Do you know what the compliance calendar includes? Corporate meeting minutes and schedules as well as any special events related to compliance activities are included.

Managers of human resources must ensure that all HR compliance requirements are met on time. In order to ensure that they don't miss any important filing dates or regulatory obligations, many types of businesses can benefit from having a compliance calendar.

Table of contents

- When and Why to Use an Organizational Compliance Calendar?

- What is a content calendar, and how does it differ from a traditional editorial calendar?

- Small Business Development Tips

- Components of Compliance Calendar

- Benefits of Keeping a Compliance Schedule

- Creating a Compliance Timeline

- What are the requirements of the ROC?

- What is the procedure for submitting the ROC form?

- Is it necessary to submit ROC forms on a monthly or yearly basis?

- Exactly what do you mean by the term "MSME"?

- When should the annual general meeting be held?

- Compliance Calendar Benefits

- Key Takeaways

When and Why to Use an Organizational Compliance Calendar?

Making sure you're in compliance with all applicable local and federal regulations is a major responsibility for any small business owner. This aspect of your business can be managed more effectively by setting up a compliance calendar.

In order to avoid fines or penalties for late or missing information, a compliance calendar keeps track of all your company's filing requirements, their due dates, and related details.

What is a content calendar, and how does it differ from a traditional editorial calendar?

When it comes to planning and organising your content, you can use a "content calendar" or "editorial calendar." There are many forms that a content calendar can take. It's possible to use a social media content calendar, for example, to organise all of your posts for the various social media platforms where you participate.

All of your upcoming content, status updates, promotional activities, partnerships, and even updates to existing content are all included in this category.

In just one day, you and your company can plan a year's worth of content.

In order to stay organised, meet your deadlines, and be more productive throughout the year, create a calendar with a prioritised list of blog post topics.

The topics around which you plan to produce content are critical to the overall success of your content calendar. First, you must figure out the topic of your writing or recording before you can begin the process.

Decide what you want to sell

But before you can begin brainstorming content ideas, you first need to know what you're trying to promote.

The problem is that many people make the blunder of assuming that any type of content they produce will be relevant to their niche. However, if you want to make any sales from the traffic that your blog receives, you must write about topics that are directly related to your product, statutory compliance calendar 2020 21.

In other words, what do you sell? Is it a physical item, digital course content, local service, or even a software service?

It's impossible to create content around a topic unless you know exactly what your target audience will buy after they've consumed your content.

Personify your ideal customer

When creating buyer personas, use this information to get started, statutory compliance calendar 2020 21. The use of a buyer persona helps you to better understand your audience as you write.

When you know who you're trying to reach, you can better tailor your content to them. People who read your content will often feel as though you are speaking directly to them, statutory compliance calendar 2020 21.

Defining objectives and establishing motifs

There are many advantages to having a bird's eye view of your content, as we've previously discussed.

It's also a good idea to have a goal in mind for your content, as well. As a result, you'll be better able to gauge whether or not your efforts are paying off, statutory compliance calendar 2020 21.

If you want your company to grow, you should always have a specific end goal in mind. It's best to keep your goals to a manageable number so that you can stay focused while still keeping them challenging enough for you to succeed. There should be no more than three at a time.

Small Business Development Tips

Market Research

Performing market research is a must when you're trying to grow your small business. As a result, you can gain a deeper understanding of both your current and future customers. It's critical to gain an understanding of your target audience's wants and needs, statutory compliance calendar 2020 21. You'll be able to see how your company can expand and adapt in order to meet these demands.

Keep an eye out for your direct competitors as well. You can make better decisions about how to grow your small business if you know what your competitors' strengths and weaknesses are, statutory compliance calendar 2020 21.

Construct a Profitable Sales Channel

A well-designed sales funnel can help your business grow. Consider a sales funnel to be a customer's path. Customers are at the top of the funnel when they enter your store or visit your website, statutory compliance calendar 2020 21. They've completed the funnel when they buy something or sign up for a service.

It's important to think of ways to move customers through the sales funnel, statutory compliance calendar 2020 21. As an example, you could offer a discount or ask for their contact information in order to keep in touch with them.

