A ledger is integral to business accounting and helps you keep track of business finances. If you own a business, it's important to understand the basics of maintaining accounts for business transactions. These basics are especially relevant if you're doing accounting and book-keeping. They are also relevant to you if you're involved in running a business or handling the affairs and transactions of a business, or doing anything that requires you to understand accounting.

A ledger is a record of accounting entries that contains information about business transactions in the form of debits and credits. It is categorized into accounts like assets, liabilities, revenues, expenses, and equity. In other words, it gives you a detailed view of your business transactions across the different facets of your business. Knowing how to read and create a ledger will help you understand your company's financial situation and help you track its progress and growth. It will also help you in accurate book-keeping.

Whether you're using a physical ledger or accounting software, this article will help you understand how a ledger works.

The topics it will cover are:

- Importance of a Ledger in Accounting

- Ledger: What Are the Types?

- 1. General ledger

- 2. Sales ledger

- 3. Purchase ledger

- What Are the Basics of a Ledger?

- What Are the Different Ledger Accounts?

- Asset accounts

- Liability accounts

- Equity accounts

- Revenue accounts

- Expense accounts

- How Do You Read a Ledger?

- How Do You Write a Ledger?

- Difference Between a Journal and a Ledger

- Ledger and the Trial Balance

- Summing Up

- How can Deskera Help You?

- Key Takeaways

Importance of a Ledger in Accounting

A ledger contains accounting entries that are used to prepare financial statements. It covers all the different accounts involved in a business. These accounting records can be used to prepare financial documents like balance sheets and income statements. These are useful tools to understand the financial situation of your business.

You can use these statements to guide you in taking business decisions as they will give you a better sense of what your business can afford.

Ledger: What Are the Types?

There are different types of ledgers that companies use. These include the sales ledger (debtor's ledger), purchase ledger (creditor's ledger), and general ledger.

1. General ledger

A general ledger is the main type of ledger that is usually used by companies. It is a comprehensive record of all the ledger accounts of a business. It contains all the types of accounts such as assets, liabilities, equity, revenues, and expenses.

2. Sales ledger

The sales ledger, also called the debtor's ledger, contains the accounting records related to sales made to customers on credit. In other words, if customers have bought goods from a business on credit, it shows all the amounts that are owed to a business by the customers.

3. Purchase ledger

The purchase ledger, also called a creditor's ledger, contains the accounting records related to purchases made by the business on credit. In other words, if the business has bought goods from sellers on credit, the details of those transactions will be entered in this ledger.

What Are the Basics of a Ledger?

A general ledger follows the double-entry book-keeping method to maintain records of financial transactions. The transactions are listed in two columns, with debits on the left side and credits on the right side. The debits represent an increase in assets and the credits represent an increase in liabilities.

Every debit has a corresponding debit of the same value because it shows how the transaction affects the two accounts concerned. The debit and credit entries should balance out. This is called balancing the books.

The ledger is further divided into separate accounts like a cash account, accounts receivable, sales, loans, etc. This makes it easier to understand the accounting entries and shows how each transaction affects different facets of a business like cash, sales, and expenses.

What Are the Different Ledger Accounts?

The ledger information is organized into specific categories of accounts. Transactions are recorded as a debit or a credit in each of these accounts.

Asset accounts

Assets include both physical assets like equipment and intangible assets like intellectual property. Some of the types of asset accounts are cash accounts, accounts receivable, and inventory. These are the short-term assets. Accounts like equipment accounts represent long-term or fixed assets.

Liability accounts

Liabilities make up what your business owes to outside parties. Some examples of liability accounts are loans, taxes, and unpaid rent.

Equity accounts

Equity is the difference between assets and liabilities, also known as the net worth of your business. The equity account reflects the actual value of your business. In simple terms, it tells you how much money would be left if your company sold all its assets and paid all its liabilities. Stocks can be thought of as an example of an equity account.

Revenue accounts

Revenue refers to the income generated by your business. This is recorded on the income statement or the profit and loss statement. Some examples of revenue accounts are sales of goods or services and investment income.

Expense accounts

Expenses are what your business has to spend as a part of its necessary costs. Examples of expense accounts include utility expenses and salaries.

How Do You Read a Ledger?

It's always helpful to know how to read a ledger. It can give you a complete picture of the finances of your business. The ledger has credits on the right-side column and debits on the left side. The first step in reading the ledger is to look at the different categories or accounts it contains such as assets, liabilities, and equity. Read the ledger from top to bottom to see the transactions entered for each month. You can see how the account balance changes at each stage. You can also look at the account balance at the end of each month.

How Do You Write a Ledger?

Whether you are filling up a physical ledger or using accounting software, it is useful to know the steps to fill up a ledger. The steps are described below.

1. Make a ledger for each type of account

Your ledger should be divided into different categories so that it represents the different types of accounts. Make a ledger for each account. For example, a cash account ledger will contain all the cash transactions. Don't put multiple accounts on one page. If there are transactions that don't fit into any of the account types, note them under a general ledger account.

2. Date, journal number, and description

Make columns on the left side of the page for the date, journal number, and description of the transaction.

