In New York, calculating taxes is a little more difficult than in other states. The state as a whole has a progressive income tax that ranges from 4% to 10.9 percent, depending on how much money an employee makes. In New York State, an employee's tax burden varies depending on where they work.

Residents of New York City and Yonkers, in particular, are subject to higher income taxes. Of course, if you don't want to be in financial and legal trouble, you can't afford to ignore commitments like taxes and payrolls. Here’s an article that summarizes all your New York Payroll related laws and taxes. Following are the topics involved:

- Payroll Taxes and Laws in New York

- Tax Exemptions and Exclusions in New York

- How Does New York Payroll System Work?

- Calculator for New York Payroll Taxes

- Forms for New York Payroll Taxes

- Key takeaways

Payroll Taxes and Laws in New York

As a small business owner in New York State, you should be aware of many payroll taxes. Let's look at some of the most prevalent taxes:

Income tax

New York has a progressive income tax that ranges from 4 to 8.82 percent depending on an employee's earnings. A 9.62 percent withholding rate is applied to any additional commissions or bonuses. Employers in New York are required to withhold state income tax from their employees' wages and remit the withheld amounts to the Department of Taxation and Finance.

All employers paying taxable wages to residents, regardless of where their services are performed, and all employers paying taxable wages to nonresidents for services performed within the state, must withhold from all payments of taxable wages paid to residents regardless of where their services are performed.

Use Tax

Use Taxes are levied on goods and services acquired outside of New York State and supplied to a business in the state. This is not taken into account when calculating payroll taxes.

All of the above taxes are in addition to federal taxes, and both must be deducted from a W2 employee's pay.

