Remember how Sheldon Cooper is very careful about his sitting spots, food, and germs? Company owners need to be as careful when it comes to avoiding unnecessary damages, both to the company and employees.

Running a company or firm is not a cakewalk, it requires you to make smart decisions. Having a Workers’ Compensation Insurance falls in the same ambit. No matter how big or small your firm is, taking care of the employees is a crucial aspect. It not only keeps your employees happy but also glorifies the company’s working atmosphere. Firms that treat their workers with respect and thoughtfulness have better chances of growing exponentially. So, what exactly is the Workers’ Compensation Policy and how does it work? Does it cost a lot?

If these questions often bother you then you have landed on the right page. Here you will find all the adequate information on Workers’ Compensation Insurance and the various ways of optimizing it for better results.

What will you find in this article

- What is Workers' Compensation Insurance / Policy?

- Why do You Need the Workers’ Comp Policy?

- Benefits of the Workers’ Comp Policy for Employees and Employers

- For Employers

- For Employees

- Why is the Workers’ Compensation Policy Essentially Beneficial for Small Businesses?

- How Does the Workers' Compensation Policy Work?

- What is Covered in a Workers' Comp Insurance?

- What is Not Covered in a Workers' Comp Policy?

- Disadvantages of Not Having a Workers' Compensation Policy

- How to Optimize your Workers' Comp Policy?

- How to Improve

- How to Save Cost

- How to Make the Policy Concrete

- How is Workers’ Compensation Insurance Different from General Liability?

- What is Common Between General Liability and Workers’ Compensation Insurance?

- Key Takeaways

What is Workers' Compensation Insurance / Policy?

The policy has many names like the Workers’ Comp Insurance or Employer’s liability compensation, etc. It refers to a policy that ensures to cover medical expenses and lost salaries in case of a medical emergency or other injuries. It proves to be of great importance for grim times when an employee gets injured at the workplace and decides to sue you for workplace injuries. So, in a way, the policy not only provides monetary assistance to an employee but also safeguards the company’s reputation.

There are different workers’ compensation insurances available as per the company’s requirements. The Workers’ Comp Policy is often made mandatory by the government in many states. But in case it hasn’t been made compulsory, it is wise to include it in your company profile. Insurance is beneficial in many aspects, plus it offers security to both the employee and the company.

Why do You Need the Workers’ Comp Policy?

Workers’ Comp Policy is not an option as it has been made compulsory by the government. So, you simply need to implement it. Also, if you want to ensure that your employees do not file a lawsuit against you in case an accident or injury occurs at the workplace, then introducing a Workers’ Comp Policy is the wisest decision you can make. Since you will be providing an amount for medical expenses in case of an injury or accident, the employer will no longer hold the right to file a lawsuit. Apart from that, your company will stay in the good list of employees catering to their needs.

Benefits of the Workers’ Comp Policy for Employees and Employers

The Workers’ Comp Policy offers multiple benefits to employees as well as employers. This insurance is widely accepted across the USA for its various advantages. Are you wondering what makes this insurance policy famous among the companies and their employees? Here are all the answers:

For Employers

- Better work environment: Employees put more effort into work when their efforts are valued. By providing Workers’ Comp Insurance, a company is actually giving a strong message to its workers. The policy makes them feel safe and secure in their job. As medical bills can badly hit a person’s financial funds, a company offering Workers’ Comp insurance is a great deal.

- More efficiency: Who wouldn’t want to work in a peaceful and happy work environment? When the employees are provided comfort, their efficiency automatically elevates. A sense of loyalty arises only because they know that their employer is providing them additional benefits.

- Reduced chances of a lawsuit: With a Workers’ Comp Policy, you basically exempt your employees from filing a lawsuit against your company in case of an injury or accident in the office. The Workers’ Compensation Insurance acts as a safety net for your company. When you are already providing them with insurance that covers all their expenses, there is no chance of them filing a lawsuit against your firm.

For Employees

- You save money: When your company is offering you a Workers’ Comp Policy, you basically save a lot of money on medical emergencies and injuries. The cost of even a minor fracture treatment can heavily affect your cash reserves. So, if you have insurance, that money shortage can be easily avoided.

- Coverage of lost wages: Suppose a person gets injured during work and has the Workers’ Comp insurance, a portion of their wage is also covered in the policy. This is offered by most insurance companies but it is better to check whether your agency offers it.

Why is the Workers’ Compensation Policy Essentially Beneficial for Small Businesses?

