Have you ever looked at a company’s balance sheet and wondered how they know what their inventory or receivables are really worth? The answer lies in a key accounting principle called Net Realizable Value (NRV). NRV helps businesses assess the true value of assets by estimating what they can actually expect to receive after selling or collecting them, minus any related costs. It's a concept rooted in practicality—after all, not everything in the books turns into cash at full price.

Net Realizable Value is essential for maintaining accurate and fair financial records. It plays a crucial role in inventory valuation and accounts receivable management, helping businesses avoid overstatements that could mislead stakeholders. By adhering to NRV principles, companies align with accounting standards such as GAAP and IFRS, ensuring transparency and compliance in their financial reporting.

This concept is especially important when market conditions shift, inventory becomes obsolete, or customers delay payments. NRV forces a realistic appraisal of what a company can recover, guiding smarter business decisions. Whether it's pricing outdated products or setting up allowances for doubtful debts, NRV serves as a financial safety net to prevent inflated asset values.

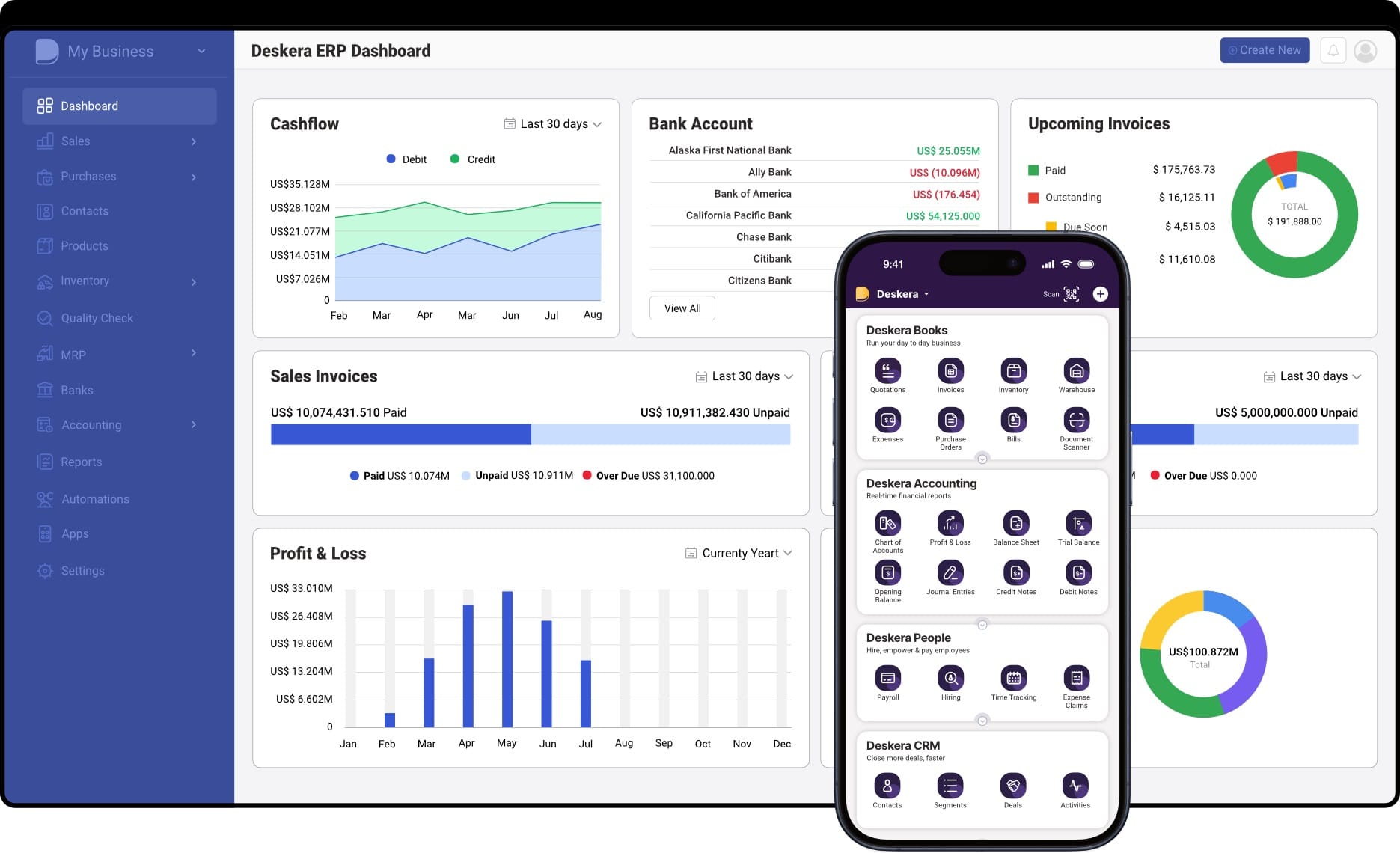

Modern ERP systems like Deskera ERP simplify and automate the process of calculating NRV. With real-time data, integrated inventory tracking, and powerful accounting features, Deskera empowers businesses to make accurate NRV assessments quickly and confidently. Its user-friendly dashboards, AI-driven forecasting tools, and seamless financial reporting make it a reliable choice for businesses aiming to stay compliant and financially agile.

What is Net Realizable Value (NRV)?

Net Realizable Value (NRV) is a financial accounting concept used to determine the actual value a company can expect to receive from an asset, after subtracting any costs associated with selling or disposing of it.

NRV is a key component of the conservatism principle in accounting, which emphasizes erring on the side of caution—recording potential losses when they're probable, but only recognizing gains when they're certain. This ensures that a company’s financial statements are not overly optimistic, offering a realistic view of asset value.

In practice, NRV is calculated by estimating the asset’s fair market value—the price a willing, informed buyer would pay for it in an open market—and then deducting any costs to complete, sell, or dispose of that asset. These costs might include things like transportation, taxes, sales commissions, or repair fees.

The result is the "net" amount the business could reasonably expect to collect. If this NRV is lower than the asset’s current book value (its original recorded cost), the company must write the asset down and record the difference as a loss, which affects its profitability.