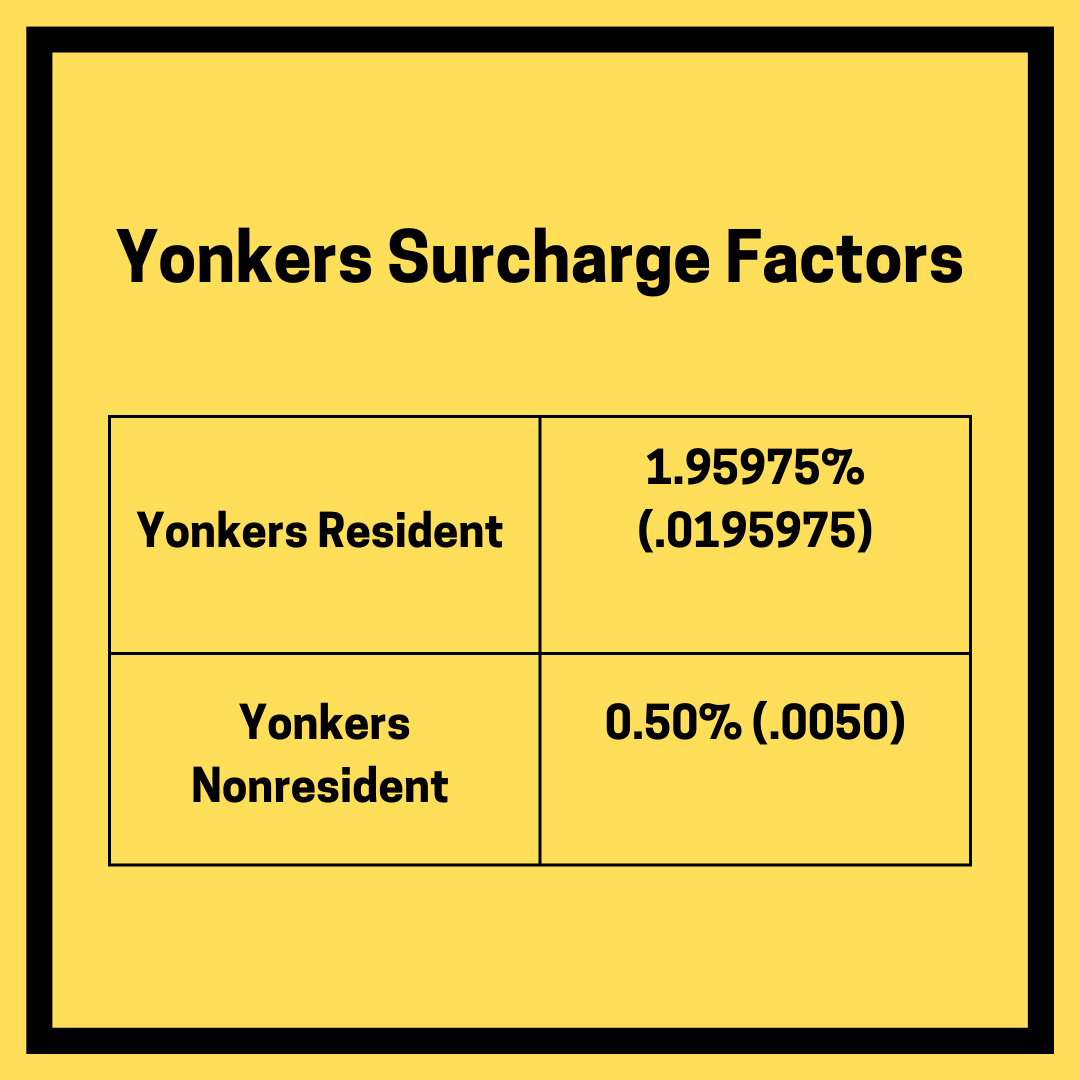

Yonkers Surcharge

Yonkers residents and workers pay a levy of less than 1% dependent on a number of variables.

New York City Surcharge

Employees in New York City have a 4.25 percent (.0425) surcharge withheld from their taxable wages.

Property taxes

Property taxes are set by local governments and vary a lot depending on where you live. The assessed property value is multiplied by the tax rate to compute such taxes. Payroll taxes are not included.

Sales Tax

Sales tax returns are filed separately from payroll. They must be filed on a monthly, quarterly, or annual basis by small firms.

Minimum Wage in New York

The minimum wage in New York is greater than the federal rate of $7.25 per hour, and it was recently increased in several parts of the state. Except for farm laborers, cab drivers, members of religious organizations, and volunteers at recreational or amusement events lasting up to eight days, all employees are covered.

Employees in most industries in New York State are covered under the state's general minimum wage schedule. Workers in fast food or hospitality who rely on customer gratuities are not included in the timetable. Let's look at what firms in the state will have to pay their employees in the future:

The minimum wage for fast-food workers has its own schedule for rate hikes. New York City has a rate of $15 as of 2021. In New York City, all fast-food workers must earn at least $15.00 per hour. Minimum wage rates in the rest of the state, excluding New York City, are set to rise annually until they reach $15.00 on July 1, 2021.

New York State payroll rules, as well as wage and hour requirements, will undergo some modifications in 2021.

The minimum pay levels that are now exempt from overtime are increasing, and some firms may no longer be able to use tip credits to offset their minimum wage.

- Non-hospitality companies subject to the Wage Order for Miscellaneous Industries and Occupations will have to lower their applied tip credit by 50% as of December 31, 2020.

- Non-food service employers, such as delivery drivers and toilet attendants, are entitled to a $2.35 per hour tip credit in Long Island and Westchester, and $2.10 in the rest of the state.

- As of December 31, 2020, food service workers such as servers, bartenders, bussers, and runners will be subject to a new tip credit per hour rate of $4.65 in Long Island and Westchester and $4.15 in the rest of the state except for NYC.

Another requirement for complying with New York State legislation is to display a minimum wage poster at your place of business. Obtaining a subscription for labor law posters can automatically offer fresh information as needed to assist stay up to date on rule changes.

Other industry-specific poster requirements exist. Foodservice establishments, for example, must post notices about pay deductions and tip appropriation. Posters about disability benefits, workers' compensation, and other programs and policies are also required on Public Works projects in New York State.

Unemployment Insurance

Businesses in New York State will very certainly be required to pay a separate unemployment tax. Any company that opened in 2020 gave 2.5 percent, while other companies' contributions ranged from 0.525 percent to 7.825 percent. Certain churches and non-profit organisations are exempt from paying this fee. You'll pay a flat rate of 3.125 percent if you're a new employer. The registration process for employers can be completed entirely online.

New York State, on the other hand, will not tax employer UI accounts for payments paid during the COVID-19 epidemic as of January 14, 2021. The state unemployment insurance (SUI) tax rates in New York for 2021 range from 2.025 percent to 9.826 percent, up from 0.525 percent to 7.825 percent in 2020.

