Despite the longstanding struggle India faced as a newly-independent nation, the improvisations in the erstwhile employment rules exhibit a promising future of the employment scenario in the country.

With the reforms in the minimum wages starting as early as in the late 1890s in other countries, the Act reached India only in 1943. Eventually, the Indian Parliament introduced the rules on March 15, 1948, when it was applied across the states of India.

This article will take us into the depths of the Karnataka Minimum Wages Rules, 1958. Let’s see what all we shall learn:

- What is the Minimum Wage and Why was it Introduced?

- What is Karnataka Minimum Wages Rules, 1958?

- Calculation and Payment of Wages

- Mode of Calculation

- Time and Conditions of Payment of Wages

- Deductions

- Weekly Day of Rest

- Number of Hours Comprising Normal Working Day

- Night Shifts

- Conditions When the Worker does not Receive full wages

- Overtime Wages

- Preservation of Records and Registers

- Notices for Inspection

- Complaints about Less Payment and Other Claims

- Actions Taken by the Authority

- Penalties for Offence Under the Act

- Compliance Forms (Download)

- Karnataka Minimum Wages Comparison Chart for Employees On Roll, 2019-2020-2021

- Karnataka Minimum Wages Comparison Chart for Employees Off Roll, 2019-2020-2021

- Important Considerations Before Fixing Minimum Wages for 2021-22

What is Minimum Wage and Why was it Introduced?

We define minimum wages as the least amount of wages that the employers pay to their workers for the work done during a specified time frame. It is also the amount that can never be lowered via an agreement or contract.

A government authority or a statute is the entity that fixes the minimum wages to ensure that the employees receive the due amount for the work they have done. It works to eliminate or reduce any occurrences of extremely low and unfair salaries to the workers.

Here are the primary objectives, the minimum wages act aims to accomplish:

- To provide minimum wages to the workers in the organized industry

- To focus on eliminating exploitation of the workers

- To empower the government to take appropriate actions at regular intervals

- To ensure a decent living for all workers

What is Karnataka Minimum Wages Rules, 1958?

The entity to set Karnataka's minimum wage is the State Level Minimum Wages Advisory Board.

- The Act is for the scheduled employment and fixes and revises the minimum wages for the sector

- As a condition of employment under this Act, employers must pay the minimum wages

- Over time, working hours, and wages are all regulated

- The Act also fixes the variable DA based on the previous calendar year's Consumer Price Index

All the rules and guidelines described in the next sections will be called Karnataka Minimum Wages Rules, 1958, and shall be applied to the entire state of Karnataka.

In the upcoming sections, we shall learn in detail about the various aspects related to the Act.

Calculation and Payment of Wages

This section explains the manner in which the wages are calculated and disbursed to the workers.

Mode of Calculation

- Wages paid in kind shall be valued based on retail prices at the nearest market. The value of the essential commodities supplied at discounted rates will also be calculated based on the same criteria. This calculation may be changed based on the directives issued by the government

- The discount on the essential commodities will be equal to the difference between the retail price of these commodities at the nearest market and the price charged by the employer

Time and Conditions of Payment of Wages

The payment of the wages must take place within a month and the wages must be paid on a working day with these conditions:

- In an establishment with less than 1,000 employees, the wages must be paid by the 7th day

- In the case of other types of establishments, the wages must be paid by the 10th day

- In the case of employment in agriculture, the employer must pay the wages as directed and revised by the government.

- When an employee is terminated, the employer must pay their wages before the end of the 2nd working day from the date of termination

- The employer has to display notices in English or a language clearly understood by the employees mentioning the dates on which they shall receive their wages (Dates specified in such notices should not be earlier than two months following the date they are displayed)

