In 1926, the Indian government communicated with neighboring governments to learn more about the situation of wage payments to workers in industry. On the 15th of February 1935, the Payment of Wages Bill, based on indistinguishable criteria from the former Bill of 1933 but completely overhauled(restored), was introduced in the Legislative Assembly.

The bill was sent to a Select Committee for further consideration. This article will serve as a guide to Payment of Wages Act. Following are the topics covered:

What are Wages?

Wage is the monetary compensation or payment, sometimes known as personnel expenses, that an employer pays to employees in exchange for work performed. Wage can be computed as a fixed amount for each task accomplished, or as an hourly/daily rate based on an easily measured quantity of work completed.

Wages comprise all monetary remunerations and "including" the following:

- Amount payable under the terms of employment

- Amount payable under any award, settlement, or court order

- Paid as overtime labor or for vacations / leave period

- Payable on account of Termination of employment

Payment of Wages Act, 1936

The Payment of Wages Act of 1936 governs how wages are paid to employees (direct and indirect). The statute is intended to protect employees from unlawful employer deductions and/or unjustifiable salary delays.

• Define laws around wage period, time, and mode of payment of wages to particular classes of workers working in industry without any unjust deductions other than those specified in the Act

• Regulates the rights of the workers covered by this Act

Applicability

All persons employed in a factory or certain designated industrial or other institutions, whether directly or through contractors, are covered by this Act.

• The Central Government is in charge of enforcing the Act in the areas of railways, mines, oilfields, and air transportation.

• All other establishments (factories and other establishments) are under the control of the state government.

• The Act does not apply to those whose monthly wage is Rs. 24,000/- or more.

Regular Pay

Payments should be made before the 7th day of the month if the number of workers is less than 1000, and before the 10th day if the number of workers is greater than 1000. The wage-period cannot be more than one month. Only employees earning less than Rs. 6500 per month are covered by the Act.

Mode of Payment

Payment must be paid in monetary notes or coins, according to the statute. Payment by check or credit to a bank account is permitted with the employee's written authorization.

Wages are deducted

Only approved deductions, as defined by the Act, are permitted by the employer. Fines (Section 8), absence from duty (Section 9), damages or loss (Section 10), deduction for services (amenities) provided to the employer (Section 11), recovery of advances and loans (Section 12, 13), and payment to cooperative societies and insurance are all examples of this (Section 13).

Employers can seek remedy from the authority (Labor Office) on their own or through a trade union.

Objectives of the Payment of Wages Act

The Payment of Wages Act governs the payment of wages to specific types of workers in the industrial sector, and its significance cannot be overstated. The Act ensures that salaries are paid on time and without deductions unless specifically permitted by the Act.

The Act establishes the employer's responsibility for wage payment, as well as the wage period, time and mode of payment, and permissible deductions, as well as a duty on the employer to seek the Government's approval for acts and permissions for which fines may be imposed by him, as well as the sealing of the fines, and a machinery to hear and decide complaints about wage deductions or delays, as well as a penalty for malicious and vexatious acts.

The Act does not apply to anybody earning more than Rs. 24,000 per month. The Act also states that a worker cannot contract out of any of the rights granted to him by the Act.

Short title extent commencement and application

(1) The Payment of Wages Act of 1936 is the name of the law.

(2) It covers the entire country of India.

(3) It shall take effect on the date specified by the Central Government in a notification published in the Official Gazette.

(4) It applies in the first instance to the payment of wages to persons employed in any factory, to persons employed (other than in a factory) by a railway administration or by a person fulfilling a contract with a railway administration, and to persons employed in an industrial or other establishment specified in sub-clauses (a) to (g) of clause (ii) of section 2, and to persons employed in an industrial or other establishment specified in sub-clauses (a) to (g) of clause (ii).