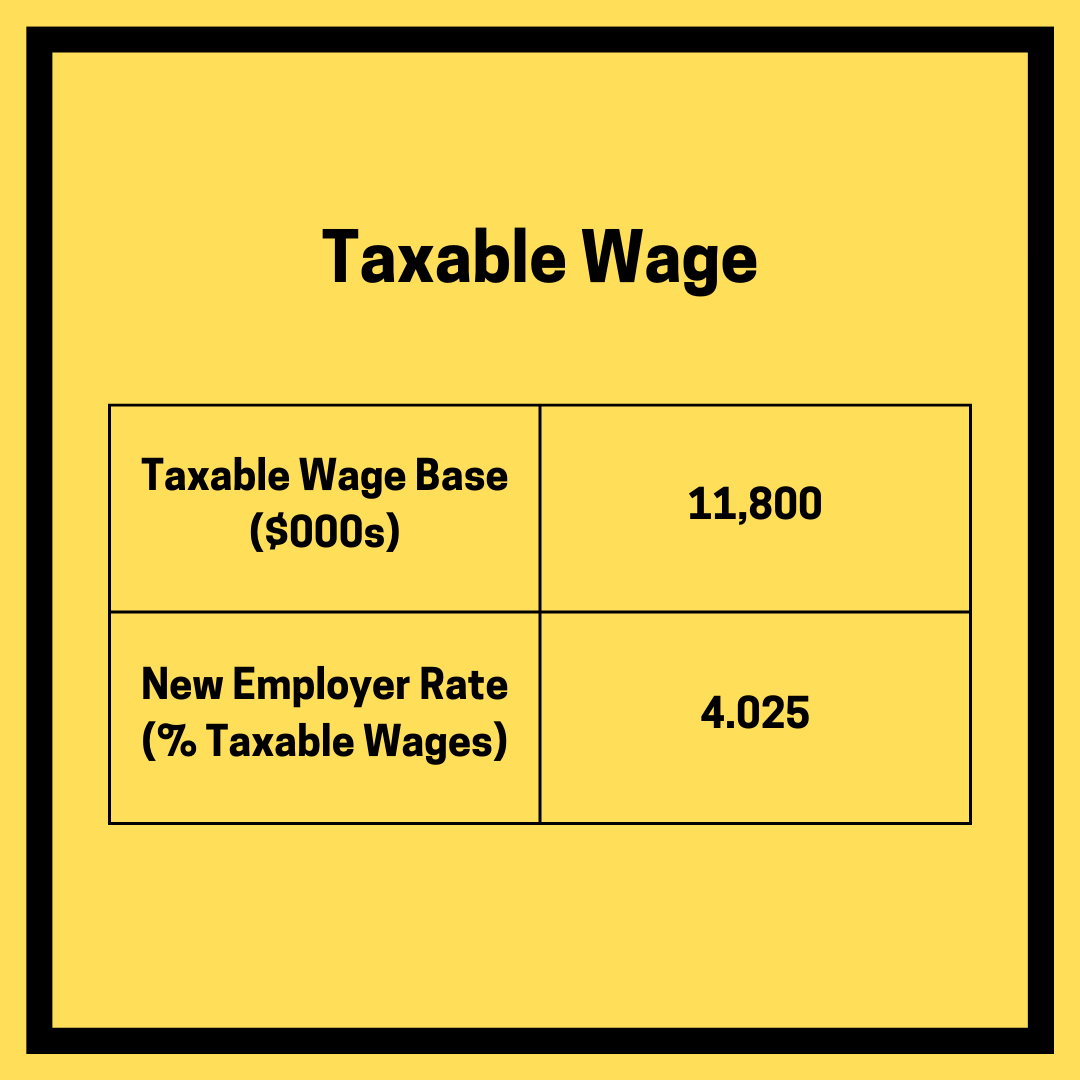

Employers will pay a new rate of 4.025 percent in 2021, up from 3.125 percent in 2020. Employers who contribute also pay a 0.075 percent Re-employment Services Fund premium.

The following are the New York State Unemployment Insurance UI contribution rates for 2021:

New York State Disability Insurance

Employers in New York are also required for providing employees with State Disability Insurance (SDI) to cover off-the-job accident or illness, in addition to payroll-related taxes and withholding. To help support this policy, the state allows companies to withhold 0.5 percent of pay from employees, but no more than $0.60 every week.

Employers in New York State are required to provide disability payments to their employees in the event of off-the-job injuries or illnesses. According to the New York State Disability Benefits Law, insurance plans must be obtained from state-licensed insurers. NYSIF is the state-run disability insurance program in New York. Employers can get a quote by filling out an online form.

The average weekly earnings of an employee during the previous eight weeks of work are used to determine disability compensation. These benefits, however, are capped at $170 a week for a total of 26 weeks in a year. Employees may not be eligible for both paid family leave and disability benefits at the same time.

Employers are allowed to deduct 0.5 percent of an employee's salary from their paycheck to help towards the expense of disability payments. This can't be more than 60 cents every week.

