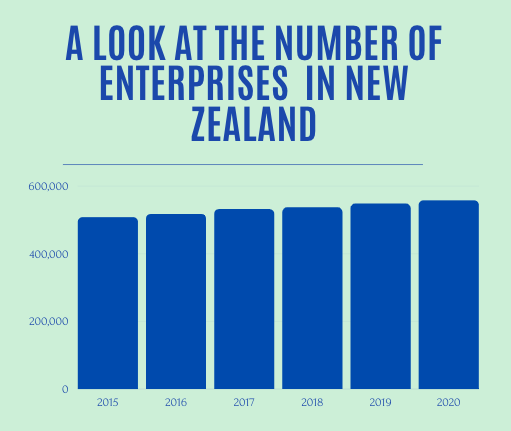

According to the statistic from StatsNZ, the number of enterprises is increasing in New Zealand. There is a total of 557,680 enterprises in New Zealand as of February 2020, an increase of 1.7% from February 2019. Understanding New Zealand GST (Goods and Services Tax) rules and regulations is a must for every organization and business owner.

Some people aspire to start their own business as they are passionate about building their own projects ever since they are young. Or, some seek changes to escape their 9-5 rat race.

Having your own business is great as you are your boss; you have complete control of your time, you're the decision-maker of your company, and most importantly, you'll have greater satisfaction from your work.

Are you feeling inspired? Suppose you're about to start your own business in New Zealand; this article might be helpful to you, as we cover the nitty-gritty details of GST compliance in New Zealand that you will have to be familiar with as a business owner.

Learn more on creating your New Zealand organization using Deskera Books

What is the GST rate in New Zealand?

The GST rate in New Zealand is at 15% on most taxable goods and services, which includes imported goods and services. GST is usually charged on the final price of goods and services.

Most businesses normally advertised the pricing of goods inclusive of GST in their physical stores or online stores unless stated otherwise.

What products and services are GST-free?

Sometimes when you purchase goods and services, you notice that no GST is added these items.

The reason the products and services are GST-free could be due to a certain reasons such as;

- sales made by an unregistered person

- sales of private property; i.e., car or home not used for business

- exempt supplies

What are Exempt Supplies in New Zealand?

Exempt supplies are not subject to GST in New Zealand, meaning you do not need to include this in your GST return.

These supplies include:

- Donated goods and services

- Financial services such as paying or collecting any amount of interest, mortgages and other loans, bank fees, securities such as stocks and shares

- Renting a place - GST cannot be charged on the rent for a residential dwelling. A landlord cannot claim any GST on dwelling expenses, such as maintenance, rates and insurance.

- The supply of residential property for lease under a head lease

- Interest charged on overdue accounts

- Fine metal is any form of; gold with a fineness of not less than 99.5%, silver with a fineness of not less than 99.9%, and platinum with a fineness of not less than 99%

What are Zero-Rated Supplies in New Zealand?

Zero-rated supplies are different from exempt supplies. Zero-rated products and services are subject to 0% GST, whereas the exempt supplies are GST-free.

Stated below are some of the zero-rated supplies:

- exported goods

- sales of going concern

- sale of land

You can claim GST on your expenses for zero-rated supplies, whereas you cannot claim any expenses for purchases of exempt supplies.

What are the items that I can claim GST?

You can claim GST for items used as part of your business purchases. These include:

- expenses paid for power, electricity, and gas bill

- telecommunications such as telephone, fax, and internet service fee

- motor vehicle expenses such as petrol, repairs of motor vehicles, warrant of fitness

- stationery products/office supplies

- repairs to business assets

- consumables, packaging

- capital, fixed assets - cars, trucks, equipment

- rent of business premises

When do I need to register GST for my business?

Before you start registering, charging, and collecting GST from your consumers, you need to check whether you meet the GST requirement stated below.