NRV is most commonly applied to inventory and accounts receivable, but it can also be used for other assets like fixed assets, real estate, and investments. For instance, if a product becomes obsolete or its market price drops due to new competition, its NRV may fall below the recorded inventory cost—triggering a required adjustment. Similarly, if customers are unlikely to pay outstanding invoices in full, the accounts receivable balance needs to reflect the lower amount actually collectible.

To keep asset valuations up to date, especially at the end of financial periods, companies often conduct NRV analyses—a best practice guided by accounting standards like GAAP and IFRS. Many businesses turn to tools like Deskera ERP to streamline this process.

Deskera helps automate inventory tracking, manage receivables, and perform real-time valuation checks. With features like AI-powered forecasting, integrated accounting, and compliance-ready reports, Deskera ensures businesses stay accurate, efficient, and audit-ready in their financial reporting.

Why is NRV Important in Accounting?

Net Realizable Value (NRV) plays a crucial role in ensuring the accuracy and reliability of a company’s financial records. It is not just a technical accounting term—it reflects the broader financial discipline of being cautious and realistic when valuing assets.

By applying NRV, companies avoid overstating the value of assets on their books, which could otherwise lead to misleading financial statements.

Below are the key reasons why NRV is important in accounting:

1. Reinforces the Principle of Conservative Accounting

NRV is closely tied to the conservatism principle, one of the foundational guidelines in accounting. This principle advises that potential losses should be recognized as soon as they are probable, while potential gains should only be recorded when they are certain.

- By valuing assets at their lower NRV rather than their original cost, businesses ensure that they are not projecting an overly optimistic financial position.

- This approach protects stakeholders from the risk of inflated earnings or misrepresented financial health.

2. Enhances Accuracy in Financial Reporting

Accurate valuation of assets is critical to producing financial statements that genuinely reflect a company’s financial condition.

- NRV ensures that values reported for inventory, accounts receivable, and other assets are not overstated.

- This leads to more trustworthy and transparent financial reporting, which is essential for decision-making by management, investors, creditors, and auditors.

3. Supports Compliance with Accounting Standards

Both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) require businesses to apply NRV principles.

- These standards mandate that inventory and receivables be reported at the lower of cost or net realizable value.

- Proper application of NRV helps organizations stay in compliance with these regulations, reducing the risk of financial misstatements and audit issues.

4. Improves Inventory and Accounts Receivable Valuation

NRV is particularly important when assessing the value of inventory and accounts receivable—two major asset categories on the balance sheet.

