Because of a special enrollment period (SEP) in early 2021, open enrollment has reached its highest level since the Affordable Care Act set up health insurance exchanges in 2013, when they were first set up.

CMS says that 13.6 million people have signed up for health insurance through HealthCare.gov or state-based marketplaces, such as those run by their own states or cities (SBM). This is higher than the numbers from the last year of the Obama administration.

It also breaks records for the traditional Open Enrollment period and the number of people who signed up for the first time on the insurance exchanges. Each year, during open enrollment, you have the option of starting, stopping, or changing your health insurance plan. Normally, you sign up for coverage at the end of one calendar year for the following complete year.

Table of contents

- What is open enrollment, and how does it work?

- Open enrollment for marketplace plans

- Open enrollment for employer-sponsored insurance

- When is open enrollment for health insurance?

- What is open enrollment for FSAs, HRAs, and HSAs?

- What Health Insurance Plans Don't Have Open Enrollment?

- What is open enrollment for benefits?

- Is it possible for employees to make adjustments after the open enrollment period has ended?

- Why Should Your Company Have Online Open Enrollment?

What is open enrollment, and how does it work?

Employees can make changes to their health insurance plans during open enrollment, which occurs once a year. Employees can enroll in your company's health insurance plan, switch to a new one, or leave their current plan during open enrollment.

This enrollment period usually applies to your company's health, dental, vision, life, and disability insurance programs. If your employee, for example, choose not to get dental insurance during open enrollment, they will have to wait until the next year's open enrollment period to enroll in a new dental plan, unless they had a qualifying life event (QLE).

Each year, during open enrollment, you can sign up for health insurance or alter your plan (if your plan is provided by an employer, open enrollment is also an opportunity to disenroll if you no longer want the coverage).

Unless you have a qualifying event, you won't be able to sign up for health insurance until the following open enrollment period if you don't sign up during open enrollment. If you're qualified for health insurance and apply during open enrollment, the plan must cover you. Medical underwriting is prohibited, as is requiring proof of insurability, both of which could make it more difficult for you to obtain health insurance.

Open enrollment for marketplace plans

Outside of open enrollment, the only option to get an individual health plan is to qualify for a special enrollment period. Tax credits to cut your monthly rates are only available on Healthcare.gov or a state exchange, which is an advantage of using this federal marketplace.

You may choose to shop for a health plan elsewhere if your income is too high to qualify for tax credits, or if you have a chronic disease and the marketplace plans don't meet your needs.

A health insurance broker or an online health insurance vendor may be able to assist you in finding a plan that is more suitable for you than those available on the state or federal marketplace.

Open enrollment for employer-sponsored insurance

If you have health insurance via your work, your open enrollment period may vary from year to year. Selection takes place in the fall, depending on a variety of circumstances. If you prefer, you can purchase a plan other than the one offered by your company. However, if you refuse your employer's insurance, you should be aware of the following:

If your employer's plan fails to meet minimum coverage and affordability standards, you won't be eligible for premium tax credits for a marketplace plan. Because most businesses pay a portion of the bill, you could end up paying a lot more. If you don't buy a plan during the open enrollment period for individual insurance, you will be uninsured and may be subject to a penalty in some jurisdictions.

Medicare open enrollment

Beneficiaries of Medicare have additional opportunities to adjust their benefits throughout the year. In addition, Medicare, unlike other types of insurance, includes additional disenrollment periods.

When is open enrollment for health insurance?

Every year, the open enrollment period for HealthCare.gov runs from November 1 to December 15; however, depending on whether you live in a state with a state-run exchange, your state's exact time frame may be different.

The timing of open enrollment is determined by the health-care plan you select: Each year, Medicare open enrollment (for Medicare Advantage and Part D plans) runs from October 15 to December 7, with a second open enrollment period for persons who currently have Medicare Advantage running from January 1 to March 31.

Because Medigap insurance does not have an annual open enrollment period, the Medicare open enrollment periods do not apply to them. Although a few states have passed laws allowing Medigap members to make annual adjustments to their policies, Medigap plans are only accessible without medical underwriting during your initial enrollment period or one of the few special enrollment periods that apply to such plans.

