Karnataka Labour Welfare Fund Act, 1965 was established to fund for the purpose of subsidizing initiative to enhance the welfare of workers in the state of Karnataka.

The Labour Welfare Fund (LWF) is a statutory payout that each state administers independently. This contribution is provided in the interests of employees and workers in the unorganized sector.

If you are in charge of your company's payroll, you must be aware of the many parts of the LWF and how they apply to you.

In this topic, we’ll cover the following sections associated with Karnataka Labour Welfare Fund (LWF). Let’s take a look:

- What’s the Labour Fund Act?

- Understanding Employer and Employee

- Objective of Labor Fund Act Karnataka

- Purpose of the Act and Applicability

- Welfare Board in Service of Workers

- Rate of Welfare Fund Contribution

- Significant Benefits of Labor Welfare Fund

- Details on Karnataka Labour Welfare Fund Act

- Consequences for not contributing in Karnataka

- Frequently Asked Questions (FAQs) on Karnataka Labour Welfare Fund, 1965

Let’s Begin!

What's the Labour Fund Act?

The Labour Welfare Fund (LWF) is a government of India program to assist and enhance the living standards of India's unorganized sector. The statute has only been enacted in 16 of the 36 states and union territories.

As a result of this act, you, as an employer, are required to contribute a set amount on your own behalf and on account of your employee as well. Depending on the state area in which your company operates, this will be different.

Furthermore, the payment, deadlines, and even penalty may vary from state to state. You must examine the applicability, which will be determined by the state in which your firm is registered.

In addition to the Labour Welfare Fund, other payroll compliances to be considered. These payroll include TDS, Employee State Insurance, Employee Provident Fund, and Professional Tax.

Understanding Employee and Employer

Employee: A person who is paid to perform any type of job in a business, whether unskilled, skilled, clerical, or manual.

Employer: It refers to someone who hires one or more employees in a business, either directly or indirectly, or through another person, on his or her own behalf or on behalf of someone else.

Objective of Labor Fund Act Karnataka

The Act's major goal is to provide authorized construction employees with health, safety, social, and economic security. Employees who perform skilled, semi-skilled, unskilled, manual, supervisory, technical, or clerical labour.

Purpose of the Act and Applicability

Check the following points that highlights the purpose of the Act and Applicability of Karnataka Labour Welfare Fund Act, 1965:

- This act extends to the whole of the State of Karnataka.

- Fund for the financing and implementation of labor-related initiatives.

Applicability

- Factories

- Plantation and Workshops

- Charitable Trusts

- Motor Omni Bus Services

- Commercial and Shops Establishment

- Societies registered under Karnataka Societies

Welfare Board in Service of Workers

The Karnataka Labour Welfare Fund was established for the purpose of supporting and carrying out initiatives to enhance the welfare of contributing employees covered by the KLW Act of 1965.

Workers in various industries/firms, as well as their dependents and children, are eligible for numerous welfare packages that are announced on a regular basis.

1. Every year, on or before January 15th, employees and employers contribute in the ratio of 20:40, i.e., the employer must remit Rs. 60/- to the Welfare Fund for each employee.

All unpaid accumulations and claims of employees, Employers to pay to the welfare commissioner.

2. For Educational Assistance to Children of the Labours: Students, Educational Institutions, Factories and Firms should register themselves in www.klwb.karnataka.gov.in website and apply for Scholarship online.

3. For the payment of Welfare Fund Factories and Firms should also register themselves in www.klwb.karnataka.gov.in and do the payment online.

Advantages are given to workers who earn Rs. 15,000 per month and are between the ages of 18 and 60.

1. Education assistance to children of the workers:

Check the following table that defines the education assistance to the children of workers:

2. Medical Assistance:

Workers between the ages of 18 and 60 are covered under the ESI system, with a minimum of Rs. 1,000 and a maximum of Rs. 10,000 available for treatment of serious ailments.

For example, kidney transplant, heart surgery, gallbladder difficulties, cancer therapy, kidney stone removal, angioplasty, eye, orthopedic, uterus procedures, and brain hemorrhage, and for each instance, Rs. 500 to Rs. 1000 for medical check-up.

3. Accident Benefits:

Workers between the ages of 18 and 60 are eligible for compensation ranging from Rs. 1,000 to Rs. 3,000; applications must be submitted within three months after the accident, along with medical documents, despite being covered by the ESI Act of 1948.

Benefits available to Workers without Wage Limit, Age 18 to 60 Years

4. Funeral Expenses:

For Rs. 5,000/- for death of the beneficiary payable to the deceased dependents, to be applied in the prescribed format within six months.

5. Medical Check-up Camps:

For Rs. 30,000/- Financial Assistance for annual medical check-up camps Sponsored by Trade Union/ Associations for workers contributing to the Welfare Fund once in a year.

6. Annual Sports Activity:

For Rs. 50,000/- Financial Assistance for annual sports at district level by registered Trade Unions one time in a year.

Financial assistance for the beneficiaries will be directly deposited to their savings account through RTGS.

