ITR or the Income Tax Return is a way of letting the income tax department know about your income from varied sources. Based on the sources and the type of taxpayers, the department segregates the process of filing in seven different types: ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7.

With our main focus on the ITR7 in this article, we shall explore the warriors aspects related with it. Here is what we shall learn about:

- What is ITR7?

- Eligibility for filing ITR7 form

- Individuals Ineligible to file ITR7

- Structure of ITR7

- How to File ITR7?

- How to Fill-out the ITR7?

Brief Look at ITR

Any person, HUF, or a company who has an income, must declare it to the Income Tax Department. Through the ITR form, the department gets to know all the details of your income and the corresponding tax against that income. Read more about Income tax and its related details here.

Also, before you could begin the process of filing returns, it would be good to learn about the Income Tax slabs and Income statements.

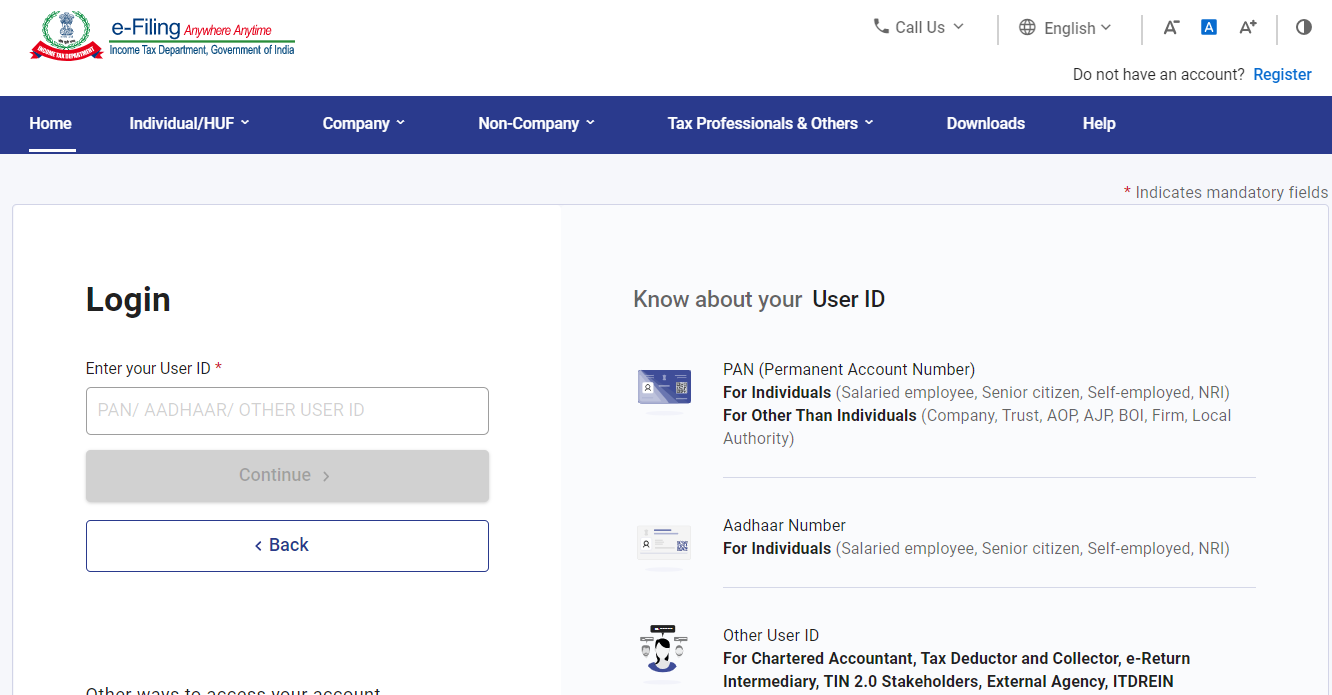

You can log in to the income tax website through the following link:

https://eportal.incometax.gov.in/iec/foservices/#/login

What is ITR7?

ITR7 is meant for the companies that have income associated with charitable and religious properties. In this category are properties that are held in trusts or under legal obligation in part or even entirely. This form is applied to a person or a company that is subject to section 139(4A) or section 139 (4B) or section 139 (4C) or section 139(4D).

You can choose to submit your returns on the ITR Form 7 by barcoded form, paperback form, digital signature mode, or by submitting a return verification through ITR-V.

No Requirement of Annexures

While filing ITR7, there is no requirement of any annexures, which implies that including TDS the process does not need any documents to be attached.

Taxpayers should verify the deducted or collected taxes on their behalf with form 26AS (which is their Tax Credit Statement form).

Eligibility for Filing ITR7 Form

Let’s take a look at the factors that lead to eligibility for filing the ITR7 form:

Individuals Ineligible to File ITR7

The form ITR-7 for Income Tax Return is not applicable to taxpayers who are not exempt from filing under Section 139 (4A), Section 139 (4B), Section 139 (4C), or Section 139 (4D).

Structure of ITR7

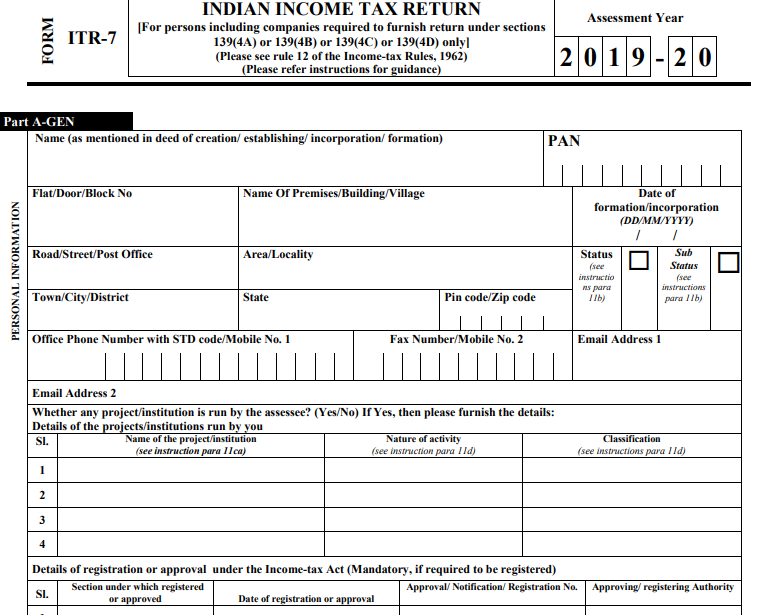

The ITR 7 Form has been divided into two parts and numerous schedules.

Part A - It comprises the General information.

Part A consists of subsections that require details of the taxpayers including name, PAN, contact details, details of projects/institution run by the taxpayer, registration details of institution, etc. The following subsections of ITR 7 Part A are:

Part B - This consists of 3 important sections:

Schedules in ITR7

How to File ITR7?

In order to file an ITR 7, you can take the following steps:

- With the use of a digital signature certificate, you can provide the returns electronically

- by transmitting the data in the return and then submitting the ITR V Return Form once it has been verified

The taxpayers have to print copies of ITR V Forms after filing their returns. Send the signed ITR V, posted by ordinary mail, to the following address:

A spare copy can be kept by the individual for his records.

How to Fill out the ITR7?

Here are the steps you need to take to fill out the ITR7 form:

- Fill up the accurate and confirmed information in the document.

- Strikeout the fields that do not apply to you.

- Before providing the return, ensure that the verification has been signed.

- Mention the designation of the person furnishing the return.

ITR7 Verification

Political Parties: It is mandatory for political parties to get the verification done through a DSC by a secretary or CEO.

Other persons: The people other than the political parties have the following options in front of them for verification:

- EVC mode (Electronic Verification Code) authentication

- Using DSC (Digital Signature Certificate)

- Signing the ITR-V form and posting it to the CPC office.

How can Deskera make Filing Easy for You?

Deskera People makes creating pay slips and payroll easy. Your taxes will be more easily filed and managed when you have this option.

Deskera People can be used for adjusting salary components, creating employee bonuses, and managing employee benefits. Automate your business management and align all of your employee information in one location, including deductions, taxes, and leave management.

Apart from handling payrolls, Deskera People calculates Employee Provident Funds (EPFs) and employee EPS contributions.

Key Takeaways

- The ITR7 form is applied to a person or a company that is subject to section 139(4A) or section 139 (4B) or section 139 (4C) or section 139(4D).

- ITR7 can be submitted by the barcoded form, paperback form, digital signature mode, or by submitting a return verification through ITR Form V.

- The ITR 7 Form has been divided into two parts and numerous schedules.

- With the use of a digital signature certificate, you can provide the returns electronically.

- Alternatively, you can also provide returns by transmitting the data in the return and then submitting the ITR V Return Form once it has been verified.

- It is mandatory for political parties to get the verification done through a DSC by a secretary or CEO.

Related Articles