Re-employment Tax

On form NYS-45, small enterprises must pay re-employment taxes every quarter. This is calculated as 0.075 percent of the total pay paid to employees during that time period. Contributions to the New York Re-employment Service Fund also do not qualify for a federal tax credit.

Temporary Disability Insurance

Employees in New York are required to be covered by disability insurance. The state insurance fund, private insurance, or self-insurance may all be used to offer coverage. Employees and employers are both required to contribute to the plan.

Metropolitan Commuter Transit Mobility Tax (MCTMT)

For some employees, some small firms in New York State may be required to pay a Metropolitan Commuter Transit Mobility Tax. The following elements are used to determine eligibility: 1) whether the company is obligated to withhold income tax from employee earnings; and 2) whether the company's payroll is larger than $312,500 every quarter.

The following thresholds are used to compute the MCTMT rate:

- Between $312,500 and $375,000: 0.11%

- Between $375,000 and $437,500: 0.23%

- Over $437,500: 0.34%

Because this tax is due quarterly, it's critical to stay on top of submission deadlines.

Payment Obligations

The regularity with which employees are paid is likewise governed by New York State law. Manual labor, for example, must be paid weekly, whereas commission workers can be paid monthly. Outside of these categories, employees should be paid every two weeks.

New York Labor Law requires that last payments be paid no later than the regular pay period if an employee is fired from a small business. Unpaid earnings of terminated sales commission employees must be paid within five business days of being fired or due for payment.

Small firms must pay an employee's final paycheck on or before the planned payday, with the option of mailing payment if the employee quits on their own.

Worker’s Compensation Insurance

Worker's Compensation Insurance (WCI) is a type of insurance that protects

You must provide worker's compensation insurance for your employees unless you are a sole proprietor or deal primarily with independent contractors. Employers cannot deduct contributions from employees' salaries to cover a portion of this expense, unlike disability insurance.

Workers' compensation insurance costs vary depending on the number of employees and the risk connected with the nature of employment. As a result, many small firms can obtain coverage for a low cost.

The Workers' Compensation Board of New York mandates that Form C-105 (which includes the insurer's details and policy number) be displayed in the workplace or face a $250 fine.

Child Law Labor Laws

The New York State Department of Labor sets age criteria, hour limits, and the types of labor that children are allowed to do.

Unless they have already graduated or dropped out of school, no minor may work during the school day. Employees aged 14 and 15 have the following restrictions while school is in session:

- Cannot work more than 3 hours on a school day

- Cannot work more than 8 hours on a non-school day

- Work no more than 18 hours per week

- Work no more than 6 days per week

The following are some other job guidelines to be aware of:

- Working hours for 16 and 17-year-olds are limited to eight hours per day, six days a week.

- 14- and 15-year-olds cannot work more than 40 hours a week when school is not in session.

- Working between 10 p.m. and 12 a.m. before a school day requires authorization from a parent or guardian.

Minors are also forbidden from performing a number of tasks and jobs. Here are some examples of small business-related items:

- Using circular or band saws

- Painting or cleaning the exterior of a structure from an elevated surface

- Using power-driven woodworking, bakery, and paper industry machines

- Working with paint

- Using a steam boiler

New York Labor Laws

There are labor laws that govern the length and frequency of breaks during the workday, in addition to the minimum wage and paid leave. Employees who work more than six hours, starting before 11 a.m. and ending at least 2 p.m., must take a half-hour lunch break between 11 a.m. and 2 p.m. Employers are not obligated to provide paid meal time.

Mandatory breaks can be used in a variety of scenarios, including:

- Employees who start work before 11 a.m. and stay till 7 p.m. are entitled to a 20-minute meal break between 5 and 7 p.m.

- Employees working six hours or more starting after 1 p.m. or before 6 a.m. are entitled to a meal break of at least 60 minutes if they work in a factory and 45 minutes if they work in another sort of business.

In addition, if the commissioner of the Department of Labor approves, shorter meal periods may be granted. This information would have to be posted on a sign or poster at the workplace by the employer.

