one and a half times or twice the ordinary rate, overtime compensation rates differ widely. Your overtime rate may be specified in your employment contract.

As an alternative, you might inquire about the company's overtime compensation rate with a member of HR. Once you are aware of this rate, you may calculate your own overtime pay rate by multiplying it by your hourly wage.

4. Multiply your hourly rate by your overtime pay rate

You have all the data you need to determine your overtime pay rate at this point. You can first determine how many overtime hours you invest in during a given week by dividing your regular work hours by your real work hours.

Furthermore, your total weekly overtime pay is calculated by multiplying your number of overtime work hours by your individual overtime pay rate.

Calculating Overtime for Everyone on your Team

Since it will be the starting point for subsequent calculations, we must first ascertain the employee's regular hourly rate of pay before we can accurately compute overtime pay for them. After we've completed that, the remaining steps should be rather simple.

Let's examine some of common and crucial scenarios:

1. Hourly Wage Only

Hourly workers are only paid for the hours they actually put in. Their income may also change depending on the number of hours they put in. They were given extra money in order to make up for their overtime, which offers them the chance to make more money throughout the year.

Example: A non-exempt worker is paid $20 per hour and is not given any further benefits. She puts in 50 hours of work in a workweek. Her overtime pay is computed in accordance with the FLSA as follows:

$20 (regular rate) x 1.5 (OT premium) x 10 hours (OT hours worked) = $300 in OT pay

2. Piece Rate

In a 50-hour workweek, an employee produces 160 units of merchandise at a rate of $10 each. To get the employee's normal rate for the week, we must sum up all of the piece rates they received during that time period and divide them by the amount of hours they put in. The calculations for overtime pay that result will be as follows:

3. Nondiscretionary Bonus

Non-discretionary incentives are ones that must be given out if an employee meets certain requirements, such as annual bonuses that are a component of an employee's compensation plan.

These bonus payments must be factored into the employee's regular rate of pay in order to determine overtime pay.

Furthermore, the bonus is not required to be included in full in the week it is paid when determining the normal rate of pay. As an alternative, you can spread the bonus money over the weeks it was received.

Afterward, your worker must be paid more for each extra week of overtime they put in within the time period. It must be the product of the number of overtime hours performed during the week and one-half of the hourly rate of pay allotted to the bonus during that week.

If allocating the bonus is not possible, the employer may choose another fair method of allocating the bonus. If the overtime premium is already covered by a bonus payment, no further payment is necessary.

Check the example of non discretionary bonus below:

A non-exempt worker receives a $12 hourly wage. He puts in 50 hours in a workweek and gets a $100 nondiscretionary productivity bonus. Calculating overtime is done as follows:

Step 1: To calculate total straight-time compensation, add the hourly straight-time pay for all hours worked and any bonuses

($15 hourly rate x 50 hours worked) + $100 bonus = $850

Step 2: To calculate the regular rate of pay, divide the total straight-time compensation by the total number of hours worked

$850 straight-time pay divided by 50 hours worked = $17

Step 3: Multiply the regular rate of pay by.5, then by the total number of overtime hours

$17 regular rate of pay x .5 x 10 overtime hours = $85

Given that the straight-time earnings for all hours worked have already been calculated, the employee is entitled to 10 hours of overtime pay at half the ordinary rate of pay (see Step 1 above).

Step 4: Determine the overall compensation

$85 overtime pay + $850 straight-time pay = $935

Note:

The nondiscretionary incentive is added to the employee's regular earnings for that workweek in order to determine the regular rate of pay if it was earned over the course of one workweek, as was the case above.

The prorated bonus, however, must be paid at the regular rate of pay in all overtime weeks included in the reward period if the incentive is achieved over a number of workweeks.

4. Commissions

Commissions must be included in an employee's regular rate of pay for overtime reasons just like non-discretionary bonus payments are.

