IRS defines depreciation as a technique of income tax deduction that aids companies recover the asset costs. Depreciation is the amount the company allocates each year or period for the use of the asset. Racehorses, automobiles, office furniture are some of the examples of the assets that undergo MACRS depreciation.

In this article:

- What is Depreciation?

- What is the MACRS method of Depreciation?

- How Does MACRS work?

- MACRS Depreciation Calculation Schedule

- Types of MACRS Depreciation

- MACRS Formula

- Classification of Property Under GDS

- Example of MACRS

- How can Deskera help your Accounting and Business?

- Key Takeaways

What is Depreciation?

Depreciation is the assessment of the drop in the value of an asset due to continuous use over its useful life. The values received after depreciating the asset are called depreciation expenses. The companies earn revenue by utilizing the assets while also expensing the cost of using the asset every year.

Depreciation is important as it allows the companies to recognize the true value of the asset and also work around the tax deductibles accordingly.

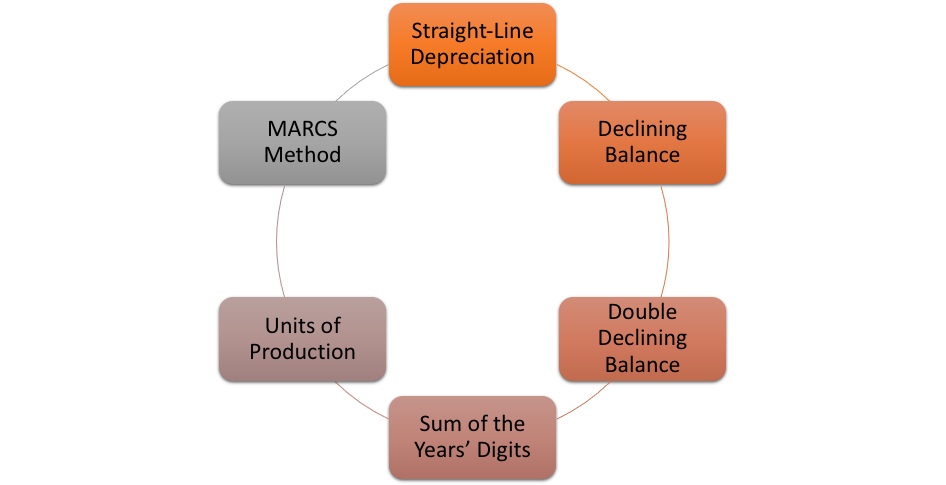

There are various methods of depreciation adopted industry wide to calculate depreciation. These are:

- Straight-line depreciation

- Declining Balance

- Double Declining Balance

- Sum of the Years’ Digits

- Units of production

- MACRS method

What is the MACRS method of Depreciation?

The MACRS or the Modified Accelerated Cost Recovery System places fixed assets into classes that have set devaluation periods. It is a depreciation method used for tax purposes in the U.S. As any other depreciation method, it allows to expense a part of the asset value over its useful life.

The IRS- International Revenue Service has designated guidelines indicating the assets that are eligible to be depreciated through MACRS. It allows a faster depreciation of the assets in the earlier years of its use and slows down in the later years.

How Does MACRS work?

The IRS describes depreciation as an amount for a tax deduction that the companies can use to recover the price of fixed assets. From the tax perspective, MACRS fairs better than a lot of other methods as it is more pragmatic in its approach. As most assets are most productive in the initial years and tend to deteriorate in the later years, using MACRS could be beneficial for calculating depreciation. The method aims at speeding up the tax deductions to improve your business capital investments.

However, the MACRS method is not advised for audited financial statements as the method does not take into account the salvage value and the asset’s useful life. The GAAP does not permit the use of MACRS and therefore, it is not used in the preparation of the balance sheet.

|

B = $400,000 |

|||

|

Year (t) |

MACRS rate (dt) |

Depreciation, (Dt = Rate X B) |

Book Value, (BVt = BVt-1 - Dt) |

|

0 |

|

|

$ 400,000 |

|

1 |

0.3333 |

$ 133,320 |

$ 266,680 |

|

2 |

0.4445 |

$ 177,800 |

$ 88,880 |

|

3 |

0.1481 |

$ 59,240 |

$ 29,640 |

|

4 |

0.0741 |

$ 29,640 |

$ - |

|

TOTAL |

|

$ 400,000 |

|

MACRS Depreciation Calculation Schedule

It is important that the businesses select the right depreciation rate and for that, they may follow one of the MACRS schedules as presented here:

Classifying Asset Property

This schedule requires the classification of the asset property based on the number of years the asset might be used. For example, a computer system is classified as 5-year property, residential property is categorized as a 27.5-year property whereas a non-residential property is under a 39-year property category.

Selecting the Right Depreciation method

For maximizing the tax savings, it is beneficial to go with a higher depreciation rate in the initial years. This is especially true for the small businesses that aim for a higher depreciation in the early years.

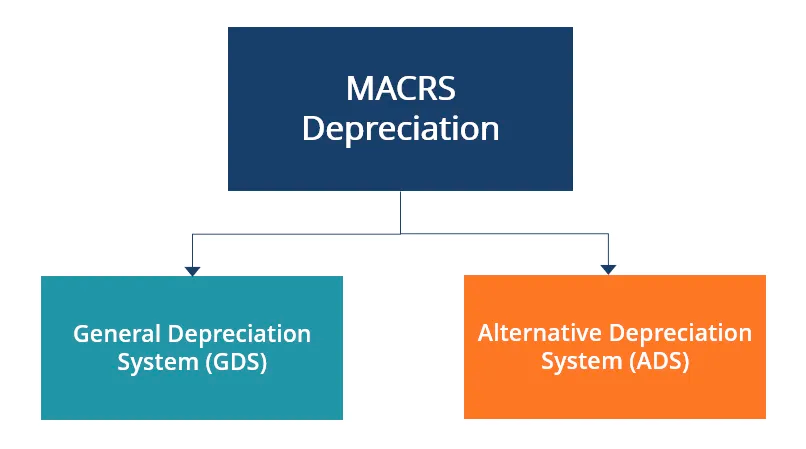

Fulfilling this purpose, there are two types of depreciation systems known as the GDS- General Depreciation System and the ADS- Alternative Depreciation System. GDS is more commonly used unless explicitly specified.

Time When the Asset was purchased and disposed of service

This principle considers the complete life of an asset from its start to the end. It focuses on the number of months for which the depreciation can be claimed in the period when the asset’s utility began and the period when its utility ends.

Here, you may opt for one of the following conventions:

Types of MACRS Depreciation

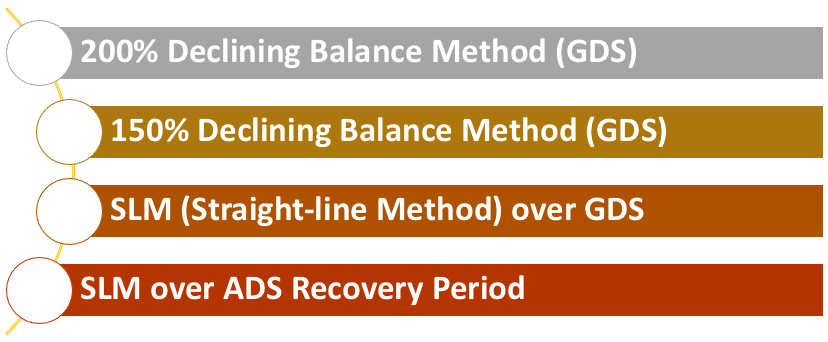

As guided by IRS, there are four methods under MACRS depreciation. One of them is placed under the ADS system and the other three are covered under GDS.

Let’s look at them one by one.

200% Declining Balance Method (GDS)

This method involves a calculation that considers the depreciation rate that is double the straight-line depreciation rate. It also facilitates the highest amount of tax deductibles in the initial years and switches to the straight-line method when that method offers a higher or an equal deduction.

150% Declining Balance Method (GDS)

This method accelerates the straight-line depreciation rate by 150%. Like the 200% method, this one also reverts to the straight-line depreciation when it provides a higher or equivalent deduction.

SLM (Straight-line Method) over GDS

This method refers to a deduction system where the same amount is depreciated every year except the first and the last year.

SLM over ADS Recovery Period

Although similar to the SLM over GDS method, this one is applicable only for properties/ assets that have been used for only 50% of the scheduled time for the business.

MACRS Formula

Now, that we know the concept, let’s move on to the formula to calculate depreciation using MACRS.

Here are the formulas you may use:

And

Classification of Property Under GDS

IRS provides the classifications of the various properties which the taxpayers can use to calculate the depreciation. Some of the examples are as presented here:

It must be noted that MACRS does not apply to intangible assets like audio recordings, films and, videotapes.

Example of MACRS

Say, a company purchases agricultural equipment worth $50,000 in 2015. We assume the half-year convention and begin our calculations using the MACRS depreciation table.

Agricultural equipment comes under the 7-year property and from the table, we use the 200% declining balance depreciation. With this information at hand, we calculate the depreciation for year 1 i.e. 2015 as follows:

$50,000 x (1/7) x 200% x 0.5 = $7,142

Now, the depreciation value for the subsequent year (2016, in this case) is calculated as:

$50,000 - $7,142 x 1/7 x 200% = $47,959

How can Deskera help your Accounting and Business?

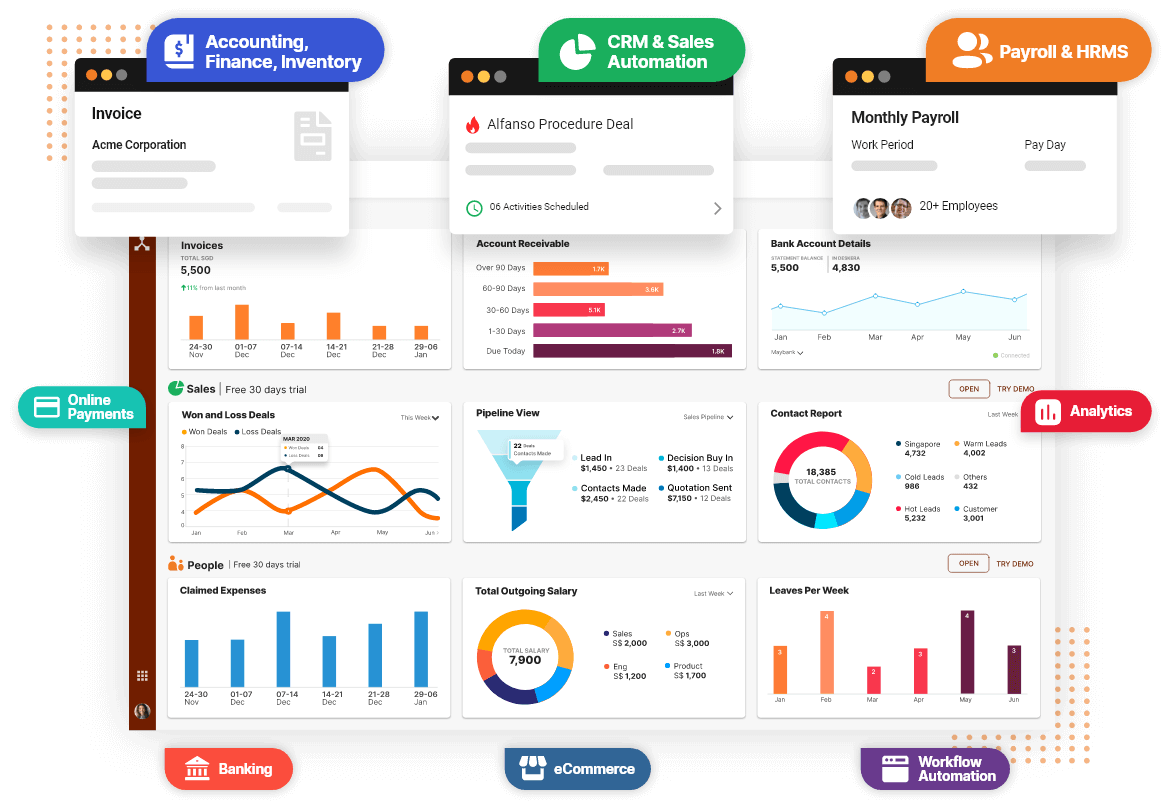

As a business owner, you can invest in accounting softwares that can help you keep track of your accumulated depreciation, salvage value, journal entries, balance sheet, inventory and production costs.A successful business needs an efficient financing process that meets its specific needs.

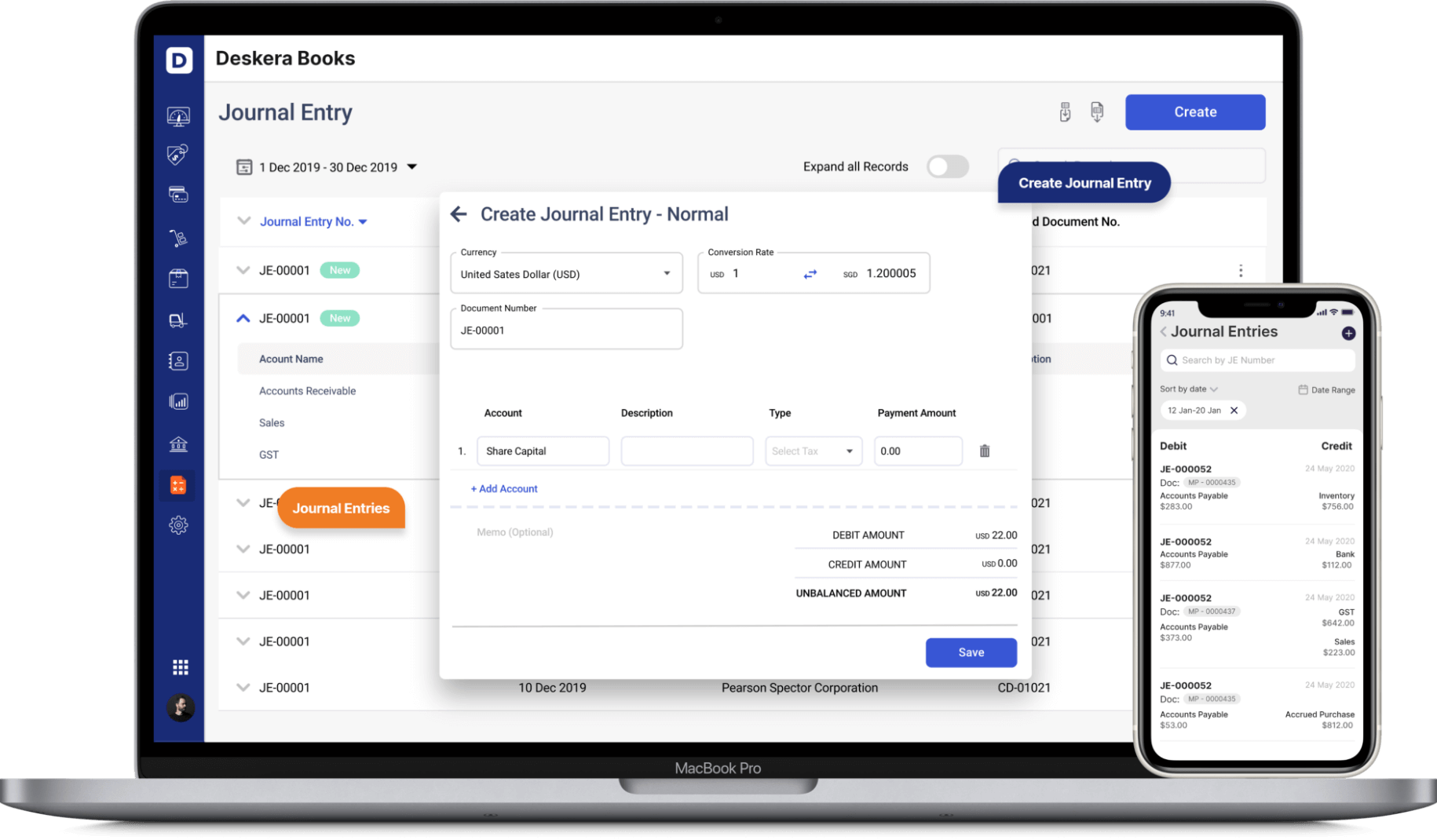

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

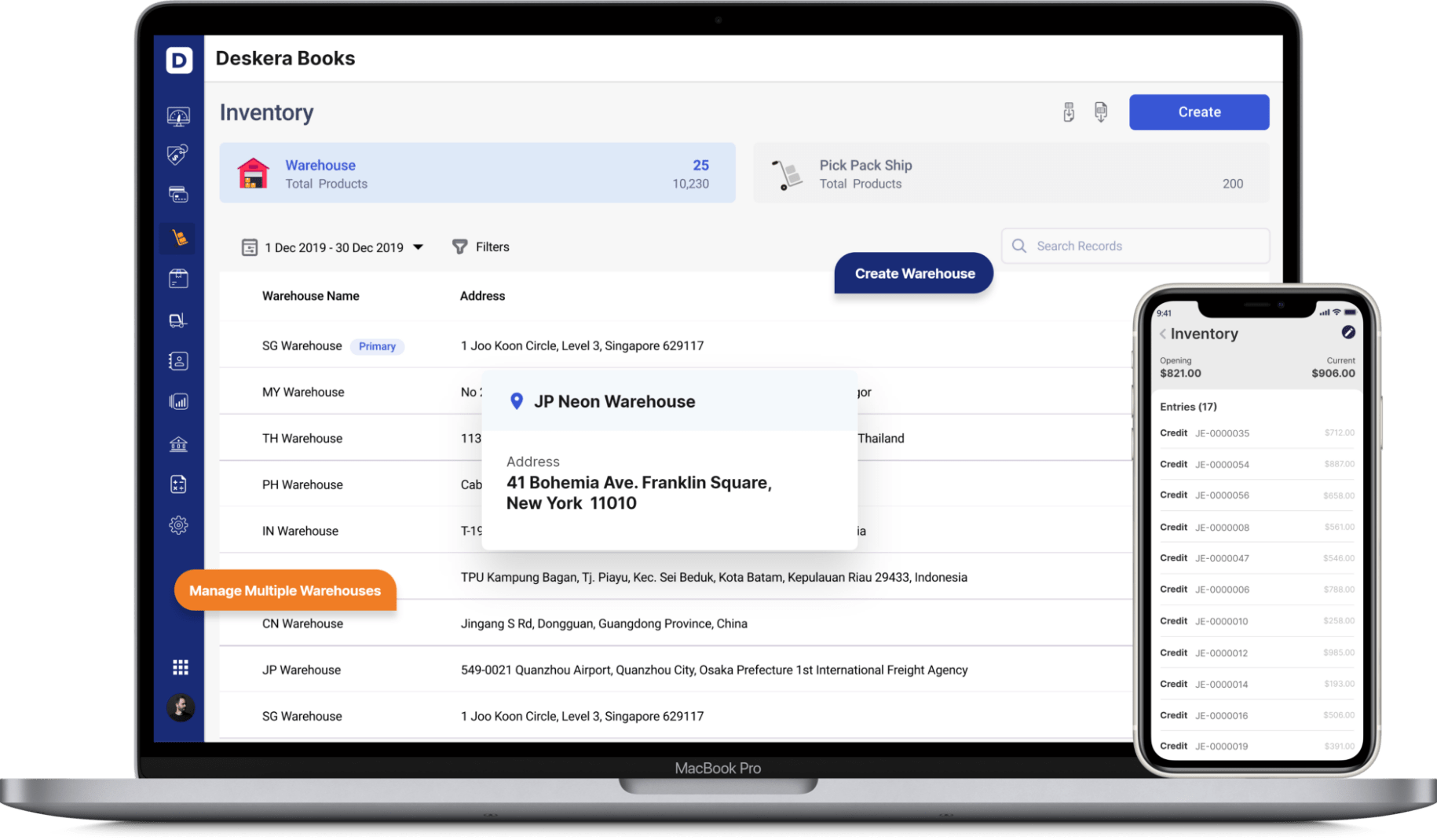

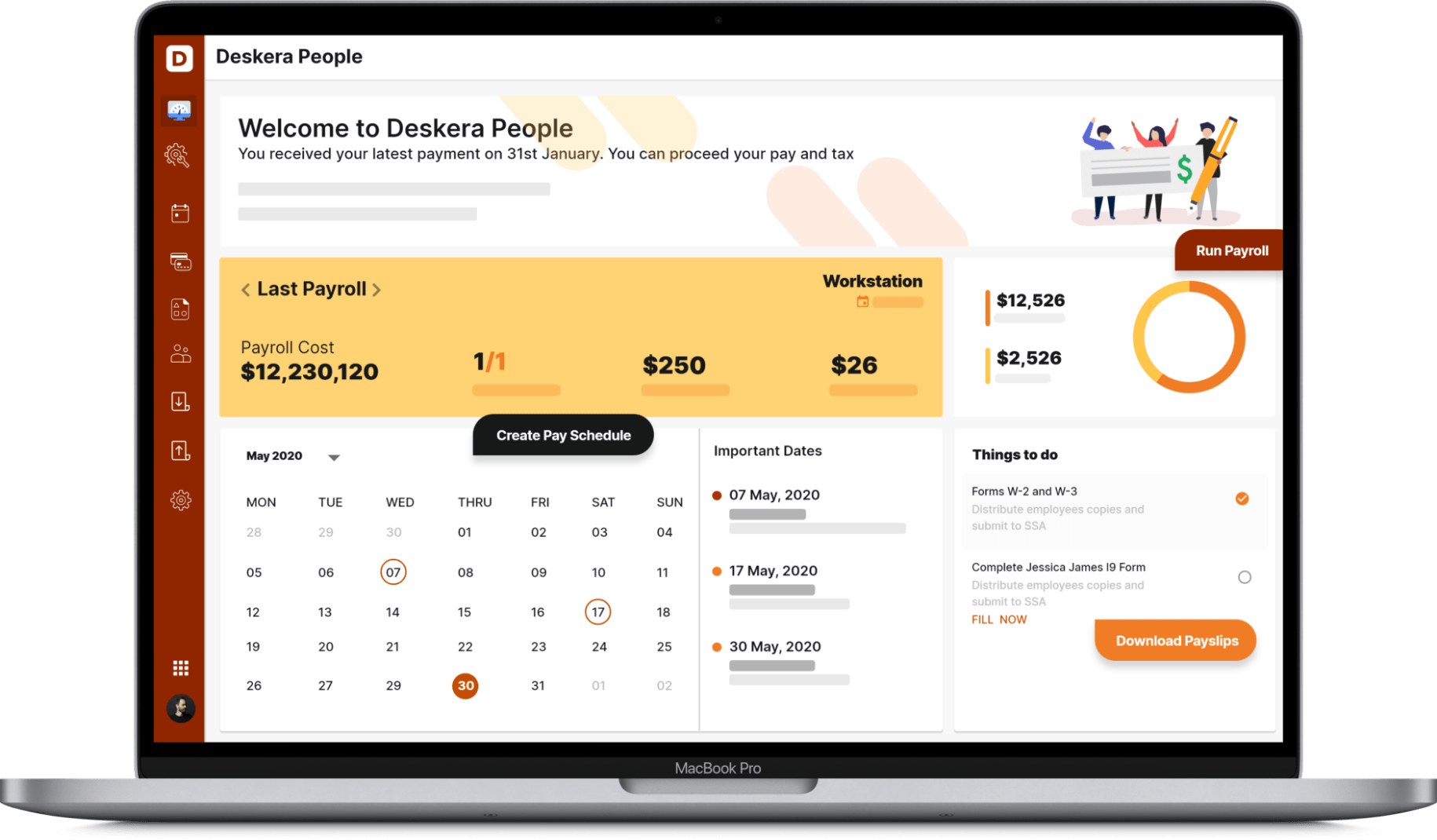

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

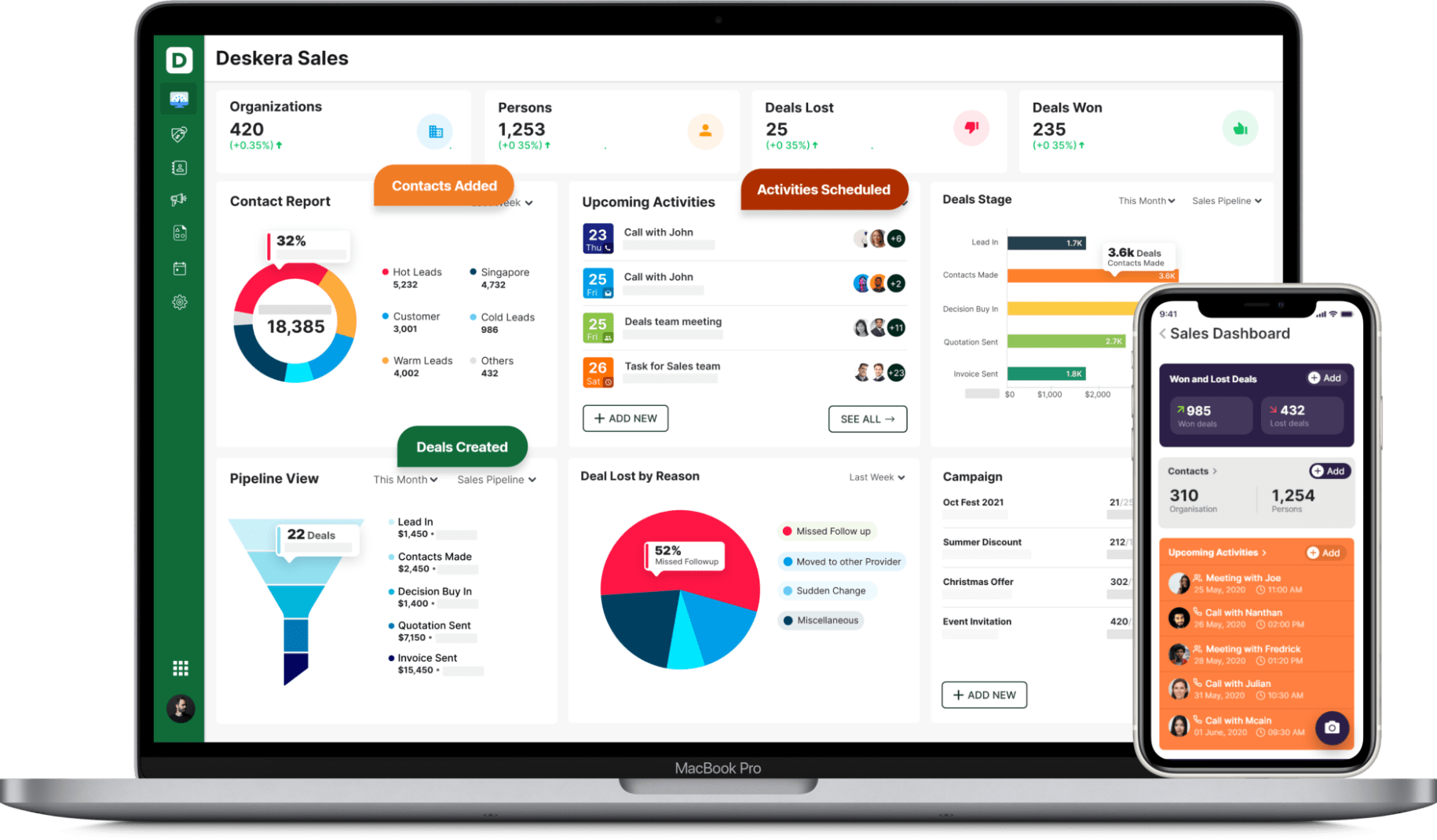

With Deksera CRM you can manage contact and deal management, sales pipelines, email campaigns, customer support, etc. You can manage both sales and support from one single platform. You can generate leads for your business by creating email campaigns and view performance with detailed analytics on open rates and click-through rates (CTR).

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Key Takeaways

Here’s a quick look at all that we saw in this article:

- Depreciation helps deduce the true value of the asset, which in turn helps companies assess their earnings and the corresponding tax deductibles.

- MACRS is a depreciation method most applicable in cases where the assets would be used up more in the initial years of their life.

- MACRS provides for a practical approach to depreciate assets as most of the assets are best-productive in their initial years. The company can gain from recording a higher depreciation in these years and thereby, incur a lower tax liability.

- MACRS is not recommended and permitted by GAAP as it does not follow the matching principle and does not consider the useful life of the asset.

Related Links