Small businesses and startups have a lot to worry about and an additional lawsuit from their employee can worsen things. It takes blood and sweat to form a company and start a new business. Small businesses try their best to avoid any kind of mess that can lend them legal as well as financial distress, not to mention the penalties that follow such incidents. A Workers’ Compensation Policy has the potential of relieving small businesses of a few issues including injuries and medical emergencies of employees.

You can always count on the Workers’ Compensation Policy if your employee attains an injury while working for you. All the medical bills will be covered including the partial compensation for the wages your employee loses while taking the time off the work. Not having insurance would lead to hefty expenses, which your company will have to bear.

In case an employee gets injured and files a lawsuit against you for negligence in preventing an accident at the workplace, bearing the expenses will be a nightmare. But having insurance will save you from such unfortunate issues.

Having a Workers’ Comp Policy is mandatory in almost all states. So, if you want to avoid penalties, you should comply with the law and offer your employees Workers’ Comp Insurance.

How Does the Workers' Compensation Policy Work?

A Workers' Compensation Insurance provides peace of mind both to the employer and employee. But it is essential to know how the insurance actually works and when to report an injury or medical emergency.

So, the first thing to be done is as soon as an employee gets injured or an accident takes place, it should be immediately reported to the insurance agency.

Medical treatment should also be sought right away and should not be delayed. Delaying the treatment may worsen the injury leading to an expensive treatment, which the insurance agency may later deny to provide because of the delay.

Once the employee has received the treatment, the medical aid provider will have to prepare a report and send it to the insurance company. The rest will be taken care of from there.

What is Covered in a Workers' Comp Insurance?

Apart from the process, it is also essential to know what is covered in the Workers' Comp Policy. A roofing expert getting injured while installing a roof is an apt example of a situation where the insurance company will definitely cover the expenses. But if an employee meets with an accident during the commute or while reaching the job site, that isn't covered in the Workers' Comp Policy. So, it will be best if you read all the insurance coverage details carefully.

Generally, a Workers' Comp Policy will cover injuries or medical situations caused during the job or while attending to a chore related to the company. These include:

- Wages lost due to an injury occurring during the job.

- Medical Compensation

- Rehabilitation expenses

- Death benefits (funeral arrangements, etc)

What is Not Covered in a Workers' Comp Policy?

Though Workers' Compensation Insurance is designed to provide medical security to the employees and other benefits to the employer, there are certain situations where the insurance doesn't work. Most of these injuries are ones that occur due to drug intoxication or events signifying negligence on the patient's part. Here are some of the injuries that are not covered in a Workers' Comp Policy:

- Any kind of injury that has taken place when you are not on your job.

- Injuries taking place when you are drunk, under the influence of illegal drugs, etc.

- When the employee violates company policy.

The laws expect every company that has even a single employee to provide them with Workers' Comp Insurance. You will be penalized if you fail to comply with the law. The amount of fine is different in different states. For example, the fine is $100,000 in California.

Disadvantages of Not Having a Workers' Compensation Policy

A company has to manage many expenses in order to thrive and survive. Imagine having to pay huge medical bills only because your employee got hurt while on the job. Or what if one of your employees files a lawsuit against you because you were unable to prevent a serious injury. A Workers' Compensation Insurance becomes your saviour during such instances. Following are the downsides of not having Compensation insurance:

- Penalty: If you are a licensed company - no matter how big or small, as long as you have at least one employee working for you, you are liable to provide them with a Workers' Comp Policy. In case you fail to do that, you will have to pay the fine, which is not at all a small amount. So, if you want to avoid getting penalized, having a Workers' Comp Policy is crucial.

- Lawsuit: A company with no Workers' Comp Policy has a high chance of being charged with a lawsuit. By providing your employees with the insurance, you are basically preventing them from filing a lawsuit against you in case a workplace injury takes place.

- Expensive medical bills: If a worker gets injured on the job and you don’t have a Workers' Comp Policy, know that a hefty medical bill is waiting for you. So, if you wish to avoid paying heavy medical bills, a Workers' Comp Policy is the best way out.

How to Optimize your Workers' Comp Policy?

Businesses are run on strategies and that is how you save money. Managing the expenses and deriving the best strategies for cutting costs wherever possible marks an appropriate money-saving technique. Workers' Compensation Insurance does not come cheap. So, you need to know certain tactics for optimizing it for better benefits. You would not want your money to go in vain and spending an inconsiderate amount is no good idea as well. To help you better optimize your Workers' Comp Policy and derive the most out of it, we have compiled a few tips for you that are widely adopted by companies:

How to Improve

Improving the Workers’ Comp Policy helps in making the workplace better for the employees and helps the company prevent as many claims as possible.