5. Multiple Pay Rate

A non-exempt employee holds two jobs with the same company. In a single workweek, the employee works 10 hours for $12 an hour and 40 hours for $20 an hour. When there are two or more pay rates, the weighted average is the usual rate for that workweek. To calculate overtime:

First Step: Determine the entire straight-time compensation

($15 hourly rate x 10 hours) + ($20 hourly rate X 40 hours) = $950

Second Step: To calculate the regular rate of pay, divide the total straight-time compensation by the total number of hours worked

$950 straight-time pay divided by 50 hours worked = $19

Third Step: Determine the overtime premium

$19 regular rate of pay x .5 x 10 overtime hours = $95

The additional amount that has to be computed is half the normal rate of pay because the straight-time earnings have already been determined (see Step 1 above).

Fourth Step: Determine the week's total compensation

$950 straight-time pay + $95 overtime pay = $1,045

State Law: Federal law also permits employers to use the hourly rate in effect at the time the overtime work is completed to determine the regular rate of pay, provided that the employee agreed to this approach in advance of conducting the work and that certain additional requirements are met. Writing down these agreements is required. Each state has its own set of laws. You can check Florida overtime law here. To verify compliance, check the laws in your state.

6. Shift Differentials

A shift differential is a premium pay given to an employee in exchange for working a shift that is less favoured.

If you require workers to work second or third shifts, weekends, or holidays, this may occur. For instance, a business might pay its staff an hourly rate of $10 plus an extra dollar per hour for any hours worked on Saturdays or Sundays, between the hours of 5 p.m. and 5 a.m., or during the week.

When calculating the regular rate, these premium rates must be considered, and overtime compensation must be given using the regular rate after taking into account the shift differential.

Why Some Workers Are Exempt From Working Extra Hours?

Some employees are thought to be exempt from obtaining overtime compensation due to the nature of their work. In order to be considered exempt worker, an employee must perform a specific set of duties.

Executive, administrative, professional, outside sales, and some technical professionals are recognized as exempt under the Fair Labor Standards Act (FLSA). When assessing whether or not an employee is exempt from working, the job description is not taken into account.

Overtime & Pay Regulations for Employees

The Wage and Hour Division of the U.S. Department of Labor regulates overtime and other pay practices through the Fair Labor Standards Act. Moreover, the Act also governs child labour and minimum wage practices by American employers in addition to its overtime rules.

Overtime rules and other labour laws may be more stringent in some states than they are in the federal government. In this situation, stricter rules must be followed. Furthermore, to evaluate state labour regulations, check with your state's labour department or consult an employment lawyer.

Keeping Track of Overtime

According to the FLSA, businesses are required to keep track of all payments made to workers, including overtime pay. An employer must be able to demonstrate that overtime payments made during an audit complied with FLSA regulations.

How much overtime compensation are employees entitled to?

The method used by the employer to determine overtime rates—which are often based on the standard pay rate—determines the amount of overtime pay.

Moreover, rates typically depend on the number of overtime hours worked, when those hours are worked, the terms of any applicable employment contracts or awards, and the amount of overtime worked.

Depending on your position and the sector you work in, you may be compensated differently for working overtime. To calculate the amount of overtime pay you are due, you can utilise Fair Work's pay calculator.

How Deskera Can Assist You?

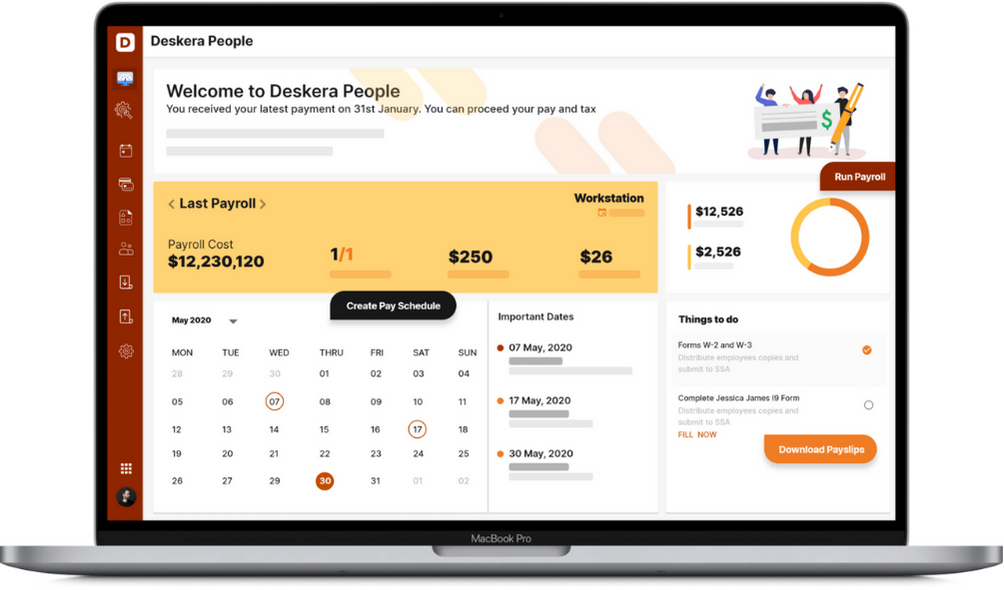

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, uploading expenses, and creating new leave types make your work simple.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- The number of hours a full-time employee works past their regularly planned shifts is referred to as overtime. Furthermore, the number of overtime hours might vary based on the company and the country where employment and labor laws are in effect.

- Employers must carefully assess if their staff members are exempt or nonexempt from overtime compensation because they are responsible for any unpaid overtime.

- Overtime pay is the extra pay rate given to hourly employees who work more than a set number of hours each week. The federal requirement for overtime pay for hourly workers is that they receive 1.5 times their usual hourly wage for labor over 40 hours per week.

- The ratio of an employee's overtime hours to their regular hours worked during a pay period is known as the overtime percentage.

- There is no legal requirement that an employer pay employees double their ordinary rate of pay. It's merely an incentive that some companies use to encourage workers to come in on days when they would otherwise take off.

- Tipped overtime is applicable to workers whose wages are less than the minimum wage and who get at least $30 in tips each week. If a tipped employee works overtime, their overtime compensation is calculated by increasing their hourly tip rate by 1.5 and deducting it from the minimum wage rate.

- When an employer requests overtime from a staff member but it is not specified in the contract, it is known as voluntary overtime. In this circumstance, employees are allowed to accept or refuse the overtime work as they see fit.

- Eight-and-eighty sort of overtime is only applicable to specific personnel, such as healthcare professionals, and it is calculated by employers for workers who put in more than the industry norm of eight hours per day.

- Employees may be entitled to time off as compensation for overtime labour instead of earning more money (TOIL). This is often the same amount of time off as was worked, taken later as arranged with the employer.

- Non-guaranteed overtime refers to a specific circumstance in which an employee's employment agreement mandates that they work overtime upon request.

- If you are paid per hour, your wage is determined by your hourly rate. For salaried employees, dividing your pay into weeks and hours will allow you to determine your hourly rate.

- Non-discretionary incentives are ones that must be given out if an employee meets certain requirements, such as annual bonuses that are a component of an employee's compensation plan.

- Commissions must be included in an employee's regular rate of pay for overtime reasons just like non-discretionary bonus payments are.

- Federal law also permits employers to use the hourly rate in effect at the time the overtime work is completed to determine the regular rate of pay, provided that the employee agreed to this approach in advance of conducting the work and that certain additional requirements are met.

- When calculating the regular rate, these premium rates must be considered, and overtime compensation must be given using the regular rate after taking into account the shift differential.

- According to the FLSA, businesses are required to keep track of all payments made to workers, including overtime pay.

- The Wage and Hour Division of the U.S. Department of Labor regulates overtime and other pay practices through the Fair Labor Standards Act. Moreover, the Act also governs child labour and minimum wage practices by American employers in addition to its overtime rules.

- The method used by the employer to determine overtime rates—which are often based on the standard pay rate—determines the amount of overtime pay.

- Moreover, rates typically depend on the number of overtime hours worked, when those hours are worked, the terms of any applicable employment contracts or awards, and the amount of overtime worked.

Related Articles