- For inventory, NRV helps identify items that may have become obsolete, damaged, or unsellable due to market changes. These items must be written down to reflect their reduced value.

- For accounts receivable, NRV is used to estimate the portion of receivables that may not be collected, prompting the creation of an allowance for doubtful accounts.

5. Aids in Strategic and Operational Decision-Making

Reliable NRV assessments inform several areas of business operations and strategy.

- By understanding which inventory items are losing value, businesses can decide whether to offer discounts, liquidate stock, or stop reordering certain products.

- In accounts receivable, identifying customers with high credit risk helps in revising credit policies or collection efforts, improving cash flow management.

6. Impacts Financial Performance and Cost Reporting

When NRV is lower than the book value of an asset, the company must make an adjusting entry, which directly affects profitability.

- For inventory, this write-down appears as an increase in the cost of goods sold (COGS) or a loss in the income statement, thus reducing net income.

- These adjustments ensure that financial results are not artificially inflated and reflect actual economic conditions.

In essence, NRV is a safeguard against overly optimistic asset valuations. It ensures that a company’s financial reports reflect the most realistic and reliable estimates of value, fostering better business practices and financial integrity.

Understanding NRV in Different Accounting Contexts

While Net Realizable Value (NRV) is most commonly associated with inventory valuation, its application extends across multiple asset categories. Each context carries its own set of considerations, but the core principle remains the same: assets should not be recorded at more than the amount they are expected to bring in.

Let’s explore how NRV is used across various accounting scenarios:

1. NRV in Inventory Accounting

Inventory is the most frequent area where NRV is applied, particularly in industries dealing with physical goods, like manufacturing or retail.

- NRV ensures inventory is valued at the lower of its historical cost or the amount it can realistically be sold for, after subtracting costs like packaging, transport, and marketing.

- This is crucial when inventory becomes obsolete, damaged, or when market conditions shift unfavorably.

- For example, if a fashion retailer holds a large stock of out-of-season clothing, an NRV analysis may result in a write-down to reflect expected markdown sales prices.

2. NRV in Accounts Receivable (AR)

In the case of accounts receivable, NRV is used to estimate the amount a company actually expects to collect from customers.

- Not all customers pay on time, and some may default altogether. Therefore, companies must reduce AR by an allowance for doubtful accounts to reflect its net realizable value.

- This helps prevent overstatement of receivables and revenue, especially in industries with high credit sales.

- For instance, if a company has ₹100,000 in receivables and expects 5% to be uncollectible, the NRV would be ₹95,000.

3. NRV in Fixed Assets

Fixed assets like machinery, buildings, and equipment are usually recorded at cost minus depreciation. However, under certain conditions, their value may need to be reassessed using NRV.

- When there's evidence of impairment—such as technological obsolescence, physical damage, or market downturns—NRV helps determine the recoverable amount.

- If the NRV is lower than the asset’s carrying value, an impairment loss must be recognized.

- For example, a company with outdated manufacturing equipment may find that its market resale value is far below its current book value, triggering a write-down.

4. NRV in Investments and Marketable Securities

For investments, particularly those not held for long-term purposes, NRV ensures they are valued fairly in financial statements.

- NRV is considered when an investment's market price falls significantly below its purchase cost and is not expected to recover soon.

- Although most investments are marked to market under fair value accounting, NRV principles support the need for valuation adjustments when liquidation costs or losses are expected.

5. NRV in Agricultural and Biological Assets

In certain industries, especially agriculture and farming, biological assets like crops or livestock are measured at NRV.

- These assets are evaluated based on their expected selling price in the market, less any costs required to bring them to sale (e.g., harvesting, transportation, regulatory fees).

- This approach ensures that the perishable and often volatile nature of these assets is fairly reflected in the financial records.

6. NRV in Liquidation or Distressed Scenarios

In cases where a company is undergoing liquidation or restructuring, NRV becomes essential to assess what value can realistically be recovered from assets.

- Assets are no longer viewed in terms of their operational utility but in terms of what they can fetch if sold immediately.

- This helps creditors, investors, and management make informed decisions about asset disposition, payouts, and recovery planning.

Understanding how NRV is applied in various contexts enables accountants and business leaders to maintain accurate, transparent, and compliant financial statements. It ensures businesses present a realistic view of their financial standing—especially under changing market or operational conditions.