Your company determines open enrollment dates for job-based health insurance, which can occur at any time during the year. Employers typically hold open enrollment periods in the fall, with new coverage commencing on January 1 of the following year.

However, some organisations choose to have a health plan year that does not correlate to the calendar year, so you may discover that open enrollment begins in June and a new plan year begins in August at your employment.

From November 1 through December 15, most states hold open enrollment in the individual market (both on and off-exchange). This design is followed by HealthCare.gov, which is the exchange platform used in 38 states as of 2020. (dropping to 36 for 2021, as Pennsylvania and New Jersey will be running their own exchange platforms).

The District of Columbia and the remaining 12 states (14 in 2021) have more registration options, with the majority of them providing longer enrollment periods. In 2021, the open enrollment periods for individual market health plans in DC, Colorado, and California have already been extended, and a few other state-run exchanges have also announced extensions.

What is open enrollment for FSAs, HRAs, and HSAs?

If your employees wish to open a flexible spending account (FSA) or a health reimbursement arrangement (HRA), they must wait for open enrollment, which may be different from your health plan's enrollment period.

Employees may have to go through one enrollment period for the group health plan and another for FSAs and HRAs because FSAs and HRAs have different plan years than group health plans.

Employees, on the other hand, can enrol in a health savings account (HSA) at any point during the plan year as long as they're enrolled in an HSA-eligible plan and make changes to their contribution at any time during the year.

What should you do to get ready for open enrollment?

Consider assessing your group health plan offerings to see if they meet your employees' demands in terms of quality and pricing before they start analysing their options. If you already provide health insurance, be sure you know when your plan is up for renewal. That's the best moment to look over your present strategy.

You have the option of working with your broker or carrier to locate a better plan or sticking with the one you have now. Renewal refers to keeping your current plan. If you decline to renew your current plan, your carrier will suggest a new one.

During the open enrollment period, the government may also compel you to deliver certain notices to your employees. Among the notices are: If your company offers a wellness programme, such as providing employees a discount if they exercise a particular number of times, the plan papers must include a detailed description of the terms.

Employees who are physically unable to satisfy the criteria must be given a reasonable alternative (or waiver) in the plan materials. If you offer QSEHRA to your employees, you must issue a written notice to each qualified employee at least 90 days before the programme begins.

If your plan covers mastectomy coverage, you must provide a WCHRA (Women's Health and Cancer Rights Act) obligatory notification. If your state provides CHIP or Medicaid premium help, you must give an Employer Notice about Premium Assistance under Medicaid or CHIP (Children's Health Insurance Program).

If your health care plan is grandfathered or purchased before March 23, you must file a Grandfathered Plan Disclosure/Notice. Other open enrollment mailings may also be required by your state. Your health insurance plan provider or broker can assist you in determining what information your employees require.

What effect does open enrollment have on payroll?

Your employees' open enrollment choices have a direct influence on their pay and, by extension, payroll. If an employee moves to a more expensive plan, for example, you'll need to deduct extra from each paycheck.

You may be able to skip this step if your payroll provider also helps you manage employee benefits. You'll need to update payroll and notify your plan provider of any new enrollments or adjustments after your employees have made their choices.

What happens if employees fail to enroll during open enrollment?

If an employee goes on vacation or simply forgets to sign up for health insurance, they may be wondering how to receive coverage now that open enrollment has ended. After open enrollment, most carriers provide you a 30-day grace period to make changes to your coverage.

Whether your company is still inside this time frame, your staff can check with your provider to see if modifications are still possible. If your employees miss this deadline, they can still enrol in health insurance during a special enrollment period that follows a qualified life event, or QLE.

A popular QLE that will trigger a special enrollment period is having a child or getting married. If your employees have experienced any of the above, they will have at least a 30-day window following their QLE to enrol in a health insurance plan that better meets their needs.

Your plan may, however, provide you up to 60 days to make these modifications. Outside of open enrollment and qualified life events, your employees can't make any adjustments, including adding their spouse or children if those additions aren't QLEs.

