Are you a business owner or an accounting professional wondering about the process of migrating from QuickBooks Desktop to the cloud? As cloud technology continues to revolutionize the business landscape, more and more companies are considering the benefits of transitioning their financial operations to the cloud.

However, for those who have relied on QuickBooks Desktop for years, the prospect of migration may raise questions and uncertainties.

QuickBooks Desktop has been a trusted accounting solution for countless businesses, offering a range of features and capabilities to manage finances effectively. However, with the increasing demand for remote work, real-time data access, and collaboration, cloud-based solutions have gained significant traction.

QuickBooks Online, the cloud-based counterpart to QuickBooks Desktop, offers numerous benefits, including anytime, anywhere access, automatic backups, and simplified data sharing.

According to a recent survey by Deloitte, 94% of small and medium-sized enterprises (SMEs) have reported benefits from migrating to the cloud, including improved efficiency and reduced IT costs. This statistic underscores the positive impact of cloud migration on businesses of all sizes, including those using accounting software like QuickBooks.

In this article, we will explore the process of migrating from QuickBooks Desktop to the cloud. We will delve into the key steps involved in the migration, such as data preparation, selecting the right cloud-based solution, and data migration strategies.

So, let's embark on this journey together as we explore the process of migrating from QuickBooks Desktop to the cloud and discover the transformative power of cloud technology in financial management.

Here is what we shall cover in this post:

- Introduction to Quickbooks Desktop

- 6 Key Steps to Move QuickBooks Desktop to the Cloud

- Evaluating Cloud Accounting Solutions

- Training and Onboarding for the Cloud System

- Integrating Cloud-Based Solutions With Other Tools

- Common Challenges and How to Address Them

- Future-Proofing Your Accounting With Cloud-Based Solutions

- How Deskera Can Assist You?

- Conclusion

- Key Takeaways

Introduction to Quickbooks Desktop

QuickBooks Desktop is a robust and widely used accounting software developed by Intuit. It is designed to help small and medium-sized businesses manage their financial transactions, track expenses, generate financial reports, and streamline their overall accounting processes.

- QuickBooks Desktop offers a comprehensive set of features and tools that make it a popular choice for businesses of all sizes.

- With QuickBooks Desktop, users can efficiently manage various financial aspects, including invoicing, payroll, inventory, and tax reporting.

- The software provides a user-friendly interface and offers a range of customization options to suit the specific needs of different industries and businesses.

- QuickBooks Desktop is available in several versions, such as Pro, Premier, and Enterprise, each tailored to cater to different business requirements. Users can choose the version that aligns best with their industry and accounting needs.

This article will delve deeper into the features, benefits, and capabilities of QuickBooks Desktop, highlighting its key functionalities that help businesses streamline their financial management and drive efficiency in day-to-day operations.

From managing financial transactions to generating detailed financial reports, QuickBooks Desktop serves as a powerful tool for businesses to achieve financial success and better manage their accounting tasks.

Benefits of Moving to Cloud-Based Accounting

Moving to cloud-based accounting offers numerous benefits for businesses of all sizes. Here are some of the key advantages of adopting cloud-based accounting solutions:

Accessibility and Flexibility: Cloud-based accounting allows users to access their financial data from any device with an internet connection. This enables business owners and accountants to work remotely and collaborate seamlessly.

Whether it's accessing financial reports on a smartphone during a meeting or reviewing transactions on a tablet while traveling, cloud-based accounting provides the flexibility to stay connected to financial data anytime, anywhere.

Real-Time Updates: With cloud-based accounting, all data is stored and updated in real time. This means that any changes made by one user are instantly visible to others, ensuring that everyone has access to the most current and accurate financial information.

Real-time updates also facilitate faster decision-making and provide a clear picture of the business's financial health at any given moment.

Cost-Effectiveness: Cloud-based accounting eliminates the need for expensive hardware, IT maintenance, and server setups. Instead, businesses pay a subscription fee based on the level of service they require.

This makes cloud-based accounting more cost-effective, especially for small and medium-sized businesses that may not have the resources to invest in an on-premises accounting system.

Data Security: Cloud-based accounting solutions often come with robust security measures to protect sensitive financial data. Reputable cloud providers employ encryption, multi-factor authentication, and data backups to safeguard against data breaches and ensure data integrity.

Cloud servers are typically monitored and maintained by experts, reducing the risk of data loss due to hardware failure.

Automatic Updates and Backups: Cloud-based accounting systems automatically update with the latest software versions, ensuring that users always have access to the newest features and enhancements.