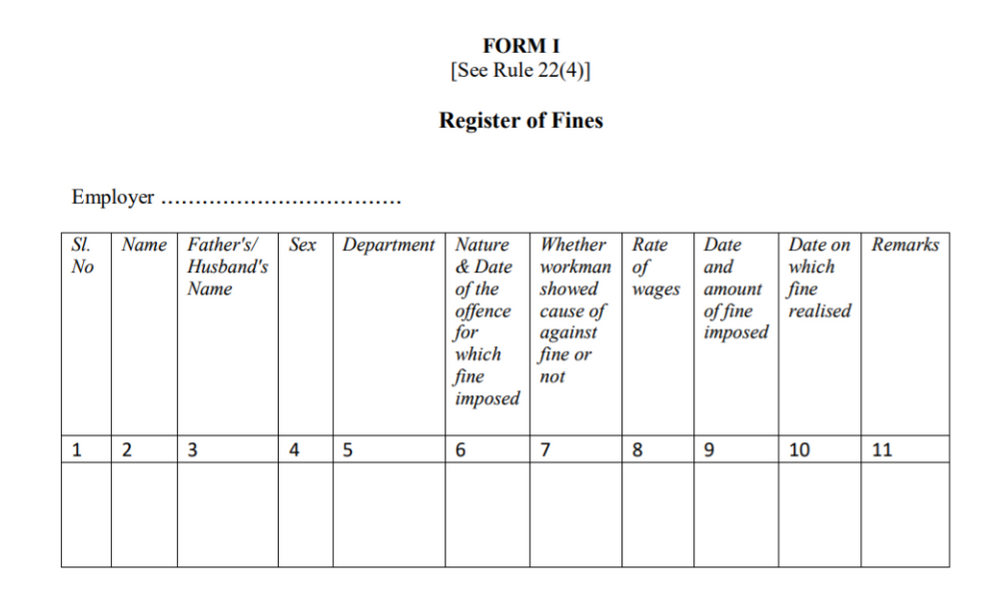

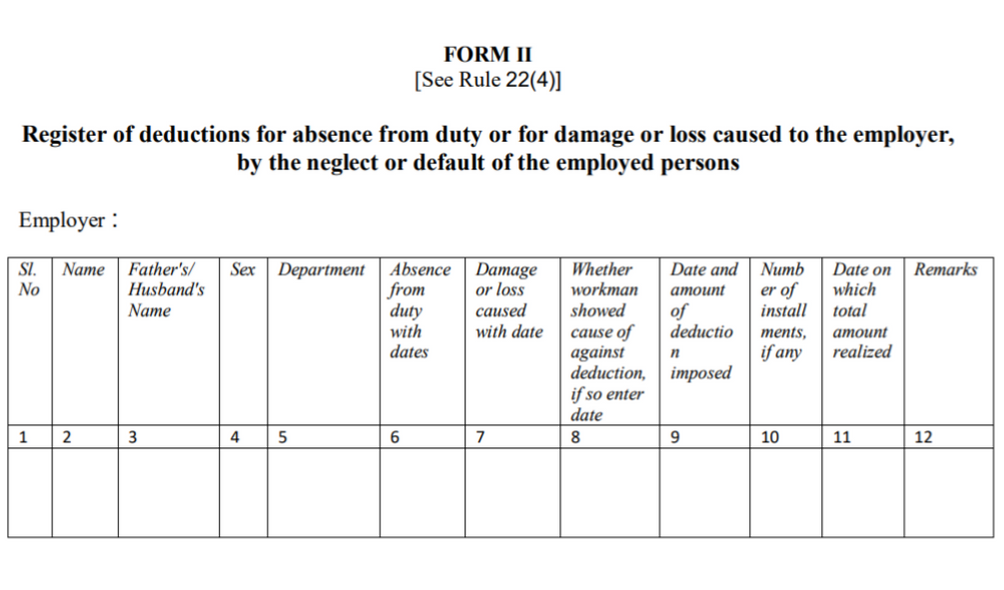

Deductions

Deductions from the wages of the employees can happen in one or more ways explained here:

- Fines for acts that are not prescribed by the government

- Deductions based on absenteeism from duty

- Deductions for causing damage to the goods in possession of the employee; or for losing the money

- Deductions for the accommodations provided by the employer or the State government, or any other authority

- Deductions for recovering or adjusting the extra wages paid erroneously

- Deductions towards the income tax

- Deductions towards the fulfillment of the order issued by a court

- Deductions towards the payments towards provident fund

- Deductions for recovering the loans

- Deductions for the contribution towards the National Defence Fund

Weekly Day of Rest

Under the scheduled employment, the weekly day of rest is referred to as the rest day.