Special Enrollment Is the Exception to Open Enrollment

In insurance plans that use an open enrollment approach, there is an exception that permits you to enrol outside of open enrollment if you have qualifying life events. You're eligible for a special enrollment period if you have a qualifying event, which permits you to sign up for health insurance outside of open enrollment. A wide range of life events qualify as qualifying life events, including:

- loss of other health insurance coverage inadvertently

- You're relocating out of your old plan's service region, or to an area where you can choose from a variety of health plans.

- getting married

- having a new baby or adopting a child

If you lost your old health insurance because you didn't pay your monthly rates, or if you deliberately terminated your prior coverage, you won't be eligible for a special enrollment period. While qualifying events and special enrollment periods in the individual market are similar to those in employer-sponsored plans, they are not the same.

Healthinsurance.org covers special enrollment periods in the individual market, both on and off-exchange, in great detail. The Society for Human Resource Management has an excellent breakdown of qualifying events that trigger special enrollment periods for employer-sponsored health insurance.

What Health Insurance Plans Don't Have Open Enrollment?

In the United States, most health insurers utilise an open enrollment programme that restricts sign-ups to a specific time each year. The following are some exceptions:

Medicaid, the state-run health insurance programme, does not have an open enrollment period. You can apply for Medicaid at any time if you meet the requirements. Enrollment in CHIP, the US government's Children's Health Insurance Program, is also not time-limited.

There are no open enrollment limits for travel insurance. Travel insurance policies aren't normally subject to open enrollment because of their short duration. However, some travel insurance firms limit your eligibility to acquire coverage to the time period immediately following the booking of your trip.

Short-term health insurance has no open enrollment periods. Short-term insurance, like travel insurance, isn't regulated by the Affordable Care Act (ACA), and plans are available all year in states that allow it (medical underwriting is used to determine eligibility, and short-term plans typically don't cover pre-existing medical conditions).

There are 11 states that do not sell short-term health plans, and many more that impose restrictions that go beyond the federal government's requirements. Supplemental insurance products are available in some instances. Individual supplemental insurance coverage are offered all year.

If your workplace provides supplemental insurance, however, you will most likely only be able to enrol during your organization's overall open enrollment period. Year-round, Medigap policies, which are designed to supplement Original Medicare, can be purchased.

However, once a person's initial six-month enrollment period has expired, Medigap insurers in nearly every state are permitted to employ medical underwriting to assess an applicant's eligibility for coverage.

What is open enrollment for benefits?

In the United States, open enrollment season is a time when employees can choose or alter their employer-provided benefits, such as health, dental, and life insurance, as well as auxiliary or voluntary benefits such as legal services and pet insurance.

Some benefits are paid in full by the company, while others are paid in part by the employee through salary deferral or a section 125 cafeteria plan. People can enrol in a health-care plan or make adjustments to their current coverage during open enrollment.

Open enrollment, which occurs once a year in the fall, may also apply to other forms of benefits, such as dental and life insurance.

Employer-sponsored health insurance and coverage purchased through the federal Marketplace are both eligible for open enrollment. Open enrollment periods usually last between two and four weeks.

An open enrollment period may not be extended by employers who only offer one health plan. The federal government's Children's Health Insurance Program (CHIP) and Medicaid programmes, which allow qualifying applicants to apply for benefits at any time, are exempt from open enrollment.

You can switch to a different health insurance plan or add dental coverage during open enrollment.

How Does Open Enrollment Work?

You can enrol in a new benefits programme or make modifications to an existing one during open enrollment. Regardless of who delivers your benefits, the open enrollment process is pretty simple, though time periods and procedures may differ.

Employees who want to alter their employer-sponsored insurance as well as consumers who participate in the government's Marketplace health plans are both eligible for open enrollment. Employees are typically not allowed to switch insurance plans outside of open enrollment.

You are responsible for communicating benefit-related information to employees during open enrollment as an employer who provides insurance coverage.

Make sure your staff are aware of open enrollment before it begins. Employees will be able to plan for changes in coverage this way. You must also inform employees about the duration of open enrollment at your company. Inform employees that they will be unable to change their plans outside of open enrollment.

