After the longest period in the USA’s history without an increase in the minimum wage, today, the federal minimum wage's worth is 17% lesser than ten years ago and 31% lesser than in 1968. This was found through an analysis by the Economic Policy Institute in 2019.

When adjusted to inflation, the real value of minimum wages of 1968 was $10.54 per hour (i.e., $21,923 per year). Whereas in 2009, when the last minimum wage increase took place, the real value of minimum wages of 2009 was $8.70 per hour (i.e., $18,096 per year).

In today's times, the real value of minimum wage is only $7.25 per hour (i.e., $15,080 per year). Hence, in comparison to 2009, the current minimum wage has resulted in a loss of $3,016 in annual earnings, and when compared to 1968, it has lost $6,843 in annual earnings.

These statistics are clear proof of why the minimum wage debate in the USA is so important and, in fact, long overdue for the nation and its workers. In fact, the Democrats of the country have proposed raising the minimum wage to $15 per hour, though with each political faction and argument that favors this rise in the minimum wage, there is always another side opposing it.

Considering all the long and arduous minimum wage debates that have already taken place and are still ongoing, this article is written in the manner that it will become your pocket guide to the minimum wage debate of the USA.

What is Federal Minimum Wage?

For covered nonexempt employees, the federal minimum wage has been $7.15 per hour since July 24, 2009, according to the Fair Labor Standards Act (FLSA). In addition to this federal law, many states have their own minimum wage laws. This hence means that an employee can be subject to state as well as federal minimum wage laws. However, in such scenarios, they are entitled to receive their pay as per the higher minimum wage rate.

Exceptions for Minimum Wage

There are various minimum wage exceptions that also needs to be considered here, based on their specific circumstances like:

- Workers with disabilities

- Full-time students

- Youth under 20 (in their 1st 90 consecutive calendar days of employment)

- Tipped employees

- Student-learners

I will now be discussing them in detail below.

Minimum Wage for Workers Who Receive Tips

As per the rules, a tipped employee should not be paid less than $2.13 per hour by an employer in direct wages. This is applicable only if the $2.13 per hour plus the tips received are at least equal to the federal minimum wage, if it is, then the employee will retain all the tips. This means that the employee customarily and regularly receives more than $30 a month in tips.

However, if the employee’s tips combined with the employer’s direct wages of at least $2.13 per hour do not match the federal minimum hourly wage, then the employer is liable to make up the difference.

Additionally, some states also have specific minimum wage laws for tipped employees. In such a case where the employee is a subject of federal as well as state wage laws, she or he is entitled to the provisions of each law that provide higher benefits.

Minimum Wage for Young Workers

For young workers who are under the age of 20, the minimum wage applicable for them is $4.25 per hour for their first 90 consecutive calendar days of employment with an employer and as long as their work does not displace other workers.

After these initial 90 days, or when the employee reaches the age of 20- whichever comes first, he or she will start receiving a minimum wage of at least $7.25 per hour as per the laws.

Minimum Wage for Workers with Disabilities

It is Section 14(c) of the FLSA that authorizes employers to pay sub-minimum wages. Sub-minimum wages are those wages that are paid to workers who have disabilities that affect the work being performed, hence justifying sub-minimum wages, which are basically lesser than the federal minimum wage.

The employers can pay sub-minimum wages only after receiving a certificate from the Wage and Hour Division. A disabled worker is someone whose earning or productive capacity for the work being performed is impaired by a mental or physical disability, including those relating to injury or age.

Also, the sub-minimum wages must be commensurate wage rates- i.e., based on the worker’s individual productivity, no matter how limited in proportion to the wage and productivity of experienced workers who do not have disabilities performing essentially the same quality, type, and quantity of work in the same geographic area.

Minimum Wages for Full-Time Students

An employer who hires students can obtain a certificate from the Department of Labor that will allow a full-time student to be paid not less than 85% of the minimum wage. Thus, this full-time student program is for all full-time students who are employed in service or retail stores, agriculture, or colleges and universities.

This certification also limits the number of hours that a full-time student can work, which is not more than 8 hours each day and 20 hours per week when the school is in session. However, when the school is not in session, the student can work for 40 hours per week. Once the student/s have graduated or left the school for good, the employer becomes liable to pay them at least $7.25 per hour, as is the minimum wage rate.

