Montana’s businesses are small, especially when compared to other states. These small businesses provide more jobs and wages than other states, implying that Montana has a higher reliance on small business than elsewhere. This indicates that there will be more start-ups or small businesses taking shelter in Montana. Resulting in more employees at work.

So you need to manage payroll and be aware of the payroll taxes in Montana. To help you with that, we have this article prepared for you to answer all of your questions. Let's get started!

This article covers the following:

- Step-to-step guide on Payroll in Montana

- Montana payroll taxes

- Employer's withholding taxes in Montana

- Montana wage and hour laws

- Montana income tax withholding

- Federal payroll forms

Step-to-Step Guide on Payroll in Montana

Here are a few steps to do your payroll in Montana.

Step 1: Set Up your Business as an Employer

At the federal level, you need to apply for an Employer ID Number (EIN) and create an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the Montana Department of Revenue.

You need your EIN, dates your employees started working in Montana, general contact information, and legal business and trade name or Doing Business As (DBA).

Once approved, you can sign up for a Transaction Portal (TAP) account. You must also register for an employer account number through the Montana Unemployment Insurance Division. Register online or mail the Montana UI-1 to Unemployment Insurance Division

P.O. Box 6339

Helena, Montana 59604-6339.

Step 3: Set Your Payroll Process

Montana has a few rules about pay frequency to set the best schedule for your business and workers. Semimonthly is the standard. You’ll also need to decide how you’ll pay employees. Direct deposit is most convenient, but check and cash payments are also accepted.

Step 4: Collect employee payroll forms

Collecting payroll forms is easiest if you do it during onboarding. Forms include W-4, I-9, and direct deposit information. For Montana, you need Form MW-4.

Step 5: Collect, Review, Approve Timesheets

You must pay employees within ten days of the pay period unless a timesheet is turned in late, so it’s important to gather and approve work hours for all employees you’re paying an hourly rate.

Many small businesses create their timesheets using a free timesheet template. Or, time and attendance software makes it easier. Maybe, try Deskera for to manage your attendance.

Step 6: Calculate Payroll and Pay Employees

To calculate payroll, you’ll need to compute several totals, including total work hours (use our free time card calculator), gross pay, taxes, deductions to withhold, etc.

An Excel payroll template and payroll software can also simplify the work and be more accurate than performing the calculations by hand. When it’s time to pay employees, you can opt for direct deposit, check, cash, or pay card.

Step 7: File payroll taxes with the federal and Montana state government.

To pay federal taxes, you can pay online using the EFTPS. Montana has essential rules.

- Montana Income Taxes: The state will send you the schedule for payments. However, you are welcome to pay withholdings every pay period.

- State unemployment insurance taxes (SUTA): You must pay these taxes online.

Step 8: Document and Store Your Payroll Records

Per Montana Rule 42.17.203, you must keep records for all of your employees, even those who have been terminated, for at least five years.

Step 9: Do Year-End Payroll Tax Reports

Send the federal Forms W-2s (employees) and 1099s (for contractors) and MW-3s by Jan. 31 of the following year? You can file MW-3, W-2s, and 1099s to the state through your TAP account or by mail to:

Montana Department of Revenue

P.O. Box 5835

Helena, MT 59604-5835

Let us learn in-depth about the Montana payroll taxes.

Montana Payroll Taxes

Here are the payroll taxes you must keep in mind:

State and Local Income Taxes

Individuals who earn wages by performing services in Montana are subject to Montana state income tax, which you must withhold. The following people are exempt:

- Spouses of US military

- North Dakota residents

- Workers subject to the Interstate Commerce Commission laws

- Native Americans

- Foreign agricultural workers with H-2A visas

Your Montana income tax withholding schedule is determined by the amount you held during the previous year’s look-back period; you’ll be notified by Nov. 1 of any changes to your payment schedule. The Montana Department of Revenue determines your schedule based on these parameters.

Unemployment Insurance

Montana charges state unemployment insurance taxes (SUTA). The SUTA is based on a taxable wage base of $35,300 for 2021. Rates range from 0.13% to 1.6% for eligible (positive-rated) employers and 3.1% to 6.3% for deficit (negative-rated) employers.

Your rating is based on your reserve ratio, which is contributions paid minus benefits paid out to ex-employees over the last three federal fiscal years. New employers pay the average contribution rate for employers in the same industry classification.

You can find your exact rates in the employer handbook online. There is also an administration fee for experience-rated employers of 0.18% of taxable wages which is also due each quarter.

You will have to pay SUTA in the following cases:

- Your annual gross wage payroll equals or exceeds $1,000 in the current or previous calendar year.

- You acquired a business subject to SUTA.

- You are subject to FUTA.

- You employed agricultural workers and paid $20,000 or more in cash during any quarter or the current or previous calendar year.

- You employed ten or more workers in agricultural labor in 20 different weeks during the current or previous calendar year.

- You employed domestic workers and paid $1,000 or more in cash for domestic services in any quarter of the current or preceding calendar year.

Worker’s Compensation

Doing payroll in Montana isn’t overly complicated, but it does require you to be on top of state income tax rates. Payroll laws align with federal laws, for the most part, so you won’t have to comply with conflicting rules. We cover how to do payroll in Montana, along with the most important HR laws that affect employee labor and wages.

Montana does have fines for late payments and noncompliance (as most states do), so if you’re concerned about doing it right, consider using payroll software like Deskera.

Montana Taxes

Employers’ Withholding Responsibilities in Montana

Employers are required by law to deduct taxes from wages paid to employees for services performed in Montana. In addition, they must make wage withholding payments and file the applicable Montana forms.

Any employer in Montana who pays wages for services performed in Montana is required to pay Montana wage withholding on behalf of their employees. Employers that may not have a physical presence in Montana, but have employees working remotely in Montana, still have wage withholding filing and payment requirements even if the employee is considered a nonresident.

A nonresident employee working in Montana generally has a filing requirement because Montana's source income includes wages, salary, tips, and other compensation for services performed in the state.

Employers must withhold tax from an employee’s wages and send the withheld amount to the Department of Revenue. The amount of Montana income tax withheld from an employee’s paycheck is a part of that employee’s wages.

Instead of paying the employee those wages, the employer sends them to the Department of Revenue as wage withholding tax. Employees trust that their employer sends that amount to Montana on their behalf and that the wage withholding the employer pays belongs to the employee until it is paid to the state.

As such, it is considered a trust tax; the individual business owner or corporate officer is liable for deducting and paying the wage withholding to Montana. Failure to pay your employee’s wage withholding can result in penalties and interest.

Employers subject to Montana wage withholding requirements must register with the Montana Department of Revenue and file all Montana Forms W-2 and Form MW-3 with the department annually. Payment of wage withholding is due based on the employer’s payment schedule.

Employer’s Guide

Payroll Withholding Guidelines Determine How Much to Withhold The amount of tax you withhold from an employee’s pay depends on three factors: 1. the length of your payroll period 2. the employee’s gross pay 3.

Determine Withholding Allowances and Exemptions Employees report their number of allowances and/or exemptions on Montana Employee’s Withholding Allowance and Exemption Certificate (Form MW-4).

Allowances are certain deductions employees may take in the calculation of their wage withholding. Allowances include an employee’s filing status, number of dependents, and itemized deductions.

Exemptions are those services and compensation that are excluded from wage withholding by law. New employees must complete a Form MW-4 when they are hired. Current employees only need to update their Form MW-4 if their tax situation changes, such as getting married, divorced, or having a Page 5 child.

If an employee files a Form MW-4 claiming an exemption, the employer must file it through TAP by the last day of the payroll period in which the form was received. Employees that qualify for an exemption of Montana withholding requirements must file a Form MW-4 to request their exemption.

New or updated Forms MW-4 are due by the last day of the payroll period when the employer receives the form. If a Form MW-4 is false or unsubstantiated, the department may adjust the form and notify you to disregard the allowances the employee claimed.

We will then advise you of the maximum number of withholding allowances the employee can claim. Exempt Wages If your employees qualify under the following exemptions, you do not need to withhold their wages. Spouse of U.S.

Armed Forces Service Member – On November 11, 2009, the Military Spouses Residency Relief Act was signed into law. The Act exempts wages paid to the spouse of a U.S. armed forces service member from state income tax if the spouse is a nonresident of the state in which the wages are earned and present in the state solely to be with the service member is stationed in the state.

To be exempt from withholding, the service member’s spouse must complete Section 2 of Form MW-4 and give it to their employer on or before January 31 of each year. North Dakota Residents Reciprocity – Subject to an agreement between Montana and North Dakota, North Dakota residents are not taxed on wages earned in Montana.

You are not required to withhold Montana income tax in this case. We may notify you to disregard an employee’s false or unsupported claim and require you to resume withholding.

Interstate Transportation – If you are a motor or rail carrier, your employees are subject to the jurisdiction of the Interstate Commerce Commission and to income tax withholding only in their state of residency. Montana resident transportation workers must pay income tax to Montana on all wages.

Native Americans – Wages paid to enrolled members of a Native American tribe are not subject to withholding if they reside on the reservation governed by their tribe and the wages are earned on that reservation.

Employees must complete Section 2 of Form MW-4 and give it to the employer, attesting that they reside on their reservation. When wages come from both reservation and non-reservation sources, only the wages from reservation sources are exempt from withholding, and only if employees meet all criteria.

When employees do not reside on their reservation for an entire pay period, only wages earned while they reside on the reservation are exempt from taxation, and only if they meet all criteria.

Withholding from Pensions, Annuities, Deferred Compensations, and IRAs Your employees’ contributions to qualifying annuity contracts such as “tax-sheltered” annuity plans for teachers, public employees deferred compensation, or other similar plans, as defined by the Internal Revenue Code (I.R.C.), are exempt from withholding requirements to the extent that the contributions are not included in their adjusted gross income for federal income tax purposes.

Contributions made to individual retirement accounts under I.R.C. 3401(a)(12), while considered compensation to the employee, are not subject to Montana withholding if you reasonably expect that your employee will be able to deduct such amounts as retirement savings account contributions.

A payer must withhold on pension payments if the recipient requests withholding. Withholding from pensions can be requested on Form MW-4. The individual must specify a flat dollar amount on Line H of the form (ARM 42.17.103). If you employ nonresidents short-term or indefinitely, their compensation is subject to withholding.

Foreign Agricultural workers with H-2A visas are exempt from state income tax withholding. Compensation that may be excluded from federal withholding or Federal Adjusted Gross Income under a U.S. tax treaty is subject to Montana income tax withholding.

The determination of whether a nonresident alien qualifies for tax treaty exclusion is not made until the Montana individual income tax return is filed by the nonresident alien.

State and Local Income Taxes

Individuals who earn wages by performing services in Montana are subject to Montana state income tax, which you must withhold. The following people are exempt:

- Spouses of US military

- North Dakota residents

- Workers subject to the Interstate Commerce Commission laws

- Native Americans

- Foreign agricultural workers with H-2A visas

Employers must pay $8.75 an hour to employees covered by Montana's minimum wage law. Exceptions apply to employees of small businesses and to farmworkers, as well as:

- Apprentices or learners for up to 30 days of employment;

- Learners under age 18 employed as farm workers for up to 180 days, provided they are paid at least 50 percent of the minimum wage; and direct sellers.

Montana Income Tax Withholding

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for services provided within Montana.

Here are the requirements for Montana tax withholding:

Take notes of these requirements as you go along the section.

Get an EIN

If your small business has employees working in the United States, you'll need a federal employer identification number (EIN). You should obtain your EIN as soon as possible and, in any case, before hiring your first employee.

The IRS issues eINs, and you'll need one first and foremost for faxes. In addition, some states use the federal EIN for state withholding tax purposes. Other states (like Montana) issue separate state tax ID numbers.

You'll need an EIN to register with the state. You can apply for an EIN at the IRS website. Generally, if you apply online, you will receive your EIN immediately.

Register With the Department of Revenue.

Apart from your EIN, you also need to establish a Montana withholding tax account with the Montana Department of Revenue (DOR). You set up your account by registering your business with the DOR online, by mail, or by fax. You can register online using the DOR's Taxpayer Access Point (TAP).

To register on paper, use Form GenReg, Registration/Application for Permit, which you can download from the forms section of the DOR website. You can submit Form GenReg by mail or by fax (the fax number is on the form). There is no fee to register your business with DOR.

Have New Employees Complete a Federal Tax Form

All new employees for your business must complete both a federal Form W-4. Unlike many other states, Montana does not have a separate state equivalent to Form W-4 but instead relies on the federal form.

You can download blank Forms W-4 from the IRS. A few parts of the federal W-4 do not apply to the state (for example, Montana does not recognize an exempt status).

Clearly, label W-4s used for state tax withholding as your state withholding form. You should keep the completed forms on file at your business and update them as necessary.

Make Scheduled Withholding Tax Payments

In Montana, there are three primary payment schedules for withholding taxes accelerated, monthly, or annually. An employer may have a so-called "not required" payment scheduled (not covered here) in rare situations.

Ultimately, your payment schedule will depend on the average amount you hold from employee wages over time. The more you withhold, the more frequently you'll need to make withholding tax payments.

Newly registered employers will follow a monthly payment schedule. For established/existing employers, the DOR will complete a look-back review to determine the reporting and payment schedule for the next calendar year.

The exact threshold dollar amounts for the different payment schedules and other rules may change over time, so you should check with the DOR at least once a year for the latest information.

Here are the due dates for various payment schedules:

- Accelerated: Follow the schedule for payment of federal withholding taxes. In other words, if your payday is Saturday, Sunday, Monday, or Tuesday, your payment is due by the following Friday. If your payday is Wednesday, Thursday, or Friday, your payment is due by the following Wednesday.

- Monthly: Payments are due by the 15th day of the month following the month in which the tax was withheld.

- Annually: Payments are due by the last day of February of the following year.

If the payment is due on a weekend or holiday, the due date is the next business day. If no wages were paid during a payment period, you are required to submit a zero dollar payment through an ePayment option or by mailing a payment voucher marked $0.00.

You can file your payments by mail or online. Use Form MW-1, Montana Withholding Tax Payment Voucher to file by mail. You can download blank vouchers from the forms section of the DOR website. You can make payments online either through the DOR's Taxpayer Access Point or through an ACH credit (see the DOR website for more details, including registering for ACH credit services).

The DOR provides several different methods for calculating how much tax to withhold. For more information, check the DOR's Employer's Tax Guide, which you can download from the forms section of the DOR website. The guide is updated each year.

No Separate State Withholding Tax Returns

Many other states require employers to file a separate state withholding tax return, analogous to the federal Form 941, each quarter. Montana, however, currently has no such requirement.

Complete an Annual Reconciliation

After the end of the year; you must file an annual reconciliation with the DOR that summarizes the employee taxes you've withheld during the year. The annual reconciliation is in addition to providing each of your employees with a federal Form W-2 summarizing the employee's withholding for the year.

Use Form MW-3, Montana Annual Wage Withholding Tax Reconciliation. You should attach copies of the federal W-2s sent to all of your employees working in Montana. You can file the reconciliation and W-2s by mail or online. Use the DOR's Taxpayer Access Point (TAP) to file the reconciliation online. To file W-2s electronically, use TAP or check the DOR website for additional options.

The annual reconciliation is due on or before the last day of February. As with tax payments, if the reconciliation is due on a weekend or holiday, the due date is extended to the next business day.

Independent Contractors are Not Employees

This article is only concerned with employees, not independent contractors. In general, different tax rules apply to independent contractors.

Using Payroll Service Companies,

You may decide that it's easiest to hand over responsibility for payroll, including withholding taxes, to outside each quarter roll service. If so, keep in mind that your business, or even you personally, may still be held directly responsible for mistakes made by an outside payroll company.

Additional Information

This article touches on only the most essential elements of Montana employee withholding taxes. Under Montana law, employers are responsible for pay amounts withheld when those amounts are due.

Otherwise, the owners of the business become personally liable for the tax due, even if the business is a corporation. Avoid possible penalties for making mistakes by checking both the IRS and DOR websites for the latest information.

Workers’ Compensation Insurance

Montana requires you to carry workers’ compensation insurance if you have even one employee. Minors and aliens, legal or otherwise, count as employees. A few exceptions include domestic employees, family members, sole proprietors, and certain people working for aid only.

You can purchase workers’ compensation insurance from a private agency, through the Montana State Fund, or by self-insuring. You can apply for the state fund on its website or through one of its agents, which you can also find on the website. Self-insuring requires setting aside money to cover claims and may not be the best choice for small businesses.

Montana Minimum Wages Laws

The Montana minimum wage is $8.75 per hour. It does not allow tip credits, meal credits, or training wages. The amount can change each Sept. 30 and is not to go below the current state minimum or the federally mandated minimum ($7.25 an hour)—you’re not allowed to pay tipped employees less.

The Montana Department of Labor & Industry calculates the next minimum wage each August to adjust for cost of living increases and rounds the amount to the nearest five cents.

Montana Tax Forms & Resources

- MW-1 Montana Withholding Tax Payment Voucher: for paying income tax withholdings by check

- MW-3 Montana Annual W-2 1099 Withholding Tax Reconciliation: the annual form sent to employees for state tax filing

For other Montana state forms that apply to business, including requests for credits and immunities. For SUTA forms, go to the Montana Department of Labor and Industry.

Federal Payroll Taxes

Here’s a quick rundown of the components that go into federal tax withholdings.

- Gross wages are simply the amount of money an employee has earned during the last pay period.

- For hourly employees, multiply the number of hours worked by their pay rate — and make sure you don’t forget to consider overtime.

- For salaried employees, divide each employee’s annual salary by the number of pay periods you have over the course of a year.

- Bonuses, commissions, and tips are all part of gross wages.

- Subtract any pre-tax withholdings. If your employees have 401(k) accounts, flexible spending accounts (FSA), health savings accounts (HSA), or any other pre-tax withholdings, subtract them from gross wages prior to applying payroll taxes.

- Deduct federal income taxes can range from 0% to 37%. We won’t get into the nitty-gritty here, but you can find further withholding information through the IRS Publication 15-T.

- Deduct and match any FICA taxes to cover Social Security and Medicare taxes:

- For Social Security tax, withhold 6.2% of each employee’s taxable wages until they have earned $147,000 in a given calendar year. As an employer, you must match this tax.

- For Medicare tax, withhold 1.45% of each employee’s taxable wages until they have earned $200,000 in a given calendar year. You must also match this tax.

For employees who earn more than $200,000 per year, you’ll need to withhold an Additional Medicare Tax of 0.9%, which brings the total employee Medicare withholding above $200,000 to 2.35%. You don’t need to match the Additional Medicare Tax. Only employees are responsible for paying this tax.

- Pay FUTA unemployment taxes, which is 6% of the first $7,000 of each employee’s taxable income. FUTA taxes come with a huge caveat that you should know about. You can claim a tax credit of up to 5.4% for the state unemployment tax you pay, as long as you pay in full and on time.

It’s an easy way to save a whopping 90%, so make sure you take advantage! Only you, as the employer, are responsible for paying FUTA taxes, so you don’t need to withhold FUTA from your employees’ paychecks.

- Subtract any post-tax deductions: Most of your employees won’t have any post-tax deductions, but if they do, you will need to withhold things like court-ordered wage garnishments, child support, etc. Make sure you consider these as well.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculates unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

Montana Payroll Tax Resources/Sources

- Montana Withholding Tax Guide: All the information you need on state income taxes, including tables to determine how much to withhold

- Montana Department of Revenue: Links to information on withholdings, forms, getting a withholding account, and more

- Montana Wage and Labor Law Guide: Codes, Acts, and other information on wage law

- Montana UI eServices for Employers: To register for accounts, get information, handbooks, and forms

- Workers’ Compensation Regulations: Information and contacts for workers’ comp in Montana

- Montana’s Child Labor Law Reference Guide: Rules and exemptions for minors

FAQs Montana Payroll Tax

What is a remittance schedule?

A remittance schedule tells you the frequency that payments for withholding are due to the state based on the lookback period. The schedule may be on an accelerated, monthly, or annual basis.

What is a lookback period?

The lookback period is the 12 months from July 1 of the preceding year to June 30 of the present year. The lookback period is used to determine an employer’s reporting and payment schedule for the coming calendar year.

Based upon this look back, an appropriate number of coupons will be mailed to all currently registered employers. I am an employer and have no filing history. I am not sure what my employee withholding will total.

What payment schedule will I use?

A new employer or an employer without a complete “lookback” period must follow the annual remittance schedule until the department is able to determine the proper remittance schedule.

Will I always remit as an annual payer because I file under this classification now?

No. On or before November 1 of each year, the department will let you know what your remittance schedule will be for the next calendar year. The notification is based upon your withholding payments during the lookback period from July 1 to June 30.

How is my withholding schedule determined?

The following chart is an overview of the requirements. To determine your schedule for the coming calendar year, add the amount of state income tax withheld during the period July 1 through June 30 of the current year. Refer to the schedule which applies to your business.

As an employer, what are my responsibilities?

Individuals who earn wages by performing services in Montana are liable for Montana income tax. As an employer, it is your duty by law to deduct the tax from the wages you pay.

Every employer who resides in Montana and every non-resident employer who pays wages for services performed in Montana must withhold Montana income tax. This money belongs to the employee and is only held, in trust, by the employer until paid to the state. The employer should not use withholding to operate the employer’s business.

Who must register?

An employer who pays or has paid $1,000 or more in wages annually is subject to withhold Montana income tax. The employer must file a withholding tax registration form (GenReg).

How much do I withhold?

The amount of tax you withhold from an employee’s pay depends on three factors: (1) the length of your payroll period, (2) gross pay, and (3) the number of withholding allowances claimed on W-4 forms. To request a copy, call (406) 444-6900. An employee may request additional monies be withheld to meet their tax obligation. The amount withheld would be reported and paid as any other withholding.

What is exempt from withholding?

There are certain kinds of services and compensation specifically excluded by law for withholding purposes. Refer to the Employment Tax Chart on pages 10 - 11 for a list of exemptions.

How Can Deskera Assist You?

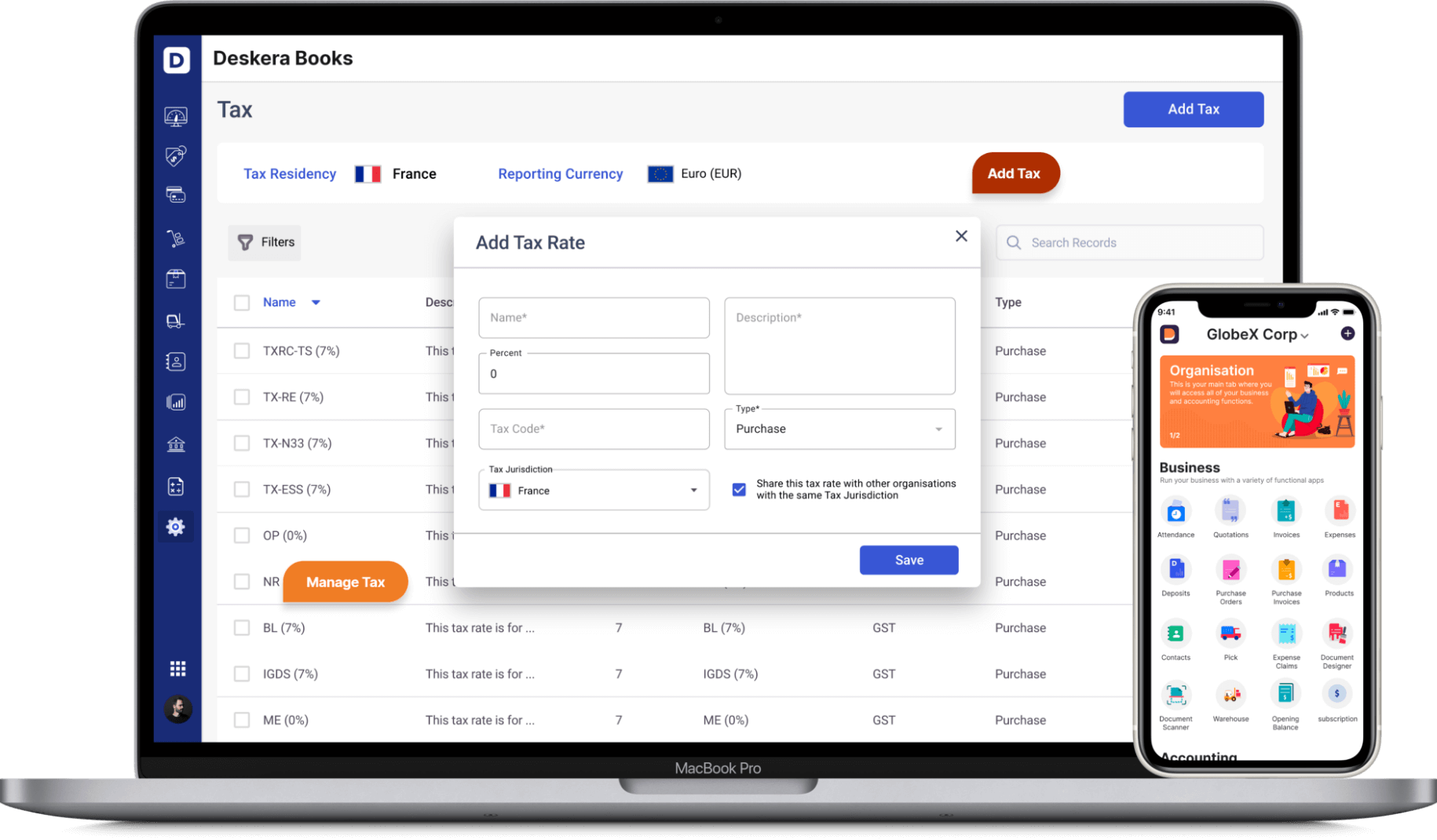

When it comes to filing taxes for your company, you need a system that can help you with it without having to go through a hassle. With Deskera, you have an automated system to file your taxes. Apart from that, managing payroll is another responsibility on your shoulder that takes a lot of work, but with the Deskera payroll system, you can do it hassle-free.

Key Takeaways

- Montana has few rules about pay frequency, so you can set the best schedule for your business and workers.

- Individuals who earn wages by performing services in Montana are subject to Montana state income tax, which you must withhold.

- Montana charges state unemployment insurance taxes (SUTA).

- Employers must pay $8.75 an hour to employees covered by Montana's minimum wage law.

- Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue.

- Montana requires you to carry workers’ compensation insurance if you have even one employee.

- FUTA taxes come with a huge caveat that you should know about.

- Individuals who earn wages by performing services in Montana are subject to Montana state income tax, which you must withhold.

- Deduct federal income taxes, which can range from 0% to 37%.

- For Social Security tax, withhold 6.2% of each employee’s taxable wages until they have earned $147,000 in a given calendar year.

Related Articles: