Calculating your monthly net income is an important part of budgeting and financial planning. It allows you to keep track of your income and expenses, as well as plan for the future.

It also helps to identify areas where you may be spending too much or areas where you could save more. By calculating your net income, you can also track your progress and make sure that you’re meeting your financial goals.

AI-powered tools like ERP.AI simplify this process by automating financial tracking, categorizing income and expenses, and offering real-time insights for smarter decision-making.

In this article you will find everything you need to know about monthly net income and how it impacts your business. So, let's get started!

What is Monthly Net Income?

When it comes to making ends meet, monthly net income is an important figure to consider. It can be difficult to determine exactly what your net income is, but with a few simple calculations, you can get a better understanding of your financial situation.

Net income is the amount of money you make each month after deducting all your expenses. This includes taxes, insurance premiums, and any other deductions that may be taken out of your paycheck. To calculate your monthly net income, you first need to figure out your gross income.

This is the amount of money you make before taxes and other deductions. Then, subtract any taxes, insurance premiums, and other deductions from your gross income. The remaining amount is your net income.

Your net income is a key factor in budgeting and planning for the future. It determines how much you have left over after paying for your basic necessities, such as food, rent, and utilities. Net income also helps you set financial goals and decide how much you can save each month.

When it comes to budgeting, it’s important to understand how your net income is calculated. Knowing your net income helps you keep track of your finances and plan for the future. It’s also important to remember that your net income can change each month, depending on your job and any other sources of income.

Understanding your monthly net income is an integral part of financial planning. Knowing your net income helps you make informed decisions about your budget and your financial future. With a few simple calculations, you can get a better understanding of your monthly net income and take control of your finances.

What are the Benefits of Calculating Monthly Net Income?

When it comes to managing your finances, having a steady, reliable monthly net income is essential. Not only does it provide stability, but it also helps you set and achieve financial goals, from saving for retirement to paying off debt. So, what exactly are the benefits of having a monthly net income?

Financial Stability

A steady monthly net income makes it easier to plan and budget for your expenses, as you can accurately predict how much you’ll have coming in each month. This is especially important if you have a family or dependents. Having a reliable monthly income can help you pay your bills on time and avoid late payment fees.

Savings

With a consistent monthly net income, you can easily set aside a portion of your earnings for savings. This way, you’ll have a financial cushion to fall back on in case of a financial emergency or unexpected expense. You can also use your savings to pay off debt or to invest in your future.

Debt Repayment

Having a reliable monthly net income makes it easier to pay off your debt. Not only will you be able to make consistent payments on your debt, but you’ll also be able to pay more each month, allowing you to pay off your debt faster.

Retirement Planning

A steady monthly net income also makes it easier to save for retirement. You can set aside a portion of your earnings each month and invest it in a retirement savings account. This allows you to build up a nest egg for your golden years and secure your future financial stability.

Overall, having a reliable monthly net income is essential for managing your finances and achieving your financial goals. It provides financial stability, allows you to save for the future, and makes it easier to pay off debt. So, if you want to take control of your finances, make sure to have a reliable monthly net income.

How to Calculate Monthly Net Income?

Calculating your monthly net income is a crucial step to understanding your financial situation. Here are the steps you need to take to calculate your monthly net income:

Calculate your Gross Income

Start by tallying up all of your sources of income. This includes your salary and wages, bonuses, tips, investments, and any other sources of income.

Subtract any Pre-Tax Deductions

Next, subtract any pre-tax deductions from your gross income. This could include tax-deductible expenses such as 401(k) contributions, health insurance premiums, and flexible spending accounts.

Calculate your Taxable Income

Once you’ve subtracted your pre-tax deductions, you’ll have your taxable income. This is the amount of income you’ll be taxed on.

Calculate your Taxes

Now, you need to calculate your federal, state, and local taxes. For federal taxes, you’ll need to use the tax bracket tables to determine your rate. For state and local taxes, you’ll need to consult the tax rates in your area.

Subtract Taxes from Taxable Income

Once you’ve calculated your taxes, subtract them from your taxable income. This will give you your net income (also known as your after-tax income).