Minimum Wages for Student Learners

This program is for all those high school students who are at least 16 years old and enrolled in vocational education (shop courses). Any employer who hires such a student will need to get a certificate from the Department of Labor to be allowed to pay not less than 75% of the minimum wage to the student for as long as the student is enrolled in the vocational education program.

Who Does the Minimum Wage Apply to?

The minimum wage law of the FLSA applies to all the employees of the enterprises whose annual gross volume of sales or business done is at least $500,000. It also applies to employees of the smaller firms if they are engaged in:

- Interstate commerce

- Production of goods for commerce

For example, employees who work in the transportation or communications department or who regularly use the mails or telephones for interstate communications. This also covers janitors, guards, and maintenance employees who perform duties that are closely related and directly essential for interstate activities that are also covered by the FLSA.

In addition to these, the minimum wages also apply to employees of the local, state, or federal government agencies, as well as to employees of schools and hospitals. Minimum wages also tend to apply to domestic workers.

A Brief History of the Minimum Wage

It was in 1938, under the Fair Labor Standards Act, that the federal minimum wage was first implemented. Back then, in order to win the support of the southern state representatives, the originally drafted 40 cents an hour was reduced to a mere 25 cents per hour.

Since then, the federal minimum wage has been increased 22 times, moving from cents to dollars to today’s $7.25 per hour rate. From the 1940s to 1960s, the trend that was observed was that wage increases kept pace with the productivity growth of the businesses. Productive growth refers to the more amount of goods and services produced per hour. Along with productive growth, inflation was also given due consideration in changing the minimum wage rate.

However, from the 1968s, though economic productivity continued to grow and America continued to become economically stronger, the pace of wage growth started slowing down to the extent that it did not even increase with an increase in inflation.

This is of concern because, over time, the federal minimum wage’s purchasing power (i.e., the amount of goods and services that your money can buy) has severely decreased over time. In fact, when adjusted as per the 2020 dollars, the $7.25 per hour minimum wage has lesser purchasing power than the minimum wage of the 1950s to 1980s had.

In fact, an analysis conducted by the Economic Policy Institute in 2019 found out that the federal minimum wage in 2019 had 17% less purchasing power than it did in 2009, whereas when compared with the minimum wage in 1968, the purchasing power of 2019 was lesser by 31%.

A similar analysis that was undertaken by Pew Research in 2018 showed that the $4.03 per hour minimum wage in January 1973 had the same purchasing power of $23.68 in August 2018- which is three times more than the actual minimum wage.

Considering the inflation that has happened since 2009, in order to match the federal minimum wage of $7.25 of 2009, the minimum wage as per 2021 dollars needs to be equal to $8.81 per hour. The highest minimum wage was in 1968 at $1.60 per hour, which would be worth $12.27 in 2021 dollars.

Every year, the Bureau of Labor Statistics does a study to know who is living off the minimum wage. Relatively, there are only a few American workers who make the federal minimum wage. This is because several states of America have their own higher minimum wages. Studies revealed that in 2019, there were 392,000 workers who earned exactly as much as the minimum wage, while there were 1.2 million workers who were earning less than the minimum wage.

Typically, these 1.2 million workers belonged to the hospitality industry, where their tips are also understood to make up for their hourly wage being below the federal minimum wage.

In fact, the federal minimum wage for these workers is just $2.13 an hour. However, both these sets of workers together only represent 1.9% of the total 82.3 million hourly-paid workers in the USA. In fact, almost all the workers in America make less than $15 per hour, which is the minimum wage only in a few places.

The minimum wage debate of the USA is hence very important because not only will it affect all those workers who are earning at or under the minimum wage, but it will also affect 17 million Americans who have earnings below $15 per hour. Hence, a hike to the $15 minimum wage will have far-reaching effects.

How Often is the Federal Minimum Wage Changed?

The federal minimum wage does not increase automatically. Any changes to it require Congress to pass a bill for the same, which is then signed by the President to make it a law.

Who Makes Sure that the Workers are Paid the Minimum Wage?

It is the Wage and Hour Division of the U.S. Department of Labor that is responsible for enforcing the minimum wage. By using enforcement as well as public education efforts, this department strives to ensure that all the workers in America are paid the minimum wage as mandated by the law. The Wage and Hour Division has offices all across the country for the same purpose.

Most Recent Update on $15 Minimum Wage Hike

On January 22, 2021, President Joe Biden signed an executive order initiating the process to raise the minimum wage for federal workers and contractors to $15 an hour. This move was in support of President Biden’s key campaign promises and reverse actions taken during the previous administration.

A few days later, the proposal- Raise the Wage act of 2021 was introduced by the congressional Democrats, which was focused on incrementally raising the federal minimum wage to $15 an hour by 2025. According to this proposal, rather than relying on Congress to agree on raising the minimum wages in 10 years or so, it would be the Department of Labor based on the Bureau of Labor Statistics data which would raise the minimum wages each year.

This legislation also aimed at phasing out the cash wage for tipped workers and eliminating sub-minimum wage payments for workers with disabilities and those under the age of 20. In fact, the $15 minimum wage provision was also made a part of President Biden’s $1.9 trillion COVID-19 relief bill.

This inclusion was done in the COVID-19 relief bill by the Democrats as they wanted to use “budget reconciliation,” which would allow them to maneuver around the filibuster and pass the measure of $15 minimum wage with a simple majority instead of a 60-vote super majority. However, the Senate parliamentarian decided that the minimum wage hike violates the rules of the relief package (which is only for the pandemic) and hence cannot stay in the final package.

How Much of the Country has a Higher Minimum Wage than the Federal Minimum Wage Floor?

Twenty-nine states of America, which is more than half of the country, have a minimum wage higher than $7.25. In addition to these states, there are 45 cities with minimum wages higher than their states. What was found out was that a large portion of the states with a minimum wage higher than $7.25 automatically raises it with inflation.

On January 1, 2021, the minimum wages went higher in 20 states, with California having the highest statewide minimum wage at $14 per hour for companies that have 26 or more employees. However, San Francisco and other cities in the state have higher wages. Other cities with higher minimum wages also include New York and Seattle.

About the People Making Minimum Wages

According to the Bureau of Labor Statistics, people making minimum wages are mostly young and less likely to have an education higher than a high school diploma. They are more likely to be working part-time rather than full-time. A larger portion of these workers tend to be women rather than men, and these women are less likely to be married.

The industries having the highest number of minimum wage earners are the service industry, particularly food service. The states with the largest proportion of minimum wage workers are in the southern states, i.e., Louisiana, Mississippi, and South Carolina. In the vast majority of the states, less than 5% of the workers who are paid by the hour make minimum wages, let alone $15 minimum wage.

Is it Possible to Live on the Minimum Wage?

An individual who works for 40 hours each week and earns as per the federal minimum wage would make $15,080. In 2021, the federal poverty line was $12,880. Considering this, a single person working full time and making minimum wage is above the poverty line.

However, this is not a comprehensive view because if this individual has a dependent to care for and is still making only minimum wages, then they do fall below the federal poverty level of $17,420.

Additionally, the poverty level in itself is a debatable topic because it does not take into account the cost of living in different places. It also does not take into consideration different family scenarios like an adult who has one or more children, or two adults where one or both are working, or a family with dependents.

Effects of Raising the Minimum Wage to $15 Minimum Wage

In order to understand the effects of raising the minimum wage to the $15 minimum wage, there are lots of different variables like the industry of the workers and the age of people affected that are taken into consideration by the researchers. It is because of this that there is a minimum wage debate and how its increment will affect employment, small businesses, and the federal deficit. Some of the common arguments for and against raising the minimum wage in terms of its effects are:

$15 Minimum Wage Pros: It Will Increase Economic Activity and Spur Job Growth

The Economic Policy Institute stated that a minimum wage increase from the current rate of $7.25 per hour to $10.10 would inject $22.1 billion net into the economy, consequently creating around 85,000 new jobs over a three-year phase-in period.