Inform employees on the options for adding, modifying, or eliminating coverage from their insurance plan. Determine which employees are qualified to get additional insurance benefits. Discuss both individual and family plans. Explain the rules of participation for employees' spouses.

During open enrollment for health insurance, employees can transfer plans. You might provide a variety of health plans with different deductibles, copays, coverage, and rates. Ascertain that employees are aware of how much they must contribute to the plans each pay period.

Also, disclose any out-of-pocket charges that employees may incur when seeking medical treatment. Employees might be able to pick between a high-deductible health plan (HDHP) and a traditional preferred provider organisation, for example (PPO).

You'd explain that HDHPs have greater deductibles and lower premiums than PPOs, then go over the payment differences in depth. Tell employees when their current coverage ends if they want to cancel their insurance plan.

What can employees change during open enrollment?

Employees can make changes to any insurance-related plans you offer during open enrollment, including health, vision, dental, life, and disability insurance. HSA (health savings account) and FSA (flexible spending account) policies can also be added, changed, or removed.

In most cases, open enrollment does not apply to employee retirement plans in small businesses. At any moment during the year, employees can make adjustments to their small company retirement plans.

Open Enrollment Periods

The federal government determines when the Health Insurance Marketplace's open enrollment period begins. Employers set the dates for open enrollment for the benefits they provide.

However, open enrollment dates are subject to alter in specific circumstances. Due to the COVID-19 pandemic in 2021, for example, the federal government held Marketplace open enrollment from mid-February to mid-May.

Making Changes

Open enrollment may allow you to make a variety of changes depending on your benefits. You may need to add or remove dependents, cancel a health plan, switch to another plan, or enrol in an insurance plan for the first time, for example.

You can apply for a new marketplace health plan or make modifications to your existing marketplace coverage during open enrollment. Open enrollment web pages are also provided by some employers. Employers may also want you to fill out and submit a form, which can be done on paper or online.

Active Enrollment vs. Passive Enrollment

Active or passive regulations may apply to open enrollment. It's critical to understand which procedures are applicable to your benefits. During open enrollment, active enrollment requires an enrollee to re-enroll for a benefit each year. Even if you don't need to make any changes, you'll need to re-enroll in your health insurance plan every year.

Passive enrollment allows you to keep a benefit without having to re-enroll. If you liked your dental insurance plan, for example, it would automatically re-enroll from one year to the next without you having to do anything during open enrollment.

Special Enrollment Period

If you have certain qualifying life circumstances, you may be eligible for a special enrollment period. If you have a federal Marketplace plan, you may be required to enrol within a certain time window.

It can range from 60 days prior to the event to 60 days afterward, depending on the type of event. Employer-sponsored plans must offer a special enrollment period of at least 30 days prior to or after the qualifying event.

Qualifying special enrollment period events can include:

Marriage or divorce, adopting or giving birth to a child, or placing a kid in foster care all result in a change in the number of household members. Moving to a new ZIP code, to or from transitional housing, to attend school, or from another country or U.S. territory are all examples of changes in location.

A change in Marketplace eligibility: Becoming a U.S. citizen, being released from incarceration, having a change in income, or attaining status as a federally recognised tribe member makes you eligible for Marketplace coverage for the first time.

Loss of health insurance: Loss of employer-sponsored health insurance as a result of a job loss, loss of insurance as a result of a wage decline, or ageing out of a parent's health care coverage after turning 26.

Only residents of the United States, citizens of the United States, and nationals of the United States are eligible to use the federal Marketplace. Citizens who are incarcerated are ineligible for Marketplace health insurance.

Preparing for Open Enrollment

Open enrollment allows you to tailor your benefits to meet your current and future requirements. If you plan to have a kid in the following year, for example, you may require a new health care plan as well as a new life insurance policy. Alternatively, you may need to switch to a new health insurance plan to cover a college-bound teen.

Furthermore, you can make changes to a flexible savings account (FSA) or a health savings account during open enrollment (HSA). You can put pre-tax money into these accounts to pay for health-care expenses. If you don't have an FSA or HSA, you may want to open one during open enrollment, or you may need to make changes to an existing account's contributions.