How to Calculate NRV: Step-by-Step Guide

Calculating NRV involves estimating the amount a company expects to receive from selling or realizing an asset, after deducting the costs directly associated with that process.

Step 1: Identify the Asset to be Evaluated

Start by determining which asset you need to assess. NRV is most commonly used for:

- Inventory

- Accounts receivable

- Fixed or long-term assets (in impairment testing)

For this guide, we’ll focus on inventory and receivables, as they are the most frequently adjusted.

Step 2: Determine the Estimated Selling Price (Fair Market Value)

Estimate the current market price of the asset — the price at which it could be sold under normal conditions.

- For inventory, this is the anticipated sales price of the item.

- For accounts receivable, this would typically be the total amount due from customers.

Example: If a company expects to sell a product for ₹2,000 in the open market, that’s your estimated selling price.

Step 3: Estimate Costs Necessary to Make the Sale

Deduct all expected costs associated with completing the sale. These may include:

- Packaging and shipping

- Sales commissions

- Disposal fees

- Taxes or regulatory costs

- Restoration or repair (if applicable)

Example: If packaging and shipping cost ₹300 and commission is ₹100, total costs = ₹400.

Step 4: Apply the NRV Formula

Use the NRV formula:

NRV = Estimated Selling Price – Estimated Costs to Sell

Example: NRV = ₹2,000 – ₹400 = ₹1,600

This means the asset should be recorded at ₹1,600 on the balance sheet if this is lower than its original cost.

Step 5: Compare NRV to Historical/Book Value

Compare the calculated NRV to the asset's current book value (usually based on historical cost):

- If NRV < Book Value → A write-down is required, and a loss is recorded.

- If NRV ≥ Book Value → No adjustment is needed under conservatism principle.

Example: If the inventory’s book value is ₹1,800 and NRV is ₹1,600 → Write down ₹200 as a loss.

Step 6: Record Adjusting Journal Entry (if needed)

If a write-down is necessary, reflect it in the accounting books:

Journal Entry:

Dr. Loss due to NRV adjustment ₹200

Cr. Inventory ₹200

This ensures your financial records reflect the conservative and realistic value of assets.

Step 7: Review Regularly

NRV calculations are not one-time events. Perform NRV assessments:

- At year-end or quarter-end

- When significant market changes occur

- When inventory becomes obsolete or damaged

NRV vs. Fair Value: Key Differences

Although Net Realizable Value (NRV) and Fair Value (FV) are both used in asset valuation, they serve different purposes and follow distinct principles under accounting frameworks like GAAP and IFRS. Below is a detailed breakdown to help you clearly differentiate between the two.

1. Definition and Concept

Net Realizable Value (NRV): NRV is the estimated amount an asset is expected to fetch upon sale, after subtracting the costs required to make the sale (such as packaging, shipping, and commissions). It emphasizes conservative estimation — never overvaluing assets.

Fair Value (FV): Fair Value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. It reflects market-based evidence rather than entity-specific intent or costs.

2. Basis of Valuation

- NRV: Based on the company’s internal estimates — expected selling price minus estimated costs to complete and sell.

- Fair Value: Based on external, market-driven factors, such as quoted market prices, independent appraisals, or observable inputs.

3. Usage in Accounting

- NRV: Primarily used under the conservatism principle for valuing:

- Inventory (as per GAAP and IFRS)

- Accounts receivable (after estimating uncollectible amounts)

- Fair Value: Commonly used for:

- Financial instruments (stocks, bonds)

- Investment properties

- Derivatives

- Business combinations (for measuring assets/liabilities)

4. Accounting Standards Guidance

- NRV: Guided under:

- GAAP: Lower of Cost or NRV for inventory

- IFRS: IAS 2 for inventory measurement

- Fair Value: Defined under:

- IFRS 13: Fair Value Measurement

- ASC 820 under GAAP

5. Treatment of Costs

- NRV: Considers costs to complete and sell the asset — integral to the calculation.

- Fair Value: Ignores transaction costs, except in some rare cases. It reflects the price in a hypothetical sale between market participants.

6. Outcome Orientation

- NRV: Focused on realizable value, i.e., what the company will likely get in cash after disposal.