(5) The State Government may, after giving three months' notice in the Official Gazette of its intention to do so, extend the provisions of this Act or any of them to the payment of wages to any class of persons employed in any establishment or class of establishments specified by the Central Government or a State Government under sub-clause (h) of clause (ii) of section 2: Provided, however, that in relation to any such establishment owned by the Central Government,

(6) This Act applies to wages payable to an employed person for a wage period if those wages do not exceed $24,000 per month or such other higher sum as the Central Government may specify, based on figures from the Consumer Expenditure Survey published by the National Sample Survey Organization, after every five years by notification in the Official Gazette.

Definitions

"employed person" [sec 2 (i)] includes the legal representative of a deceased employed person;

"employer"[sec 2 (ia)] includes the legal representative of a deceased employer;

"industrial or other establishment"[sec 2 (i1)] means any -

(a) tramway service or motor transport service engaged in carrying passengers or goods or both by road for hire or reward;

(aa) air transport service other than such service belonging to or exclusively employed in the military naval or air forces of the Union or the Civil Aviation Department of the Government of India;

(b) Dock wharf or jetty

(c) inland vessel mechanically

(c) inland vessel mechanically propelled;

(d) mine quarry or oil-field;

(e) plantation;

(f) workshop or other establishment in which articles are produced adapted or manufactured with a view to their use transport or sale;

(g) Any place where work is being done on the construction, development, or maintenance of buildings, roads, bridges, or canals, or on operations related to navigation, irrigation, or water supply, or on the generation, transmission, and distribution of electricity or any other form of power;

(h) any other establishment or type of establishments that the Central Government or a State Government may specify by publication in the Official Gazette, having regard to the nature of the establishment, the necessity for protection of persons employed within, and other relevant circumstances.

"Wages" [sec 2 (iv)] means all remuneration (whether in the form of salary allowances or otherwise) expressed in money or capable of being expressed in money that would be payable to a person employed in respect of his employment or work done in such employment if the terms of employment express or implied were fulfilled, and includes –

(a) any income due by a court order, award, or settlement between the parties;

(b) any additional payment due under the terms of employment (whether called a bonus or by any other name);

(c) any remuneration to which the person employed is entitled in respect of overtime work, holidays, or any leave period;

(d) any sum payable due to the person's termination of employment under any legislation, contract, or instrument that allows for the payment of such sum, with or without deductions, but does not specify a time limit within which the payment must be paid;

(e) any payment to which the employee is entitled under any system framed under any law in force at the time, but excluding –

(1) any incentive (whether through a profit-sharing arrangement or elsewhere) that is not included in the remuneration payable under the terms of employment or that is not payable under any award, settlement, or court order;

(2) any house-accommodation, light water supply, medical attendance, or other amenity, or any service excluded from the computation of wages by a general or special order of the State Government;

(3) any contribution made by the employer to any pension or provident fund, and any interest accrued thereon;

(4) any travel allowance or the value of any travel concession;

(5) any sum paid to the employed person to offset particular expenses imposed on him by the nature of his work; or

(6) any gratuity payable on termination of employment in circumstances other than those listed in sub-clause (d).

Responsibility for payment of wages

Every employer is accountable for paying the needed wages to those who work for him.

- In the event of a factory, the management of that factory is responsible for paying the salary of his employees.

- In the event of industrial or other businesses, those in charge of monitoring are responsible for paying wages to employees who work for them.

- In the case of railways, a person designated by the railway administration for a certain area is responsible for paying the employees' wages.

- In the event of a contractor, the payment of wages to employees is the responsibility of a person chosen by the contractor who is directly under his control. If he fails to pay wages to employees, the person who hired them is responsible for paying those wages.

The state government has the power to change the person responsible for the payment of salaries in the railways, or the person responsible for daily-rated personnel in the Public Works Department of the Central Government or the State Government, with the approval of the central government.

Fixation of wage-periods

Every person who is responsible for the payment of salaries under section 3 must establish payment schedules for such wages. A salary period of more than one month is prohibited. This means that wages can only be paid on a daily, weekly, fortnightly (every 15 days), or monthly basis. According to this statute, the salary period for payment of wages to employees by the employer should not exceed 30 days, or one month.

Wages, on the other hand, cannot be paid quarterly, half-yearly, or once a year.