Retaining Customers

If you want to grow your business, you need more than just new customers. In addition, you must keep your current clients coming back. You can boost sales by increasing customer retention, which can build customer loyalty, statutory compliance calendar 2020 21.

Since acquiring new customers costs five times as much as keeping an existing one, focusing on customer retention means that your business won't waste money on something that isn't a sure thing.

Prioritizing the needs of the customer

Treating your customers well will keep them coming back for more. Customer service is a reflection of how much you care about them as a person and as a customer.

You can use CRM systems to keep track of customers and potential customers. In addition to helping you keep track of important customer data, they can also point out potential revenue streams, statutory compliance calendar 2020 21. One of the most significant advantages is that all of your data is kept in one location, making it easily accessible to you and other employees.

These programmes reward your loyal customers for their continued support of your company. statutory compliance calendar 2020 21. In addition, they can help you attract new customers or re-enter the market with those who have already left your company, statutory compliance calendar 2020 21.

Making a promotional email campaign

You can keep your business at the forefront of customers' minds by using an email campaign. A great way to move customers from one stage of the sales process to the next.

Using social media to interact with customers

On social media, your customers may have a question or a problem they'd like you to address, and you can respond to them, statutory compliance calendar 2020 21. As a show of respect, take the time to respond and engage in conversation with them.

Keeping your promises is a good rule of thumb

Nobody enjoys being left out of someone's plans. Make good on your promise to a customer that you'll get back to them with additional information or contact them in the future, statutory compliance calendar 2020 21. If you don't, your customers may form an unfavourable opinion of your company.

Make an effort to attend social events

New customers can be gained by increasing your brand's visibility. Attending networking events is a good way to do this. Don't be afraid to attend a few events in order to spread the word about your company.

Adopt a socially responsible business approach

It's not uncommon for customers to seek out businesses that share the same core values as themselves, statutory compliance calendar 2020 21. As a company, you are responsible for ensuring that your actions have a positive impact on society as a whole, statutory compliance calendar 2020 21. Your business' bottom line can benefit from letting the public know what you're doing to make a positive difference.

Volunteering in the neighbourhood

Your employees can make a difference by becoming active members of the neighbourhoods where they live and work. Volunteering at a food bank or cleaning up public spaces shows that your business cares about the community and the people who live there.

Establish Long-Term Business Relationships

Strategic partnerships with other businesses can allow you to reach a wider customer base or align your business plan's growth with your company's strategic goals. statutory compliance calendar 2020 21. Starbucks and other national retailers like Barnes & Noble and Target are good examples of a successful strategic partnership. As a result of the partnership, the coffee chain's reach and revenue are boosted across the country.

Franchising your small business may be an option

Small businesses often use business franchising as a means of expanding their operations. This means that you hand over control of your business to a new owner, statutory compliance calendar 2020 21. After that, they'll open and run their own branch of your company.

Companies like McDonald's and Starbucks are among those that offer franchises for sale, statutory compliance calendar 2020 21. New franchises bring in more revenue because they expand your business's geographic reach.

Analyze Your Results and Keep Improving Over Time

While there are many ways to grow your small business, it's important to keep track of what's working. A customer loyalty programme that isn't boosting customer retention may necessitate an adjustment in strategy, statutory compliance calendar 2020 21. Engaging with customers on a regular basis, whether through email campaigns or social media, could be as simple as implementing a customer relationship management system (CRM).

Components of Compliance Calendar

When it comes to planning your schedule, it all depends on the nature of your business and the compliance dates it must meet. A variety of filing deadlines and timings exist depending on the state in which you live and the industry you work in, such as tax payments, statutory compliance calendar 2020 21.

In addition, many types of licence and permit renewals are done annually as part of the company's filing obligations. In order to keep track of these annual filing deadlines, you can use a compliance calendar.

Your compliance calendar might also include filings for meeting minutes and schedules, annual reports, and any other special events related to compliance activities, statutory compliance calendar 2020 21.

Benefits of Keeping a Compliance Schedule

This means that you, the owner of the company, would have one less thing to keep track of, making it easier for you to run your business, statutory compliance calendar 2020 21. You can use a calendar to keep track of all the paperwork you need to submit and when it needs to be done.