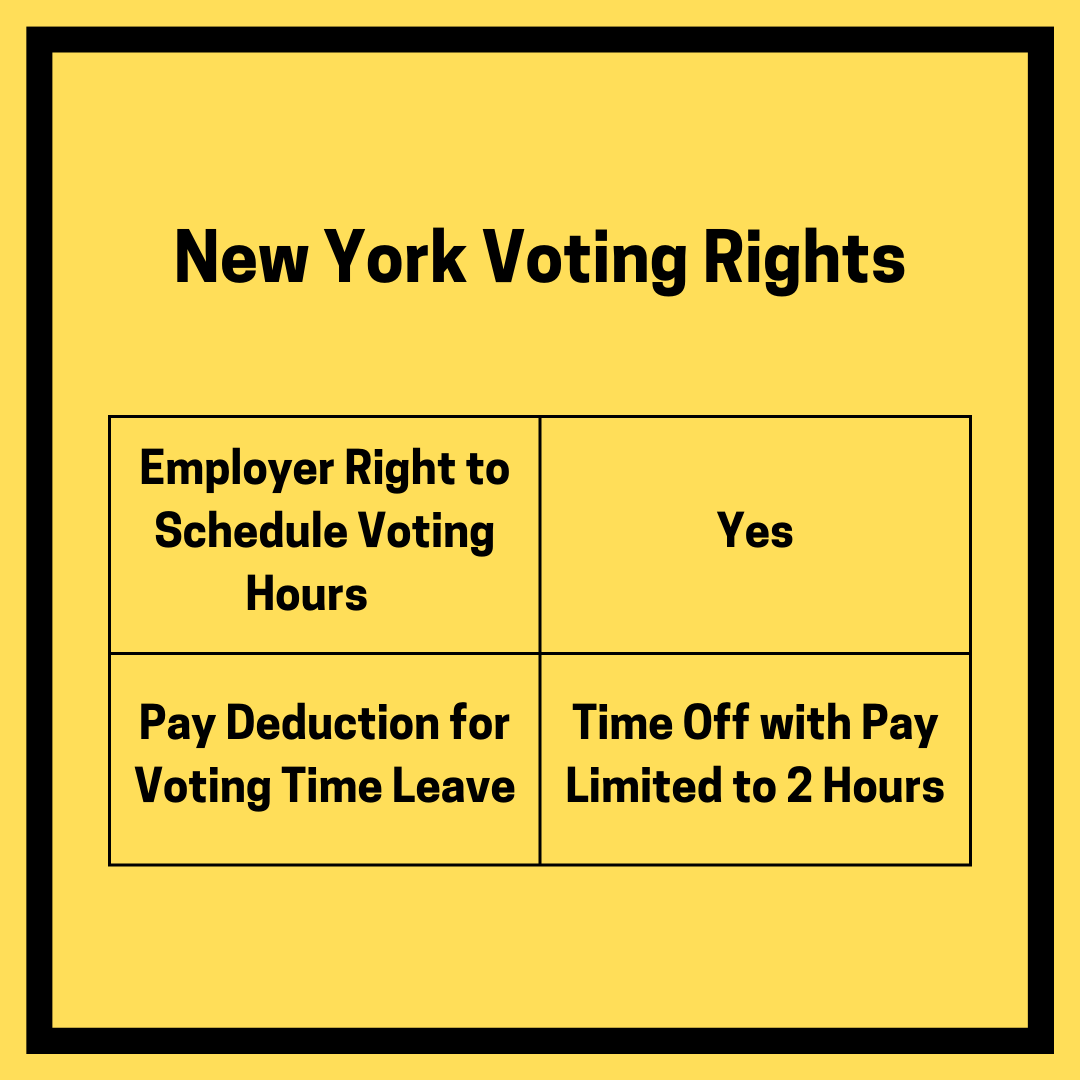

New York Voting Rights

If employees do not have enough time to vote before or after work, all employers in New York must give them time off to vote. The scope of this overview is limited to private employers.

The law does not define exact amount of voting time leave must be awarded, however employees who are absent from work for four hours in a row when the polls are open are not eligible to voting time leave.

PTO Policy

Unless it is part of their benefits package, small firms are not required to pay for time not worked in some forms (holidays, personal leave, vacation). Other circumstances, on the other hand, necessitate paid time off.

Employers in New York must provide up to 12 weeks of paid family leave starting in January 2021. In addition, select companies in New York State are required to offer at least five days of job-protected, paid sick leave to employees who are subject to a mandatory or precautionary quarantine or isolation order as a result of the COVID-19 pandemic. Employers' paid sick leave policies are determined by the number of employees they employ as well as their net annual income.

On April 3, 2020, the New York State government signed new paid sick leave legislation into law, with the following conditions:

- Small businesses (1-99 employees): five paid sick days per year

- Large businesses (those with 100 or more employees) are entitled to 14 days of paid sick leave each year.