Hazard Safety

Safety for the customers and clients is a priority of most businesses. Some businesses however overlook the importance of workplace safety for their employees. Ensure that your place of business has all the safety hazards that can prevent unforeseen mishaps.

For example, the backdoor entry in most businesses is never protected and maintained. The unclean floors or loose doors can cause an accident with the employees.

Here are some preventive measures that can be taken to ensure safety -

- Educate the employees about workplace safety and ensure they are aware of its importance.

- Introduce and practice wearing safety gear like eye protectors, safety suits, etc. to ensure safety.

- Encourage or make it mandatory to use gloves while working with chemicals, welding guns, cutters, etc.

- Ensure the employees are wearing appropriate attire for the business as per safety measures.

- Fix the place with fire extinguishers and conduct fire drills once in a while.

Hiring Checks

Before hiring an employee, it is essential to be aware of their medical history and background. An employee who has had an unstable working experience, drug abuse history, or disinterest in the kind of job they have applied for, is most likely to get injured. This happens as their mind is not at peace and their focus is distracted.

This will also result in them taking longer than they need to return to work after they have recovered from the injury. This will ultimately cost the company more human power and finances wasted.

Enhanced Relationship

The heads of the company may or may not have a good and easy-to-communicate relationship with employees. This can create a high impact negative effect on employees ultimately resulting negatively on the company.

When employees do not have the support and easy channel of communication with their seniors, they feel neglected and undervalued.

After recovering from the injury, if they still feel unvalued, there is a higher chance of the employees not being willing to come back to the workplace.

To ensure this does not happen, keep in constant contact with employees. Keep checking up on them while recovering. Make them feel they are being missed and or of value to the company.

Active Participation in Investigation and Involvement with Society Insurance

For the injured employee, the entire accident is painful as well as traumatic. In such a situation, it is not always humanly possible for the employee to actively participate in the investigation process with the social insurance investigation department.

The evidence also needs to be captured right when the accident happened. To ensure the claim filed is approved, take pictures of the proofs you may find around.

Be involved in the process and help the employee. Keep the equipment involved in the accident untouched. Request information for the claim and the cost to help the employee. Do as much as you can to help out the employee by making the process swift for them.

Faster Reporting

Evidence of the accident may not last for a long time. At times, the evidence only lasts a couple of hours. If the actions are not taken instantly, it can become difficult, or at times, impossible to claim insurance.

For the same, rapid actions should be taken on the end of employees as well as the employer by helping them out in the right way.

Assign Small Duties

While the employee is away from work, recovering from injuries and the accident, they might feel neglected or incompetent. To ensure this does not happen, the company should assign some night, less time-consuming tasks to the employees after they are able to work in small amounts.

This will keep their energy up, will keep them secure about their job, and will also help them in being productive.

This will also encourage them to return to work sooner. Once lost touch with work, it becomes difficult for employees to return. This way, the employees can be protected from losing interest as well.

How to Save Cost

Workers’ Comp Policy claims can drain out a lot of money from any business. A business has to work on ways in which this cost can be saved as much as possible. The points here will help you optimize your Workers’ Comp Policy in a way to save more cost.

Prevent Claims from Workers

A business cannot forcefully stop any employee from filing a claim. However, there are ways where you can prevent the employees from filing claims as much as possible.

To begin with, when an employee suffers an injury in the workplace, the insurance carrier will have to pay the lost amount of wages as well as medical expenses. To ensure that never happens, improve the security and safety in the workplace. Educate the employees about workplace safety. Appoint psychologists in the workplace to help out distracted employees.

Lower the Cost of Claim

A great way to reduce the cost of a claim is by introducing a new back-to-work scheme. Reduce the burden on your company by calling the injured employees back to work early. Call them as soon as they are well enough to work again. This way the employees will be taken off the workers' comp benefits sooner.

Improve Risk Management

Every business has risks involved. Every contract has some loopholes. As a business, it becomes your priority to eliminate all those risks and loopholes. The priority in risk management is to prevent the employee from getting injured, especially within the workplace.

This way the company can save a lot of cost on claims your company faces.

How to Make the Policy Concrete

Choose Wisely

The decision of finalizing an insurance company should not be taken abruptly. It needs to be a well-informed and thoughtful decision. Conducting a survey and comparing the prices, coverage, premium, etc will give you a fair idea of the market. Once you have narrowed down some of the agencies, analyze which one offers the best services at a comparatively lesser price. Finally, you will have the most suitable Workers' Comp Policy provider.