There are two conditions that you have to satisfy before registering GST:

- You perform taxable activities in your business, and you add GST to the price of goods and services you sell

- Your business turnover (total income before expenses and GST) is at least $60,000 in the last 12 months or expected to reach $60,000 in the subsequent 12 months

Even if you didn't meet the business turnover requirement, you could still register voluntarily for GST.

What are taxable activities?

Taxable activities refer to the supply of the goods and services such as:

- Products: sales of apparel and garments, cars, electronic devices, etc

- Services: providing child care services, graphic design services, make-up services, hairdressing, painting, etc

- Professional services: legal advice, consulting services, etc

- Experiences: kayaking, karting, bungee jumping, skydiving, etc

Also, you need to note that taxable activities do not include:

- Paying salary or wages to employees or directors.

- Indulging in hobbies or private recreational activities.

- Making any GST-exempt supplies

What is an IRD Number?

Your IRD is a unique eight or unique number issued by the Inland Revenue in New Zealand to individuals and non-individuals. Non-individuals are companies, partnerships, trusts, and charities.

The IRD number is an essential number that you need if you earn salary from a job or pension, apply for Work for Families Tax Credit, apply for student loan, open a bank account, join KiwiSaver account, or filing your tax returns.

How can I register for GST in New Zealand?

Once you have reached the business turnover GST requirement, it's time for you to register for a GST account.

You can only apply for a GST account online.

Before applying online, there a few documents that you need to prepare:

- Your IRD number

- Your bank account number, in case of GST refunds

- Your business' turnover in the last 12 month and the turnover in the next 12 month

