While filing income tax returns could be deemed as a time-consuming and hassling process, a piece of clear information on the topic can come in handy for you. To present all the attributes and elements in the various ITR forms, we have put together a series on the ITR forms and the process to file them.

There are 7 different ITR forms the income tax department has introduced to simplify the process of filing for the taxpayers. ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7 are the types of forms that the taxpayers

From this article, which covers all the details of filing ITR4, here’s what we shall learn:

Quick Look at ITR

ITR or the Income Tax Return is a form to be filed by all the eligible individual taxpayers or HUFs and submitted to the Income Tax Department of India. The form encompasses detailed information about your income for the fiscal year.

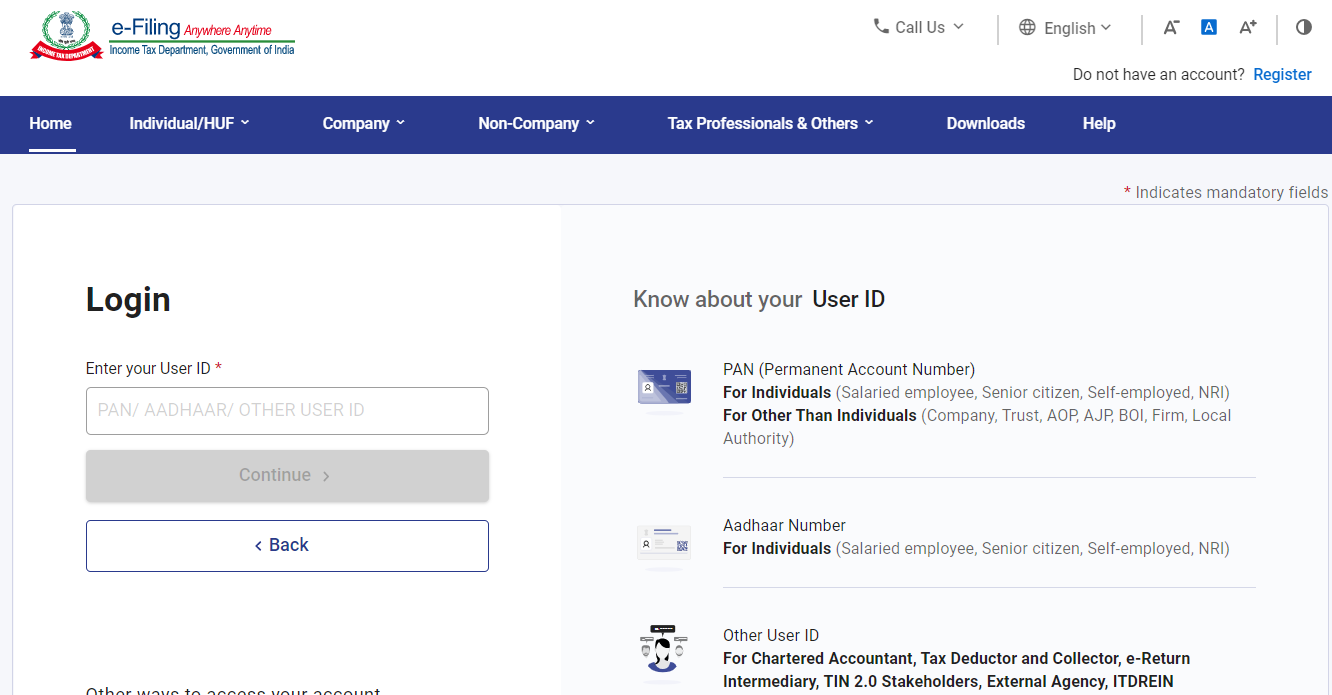

You can log in to the income tax website through the following link:

https://eportal.incometax.gov.in/iec/foservices/#/login

For a complete guide on E-filling your Income Tax Returns, please click here.

Depending on the type of income, individuals or HUFs are required to file the applicable ITR form. There could be various sources of income including:

- Salary

- Income from business and profession

- House property income

- Capital gains

- Other sources like interest on deposits, royalty earning, dividends, earnings from lotteries, and so on.

What is ITR4 Form?

Form ITR 4 is to be filed by the individuals who have chosen the Presumptive Taxation Scheme under Section 44D, 44DA, 44AE of the Income Tax Act,1961. There is a limit to how much turnover the business must have, i.e. in case it exceeds Rs.2 crore then the taxpayer must file ITR 3 form.

What is Presumptive Taxation in Scheme?

Presumptive Taxation Scheme is a scheme in which the small taxpayers are exempted from maintaining the books of accounts.