Calculate your Monthly Net Income

Finally, divide your net income by 12 to get your monthly net income. This is the amount of money you’ll have left after taxes each month. By following these steps, you can calculate your monthly net income and gain a better understanding of your financial situation.

How to Understand your Income Sources?

Most people have multiple sources of income, and understanding the details of each one can be overwhelming. That’s why it’s important to take the time to understand each source and track your monthly net income. Doing this will give you a better understanding of your overall financial position and help you make better financial decisions for the future.

Step 1: Calculate Your Monthly Income

The first step in tracking your net income is to calculate your monthly income. This includes all sources of income, from your regular job to any freelance work, investments, alimony, or other sources. Don’t forget to include any bonuses or other income that comes in on a regular basis.

Step 2: Track Your Expenses

Once you’ve calculated your monthly income, it’s time to track your expenses. This includes all the money you spend, from rent and utilities to groceries and entertainment. Make sure to track all of your expenses, even if you don’t think they’re significant.

Step 3: Calculate Your Net Income

Once you’ve tracked your monthly income and expenses, it’s time to calculate your net income. This is done by subtracting your total monthly expenses from your total monthly income. The result is your net income.

Step 4: Analyze Your Net Income

Now that you know your net income, it’s time to analyze it. Look at your income sources and compare them to your expenses. Are you spending more than you’re earning? Are there any areas where you can cut back? Are there any areas where you can increase your income?

Step 5: Set Financial Goals

Once you’ve analyzed your net income, it’s time to set financial goals. This could include paying off debt, increasing your savings, or investing in something that will grow your wealth.

Whatever your goals may be, it’s important to have a plan in place to achieve them. Tracking your monthly net income is a key part of financial planning. Taking the time to understand your income sources and analyze your net income will help you make smarter financial decisions and set yourself up for long-term success.

What are Some of the Great Tips to Increase Monthly Net Income?

When it comes to increasing your monthly net income, there are a few tried and true tips that can help you get started. Here are some of the best ways to increase your monthly net income:

Get a Side Hustle

One of the best ways to increase your monthly net income is to start a side hustle. This could be anything from freelancing to driving for a rideshare company to selling products online. It doesn’t matter what you do as long as you make sure it’s something you enjoy and can make money from.

Take Advantage of Tax Breaks

Many people don’t realize that they can take advantage of numerous tax breaks. These include deductions, credits, and other strategies that can help you reduce your taxable income. Make sure to speak with a qualified tax professional to make sure you’re taking advantage of all the tax breaks you’re eligible for.

Negotiate Your Salary

Another great way to increase your monthly net income is to negotiate your salary. If you’re a valuable employee, your employer should be willing to give you a raise if you’re willing to advocate for yourself.

Invest in Yourself

Investing in yourself is one of the best ways to increase your income. This can include getting additional training or certification or even starting your own business. Investing in yourself will pay off in the long run, as you’ll be able to increase your income.

Save and Invest

Finally, saving and investing your money is another great way to increase your monthly net income. Even if you can only save a little bit each month, that money can add up over time.

Investing your money in stocks or mutual funds can also be a great way to increase your income as well. By following these tips, you should be able to increase your monthly net income and reach your financial goals. Good luck!

How to Maximize Your Tax Benefits?

Preparing your taxes can be a daunting task, but it doesn’t have to be. Knowing how to maximize your tax benefits can help you get the most out of your monthly net income. Here are some tips to help you maximize your tax benefits:

Take Advantage of Tax Credits

Tax credits can be one of the most beneficial ways to reduce your tax bill. Tax credits are available for a wide range of items, such as education expenses, childcare costs, or even energy-efficient home improvements. Research the credits available to you and make sure you are taking advantage of all the credits you qualify for.

Track Your Expenses

Keeping track of your expenses is a great way to ensure that you are getting the most out of your deductions. Make sure to keep all your receipts and document everything you spend money on. This will also help you to identify any potential deductions that you may have overlooked.

Keep Your Records Up-to-Date

Make sure to keep all your tax documents up-to-date. This includes receipts, invoices, and other important documents related to your taxes. Keeping your records organized and up-to-date will make filing your taxes much easier.