In fact, this was supported by the predictions of the Federal Reserve Bank of Chicago, which predicted that even a $1.75 raise in the federal minimum wage would increase the aggregate household spending by $48 billion the following year. This would boost the GDP while also leading to job growth.

$15 Minimum Wage Cons: It Will Kill Jobs and Increase Prices of Goods and Services

One of the reasons against the $15 increment in the minimum wage debate is that it might result in potential job losses because of the businesses absorbing the costs of having to pay the employees more, which will result in more expenses as well as the need for having a larger working capital. It might also lead to the ratio of operating expenses increasing more than the operating income.

A report from the Congressional Budget Office (CBO) estimated that 1.4 million jobs would be lost, which is equal to 0.9% of employment by the time the federal minimum wage reaches $15 in 2025.

This would also result in an increase in the federal deficit by $54 billion over the next ten years due to increased spending on the federal programs to look after rising unemployment. However, another researcher- Arindrajit Dube, found the CBO’s methodology to be incorrect and said that with an increase in the federal minimum wage to $15 per hour, under 500,000 jobs would be lost.

Yet another researcher- Daniel Kuehn, said that the employers would be able to absorb the wage hike costs in other ways like, for example, by reducing fringe benefits. Fringe benefits involve benefits like free restaurant servers or employee discounts for retail servers. He believes that the impact of wage hike will raise the prices of goods and services, the increase would be spread out among many consumers, which will make the overall impact smaller and bearable.

$15 Minimum Wage Pros: It Will Benefit Millions, Lift Struggling Workers Out of Poverty

One of the most positive news that the report of the Congressional Budget Office had was that a $15 federal minimum wage would lift nearly 1 million people out of poverty while positively affecting nearly 32 million workers. This will mean that the government will have to spend less on food assistance and other such programs. In terms of the overall economy, the effects of the minimum wage increase are positive.

A recent analysis undertaken by the Economic Policy Institute (EPI) and National Employment Law Project also found that around 59% of workers with family income totals below the poverty line would also see an increase. Additionally, the $15 minimum wage’s pro is also that it will bring significant gains for racial minorities and women who are over represented in low-wage jobs and underrepresented in high-wage jobs. In fact, the EPI has estimated that the $15 minimum wage hike would affect 31% of African Americans and 26% of Latinos.

However, the exact impact will vary from location to location as some states have a higher standard of living than others. For example, a hike to the $15 minimum wage will have a more consequential effect on states like Kentucky and Alabama rather than on states like California and New York, where the prices and wages are already higher.

This is because, currently, the state minimum wages of Kentucky and Alabama are equal to the federal minimum wage of $7.25, whereas the minimum wage of California is $13 or $14 per hour depending upon the number of employees of the company, whereas in New York, it is $15 per hour.

This also highlights the $15 minimum wage con for states like Kentucky and Alabama, where their small businesses would be shocked by more than double the hike in the minimum wages because with the cost of living being already low, their revenues are likely to be smaller to the companies where the cost of living is high. However, the employers are going to be given a period of four years to figure out a way to balance their costs, cash flow, and their balance sheets.

$15 Minimum Wage Cons: It Will Hurt Small Businesses and Force Companies to Close

According to a 2013 Gallup Poll, 60% of the small business owners said that raising the minimum wage to $15 will hurt them. For example, the VP of the fast-food chain White Castle said that it would be forced to close almost half of its stores while also letting go of thousands of its workers if the federal minimum wage is increased to $15. In fact, Forbes also reported how an increase in the minimum wage led to Wal-Mart stores closing down several of its stores while also not opening the ones that they had promised to open.