Eligibility for filing ITR4 form

Tax payers with an income that comes from the following sources are required to file ITR 4 Form:

- Income from a business in accordance with Section 44AD/Section 44AE.

- Professional Income in accordance with Section 44ADA.

- Salary or Pension Income up to INR 50 lakh.

- An individual with an income from other sources up to INR 50 lakh (this excludes the winning amounts from horse racing or lotteries or any other legal gamble.)

- An individual earning an Income from One house property up to INR 50 lakh (this excludes the losses carried forward)

- Freelancers whose income has not exceeded the INR 50 Lakhs mark also should file the ITR4.

Individuals Ineligible to file ITR4

The following individuals need to file ITR-4:

- When the income of an individual from house property, salary, or other sources is above INR 50 lakh.

- An individual who holds the post of the Director in a company or has invested in unlisted equity.

- The ITR4 form is not required to be filed by an individual, HUF, or a partnership firm that has their accounts audited in accordance with the Income Tax Act, 1961.

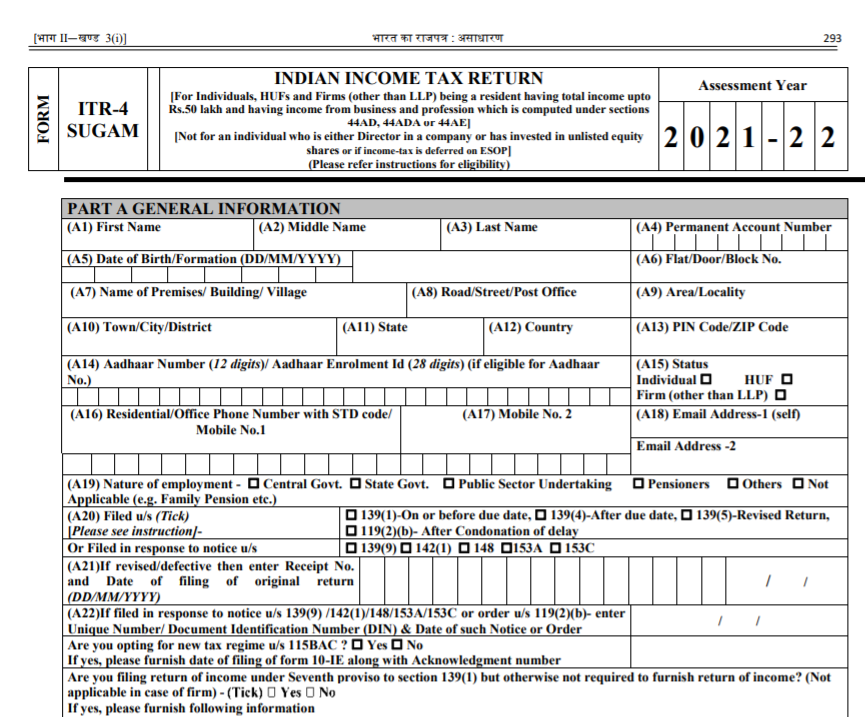

Structure of ITR4

The structure of the ITR4 form comprises 4 parts as explained here:

