When we think of expenses, we usually also think of the money needed to pay for them.

In accounting, however, not all expenses are related to cash, or involve any cash exchanges in the time period that they occur.

These types of expenses are known as non-cash expenses and are an important part of the business’ income statement.

In this guide, we will go through what non-cash expenses are, the most common types used in business, and some practical examples on how to record them.

Read along to learn about:

- What Are Non-Cash Expenses?

- Types of Non-Cash Expenses

- Non-Cash Expense Examples

- Automate Non-Cash Expenses with Accounting Software

- Non-Cash Expense FAQ

What Are Non-Cash Expenses?

Non-cash expenses are expenses that don’t involve any type of cash transaction in the accounting period that they occur.

Let’s break down what all of that means.

When using accrual accounting (which is the most commonly applied basis of accounting among businesses) revenues and expenses are recognized when they occur.

So, for example, if a piece of equipment has an expected life of 5 years, that equipment will be expensed for the entirety of those 5 years, even if payment was made in full from the beginning.

As long as the equipment is still of use, it will be expensed as a non-cash expense according to its value.

This is necessary so that the financial statements of the business are kept accurate, up-to-date, and fit accrual accounting principles. The financial statement non-cash expenses are recorded under is the income statement.

Types of Non-Cash Expenses

The most common non-cash costs used in business include depreciation, amortization, depletion of natural resources, stock-based compensation, unrealized gains & losses, and unfunded postretirement costs.

1. Depreciation

Every business has fixed assets such as equipment and vehicles that last more than a year. Although these assets last longer, they eventually wear out or become outdated, and need replacing.

To allocate the costs of these fixed assets over one accounting period, accountants use a method called depreciation.

With the depreciation expense, you subtract a portion of the entire cost of an asset, to reduce its value over time.

But how is this portion calculated?

There are four methods you can choose to estimate depreciation and include the straight-line, declining balance, sum-of-the-years digits, and units of production method. The most commonly practiced one is the straight-line method, which spreads the costs of the asset evenly over its estimated life.

Now, not all assets can be depreciated. Low-cost items or purchases that aren’t expected to last longer than a year are immediately expensed. Land can’t be depreciated either, since you can always make use of it and it will never devalue.

If you want to learn more about depreciating property, and the useful life of fixed assets, head over to the IRS website.

2. Amortization

Amortization is very similar to depreciation, but instead of expensing fixed physical assets, it deals with devaluing intangible ones such as patents or copyrights, that last longer than a year.

And again, just like depreciation, most intangibles are amortized with a straight-line basis, using the estimated useful life.

Assume, for example, that the U.S government grants your business patent protection for a time period of 20 years. If the business paid $10,000 for the patent, that payment would be amortized over the entire course of 20 years for $500 a year, as a non-cash expense.

3. Depletion of Natural Resources

Just like depreciation and amortization, depletion is a non-cash expense that reduces the value of an asset. Depletion, however, deals with allocating the costs of natural resources (such as minerals, oils, and timber) being extracted from the land.

4. Stock-Based Compensation

Some businesses pay their employees with company shares, instead of direct cash. This is called a stock-based option plan, and it’s typically used to motivate employees beyond their regular cash salary.

5. Unrealized Gains & Losses

Unrealized gains and losses are potential decreases or increases in the value of an investment, that only exist on paper. There’s no actual profit or loss in cash until the position is closed.

For instance, assume an investor buys 50 shares of stock in XYZ company for $15 per share. If the stock price drops to $10 per share, the investor would have an unrealized loss of $250 ($5 per share × 50 shares).

6. Unfunded Postretirement Costs

Employers are liable for making periodic payments to employees’ pension funds, throughout the years that they work for the company. Now, alongside pension funds, some businesses also provide employees with additional postretirement benefits.

These benefits can either be fully funded at the corresponding time period the employee earns them or left unfunded until the employee retires.

When postretirement costs are left unfunded, we’re dealing with a non-cash expense. Why?

Because even though the expense for the postretirement benefit is being charged against current earnings, there are no corresponding cash payments during that time period.

Non-Cash Expense Examples

Example 1

Assume company XYZ purchases all of their equipment for $20,000 for cash when they first begin the business, in January 2019. The estimated useful life for the equipment is 5 years.