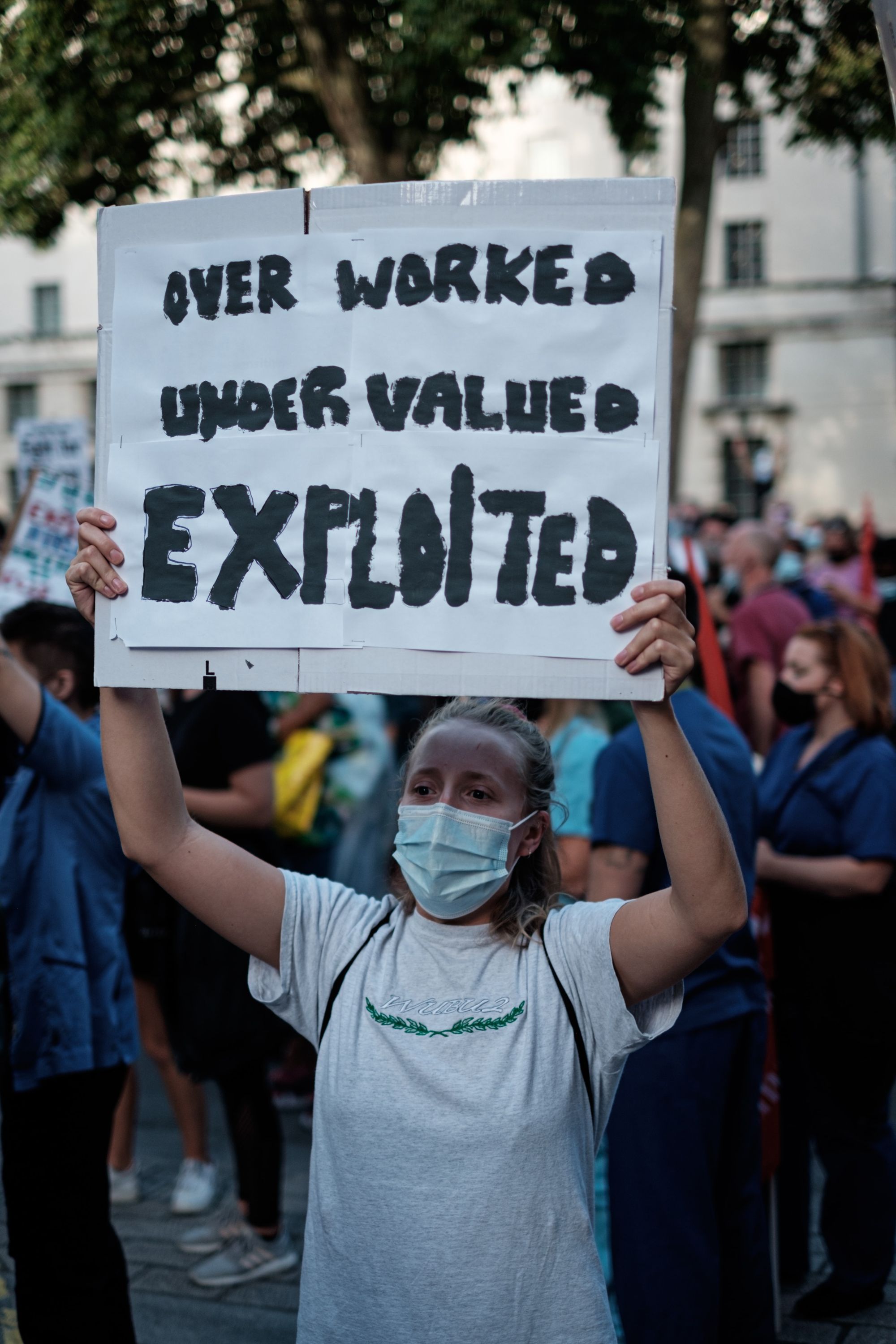

$15 Minimum Wage Pros: Workers’ Standard of Living will Improve

Currently, the minimum wage has not kept up with the rising inflation, thereby decreasing the purchasing power of the workers. By raising the federal minimum wage to $15, and indexing it to inflation would help in ensuring that the low-wage workers are able to adopt a standard of living that is commensurate with the current economy.

However, one of the possibilities that should be considered here is that raising the minimum wage might result in a decrease in employee benefits, with a simultaneous increase in tax payments, which might again hamper their standard of living. For example, one of the benefits they might lose is housing subsidies even while they are still unable to afford market-rate rents.

$15 Minimum Wage Cons: Teenagers and Young Adults May Be Shut Out of the Workforce if the Minimum Wage is Increased

The minimum wage workers are disproportionately young because 16-24-year-olds make up 50.4% of minimum wage earners, even though they represent only 13.7% of the workforce as a whole. This highlights one of the major cons of the $15 minimum wage, which is how the firms will not pay many young workers with no skills or experience minimum wage, let alone a higher wage.