Time Of Payment Of Wages

- If there are less than 1000 employees in a railway factory, industrial, or other institution, pay should be paid before the 7th day after the last day of the wage period. (For example, wages should be paid within 7 days of the beginning of the current month, i.e. before the 7th day if wages were paid on the 1st of the previous month.)

- If there are more than 1000 employees in another railway factory, industrial, or other facility, pay should be paid before the 10th day after the last day of the wage period. (For example, wages should be paid within 10 days of the beginning of the current month, i.e. before the 10th date if wages were paid on the 1st of the previous month)

- For employees of the port area, mines, wharf, or jetty, wages should be paid before the end of the 7th day after the last day of the wage period.

If an employee is terminated or removed from employment by the employer, his or her wage should be paid within two days of the date of termination or removal.

If an employee was dismissed or removed from employment by the employer on the 10th of this month, his wage should be paid within two days of the date he was removed or terminated, i.e. by the 12th of this month, and this date should not be exceeded.

Except for the compensation of a terminated employee, all employees' wages shall be paid by their employer on a working day only.

Amendments

All wages shall be paid in current coin or currency notes, by cheque, or by crediting the wages into the employee's bank account: Provided, however, that the appropriate Government may, by notification in the Official Gazette, specify the industrial or other establishment, the employer of which shall pay the wages only by cheque or by crediting the wages into the employee's bank account to every person employed in such industrial or other establishment."

Deductions which may be made from Wages

Employers should only make deductions in accordance with this statute when paying wages to employees. The employer should not be able to make whatever deductions he wants. Deductions are the amounts paid by an employee to his employer.

The following are not called as the deduction

- Employee increase has been halted.

- The employee's promotion has been halted.

- Lack of performance by the employee causes the incentive to be halted.

- The employee was demoted.

- Suspension of employment

The employer's activities should have a good and sufficient reason for them.

Deductions

Employer deductions should only be made in compliance with this act. The following are the deductions that are said to be permitted under this act.

- Fines,

- Deductions for absence from duty,

- Deductions for damage to or loss of goods made by the employee due to his negligence,

- Deductions for contributions to any insurance scheme framed by the Central Government for the benefit of its employees with the acceptance of employee,

- Deductions for house-accommodation supplied by the employer or by government or any housing board,

- Deductions made if any payment of any premium on his life insurance policy to the Life Insurance Corporation with the acceptance of employee,

- Deductions for such amenities and services supplied by the employer as the State Government or any officer,

- Deductions for recovery of advances connected with the excess payments or advance payments of wages,

- Deductions for recovery of loans made from welfare labor fund,

- Deductions for recovery of loans granted for house-building or other purposes,

- Deductions of income-tax payable by the employed person,

- Deductions for recovery of losses sustained by a railway administration on account of acceptance by the employee of fake currency,

- Deductions by order of a court,

- Deduction for payment of provident fund,

- Deductions for payments to co-operative societies approved by the State Government,

- Deductions for payments to a scheme of insurance maintained by the Indian Post Office

- Deduction made if any contribution made as fund to trade union with the acceptance of employee,

- Deductions, for payment of insurance premium on Fidelity Guarantee Bonds with the acceptance of employee,

- Deductions for recovery of losses sustained by a railway administration on account of failure by the employee in collections of fares and charges,

- Deduction made if any contribution to the Prime Minister’s National Relief Fund with the acceptance of employee,

Limit for deductions

The entire amount of deductions from employees' earnings should not exceed 50%, although deductions from employees' wages can be up to 75% in the case of payments to co-operative organizations.

Fines

The employer should impose a fine on the employee with the agreement of the state government or other appropriate body. Before imposing a fine on an employee, the employer should follow the rules outlined below.

1. A penalties notice board for employees should be posted in the workplace, and it should include actions that employees should not engage in.

2. No fine should be imposed on the employee until he provides an explanation and justification for his actions or omissions.