Market Variation Awareness

The market is changing forever and new companies are coming up time and day. There is a lot of competition in the industry and insurance providers are fighting to get clients. It is recommended that you keep a track of the major insurance providers and switch to a better one whenever you find a new one. Sticking to one insurance agency means buying a product and using it for a long time without realizing that better ones have come up. There are high chances that in the next financial year, you will find a better Workers' Comp Policy provider at a lower rate. All you need to do is stay aware of the market changes.

Carefully Crafted Injury Plan

Injuries and accidents are sometimes inevitable, they just happen. Having an injury plan can reduce the severity and also ensures timely treatment. Above all, it gives your employees a sense of protection and security. They know that their company cares for them. Security workshops should be held at regular intervals so the employees know what to do in case of a medical emergency. This also ensures that if and when a medical injury arises, it is treated quickly reducing the chances of serious issues.

Classification of the Employees

Not all the employees in your company are prone or subjected to similar conditions. Some have more chances of attaining an injury than others. Your field workers stay outdoors most of the time and are met with conditions that can lead to injury. For instance, a mine worker would need a higher coverage than a desk employee. So, you should provide plans to your workers based on their field of work. Companies save a lot of money by following this classification policy. The premium is different for different plans. It is best to choose the most expensive ones for the employees who are exposed to unfavorable conditions.

Discount From the State

This may not get you a high discount but you will still be able to save some money. In most states, the authorities grant you some discount on Workers’ Compensation Insurance if a company promotes safety. For example, promoting a drug-free workplace gets you a discount in most States.

Follow the Best Practices of the Claim

The most crucial action a company can take, in my opinion, is to make sure that its claims adjuster adheres to the industry's best claims management procedures. This has the potential to cut the payout by up to 50%. Any business needs savings of this nature. These "best practices" involve straightforward actions like speaking to the employee face-to-face and possibly involving medical personnel in order to address any potential difficulties as soon as they appear. An adjuster can expedite the process and help you save money by, among other things, ensuring that all documentation is filed on time, checking for coverage, and keeping a daily log of all work done on the claim.

Tips to choose a suitable Workers’ Comp Policy

There are a few things to keep in mind when you're searching for Workers’ Comp insurance.

1. First, make sure you understand your State's requirements. You may be required to have certain coverage levels in order to do business in your state.

2. Second, think about how much coverage you need. The amount of coverage you need will vary depending on the type of business you have and the risks involved.

3. Third, shop around and compare rates from different insurers. Be sure to get quotes from several different companies so that you can compare prices and coverage levels.

4. Finally, be sure to survey the market periodically to make sure you're getting the best possible rate. By following these tips, you can save money on your work comp insurance and be sure you're adequately protected.

How is Workers’ Compensation Insurance Different from General Liability?

You might wonder that if you are already providing General Liability Insurance, what is the need for Workers’ Compensation Insurance? Well, the two are completely different. The objective of general liability is to protect you from claims that your business caused any bodily injury or property damage. If a customer trips and falls on the company’s premises, the cost can be covered by general liability. On the other hand, Workers’ Compensation Insurance will cover all the medical expenses.

What is Common Between General Liability and Workers’ Compensation Insurance?

There are a few key things that general liability insurance and workers’ compensation insurance have in common. For one, they’re both designed to protect businesses from potentially costly lawsuits.

Perhaps the most important similarity between the two types of insurance is that they both cover bodily injury. This is important because if an employee is injured on the job, they may be able to sue the company for damages. By having workers’ compensation insurance, the company can avoid this type of lawsuit.

Another similarity between the two types of insurance is that they both have limits on the amount of money that they will pay out. This is important because it means that the company will still be responsible for any damages that exceed the limit of the insurance policy.

Finally, it’s important to note that Workers’ Comp is required by the law in most States whereas General Liability is not. However, they are both highly recommended for businesses of all sizes.

How Can Deskera Help you?