The company decides to use the straight-line method to depreciate their equipment once a year, for the following 5 years. So, every year the firm will convert $4000 ($20,000/5 years) worth of equipment into a non-cash expense.

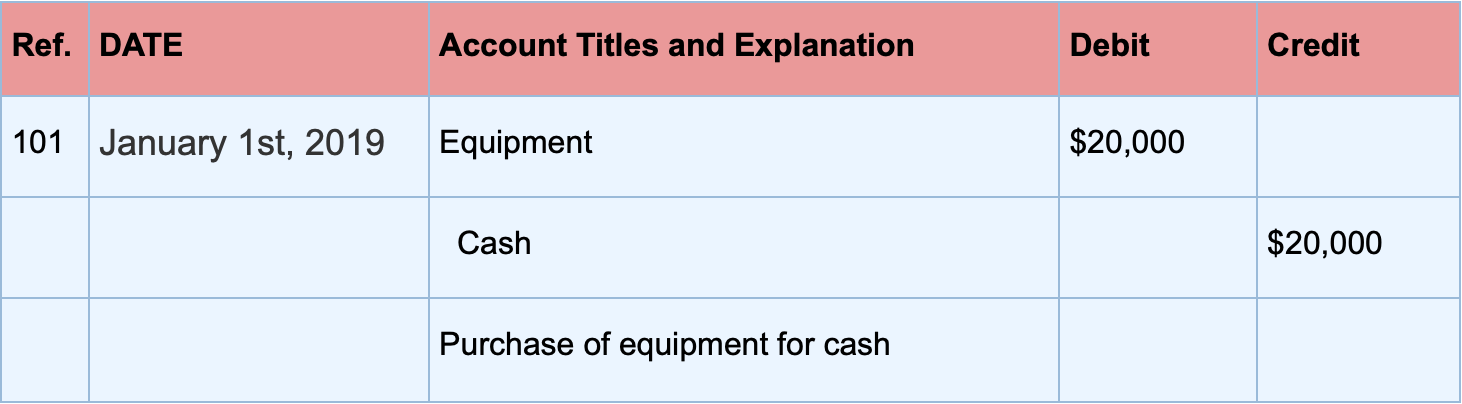

The first journal entry that recognizes the asset debits the equipment account and credits cash for the full amount that the equipment cost:

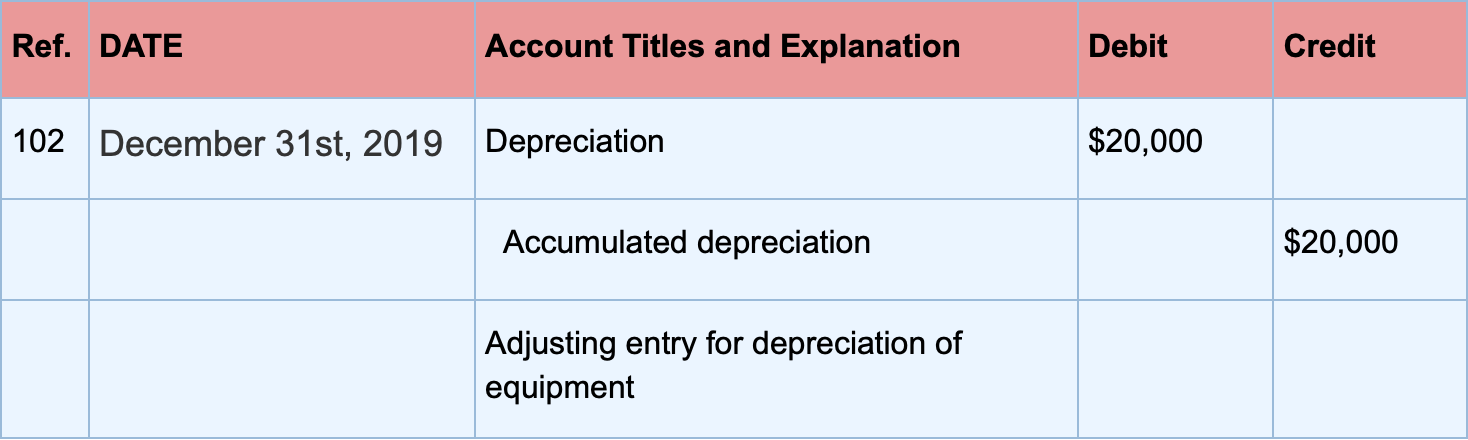

Now, when it’s the end of the year 2019, the company has to depreciate the equipment, by debiting the depreciation expense account and crediting accumulated depreciation for $4000.