3. Debit, credit, and balance

Make columns for debit, credit, and balance. Debit shows an increase in assets or the money your business receives. Credit shows an increase in liabilities or the money your business has to pay. Balance is the difference between debit and credit.

4. Journal entries

Enter the information for each journal entry. Debits and credits that correspond to each other should be entered side by side. This makes it more convenient to see the balance and understand the transaction.

5. Ledger posting

Record the transactions as they occur. If you make a journal entry, fill it in the ledger. The process of transferring entries from a journal to the ledger accounts is called ledger posting.

6. Combine the ledgers

Combine the ledgers of different accounts to make a complete ledger. The front page includes the chart of accounts, listing each account in the ledger and its number. List all the accounts in the ledger on the front page. This list is called the chart of accounts.

Difference Between a Journal and a Ledger

The journal and ledger are both important accounting records. Each is used at a different stage of the accounting process.

- The journal is the first stage of recording accounting entries. Transactions of your business are recorded in the journal as debits and credits and then entered in the ledger in the different category ledgers

- In the journal, transactions are recorded according to the double-entry system. Since it is the first stage of recording, the journal is also called the primary book of accounting or the book of original entry. In the journal, the transactions are not divided into different categories but are usually recorded one after the other as and when they take place. It shows every transaction that takes place in chronological order, without dividing the transactions into different types of accounts

- The ledger contains the information of the journal entries divided into different account types. The journal entry specifies the details of the account in which the credit and debt are taking place. For example, it will mention a $1500 debit in the cash account along with a $1500 credit in the accounts payable. This makes it easy to enter the details into the ledger under the respective heads

- The ledger helps understand the overall finances of your business. It is called the principle book of accounting. It is used to create the trial balance. The trial balance is then used to create financial statements such as balance sheets.

Ledger and the Trial Balance

The trial balance is a report that lists the balances of all the general ledger accounts of your business at a given point in time. The main purpose of the trial balance is to show the balance of debits and credits of all the transactions in the general ledger.

The report lists all the general ledger account totals with the account number, description, and the final balance of debits and credits. Unlike the general ledger, the trial balance shows only the account totals and doesn't show each transaction.

Summing Up

The ledger is an important document in accounting as it gives you a comprehensive view of your business finances. In business accounting, it is the bridge between the immediate recording of transactions in a journal and the adding up of balances in the trial balance. It forms the basis for the final balance sheets of your business. Understanding how a ledger works will help you keep tabs on the financial health and growth of your business.

How can Deskera Help You?

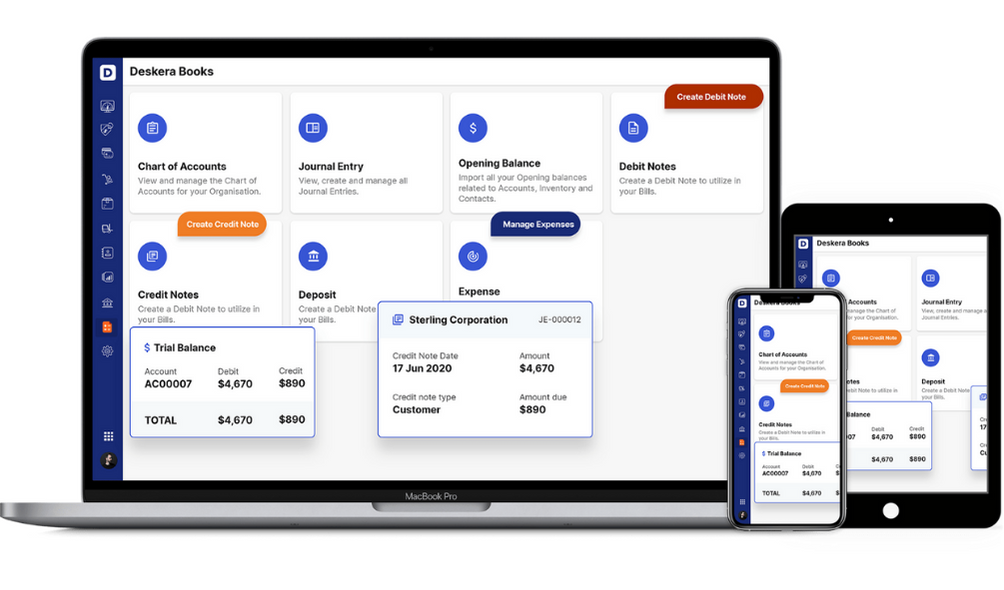

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- A ledger is a record of accounting entries that contains information about business transactions in the form of debits and credits. It is divided into different accounts like assets, liabilities, revenues, expenses, and equity

- A general ledger is the main ledger that businesses use. It contains all the ledger accounts of a business. It follows the double-entry book-keeping method. The transactions are listed in two columns, with debits on the left side and credits on the right side

- The debits represent an increase in assets and the credits represent an increase in liabilities. Every debit has a corresponding debit of the same value so that it shows how the transaction affects the two accounts concerned. The debit and credit entries should balance out

- The ledger records are used to create the trial balance, which is used to make the final balance sheets. These accounting records are used to prepare balance sheets and income statements, which help track the financial situation of your business.

Related Articles