- Fair Value: Represents an objective market value, regardless of whether the asset is actually sold.

7. Nature of Approach

- NRV: More entity-specific, reflecting what the company realistically expects to realize.

- Fair Value: More market-centric, based on what others would pay in the open market.

8. Conservative vs. Neutral

- NRV: Aligns with the conservatism principle — favoring losses over unrealized gains.

- Fair Value: Based on neutral valuation, aimed at providing relevant and unbiased market information.

Comparison Table:

While both NRV and Fair Value help companies ensure their assets are accurately represented on financial statements, they cater to different goals. NRV is about being cautious and realistic, mainly for items like inventory and receivables. Fair Value, on the other hand, reflects current market dynamics and is often used for investment and financial reporting purposes.

Advantages of Net Realizable Value (NRV)

Net Realizable Value is a fundamental concept in accounting that plays a key role in ensuring the accuracy, reliability, and transparency of financial statements. Here are the major advantages of using NRV in accounting practices:

1. Promotes Conservative Accounting

NRV adheres to the principle of conservatism, which guides accountants to avoid overstating the value of assets and income. By valuing assets at the amount that is actually expected to be realized (after deducting selling costs), NRV ensures that financial statements reflect a cautious and realistic picture of the company’s financial position. This minimizes the risk of reporting inflated profits or asset values.

2. Reflects Current Market Conditions

Unlike historical cost accounting, NRV takes into account changes in market conditions that affect the value of an asset. For example, a sudden decline in market demand or technological obsolescence can reduce the expected selling price of inventory. NRV allows businesses to adjust asset values accordingly, ensuring that balance sheets present up-to-date and relevant information.

3. Enhances Accuracy of Financial Reporting

NRV ensures that the value of assets reported on the financial statements is neither overstated nor misleading. This improves the overall accuracy of financial reporting and helps stakeholders—such as investors, creditors, and auditors—make informed decisions based on the true financial health of the organization.

4. Facilitates Better Inventory and Receivables Management

By regularly analyzing NRV, companies are prompted to monitor their inventory turnover, sales trends, and collectability of receivables. This helps in identifying slow-moving or obsolete inventory and doubtful debts early, enabling timely corrective actions such as markdowns, promotional strategies, or writing off bad debts.

5. Supports Compliance with Accounting Standards

NRV is a requirement under both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), particularly in the context of inventory valuation. Adopting NRV helps businesses stay compliant with these regulatory frameworks, reducing the risk of audit issues or financial restatements.

6. Aids in Loss Prevention and Risk Management

Using NRV, companies can identify potential losses early by comparing book values with realizable values. This enables more proactive risk management, as it alerts management to take steps—such as adjusting production levels or renegotiating sales terms—to mitigate losses before they occur.

7. Enhances Credibility and Trust

When companies use NRV to report asset values accurately, it builds credibility with stakeholders. Investors and lenders are more likely to trust businesses that provide honest and transparent financial information, which can lead to easier access to capital and improved investor confidence.

8. Useful During Financial Downturns

In times of economic uncertainty or declining markets, NRV provides a mechanism to adjust asset valuations realistically. This helps companies reassess their positions and make strategic decisions that are grounded in the financial realities of the moment, such as scaling back inventory or changing pricing strategies.

Disadvantages of Net Realizable Value (NRV)

While Net Realizable Value (NRV) is essential for promoting transparency and accuracy in financial reporting, it also presents certain limitations and challenges. Businesses must be aware of these drawbacks to implement NRV effectively and avoid unintended financial consequences.

Below are some of the key disadvantages associated with NRV:

1. Subjectivity in Estimations

One of the primary drawbacks of NRV is the reliance on estimates, particularly when calculating selling prices and associated costs. Estimating fair market value and expected disposal or selling costs often involves judgment and assumptions that may vary between individuals or organizations. This subjectivity can lead to inconsistencies in how assets are valued and may impact the comparability of financial statements.

2. Prone to Errors and Misjudgments

Since NRV calculations depend on future projections—such as future selling price, costs of completion, and costs to sell—there is always a risk of overestimating or underestimating these amounts. Misjudgments can result in either an unnecessary write-down of assets or an overstatement of their value, both of which can distort a company’s financial performance and condition.