3. The total amount of the fine shall not exceed 3% of his annual salary.

4. No fines shall be levied on employees under the age of fifteen.

5. A one-time fine should be imposed on the employee's wage for the conduct or omission he committed.

6. Fines should not be collected from the employee in installments.

7. The fine must be paid within 60 days of the day the fine was imposed.

8. A fine should be issued for the employee's daily act or omission.

9. All fines collected from employees should be credited to the common fund and used for employee benefit.

Deductions for absence from Duty

- Employers can make deductions for an employee's absence from work for a single day or for a period of time.

- The amount deducted from duty for absence should not be more than a sum that bears the same connection to the wage payable in respect of the wage period as this duration of absence does to such payment period. (For example, if an employee's monthly compensation is 6000/- and he is absent for one month.) Absence from duty should not be deducted more than 6000/- from the salary.)

Employees who arrive at work and refuse to work for no apparent reason are considered absent from duty.

If ten or more people are away from work without notice or reasonable cause, the employer has the right to withdraw eight days' salary from their pay.

Deductions for Damage or Loss

Employers should offer employees the opportunity to explain why and how the damage or loss occurred, and deductions from employee wages should not exceed the value or quantity of damage or loss suffered by the employee.

[Section 10(2)] All such deductions and realizations shall be recorded in the form provided in a register to be kept by the person responsible for the payment of wages under section 3.

Deductions for services rendered

If the employee accepts the employer's house-accommodation amenity or service, the employer is the only one who can take from the employee's pay. The amount deducted shall not exceed the value of the house-accommodation amenity or service provided.

Deductions for recovery of advances

If the employer paid an advance to the employee before the employment began, the employer should be reimbursed from the first payment of wages/salary to the employee. However, the employer should not be able to recoup the advance granted for the employee's travel expenses.

Deductions for recovery of Loans Any rules set by the State Government governing the extent to which such loans may be given and the rate of interest due thereon will apply to deductions for recovery of loans provided for house-building or other purposes.

Deductions for Payments to Co-operative Societies and Insurance Schemes

Deductions for payments to co-operative societies, deductions for payments to the Indian Post Office's insurance scheme, and employee acceptance deductions for payment of any premium on his life insurance policy to the Life Insurance Corporation are subject to any conditions imposed by the State Government.

Maintenance of Registers and Records

Every employer is required to keep such registers and records as may be prescribed, including information about the people he employs, the job they do, the pay they are paid, the deductions taken from their earnings, the receipts they provide, and other information.

Every registration and record must be kept and preserved for three years from the date of the last entry. It means that every transaction between the employer and the employee should be recorded for three years.

Powers of Authorities Appointed

Taking evidence, requiring witnesses to appear, and requiring the production of documents.

Inspectors

For the purposes of this act, the state government may designate an inspector. Every Inspector shall be considered a public servant within the meaning of Section 14(5) of the Indian Penal Code, 1860. The inspector of this act has the following authorities.

- Inspectors can investigate and examine employers to see if they are following the requirements set forth in this legislation.

- Inspector may enter, inspect, and search any premises of any railway, factory, industrial, or other institution at any reasonable time for the purpose of carrying out the objects of this Act with such assistance as he deems necessary.

- The inspector has the authority to supervise the payment of wages to persons employed on any railway, in any factory, industrial, or other establishment, and

- To seize or copy any registers or documents, or portions thereof, that he considers relevant in relation to an offence under this Act that he has reason to believe has been committed by an employer.

Facilities to be afforded to Inspectors

Every employer must provide all reasonable facilities for an Inspector to conduct any entry, inspection, supervision, examination, or inquiry required by this Act.

Claims arising out of deductions from wages or delay in Payment of wages and Penalty for Malicious or Vexatious Claims (2005 amendments)

A person named below will be chosen by the competent government to hear and decide all claims arising from deductions from wages or delays in payment of wages of persons hired or paid, including all things ancillary to such claims.