In fact, even after the minimum wage hike of 2009, the teenage employment index had fallen sharply by 8% in mere three months. Hence, a $15 minimum wage will expose them to unemployment at an early age with years of lower earnings and even the possibility of continued unemployment for other years as well.

$15 Minimum Wage Pros: It will Reduce Income Inequality

A study in 2015 had found that one of the major contributors to America’s high levels of inequality was the decrease in the inflation-adjusted value of the minimum wage since the 1980s. Hence, by raising the minimum wage to $15, Americans would be able to combat the issue of income inequality.

$15 Minimum Wage Cons: Increased Usage of Robots and Automated Processes to Replace Service Employees

If due to the increase in the minimum wage to $15, the companies cannot afford to pay this higher wage to low-skilled service employees, then they are more likely to shift to automation so as to avoid hiring people in those positions altogether.

Today, commercial service robots are able to perform more complex tasks in food preparation, health care, commercial cleaning, and elderly care, making it a near-future of humans being replaced by these robots.

In fact, many restaurant chains in America are already looking for ways to take humans out of the picture of their industry, thereby threatening the employment of 2.4 million wait staffers, 3 million cooks and food preparers, and around 3.3 million cashiers. A minimum wage hike to $15 might speed up this whole transition.

Public Opinion on the Minimum Wage Debate

According to the Pew Research Center, 67% of Americans are in favor of raising the federal minimum wage to $15. Out of these 67% Americans, 41% are strongly in favor of this change. In addition to the American citizens, the $15 federal minimum wage is also getting support from American companies like Amazon (one of the country’s largest employers), as well as other retail giants like Target and Costco.

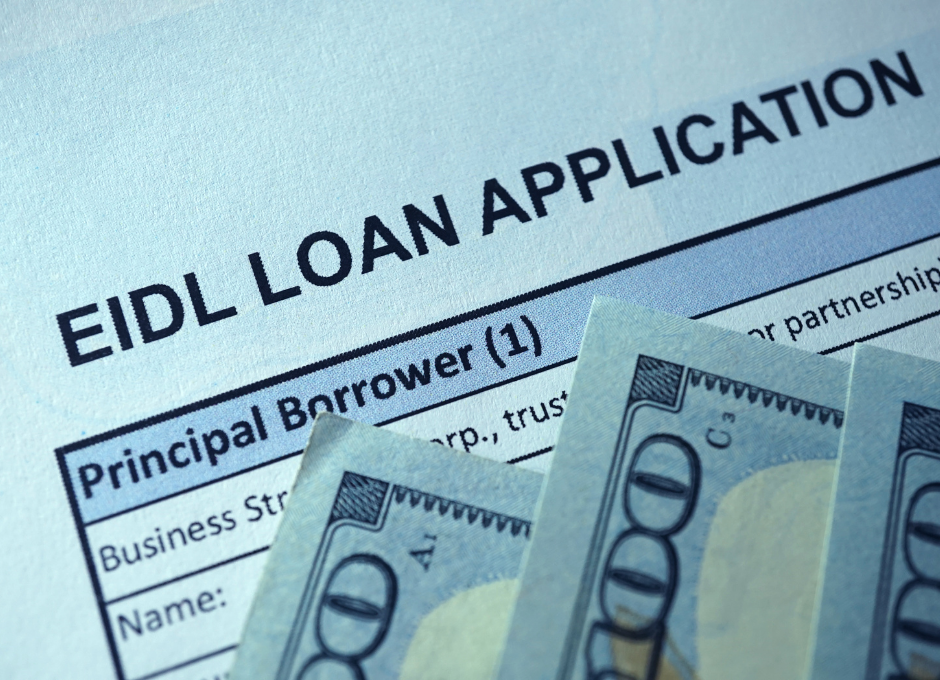

Despite this corporate support, however, there are concerns about how the $15 federal minimum wage will affect small businesses, i.e., all those businesses that have less than 500 workers. In the American economy, small businesses account for about 47% of private-sector employment and are already facing several challenges due to the pandemic. This is despite the $659 billion aid offered through the small business administration’s paycheck protection program.

