Creating a journal entry is the process of recording and tracking any transaction that your business conducts. Journal entries help transform business transactions into useful data.

Want to learn how to correctly write journal entries for your business? You’ve come to the right place!

What Is a Journal Entry?

Journal entries are records of financial transactions flowing in and out of your business. These transactions all get recorded in the company book, called the general journal.

Journal entries are the very first step in the accounting cycle. The main thing you need to know about journal entries in accounting is that they all follow the double-accounting method.

What this means is that for every recorded transaction, two accounts are affected - and as a result, there is always a debit entry and a credit entry.

Before diving into the nits and grits of double-entry bookkeeping and writing journal entries, you should understand why journal entries are so important for a business.

Why Are Journal Entries So Important?

Well, for starters, maintaining organized records of your transactions helps keep your company information organized. Accountants record data chronologically based on a specific format. This way they can easily find information and keep an eye out for any possible accounting errors.

Secondly, journal entries are the first step in the recording process. So you’ll eventually need them to prepare other financial statements. The income statement, cash flow, balance sheet, all of them are based on the initial recordings of journal entries.

Lastly, performance measurement. Auditors use financial reports to analyze how transactions are impacting the business.

What Is Double-Entry Bookkeeping?

As we said above, in every transaction, at least two accounts will change, where one is debited and the other one credited. This is known in accounting as double-entry bookkeeping.

Double-entry bookkeeping isn’t as complicated as it might sound. To understand the concept, think about any purchase you’ve ever made.

Money in exchange for a product, right? In accounting language, this is a transaction that simultaneously affects two accounts. The cash account, which decreases since you’re paying, and the equipment account, which increases from buying the product.

So in simple terms, in the business world, money doesn’t simply appear or disappear. If it goes into one account, it has to get out of another. That’s why it’s called “double-entry”.

This is where the concepts of debit and credit come to play.

First, let’s get some common misconceptions out of the way.

Debit and credit are neither good nor bad. And no, they’re not the same as adding or subtracting.

They are just words that show the double-sided nature of financial transactions.

In brief: debit is money that flows into an account, whereas credit is money that flows out of an account.

Here’s all you need to remember:

- A credit is always on the right side of a journal entry. It increases the owner's equity, liabilities, and revenue when credited. It decreases them when debited.

- A debit, on the other hand, is always on the left side of a journal entry. It increases assets and expenses when debited. It decreases them when credited.

- At the end of the journal entry, the credit and debit balance should be equal to each other. If they don’t, double-check because you’ve probably made a mistake.

Does it all still sound a bit confusing? Don’t worry! We’ve made a cheat sheet so you can easily remember.

Ready to solve an example? Let’s take a simple one and explain the process step-by-step.

Double-Entry Bookkeeping Example

Let’s say the owner of an advertising company decides to invest $10,000 cash in his business.

There are three main steps you have to follow to make the perfect journal entry:

First, figure out which accounts are affected. In this transaction, they are the assets account and the owner’s equity account.

Now, determine which items have been increased or decreased, and by how much.

Since the owner is making an investment, both of the accounts will increase by $10.000. The asset account will have $10.000 more in cash, whereas the Owner’s Equity account $10.000 more in Capital.

Lastly, we have to translate the changes into debits and credits. We learned that debits increase assets, so cash will be debited for $10,000. On the other hand, the opposite will happen to the owner’s equity. Capital will be credited for $10,000.

After this point, the hardest work is done. All there’s left to do now is neatly document the transaction.

Here’s how you do it ...

What Is Included in a Journal Entry?

To make a complete journal entry you need the following elements:

- A reference number or also known as the journal entry number, which is unique for every transaction.

- The date of the journal entry.

- The account column, where you put the names of the accounts that have changed.

- Two separate columns for debit and credit. Here you will put the amounts that will be credited and debited. Again, it’s important to remember that they must be equal in the end. If you’re using accounting software, it won’t let you post the journal entry unless the amounts match. However, if you’re using manual apps like Sheets or Excel, always triple check the balance.

- Lastly, the journal entry explanation. This needs to be a brief but accurate description of the journal entry. You may need to refer back to it in the future, so be as clear as possible.

This is what the previous transaction would look like in a Journal:

What are the Most Common Types of Journals?

Businesses are diverse - in size, service, ownership. That’s why there are different types of journals, based on the company you run. Mainly, however, we divide them into two categories: general and special.

We briefly mentioned the general journal in the beginning. To recap, the general journal is the company book in which accountants post (or summarize) all journal entries.

While small businesses and startups might not have difficulty fitting all of their entries in the general journal, that’s not always the case.

