Wrong purchasing decisions affecting your profits?

Understanding the core of inventory and inventory valuation can do the trick if you are hassled by erroneous decisions pertaining to your inventory. But how? You may ask.

Well, your inventory is your current asset, and you must have inventory valuation and inventory accounting methods to enhance your business decisions. In a way, your profits hugely depend on how your inventory recording shapes up.

This is the primary reason why you should be keeping an eye on the acquisition price, current costs, capital gains, and operating expenses. Your financial statements can look healthier if you have inventory valuation techniques.

The following aspects are discussed in detail in the post:

- What is inventory valuation?

- Why is Inventory valuation Important?

- What are Inventory Valuation Methods?

- What Is the Difference Between FIFO and LIFO?

- Which Method Is Better, FIFO or LIFO?

- How Do You Calculate FIFO and LIFO?

- Is LIFO Allowed Under GAAP?

- Which is the best inventory valuation method for your business?

What is Inventory Valuation?

Inventory valuation refers to the process of calculating the value of the unsold inventory stock when the companies prepare their financial statements.

As inventory is considered an asset for the company, it needs to be assigned a financial value so it can find a place in the balance sheet. Moreover, it is also important for determining your inventory turnover ratio.

All these factors put together will result in better purchasing decisions for your business.

For perspective, if you are the owner of a handbags outlet and are left with 100 handbags at the end of the year, then you will have to do accounting for these remaining bags. For this, you must calculate their financial value and record it in your balance sheet.

Why is Inventory Valuation Important?

In this part of the article, we shall learn how the different methods yield varied results and how they affect your purchasing decisions. Moreover, inventory valuation is a great way to understand why you must have a grip over inventory management.

Considering the handbag example for clearer understanding:

Once you have noted down the number of unsold goods, you will also have to track the rate to multiply by the number of goods to derive the final value of the goods. The rate refers to the common value of all the goods that you may have bought at different prices throughout the year.

Taking the example of the handbags, let’s look at the following table:

As observed, there is a fluctuation in the purchase price of the handbags. Therefore, the owner of the shop needs to find a technique that would give a clear presentation of inventory valuation.

So, inventory valuation is important because it helps businesses calculate the rate at which the goods were sold that year. The value of the rate is important as it can then be used in various valuation techniques to ultimately arrive at the final financial value of the inventory.

The next section takes us through the various methods of inventory valuation.

What are Inventory Valuation Methods?

The three well-known methods for inventory valuation used by companies are:

- FIFO - First In, First Out

- LIFO - Last In, First Out

- WAC - Weighted Average Cost

FIFO

When you make your sale considering the FIFO technique, you are selling the goods purchased first. This implies that the stock to reach first into your warehouse is the first to leave as well. So, in other words, under FIFO, the goods from your first list of products will be subtracted first that came into your warehouse or inventory store.

LIFO

Under LIFO, the goods that enter your warehouse last are the first ones to leave.

WAC

This method is applied by considering the average cost of the goods throughout the year. It is derived by dividing the total cost by the total number of purchased goods that year.

So, considering our example of handbags here is a summary of the inventory valuation when different methods are considered:

Observations from the table are as follows:

- The value of the inventory depends on the method used to calculate it

- The value derived using LIFO is greater than the one calculated in FIFO. However, this may not always be the case as the values depend on the price of the goods bought and also on the inventory valuation method.

What Is the Difference Between FIFO and LIFO?

We have already observed the meaning and definitions of the two valuation methods. In this section, we shall see a factor-wise comparison between LIFO and FIFO.

In times of economic inflation, the unsold stock will be low, while the cost of goods sold will be high. Thus, profits will be low, and tax revenues will also be low.

Conversely, in deflationary circumstances, the whole scenario will reverse itself due to lower general prices. In turn, income taxes and profits will rise.

Although, the assumption is proved incorrect and in opposition to the stock movement in the business organization. This has resulted in the LIFO method no longer being used to value inventories.

Which Method Is Better, FIFO or LIFO?

FIFO is generally more trusted by businesses to calculate the value of the sold goods. There are various advantages to it.

It is easier to implement than LIFO as most companies tend to sell off their oldest goods as the older ones are more prone to losing value and becoming obsolete. So, FIFO actually follows the natural way how a business carries on with selling its goods. Therefore, the chances of errors occurring can be much less.

LIFO, on the other hand, uses up the latest inventory first. The costs involved are generally higher than the costs assumed to manufacture or produce the initial set of goods. Consequently, the profits drift to the lower side.

LIFO does have a plus point. It shows lesser profits and, therefore, the tax amount is less, too. However, it also implies that FIFO is much cleaner in its implementation and assumptions as to the initial or the older inventory gives back the actual value of the inventory.

If a company shows higher profits while calculated under FIFO, then the company certainly depicts more potential and signifies more lucrativeness for investors.

Moreover, with LIFO, the older inventory may never get sold and may always remain on books. Also, LIFO facilitates for manipulation of financial records, which makes it an even less favorable method.

The conclusion can, therefore, be given in favor of FIFO. Having said that, businesses select the valuation technique depending on their financial goals and the prevailing market conditions. Regardless of whether you are a startup or an established business, you need to get a strong grip over the concepts of inventory valuation, as inventory is one of the most crucial components of your business. It plays a major role in the assets of your balance sheet.

How Do You Calculate FIFO and LIFO?

We shall take up another example to understand the calculations made under FIFO and LIFO.

Let's assume an electronic goods business that wants to calculate the price of the inventory using both FIFO and LIFO methods.

Here’s the summary of the company’s inventory costs for the said year:

Total Units purchased = 1400

Total Units sold = 1000

As observed, the price of the purchased units was steadily rising. Assuming the company’s selling price remained the same throughout the year, it generated a lesser profit at the end of it.

Now, let's move on to calculating the cost of the goods sold.

FIFO method calculation

Under this, the company should be selling the oldest acquired units first.

The COGS calculation goes as:

300 x 500 = 150,000

300 x 550 = 165,000

200 x 600 = 120,000

200 x 650 = 130,000

The total COGS by the company is $565,000

LIFO Method calculation

Under the LIFO method, the company must sell the latest inventory first and assume those costs for calculating the inventory value.

So, the calculation goes as:

600 x 650 = 390,000

200 x 600 = 120,000

200 x 550 = 110,000

The total COGS by the company is $620,000

Conclusion

For the company, the LIFO method may seem more lucrative as it shows a higher cost of inventory, which implies lesser profits and, ultimately, lesser tax incurred. However, if the company is looking at it from another perspective of generating more profits, then FIFO turns out better.

The remaining goods that were unsold will be accounted for under ‘inventory’ during accounting.

Is LIFO Allowed Under GAAP?

GAAP is the Generally Accepted Accounting Principles, and it does allow the use of LIFO in the US. GAAP is the entity that enforces standardized accounting procedures across the US. It sets standards pertaining to foreign currency, liabilities, assets for businesses to follow the same set of rules.

However, LIFO is not allowed to be included in accounting practice outside of the US. Therefore, companies in the US may use LIFO for their local operations but switch to FIFO for their international deals.

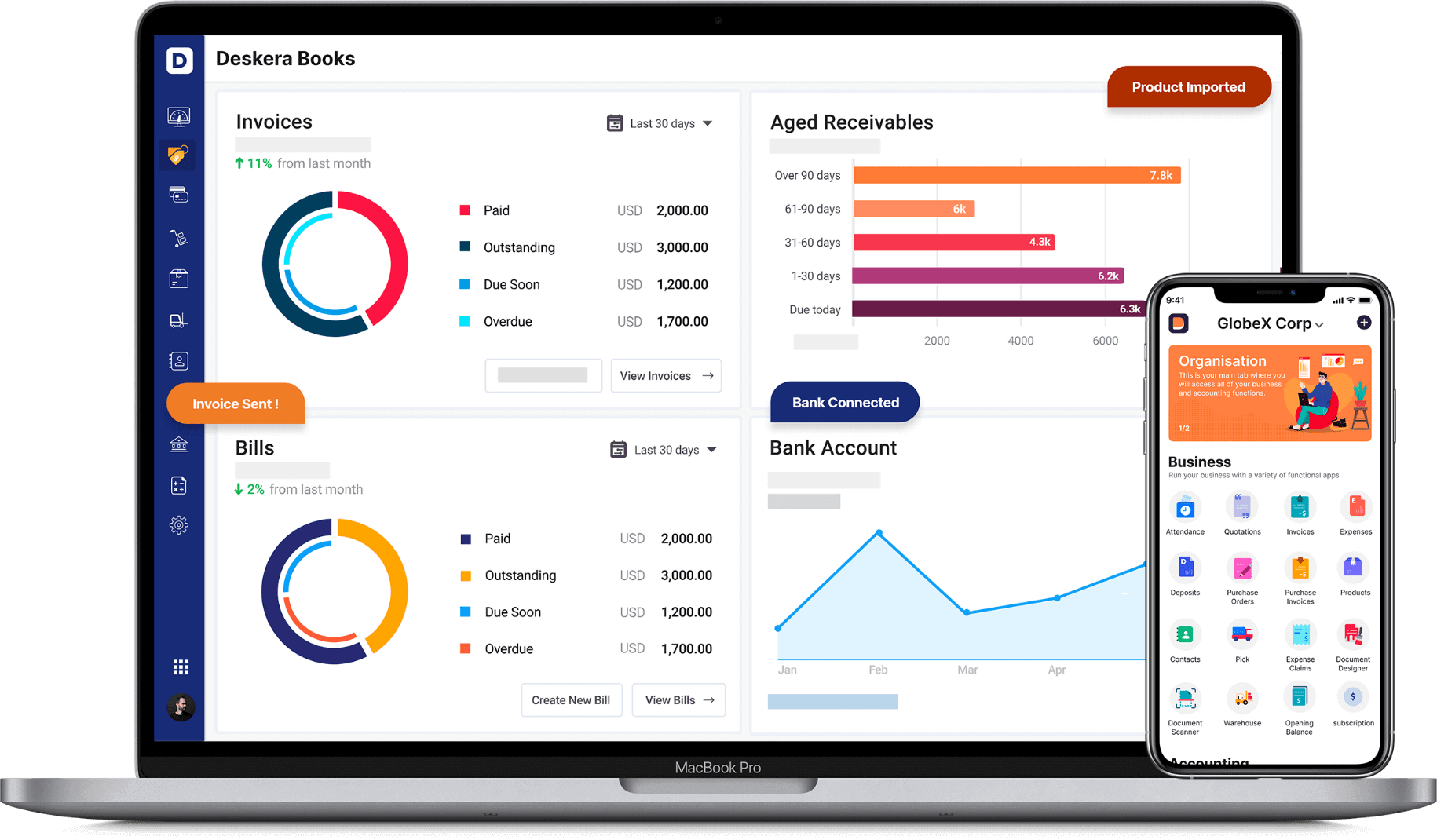

How can Deskera Help You?

If advanced inventory management is the need of the hour for you, then Deskera Books is one platform that comes to your rescue. Have your invoices, bills, receipts, receivables, bill of materials in one place and get all your accounting needs addressed.

Learn about the exceptional and all-in-one software here:

Key Takeaways

The concepts of inventory valuation may tend to intimidate and confuse in the beginning. However, a detailed and thorough understanding makes it easy to calculate. We hope to have cleared a lot of smog for you with this article regarding the valuation methods: FIFO and LIFO.

A quick look back:

- Inventory valuation is the technique to arrive at the cost of the unsold stock or inventory

- Businesses need to opt for a method that best suits their business; they need to take into account the price of purchasing at each stage throughout the year as that ultimately affects profits and tax amounts

- FIFO, LIFO, and WAC are the three commonly used methods of inventory valuation

- FIFO is First In, First Out and considers the stock that reaches first into your warehouse is the first to leave

- LIFO is Last In, First Out: considers the selling of the latest goods first

- Businesses select the valuation technique depending on their financial goals and the prevailing market conditions

Related Articles