Businesses across India are carried out from various locations. It could be from home, a local market store or even a shop in a very prominent market area of the city or town. Employers in India need to maintain accurate data of the employees at the workplace.

When an individual gets employed at a shop in Orissa, he needs to submit an employer certificate format to be submitted to the government of Orissa under the Orissa Shops and Commercials Establishment Act that was established in the year 1958. Let us understand what is form 15 or employer certificate format through this blog. We are going to cover the following points in this blog

- What is Orissa Shops and Commercials Establishment Act?

- Why was form 15 established by the state government?

- What to submit in form 15?

- What are the exemptions for employer certificate?

- What is the layout of the employer certificate format?

- Conclusion

- How can Deskera Assist you?

- Key Takeaways

What is Orissa Shops and Commercials Establishment Act?

According to available information from the internet, the Orissa Shops and Commercials Establishment Act received the assent of the then governor of Orissa on 14 December 1956 and got published on 28 December 1956. This act was established to regulate the conditions of work and employment for workers in the shops and commercial establishments in the state of Orissa in India. The act was put into effect by the state government to put an end to the immoral practices by the employer even if they sounded practical at that time. Ir was enacted by the legislature of Orissa in the seventh year after India was officially declared a republic nation in 1950.

The Act can be read on the link given below -

Why was form 15 established by the state government?

The Orissa Shops and Commercials Establishment Act is considered to be an important Act for the employer certificate format to be submitted by every business owner of the state. It extends to the entire state of Orissa and is known to come into force with immediate effects once it was published in the Orissa Gazette by the state governor. It is considered to be an important form for employees working regular time as well as overtime. The employers or business owners have to maintain an accurate record of the timings of the employees so that they can submit it to the state government when required.

What to submit in form 15?

As per the rules of the state government of Orissa, an employer or business owner is required to submit the employer certificate format before the 31st of December for the previous financial year. It is considered to be a self-certificate or employer certificate format to be submitted by the small business owners or employers under the Orissa shops and commercial establishment act, 1956 and Orissa shops and establishment rules, 1958.

In this act, there is nothing repugnant and the entrepreneur must know about the following definitions in this act -

- Apprentice: An apprentice is a person who is not less than twelve years of age and is employed by the shop owner or businessman. He can be a part of the workforce under some payment of wages or for training purposes to learn any trade or craft.

- Chief Inspector: He is an individual who has been assigned as the chief executive authority under the Act.

- Closed: It means the shop or commercial establishment is not open for any kind of service or business for the customers.

- Commercial establishment: A commercial establishment in Orissa refers to any commercial, trading, banking or insurance establishment which has employed employees and engaged them in official work, hotel, theatre, restaurant, refreshment house or any other place of amusement.

- Day: It is the period of twenty-four hours and is counted from midnight.

- Employee: An employee is an individual who is at a part-time or full–time work and in connection with the establishment in the state. The employees who do clerical work, apprentice work provided he is not a member of the employer’s family and other staff-related jobs in an industrial establishment are also included under this act.

- Employer: An employer is an individual who is in charge of the establishment. He has ultimate control over the work of the shop, business or organization. His team comprises a manager, agent or another individual who is in the general management group or has control over the establishment.

- Establishment: According to this act, an establishment refers to a shop that has a small business or is a commercial establishment.

- Family: A family relation of an employer refers to the husband or wife, son, daughter, mother, father, sister or brother of the individual who resides with the entrepreneur and is dependent on him.

- Inspector: Inspector is the police personnel appointed by the state government under this act to check the employer certificate format

- Leave: Leave is considered to be a day off in the employment period.

- Night: It is the time period of at least 12 consecutive hours that has the interval between 10 p.m. and 6 a.m.

- Opened: It means the shop or establishment is open for the service of customers or other businesses that are connected with the business owner.

- Period of work: It is the time in which the employee has to fulfil his duties at the work location.

What are the exemptions for employer certificate?