(a) any Commissioner for Workmen's Compensation; or

(b) any officer of the Central Government with at least two years' experience performing the functions of – I Regional Labor Commissioner; or (ii) Assistant Labor Commissioner; or

(c) any officer of the State Government with at least two years' experience performing the functions of – I Regional Labor Commissioner; or (ii) Assistant Labor Commissioner; or

(d) a presiding officer of any Labor Court or Industrial Tribunal established under the Industrial Disputes Act, 1947 (14 of 1947) or any corresponding law in force in the State relating to the investigation and settlement of industrial disputes; or

(e) any other officer with experience as a Civil Court Judge or a Judicial Magistrate, as the authority to hear and decide for any specified area all claims arising out of deductions from wages, or delays in payment;

If the appropriate government deems it necessary, it may appoint more than one authority for any given area and provide for the distribution or allotment of work to be undertaken by them under this Act by general or special order.

Any lawyer, any Inspector under this Act, or an official of a registered trade union authorized to write an application to the authority appointed by the government for direction of payment of wages according to this act if any employer does anything contrary to the provisions of this act, any unreasonable deduction from an employed person's wages has been made, or any payment of wages has been delayed, in such case any lawyer, any Inspector under this Act, or any official of a registered trade union authorized to write an application to the authority appointed by government for direction of payment of wages according to this act.

Any such claim must be submitted within 12 months of the date on which the deduction from wages was made or the date on which the wages were due to be paid. If there is a good reason, the time it takes to submit an application can be extended.

Following receipt of the application, the authority will hold a hearing with the applicant and the employer or other person responsible for wage payment, and if required, will undertake an investigation.

If an error with the employer is discovered, the authority may compel the employer to pay the wage or return to the employee the amount deducted unfairly or pay the delayed wages, as well as pay any other compensation the authority deems appropriate. If there is a fair and genuine basis for the delay in the payment of wages, the employer will not be liable for any compensation.

Single Application respect of Claims from Unpaid Group

If there are numerous employees whose wages have not been paid, there is no need for a large number of applications. As a result, all employees can submit a single application to the authority for wage payment under this legislation.

Appeal

Parties who are displeased with the outcome might take their case to the district court.

- If the application is denied by the above-mentioned agencies,

- The authorities ordered a compensation of more than 300/- rupees on the employer.

- If the amount withheld by the employer exceeds 25/- rupees for a single unpaid employee. 50/- in the case of a large number of underpaid employees.

Penalty for offences under the Act (2005 amendments)

Reasons for penalty

- Delay in payment of wages

- Unreasonable deductions

- Excess deduction for house-accommodation amenity or service

- Failure to maintain record for collected fines from employee.

- Improper usage of fine collected from employees.

- Excess deduction for absence of duty

- Excess deduction for damage or loss to employer

- Failure of employee to display notice containing such abstracts of this Act and of the rules made.

Punishable with fine which shall not be less than 1000/- rupees but which may extend to 7500/- rupees. If Wage period exceed one month.

- Failure in payments of wages on a working day.

- Wages not paid in form of current coin or currency notes or in both.

Punishable with fine which may extend 3000/- rupees

- Whoever obstructs an Inspector in the discharge of his duties under this Act

- Whoever refuses or willfully neglects to afford an Inspector any reasonable facility for making any entry, inspection, examination, supervision, or inquiry authorized by or under this Act

- Whoever willfully refuses to produce on the demand of an Inspector any register or other document.

Fines of not less than 1000/- rupees, but not more than 7500/- rupees, may be imposed.

Whoever does the same offence more than once.

Imprisonment for a period of not less than one month, but not more than six months, and a fine of not less than 3750 rupees, but not more than 20500 rupees.

Procedure in the trial of offences

- No Court will consider an objection against an individual for an offence under subsection (1) of section 20 unless an application in regard to the realities establishing the offence has been displayed under section 15 and has been allowed entirely or partially, and the authority engaged under the last section of the investigative Court has authorized the creation of the grievance.

- Before authorizing the creation of a protest against any individual for an offence under subsection(1) of section 20, the power granted under section 15 or the Appellate Court, all things considered, will give such individual a chance to show cause why such approval should not be granted, and the assent will not be granted if such individual fulfills the position or Court that his default was expected to—

- a bona fide error or bona fide dispute about the amount payable to the employed individual, or the occurrence of a crisis, or the presence of exceptional circumstances, such that the individual responsible for wage payment was unable, despite exercising reasonable persistence, to make prompt payment, or the failure of the employed individual to apply for or acknowledge payment.