3. Frequent Recalculations May Be Required

Because market conditions, customer preferences, and selling costs can change rapidly, NRV values must be reviewed regularly to ensure accuracy. This requires companies to perform frequent re-evaluations and possibly make multiple adjusting entries, increasing the accounting workload and operational burden—especially for businesses with large inventories or diverse asset portfolios.

4. Impact on Profitability

When the NRV of an asset falls below its historical or book value, companies are required to write down the asset and recognize a loss on the income statement. These write-downs can reduce reported profits, which might negatively impact investor perception, stock prices, or the ability to secure financing—even when the underlying issue is temporary or market-driven.

5. Not Reflective of Long-Term Value

NRV is designed to capture the immediate realizable value of an asset, not necessarily its long-term potential. For instance, inventory that is written down today due to a dip in market demand may regain its value in the future. However, under NRV, companies cannot reverse the write-downs under U.S. GAAP, potentially leading to undervaluation of assets over time.

6. Complexity in Implementation

Implementing NRV-based adjustments across a company’s financial records requires a robust internal control system and skilled accounting personnel. Businesses must track fluctuating selling costs, evaluate asset utility, and apply NRV rules accurately across various asset types, which can be complex and time-consuming—especially for small or medium enterprises lacking dedicated accounting resources.

7. Inconsistencies Across Reporting Standards

While NRV is recognized under both GAAP and IFRS, there are subtle differences in how each standard applies the concept, especially concerning reversals of inventory write-downs. Companies that operate across multiple jurisdictions may face challenges in harmonizing these practices for consolidated reporting, potentially leading to confusion or compliance risks.

8. May Create Undue Management Conservatism

Over-reliance on NRV as a conservative accounting tool can sometimes encourage excessive caution from management. This may result in writing down assets prematurely or hesitating to invest in new inventory, even when future prospects are positive. Such conservatism could hinder growth or distort the company’s true potential in the eyes of investors.

Best Practices for NRV Estimation

Accurate Net Realizable Value (NRV) estimation is essential for maintaining the integrity of financial statements and adhering to accounting standards such as GAAP and IFRS. Poor estimation can lead to misstated asset values and distorted profit figures.

By following well-defined best practices, companies can ensure their NRV calculations are reliable, consistent, and aligned with both internal and external reporting expectations.

1. Establish Clear Estimation Policies and Procedures

To reduce ambiguity, businesses should develop standardized policies for determining NRV. These policies should outline:

- The types of costs to deduct (e.g., selling costs, completion costs)

- The methods for determining fair market value

- Thresholds for triggering NRV reviews

- Frequency of reassessments

Consistent application across departments ensures accuracy and compliance.

2. Conduct Regular Market Reviews

NRV depends heavily on market conditions. Companies should monitor market prices, customer demand, and industry trends regularly. This is particularly important for businesses operating in fast-moving sectors such as electronics, fashion, or perishable goods. Early identification of declining selling prices can help initiate timely NRV adjustments.

3. Use Historical Data for Cost Estimation

Selling and disposal costs should not be estimated in isolation. Leverage historical data from past transactions to calculate typical costs like:

- Shipping and handling

- Sales commissions

- Taxes or tariffs

- Storage and warehousing

- Marketing or promotional expenses

This practice minimizes estimation bias and strengthens audit trails.

4. Involve Cross-Functional Teams

NRV estimation benefits from input across departments—especially finance, operations, procurement, and sales. While accounting handles the valuation, operations can report on obsolescence or damage, and sales can provide input on realistic selling prices. Collaborative review ensures all relevant factors are considered.

5. Segment Inventory and Assets

Not all assets or inventory items carry the same risk. Segregate inventory into categories such as:

- Obsolete or slow-moving

- High-value or specialized

- Perishable goods

- Standard stock items

This allows for more targeted and appropriate NRV analysis, rather than applying broad assumptions across all items.

6. Leverage Technology and ERP Systems

Modern ERP systems, such as Deskera ERP, can automate much of the NRV estimation process. Deskera, for instance, provides real-time inventory tracking, customizable cost allocation methods, and automated reporting features. These capabilities help businesses identify NRV issues quickly and maintain compliance with accounting standards through system-generated audit trails.

7. Align with Auditors and Reporting Standards

Ensure that your NRV methodology aligns with the requirements of your chosen accounting framework (GAAP or IFRS). Review your estimation process regularly with internal and external auditors to confirm that practices remain compliant and transparent.