Minimum Wage Debate: Where Democrats, Republicans Stand

The Democrats are firm on their standing in favor of the proposed federal minimum wage increase to $15. In fact, they are even hoping to pass it as part of the next stimulus package; however, the Senate parliamentarian has ruled that it cannot be included under the reconciliation process. This means that while it may pass in the house, it will most likely not be a part of the bill that goes to the Senate.

This has brought the Plan B of the lawmakers, which is to tax companies that have revenues of $1 billion or more if they do not pay their employees a $15 wage. This proposal was put forth by Republican Senator Josh Hawley (MO).

While some of the Republicans have supported raising the federal minimum wage, they are not in favor of it being raised to $15 per hour. In fact, Sen. Mitt Romney (UT) and Sen. Tom Cotton (AR) offered a counter proposal of increasing the minimum wage to $10 per hour over four years, for which, however, the employers will have to prove that their workers are legally documented.

However, a CBO report of 2019 estimated that raising the federal minimum wage to $10 per hour instead of $15 per hour would have much smaller effects for workers. In fact, a $10 per hour raise would have negligible effects on the number of people in poverty.

Why is Raising the Minimum Wage the Right Thing to Do?

Over the past 12 years, the current federal minimum wage has flat-lined, which has made it clear that the low-wage earners are falling behind because they are now working for less money, thanks to inflation which has been making them poorer over time.

Pew Research has pointed out that wage growth has largely gone to the highest earners. A separate EPI analysis also notes that the wage growth has remained unequal by race, with significant widening gaps in wages between black and white Americans- however, here, raising the federal minimum wage will be helpful.

This is supported by research on the minimum wage hike in 1966, which revealed that it led to a significant drop in earnings inequality between black and white Americans. In fact, the 1966 wage hike reduced the gap between racial earnings and their income gap by 20%. This also proves how a stagnant minimum wage does become a contributing factor in the widening racial wealth gap in the country.

A letter from the Economic Policy Institute (EPI) has signatures of over 100 economists in favor of raising the federal minimum wage to $15 per hour by 2024. Two of the reasons justifying their support are:

- The stagnant minimum wage growth is “directly responsible for growing inequality between the bottom and the middle class.”

- “This minimum wage increase would provide a significant and much-needed boost to the earnings of low-wage workers.”

This letter has also suggested that complementary policies like expanded Earned Income Tax Credit (EITC) and increased job training should accompany the wage hike. These changes have also been included in President Biden’s $1.9 trillion American Rescue Plan.

Hence, what is expected is both the Democrats and Republicans raising the wage in a separate bill, even if it does not land directly on $15 an hour.