Apart from an objection filed by or with the assent of an Inspector under this Act, no Court lobby takes notice of a repudiation of section 4 or section 6, or of a negation of any standard established under section 26.

The Court will consider the amount of any payments already granted against the defendant in any procedures conducted under section 15 when imposing any fine for an offence under paragraph (1) of section 20.

Bar of suits

No Court will entertain any suit for the recovery of wages or any deduction from compensation to the extent that the entirety so guaranteed-

- has shaped the subject of a course under section 15 for the offended party; or

- structures the subject of an application under section 15 which has been displayed by the offended party and which is pending before the power selected under that section or of intrigue under section 17; or

- has been decreed, in any proceeding unrelated to the offended party

- could have been recovered by an application under section 15.

Contracting out

Any agreement or arrangement, whether established before or after the start of this Act, in which an employed individual relinquishes any privilege granted by this Act will be null and void to the extent that it implies depriving him of such right.

Display by notice of abstract of the Act

The person responsible for paying wages to individuals employed in a plant will post a notice in the plant stating such summaries of this Act and the standards promulgated there under in English and the language of the majority of the people working in the plant as may be recommended.

Payment of undisbursed wages in case of Death of Employed Person

The employer pays the individual whom the employee has nominated.

The employer is relieved of his obligation to pay those wages if the wages are deposited with the specified body.

If no such nomination has been made or if the amounts cannot be given to the person so nominated for whatever reason, they must be deposited with the appropriate authority, who will deal with the funds in the way provided.

Rule-making power

Specifically and without bias to the simplification of the previous power, rules made under sub-section (2) may-

(a) require the upkeep of such records, registers, returns, and notification as are necessary for the Act's authorization and recommend the structure thereof;

(b) necessitate the posting of notices defining the rates of wages payable to employees employed on such premises in a visible location on-premises where work is done;

(c) to allow for the routine verification of weights, measures, and weighing equipment used by employers to verify the wages of their employees;

(d) suggest a method for withdrawing from the days on which pay will be paid;

(e) suggest the position that can be favored under section 8 sub-section (1), as well as deductions for which fines may be imposed;

(f) recommend a system for calculating the annoyance of fines under section 8 and creating discounts under section 10;

(g) suggest the conditions under which deductions under section 9's proviso to subsection (2) may be made;

(h) recommend the power capable of defending the causes for why fines will be consumed;

(i) in relation to clause (b) of section 12, define the extent to which advances may be made and the portions by which they may be recovered;

(j) direct the scale of costs which might be permitted in procedures under this Act;

(k) prescribe the amount of court-charges payable in connection with any procedures under this Act; and

(l) prescribe the amended works to be included in the notification required by section 25.

(4) The State Government may provide in any regulation made under this section that any violation of the rule would be punished by a fine of up to 200 rupees.

(5) All guidelines issued under this section will be based on the state of previous publication, and the date determined under clause (3) of section 23 of the General Clauses Act, 1897, will not be less than a quarter of a year after the suggested principles drafting was circulated.