Example 2

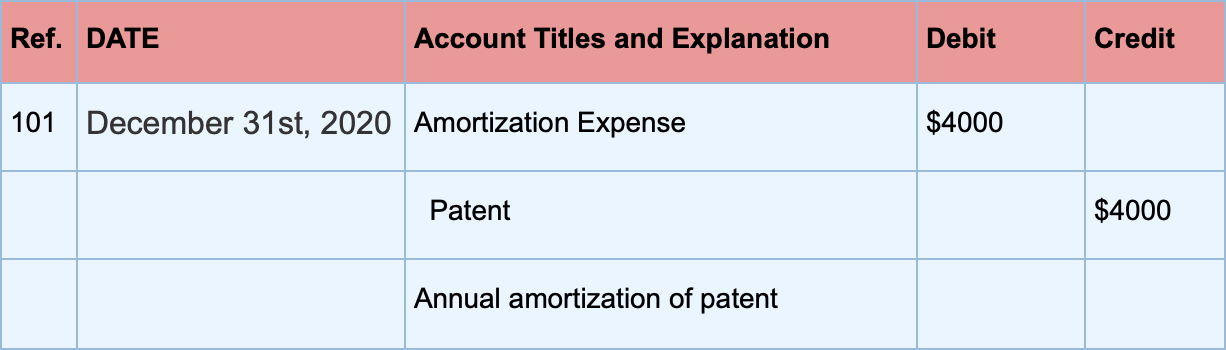

Company ABC buys a patent for $40,000 at the beginning of the year 2020, with an estimated useful life of 10 years.

Using the straight-line method, the amortization expense for each year would be:

$40,000 / 10 years = $4000 per year

To record the non-cash expense at the end of the year 2020, there needs to be a:

- Debit to the amortization expense, and

- Credit to an accumulated amortization account or to the patent directly.

Most companies usually just credit the patent directly, as shown in the journal entry below:

Want to learn more about how to record transactions for double-entry bookkeeping? Head over to our accounting guide on double-entry bookkeeping for small businesses.

Automate Non-Cash Expenses with Accounting Software

Tired of manually recording your non-cash expenses every accounting period?

Use the cloud accounting platform Deskera to automate the process within seconds, by setting up a Depreciation Schedule.

Simply select the asset name, method of depreciation, and the time period, tap Post and you’re done!

You can also use the schedule to calculate loan amortization or resource depletion.

With Deskera, you can also manage all of your other expenses, integrate directly with your bank account, and automate any recurring invoice payments.

Want to send payment to an international supplier? Easily pay overseas with Deskera’s multi-currency support, which supports 120+ currencies worldwide.

Don’t worry about exchange rates either: they’re updated in real-time!

The best part? The software is accessible anytime, anywhere! All you have to do is download the Deskera mobile app on your mobile phone, or tablet.

Try the software out yourself right away, with our free trial.

Non-Cash Expense FAQ

#1. What Is a Non-Cash Asset?

A non-cash asset is any asset of a business that doesn’t have a precise value in cash, and can’t be converted into a cash equivalent easily. These assets can be both tangible and intangible.

Some examples of non-cash assets include property, equipment, inventory, patents, copyrights, etc.

#2. Is Goodwill a Non-Cash Expense?

Goodwill is an intangible asset, but it’s not a non-cash expense.

Goodwill is only recorded in the accounting books when it’s purchased during a business investment. Therefore, money should be paid to acquire goodwill, so it’s not considered a non-cash expense.

Key Takeaways

And that’s a wrap! We hope you found our guide to non-cash expenses helpful.

Before leaving, let’s go over some of the main points we’ve covered:

- Non-cash expenses are expenses that don’t involve any type of cash exchange at the time they occur.

- The recording of non-cash expenses is done so that expenses are recognized at the time they happen, not when payment is made.

- The most common type of non-cash expense is depreciation, which allocates the costs of fixed assets over multiple accounting periods.

- Other types of non-cash expenses include amortization, depletion, stock-based compensation, unrealized gains & losses, and unfunded postretirement benefits.

Related Articles