These rules apply to small firms with a net income of more than $1 million in 2019. Instead of offering new sick days, any small firm generating less than $50,000 per year can use Paid Family Leave or disability benefits.

The new paid sick leave rules in New York took effect on September 30, 2020. Since then, employees have collected paid sick leave that will be available after January 1, 2021. It's worth emphasizing that throughout sick leave, employees' earnings would stay unchanged.

Small firms may be required to cover certain employees for New York paid family leave under certain conditions. The following situations may qualify for 10 weeks of paid family leave:

- Forming a bond with a child within a year after their birth, adoption, or foster placement.

- Caring for a family member who has a significant medical condition

- Assisting family members when a spouse, partner, kid, or parent is called to active duty.

Domestic employees working 40 hours or more per week for an employer, as well as all part-time and full-time employees, may be eligible for paid leave (unless they have signed a waiver and were eligible to do so). The majority of these regulations take effect four weeks after an employee has worked for your company for 30 days.

Finally, organizations with at least 10 employees may be eligible for paid jury duty.

An employer could be held accountable for up to $40 in earnings for three days of jury duty in this case.

New Hire Reporting

When you hire or rehire an employee after a 60-day absence from your company, you must give them and the Department of Taxation and Finance specific information within 20 days after the hire date. The hiring date is not the day on which you give an offer to an employee; rather, it is the date on which they begin working for pay, tips, or commission. On the day they are hired, employees must get the following information in writing:

- Salary for the position

- If applicable, overtime rate

- How will they be compensated? (e.g., per hour, shift, week)

- Any sum that the employer wants to deduct from the minimum wage (e.g., tips, meals, lodging)

- The payment schedule

- The name of the employer and the names of the companies with whom he or she does business

- The address and phone number of the employer

You'll also need to give the Department of Taxation and Finance the following information

- Employee: Name, address, Social Security number, and date of hire for each employee

- Employer: Name, address, Social Security number, and health insurance benefits, including the date the employee becomes eligible.

This can be done online or by mail, according to New York State's website. A $20 penalty is imposed if a new hire is not disclosed.

It's crucial to confirm if subcontractors are deemed workers under New York State tax law before hiring them. In the performance of their duties, subcontractors are not supervised, directed, or controlled by their employers. If someone working under you meets any of these conditions, they should be treated as an employee and reported as such.

Employees in New York State are protected from discrimination based on their age, race, color, national origin, sexual orientation, gender identity or expression, military status, sex, disability, predisposing genetic characteristics, familial status, marital status, or status as a victim of domestic violence under the state's Human Rights Law. It is unequal opportunity hiring to refuse to hire a candidate because of any of these criteria.

Tax Exemptions and Exclusions in New York

Employers are required by New York tax law to deduct the amount expected to be payable from an employee's gross income. There are several special exclusions and exemptions in this section that may affect how you finish payroll.

Income that isn't taxed and is counted separately from taxable income is referred to as exclusions.

Exclusions differ from deductions in that they do not require the taxpayer to incur any costs. The following are certain exclusions that are important to small businesses:

- Independent contractors

- Students enrolled in certain work-study programs

- A sole proprietor, their spouse, or a kid under the age of 21

- Persons whose employment is subject to the Federal Railroad Unemployment Insurance Act

- Freelance reporters under certain conditions

Employees who do not have some taxes taken from their paychecks are eligible for exemptions. Here are some examples of situations when an exemption may be granted:

- Military spouses are exempt from New York State income tax under the service members Civil Relief Act and Veterans Benefits and Transition Act, and full-time students under the age of 25 who had no New York income tax liability in the previous taxable year and expect none in the current year.

- If your company is a START-UP NY participant and operates in a tax-free zone, some or all of your employees' pay may be exempt from income tax withholding in New York State, NYC, and Yonkers.

How Does New York Payroll System Work?

Let's get into the nitty-gritty of how payroll works for small businesses in the Empire State now that we've covered the basics of New York State taxes and regulations.

Step 1: Ensure that you are adhering to all New York Payroll Laws.

The first step should be to double-check that you are following all of the laws and regulations listed above. Otherwise, you and your company may face penalties, costs, and criminal accusations, including:

- If convicted of not providing worker's compensation insurance, you might face fines of up to $50,000.

- Fines ranging from $1,000 to $3,000 for breaking child labour legislation

Step 2: Have the Right Documentation for Your Employees

After you've double-checked that you're complying with New York State law, it's important to organize all of your employee paperwork and documentation:

- I-9: An employee's identification and ability to work in the United States is verified with this form.