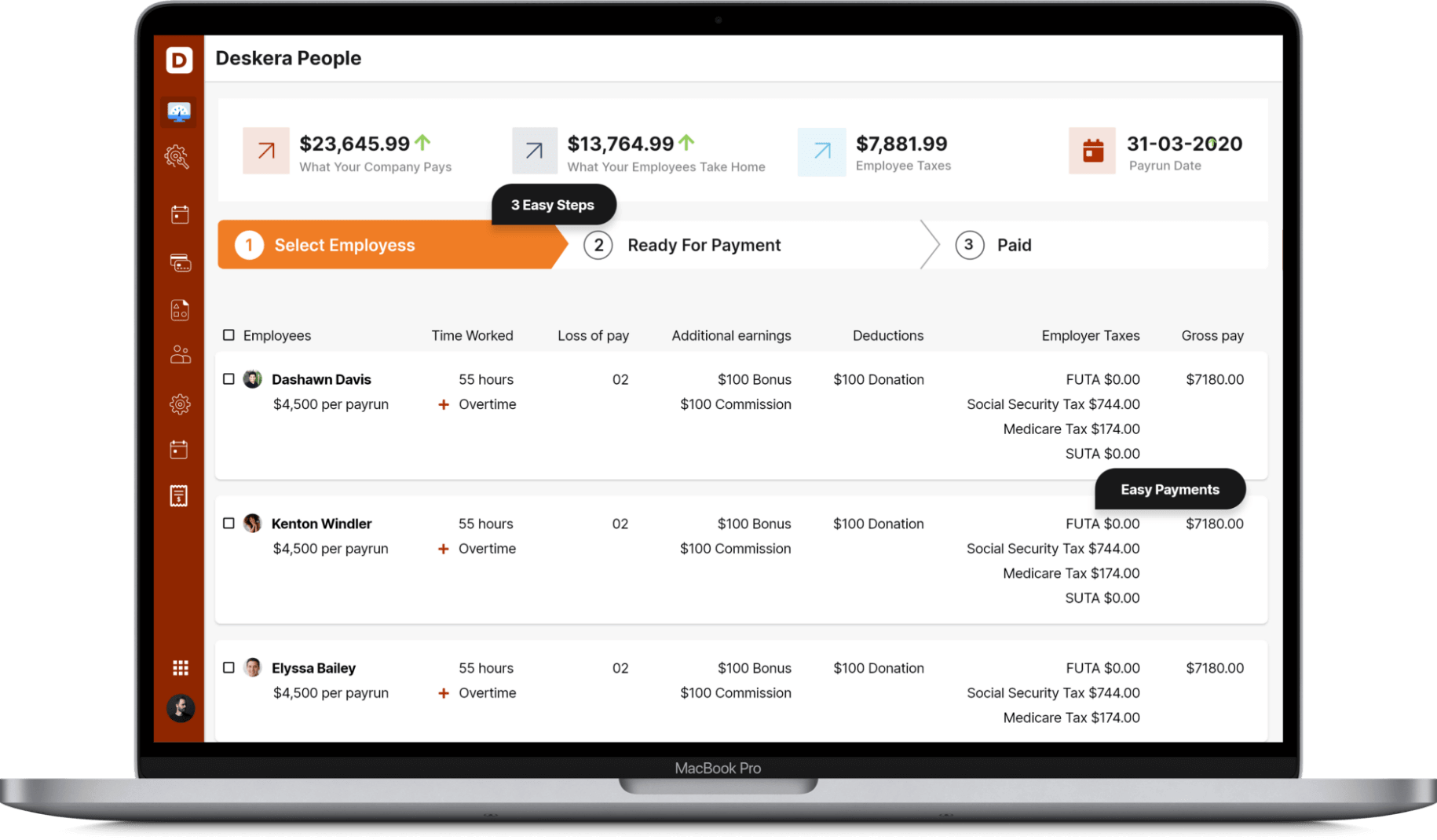

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- In terms of offences and penalties, the Code has undergone significant revision. The reformatory arrangements provide significant reason and proportionality, with the goal of assisting rather than hindering company leadership.

- The period for paying salaries to an employee shall not be longer than one month. That is, an employer can choose to pay wages to a worker hired by him once a week or twice a fortnight, but not once every two months or three months, as Section 4 specifies.

- The provisions of the Code help to build trust in the business network, and once the Code's subordinate enactments and rules are in place, even more clarity can be achieved. It would also be fascinating to see how several rules relating to government disabilities, mechanical well-being and welfare, and modern interactions will interact with the Wage Code if it is passed.

- People whose monthly payment or wage is Rs. 24,000/– or more are exempt from the Act. The Act further stipulates that a worker cannot contract out of any privilege or right conferred upon him by the Act.

Related articles