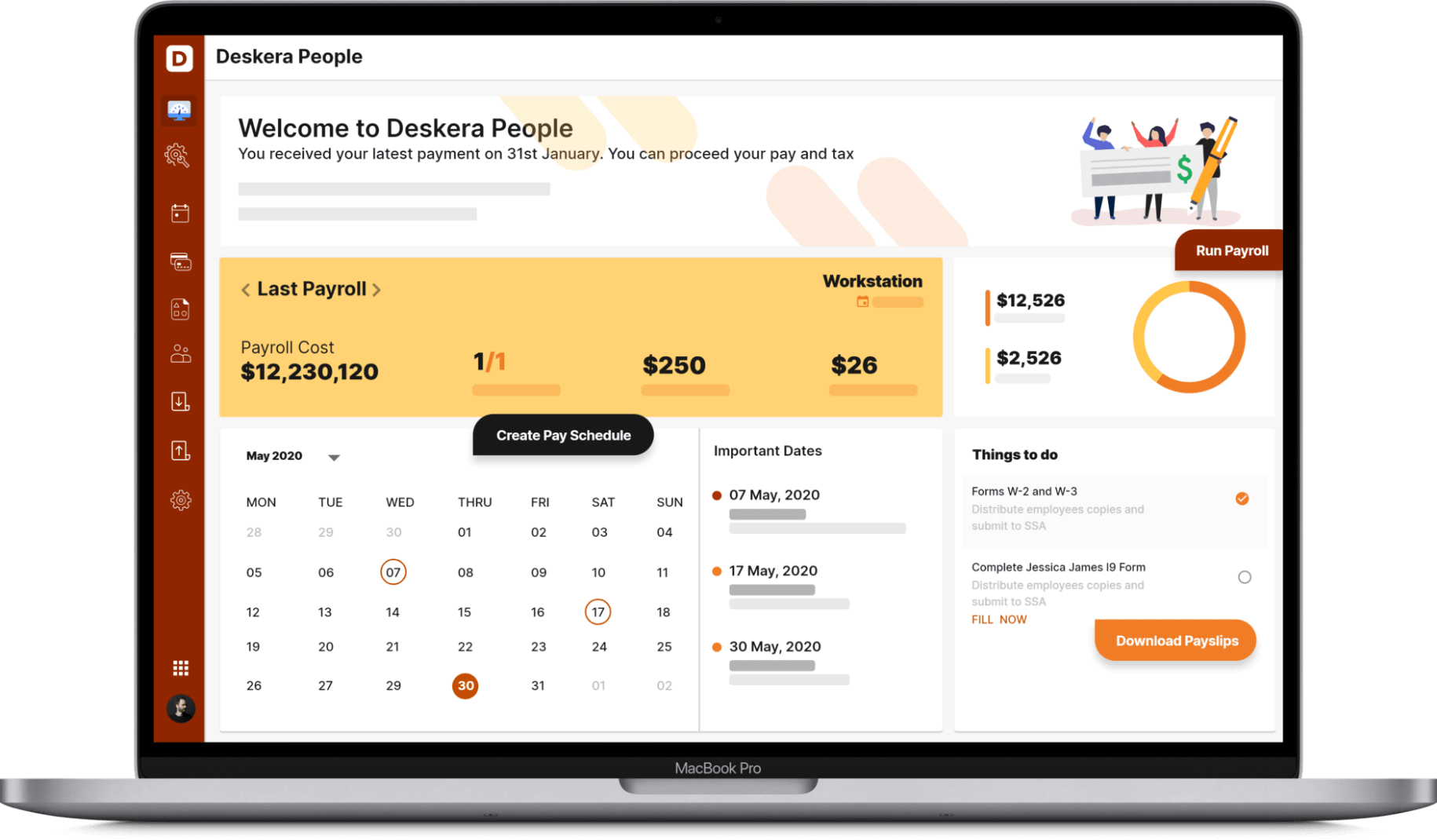

How Can Deskera Help with Minimum Wages?

Deskera People is the cloud-based software that will be able to help employers with minimum wages. By using Deskera People, payroll and payslips can be generated within a few minutes. In fact, the three steps easy process for managing payroll is:

- Add employees

- Select the amount

- Pay them

In fact, the employers would also be able to group his or her employees based on their pay frequencies like weekly, semi-monthly, monthly, etc. This further smoothens the whole process of the pay run while also giving detailed insights into the payroll processes.

In fact, employees would also be able to view their payslips, apply for time off, and file for their claims and expenses online. Additionally, Deskera People also provides the withholding forms with the right information for an employee or a contractor within a couple of clicks, which also ensures the maintenance of your clean legal compliance history.

Key Takeaways

Considering everything, there are wider pros in favor of increasing the federal minimum wage to $15. Some of these pros include lesser employee turnover and employee turnover associated costs, better standard of living for the employees, reduced poverty, lesser expenditure on government grants, and so on.

However, what is also very much true is the fact that if this change in policy is not implemented carefully, then it will end up having larger cons and negative implications than positive effects like reduction in employee benefits to the extent that the wage hike ends up disrupting their life rather than improving it.

This is because this policy change will affect several sections of the society, starting from employees, businesses to the government itself, requiring the policymakers to take utmost care here.

When considering the public opinion in regards to this minimum wage debate, it was noted that 67% of Americans are in favor of this change, out of which 41% strongly favor it.

In addition to this, the $15 minimum wage hike is also being supported by American companies like Amazon, Target, and Costco. However, there are concerns for small businesses and how this hike will impact their functioning, as well as how this minimum wage hike will affect the employment of lesser experienced workers.

Related Articles