8. Document All Assumptions and Methodologies

During audits or internal reviews, clear documentation of assumptions, inputs, and calculation methods is essential. Keep a record of:

- Fair market price sources

- Cost components considered

- Any rationale for assumptions made

- Dates of NRV assessments

Good documentation reduces the risk of disputes and provides justification for management’s decisions.

9. Monitor Post-Adjustment Performance

After making NRV-based write-downs, companies should monitor the future performance of those assets. This practice can provide feedback on the accuracy of past estimates and help refine future projections.

How Can Deskera ERP Help with NRV Estimation and Inventory Valuation?

Net Realizable Value (NRV) estimation is an essential process for ensuring that assets, especially inventory and receivables, are accurately valued according to accounting standards. However, manually tracking inventory movement, calculating costs, and adjusting asset values can be time-consuming and error-prone. This is where Deskera ERP proves invaluable.

Deskera ERP is a comprehensive business management platform that simplifies inventory tracking, financial reporting, and compliance with accounting standards like GAAP and IFRS. Its integrated approach helps businesses estimate NRV accurately, streamline asset valuation, and maintain transparency in their books. Here's how:

1. Real-Time Inventory Management

Deskera ERP offers real-time visibility into stock levels, movement, and location. It tracks each item from procurement to sale, helping you identify obsolete, slow-moving, or high-risk inventory that may require NRV assessment. With timely updates, businesses can react quickly to changing market conditions or product demand.

2. Automated Cost Tracking

The platform supports multiple inventory costing methods such as FIFO, LIFO, and weighted average, which are essential for accurate inventory valuation. Deskera automatically calculates the cost of goods sold (COGS) and updates inventory values, making it easier to determine when NRV adjustments may be required.

3. Integrated Accounting and Reporting

With built-in accounting modules, Deskera ERP ensures that any NRV adjustments are correctly reflected in financial statements. Journal entries for write-downs, depreciation, or impairments are automatically created and can be traced back to their source, maintaining an audit-ready trail for compliance.

4. Alerts for Inventory Revaluation

Deskera allows users to configure alerts for conditions that might trigger NRV reassessments—such as stagnant stock, declining sales, or drops in market price. These alerts help ensure that potential losses are captured in a timely and compliant manner.

5. Collaborative Workflows

With Deskera’s cloud-based interface, different departments—finance, procurement, warehouse, and sales—can collaborate seamlessly. Everyone has access to updated inventory and financial data, ensuring that NRV estimation is based on accurate, cross-functional insights.

6. Simplified Audit Trails and Documentation

For each NRV-related adjustment, Deskera stores supporting documentation, including cost calculations, market price data, and internal memos. This makes it easy to respond to auditor queries and demonstrate compliance with accounting standards.

7. Scalability and Adaptability

Whether you are a small business or a growing enterprise, Deskera ERP scales with your needs. As your inventory grows in complexity, Deskera ensures that NRV analysis remains accurate and efficient across product lines and markets.

Key Takeaways

- Net Realizable Value (NRV) is a conservative accounting principle that ensures assets are not overstated by valuing them at their estimated selling price minus any costs needed to complete and sell them.

- NRV supports accurate financial reporting, helps identify potential losses early, and aligns with GAAP and IFRS standards by encouraging a cautious and fair valuation of assets.

- While commonly applied to inventory, NRV is also used to evaluate accounts receivable, fixed assets, and investments to reflect their true recoverable value.

- To calculate NRV, subtract all expected costs of completion and sale (e.g., handling, transportation, and marketing) from the asset’s estimated selling price.

- Fair value refers to the price an asset would fetch in the market under normal conditions, while NRV accounts for selling costs, making it more conservative in valuation.

- NRV ensures conservative asset valuation, improves the reliability of financial reports, supports risk management, and helps prevent overstatement of profits.

- Estimating NRV can involve subjectivity, market volatility can cause frequent recalculations, and it may lead to undervaluation of profitable assets.

- Implementing frequent reviews, using real-time data, collaborating across departments, and maintaining documentation are essential for accurate NRV estimation.

- Deskera ERP streamlines NRV estimation by offering real-time inventory tracking, automated costing, and integrated accounting, all within a collaborative and scalable platform.

Related Articles