A compliance calendar can mean the difference between staying in business and going out of business if you run a limited liability company (LLC). You may get into trouble with the state agency that regulates businesses if you overlook a minor detail, statutory compliance calendar 2020 21. You can use a compliance calendar to keep everyone on the same page when it comes to meeting filing deadlines.

Additionally, the calendar would be readily available for submission to regulatory agencies if the need ever arose.

Creating a Compliance Timeline

Maintaining your business's smooth operation may require entrusting some of these responsibilities to an online services company, which can ensure that nothing slips between the cracks, statutory compliance calendar 2020 21.

In addition to determining what you need to do and how to do it, most providers offer systems with automatic reminders to remove all of the guesswork about regulatory deadlines, statutory compliance calendar 2020 21. The best part is that you won't have to worry about missing a deadline anymore because you've got your compliance obligations under control.

Due to the fact that no two businesses are the same, it's critical to work with a service that can customise a compliance calendar just for you, statutory compliance calendar 2020 21. There's no better time to start organising your compliance calendar than right now, especially if you're facing impending deadlines.

This decade has been a roller coaster of global regulatory changes, and it's unlikely that the next decade will be any less tumultuous. Regulatory authorities around the world have been looking for ways to make organisations' operations more transparent and to eliminate any levers or corners where bad actors could hide their activities since the global financial crisis in 2008, statutory compliance calendar 2020 21.

This ever-increasing regulatory compliance burden affects even organisations that follow the rules. It's difficult for any compliance manager to keep up with the demands of jurisdictions, which include regular filing deadlines and reporting requirements.

In this environment, having all of your compliance and governance ducks in a row is critical. Any organization's compliance officers, whether they are in charge of protecting the interests of individual clients or overseeing the company's adherence to government regulations, must have a system in place that is flexible enough to adapt quickly while also being robust enough to ensure that no current deadlines are missed.

Managing legal entities necessitates the use of a compliance calendar

Enter the compliance calendar. Regulations and reporting requirements for the labour market, the industry, and the regulatory environment are constantly evolving, so failing to keep up with these changes could result in fines and harm to the company's reputation.

When it comes to complex regulatory environments, it's easy to miss out on important requirements or deadlines that can have an enormous impact on an international group structure and the parent company, statutory compliance calendar 2020 21.

In order to keep track of all applicable laws and regulations in all jurisdictions, a compliance calendar is necessary. For multinational corporations, the compliance calendar can help identify the compliance status and requirements of every jurisdiction to ensure efficient legal operations; for smaller businesses, the calendar is just as important to ensure that entities remain legitimate and able to operate legally wherever they are.

To ensure that internal meetings and groups are brought together in time to meet the regulatory requirements, the calendar can track filings such as minutes of board meetings, annual report filing deadlines, and so on.

As a way to keep companies up to date, most regulators and official organisations will produce a calendar of filing dates, but most come with the caveat that it may not be a complete list, statutory compliance calendar 2020 21.

Firms must do their own due diligence to ensure that they comply with all of their regulatory and filing requirements, and their reliance on this report does not create a safe harbour from a firm's regulatory obligations tough talk for an official body, but it shows the importance of cross-referencing multiple sources to get those ducks ready. This one is from FINRA in the US, statutory compliance calendar 2020 21.

Complying with regulations, reporting obligations, industry filings, permits and accreditations are just some of the requirements that are tracked by compliance calendars. Even internal events, such as the annual general meeting (AGM) or any training sessions, can be included in the compliance calendar, statutory compliance calendar 2020 21.

What are the requirements of the ROC?

It is mandatory for all registered companies and LLPs in India to submit their annual ROC compliances by the due date specified in the Companies Act, 2013 and Companies Rules. Companies and LLPs that fail to submit their ROC forms to ROC by the deadline will be subject to a fine, statutory compliance calendar 2020 21.

What is the procedure for submitting the ROC form?

The forms can be downloaded from the MCA website by companies and LLPs. After completing and submitting this application on MCA's website, they will receive a confirmation email from us.

Is it necessary to submit ROC forms on a monthly or yearly basis?

There are only a few ROC forms each year. The ROC does not require any forms to be submitted on a monthly basis. The ROC forms pertain to a company's or LLP's financial records for a given fiscal year.

The 2021-22 ROC Compliance Calendar

in accordance with the Companies Act, 2013, and the Limited Liability Partnership Act, 2008, in India, companies and LLPs must file annual reports. There should be an annual or specific event-based filing with the ROC.

Complying with ROC regulations

It is imperative that corporations and limited liability companies (LLPs) adhere to the due dates for compliance. There will be a significant fine imposed on companies and LLPs that do not meet the compliance requirements. As a result, businesses and LLPs should be aware of the ROC compliance requirements that must be met on a yearly basis.

Form 11

The LLP and its partners are required to submit an annual financial statement. Within 60 days of the end of the fiscal year, all LLPs registered with the state must submit this form.

Each year, on or before the 30th of October, the Statement of Accounts and Solvency (Form 8) must be filed within 30 calendar days of six months having elapsed since year's end, statutory compliance calendar 2020 21.

This article explains how to fill out the Form 11- Annual Return. Here are some of the most important things to keep in mind when filling out Form 11.

It is mandatory for all Limited Liability Partnerships (LLPs), regardless of their turnover for the year, to file Form 11 annually. Form 11 must be filed even if an LLP does not conduct any operations or business during the fiscal year, statutory compliance calendar 2020 21.

The MCA portal must be used to submit it. In order to complete the e-form, you must first download it and complete it offline, statutory compliance calendar 2020 21. In order to save time, you can use the pre-fill feature, and the Pre-scrutiny button verifies the information you've entered. Before you submit the form online, this is done.

PAS-6

Unlisted public companies must file a Reconciliation of Share Capital Audit Report 60 days after the end of each half-year.

DPT-3

Deposits will be refunded. Every business is required to submit this form, which includes details on any deposits or unpaid loans or other sources of funds besides deposits.

Except for government-owned firms, all private companies must now submit a single DPT 3 return, as announced by MCA in a notification dated January 22, 2019. It's also a requirement that it be filed every year, statutory compliance calendar 2020 21.

The one-time return must be filed between April 1, 2014, and March 31, 2019, inclusive. It was therefore necessary to report any and all receipts received during this time period that were still outstanding on March 31st, 2019. The annual report covers the time frame beginning on April 1 and ending on March 31, 2020. All outstanding debts will be included in this statement.

DIR-3 KYC

Until the end of March 2022, DIN holders will be required to submit a director's KYC. Anyone who has been assigned a DIN and whose DIN status has been upgraded to "Approved."

If you want to become a company director, or if you are already one, you will be given a director identification number (DIN). When applying for DIN in the digital age, an eForm DIR-3 application was sufficient, statutory compliance calendar 2020 21.

Anyone who plans on becoming a director of one or more companies has to go through this process once. As a result of the MCA's decision to update its registry, all directors with DINs will now be required to submit their KYC information on a yearly basis via eForm DIR-3 KYC.

Anyone who received a DIN on or before March 31st, 2018 and has it in an approved status must submit his or her KYC information to the MCA, according to a recent announcement from the MCA. It's also mandatory for disqualified directors to go through this process, statutory compliance calendar 2020 21.

Form DIR-3 KYC will be required for all directors who have been assigned a DIN by the end of the fiscal year and whose DIN is in approved status as of the fiscal year after that, beginning with the 2019-20 fiscal year.

Form ADT

In less than 15 days after the AGM's conclusion, a report must be filed. The ROC should be informed of the appointment of an auditor by every company.

Following its annual general meeting, a company uses Form ADT-1 to notify the Registrar of Companies of the appointment of an auditor (AGM).

139(1) of the new Companies Act 2013 mandates the submission of this form, which must be done annually following the AGM at which the auditor was appointed, statutory compliance calendar 2020 21.

Form 8

The ROC recommends that you submit the form each year. The statement of accounts and solvency is another name for this document. Profit and loss information, as well as a balance sheet, should be provided by every limited liability partnership (LLP).

The returns for a Limited Liability Partnership (LLP) should be filed on a regular basis to ensure compliance and avoid heavy fines under the law for non-compliance statutory compliance calendar 2020 21. Compared to private limited companies, Limited Liability Partnerships have a surprisingly low number of annual compliance requirements. In spite of this, fines appear to be rather large, statutory compliance calendar 2020 21.

The elected partners of a Limited Liability Partnership (LLP) are responsible for keeping a proper book of accounts and submitting an annual report to the Ministry of Corporate Affairs (MCA) each year.

Partnerships with a limited liability are exempt from auditing their books of account unless their annual turnover exceeds Rs.40 lakh or the contribution exceeds Rs.25 lakh in value. As a result, an LLP that meets the criteria outlined above does not need to have its books of account audited, making the annual filing process easier.

Form AOC-4

To be submitted within 30 days of the conclusion of the Annual General Meeting. Financial statements must be submitted to the ROC by specified companies.

Financial statements, disclosures, the board's report, and the auditor's report are all ways in which a company must answer to its stakeholders. The financial statements are the primary means of communication between the Board of Directors and the shareholders, statutory compliance calendar 2020 21. The Registrar of Companies receives the annual financial statements via Form AOC 4. (ROC). The AOC 4 CFS must be submitted by the company in the case of consolidated financial statements.

MGT-7

To be submitted within 60 days of the AGM's conclusion. Every company is required to submit an annual report that includes information about the business.

Every year, a company must submit an annual return to the ROC. As of the end of the fiscal year, on March 31st, this report contains the basic information about a company and its shareholders, directors, and so on. Annual returns in Form MGT-7 are required by law for all companies that have been registered, statutory compliance calendar 2020 21.

The Ministry of Corporate Affairs provides all corporations with an electronic form, known as MGT-7, on which to enter information for their annual tax returns. The Registrar of Companies maintains this e-form via electronic mode and on the basis of the company's statement of correctness.

MGT-14

Report and annual accounts resolutions to be submitted to ROC. There should be a record of the resolutions that were passed.

Form MSME

Payments due to Micro, Small, and Medium Enterprises (MSMEs) should be reported to the registrar at least once every six months by all of the specified companies.

Exactly what do you mean by the term "MSME"?

This type of business is referred to as a Micro, Small, and Medium Enterprise (MSME). A micro-enterprise is one with an annual revenue of less than Rs. 5 crore and an investment in plant and machinery or equipment of less than Rs. 1 crore.

A small business is defined as one that has an annual turnover of less than Rs. 50 crore and an investment in plant and machinery or equipment of less than Rs. 10 crore. Investment in plant and machinery or equipment does not exceed Rs.50 crore and annual turnover does not exceed Rs.250 crore for a medium enterprise.

When should the annual general meeting be held?

The AGM must be held within six months of the end of the financial year for all companies except the One Person Company (OPC). An annual general meeting (AGM) must be held by the company before the 30th of September if its fiscal year ends in March.

An AGM can be held less than nine months after the end of a company's first financial year if the company holds its first AGM. A company's two annual general meetings (AGMs) should be separated by no more than 15 months, statutory compliance calendar 2020 21.

Compliance will be more important than ever

A compliance calendar isn't just for the first week of January; paralegals and legal operations professionals need a way to regularly check deadlines and requirements without the updating becoming a full-time job.

In order to ensure that your compliance calendar is up-to-date for the new year, you need to use a calendar that is both a diary and a spreadsheet. In addition to the time and effort required, manual updating is prone to human error. Many paraprofessionals are turning to digital methods of compliance tracking, especially as automation and machine learning bring compliance to the 21st century.

With cloud-based entity management software, you can keep track of all of your regulatory obligations.

A paralegal's time is valuable, and he or she would prefer to work with a single platform that is fully integrated with all the other processes and systems they use. Consolidating services is the key to achieving greater savings.

You're looking for an entity management system that's easy to use and navigate for your customers. It should be intuitive. People like you, who have similar problems to solve, have been and will continue to be involved in the development of the legal entity management platform, statutory compliance calendar 2020 21.

Automated reminders, email notifications, data reports, and other features help you keep track of thousands of filing and compliance events across entities and jurisdictions, so you never miss a filing deadline again.

Calendars for Monitoring Compliance

Business regulation has its own set of set of rules. In the world of labour laws, industry regulations, and reporting requirements, things are constantly evolving.

The consequences of failing to meet these dates or deadlines can be far more severe, including possible penalties or fees for your organisation, as well as the reputational costs and the time and effort it takes to get your company back into compliance, statutory compliance calendar 2020 21.

Compliance requirements must be met on time, every time, by your legal team. A compliance calendar is a useful tool for keeping track of and organising your company's upcoming compliance requirements.

Navigating the Complexity of the Regulatory Environment

Complying with regulations, reporting obligations, filings in the industry, permits, and accreditations are all tracked on a compliance calendar. Using this as a compass, you can navigate the year's regulatory landscape, statutory compliance calendar 2020 21. Compliance calendars can track internal events at the local, national, or international level, whereas many compliance initiatives focus on external federal agencies.

Using compliance calendars helps teams keep track of important dates and streamline the process of implementing policies and procedures. In order to keep your compliance team on track and avoid penalties, automated compliance programmes send reminders of upcoming deadlines to the right people, statutory compliance calendar 2020 21.

Compliance Calendar Benefits

Compliance calendars aid in the protection of corporate information

We've all heard about the dangers of data breaches by now. The importance of protecting customer data has never been greater as regulations like the EU's GDPR come into effect this year. Data security can be strengthened in your organisation through the thoughtful application of compliance calendars.

Calendars for compliance help disseminate information about compliance across the company

Ignorance is often the root cause of an employee's noncompliance with a mandate, rather than malice. In order to keep everyone in the company up to date and aware of all applicable compliance measures, compliance calendars can be a useful tool, statutory compliance calendar 2020 21.

Complying with regulations is easier when you use compliance calendars

In the face of constantly shifting regulations, many organisations are forced to jump from one crisis to the next, extinguishing one fire only to discover a new one, statutory compliance calendar 2020 21. There are many benefits to using a compliance calendar, the most important of which is the ability to plan ahead for your organization's compliance requirements.

The use of compliance calendars improves transparency

With compliance calendars, everyone in the company can keep track of how well compliance measures are being implemented. To keep stakeholders and board members informed and remove any ambiguity around compliance measures, such results can be used to do so.

The use of compliance calendars aids in the management of global operations

Securing compliance across continents is a common problem for multinational corporations. Compliance officers can easily keep track of any tasks that are past due or that need to be addressed by the compliance team by using a statutory compliance calendar 2020 21.

To ensure that organisations are prepared for compliance audits and reports, compliance calendars are a useful tool.

Compliance auditors will be able to see how your organisation is addressing each compliance obligation if you have a well-organized compliance schedule.

Creating a Compliance Calendar for Your Organization Using the Best Practices

Your company's current compliance manual should be reviewed. A compliance manual is a necessity for every company. Getting started with the year's compliance plan is a good place to start. Ensuring that your company's policies address any new regulations or initiatives is essential. In addition, make sure that the compliance procedures in place on the ground match those in the manual.

Analyze your entire compliance strategy. Evaluate the efficacy of ongoing measures as you plan your organization's annual compliance strategy. It's a good time to bring in new elements in response to new regulations, or to get rid of old ones that aren't meeting your company's needs.

Set the frequency of tasks based on your industry's requirements. Planned tasks can be ongoing or scheduled on a regular basis (monthly, quarterly, or annually). You should make sure that these timetables are in line with the demands of your company and industry. More frequent monitoring may be necessary in high-risk areas.

Consider the advantages of automation. Automated compliance calendar software can help a company move from a spreadsheet-based calendar to a centralised database that can be easily and fully accessed by compliance officers and other relevant users.

Improve Compliance by Using Technology

Businesses looking to grow face an ever-increasing burden of regulatory compliance. Organizations face legal repercussions, financial penalties, and reputational harm if they fail to meet their compliance obligations.