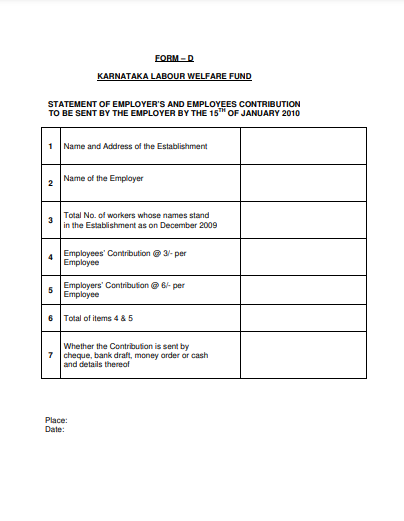

Rate of Welfare Fund Contribution

You must register for the plan if your firm is registered in Karnataka and has 50 or more employees. These contributions must be made on an annual basis. This must be completed by the 15th day of the following year (meaning, 15th of January).

- Employees donate Rs. 20/-, whereas the employer contributes three times that amount. This equates to Rs. 40/-. As a result, each employee is required to contribute Rs. 60/-.

Contribution form:

- Workers who perform clerical or manual labour, whether skilled or unskilled.

- the deduction is not applicable for the Managers, Supervisors, and other officers.

Payment to: Welfare Commissioner, Karnataka Labour Welfare Board

Mode of Payment: You can make the payment through DD/Cheque/RTGS/NEFT

Unpaid Accumulations

Along with Annual Welfare Fund Contribution the employer’s also need to remit unpaid accumulations to the Labour Welfare Fund.

Unpaid Accumulations Meaning:

As per section 2(10):

- Employees are owed money, but it has not been paid to them in three years.

- This includes all legally owed wages and gratuities.

- This does not, however, include the payments made into the Provident Fund.

Significant Benefits of Labor Welfare Fund

Following we have discussed some of the crucial benefits of Labour Welfare Fund:

- Program Scholarship

- Assistance from the deceased workmen's family for the performance of last rites

- Annual Sports

- Medical Assistance

- In the event of an accident, workers are entitled to financial support.

- Financial help for the acquisition of artificial bodily organs for people with disabilities.

- Tricycles for Disabled Employees

- Employees' dependents can take computer classes.

- Courses in spoken English for employees' dependents

Details on Karnataka Labour Welfare Fund Act

Check the following table:

Karnataka Labour Welfare Fund Form:

Consequences for Not Contributing in Karnataka Labour Welfare Fund

Following we have listed consequences for not contributing in Karnataka Labour Welfare Fund:

- In the case of a first offence, the penalty is imprisonment for a period of up to three months and/or a fine of up to Rs.500/-.

- For the second or subsequent offences, a period of imprisonment of up to 6 months may be imposed, as well as a fine of up to Rs.1000/-. If only a fine is imposed, it will not be less than Rs. 50/-.

- If you don't pay your contribution on time, you'll be charged interest at the rate of 18% on the amount you owe.

Frequently Asked Questions (FAQs) on Karnataka Labour Welfare Fund, 1965

Following we have discussed some of the crucial frequently asked questions on Karnataka Labour Welfare Fund, 1965:

Que 1: What exactly is the LWF deduction?

The Labour Welfare Fund, or LWF, is a programme of the Indian government. The Labour Welfare Fund is managed and controlled by the Ministry of Labour. It was established to assist the unorganized sector.

The fund's goal is to provide a certain level of social security to the workers and their families.

Que 2: Who is in charge of the Workers' Compensation Fund?

The employer and the employee are both in charge and required to contribute to the Labour Welfare Fund.

Que 3: Is it required to make a donation to the Labour Welfare Fund?

The Labour Welfare Fund is governed by separate state bodies. If the Labour Welfare Fund is acceptable in your state, it is vital that you donate.

While each state has its own set of standards, non-compliance can result in fines ranging from Rs. 50 to Rs. 20,000, a year in prison, or both, based on the state.

How Can Deskera Help You?

Deskera People helps digitize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth

Final Takeaways

We have finally reached the end section of this guide. Let’s take a look at some important information:

- Karnataka Labour Welfare Fund Act, 1965 was established to fund for the purpose of subsidizing initiative to enhance the welfare of workers in the state of Karnataka.

- The Labour Welfare Fund (LWF) is a statutory payout that each state administers independently.

- You, as an employer, are required to contribute a set amount on your own behalf and on the account of your employee as well.

- The payment, deadlines, and even penalty may vary from state to state. You must examine the applicability, which will be determined by the state in which your firm is registered.

- You must register for the plan if your firm is registered in Karnataka and has 50 or more employees. These contributions must be made on an annual basis.

- Every year, on or before January 15th, employees and employers contribute in the ratio of 20:40

- Employees donate Rs. 20/-, whereas the employer contributes three times that amount. This equates to Rs. 40/-. As a result, each employee is required to contribute Rs. 60/-.

- In the case of a first offence, the penalty is imprisonment for a period of up to three months and/or a fine of up to Rs.500/-.

Related Articles