For big industries like trading or manufacturing, other journals, called special journals are necessary. Their purpose is to group and record transactions of a specific type. These types depend on the nature of the business. Usually, though, special journals record the most recurring transactions within a company.

Here’s a list of the most frequent types of special journals utilized by companies:

- Sales - income you earn from sales.

- Sales Return - loss of income from sales you’ve refunded

- Accounts Receivable - cash owed to the company

- Accounts Payable - cash the company owes

- Cash Receipts - cash you’ve gained

- Purchases - payments you’ve done

- Equity - owner’s investment

- Payroll - payroll transactions such as gross wages, or withheld taxes

Most Common Journal Entries for a Small Business

Some of the most common types of journal entries that a small business will make are the following:

All examples assume tax is applied on sales and purchase. If no tax, then it can be removed as the value will be zero.

Journal Entry for Sales of Services

Journal Entry for Sales Invoice - Goods/Inventory

Journal Entry for Cash Sales

Journal Entry for Receiving Payment for Invoice

Journal Entry for Purchase of Goods

Journal Entry for Purchase of Services

Journal Entry for Making Payments for Purchases

Journal Entry for Only Fulfilling Orders (transfer of goods/inventory out of the system)

Journal Entry for Only Receiving Goods (transfer of goods/inventory into the system)

As you might’ve guessed, a journal entry for sales of goods, is created whenever your business sells some manufactured goods. Since these are self-descriptive enough, let’s move on to some more complex accounting journal entries.

What Are the Different Types of Journal Entries?

There are three other main types of journal entries in accounting:

Compound Entries

When transactions affect more than two accounts, we make compound entries. These are common when the recordings are related in nature or happen during the same day.

Remember: debits and credits must always be equal. The principle stays the same, there are just more accounts that change.

Let’s check out an example.

XYZ company decides to buy new computer software for $1,000. They pay $500 in cash right away and agree to pay the remaining $500 later.

The steps are the same as in the double-entry bookkeeping.

First, we figure out which accounts have changed and by how much. In this scenario, those are three:

- Asset account, which increases by $1,000 when buying the new computer software.

- Cash account, which decreases $500 in Cash from paying.

- Accounts payable account, which increases $500 from the remaining unpaid amount.

The next step is to translate them into debit and credit.

Assets increase when debited, so Equipment will be debited for $1,000. Expenses decrease when credited, so Cash will be credited for $500. Liabilities increase when credited, so Accounts Payable will also be credited for $500.

This is what the transaction would like in a Journal:

Adjusting Entries

Adjusting entries are used to update previously recorded journal entries. They ensure that those recordings line up to the correct accounting periods. This does not mean that those transactions are deleted or erased, though. Adjusting entries are new transactions that keep the business’ finances up to date.

They are usually made at the end of an accounting period. The accounting period usually coincides with the business fiscal year.

There are four main types of adjusting entries:

- Prepaid expenses are payments in cash for assets that haven’t been used yet. Think of insurance. It protects a company from possible losses, like fire or theft, which haven’t happened yet.

- Unearned revenue is cash received before the product or service is provided. Take your yearly gym membership or Spotify subscription - you’re paying in advance for future service.

- Accrued revenue is money earned, but not collected. If you take a loan, the interest rate income from the loan will be recorded as an accrued revenue.

- Accrued expenses are expenses made, but not paid. An example would be not paying your workers their salary until the end of the month.

Let’s put all of this information into a concrete exercise.

On October 2nd, you sell to a client, a service worth $3,000. You receive the payment for the provided service, however, you forget to make a journal entry.

Then at the end of October, you compare the actual cash reserve with the cash reserve shown on the balance sheet.

Since the two sums will not match, it means that there is a missing transaction somewhere. At this point, you need to make a journal entry adjustment.

The journal entry on October 31st would look like this:

Reversing Entries

Reverse entries are the opposite of adjusting entries. When we say the opposite, we don’t mean that the adjusting entries get deleted. No amount previously recorded changes. Reverse entries only simplify financial reports, by canceling out the effect of the adjusting entries.

Since their goal is just to simplify, reverse entries are optional. Some accountants choose to make them, others don’t.

They’re usually done at the start of a new accounting period.

Why?

Because adjusting entries are made at the end of the period. So, for instance, if the period ends on December 31st, you would do the reverse the next day, on January 1st.

Now, you can’t reverse all types of adjusting entries: only accrued revenues and accrued expenses.

Let’s see how the previous accrued revenues example would look like reversed.

The adjusting entry in the last section was:

- Accounts receivable debited for $3000

- Service revenue credited for $3000

What reversing entries do is switch the places of the two. So now:

- Service revenue will be debited for $3000

- Accounts receivable will be credited for $3000

This is what the complete journal entry would look like:

How to Use Accounting Software to Document Your Journal Entries

Running your own company comes with many challenges. No business owner has time to write down all of their journal entries by hand.

That’s why most companies record their entries using accounting software.

You might be thinking - isn’t accounting software only for accountants?

Well, most are, but we at Deskera prioritize small business owners. We’ve spent over 10 years working with small business owners from 100+ different countries to create a cloud accounting software that fits any type of business.

Need to create invoices, manage inventory, create financial reports, track payments, manage dropshipping? You can do all of that with Deskera. Our program is specifically built for you, to easily manage and oversee the finances of your business.

Here’s how you can use Deskera Books to record journal entries.

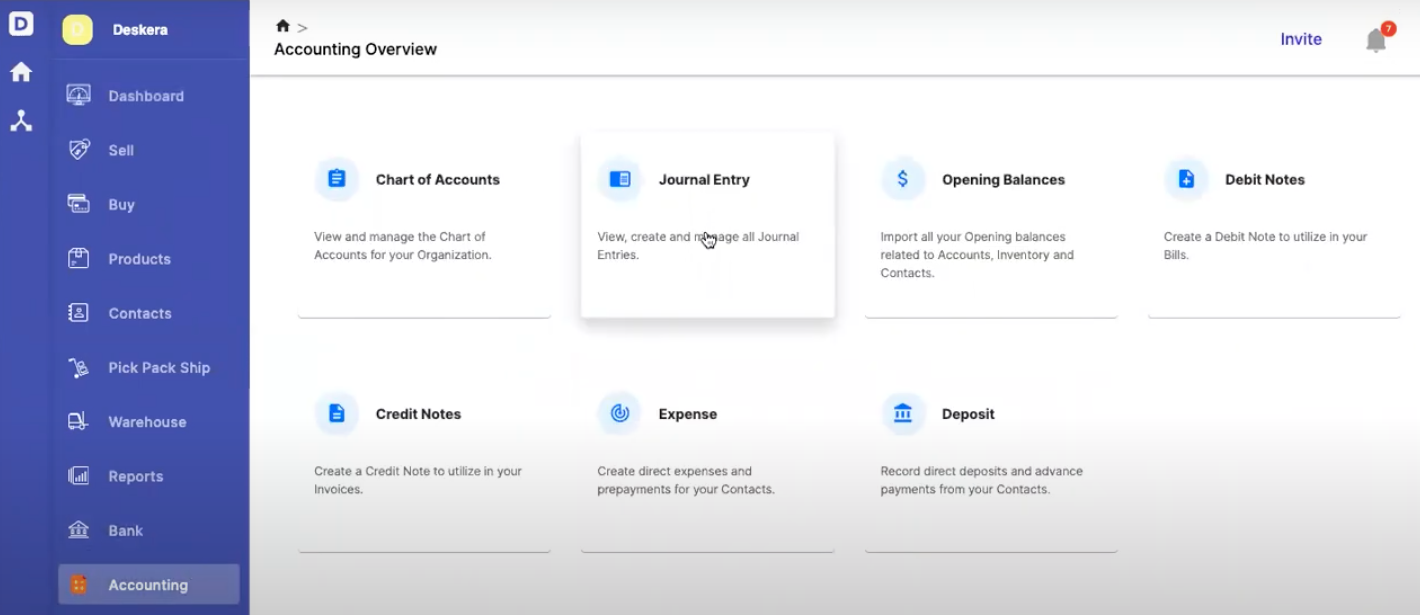

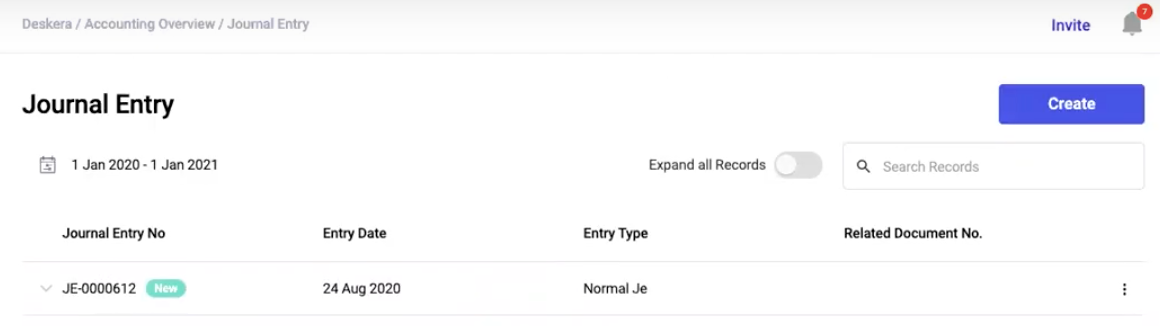

1. Go to Accounting > Journal Entry.

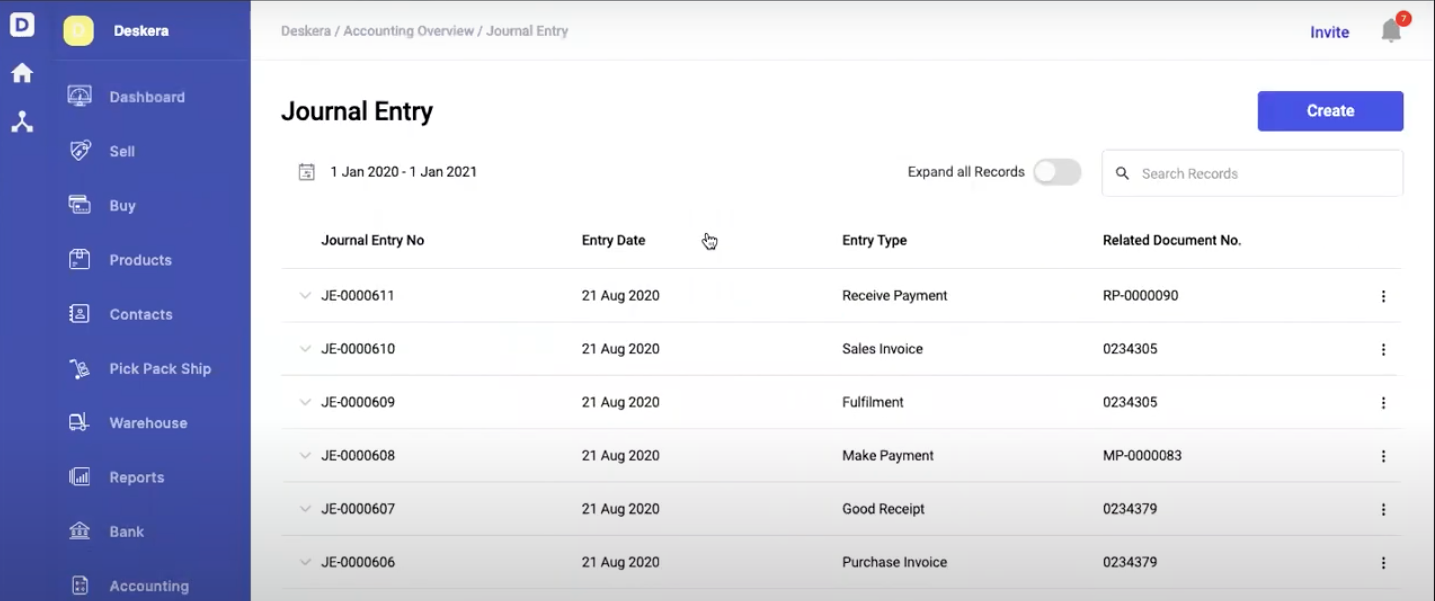

Here, you’ll be able to view, create, and manage all your journal entries. The main attributes displayed for every entry here are the journal entry number, the journal entry date, the journal entry type, and the related document number.

To view the details of each journal entry, you can press on the expand all records button. As you can see, the account name, debit amount, credit amount, and description will all appear.

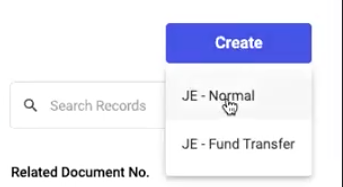

2. Next, to manually create a journal entry, press on the create button on the top right. You’ll notice two journal entry options: normal or fund transfer. Each option depends on the type of entry you’re making.

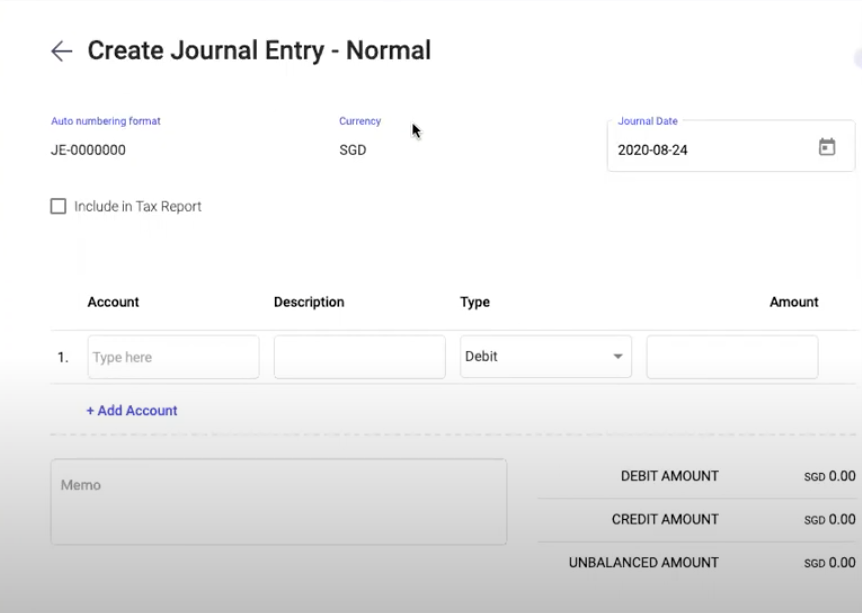

3. Click JE - Normal. This will take you to the general journal page.

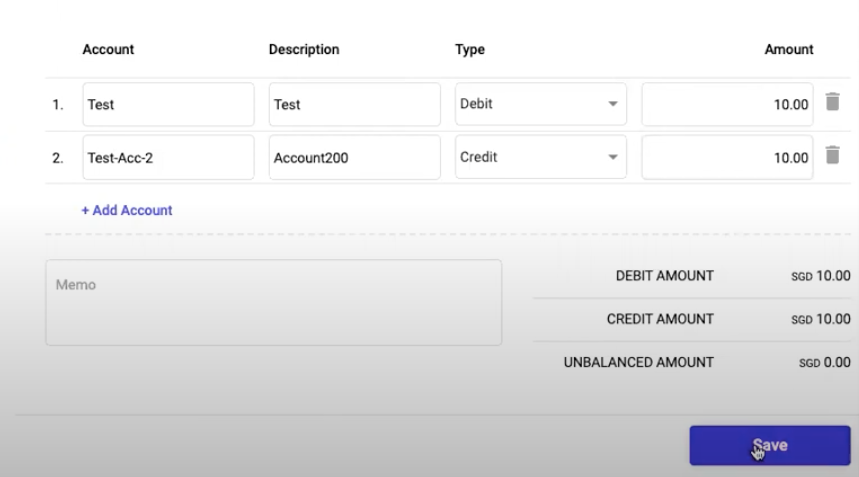

The top half of the page contains the auto numbering format, currency, and journal date. There’s also an option that allows you to include the entry on the tax report. Then there’s the bottom half, where you can add the account, description, type, and amount.

4. Fill in all of these boxes with the appropriate information and press Save. Ta-da, you’ve created a journal entry!

What if you accidentally enter the wrong amounts? The software will notice and won’t save the journal entry. That’s what the “unbalanced account” on the bottom right of the page serves for. The exact off-balance amount will show.

Automate Journal Entry Creation Using Accounting Software

Businesses have moved on from the age of pen and paper for a reason. Using accounting software like Deskera will help you automate the entire journal entry creation process.

When your business creates an invoice, the corresponding journal entry is added automatically by the system in the respective ledger for Accounts Receivable, Sales, Sales Tax, etc...

Similarly, when a payment is processed, the bank and the accounts receivable are adjusted automatically by the accounting software.

Deskera, allows you to integrate your bank directly and track any expenses automatically. When you make an expense, the journal entry is automatically created, and it is mapped to the correct ledger account.

You can also create custom invoices using the provided templates, and send reminders to make sure you don’t miss out on any invoice payments.

To top it off, creating financial reports with Deskera is as easy as 1-2-3.

Still not sure?

Well, luckily Deskera offers a completely free trial. You can sign up here and try out all 3 Deskera platforms - Books, Sales (CRM), & People (HRIS).

Key Takeaways

Hope our guide to journal entries was helpful!

For a quick recap let’s go through the main points we’ve covered:

- Journal entries record the financial transactions of a business. They’re the first step in the accounting cycle.

- Each transaction in a journal entry affects two accounts. One of them is debited, the other one credited. Simply put, debit is money flowing into a company, whereas credit is money flowing out.

- Never forget: debits and credit should always be equal in the end.

- To write a journal entry you need to figure out which accounts are affected, which items decrease or increase, and then translate the changes into debit and credit.

- A complete journal entry is made of 6 elements: a reference number, date, account section, debits, credits, and a journal explanation.

- You can record these journal entries into either a General Journal or a Special Journal.

- There are three main types of journal entries: compound, adjusting, and reversing.

- Use accounting software like Deskera to automate the process of creating journal entries, and save a ton of time!

Related Articles