If your business motive only focuses on gaining a profit, then you are taking the very wrong approach to sustainably achieving a healthy business goal. It cannot be denied that profit contributes majorly to making up the backbone of the business structure. However, focusing only on making a profit can hinder the growth of your business.

You must be wondering how it is possible. Well, no matter how large your business is, sometimes it is not possible to predict the profit margin and sometimes it does not meet the expected profit margin. However, cash flow is an important factor that crucially determines not only your present business health but also the future of your business.

Cash flow accounts for the amount of money that comes in and also goes out of the business. This factor works as a crucial indicator to determine your company’s financial health. The well-monitored financial stability of a company keeps the major business risks away. These include unprofitable business margins; diminished business structure; business model collapses; etc. So, maintaining the financial health of a company is mandatory.

Cashflow can be further divided into two main spectrums, including positive cash flow and negative cash flow. When the incoming cash flow surpasses the outgoing cash flow, positive cash flow happens. This is desirable to keep the business going on the right path. However, sometimes businesses experience a hindrance in their financial flow. You may have more outgoing cash than incoming cash, which is termed "negative cash flow".

It is needless to say that negative cash flow indicates a downtrodden business economy, which is unfortunate for business health. So, if you own a business or if you are looking forward to starting a business, it is crucial to know what negative cash flow means.

This article will give you a clearer idea about the negative cash flow. It will cover the following topics in detail:

- What Is Negative Cash Flow?

- Negative Cash Flow In Small Businesses

- What Are The Major Causes Of Negative Cash Flow?

- No Coordination Between Income And Expenses

- Large Business Payments

- Seasonal Causes

- Inappropriate Business Model

- Downtrodden Economic Condition

- Dishonest Employees Or Vendors

- How To Handle Negative Cash Flow In A Business?

- Search for the source

- Manage a planned payment term

- Apply for business loans

- Eliminate operational costs

- Conclusion

- How can Deskera Help You?

- Key Takeaways

What Is Negative Cash Flow?

If your company is new to dealing with the business game, it is quite normal that your company would experience negative cash flow. When a company invests an amount to build its business and receives an amount from the business that is lower than the outgoing amount, negative cash flow happens.

Apart from the initial phase, if a business experiences negative cash flow for a very long time, the collapse of the business is inevitable. Negative cash flow indicates the loss of funds if your company can not manage to acquire enough profit to cover your costs.

Negative Cash Flow In Small Businesses

Negative cash flow in your small business mostly indicates poor coordination of income and expense timing. Adding to that, if negative cash flow persists over a longer period of time, this can lead to the loss of business funds. Your small business can even make a profit while experiencing a negative cash flow. This negative cash flow example includes your company's invoices that might be due before a client pays their bills. This situation might lead to an undesirable position where you won't be able to meet your bills because of a fund deficit.

A small business requires a large percentage of profit to be used as a reinvesting amount. Otherwise, it is difficult to meet the business costs. However, if your small business venture experiences negative cash flow, it becomes challenging to reinvest in your firm. So, this crisis forces small business owners to keep their businesses running without expecting much of a profit. Negative cash flow drastically reduces the chance of expanding a small business too.

What Are The Major Causes Of Negative Cash Flow?

It is quite clear that irrespective of business size, negative cash flow is not at all a desirable phenomenon in a business structure. You may suffer a cash flow constraint if you don't monitor your cash intake well enough to deal with unanticipated costs. So, if you want to avoid negative cash flow in your company, you must learn about the causes that majorly contribute to this malfunction.

No Coordination Between Income And Expenses

The imbalance between expenditure and income over a particular period is one of the most prominent causes of negative cash flow in a corporation. If you look into the annual cash flow report of a business, it might seem to be normal. However, the cash flow turns to negative cash flow during the month of ordering supplies in most cases. Other factors also contribute to the negative cash flow of a corporation, including yearly tax payments, costs, or unpaid bills.

The occasional non-coordination between expenses and income leads to the unfortunate condition of negative cash flow in a business. This might appear as a business issue for a particular period of time. However, proper planning and expert financial management might help you save your company from a severe cash flow crisis.

Large Business Payments

Businesses do more than just sell their products or services; they also invest in different sectors to help the business grow. If you own a company and want to improve its infrastructure or want to purchase a large quantity of raw materials, you will need to make an enormous payment.

Paying a huge lump-sum amount may affect the balance sheet of the company for a particular period. However, this factor rarely contributes to endangering the organization. This concept can be further clarified by an example.

Suppose you have bought an oven for business-related purposes in a particular month. This would require you an extra amount of expenditure, leading to a periodic imbalance in the balance sheet of that month. The financial flow will turn into negative cash flow for that particular month. However, since this newly bought oven will also contribute to the business, the cash flow may return to normal gradually.

Seasonal Causes

Despite running a business venture successfully and maintaining a healthy financial base, your company might experience negative cash flow due to seasonal reasons. The enterprises that are mostly dependent on seasonal gigs are mostly the ones that experience this situation. This refers to the businesses associated with tourism, ski resorts, professional sports teams, etc.

Since these firms are entirely dependent on seasonal events, they are more likely to experience negative cash flow during the off-season. The off-season refers to the period when the company carries on its business either at a lesser capacity or shuts down due to lack of demand. However, this type of negative cash flow is not at all alarming for your organization as long as the company's yearly cash flow runs on a positive notion.

Inappropriate Business Model

It is quite common for early business owners to go through negative cash flow. However, as long as the yearly cash flow is positive, there is nothing to worry about. The same theory applies to companies with seasonal business activities, occasional mismatched income and expenditure imbalances, etc. The chance of facing major financial harm occurs if your business consistently earns less income than is required to pay costs each month or quarter.