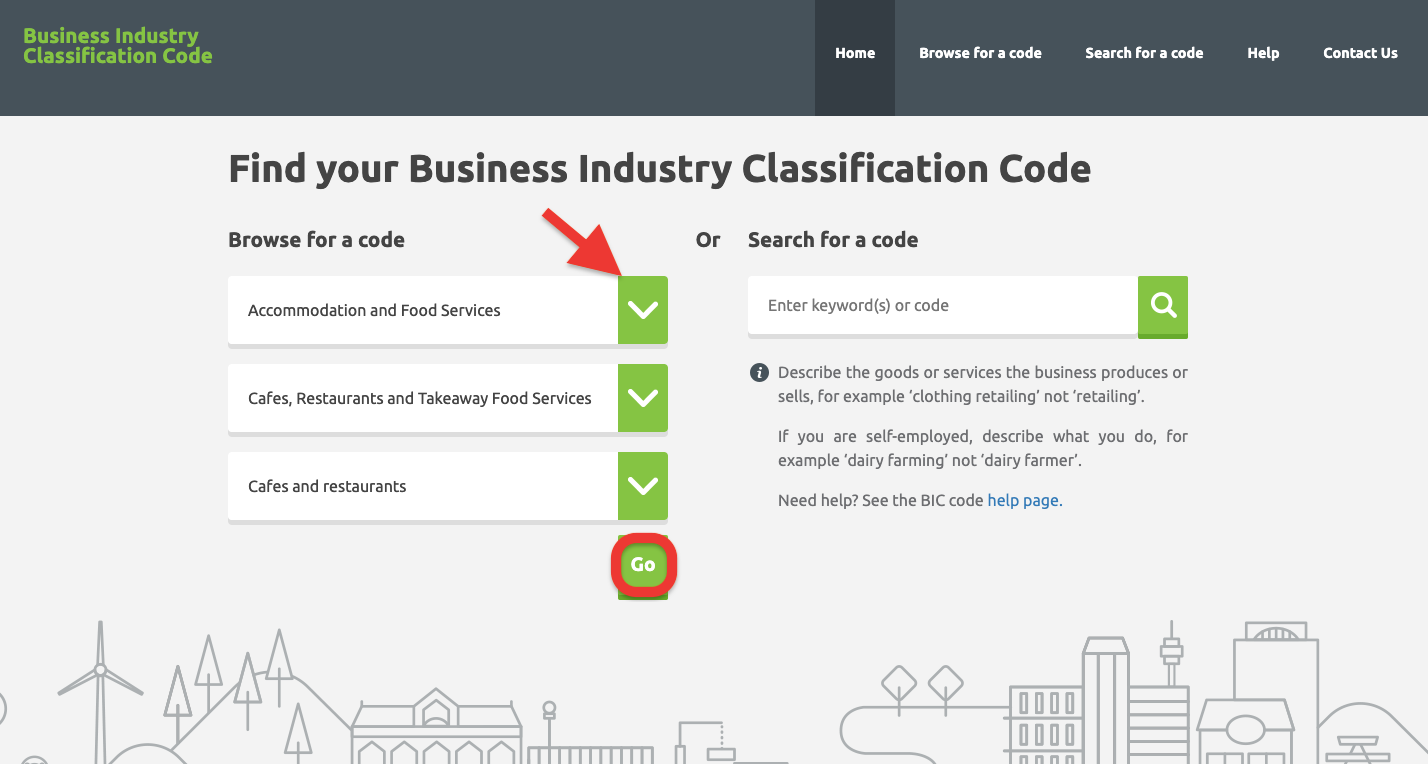

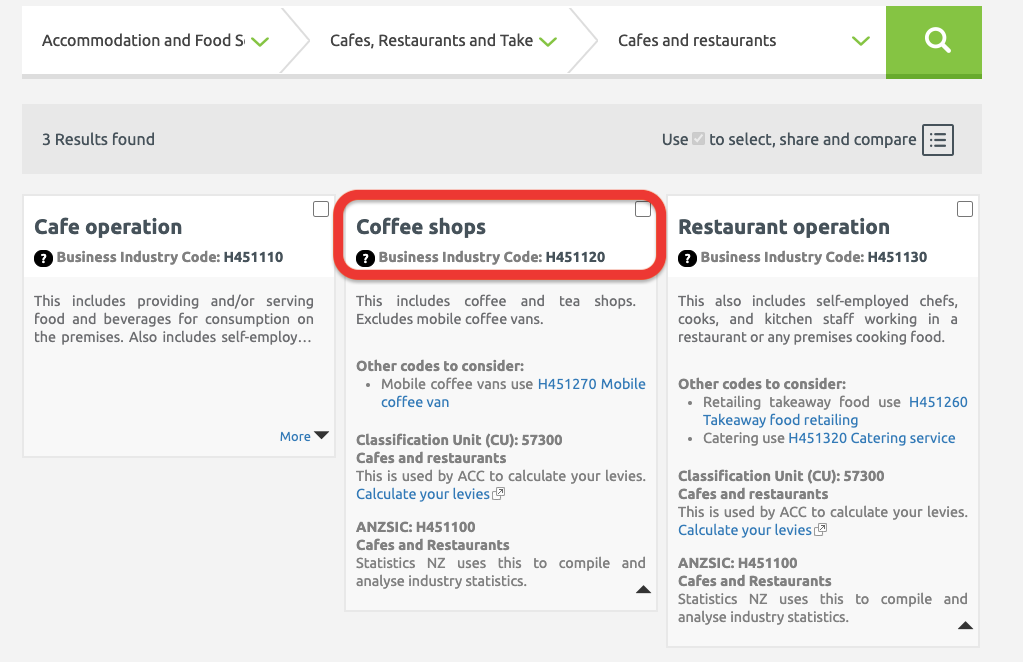

During the GST registration process, you are required to fill in the business industry classification code (BIC).

If you're unsure of your Business Industry Classification Code (BIC) , you can check the tool here.

Your BIC code will be auto-populated here. Click on the drop-down arrow to find out more about the code that suits your business nature in greater depth.

Compute GST rate for the price of goods and services

When buying products and services, some products' pricing are exclusive of GST, whereas some other are GST-inclusive.

In this section, you will learn how to compute GST-inclusive pricing and GST-exclusive pricing.

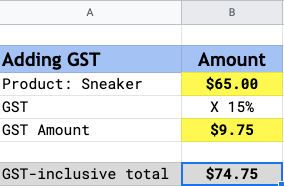

For example, Joe owns a sneaker store in town, and he would like to compute the GST-inclusive pricing for his sneakers.

To compute the GST-inclusive pricing:

- He will need to calculate the GST rate by multiplying $65 with 15% =$9.75

- Add the final price of goods ($65) with the GST amount ($9.75)

- The GST-inclusive price to charge his customer is a total of $74.75

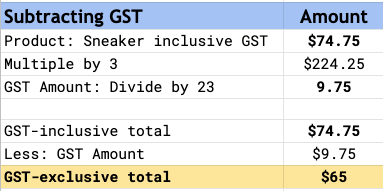

You are Joe's regular customer, and you have purchased a pair of sneakers at $74.75 in total (the price is GST-inclusive).

So, you want to know the allocation of GST amount and price of the sneaker exclusive GST, but you do not know how to do so. Don't worry as you can use the formula below to guide you.

To compute the GST-exclusive amount, you can:

- Use the total price of goods and services, inclusive of GST, multiply by (3) and then, divide the total by twenty three (23)

- You will arrive at the total amount of GST

- Subtract the total price of sneaker inclusive of GST from the GST amount

- You should be able to compute the price of the sneaker exclusive GST

How do I determine my filing frequency?

There are three types of filing frequency in New Zealand, and the options available are monthly, two-monthly, or six-monthly.

You can choose the filing frequency that suits your business. If you didn't select your filing frequency, the tax authority would put you on a two-monthly basis option matching your balance date.

You can always write to IRD and state the filing frequency you prefer if the filing frequency didn't match you.

If your request is approved, IRD will contact you with a new taxable period. Otherwise, do not change the filing frequency without any approval.

Do you know that you can customize your tax rate using Deskera Books? Read more below.

When do I file my GST return?