Invest in Tax-Saving Accounts

Investing in tax-saving accounts such as a 401(k) or IRA can be a great way to save money on taxes. These accounts allow you to make pre-tax contributions and offer various tax benefits.

Utilize Tax Software

Tax software can be a great way to help you maximize your tax benefits. Tax software can help you identify possible deductions and credits, as well as make sure you are filing your taxes correctly.

By taking the time to understand and maximize your tax benefits, you can make sure you are getting the most out of your monthly net income. With the right strategies, you can ensure that you are paying the correct amount of taxes and that you are getting the most out of your deductions and credits.

How to Invest your Monthly Net Income?

If you’re looking to make the most of your monthly net income, investing is a great way to do it. Investing your money can help you reach your financial goals, such as saving for a home or retirement, while also providing a potential source of passive income. But before you start investing, it’s important to make sure you have a good financial foundation.

Make sure to pay off any high-interest debt you may have, as this will save you money in the long run. Once you’ve done that, you can start to think about investing. One way to invest your monthly net income is to open a brokerage account.

With a brokerage account, you can invest in stocks, bonds, mutual funds, and other investments. Before investing in any of these, make sure you understand the risks and rewards associated with each type of investment.

Another way to invest your monthly net income is to open a savings account. Savings accounts often have higher interest rates than checking accounts, so you can earn more money over time. You can also use a savings account to save for specific goals, such as a down payment for a home or a vacation.

Finally, you can also look into investing in real estate. This can be a great way to generate passive income and build wealth over time. Before investing in real estate, you should make sure you understand the risks and rewards associated with it. No matter which way you choose to invest your monthly net income, it’s important to make sure you have a well-diversified portfolio.

This will help reduce your risk and ensure you have a steady stream of income. Investing in your monthly net income can be a great way to help you reach your financial goals. With a little research and planning, you can make the most of your money and reach your dreams.

What are the Common to Avoid When Calculating Monthly Net Income?

Calculating monthly net income can be a tricky process. It’s important to get it right as it’s the amount you have left to pay your bills and live on each month. Here are some common mistakes to avoid when calculating your monthly net income:

Not Taking Taxes Into Account

Taxes are an important factor to consider when calculating your net income. Make sure to factor in both federal and state taxes when calculating your net income. This will help you better understand how much you will be bringing home each month after taxes.

Forgetting About Benefits

Benefits can have a significant impact on your net income. Make sure to include any benefits you receive from your work, such as health insurance, 401k contributions, and other perks.

Ignoring Deductions

Deductions are another important factor to consider when calculating your net income. Make sure to factor in any deductions you have, such as student loan payments, union dues, or medical expenses.

Not Accounting for Other Sources of Income

Make sure to include any additional sources of income, such as side hustles, investments, or passive income, in your net income calculation.

Not Planning For The Future

Finally, don’t forget to plan for the future when calculating your monthly net income. Make sure to set aside some of your income for savings and investments. This will ensure you are prepared for any unexpected events that may occur.

By avoiding these common mistakes when calculating your monthly net income, you can ensure you are accurately calculating the amount of money you have left to pay your bills and live on each month.

How AI Optimizes Financial Management

With AI solutions, businesses and individuals can track monthly net income with greater accuracy and speed. AI algorithms automatically classify income and expenses, flag anomalies, and provide clear financial summaries in real time.

Additionally, AI tools forecast cash flow, detect spending trends, and suggest optimizations—helping users make smarter budgeting and investment decisions. By minimizing guesswork and enhancing clarity, AI helps ensure stronger financial health and long-term planning for both personal and business finance.