One of the major causes behind this kind of negative cash flow occurs when a company runs on a defective business model. A company's business model plays a crucial role in determining a company's financial health. An unsustainable business model can never help the company to reach a better position. For many organizations, a remedy to this challenge is to boost product and service prices while reducing overhead expenditures like insurance coverage and leases.

Downtrodden Economic Condition

There are some external factors, apart from the business-oriented factors, that can cause negative cash flow in a business entity. One of the major factors is economic uncertainty due to inflation, recession, national emergency, and defective economic policies. Despite not being the result of any inside business mismanagement, these factors can severely cause damage to the business structure, inviting negative cash flow. It can lead to reducing or stopping income for extended periods of time.

Maintaining your firm successfully during a downturn or major national disaster, such as the COVID-19 epidemic, will almost certainly necessitate certain structural modifications. Due to the impossibility of serving customers with an indoor dining facility during the epidemic, several restaurants have switched to takeaway and delivery services to generate money. Some firms have also relocated their businesses; some have resorted to remote work; and some have temporarily halted operations in order to save costs.

Dishonest Employees Or Vendors

Apart from business-induced mismanagement and external factors, theft and fraud might be considered a major reason behind the negative cash flow. The malpractice of theft and fraud generally takes place due to the engagement of dishonest associates or vendors with a company. It should be considered one of the most exceptional circumstances to cause negative cash flow. If you suspect a worker is stealing money or a vendor is slashing earnings, you should contact a law enforcement agency to look into this matter.

How To Handle Negative Cash Flow In A Business?

Negative cash flow that persists for a longer period can impair a company's operations and jeopardize its capacity to stay stable and profitable. So, it is very crucial to manage the negative cash flow in a fruitful way to mitigate the issues associated with it. The following steps might guide you in this matter.

Search for the source

Finding out the main source contributing to negative cash flow is very crucial. Evaluate if negative cash flow is occurring due to operational loss or due to misaligned income and expense structure.

Eliminate payables from receivables to discover the cause of negative cash flow.

If the difference between receivables and payables is negative, the company has a negative cash flow from operations. Your earnings are below the costs you must cover. You are either producing too few sales or overspending.

Manage a planned payment term

Managing payment terms can generally help in eliminating payment-related confusion along with ensuring a healthy cash flow. You provide your client with invoice payment terms so they realize and have a clear idea about when to pay you. You also need to adhere to the payment conditions of your vendors so that you know when to clear their dues. To enhance cash flow, you might consider adjusting either of these payment conditions.

Apply for business loans

You may need to make investments or borrow to make up for low sales. A business loan might be beneficial in this scenario. To pay for expenses, you might get a company credit card. Before accepting the agreement conditions, consider checking the interest rates thoroughly. To stay out of debt accumulation, pay off the credit card soon.

Eliminate operational costs

Analyze your present operational costs to determine the costs that can be avoided. Ensure that you are not overpaying for the goods and services that are required to keep your company running. Compare prices from other suppliers to assess if it is manageable to find a better offer.

Conclusion

Negative cash flow implies a struggling corporate environment, which is bad news for the company's finances. If you own a business or want to establish one, you must understand what negative cash flow entails. The aforementioned discussion regarding negative cash flow might help you to be aware of the causes and consequences of negative cash flow.

How can Deskera Help You?

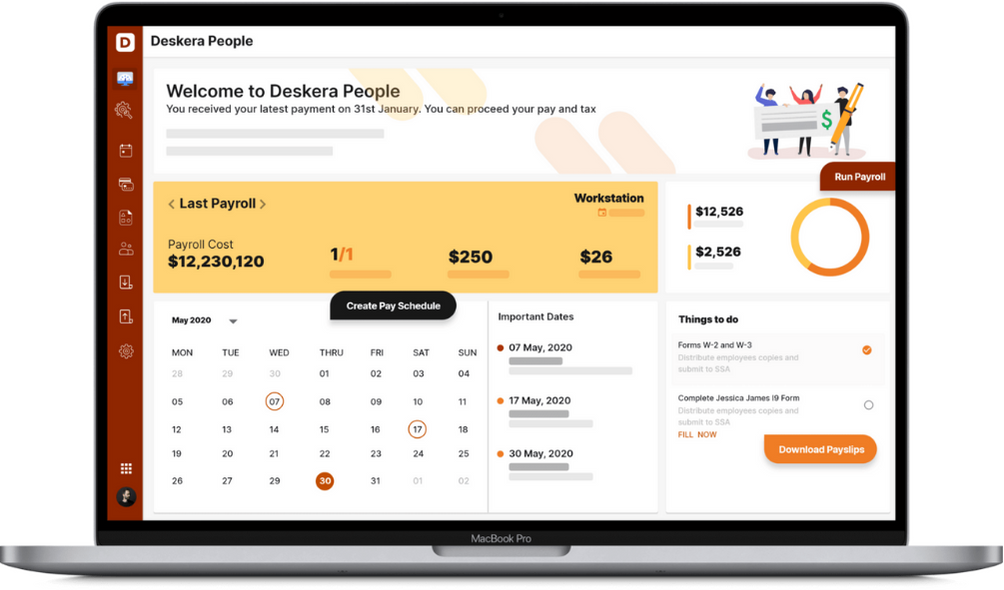

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

If you are a business owner or an aspirant, you will need to take steps to safeguard your business from negative cash flow. Look out for major causes that play a major role in inviting negative cash flow:

- Poor coordination between income and expenses

- Huge business investments and large payments

- Seasonal business activities

- Delay in clearing payments

- A faulty business model

- Economic upheaval

If negative cash flow damages the business structure, you should look forward to taking the steps mentioned below:

- Searching for the source

- Well maintained payment terms with customers and vendors

- Business loans

- Avoiding operational costs

Related Articles