- W2: This is a wage and tax statement that employers are required to give to employees and the Internal Revenue Service (IRS) at the end of the year.

- W4: This form must be completed and returned by new employees in order for their first paycheck to be accurate.

Step 3: Calculate Your Employee’s Pay

Calculating employee compensation may not be too difficult for small organisations with only one or two employees. To get an accurate total, remember to add tips, commission, and paid time off to your income or hours worked.

There are various small business payroll software choices to consider if you have a large number of employees or simply need some help with math.

Step 4: Payroll Taxes (Federal & State)

Following that, you must deduct both federal and state payroll taxes. Let's run through the list quickly because it's quite long.

Federal:

- Federal Income Tax: Withholding are determined by the information on the W4 form.

- Federal Unemployment Tax: On the first $7,000 in wages, the rate is 6%.

- Social Security: In 2021, a flat rate of 6.2 percent will apply to wages up to $142,800.

- Medicare: 1.45% flat tax, plus an additional 0.9 percent for employees earning more than $200,000, and a flat rate of 2.9 percent for self-employed people.

State of New York:

State Income Tax: Depending on an employee's income, this tax ranges from 4 to 8.82 percent. A 9.62 percent withholding rate is applied to any additional commissions or bonuses.

Unemployment Insurance (UI): UI rates in New York State range from 2.025 percent to 9.826 percent.

Disability Insurance: Employers may deduct 0.5 percent of an employee's salary, up to a maximum of $60, from their paycheck.

Step 5: Process Payroll

You will pay your employees their net earnings after eliminating deductions and withholding. While it may be advantageous for a small firm to save money by writing checks by hand, payroll software may save time and eliminate human error.

Step 6: Remember to Keep Records

Paying your employees isn't the end of the process. Maintaining proper payroll records to submit to the IRS and New York State is crucial. One option is to provide pay stubs to employees, which is required by law. Electronically storing information on a hard disc is also a smart option.

New York State requires that you file electronically, or you will face penalties and possible delays.

This will necessitate the filing of a NYS-45 form on a quarterly basis. Combined withholding, wage reporting, and unemployment insurance returns are all examples of this.

Calculator for New York Payroll Taxes

The federal payroll tax withholding for both your employees and your firm can also be calculated using our New York payroll calculator.

The following is a rundown of the steps involved in determining the payroll tax for a New York employee. Check out our step-by-step approach here if you want to see a more complete computation.

1. Determine the employee's gross pay. The amount of money earned by an employee during the most recent pay period is referred to as gross wages.

a.Hourly employees: Multiply their pay rate by the number of hours worked in the most recent pay month. Ensure that any overtime hours performed is calculated at the correct rate.

b.Salaried employees: Divide the annual salary of each employee by the number of pay periods you have each year.

2. Subtract any withholding made before taxes. Do your employees have access to a 401(k), a flexible spending account (FSA), or any other pre-tax benefits? If this is the case, deduct them from your gross salary before calculating federal payroll taxes.

3. To cover Medicare and Social Security taxes, deduct and match any FICA taxes:

a.Social Security tax: You must deduct 6.2 percent of each employee's taxable salary until they reach $142,800 in a calendar year. This tax must be matched by the employer.

b.Medicare tax: Withhold 1.45 percent of taxable pay from each employee. You'll also have to match this tax. You must withhold an Additional Medicare Tax of 0.9 percent from employees who earn more than $200,000 in taxable pay. The Additional Medicare Tax is solely the responsibility of the employee.

4. FUTA unemployment taxes must be paid: You, as the employer, are responsible for paying 6% of an employee's first $7,000 in taxable income per year. You can receive a tax credit of up to 5.4 percent if you pay your New York state unemployment taxes in full and on time each quarter, which means you'll only have to pay 0.6 percent FUTA tax when everything is said and done. It's worth noting that employees aren't accountable for FUTA taxes.

5. Take a deduction for federal income taxes, which can range from 0% to 37%. The IRS can provide you with withholding information.

6. Subtract any post-tax deductions: Some employees may be subject to wage garnishments or child support payments as a result of a court order. They can also make after-tax contributions to savings accounts, elective benefits (such as life insurance), and other withholding.

Forms for New York Payroll Taxes

The New York Department of Taxation has thorough instructions on how to apply these local New York payroll taxes. The following forms should be used to pay taxes to the state on a regular basis:

- Form NYS-1: Monthly Withholding Payment. You'll need to register as a new employer before you can complete out your NYS-1.

- Form NYS-45: Quarterly Withholding Reconciliation, Wage Reporting, and Unemployment Insurance Reporting. Here are the instructions in detail.