- An employee shall receive one day in a week as the rest day, ordinarily a Sunday

- In case of any changes in the rest day, the employer must notify the employees by displaying a notice about the same

- An employee will not be allowed or required to work on a rest day unless they have a substituted rest day on one of the three days immediately before or after the rest day

- An employee may have to work on a rest day if the employer has notified about it in advance

- If an employee has worked on a rest day, they must get a substituted rest day on any of the three days before or after the rest day. In such a case, their working hours will be calculated for the week in which the substituted rest day occurs

- Rest day wages shall be equal to the average of the employee's daily wages for the preceding week

- In the case where an employee works on a rest day, the employee shall be paid, wages for the rest day on which he worked, wages for the substituted rest day, based on the average daily wage for the preceding week

- This rule applies to employees in scheduled employments except for agricultural employment

Number of Hours Comprising Normal Working Day

The number of hours for a normal working day shall be as follows:

- 9 hours in case of adults

- 4 1/2 hours in case of a child

- In the case of a child employed in the Plantation, the number of normal working hours will be 6 2/3 hours

- In the case of employment in Public motor Transport and Plantations, adult women must not be employed for a period of over 54 hours per week

- The work hours are to be fixed being mindful that all workers get an interval after 5 hours of work

- Interval or rest should be a minimum of half an hour

- With respect to the Public Motor Transport and Plantations, the work hours should not go spread over 12 hours inclusive of intervals

- With respect to any other scheduled employment, the work hours should not spread over 10 1/2 hours

- The number of work hours will be the same for adolescents as that of an adult in case of employment in plantations when the adolescents have been certified to work as an adult by a medical practitioner

Night Shifts

Night shifts are defined as the work hours that spread over and beyond midnight.

- A worker will get a whole day or 24 hours rest after the night shift has ended

- The hours for which the worker has worked past midnight will be counted towards the previous day

Conditions When the Worker does not Receive full wages

A worker who hasn’t been employed for the normal working hours shall not receive the wage in full.

- In case of storms, fire, power cuts, epidemics, and other circumstances that an employer cannot control, the employees will not receive full payment of wages

- If an employee refuses to work, they may not receive full wages

- If employees participate in strikes or stay in strikes, they may not receive full wages

- If the number of work hours is less than 4, their wages may be slashed

- In case of storms, fire, power cuts, if an employee has already started their work shall receive half the minimum wage if the interruption occurs anytime before the interval

- If an employee is unable to work due to a power cut, the employee shall receive his wages for that day in proportion to the number of hours he worked that day

- If an employee works for less than 4 hours, then they shall be paid for the number of hours they have worked

Overtime Wages

When the employees work for over 9 hours a day, over 48 hours a week, or more than the prescribed number of hours, they shall be entitled to receive wages for the overtime beyond the ordinary rate of wages.

Here the ordinary rate of wages refers to the Basic wage + allowances that include cash equivalent of advantages accrued to the worker. These advantages include food grains at discounted rates. However, these do not include bonuses.

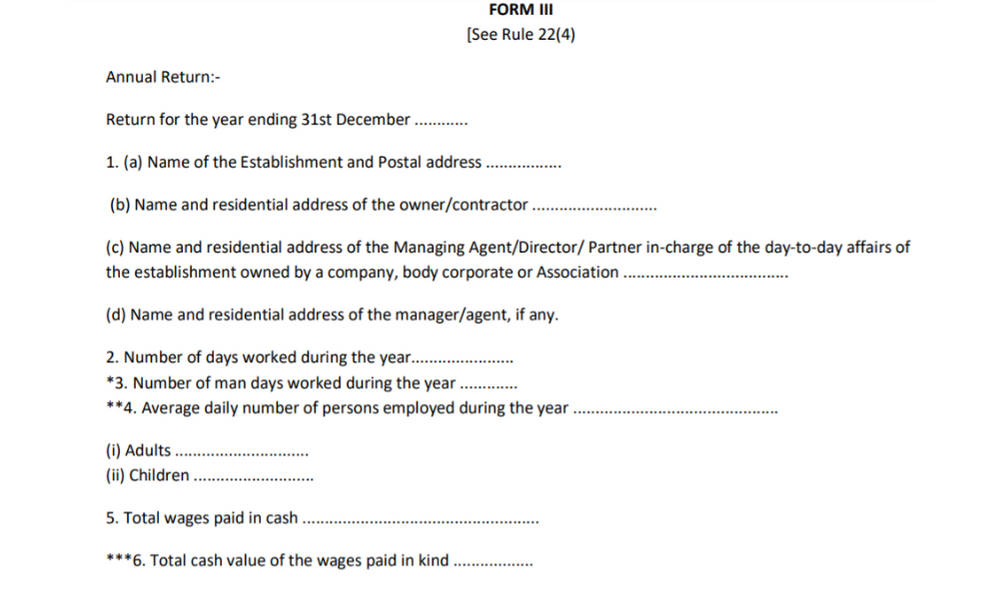

Preservation of Records and Registers

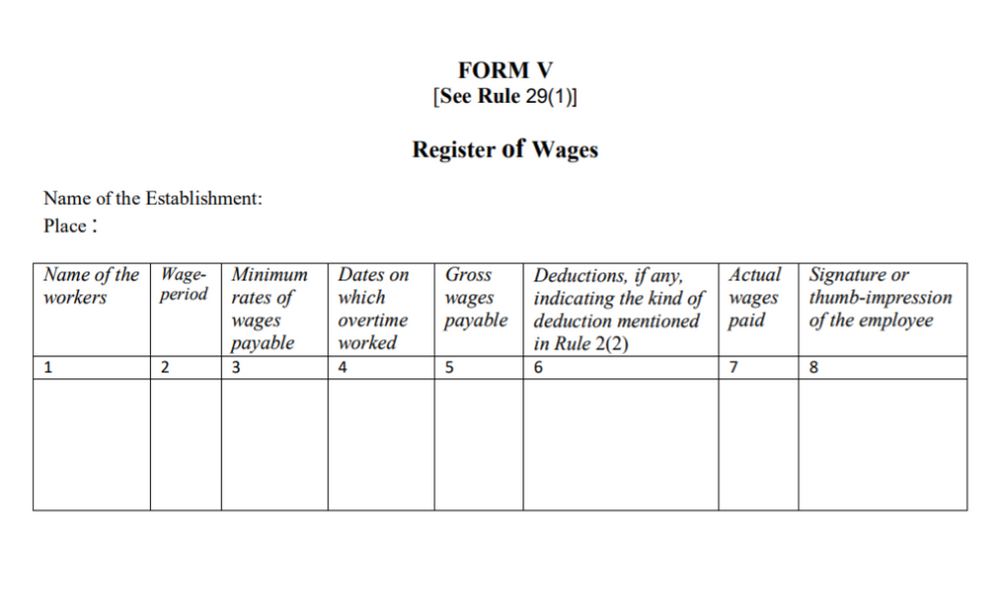

All employers must maintain a register of wages in Form V.

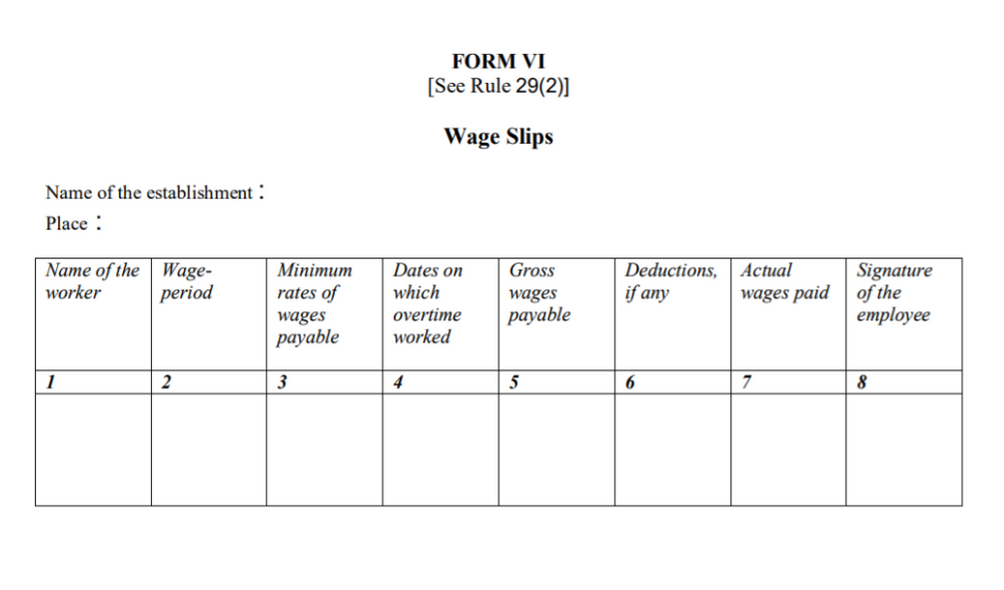

- The employer must issue wage slips to every employee a day before disbursing the wages

- The employer must issue wage slips in Form VI to every employee a day before the disbursement of the wages

- The register must include minimum rates of payable wages, gross wages, number of days of overtime work, deductions, the wages actually paid, and the date of payment

- Employers must obtain thumb impressions or signatures of the employees on the wage slips and wage registers

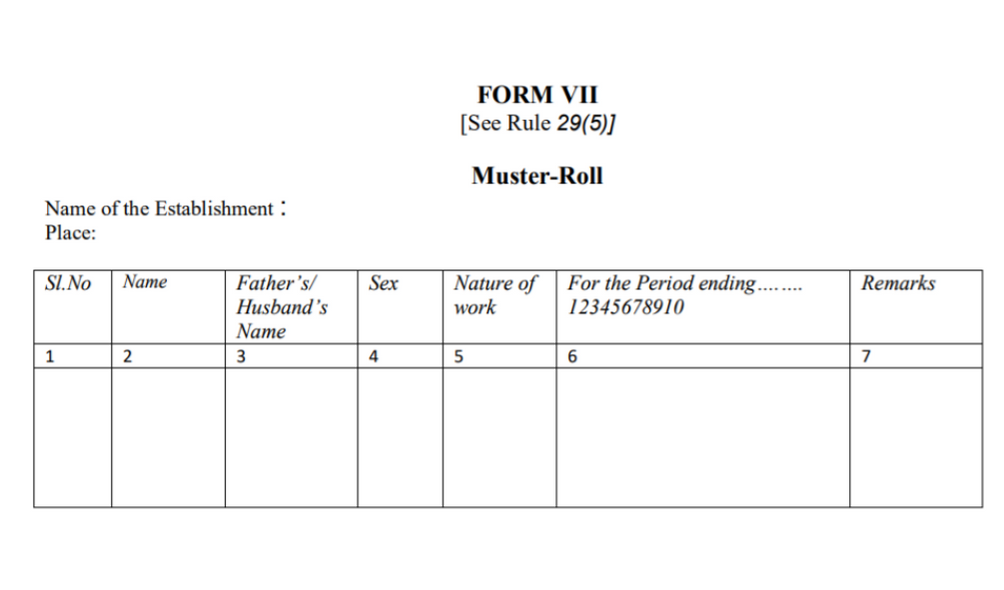

- Employers must also maintain a muster roll to be kept in Form VII

- The muster rolls are in a language other than English or Kannada, then a clear translation should be done in English

- The registers maintained must be preserved for a span of 3 years from the date of last entry

- The employer must produce the documents in the case, an inspector demands to inspect the registers

Notices for Inspection

Inspection books must be kept ready by the employers for an inspection as and when notified. An Inspector has the right to enter and examine the premises. The inspector can also demand to see and go through the documents in the premises and collect any necessary evidence as they deem fit.

Complaints about Less Payment and Other Claims

Employees can make claims and register their complaints in case they are paid less than the minimum rates of wages. They can share an application with their complaints regarding the low wages to the appointed authority.

They must send the application within 6 months through the prescribed form. The employees can take help from a legal practitioner to make the complaint or application on their behalf. The affected employees can apply through a single application and mention the delay or denial of wages through the application.

- Section 22 of the Act enables the employees to approach courts with a sanction from the authority within a month of obtaining the sanction

- Section 22 of the Act enables the employees to lodge a complaint in the courts only with the sanction of an Inspector within 6 months of the committed offense

Actions Taken by the Authority

- On receiving the complaints, the Authority may direct the payment of minimum wages exceeding what is actually paid in addition to compensation not exceeding ten times the excess wage

- An applicant who is found to have made a malicious complaint may be fined up to Rs. 50 by the Authority which should be paid to the employer

Directions from the Authority are final.

Penalties for Offence Under the Act

- An employer who has defaulted in payment of wages or has infringed any of the rules of the payment of wages, weekly holidays, or normal working day is punishable with imprisonment of six months or a fine of Rs. 500, or both

- An employer who has failed to maintain the registers and records will be punishable with a fine of up to Rs. 500

Compliance Forms

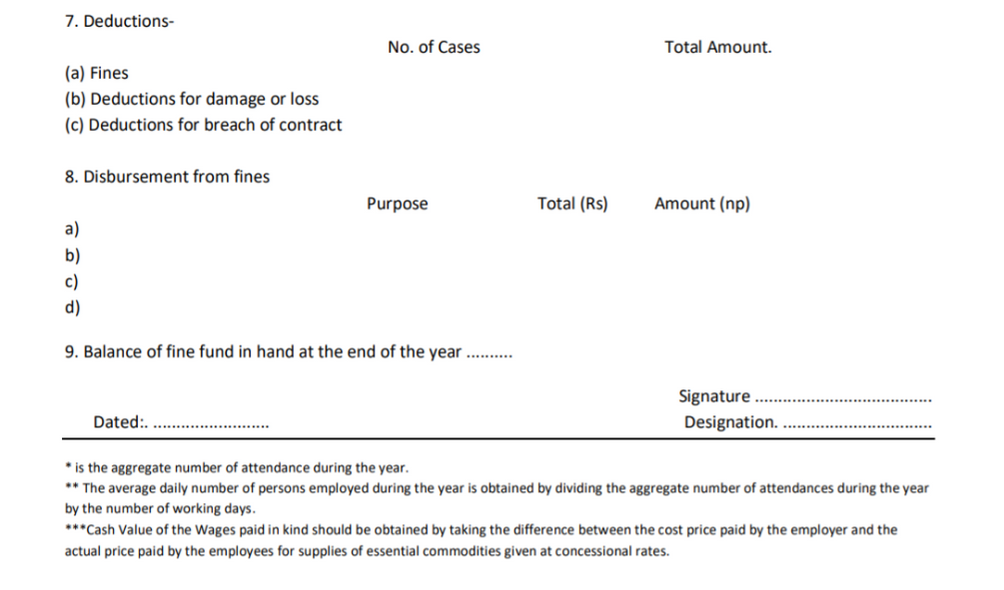

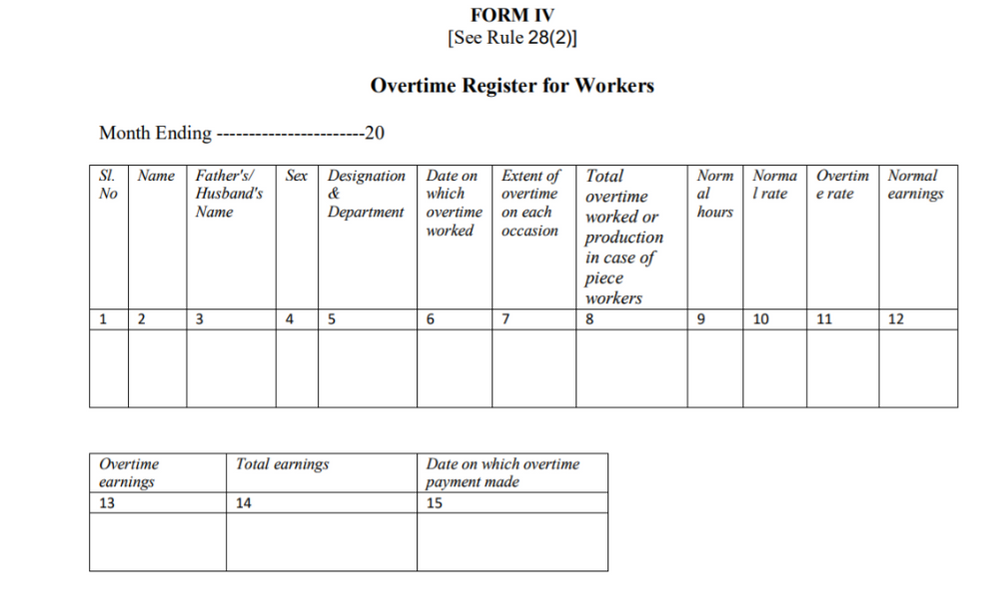

Here are the significant forms mentioned in the Karnataka Minimum Wages Rules, 1958:

- Form I - Register of Fines

- Form II - Register of Deductions

- Form III - Annual Return

- Form IV - Overtime Register

- Form V - Register of Wages

- Form VI - Wage Slips

- Form VII - Muster Roll

Karnataka Minimum Wages Comparison Chart for Employees On Roll, 2019-2020-2021

The minimum wage in Karnataka is now revised by Rs. 428.40/- for the year 2021-22. Currently, the DA is Rs.2631.6/- for the security sector and Rs. 1723.20/- for the S&E sector.

Karnataka Minimum Wages Comparison Chart for Employees Off Roll, 2019-2020-2021

Important Considerations Before Fixing Minimum Wages for 2021-22

The following list presents the information that must be considered before finalizing the minimum wages for the year 2021-22:

- A minimum daily wage rate for daily wage earners is calculated by dividing the monthly rate by 26 days and including wages for four weekly holidays

- The same rates of wages shall be paid to women and men when the types of work are the same

- The higher wages shall be paid in cases where the prevailing rates of wages are higher

- For eight hours of piecework, the daily total earnings of those workers shall not be less than the daily rate of wages set for that category of employees. To compute these rates, an 8-hour day is regarded as a full day of work. For workers employed for less than 8 hours, they must be paid 4-hour wages for less than 4 hours and 8-hour wages for more than 4 hours

- Employees who work beyond normal working hours will receive two times the normal rate of pay. According to S&E Act Sec 16, Definition of Wages = Total Full-time earnings

- Those workers not mentioned in this notification will be compensated based on the type of work they perform

- Workers working on a weekday holiday, a national holiday, or a festival holiday are entitled to double their normal wages (gross wages)

- As per KN CLRA Service conditions notified in 2013, every contract employee who has completed 240 days in a year will receive 2% of their basic salary as service weightage

- Section 4 of the Karnataka Minimum Act, 1948 provides for the fixation of minimum wages by the appropriate government. Accordingly, Karnataka has considered the Basic & DA components as the minimum wages

- Based on the directives taken from Section 6- Payment of Wages Act, 1936, the employers must directly credit the wages in the employees’ bank accounts

- All other benefits already provided will be continued

- The employers of all establishments under the Contract Labour (Abolition and Regulation Act), 1970, must implement the rules laid down under the minimum wages Act and all the other applicable acts

Deskera People

Payroll management and employee management are integral to any organization. If you are looking for a comprehensive and automated tool to manage payroll, employees, expenses, contractor management, Deskera People could be the apt solution.

Key Takeaways

Let’s quickly walk through the most important points mentioned in the article:

- The Indian Parliament introduced the rules on March 15, 1948, when it was applied across the states of India

- We define minimum wages as the least amount of wages that the employers pay to their workers for the work done during a specified time frame

- A government authority or a statute is the entity that fixes the minimum wages to ensure that the employees receive the due amount for the work they have done

- The entity to set Karnataka's minimum wage is the State Level Minimum Wages Advisory Board

- The Act is for the scheduled employment and fixes and revises the minimum wages for the sector

- As a condition of employment under this Act, employers must pay the minimum wage. Over time, working hours, and wages are all regulated

- The Act also fixes the variable DA based on the previous calendar year's Consumer Price Index

- All these rules and guidelines in the Act are called Karnataka Minimum Wages Rules, 1958, and are applied to the entire state of Karnataka

- The rules prescribe the manner in which the mode of calculation will take place

- It also describes the time and conditions for the payment of wages

- Deductions from the wages of the employees can happen in one or more ways including for income tax, adjustments, errors in handling money, for recovering loans, and so on

- An employee shall receive one day in a week as the rest day, ordinarily a Sunday

- The number of hours for a normal working day shall be 9 hours in case of adults, 41/2 hours in case of a child

- A worker working night shifts will get a whole day or 24 hours rest after the night shift has ended

- The Act also prescribes the conditions when they may not receive full wages

- A worker who hasn’t been employed for the normal working hours shall not receive the wage in full

- When the employees work for over 9 hours a day, over 48 hours a week, or more than the prescribed number of hours, they shall be entitled to receive wages for the overtime beyond the ordinary rate of wages

- All employers must maintain a register of wages in Form V

- Inspection books must be kept ready by the employers for an inspection as and when required

- Employees can make claims and register their complaints in case they are paid less than the minimum rates of wages

- On receiving the complaints, the Authority may direct the payment of minimum wages exceeding what is actually paid in addition to compensation not exceeding ten times the excess wage

- An employer who has defaulted in payment of wages is punishable with imprisonment of six months or a fine of Rs. 500, or both

- The minimum wage in Karnataka is now revised by Rs. 428.40/- for the year 2021-22

Related Articles