The state government of Orissa have exempted a few employers from submitting the employer certificate. These exemptions are as follows -

- Noting in the Orissa Shops and Commercials Establishment Act shall apply to -

a. Offices of or the establishments that come under the Central or State Government or local authorities

b. Offices which are under the Reserve Bank of India

c. The establishments that are run by business owners themselves by being a sole proprietor. It means he has not employed any other employee in the company or runs a family business.

d. The establishments that do the task of providing care and treatment to the sick elders, destitute or mentally ill individuals

e. Establishments which has employees working in management position or has workers that are employed under confidential circumstances.

f. Employees whose profession is of a care-taker or a traveller

g. Individuals who are directly engaged in preparatory work like forwardng clerks that are responsible for dispatching goods in the market

h. Fairs for sale of charitable products or other purpose in which the employer has no private profit.

i. Libraries where the business owner does the business of lending periodicals or books to other people with no motto of making profits that would be donated for philanthropic, charitable or religious reasons.

2. Furthermore, the state government can give a notification to exempt for a temporary period or even permanently any establishment to whom the Act is applicable.

What is the layout of the employer certificate format?

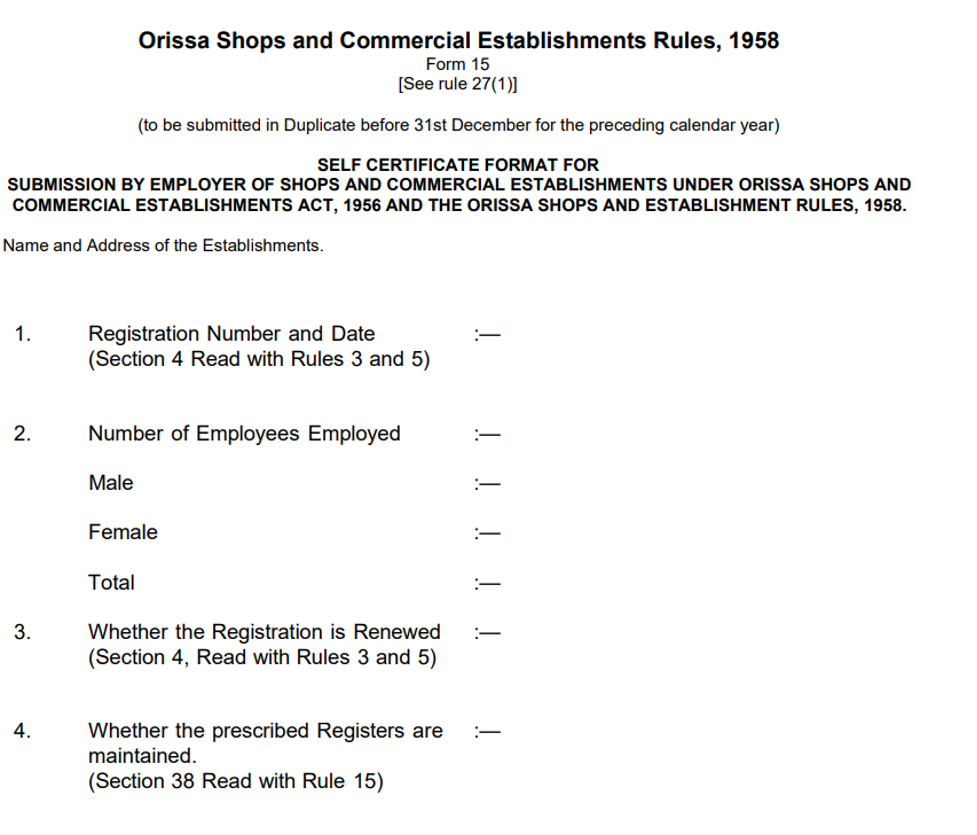

The government of Orissa has defined a easy to understand employer certificate format for the employers in this state. They are required to fill the details of the information requested on this form to tell the government about the employees working in their shop or businesses. The format of this form 15 is as given below -

- Registration date - On line number 1, the employer must mention the date on which had registered his establishment with the state government.

- Number of workers - On line number 2 of this employer certificate format, the business owner has to give the details of total number of employees working in his shop or business. He should specify the number of male and female workers separately in this section

- Whether registration is renewed - Here the business owner must clarify in the employer certificate format that if it is a renewed registration or new one for his establishment.

- Whether the prescribed registers are maintained - The business owner must tell specifically if he maintains the prescribed registers for his employees.

- Exemption: On this line of form 15, the small business owner must tell if he has obtained the exemption for maintaining computerized and alternative forms from the state government.

- Holiday: In this line, the employer needs to clarify if he has maintained the prescribed hours of work, holidays, leaves and even maternity benefits for the employees in his business

- Tax: In this line of the form, the business owner must talk about the income tax he gives to the government and even mention about the annual returns he has for the specific financial year he is talking about.