How Deskera Can help You?

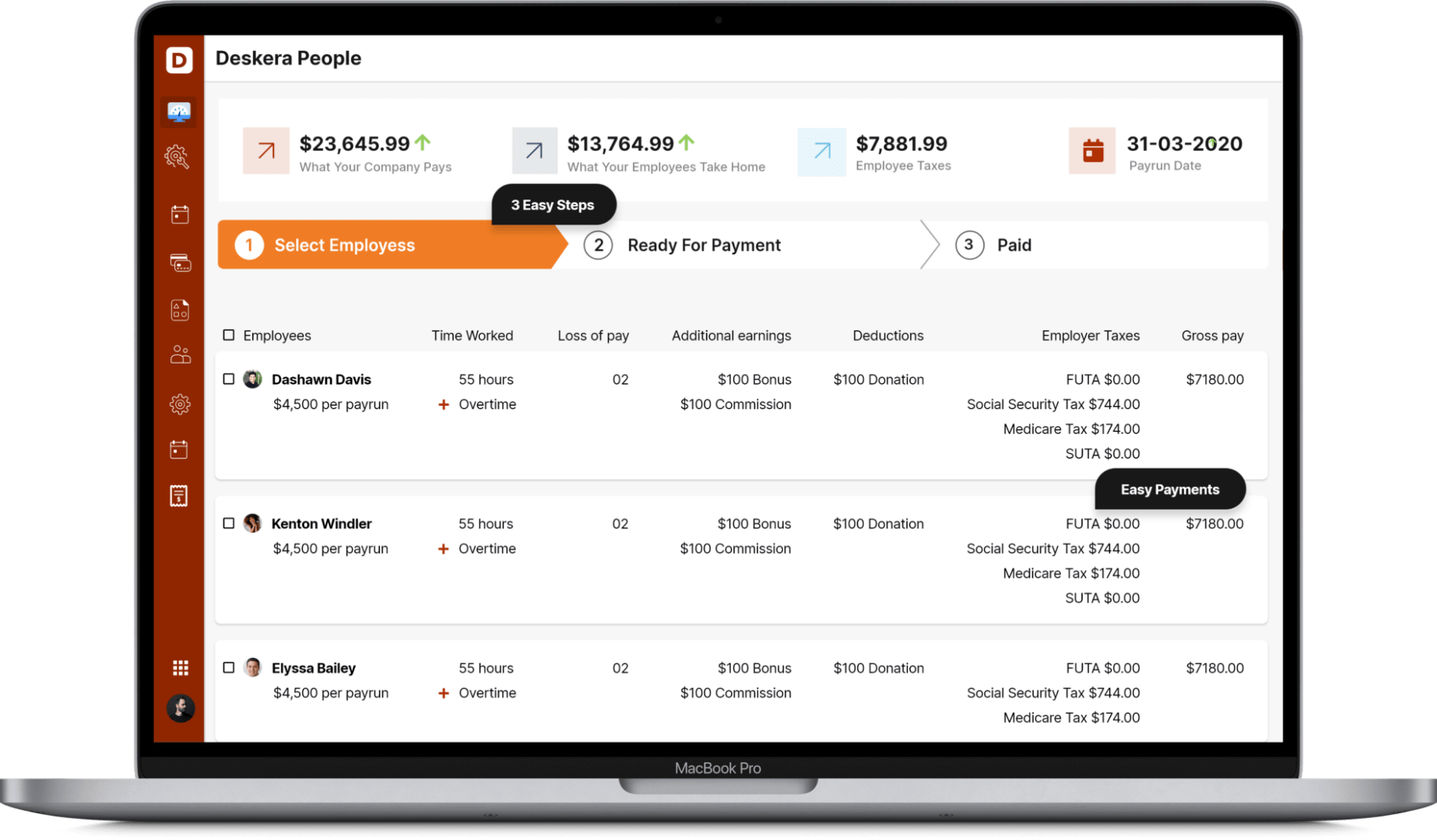

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- Employers subject to New York's wage payment statute are required to pay manual laborers weekly and all other paid workers twice a month. Salespeople who are paid on commission must be paid at least once a month.

- Don't forget to set aside the employer taxes your company is accountable for, in addition to making sure your employees are paid on time. If you don't remit your FICA and UI payments on a regular manner, they can pile up.

- Although federal tax filings are due quarterly (Form 941), and annually (Form 940), most New York employers must pay taxes on a regular basis via the EFTPS payment system.

Related articles: