Every work sector has compliances and mandatory elements that need to be fulfilled by the employees or the workers; failing to do so may result in fines being levied by the business owner. Karnataka Form I is a Register of fines that keeps track of such fines imposed on the workers. It is a part of the Minimum Wages Act of 1948; therefore, we must understand the Act well.

The Constitution of India requires the government to make every effort to ensure that people have jobs that provide a good standard of living and allow them to fully enjoy leisurely Activities other than work. The Minimum Wages Act of 1948 was created to establish minimum wages in specific occupations and provide developed security for the workers or employees. The Act's provisions are intended to fulfill the goal of fairness and equality for employees in scheduled employment by establishing minimum wage rates.

As an added measure, the Payment of Wages Act of 1936 ensures that wages are paid on time and without deductions unless explicitly allowed by the Act.

To learn more about the form, we shall be going through the following points in the article:

- What is the Karnataka Form I Register of Fines?

- Karnataka Minimum Wages, 1958: An Overview

- Compliances and Applicability of Karnataka Minimum Wages, 1958

- Maximum fine that could be imposed under Labor Law in India

- Difference between Fines and Penalties

- Is fine a type of deduction?

- Provisions related to deduction of fine

- How can Deskera Help You?

- Key Takeaways

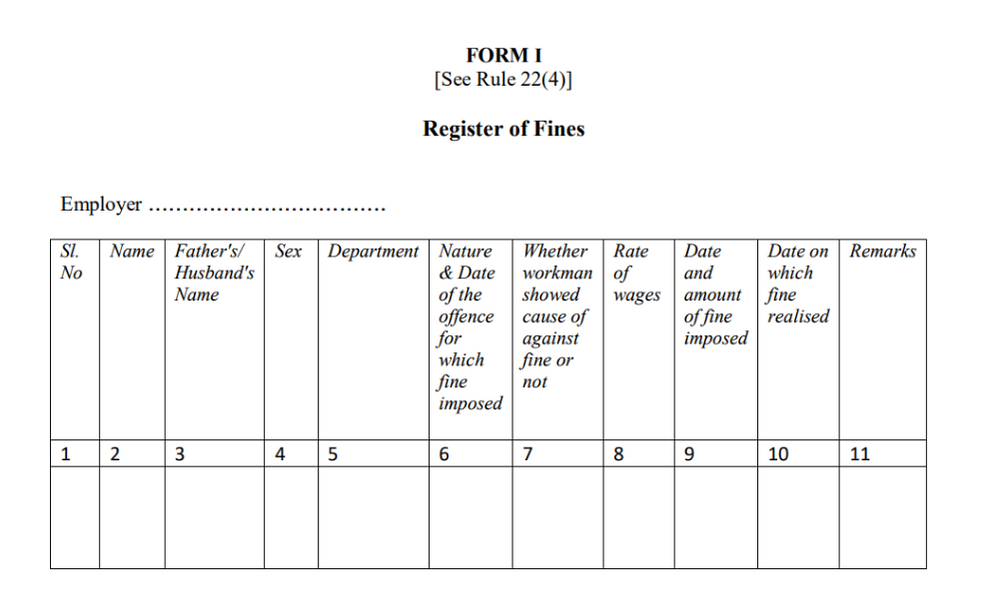

What is the Karnataka Form I Register of Fines?

Karnataka Form I Register of Fines is a part of the Karnataka Minimum Wages Rules of 1958.

The Karnataka fine check is a record that the manager or employer must maintain for all employees. The form requires the employer to maintain all the details in the form that include the following:

- Name of the employee

- Employee’s father’s or husband’s name

- Gender of the worker

- Department

- Nature of the offense and the date on which it was committed

- Next, they must enter whether or not the worker has shown cause against the fine

- Enter the rate of wages as applicable

- Date and amount of the fine imposed on the worker

- Enter the date on which the fine is realized

- Enter any additional and relevant remarks, if any

Besides this information, it must be noted that the fine amount is primarily determined and prescribed by the state government. All the fines the employer collects must be entered and recorded in this Register of fines.

Furthermore, the employers must maintain this record within the premises of the workplace. The Register must be produced as and when ordered or requested. Also, it must be kept updated. A Nil entry shall be placed in the Register after the salary period if no fine has been levied on any employee during that wage period.

Karnataka Minimum Wages, 1958: An Overview

While speaking about Karnataka fine check, we must understand that the form falls under the Minimum Wages Rules of Karnataka. This brings us to learn about the Minimum Wages Rules as adopted by the state of Karnataka.

The Rules comprise seven chapters that lay down the rules for the corresponding areas. They can be summed up as follows:

- Chapter 1: Preliminary with important definitions, terms, and terminologies. This includes the terms used throughout the document for easy understanding of the readers.

- Chapter 2: Description of Board and committee. The chapter describes the member of the board committee. It also informs about the term of office members on the board.

- Chapter 3: Summoning witnesses and Producing the documents.

- Chapter 4: Calculation of wages, hours of work, and rules for holidays. This is the most important chapter that lets us know the basis on which the wages of the workers are determined.

- Chapter 5: Claims that are made under the Act

- Chapter 6: Scale of Costs (incurred for court fees, pleader’s fees, and so on) under the Act

- Chapter 7: Miscellaneous, which includes repeal and savings. This entails repealing The Bombay Minimum Wages Rules, 1951, The Hyderabad Minimum Wages Rules, 1951, The Minimum Wages (Madras) Rules, 1953, and The Coorg Minimum Wages Rules, 1954.

Finally, at the end of the document, we have all the forms that must be maintained by the employer.

Compliances and Applicability of Karnataka Minimum Wages, 1958

The Karnataka Minimum Wages of 1958 make it mandatory for certain compliances to be met.

- Form I - Register of Fines

- Form II - Register of Deductions

- Form III - Annual Return

- Form IV - Overtime Register

- Form V - Register of Wages

- Form VI - Wage Slips

- Form VII - Muster Roll

Applicability of the Karnataka Minimum Wages Rules

The Karnataka wages rules apply to the following scenarios:

- The Act covers all schedules of work when minimum wages are estimated or revised.

- Under this Act, every employer must pay the minimum wage for all scheduled employment. There are provisions for setting work hours, overtime, and overtime pay.

- The Consumer Price Index from the prior calendar year is used to calculate variable DA.

- In Karnataka, minimum wages are set based on the State Level Minimum Wages Advisory Board.

Maximum fine that could be imposed under Labor Law in India

The maximum fine that an employer can impose on an employee or worker is 3% of the salary of the employee. Having said that, a proper show cause procedure must be completed before the fines can be imposed.

Moreover, a young person worker who is less than 15 years of age cannot be levied a fine.

Difference between Fines and Penalties

After reading through the article so far, if you seem to be lost between the terms fines and penalties, then let’s clear it out in this section.

The contrast between a fine and a penalty can be recognized clearly in the various principles:

A fine is a sum of money that a court orders you to pay as a penalty or punishment. Punishment, on the other hand, is retaliation for failing to follow the rules of a certain act. While fines are levied when a crime or offense is committed, a penalty is issued when a law or agreement is broken.

The court imposes a penalty on the perpetrator, while the concerned authority imposes a penalty on the individual who breaks the law. Fines can range from monetary payments to court appearances, jail, or mandating community service. Fines, on the other hand, can take the shape of restitution, property confiscation, or even jail.

Is Fine a type of Deduction?

Yes. Fine is a type of deduction. Based on the Payment of Wages Act of 1936, there is a certain category of primary deductions that have been approved. These are as mentioned in the following list:

- Fines

- Deduction for the period of absence

- Deduction for goods expressly entrusted to the employed person that have been damaged or lost.

- Deduction for lodging or accommodation

- Deductions against the services and amenities offered by the employer based on the employee agreement

- Deductions for recovering the advance payments, adjusting overpayments, and interests

- Deductions for the recovery of loans from any grant or fund established for the welfare of labor as consented between the employer and the employee

- Income tax deductions

- Deductions based on the court or other authority orders

- Deduction from any Provident Fund for subscription and return of advance

- Payments to cooperative societies are deducted as agreed between the employer and the employee.

- Deduction of LIC premiums with the employer's written permission; or any other investment in Post Office Savings Schemes

The most important point to be noted is that as stated in section 7 of the Act, the total amount of deductions in any salary period should not exceed 75 percent of the employee's income if the deductions are for payments to cooperative societies in whole or in part. In all other circumstances, the percentage should not exceed 50%.

Provisions related to deduction of fine

If fines must be levied on an employee, they should only be for Acts and omissions that are listed and approved by the corresponding government. Fines should not be more than 3% of a worker’s salary. Additionally, this must be collected within 90 days of the Act or omission, must be imposed via a competent show cause procedure, and cannot be imposed on an employee under the age of 15.

Employers are required to keep the following records in the prescribed formats:

- Wages Register

- Fines Register

- Deductions for damages or loss Register

How can Deskera Help You?

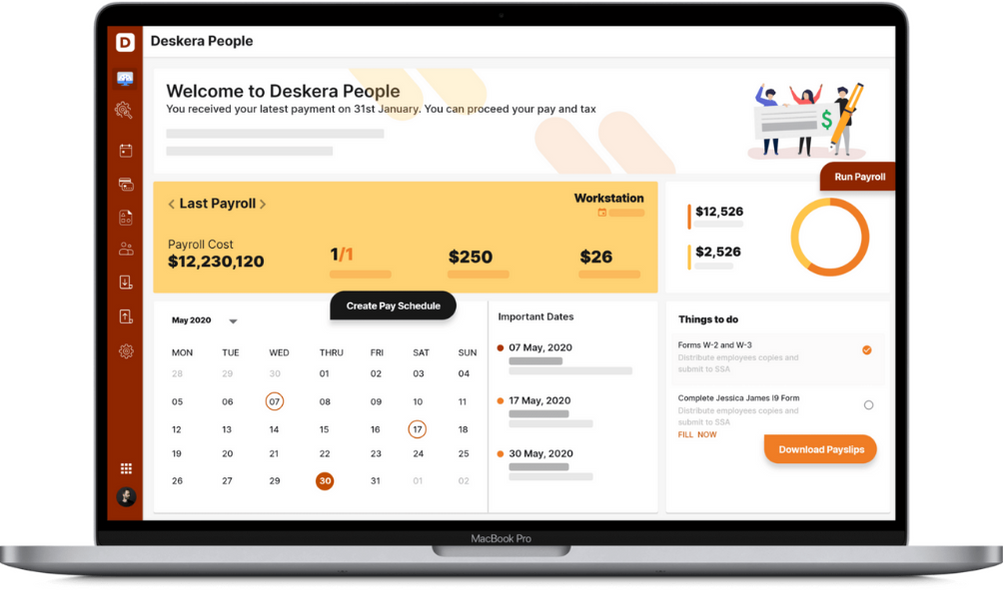

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Key Takeaways

- The Minimum Wages Act of 1948 was created to establish minimum wages in specific occupations and provide developed security for the workers or employees.

- The Act's provisions are intended to fulfill the goal of fairness and equality for employees in scheduled employment by establishing minimum wage rates.

- Karnataka Form I Register of Fines is a part of the Karnataka Minimum Wages Rules of 1958.

- The Karnataka fine check is a record that the manager or employer must maintain for all employees.

- The form comprises details of the employees such as name, gender, department, nature of offense and date, rate of wages, date and amount of fine imposed, and date on which the fine is realized.

- The fine amount is primarily determined and prescribed by the state government. All the fines the employer collects must be entered and recorded in this Register of fines.

- The Register must be produced as and when ordered or requested. Also, it must be kept updated.

- A Nil entry shall be placed in the Register after the salary period if no fine has been levied on any employee during that wage period.

- The Karnataka wages rules apply to various scenarios. The Act covers all schedules of work when minimum wages are estimated or revised.

- Under this Act, every employer must pay the minimum wage for all scheduled employment. There are provisions for setting work hours, overtime, and overtime pay.

- In Karnataka, minimum wages are set based on the State Level Minimum Wages Advisory Board.

- The maximum fine that an employer can impose on an employee or worker is 3% of the salary of the employee. Having said that, a proper show cause procedure must be completed before the fines can be imposed.

- A young person worker who is less than 15 years of age cannot be levied a fine.

- Fines should not be more than 3% of a worker’s salary. Additionally, this must be collected within 90 days of the Act or omission, must be imposed via a competent show cause procedure

Related Articles