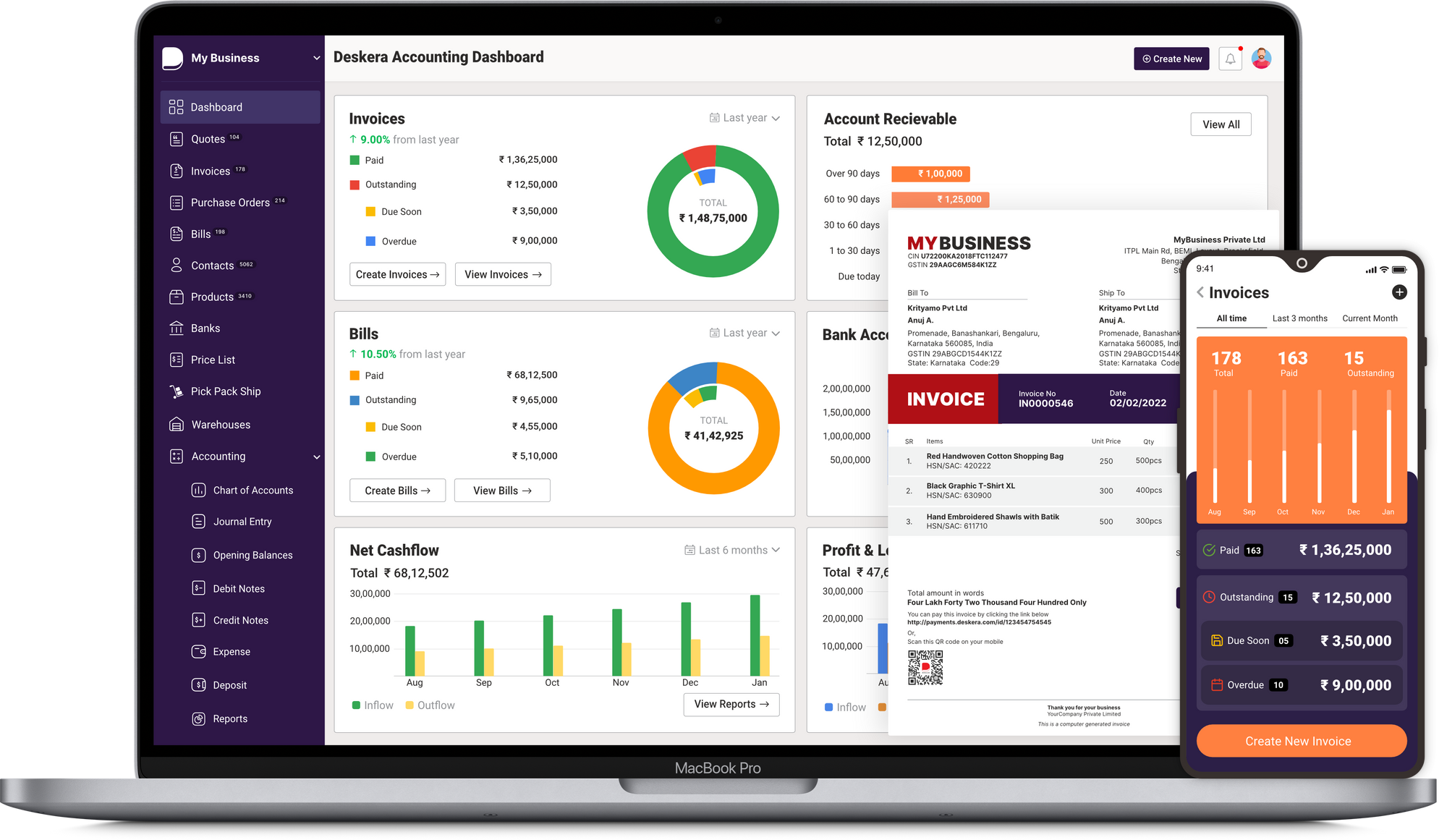

How Can Deskera Assist You?

A balance sheet, cash flow statement, and annual report with income statements help an individual determine the future financial trajectory of a business and its value and efficiency.

Analysis of an income statement can reveal if the sales are improving, the cost of goods sold is falling or if the return on equity is rising. If you are planning to invest in a company, an income statement will be one of the most critical documents you need to evaluate.

Key Takeaways

- Understanding your monthly net income is an integral part of financial planning.

- A steady monthly net income makes it easier to plan and budget for your expenses, as you can accurately predict how much you’ll have coming in each month.

- To calculate your monthly net income, you first need to figure out your gross income.

- With a consistent monthly net income, you can easily set aside a portion of your earnings for savings.

- If you’re looking to make the most of your monthly net income, investing is a great way to do it.

- Taxes are an important factor to consider when calculating your net income.

Related Articles: