Small businesses created 10.5 million net new jobs between 2000 and 2019, accounting for 65.1% of net new jobs created since 2000, according to the Bureau of Labor Statistics’ Business Employment Dynamics report.

Starting a small business venture is a daunting task. It may seem easy but it requires a lot of effort. However, it has the opportunity to make you a billionaire, if scaled the right way. Along with the opportunities, comes major challenges that need to be mastered. Meeting the legal requirements is one such challenge that you would face while setting up a small business. However, knowing about these requirements can make the task easy-breezy for you.

Let’s take a look at some of the legal requirements for starting a small business:

Create a Business Structure

When you think of setting up a small business, the first thing to do is to carry out thorough research and ask yourself various questions such as:

- What is my goal?

- Do I need to provide products or services?

- Is there a need to hire more employees or do I need to be a solopreneur?

- What business capital is required to meet the financial requirements?

Since every business has different requirements, it is important to figure out what kind of business structure you want to have. Let’s take a look at some of the different types of business structures:

Sole Proprietor

A sole proprietor is a person who is the exclusive owner of the enterprise. No kind of legal distinctions is present between the business and the person. However, there are certain situations that should be considered if you want to opt for this type of business structure. Some of the instances can be:

- Your personal property can get forfeited if found liable

- Business losses can get reported in personal income

- If you opt for a sole proprietorship, you will have to pay a small self-employment tax

Limited Liability Company

LLC or Limited Liability Company is a private limited company that is created to protect owners from certain-business related liabilities. With an LLC, a legal distinction can be made between the owner and the business. You get the best of both worlds with LLC, limited liability of a corporation, and pass-through taxation that you get in a partnership. Thus, your personal assets are protected if you opt for LLC.

S Corporation

Often regarded as S-Corp, S Corporation are pass-through taxation entities in which the company can give up paying business taxes by reporting losses and revenue. It provides limited liability protection. The profit under this business structure is reported under separate tax filing return form 1120S. In this type of business structure, there is a single level of tax.

C Corporation

This is a corporation where the owner and business pay separate taxes. In this type of business structure, the owners become shareholders with added tax advantages. The company gets limited liability and unrestricted growth potential with C Corporation.

Partnerships

Partnership refers to the arrangement between two or more people who manage and operate the business and the profit is split between them. In this kind of business structure, profit and liability are shared equally. Form 1065 has to be filled for taxes, but there is no requirement to pay these business taxes.

Register your business name

Every small business requires a name that the local and state government use to track your actions. If you are a sole proprietor, you will have to register a Fictitious Business Name (FBN) or Doing Business As (DBA). In case you don’t register as DBA for sole proprietor, then the name of the business will be considered as the legal name of the owner.

There are various steps that are required while filing a business name:

Check for availability

When you start your business, the first thing that you are required to do is to check whether the name is available or not. For this, you can even check the official database of the county clerk.

File the name

In order to file the name, you will have to fill out the form at the county clerk’s office. Basic details such as your full legal name, business address, address, DBA, names of registered owners, state business ID number, and type of business, have to be included in the form. Then the form has to be validated and then you are required to submit the required paperwork within 40 days of starting the business.

Pay filing fees

DBA filing fees vary depending on your county.

Publish the name

Once the filing is done, you will have to publish the DBA statement once a week for four weeks in your local county publication. This process should begin within 30 days of filing and the publication will then provide an affidavit of your complicity.

Obtain an EIN

Once you register the business name, you are required to acquire an Employer Identification Number (EIN). This will act as your small business’ identifier for tax purposes. It can be your Social Security number but only for your business. An EIN can be used to open a business bank account, apply for business licenses, and file tax returns.

If you want to qualify for an Employer Identification Number, you need to fulfil the below-mentioned conditions:

- Operate your business primarily within the U.S. or U.S. Territories

- Have a legal Taxpayer Identification Number (TIN)

- Be the owner

- Complete an IRS Form SS-4

The best way to apply for your EIN is through the IRS website.

Obtain Business Permits and Licenses

Independent contractors are required to obtain proper permits and licenses. Depending upon your industry and business location, you have to get federal or state licenses. If you are involved in a business that involves activities that are supervised by the federal agency, then federal licenses will be required. On the other hand, state licenses and business permits depend on the location.

Figure Out Your Federal Taxes

Every small business owner is required to pay annual taxes. The amount and type of taxes depend on your business structure. Generally, small business owners are required to pay some combination of the following federal taxes:

- Income tax

- Self-employment tax

- Excise tax

- Employer Tax

- Estimated tax

- Sales tax

To simplify the tax process, you can even hire an accountant, tax advisor, or use accounting software to ensure compliance with tax laws. These professionals can help you in every aspect right from keeping your books in order to the filing transactions and documents. In case, you don’t want to wait until April to file taxes, you have the option for quarterly pay, provided by IRS.

If you are planning to hire employees, you will be required to set up tax withholding records. The types of taxes you are required to pay will depend upon the employees, you are; whether you hire full-time, part-time, or independent contractors. You will have to set up the following:

Federal Income Tax Withholding –New employees will have to fill out a W-4 employee withholding, which will further be sent to the IRS.

Federal Wage and Tax Statement – Every new employee who joins your small business will have to fill out and file a W-2 Form and then send it to the SSA.

In addition to this, small business owners will be required to pay state and local taxes along with federal taxes. These state and local taxes may include:

- Income

- Payroll

- Sales

- Property tax

- Self-employment

- Unemployment

Generally, the type of the taxes will depend on the type of your business structure and the state you are operating in.

Create a compliance plan

Even if you are a small business owner, you will have to follow some rules and regulations. Be it marketing, advertising, finance, privacy laws, or intellectual property, there are some laws that your business needs to comply with. You must ensure that you are free from contractor misclassification concerns.

Get Business Insurance

One of the best ways to protect yourself from liability losses is by getting business insurance. There are a plethora of insurance options that you can choose from. However, the right kind of insurance will depend upon the type of business you own, the size of your business, and the clients you have.

Let’s take a look at different types of business insurance options that are available:

General Liability Insurance

General liability insurance is important for independent business owners. It provides compensation for a number of incidents including accidental damage to a property, malfunctioning of goods or services, cost of defending lawsuits, and a lot more. However, every policy will vary according to the specific requirements of the small business.

Errors and Omissions Insurance

Errors and Omissions Insurance, also known as Professional liability insurance provides protection from liability related to improper services. Occupations that are covered in errors and omissions insurance are beauticians, lawyers, dentists, orthodontists, accountants, hair stylists, aestheticians, money managers, etc.

Workers’ Compensation

If you have employees, you are liable to get workers’ compensation. This insurance provides protection to the employees who might get injured while working. It includes medical coverage and benefits for injured employees. It also provides monetary payments to injured employees who are not able to work. This insurance also protects from injury lawsuits

If you fail to get this obtain a policy, then it can lead to fines, fees, or even shut down of your business.

Property Insurance

If you are thinking to rent or purchasing a location to run your business, then you should have property insurance. This type of insurance provides protection to your property, inventory, and equipment from various disasters such as fires, theft, and vandalism. Disasters such as floods or tornados are not covered in all insurances. So, it is better to consult your insurance provider to discuss the best insurance for your business.

Home-based business

Most of the small businesses usually start from their homes. Generally, a homeowner’s insurance doesn’t cover losses related to home-office including damaged equipment or inventory. That is why it is advisable to buy a home-based business insurance policy if you are operating your business from home.

These are some of the legal requirements for starting a small business. However, there are some more requirements that are based on the type of business entity and the location that you are operating in. If you find it difficult to make your business legally compliant, you can even hire experienced business lawyers, so that they can help you handle any type of legal issue with much ease.

How can Deskera Payroll Help

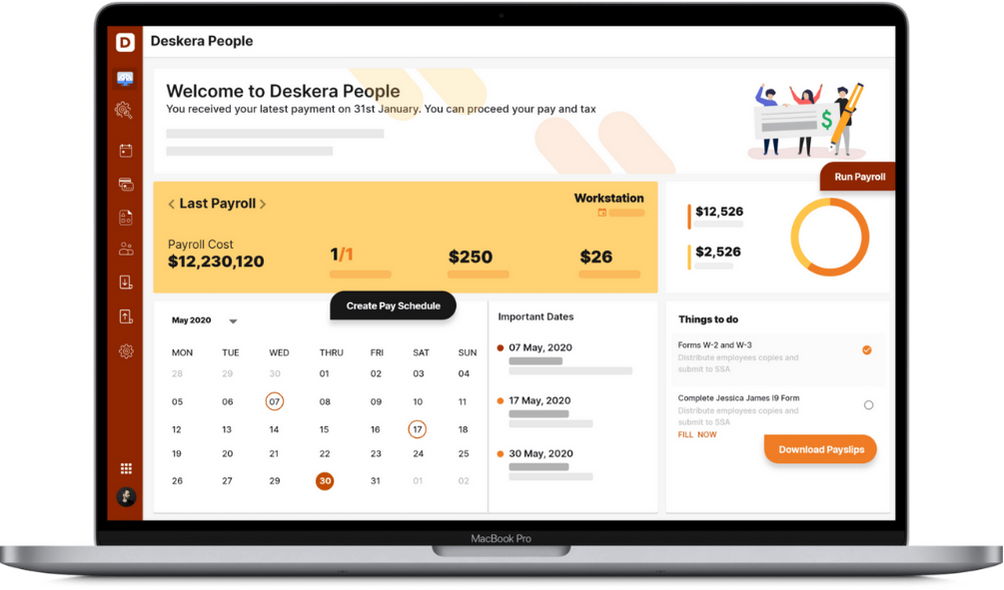

Payroll management and employee management are integral to any organization. If you are looking for a holistic and automated tool to manage payroll, employees, expenses, contractor management, Deskera People could be the apt solution.

Process your payroll now with Deskera People:

Key Takeaways

- Meeting the legal requirements is imperative if you want to start a small business

- Creating a business structure is one of the most important tasks when it comes to starting a business.

- There are various types of business structures including sole proprietor, S corporation, C corporation, LLC, and partnerships

- The next step is to get your business name registered whatever the type of business entity you own

- Once you register the business name, you are required to acquire an Employer Identification Number (EIN)

- Depending on the type of your business structure and location, you are required to obtain proper permits and licenses

- Every small business owner is required to pay annual taxes. The amount and type of taxes depend on your business structure

- Be it marketing, advertising, finance, privacy laws, or intellectual property, there are some laws that your business needs to comply with

- One of the best ways to protect yourself from liability losses is by getting a business insurance

- There are various types of business insurance options such as General Liability Insurance, Errors and Omissions Insurance, Workers’ Compensation, Property Insurance, and Home-based business insurance

Related Articles