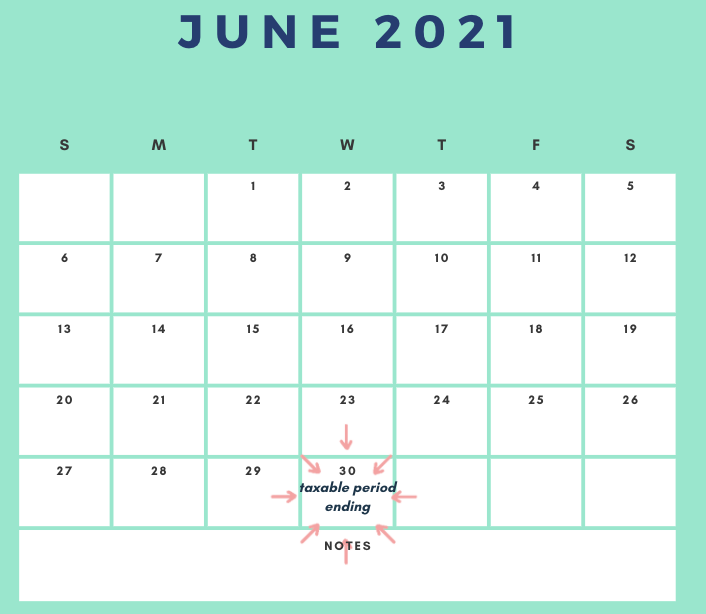

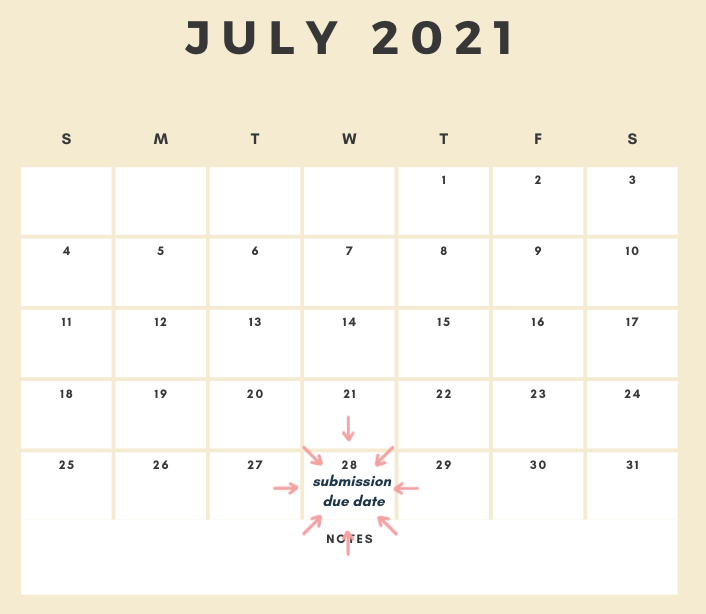

The GST filing date is due on the 28th of the following month after your taxable period.

For example, Jenny owns a boutique and her taxable period ends on 30th June. Jenny has at least a month to prepare her GST return and file her tax return. Her GST return and payment due will fall on 28th July.

The same applies if your taxable period ending falls on 31st July. Your GST return and payment due will be on the 28th of the following month, on 28th August.

This rule does not apply to you if your taxable period ends on 31st March and 30th November. If your taxable period ends on the 31st March, then your due is on the 7th May, whereas the latter falls on 15th January.

When filing a GST return, you have to ensure that you make your payment as well. If you fail to do so, late payment and submission will incur some penalty and interest.