Additionally, cloud providers frequently perform automated backups, mitigating the risk of data loss due to accidental deletion or system failure.

Scalability: Cloud-based accounting systems are highly scalable and can accommodate the changing needs of a growing business. As the business expands, additional users or features can be added seamlessly without the need for hardware upgrades or complicated installations.

Integration with Other Software: Cloud-based accounting solutions often offer integration with other business applications, such as customer relationship management (CRM) software, payment gateways, and inventory management systems.

This integration streamlines data flow between different departments, eliminating the need for manual data entry and reducing the risk of errors.

Environmental Benefits: Adopting cloud-based accounting can lead to reduced energy consumption and carbon emissions. By relying on shared servers in data centers, businesses contribute to a more sustainable and eco-friendly approach to data management.

Overall, moving to cloud-based accounting offers businesses greater flexibility, cost savings, data security, and real-time insights, making it an attractive option for modern accounting and financial management.

6 Key Steps to Move QuickBooks Desktop to the Cloud

Moving QuickBooks Desktop to the cloud can be a smooth and efficient process when done correctly. Here are six key steps to guide you through the migration:

Step 1: Choose the Right Cloud Service Provider

The first and most crucial step is to select a reliable and reputable cloud service provider. There are numerous cloud hosting providers in the market, and choosing the right one can make a significant difference in the success of your migration.

Consider factors such as data security, data center locations, scalability, customer support, and pricing. Look for providers that specialize in hosting QuickBooks Desktop and have a proven track record of providing excellent service to their clients.

Step 2: Assess Hardware and Software Compatibility

Before starting the migration process, it's essential to assess your existing hardware and software for compatibility with the cloud environment. Check the system requirements of the cloud service provider and ensure that your current infrastructure meets those requirements.

If necessary, make any required upgrades or updates to ensure a smooth transition. Properly assessing compatibility will prevent potential issues and disruptions during the migration.

Step 3: Back Up QuickBooks Data

Data is the lifeblood of any business, and it is crucial to safeguard it during the migration process. Before proceeding, create a comprehensive backup of all your QuickBooks data, including company files, financial records, and other important information.

Store the backup on a secure and reliable external storage device or a cloud-based backup service. Regular backups are essential not only for the migration but also as part of a sound data management strategy.

Step 4: Choose the Right QuickBooks Hosting Plan

Cloud service providers offer a range of hosting plans to cater to the diverse needs of businesses. Assess your requirements, such as the number of users, storage capacity, and specific features needed for your business operations.

Based on your needs, select the appropriate hosting plan that aligns with your budget and desired functionalities. It is crucial to choose a plan that can accommodate your current needs while also allowing room for future growth.

Step 5: Migrate QuickBooks Data to the Cloud

With the preliminary groundwork completed, it's time to migrate your QuickBooks data to the cloud. The process may involve uploading your QuickBooks company files to the cloud server or performing a data transfer from your local system to the cloud environment.

The complexity of the migration will depend on factors like the size of your data and the hosting provider's migration process. Work closely with the cloud service provider to ensure a smooth and error-free migration.

Step 6: Test and Verify Data Integrity

Once the migration is complete, thorough testing is essential to ensure the integrity and accuracy of your data in the cloud environment. Conduct a series of tests to validate that all financial data, reports, and functionalities are working correctly.

Test various scenarios to ensure that the software behaves as expected. Any discrepancies or issues found during testing should be promptly addressed to avoid potential complications in the future.

Evaluating Cloud Accounting Solutions

As businesses increasingly embrace digital transformation, cloud accounting solutions have emerged as a popular choice for managing financial operations. The shift to cloud-based accounting offers numerous advantages, including increased flexibility, real-time access to data, enhanced security, and cost-effectiveness.

However, with a wide range of cloud accounting providers available in the market, choosing the right solution for your business can be a daunting task. This guide aims to help businesses evaluate and select the best cloud accounting solution to meet their specific needs and requirements.

- Assess Your Business Needs:

The first step in evaluating cloud accounting solutions is to thoroughly assess your business needs. Identify your specific accounting requirements, including the number of users, the complexity of financial operations, integration with other software systems, and reporting capabilities.

Consider factors such as multi-currency support, inventory management, payroll processing, and tax compliance. Understanding your business needs will help you narrow down the list of potential cloud accounting providers.

- Security and Data Protection:

Data security is a critical consideration when selecting a cloud accounting solution. Ensure that the provider follows industry best practices for data encryption, access controls, and data backups. Look for certifications like ISO 27001 and SOC 2 compliance, which demonstrate a commitment to data security.