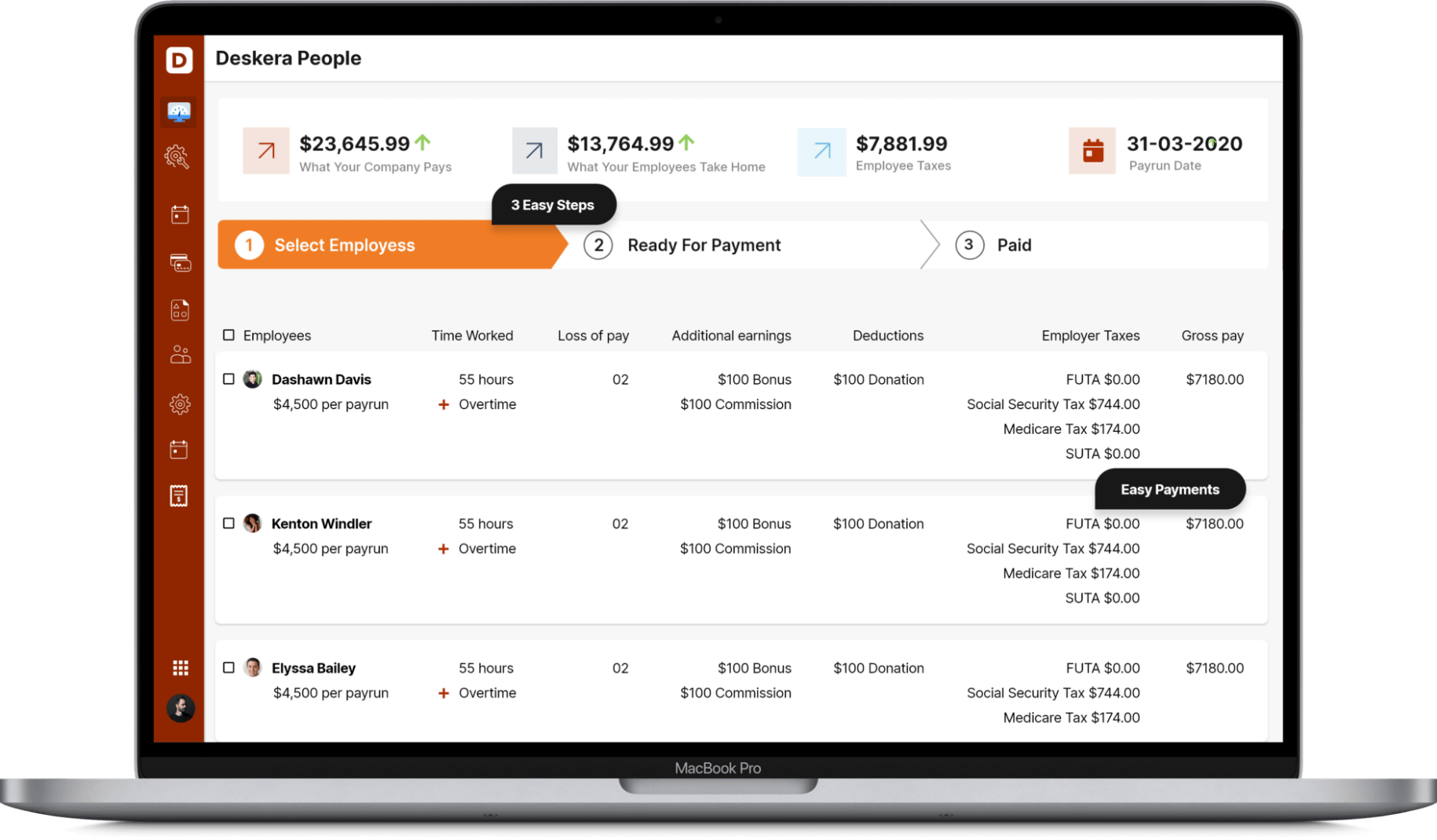

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Key Takeaways

Workers' Compensation Policy benefits all types of businesses. Whether you own a small business startup or even a well-established company, Workers' Comp insurance can save you a lot of money. It was introduced to offer ease and comfort both to the company and its workers - something that is invaluable for any business. So far there have been positive outcomes regarding it. Above all, who wants to spend money on huge medical bills? Especially, when you run a company, you understand the value of every penny.

- The insurance will protect you against any lawsuit filed by an employee for negligence in preventing an accident.

- It will cover all the medical expenses and off-work wages of the injured worker. Having a Workers’ Comp Policy will promote calmness and loyalty, and also instil work ethics in your employees.

- Saving costs on various expenses is something every business dreams of. A Workers’ Comp Insurance is an apt way of achieving it.

- Since the majority of the States have made the Workers’ Comp Policy mandatory, by adding it to your business you will be complying with the official regulations. This will also protect you from getting penalized.

So, if you wish to work peacefully without being bothered by medical bills, you should contact a reliable Workers' Compensation Insurance provider now. Make sure that you follow all the tips mentioned in this blog before finalizing an insurance provider. Remember, the aim is to save money and offer protection to your employees. An acclaimed and professional insurance company will cater to all your requirements while also offering reasonable prices.

Related Articles