Not all assets can be easily liquidated. Usually, high-value fixed assets such as buildings, equipment, or vehicles take months and a lot of convincing to be sold and then converted into cash.

That’s why, when it comes to measuring a business’ financial security, and the ability to access money on short notice, companies take advantage of a measurement known as liquid net worth.

Liquid net worth is the total of remaining cash and cash equivalents after liabilities have been deducted from liquid assets.

In this guide, we’ll be explaining in depth what liquid net worth means, why it’s important, how it can be calculated, and tips on how you can increase liquid net worth for your small business accounting.

Read along to learn about:

- What Is Liquid Net Worth?

- Why Is Liquid Net Worth Important?

- How to Calculate Liquid Net Worth?

- Liquid Net Worth Example

- Tips on Increasing Liquid Net Worth

- Liquid Net Worth FAQ

What Is Liquid Net Worth?

Liquid net worth is the remaining value of liquid assets, after liabilities and financial obligations have been deducted. Or in simpler terms, it’s the worth of your estate if it was all liquidated.

Let’s break down this definition by explaining each component one by one.

Liquid assets are those assets that can easily be converted into cash. They’re also often referred to as cash, and cash equivalents. Examples of liquid assets include cash, money market accounts, checking accounts, savings accounts, accounts receivable, stocks, funds, bonds, and any other securities that can be quickly sold and turned to cash.

Liabilities and other financial obligations cover everything a business owes, such as loans, accounts payable, mortgages, bonds, accrued expenses, wages payable, and so on.

A company’s liquid net worth is found by subtracting the total sum of these liabilities, from the total sum of liquid assets.

People often confuse liquid net worth with net worth, as the two are very similar.

However, these financial terms aren’t synonymous. Your net worth is the total wealth you have, which includes both liquid and non-liquid assets. Whereas liquid net worth only includes liquid assets which you can access easily and at a short notice.

Liquid vs Non-Liquid Assets

We classify assets into two main categories: liquid and non-liquid.

A liquid asset can be easily and fairly converted into cash, while a non-liquid asset can’t. A building, or a house, for instance, is a non-liquid asset because it might take from months to years to sell it.

Other common examples of non-liquid assets include:

- Land

- Real estate investments

- Equipment

- Art

- Vehicles

- Jewelry

- Collectibles

Assets such as stock, on the other hand, are considered liquid, because they can be sold and converted into cash within a few days.

The most typical liquid assets used in business include:

- Cash in hand

- Cash in bank

- Cash equivalents

- Accrued income

- Promissory notes

- Government bonds

- Marketable securities

Why Is Liquid Net Worth Important?

The most important reason why you should care about your liquid net worth is that it represents the number of funds you can access under short notice. Liquid net worth is based on what’s available to you right now. It’s not what you would own if you took extreme action and liquidated every asset, but the amount of money you can sensibly expect to hold under a short period of time.

So, should you face an immediate, unexpected need for money such as a medical crisis, equipment malfunction, lawsuit, or business opportunity, your liquid net worth is where you’ll confide in. Thus, the measurement is a reflection of your business’s financial security and ability to react to challenges and opportunities. Even if there isn’t any immediate emergency, calculating your liquid net worth can help you feel confident about your cash flow and avoid financial stress.

How to Calculate Liquid Net Worth?

As we’ve briefly mentioned, calculating liquid net worth is quite simple. All you have to do is subtract liabilities from your liquid assets, as shown in the formula below:

Liquid Net Worth = Liquid Assets - Liabilities

That’s all there is to it. The specific liquid assets and liabilities you’ll use depend entirely on your business operations and financial activity.

Liquid Net Worth Example

Assume this is the financial situation of Company XYZ:

- Cash: $150,000

- Savings account: $60,000

- Checking account: $40,000

- Stock and bond investments: $250,000

- Equipment: $75,000

- Credit card debt: $5,000

- Accounts payable: $60,000

- Mortgage: $100,000

- Salary: $100,000

If the business wanted to calculate its net worth, it would need to subtract its total assets from total liabilities.

Total assets include cash, savings account, checking account, stock and bond investments, and equipment, so:

$150,000 (Cash)

+$60,000 (Savings account)

+$40,000 (Checking account)

+$250,000 (Stock and bond investments)

+$75,000 (Equipment)

= $575, 000 in Total Assets

Total liabilities include credit card debt, accounts payable, and mortgage, so:

$5,000 (Credit card debt)

+$60,000 (Accounts payable)

+$100,000 (Mortgage)

+$100,000 (Salaries)

= $265,000 in Total Liabilities

Net worth would equal $575,000 minus $265,000 = $310,000.

Liquid net worth is similar, except you don’t include non-liquid assets. Your liquid assets include cash, savings account, checking account, and stock and bond investments, which equal to:

$150,000 (Cash)

+$60,000 (Savings account)

+$40,000 (Checking account)

+$250,000 (Stock and bond investments)

= $500,000

Liabilities remain the same, so liquid net worth amounts to $500,000 - $265,000 = $235,000.

As you probably notice, in this case, your net worth of $310,000 is significantly higher than your liquid net worth of $235,000. The reason for this is because the equipment isn’t a liquid asset, and thus, your liquid net worth amounts to a lower value.

Tips on Increasing Liquid Net Worth

#1: Review Your Liabilities

Consider making recurring reviews on your liabilities, to check whether some can be reduced or eliminated altogether. The less debt you have, the higher your net worth will be.

If you want to learn about how you can verify and examine your business’ financial records, head over to our guide on auditing.

#2: Evaluate Your Assets

It could happen that you don’t know the exact value of your assets, or how much that figure is going to change. So, do regular evaluations and try not to leave any out when calculating your liquid net worth.

#3: Cut Down on Your Business Expenses

The fewer funds you spend, the more net worth you can accrue. If you haven't done a budget review in a while, take a look at your current business expenses and see if there are any areas where you can save money. This can include bigger things, like selling one of your vehicles if you have multiple car payments, as well as smaller things like skipping business lunches or unsubscribing to newspapers you don't read anymore.

#4: Prepare Budgets

As a popular saying goes, the best way to predict the future is by creating it. If you plan ahead and create realistic budgets, keeping expenses in line will become much easier. And thus, you’ll have fewer bills to pay and increase the value of your liquid net worth.

#5: Use Accounting Software

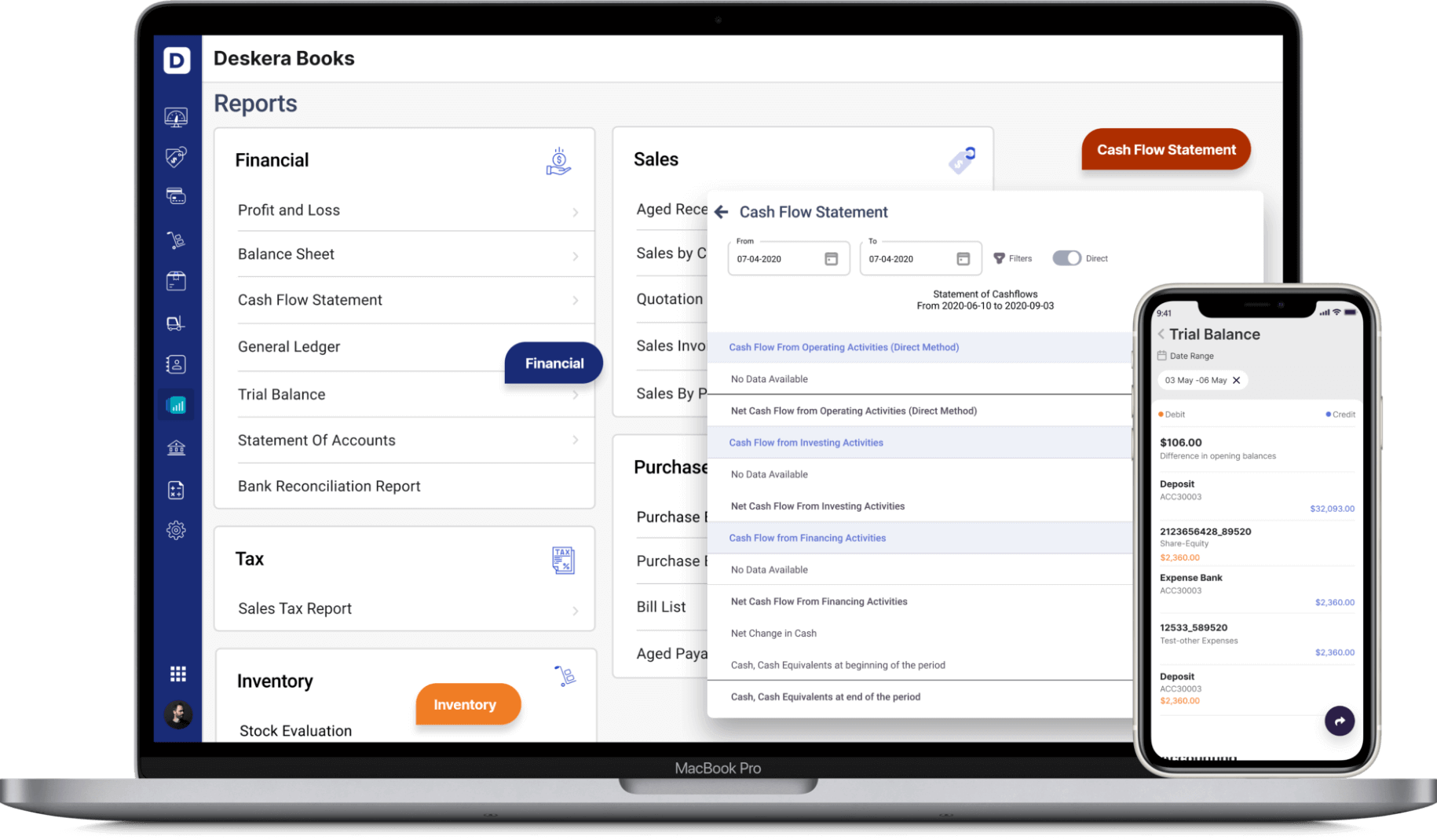

With cloud-based accounting software like Deskera, you can automate tons of repetitive tasks such as invoicing, financial reporting, recurring payments, budgeting, inventory tracking, and more. This automation allows you to save up time, as well as all of the employee costs that it would take to manually go through each one.

At the same time, Deskera helps you with your credit control. The platform allows accurate and quick access to information on overdue accounts and notifies you every time your outstanding invoices are close to their due time.

These features, and many more, help you better control our business’s financial health, spend less, find improvement possibilities, and thus, increase your liquid net worth. For as little as $9 per month!

You can even give Deskera a try out right away, with our completely free trial. No credit card details necessary.

Liquid Net Worth FAQ

#1: Do You Include Retirement Accounts in Liquid Net Worth?

When measuring your liquid net worth, you want to include the kind of assets that can easily and quickly be converted into cash. Now, the definition of quick and easy varies for every individual.

In general, though, retirement accounts and plans are not considered liquid unless you’re close to your retirement years and can gain access to the funds without any fees or penalties. In any other case, if you withdraw your retirement funds earlier than expected, you’ll most likely be subject to early withdrawal fees. So, for that reason, they typically are not included in your liquid net worth calculations because you cannot quickly exchange them for cash for their full market value - at least not without any additional charges.

#2: What Is the Most Liquid Investment?

Cash in hand is by far the most liquid investment, as it is easily accessible and you don’t have to sell cash to use it. Then come checking accounts, high-interest rate savings accounts, certificates of deposits, bonds, and so on.

How can Deskera Books Help Your Business

Take your business to the next level with Deskera All-in-One. It is a platform that offers Invoicing, Accounting, Inventory, CRM, HR & Payroll all under one roof. With Deskera books, you can keep track of your business cash flow and revenue using its financial reports. Accounting can be easily managed Deskera Books and can help you keep track of your balance sheet, profit and loss statement and journal ledger. All this simplifies your accounting and tracking of your financial records, making it easy for your business to get business credit and to secure loans.

With Deskera Books, you can avail of online invoicing, accounting & inventory software to boost your business. It covers all the significant aspects of business such as billing, payments, warehouse management, Credit & Debit Notes, financial reports, an elaborate business dashboard apart from many other features.

Key Takeaways

And that’s a wrap!

For a quick recap, here are some of the main points we’ve covered:

- Liquid net worth is what’s left in cash and cash equivalents after deducting liabilities from liquid assets. By definition, liquid assets are those which can be easily converted into money, such as cash, checking accounts, stock, funds, and so forth.

- Liquid net worth is very similar to net worth, however, it excludes non-liquid assets such as land, real estate investments, equipment, and so on.

- Knowing liquid net worth is very important as the measurement represents the amount of money you can gain access to on short notice, to use for immediate, unexpected scenarios.

- You can calculate it by subtracting liquid assets from your total liabilities.

- Use accounting software like Deskera to automate repetitive tasks, spend less, better control your business financial health, and ultimately, increase your liquid net worth.

Related Articles