Additionally, inquire about the provider's disaster recovery plans and how they handle data breaches. Choosing a reputable and secure cloud accounting solution will safeguard your sensitive financial information.

- Scalability and Flexibility:

As your business grows, your accounting needs may change. Therefore, it's essential to select a cloud accounting solution that offers scalability and flexibility. Evaluate the provider's pricing plans and determine if they can accommodate your future growth without significant disruptions or additional costs. Additionally, consider the ease of adding new users, features, or modules as your business requirements evolve.

- Integration Capabilities:

Efficient accounting operations often require seamless integration with other business software, such as customer relationship management (CRM), inventory management, and payroll systems.

Evaluate the cloud accounting solution's compatibility and integration capabilities with other essential software applications used in your business. A well-integrated system reduces manual data entry, minimizes errors, and improves overall efficiency.

- User Experience and Interface:

User-friendliness is a crucial aspect of any accounting software. Evaluate the user interface and overall user experience of the cloud accounting solution. It should be intuitive, easy to navigate, and require minimal training for your accounting team. Conduct a trial or request a demo to get a firsthand experience of the platform and assess its usability.

- Customer Support and Training:

Efficient customer support is vital in case you encounter any issues or have questions regarding the accounting software. Research the provider's customer support options, including availability, response times, and channels of communication.

Additionally, inquire about the availability of training resources and materials to help your team get up to speed with the new system.

- Pricing and Cost Considerations:

Cost is a significant factor when evaluating cloud accounting solutions. Compare pricing plans and evaluate what features are included in each package. Consider whether the pricing is based on the number of users, transaction volume, or other factors.

Look for hidden costs, such as data storage fees or add-on features that may incur additional expenses. Choose a solution that aligns with your budget while offering the necessary functionality.

Preparing Data for the Migration

Migrating QuickBooks Desktop to the cloud can provide numerous benefits to businesses, including improved accessibility, scalability, and data security. However, before embarking on the migration process, it is essential to prepare the data to ensure a smooth and successful transition.

This guide outlines the key steps to prepare data for moving QuickBooks Desktop to the cloud.

- Backup Your Data:

Before starting the migration process, it is critical to create a backup of your QuickBooks Desktop data. This step ensures that you have a secure copy of your financial information in case of any unforeseen issues during the migration.

QuickBooks Desktop allows users to create backup files with the ".qbb" extension. Store the backup files in a safe location or on an external storage device.

- Clean-Up Data:

Take the opportunity to clean up your QuickBooks data before migrating to the cloud. Remove any duplicate or outdated records, reconcile bank accounts, and ensure all transactions are accurately recorded. Cleaning up the data will help improve the overall efficiency and accuracy of the cloud-based QuickBooks.

- Verify Data Integrity:

Perform a data verification process within QuickBooks Desktop to check for any data integrity issues. The verification process will identify and rectify any data corruption or inconsistencies that could potentially cause problems during migration.

Fixing these issues before migration will help ensure a seamless transition to the cloud.

- Evaluate Data Migration Tools:

If your chosen cloud accounting platform provides data migration tools, evaluate their capabilities and compatibility with QuickBooks Desktop. These tools can streamline the migration process and ensure that all your data is transferred accurately to the cloud.

- Export QuickBooks Data:

To move your QuickBooks Desktop data to the cloud accounting platform, you will need to export the data from QuickBooks. Depending on the cloud platform you have chosen, you may need to export data in a specific format.

Follow the instructions provided by the cloud platform or migration tools to export your QuickBooks data.

- Import Data to the Cloud:

Once you have exported your QuickBooks data, it's time to import it into the cloud accounting platform. This step may involve mapping the fields in QuickBooks to the corresponding fields in the cloud platform to ensure the data is correctly organized.

- Verify Data Accuracy:

After the data has been imported to the cloud accounting platform, verify its accuracy and completeness. Check that all transactions, accounts, and records have been migrated correctly. Perform a series of tests to ensure the data is accurate and matches the information on your QuickBooks Desktop.

- Train Users:

Provide training to your accounting team and other relevant users on how to use the new cloud-based QuickBooks system. Ensure they are familiar with the platform's features, navigation, and functionality. This will help your team quickly adapt to the new system and minimize any disruptions to your accounting processes.

- Monitor and Troubleshoot:

After the migration, closely monitor the cloud-based QuickBooks system to ensure everything is functioning correctly. Address any issues or discrepancies promptly to avoid any negative impacts on your business operations.

Training and Onboarding for the Cloud System

Training and onboarding are crucial steps in the successful adoption of a cloud accounting system.