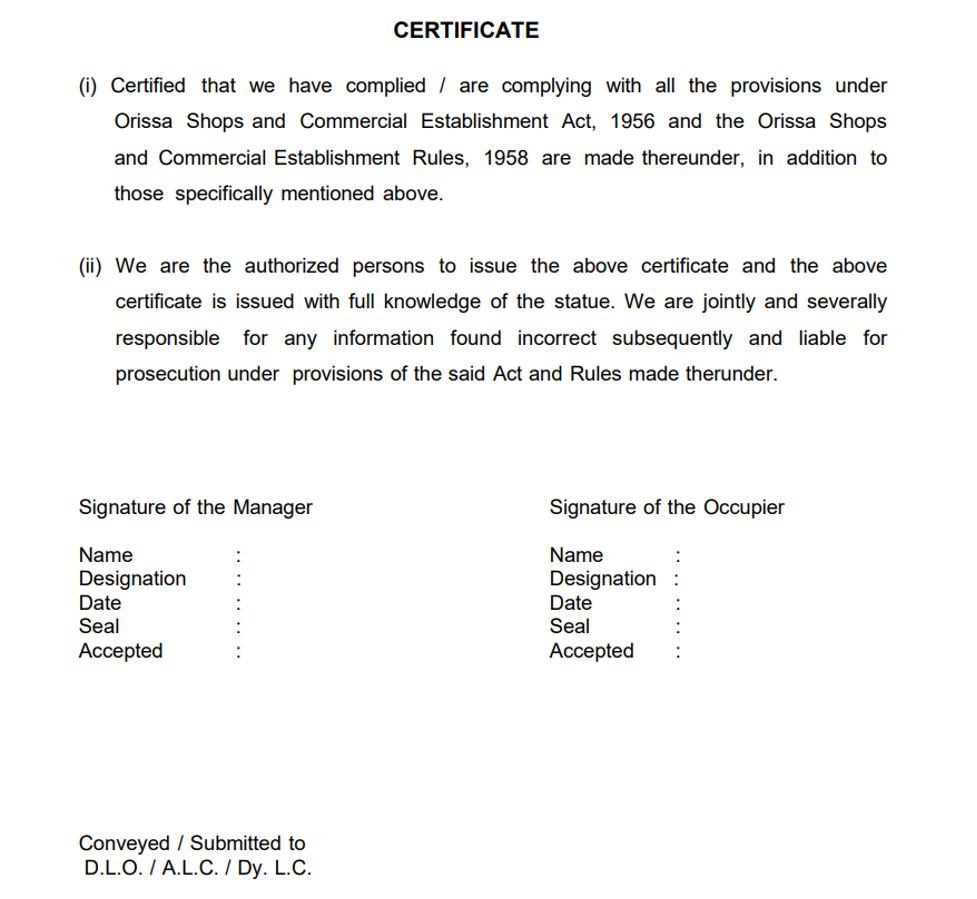

On the second page of this employer certificate format, the employer must specify that he is willing to comply to all the provisions mentioned in the form under the Orissa Shops and Commercial Establishment Act and the Orissa Shops and Commerical Establishment Rules. He must show an authority to issue this employer certificate to the state government and take responsibility for any misinformation or incorrect data identified by them later. This form must be duly by the business owner and the manager.

Conclusion

Every business owner in Orissa has to submit the employer certificate format to the state government under the Orissa Shops and Commercial Establishment Act. He should give proper details about the work hours, leaves, management and employees in his organization to the government before 31st december of the year.

How can Deskera Assist you?

Deskera People is the perfect platform to get all the information a business owner needs for his business. We have sorted the topics in the grid that are related to accounting, HR and payroll.

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Employers in Orissa need to fill the form 15 under the Orissa Shops and Commercial Establishment Act and Orissa Shops and Commercial Establishment Rules.

- The business owner must talk about the number of employees, both male and female in his business. He should mention their business registration date, whether it is renewed, hours or work, holidays and benefits provided to the employees in this form.

- A business owner who is in the list of exempted employers should not submit this format to the state government.

- The business owner must agree to the compliances that are mentioned in the form and submit a signed copy of it to the Orissa government within the last date which is 31 december of the concerned year.

- The sole proprietor or an employer involved in family business in this state where he has relatives working in the organization need not submit this form.

Related Articles