Organization and prioritisation of compliance tasks, as well as tracking of permits, deadlines, and communications with regulatory agencies, are all made possible through the use of compliance calendars.

To manage your costs and expenses you can use many available online accounting software.

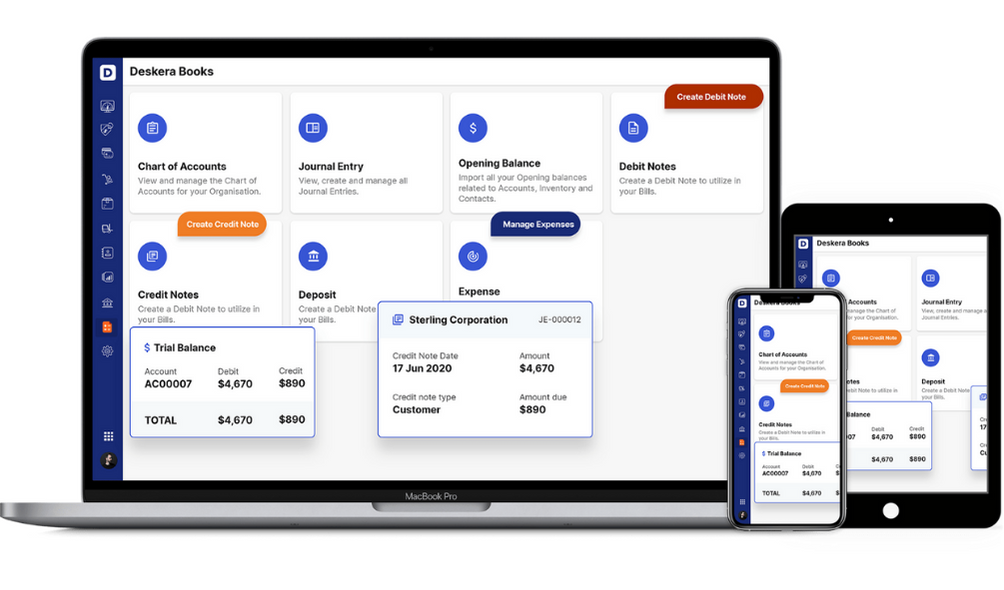

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Making sure you're in compliance with all applicable local and federal regulations is a major responsibility for any small business owner. This aspect of your business can be managed more effectively by setting up a compliance calendar. In order to avoid fines or penalties for late or missing information, a compliance calendar keeps track of all your company's filing requirements, their due dates, and related details.

- When it comes to planning and organising your content, you can use a content calendar or editorial calendar. There are many forms that a content calendar can take. It's possible to use a social media content calendar, for example, to organise all of your posts for the various social media platforms where you participate.

- The topics around which you plan to produce content are critical to the overall success of your content calendar. First, you must figure out the topic of your writing or recording before you can begin the process.

- A compliance calendar can mean the difference between staying in business and going out of business if you run a limited liability company (LLC). You may get into trouble with the state agency that regulates businesses if you overlook a minor detail. You can use a compliance calendar to keep everyone on the same page when it comes to meeting filing deadlines.

- For multinational corporations, the compliance calendar can help identify the compliance status and requirements of every jurisdiction to ensure efficient legal operations; for smaller businesses, the calendar is just as important to ensure that entities remain legitimate and able to operate legally wherever they are.

- There are only a few ROC forms each year. The ROC does not require any forms to be submitted on a monthly basis. The ROC forms pertain to a company's or LLP's financial records for a given fiscal year.

- With compliance calendars, everyone in the company can keep track of how well compliance measures are being implemented. To keep stakeholders and board members informed and remove any ambiguity around compliance measures,

- A small business is defined as one that has an annual turnover of less than Rs. 50 crore and an investment in plant and machinery or equipment of less than Rs. 10 crore. Investment in plant and machinery or equipment does not exceed Rs.50 crore and annual turnover does not exceed Rs.250 crore for a medium enterprise.

- Evaluate the efficacy of ongoing measures as you plan your organization's annual compliance strategy. It's a good time to bring in new elements in response to new regulations, or to get rid of old ones that aren't meeting your company's needs.

Related Articles