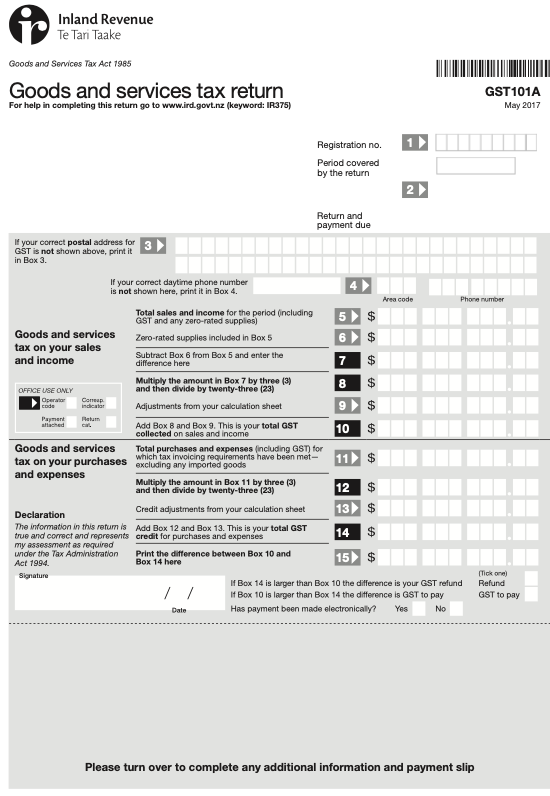

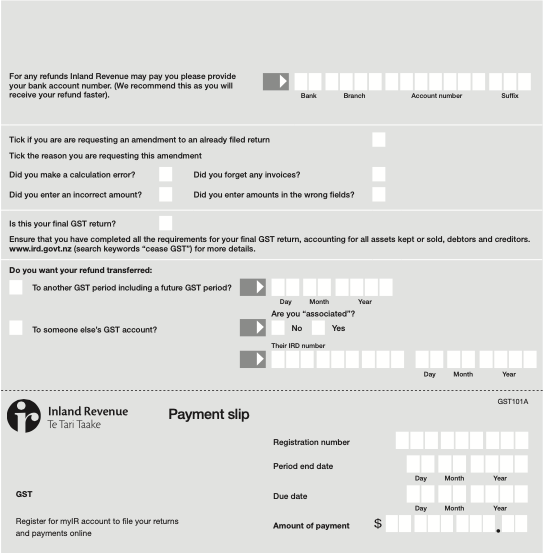

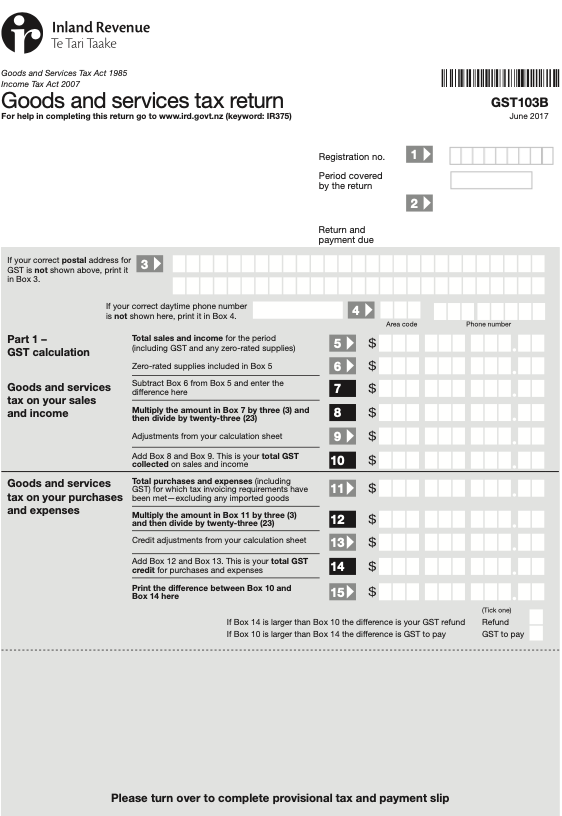

What is GST101A Form and GST103B Form?

There are two forms that you need to be aware of and these are:

- GST101A - This is your sales and service tax return

- GST103B - This will be both your GST and provisional tax return

GST101A

Read through the sections in GST101A form fill in the amount for each box accordingly.

GST103B

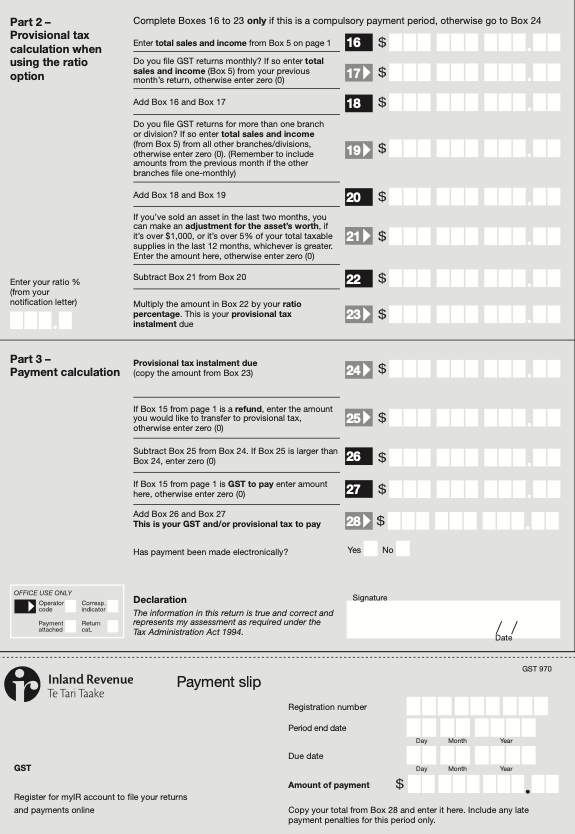

There are three sections in GST103B Form.

Part 1

Notes: If Box 14 is greater than Box 10, the difference will be your GST refund. On the other hand, if Box 10 is greater than Box 14, the difference is the GST amount that you need to pay.