It's also open enrollment time to get rid of any perks you don't use. Because your beloved dog recently died, you may be able to forego pet insurance. Check the payroll deductions on your paycheck stub, which should itemise all payments, if you're unsure what perks you pay for.

Determine whether you need to add or delete beneficiaries if your benefits include life insurance. Consider benefit adjustments required to support approaching retirement plans or the addition of a new domestic partner or spouse.

Is it possible for employees to make adjustments after the open enrollment period has ended?

Employees can make changes to their insurance plans outside of the open enrollment period under certain circumstances. Employees have a limited period of time to add, reduce, or cancel coverage after a qualifying life event.

When an employee is married or divorced, has a child, or loses coverage, these are examples of qualified life events. Employees cannot change their insurance plans outside of open enrollment unless they have a qualified life event.

Payroll and open enrollment

Changes in insurance plans might have an impact on how you manage payroll. Insurance premiums are deductions from an employee's gross pay that you must make.

The amount you withhold from an employee's wages changes when they add, update, or delete coverage.

Changes in insurance contributions may affect the tax liability of the employee.

During open enrollment, make sure to distribute and collect benefit enrollment paperwork from employees. You'll need enrollment forms not just to make modifications to their plans, but also to keep track of them in your records.

It begins for businesses well in advance of the opening and closing dates, when relevant information and enrollment form forms are distributed to employees. To ensure that everyone gets the coverage they want and need, businesses must answer inquiries, request and provide advice, and have employees thoroughly complete paperwork.

Failure to meet open enrollment dates might result in subpar or no coverage for the coming year, so it's crucial that the process goes smoothly. Businesses will need to keep a close eye on who has returned their forms and who hasn't once they've been provided.

Employees must return forms on time, complete them correctly, and sign them, according to open enrollment administrators. Open enrollment administrators must send out reminders to those employees who fail to complete and submit the forms by the December 15 deadline.

Businesses must produce copies for employee healthcare files and deliver the original, signed forms to the proper carriers when employees have handed in all of the forms. Employees have until December 15 to submit their applications.

Carriers set extended deadlines for companies to bring in full forms so that they can enrol employees or make election changes before the year's final due date of January 1. Employee elections take place at this time. Depending on the carrier, you may only have 5 days to submit full enrollment forms in order to fulfil the enrollment date.

Why Should Your Company Have Online Open Enrollment?

The amount of paperwork to complete for small to medium-sized business owners typically surpasses the amount of time allocated to running or growing the business.

You probably spend a lot of time organising what employees have given in, what they haven't, and who you need to track down to collect what's missing, in addition to dealing with all the papers that employees need to fill out. SMBs, many of which run lean and efficient operations, pay a high price for these time drains.

Getting rid of the paperwork that is dragging you down isn't just another unpleasant task off your desk; it might also represent a competitive advantage. In today's competitive environment, having to deal with a lot of paperwork can give your competitors an advantage.

Benefits of Online Enrollment

Costs and time are saved

SMBs will benefit from the ability to move open enrollment online. Not only is the process removed from your control, but it is also placed in the hands of specialists.

Your time is valuable, and you'd be better off investing it in building your company, helping customers, or educating your personnel. The annual open enrollment period is a time-consuming process that can be easily avoided by using a professional, online service.

Less paperwork to deal with

Businesses spend many hours building benefits enrollment packages for their employees on the front end. They can include anything from an overview of employee alternatives to specifics on each perk provided.

To ensure that everyone has completed and returned all forms, businesses send out checklists and construct spreadsheets. Then there's the job of double-checking forms to make sure staff have filled them out correctly. The next item on the to-do list is to organise these so they don't get misplaced.

Enrollment is a lengthy procedure in and of itself. Another day (or more) lost for SMBs is ensuring you have all of the documentation from each employee and then ensuring you send them to the appropriate carrier and on time.

Moving to online enrollment not only eliminates these procedures, but it also eliminates the paper used to print and copy forms for employees to complete. Less paperwork and trips to the post office are usually beneficial.

