Millions of business owners require a business line of credit (LOC) to operate a smooth business. Even successful organizations experience gaps during seasonal lagging of sales, cash-flow concerns, and much more. Therefore, business lines of credit work as the best option that you should definitely consider for businesses.

In this article, we have covered certain aspects related to the business line of credit. It covers:

- Understanding business line of credit

- A business line of credit working

- Secured and Unsecured business line of credit

- Requirement for a business line of credit

- Opening of business LOC

- Pros and Cons of the Business Line of Credit

- Tips on keeping LOC

- Business LOC to grow your business

- Difference between a Business term loan and business LOC

- Business Credit card vs Business line of credit

- LOC for personal use

- Obtain a business LOC

Let’s learn.

Understanding Business Line of Credit

A business line of credit works similarly to a credit card. It provides access to business owners to a funds pool that can be withdrawn for business needs. Further, it is up to the lender to decide certain terms and conditions such as the amount of interest, payment size, and much more.

In addition, a business line of credit offers flexibility to borrowers to obtain a set of capital ranging from $50,000 to $500, 000 (for large-business loans). And, for a smaller business loan, you can obtain a loan ranging from $1,000 to $250,000.

How Does the Business Line of Credit Work?

When you create a line of credit, you'll get access to a set amount of money that you can use whenever you desire. Furthermore, the amount of credit that you have used along with the interest charges, is then reflected on a monthly invoice.

Moreover, your payment is calculated based on the actual interest earned on these funds. It is done while they are in your possession. However, once the money has been reimbursed, you will have access to that amount whenever you need it. Note that only the amount of the loan that you actually use is charged interest.

In addition, lenders establish LOC rates and restrictions based on certain elements. It includes risk level, collateral, and any servicing requirements. Further, your risk grade is determined by criteria such as your company's financial success, the status of your industry, your business and personal credit scores, and collateral.

In addition to interest, most lenders will impose an annual fee for the LOC. Transaction costs may apply if you will need a large number of loan advances and repayments.

Secured Vs Unsecured Business Line of Credit

Following are the two sets of business lines of credit — Secured and Unsecured. Let’s discuss them in detail:

Secured Business Line of Credit:

It means that you are placing your assets such as equipment, property, or inventory as collateral. Further, there include secured lines of credit that need a personal guarantee or lien on your business. In case, you fail to return the business credit line, then the lender could seize your assets.

Furthermore, if your business is new or startup and you have low sales (with zero business credit score), then you can easily get secured credit lines. Make sure that you avoid pledging any collateral that you want to protect.

Unsecured Business Line of Credit:

Unlike secured lines of credit, you do not need any collateral in unsecured lines. However, they generally need a personal credit score, a higher business, annual revenue, a lien on business assets, and detailed business history.

Nevertheless, providing a personal guarantee provides access to lenders that they can go for your business assets. However, it will happen only if you fail to pay back the loan. Also, check the requirements of lenders that could work for your business.

Note: Even though you are qualified for an unsecured line of credit, it would be better to register for a secured line of credit. It is mainly because the unsecured line of credit charges a higher rate of interest than a secured line of credit. And, it also offers lower credit limits. So, check and review all aspects before making the final decision.

Requirements for a Business Line of Credit

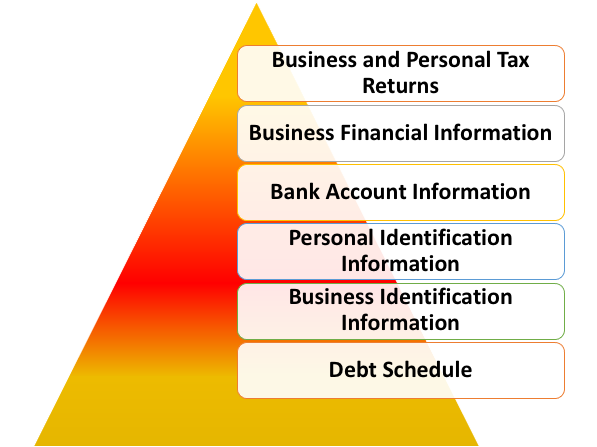

Though requirements to qualify for business lines of credit may vary from lender to lender. However, we have provided you the general requirements that you need to qualify for a business line of credit. It includes:

- Business and Personal Tax Returns: It works as proof to showcase your business revenue.

- Business Financial Information: This works as proof of annual revenues. It also includes showcasing your other income sources. All this information will represent your financial security and stability to pay back the credit line on time.

- Bank Account Information: Some lenders require your business bank accounts information to check your financial status and information.

- Personal Identification Information: It includes your identification and Social Security Number (SSN).

- Business Identification Information: It includes your business name, business licenses or permits, Employer Identification Number (EIN), business address, and business entity type.

- Debt Schedule(Current): Lenders will check your monthly repayment commitments if your business has any outstanding debts or loans.

What You should know before opening a business line of credit

Before you open a business line of credit, you need to understand certain aspects that will help you learn in detail. Let’ check:

- You may have to pay for setting your account, annual fees, and transactions. For example; a bank may charge a fee for opening an account that would be around $150. However, the fees may get higher depending on the credit cost. Also, you may not have to pay annual fees (for the first 12 months). However, you will be charged annual fees for the second year.

- Because of the volatile nature of the market, the lender maintains the right to demand quick payment of a LOC. Further, it implies you'll have to pay the entire sum, and your LOC will be cut to zero without warning. However, if your firm relies on a line of credit, this can be a serious problem. Therefore, you should always be prepared to replace it or cut it back in order to overcome the loss of credit.

- Some lenders demand firms pay down their outstanding LOC debt to $0 at some time during the year, usually for at least 30 days. It is usually to reduce risk. Also, it informs a lender that the borrower is generating enough cash flow to operate independently of the lender's finances. Also, that the LOC is not being used to replace the owner's capital.

When should you use a business line of credit?

It is important to understand when one should use a business line of credit. First and foremost, a business line of credit is perfect for businesses that want flexible funding options. As businesses have continuous requirements for capital and funds, therefore, you need available cash flow to manage and cover those needs or expenses.

Nevertheless, there are always disparities associated with investments and expenses capital for most businesses. Also, cash flow varies as well. As a result, it becomes highly critical to managing expenses beforehand.

Ultimately, a business line of credit comes to your rescue. It provides you the funding access to cover and manage your business needs. Also, it would come with a lower rate of interest than what you will pay for a credit card. Finally, you will be able to cover certain expenses that include:

- Equipment

- Past-due invoices

- Quarterly tax payments

- New hires

- The seasonal drop in business

Pros and Cons of Business Line of Credit

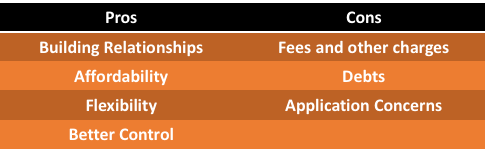

There are certain pros and cons associated with a business line of credit.

Pros

Following is the list of pros of a business line of credit:

- Building Relationships: While negotiating a line of credit depends on the relationship with your lender. If you have a good relationship with lenders, then you can have additional finances, extended deadlines, and much more.

- Affordability: When compared to short-term loans (of comparable size), a line of credit has a lower rate of interest. Nevertheless, terms and rates may differ depending on certain aspects. It includes annual revenue, credit score, and other financial aspects.

- Flexibility: Unlike a term loan, which requires you to take out a big sum of money and make regular payments, a line of credit can be used whenever you need it. Furthermore, you pay interest solely on amounts drawn, and you repay as you use the funds.

- Better Control: You can utilize the funds when you desire with a line of credit. It includes continuing operating costs, cash flow shortages, and more.

Cons

Every coin has two sides and the same goes for a business line of credit. Following is the list of cons of a business line of credit:

- Fees and other charges: As you have to pay heavy rates of interest on credit cards and also you have to pay fees for withdrawals and maintenance. Therefore, you have to make sure that your interest rate should be low enough to compensate for any other added charges.

- Debts: While having a line of credit on-hand is convenient in an emergency, you may find that you have used up all of your available credit. And then you will be unable to repay it due to a business downturn. However, to avoid the lure of fast cash, some firms may be better off with a traditional loan.

- Application Concerns: Your bank may ask that your business be at least two years old when you apply for a line of credit. Further, you may be expected to give significant financial data, such as tax returns, cash flow statements, and more, unlike credit cards.

A credit line can be very beneficial for any business growth. But, before you apply, make sure you understand the risks and make sure they don't outweigh the benefits. Therefore, make sure you review all the aspects before investing your time and energy in the business line of credit.

Tips on keeping LOC

Here is a list of a few tips to keep the line of credit. Let’s check:

- Make sure to repay your full loan or debt periodically. Also, you need to avoid reaching the credit limit as it will only cause frustration and panic. Moreover, it will keep your lender’s trust in you as well.

- You should set up a business line of credit in advance of your business requirements. During that time, your cash flow is strong and lenders will more likely approve a line of credit. In addition, it will provide you financial stability especially during emergencies.

- Avoid covering your organization’s losses as it will only cause trouble when you need funds for your business.

What credit score is used for business LOC?

Having a good credit score is quite crucial to obtain a business line of credit. However, there are certain factors that impact the business credit score. It includes— payment history, industry risk, debt and debt usage, age of credit history, and company size.

Furthermore, the three leading agencies of credit-rating — ranges from 300 to 850. In addition, with a credit score of 650 to 749, you can get a business loan on your lender's terms. While not ideal, a credit score of 650 to 749 is acceptable.

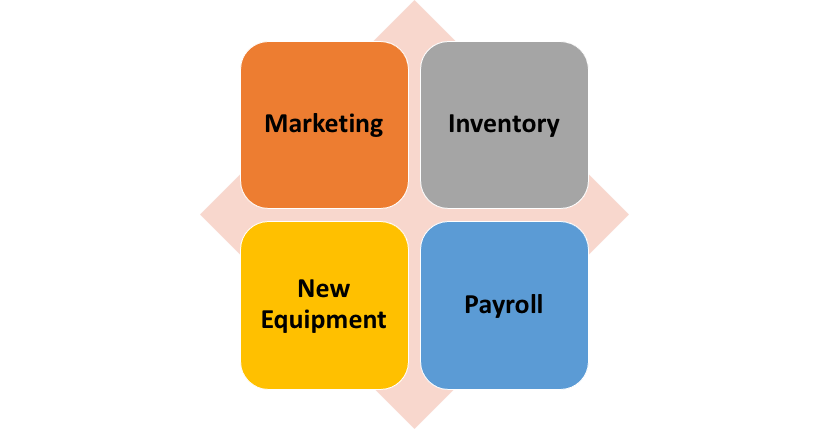

Using Business LOC to grow your business

A business line of credit is the most effective financial tool that will help to grow your business. Here is the list of opportunities that you should consider to boost your business. It includes:

Marketing

It is a crucial aspect to expand your business to get an advantage over competitors and retain clients. However, a business line of credit would provide you an edge to implement marketing initiatives. It would further help to avoid any financial constraints for campaigns. It ensures cash flow to sustain any business challenges.

Inventory

When it comes to planning for a sales drive, business owners know that having a positive cash flow is important. Further, with a line of credit, you can take advantage of a predicted increase in sales. Also, you can make use of short-term cash support to expand your business.

New Equipment

Increased demand for your equipment puts strain on the business owner. It generally occurs when industries expand. At certain stages of your business's development, you may require certain crucial things. It includes updates, new equipment purchases, or the replacement of outdated gadgets, and more. Therefore, taking out a line of credit for equipment purchases makes a lot of financial sense since it gives you more flexibility.

Payroll

Avoid approaching lenders for loans when your organization is facing payroll deficits. Further, you can take a business line of credit as a backup account. It will help to cover any gaps in your cash flow. Moreover, it will allow you to continue operating your business smoothly.

What are the interest rates of Business LOC?

Interest rates on company lines of credit vary widely based on market conditions and the lender you choose. Furthermore, a typical interest rate for a company line of credit might start as low as 5% and go up to more than 20%. It also emphasizes the importance of shopping around for the best interest rate on your business line of credit and comparing lenders.

Moreover, interest rates for business lines of credit generally depend on business and personal credit scores. In case, your credit score is low, your interest would be higher initially. However, if you make sure to responsibly handle your credit line, then your lender may modify its terms. It would be further helpful for your business.

Note that most lenders rely on the 5 C’s of credit. It helps to assess the size of the credit line. It includes — Capacity, Capital, Character, Conditions, Collateral.

When is a business LOC a good idea?

This is the most interesting question that mostly pops into our minds. Firstly, the best time to obtain a line of credit is when your business has better cash flow and revenue.

Furthermore, avoid getting a line of credit when you are facing a financial crunch. Although, it is obvious that you will get approved for a line of credit only when your financial health is stronger. And, you are not facing any cash flow concerns.

In addition, note that you will be charged with the rate of interest only on the borrowed amount. Also note that if you are looking for capital for long-term or one-time projects, then you should go for a small business loan instead of a business line of credit.

Difference between a business term loan and a business line of credit

Business term loans are given in one lump sum and have a predetermined repayment schedule. Further, interest is imposed on the amount owed as it is paid off. And, prepayment penalties may apply if the loan is paid off early. Nevertheless, business loans are often better suited for substantial, long-term expenses.

Business lines of credit differ from personal lines of credit as they can be used several times. And, also whenever the need arises. However, note that you only withdraw the amount of money you require. In addition, the amount you withdraw is subject to interest. You can usually return the debt without penalty if you pay it off early.

Difference between a business credit card and a business line of credit

Smaller bills can be paid quickly using business credit cards. As they are simple to use and provide immediate access to funds. They may, however, have smaller credit limits and higher interest rates. Furthermore, credit cards are unlikely to be accepted for lease payments, bills, or payroll.

A business line of credit has a bigger credit limit than a company credit card. It can further be used to cover unforeseen costs or new opportunities. Moreover, you can use a business line of credit to fund new projects. It can also keep your business afloat during temporary downturns once you've been approved.

Is it hard to get Business LOC?

Obtaining a small-business line of credit can be tough for newer enterprises. Furthermore, to obtain any form of financing, traditional lenders, such as banks, often demand enterprises to have several years of operations, revenue, and excellent financials.

Can you use business LOC for personal use?

If you are planning to use a business line of credit for personal use, then you are definitely stepping into huge risk.

Note that when you pay for personal costs then taxes are not deductible. Therefore, many owners take the risk of paying personal costs from the business line of credit. However, if the Internal Revenue Service (IRS) discovered this activity, then they would reject all interest payments even if it was a small amount.

Therefore, it is important to follow all the rules and regulations to keep oneself and your business on the safer side. Moreover, make sure to keep your personal and business credit lines separate for better efficiency.

Where can you obtain a business line of credit?

You can obtain a business line of credit through certain origins. It includes online lenders, banks, and small business administration (SBA). Let’s check:

Lenders

There are numerous online websites where you can apply for a business line of credit. Moreover, it has a faster and easier process. Note that online lenders typically demand higher loan rates than banks.

They might pay greater attention to your cash flow than financial statements. They're also more flexible in their approval standards than traditional banks.

Banks

Banks have more stringent lending criteria for lines of credit than online lenders. Furthermore, banks typically provide cheaper interest rates, better conditions, and higher credit limits.

Further, your present business bank may be an excellent location to start looking into lines of credit and your business credit note. But, you should check around and observe what other lenders have to offer.

Small Business Administration (SBA)

A seasonal line of credit, a working capital line of credit, a line of credit for builders and contractors, and a line of credit for subcontractors are all available through the SBA CAPLines program.

Furthermore, you must meet the requirements for the SBA's 7(a) lending program to consider for any credit lines.

The Small Business Administration does not provide credit lines directly. However, it instead collaborates with licensed lenders. Furthermore, lenders are more inclined to give credit to small firms. It is because the SBA guarantees a percentage of the credit limit.

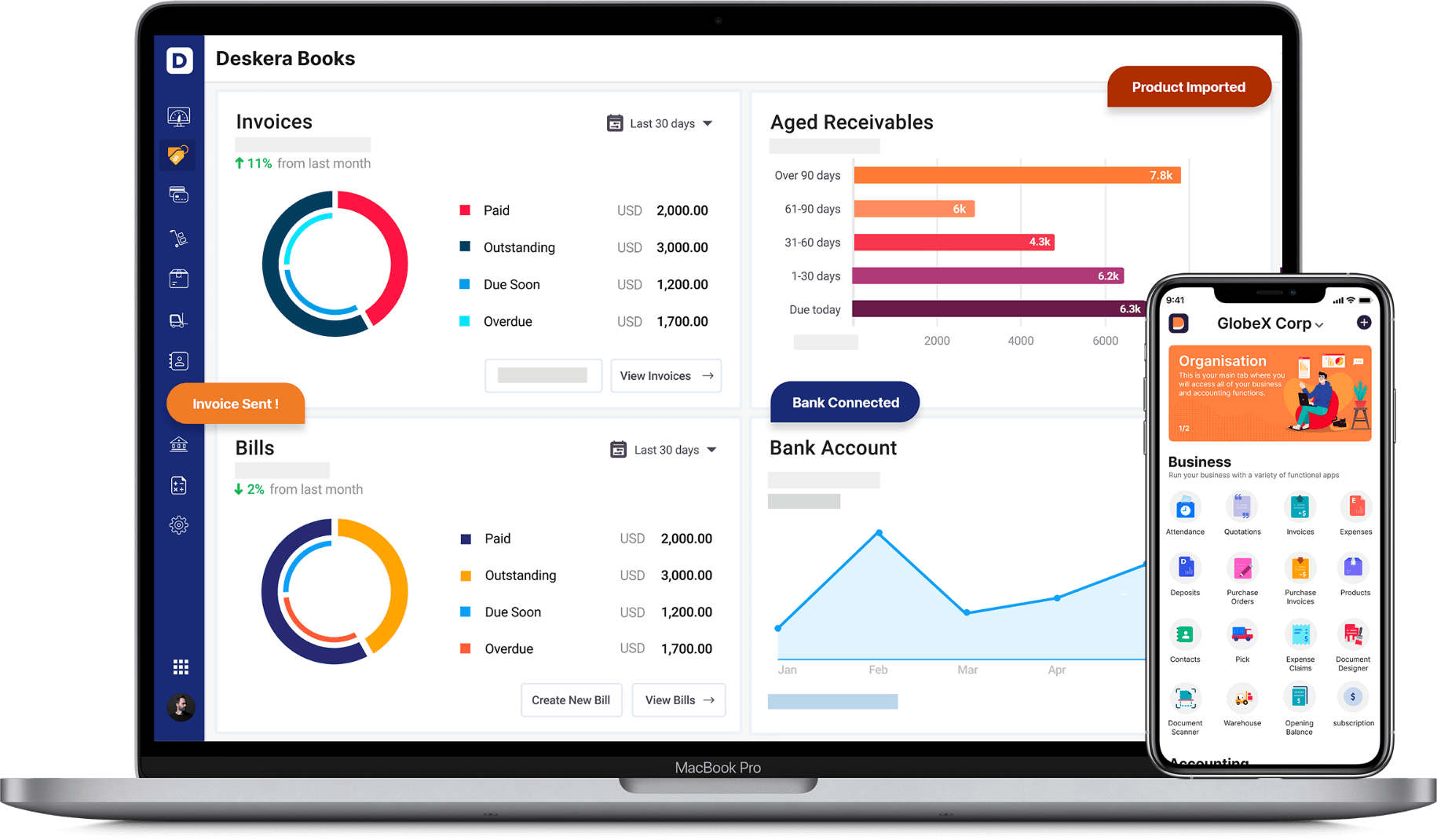

Deskera

Deskera offers you to learn the concepts of business and get acquainted with the top software applications for startups and can also help with accounting for startups. You may refer to Deskera’s blogs to get a better grip over business topics such as How to understand a balance sheet, Main financial statements, Why are income statements important.

Besides, you may also learn a lot from the Best Marketing Blogs 2020 and the user-friendly CRM, Business Expense, Accounting Cycles.

Take your business to the next level with Deskera All-in-One. It is a platform that offers Invoicing, Accounting, Inventory, CRM, HR & Payroll all under one roof. With Deskera Books, you can avail of online invoicing, accounting & inventory software to boost your business. It covers all the significant aspects of business such as billing, payments, warehouse management, Credit & Debit Notes, financial reports, an elaborate business dashboard apart from many other features.

Key Takeaways

Finally, we have reached the end of this comprehensive guide. We have summarised all the important points for your reference below:

- A business line of credit is similar to a credit card.

- When you create a line of credit, you'll get access to a set amount of money that you can use whenever you choose.

- A business line of credit is perfect for businesses that want flexible funding options.

- Having a good credit score is quite crucial to obtain a business line of credit.

- A typical interest rate for a company line of credit might start as low as 5% and go up to more than 20%.

- The best time to obtain a line of credit is when your business has better cash flow and revenue.

- Make sure to keep your personal and business credit lines separate for better efficiency.

- Obtain a business line of credit via online lenders, banks, Small business administration(SBA).