Moving to the cloud brings significant changes to the way accounting and financial tasks are managed, and proper training ensures that users can efficiently navigate the new platform and utilize its features effectively. Here is a comprehensive guide on training and onboarding for the cloud system:

Assess Training Needs: Start by assessing the training needs of your team members. Identify the different user roles within your organization and determine the specific skills and knowledge they require to use the cloud accounting system effectively. This assessment will help tailor the training program to meet the needs of each user group.

Develop a Training Plan: Create a comprehensive training plan that outlines the objectives, content, and timeline of the training program. The plan should include details about the training format, such as in-person sessions, virtual training, webinars, or self-paced online courses.

It should also specify the training resources, materials, and tools that will be used during the training.

Choose the Right Training Method: Consider the learning preferences and accessibility of your team members when selecting the training method. Some employees may benefit from in-person training sessions or hands-on workshops, while others may prefer self-paced online courses.

Offering a variety of training methods ensures that all users can participate in the training effectively.

Provide Hands-On Practice: Hands-on practice is essential for users to become comfortable and proficient in using the cloud accounting system. Include practical exercises, case studies, and simulations in the training to allow users to apply their learning in a real-world context.

This approach will help build confidence and competence in using the new system.

Offer Role-Specific Training: Tailor the training to meet the specific needs of different user roles within your organization.

For example, finance managers may require advanced training on financial reporting and budgeting features, while accounts payable staff may need training on processing invoices and payments. Role-specific training ensures that users receive the knowledge and skills necessary for their job responsibilities.

Utilize Vendor Resources: Most cloud accounting providers offer training resources and support to help users get started with their platform. Take advantage of these vendor resources, such as webinars, tutorials, and knowledge bases, to supplement your training program.

These resources are often designed to provide specific guidance on using the cloud system efficiently.

Provide Ongoing Support: Offer ongoing support and assistance to users as they start using the cloud accounting system in their day-to-day tasks. Implement a support system, such as a helpdesk or a dedicated point of contact, to address any questions or issues that arise after the initial training.

Regular check-ins and refresher training sessions can also be beneficial for continuous learning and improvement.

Encourage Collaboration and Knowledge Sharing: Promote a culture of collaboration and knowledge sharing among your team members.

Encourage users to share tips, best practices, and insights they have gained from using the cloud system. This collaborative approach fosters a learning environment where users can learn from each other and continuously improve their skills.

Measure Training Effectiveness: Evaluate the effectiveness of your training program through feedback surveys, assessments, or performance metrics. Gather feedback from users to identify areas of improvement and address any gaps in knowledge or skills.

Monitoring training effectiveness allows you to make necessary adjustments to ensure successful onboarding.

Post-migration Tasks and Adjustments

After successfully migrating from QuickBooks Desktop to the cloud, there are several post-migration tasks and adjustments that you should consider to ensure a smooth transition and optimize your experience with the new cloud-based accounting system. Here are some key tasks to focus on:

- Data Validation and Reconciliation: Review and validate all data migrated to the cloud accounting system to ensure its accuracy. Perform data reconciliation to confirm that all transactions, balances, and reports are consistent with your previous QuickBooks Desktop records.

- User Access and Permissions: Set up user access and permissions in the cloud accounting system based on the roles and responsibilities of your team members. Ensure that users have appropriate access to the modules and features they require for their respective tasks.

- Customization and Configuration: Customize the cloud accounting system to match your business needs and preferences. Set up a chart of accounts, product or service lists, customer and vendor profiles, and other settings according to your specific requirements.

- Bank and Credit Card Connections: Establish bank and credit card connections within the cloud accounting system for seamless and automatic transaction imports. This feature streamlines the bank reconciliation process and ensures that your financial data is up-to-date.

- Integrations with Third-Party Apps: Explore and integrate with third-party apps that complement your cloud accounting system. Many cloud accounting platforms offer a range of integrations, such as payment gateways, CRM systems, or project management tools, to enhance efficiency and productivity.

- Automated Workflows: Leverage automation features in the cloud accounting system to streamline repetitive tasks and improve efficiency. Set up automated workflows for invoicing, billing, and other processes to reduce manual efforts.

- Budget and Cost Control: Review your budget and cost structure to ensure that the cloud accounting system aligns with your financial goals. Evaluate the cost-effectiveness of the cloud solution compared to QuickBooks Desktop.

- Collaboration and Communication: Encourage collaboration and communication among your team members using the cloud accounting system. Utilize features like user comments, audit logs, and real-time access to promote effective teamwork.

- Feedback and Continuous Improvement: Gather feedback from your team members about their experience with the new cloud-based accounting system. Use this feedback to identify areas of improvement and make necessary adjustments for better performance and user satisfaction.

Integrating Cloud-Based Solutions With Other Tools

Integrating cloud-based solutions with other tools is essential to create a seamless and efficient workflow across various business processes. The integration allows data to flow freely between applications, eliminating manual data entry and reducing the risk of errors.

Here are the key steps to successfully integrate cloud-based solutions with other tools:

- Assess Integration Needs: Begin by assessing your organization's specific integration requirements. Identify the tools and applications you want to integrate with the cloud-based solution and determine the data and processes that need to be synchronized between them.

- Choose Compatible Tools: Select tools and applications that are compatible with the cloud-based solution. Look for pre-built integrations or application programming interfaces (APIs) that allow for easy data exchange and communication.

- Use API Integration: Application Programming Interface (API) is a set of rules and protocols that enable different software applications to communicate with each other. Many cloud-based solutions offer APIs that allow seamless integration with other software. Work with your IT team or a developer to implement API integration between your cloud-based solution and other tools.

- Data Mapping and Transformation: Ensure that data is mapped correctly between the integrated tools. Data mapping involves matching fields in one application with corresponding fields in another to ensure that data is accurately transferred. If needed, perform data transformation to convert data formats and structures to match the requirements of the target tool.

- Evaluate and Optimize: Regularly evaluate the performance of the integrated tools and gather feedback from users. Use this feedback to optimize the integration and make necessary adjustments for better efficiency and productivity.

- Stay Updated: Keep abreast of updates and changes to both the cloud-based solution and the integrated tools. Updates to either system may impact the integration, so it's essential to stay informed and make any necessary adjustments promptly.

By following these steps, you can successfully integrate your cloud-based solution with other tools and create a cohesive and productive digital ecosystem for your business. The integration will streamline your workflows, enhance data accuracy, and improve collaboration across your organization.

Cost Comparison: Quickbooks Desktop vs. Cloud

When comparing the costs of QuickBooks Desktop and cloud-based accounting solutions, there are several factors to consider. Each option has its unique pricing structure and associated costs.

Let's break down the cost comparison between QuickBooks Desktop and cloud-based solutions:

Initial Investment:

- QuickBooks Desktop: Typically, QuickBooks Desktop requires a one-time upfront payment for the software license. The cost may vary based on the edition and number of users.

- Cloud-based Solution: Cloud accounting solutions generally operate on a subscription-based model, where you pay a monthly or annual fee. The subscription cost usually covers software updates, maintenance, and customer support.

Hardware and Infrastructure:

- QuickBooks Desktop: You may need to invest in a dedicated server or robust hardware to host QuickBooks Desktop if you have multiple users accessing it simultaneously.

- Cloud-based Solution: Cloud-based solutions eliminate the need for local server hardware, reducing upfront infrastructure costs. All data is stored securely on cloud servers, and you access the software through web browsers or dedicated apps.

IT and Maintenance:

- QuickBooks Desktop: With QuickBooks Desktop, you might need dedicated IT support for server maintenance, data backups, and software updates.

- Cloud-based Solution: Cloud accounting solutions handle all IT maintenance, data backups, and software updates on their end, reducing your IT overhead.

Accessibility and Mobility:

- QuickBooks Desktop: QuickBooks Desktop is limited to the devices where the software is installed, making it less flexible for remote work and collaboration.

- Cloud-based Solution: Cloud solutions offer accessibility from any internet-enabled device, providing real-time access to financial data and enabling remote work.

Scalability:

- QuickBooks Desktop: Scaling QuickBooks Desktop might require additional software licenses and hardware upgrades, resulting in higher costs.

- Cloud-based Solution: Cloud solutions offer scalability without the need for significant hardware investments. You can easily adjust your subscription plan based on your changing business needs.

Data Security:

- QuickBooks Desktop: The responsibility of data security, including backups and disaster recovery, lies with your organization.

- Cloud-based Solution: Cloud providers implement robust security measures to protect your data, including encryption, firewalls, and multi-factor authentication.

Additional Features:

- QuickBooks Desktop: Some advanced features might require add-ons or upgrade to a higher edition, incurring extra costs.

- Cloud-based Solution: Cloud accounting platforms often offer various add-ons and integrations as part of their ecosystem, simplifying access to additional features.

It's important to evaluate your business needs, budget, and long-term goals when comparing the costs of QuickBooks Desktop and cloud-based solutions. While QuickBooks Desktop might have a lower upfront cost, cloud-based solutions offer several advantages, such as scalability, accessibility, and reduced IT burden.

The total cost of ownership for cloud-based solutions may be more favorable for businesses looking to stay agile, collaborate efficiently, and leverage the latest advancements in accounting technology.

Common Challenges and How to Address Them

Moving from QuickBooks Desktop to a cloud-based accounting solution can bring numerous benefits, but it may also present certain challenges. Here are some common challenges and strategies to address them:

Data Migration Challenges

One of the primary concerns when moving to the cloud is data migration. QuickBooks Desktop data needs to be transferred to the cloud-based accounting solution accurately and securely. Challenges may include data formatting discrepancies, missing information, and potential data corruption during the migration.

Addressing Data Migration Challenges:

- Evaluate the cloud-based solution's data migration capabilities and tools. Many cloud providers offer specific data migration services or tools designed to streamline the process.

- Perform thorough data validation before and after the migration to ensure that all financial data is accurately transferred to the cloud. This process helps identify and rectify any data discrepancies or errors.

- Back up QuickBooks Desktop data before migration to prevent any irreversible data loss. This step acts as a safety net in case any issues arise during migration.

- Train employees on the proper use of the cloud-based solution to maintain data integrity and consistency during and after migration.

Learning Curve for Employees

Employees who are accustomed to using QuickBooks Desktop may encounter a learning curve when transitioning to a new cloud-based accounting system. This challenge can lead to a temporary dip in productivity and efficiency as users adapt to the new software.

Addressing the Learning Curve Challenge:

- Provide comprehensive training and resources to help employees become familiar with the new cloud-based accounting software. Offer hands-on training sessions and access to online tutorials and support materials.

- Encourage employees to ask questions and seek assistance from designated experts or support teams to ease the learning process.

- Consider conducting a phased transition where employees are gradually introduced to the new system, allowing them time to adjust without overwhelming them with changes.

- Promote a positive and supportive work culture during the transition, emphasizing the benefits of the new system and how it aligns with the organization's growth objectives.

Integration with Third-Party Applications

QuickBooks Desktop may have been integrated with various desktop applications that facilitate specific business processes. When transitioning to a cloud-based accounting solution, businesses need to ensure that these integrations are available or replicated in the new system.

Addressing Integration Challenges:

- Research and choose a cloud-based accounting solution that offers a wide range of integrations with other commonly used business applications.

- Collaborate with the cloud provider's support team or technical experts to ensure a smooth integration of existing applications with the cloud-based accounting software.

- Conduct thorough testing of integrations to verify that data is seamlessly synchronized between the cloud-based solution and other applications.

- Plan for potential changes in workflow or processes due to differences in integration capabilities between QuickBooks Desktop and the cloud-based system.

Internet Connectivity Dependence

Cloud-based accounting relies on stable internet connectivity. Any disruptions in internet service can hinder access to financial data and accounting operations.

Addressing Internet Connectivity Challenges:

- Evaluate the reliability and speed of the organization's internet connection. Consider upgrading to a higher-speed internet plan or having a backup internet connection in case of outages.

- Implement a robust network infrastructure with redundant systems to minimize the risk of internet interruptions.

- Work with the cloud provider to understand their offline capabilities and whether certain features are available in offline mode.

Security Concerns

Businesses may have reservations about data security and privacy when transitioning from an on-premises system to the cloud. Data breaches or unauthorized access to financial information are potential concerns.

Addressing Security Challenges:

- Choose a reputable cloud service provider with a proven track record in data security and privacy.

- Ensure that the cloud provider employs strong encryption methods to safeguard data during transmission and storage.

- Implement multi-factor authentication to add an extra layer of security to user logins.

- Regularly monitor user access and permissions to prevent unauthorized access to sensitive financial data.

- Train employees on best practices for data security and the importance of safeguarding login credentials.

Customization and Reporting Limitations

QuickBooks Desktop offers extensive customization options, allowing businesses to tailor the software to their specific needs. When moving to a cloud-based system, businesses may find that certain customization and reporting features are limited.

Addressing Customization and Reporting Challenges:

- Evaluate the customization and reporting features offered by the cloud-based accounting solution to ensure it meets the organization's specific requirements.

- Work with the cloud provider's support team to explore alternative solutions or workarounds to replicate the desired customization.

- Consider the trade-offs between customization and other benefits provided by the cloud-based system, such as real-time collaboration and automated processes.

Future-Proofing Your Accounting With Cloud-Based Solutions

As the business landscape continues to evolve at a rapid pace, organizations are embracing digital transformation to stay competitive and future-proof their operations.

Cloud-based solutions, particularly in the realm of accounting, have emerged as a game-changer for businesses seeking flexibility, scalability, and enhanced efficiency.

Facilitating Collaborative Workflows

Collaboration is the key to success in the modern business landscape. Cloud-based accounting solutions enable real-time collaboration among team members, regardless of their physical location.

With shared access to financial data, accountants, managers, and executives can collaborate seamlessly, leading to increased efficiency and accuracy in decision-making. The elimination of data silos fosters a collaborative work culture and promotes cross-functional communication.

Automation for Streamlined Processes

Cloud-based accounting solutions come equipped with robust automation capabilities. Mundane and repetitive tasks, such as data entry, invoice processing, and report generation, can be automated, freeing up valuable time for finance professionals to focus on strategic initiatives.

Automation not only boosts productivity but also minimizes the risk of human errors, ensuring accuracy in financial reporting and analysis.

Mobile Accessibility for On-The-Go Management

In an increasingly mobile-centric world, cloud-based accounting solutions offer mobile applications that enable users to access critical financial information on the go.

Whether it's reviewing financial reports during business trips or approving invoices while away from the office, mobile accessibility empowers decision-makers to stay connected and informed at all times.

This level of agility is crucial for business leaders who require real-time insights to make informed decisions.

Cost-Effectiveness and Reduced IT Overhead

Maintaining on-premises accounting software often incurs significant upfront costs and ongoing IT expenses. Cloud-based solutions, on the other hand, typically follow a subscription-based model, providing predictable and manageable costs.

Additionally, cloud systems eliminate the need for hardware upgrades and maintenance, further reducing IT overhead. For smaller businesses and startups, cloud solutions offer a cost-effective alternative to traditional accounting software.

AI and Automation Capabilities

As artificial intelligence (AI) continues to advance, cloud-based accounting solutions are incorporating AI and machine learning capabilities. AI-powered features can automatically categorize transactions, generate financial reports, and identify patterns in financial data.

Automation streamlines repetitive tasks and enhances data accuracy, making the accounting process more efficient and error-free.

How Deskera Can Assist You?

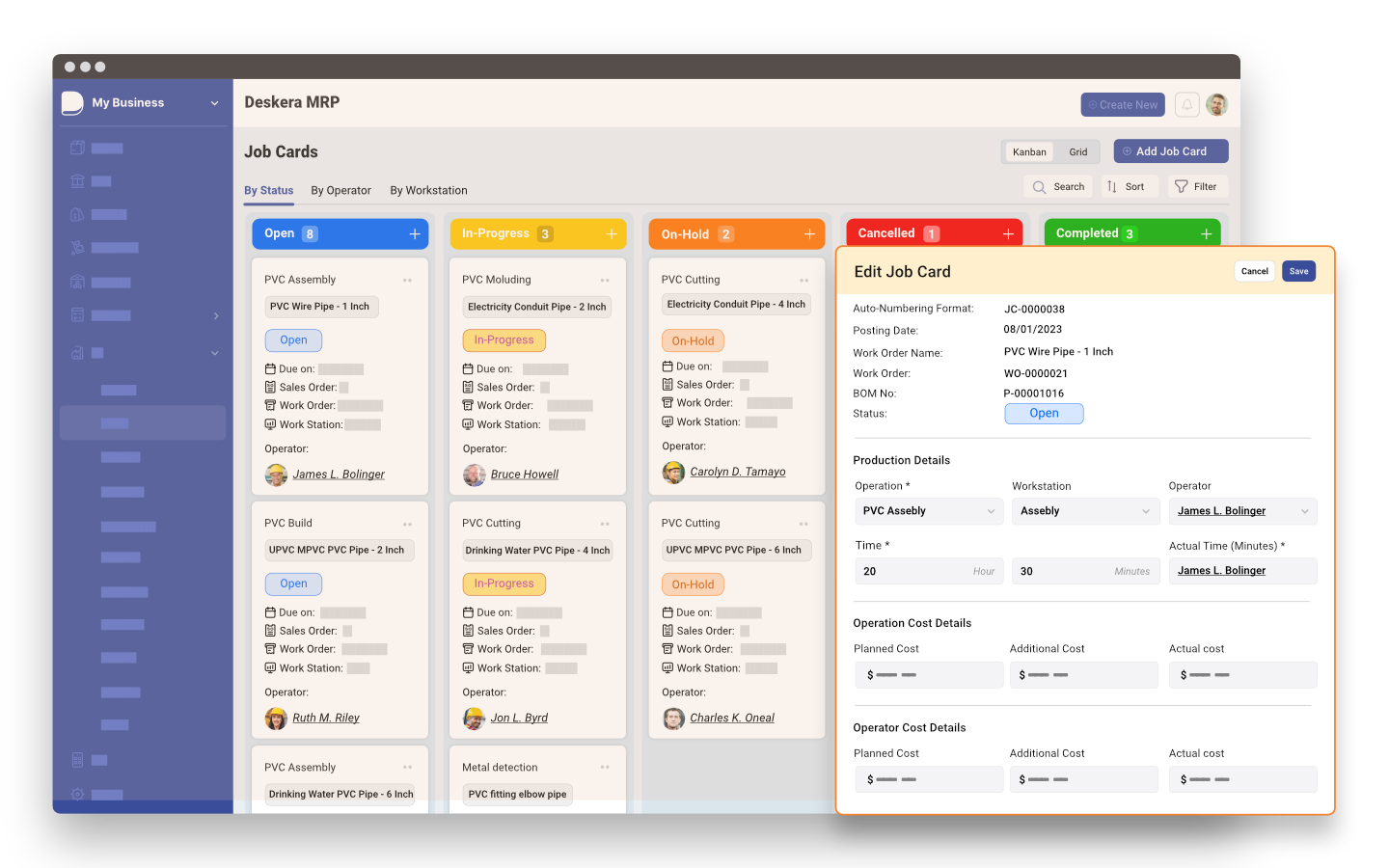

Deskera ERP and MRP system can help you:

- Manage production plans

- Maintain Bill of Materials

- Generate detailed reports

- Create a custom dashboard

Deskera ERP is a comprehensive system that allows you to maintain inventory, manage suppliers, and track supply chain activity in real time, as well as streamline a variety of other corporate operations.

Deskera MRP allows you to closely monitor the manufacturing process. From the bill of materials to the production planning features, the solution helps you stay on top of your game and keep your company's competitive edge.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

Migrating from QuickBooks Desktop to the cloud is a transformative step that offers businesses a plethora of benefits, efficiency gains, and enhanced capabilities in financial management.

This article has explored the various aspects of the migration process, the advantages of cloud-based accounting solutions, and the considerations businesses need to take into account when making this transition.

The shift towards cloud-based solutions is driven by the need for real-time data accessibility, remote collaboration, and scalability. Cloud platforms offer businesses the flexibility and mobility required in today's dynamic business environment, allowing them to adapt quickly to changing market conditions.

Cloud platforms provide automatic data backups, enhanced data security, and remote access to financial information, ensuring critical data is protected and accessible from anywhere with an internet connection. These features offer businesses peace of mind and facilitate smoother operations.

Cloud-based accounting solutions employ robust security measures, including data encryption, firewalls, and multi-factor authentication, to safeguard sensitive financial information. These security features address the concerns some businesses may have about moving their financial data to the cloud.

Moreover, we explored the potential challenges and pitfalls that businesses may encounter during the migration process. Data migration, compatibility issues, and change management are some of the challenges that need to be addressed proactively.

Businesses can mitigate these challenges by conducting thorough testing, seeking expert guidance, and involving key stakeholders in the process.

Key Takeaways

- Integration capabilities of cloud platforms streamline workflows by allowing seamless data flow between different business systems, reducing manual data entry, and improving operational efficiency.

- Cloud-based solutions often operate on a subscription model, providing businesses with predictable and manageable costs, eliminating large upfront software investments and periodic upgrades.

- Data security is a priority during the migration process, and cloud-based accounting solutions employ robust security measures, including data encryption and multi-factor authentication.

- Proper planning and preparation are crucial for a successful migration, requiring businesses to analyze their current accounting processes, data, and IT infrastructure.

- Training and user adoption play a vital role in ensuring a seamless transition, with employees needing to be familiar with the new cloud-based accounting software to maximize its benefits.

- Potential challenges during the migration process, such as data migration and compatibility issues, can be mitigated through thorough testing and seeking expert guidance.

- Scalability and growth are facilitated with cloud-based accounting solutions, accommodating increased transaction volumes, additional users, and new functionalities without extensive hardware upgrades.

- Partnering with experienced cloud service providers ensures a well-executed and successful migration, with expert guidance and support throughout the process.

- Businesses can benefit from enhanced mobility, allowing employees to access financial data and perform accounting tasks from various devices with internet access.

- Cloud-based accounting solutions offer automatic software updates, ensuring businesses always have access to the latest features and improvements without manual installations.

Related Articles