Employees should be empowered

Staffers can communicate with family members about their alternatives when they can complete enrollment from anywhere (even home). How many times have you mentioned a benefit to a staff member only to have their spouse ask questions?

Employees can study possibilities at their own pace and with any family members who have been involved in the decision-making process. Workers can also look at all of their possibilities using online platforms.

They can get answers to their queries when they compare benefit packages to locate the ones that best suit their needs during the registration process. The time you save searching through plan documentation for answers is priceless: the system takes care of it for the employee faster and more efficiently than you could.

Stop chasing employees

The craziness begins once enrollment begins. Only a few employees will return their paperwork on time, but the others will require constant prodding. There are always employees who put off filling out their forms until the eleventh hour, usually with a laundry list of inquiries before making their final decisions.

You spend numerous hours phoning, messaging, emailing, and appealing with folks who returned forms incomplete or unsigned, asking them to complete the forms correctly, attach supporting papers, or simply sign. Even if it is in their best interests for them to complete their forms on time, some SMBs must urge managers to put pressure on employees to complete the forms.

Employees are reminded to finish their forms or submit supplementary papers by online enrollment systems, which handle the chasing for you. SMBs can watch the status of enrollment submissions, but they don't have to worry about finding stragglers.

Enhance the employee experience

Online enrollment takes the fuss out of yearly benefits enrollment for employees by making it quick and easy to access from anywhere at any time. They can examine policies, benefits, and costs at their leisure, without the stress of work looming over them. Staffers can use online enrollment to make the best decisions for themselves and their families.

The process is easy and pleasant when open enrollment is smoothly connected with your current benefits providers (or even if you're shopping for new carriers). It's easier to attract employees to engage in open enrollment when it's simple.

Avoid errors and omissions

Even the most diligent benefits administrator can overlook an unsigned form or an incomplete enrollment packet. These mistakes could be modest or quite costly. Staff employees who miss registration deadlines may suffer consequences for the rest of the year. Employee errors become a thing of the past when an online system automates enrolment.

Individual forms can only be submitted if they are completely filled out. The enrollment process isn't finished until the employee has selected all of their benefits selections. Employees will be unable to complete the process without doing it completely and accurately if they do it online.

Lower the overall cost

How many hours of labour do you devote to open enrollment each year? Preparing paperwork, answering questions, assembling enrollment materials, and mailing them? What is your hourly wage on average? That's only the beginning of the costs associated with manual open enrollment.

Remember to factor in the time you spend tracking down employees who haven't turned in their paperwork or who have filled them out improperly. Consider the employees who are waiting for you to answer their inquiries or assist them in accurately filling out documents.

The time they spend with you is time they could be spending with their team or themselves. These hourly rates are also taken into account while calculating your total charges. Open enrollment is a time-consuming process.

You may not realise how much effort and money you put into this annual event, but outsourcing enrollment so that employees can fill out their forms whenever and from wherever they choose is a wise decision for any company.

Open enrollment deadlines apply to all benefit options

Open enrollment provides a wide range of employee benefit options in addition to healthcare coverage and spending accounts. During open enrollment, you can manage your retirement plan deductions for the future year.

Employees may modify the way their assets are handled at any time during the year, depending on the plan, but they may only decide how much of their pay to contribute to their fund for the future year at annual open enrollment.

Some employers offer life insurance and long- and short-term disability plans, while others give employees access to legal and financial advice accounts. There are numerous choices for providing financial, medical, and wellness benefits to employees.

During the open enrollment period, employees must choose everything they desire. To ensure accuracy and coverage, employers must methodically collect, document, and transmit all of their options to the relevant authority.

The consequences of a staff member missing open enrollment might be severe. If they were already enrolled in healthcare coverage, they will remain on the same plan for the rest of the year with no modifications permitted.

Those who have not already enrolled may have to wait for a qualifying event or until the next open enrollment period in November of the following year to sign up for coverage.

Open enrollment is a time-consuming process that necessitates rigorous attention to detail.

The process of managing open enrollment in-house for SMBs can take months. Every year, employees can choose from a long list of benefits. However, the period of time employees and employers have to make their elections and have them implemented for the future year is extremely limited.