Part 2

Fill in this section only if this is a compulsory payment period using the ratio option. Otherwise, skip this section and proceed to Box 24

Part 3

If you have challenges in completing your GST return, you can always reach out to your accountant or your tax agent for advice. You can also call IRD on 0800 377 776 to get help.

Learn how to generate GST101A and GST103 with Deskera Books.

Which form do I use?

If you are not liable for provisional tax, you can file a simple GST101A report.

Otherwise you have to file GST103 Report, if you're liable for provisional tax.

How can I make payment?

Now you're aware that your filing due date is also the due date to make your tax payment. Hence, you need to ensure that you clear your outstanding tax liability on the same day.

Making payment to IRD is fairly simple and hassle-free.

You need an IRD number to remit payment. Your IRD number serves as a reference number.

Once you have your account set-up, you can make payment anytime, anywhere. One important thing you must not forget is the payee code, which shows the type of tax the payment is for.

There are a few options available. Here are the methods that you can use to make payment:

- Using electronic - internet banking, using VISA or Mastercard debit or credit card, set up direct debit payments in your myIR account.

- Use your phone - dial 0800 257 777. You will need to provide your IRD number and payment details such as tax type, tax period, and tax amount to remit

- Paying from overseas - You can use debit and credit cards to make payments. An international fee will be imposed for these transactions. Hence, call your bank to confirm the charges apply.

- Paying at Westpac - Visit the Westpac branch or nearest Westpac Smart ATM near you. Remember to bring your statement that shows the barcode.

How can I file GST103B and GST101A?

There are three methods of filing your GST return. These methods are:

- Using your accounting software - confirm with your software if the filing feature is included

- Login to your myIR account

- Manual filing - using paper return if you do not have a myIR account

You can only file using your myIR account or manual filing if you are using the ratio option to compute your provisional tax.

What are the penalty for late submission?

If you failed to submit your return on time, you will incur penalties and interest. The penalty imposed onto you is depending on your accounting basis. For example, you will be charged;

- payments basis - $50 for each return

- invoice or hybrid basis - $250 for each return

If you have difficulty making payment, you can still file your GST return and then call IRD at 0800 377 774 to discuss your payment options.

Remember to file your GST return by the due date even though you have NIL return.

GST, GST Return and Invoicing in New Zealand Using Deskera Books

Generate GST and GST Return is simple and easy with Deskera Books.

You can setup your New Zealand company in minutes and start creating and sending invoices immediately.

With Deskera Books, generating beautiful invoice templates from the system is a piece of cake. You do not need to design your template from scratch, which is awesome!

Also, you can specify your customers' location and charge the correct tax rate using the tax configuration feature in the system.

Here are the essential pieces of information that you can include in your invoice:

- Your company name and address

- The date when you issue the invoice

- Your IRD number/GST number

- The purchaser's name and address

- Your purchaser's email address and phone number

- Payment Term

- Products' name and description

- Products' UOM and quantity purchased

- Tax component

- Total amount payable

Learn more about the invoicing feature using Deskera Books.

Key Takeaways

And that is a wrap. From this article, you can take away the following points:

- What is the GST rate in New Zealand?

- What products and services are GST-free?

- What are Exempt Supplies in New Zealand?

- What are Zero-Rated Supplies in New Zealand?

- What is an IRD Number?

- When do I need to register GST for my business?

- What are taxable activities?

- How can I register for GST in New Zealand?

- Compute GST rate for the price of goods and services

- How do I determine my filing frequency?

- When do I file my GST return?

- What is GST101A Form and GST103B Form?

- Which form do I use?

- How can I make payment?

- How can I file GST103B and GST101A?

- What are the penalty for late submission?

- GST, GST Return and Invoicing in New Zealand Using Deskera Books

With Deskera, you can easily apply the New Zealand GST tax rates to your transactions and generate a proper sales invoice.

You can rest assured as the software will do the work for your tax calculation. Instead of spending a tremendous amount of time on manual tasks, you can have more time for the things you love with Deskera.