To manage your costs and expenses you can use many available online accounting software.

How Deskera Can Assist You?

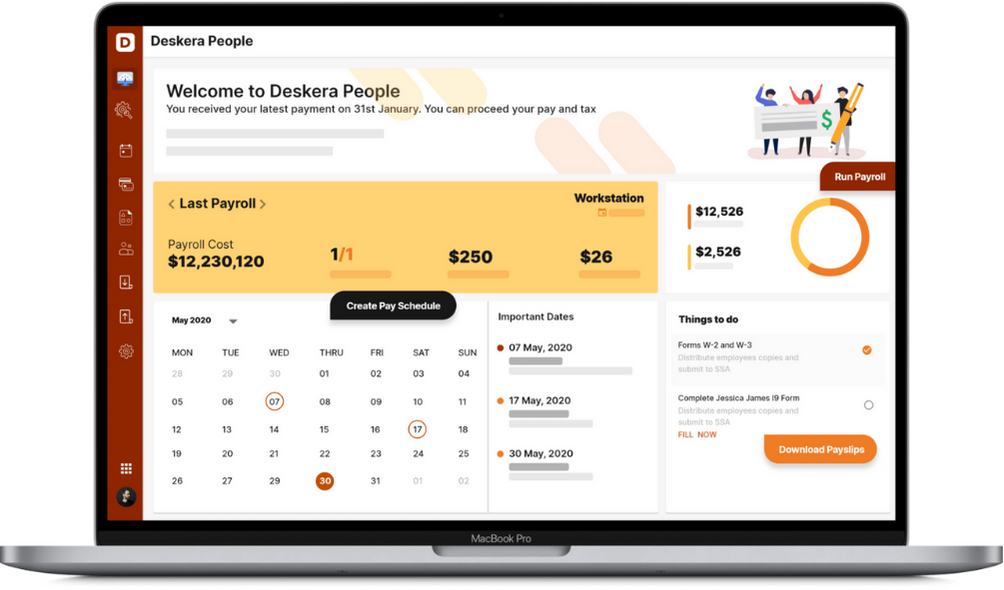

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Employees can make changes to their health insurance plans during open enrollment, which occurs once a year. Employees can enroll in your company's health insurance plan, switch to a new one, or leave their current plan during open enrollment.

- Outside of open enrollment, the only option to get an individual health plan is to qualify for a special enrollment period. Tax credits to cut your monthly rates are only available on Healthcare.gov or a state exchange, which is an advantage of using this federal marketplace.

- Your company determines open enrollment dates for job-based health insurance, which can occur at any time during the year. Employers typically hold open enrollment periods in the fall, with new coverage commencing on January 1 of the following year.

- If an employee goes on vacation or simply forgets to sign up for health insurance, they may be wondering how to receive coverage now that open enrollment has ended. After open enrollment, most carriers provide you a 30-day grace period to make changes to your coverage.

- You have the option of working with your broker or carrier to locate a better plan or sticking with the one you have now. Renewal refers to keeping your current plan. If you decline to renew your current plan, your carrier will suggest a new one.

- There are no open enrollment limits for travel insurance. Travel insurance policies aren't normally subject to open enrollment because of their short duration. However, some travel insurance firms limit your eligibility to acquire coverage to the time period immediately following the booking of your trip.

- You can enroll in a new benefits programme or make modifications to an existing one during open enrollment. Regardless of who delivers your benefits, the open enrollment process is pretty simple, though time periods and procedures may differ.

- Inform employees on the options for adding, modifying, or eliminating coverage from their insurance plan. Determine which employees are qualified to get additional insurance benefits. Discuss both individual and family plans. Explain the rules of participation for employees' spouses.

- Enrollment is a lengthy procedure in and of itself. Another day (or more) lost for SMBs is ensuring you have all of the documentation from each employee and then ensuring you send them to the appropriate carrier and on time.

- Moving to online enrollment not only eliminates these procedures, but it also eliminates the paper used to print and copy forms for employees to complete. Less paperwork and trips to the post office are usually beneficial.

Related Articles