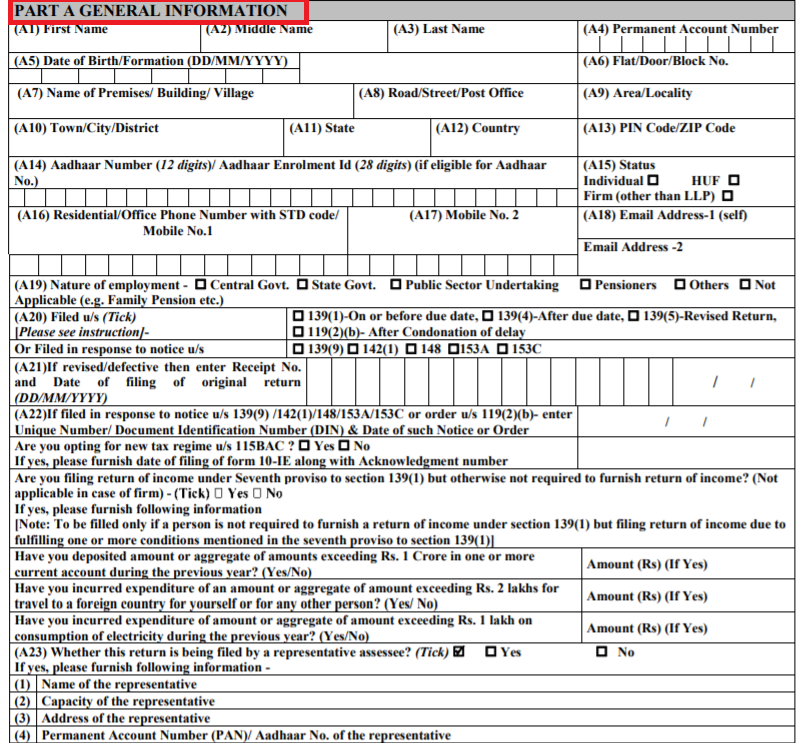

Part A: General Information

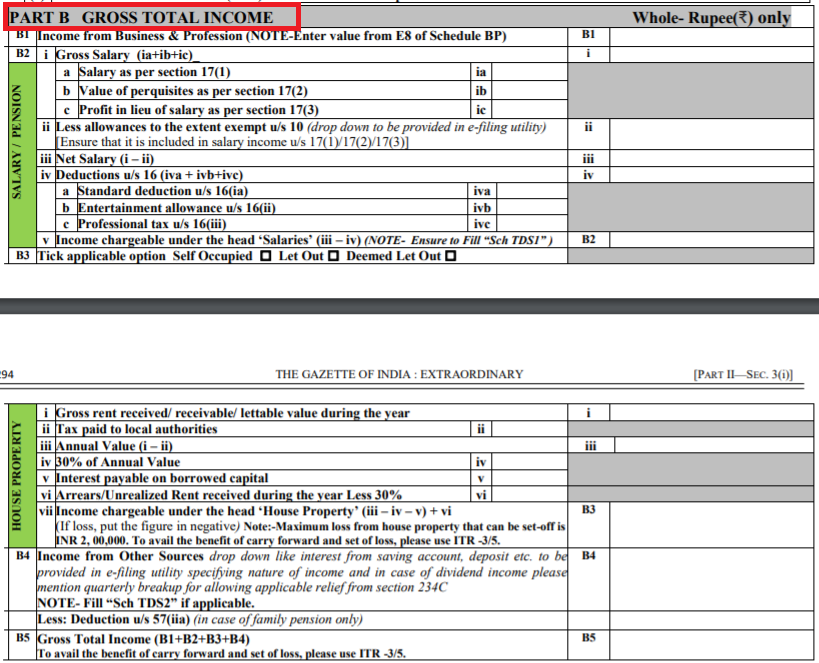

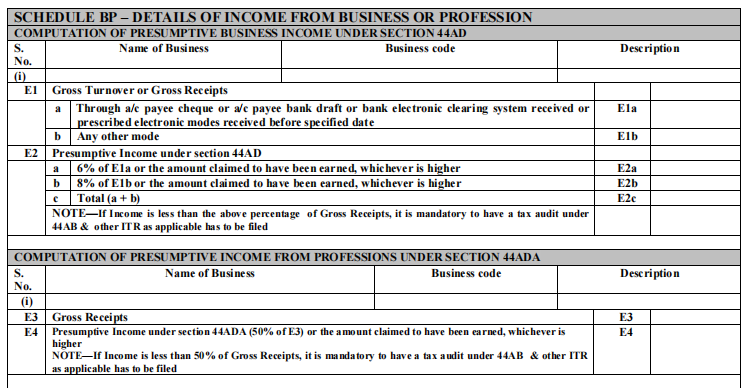

Part B: Gross Total Income

Part C: Deductions and Taxable Total Income

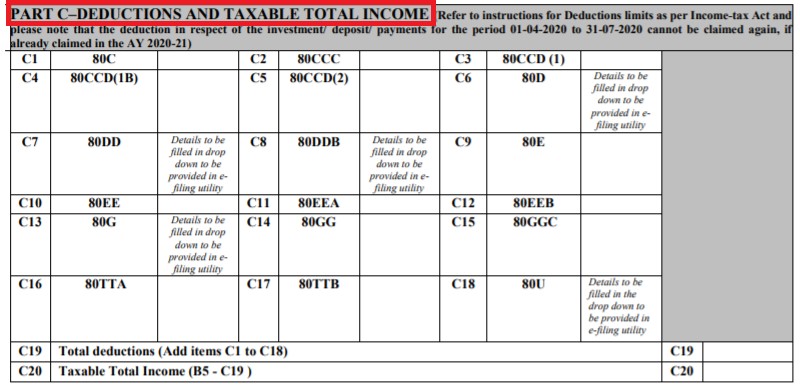

Part D: Tax Computations and Tax Status

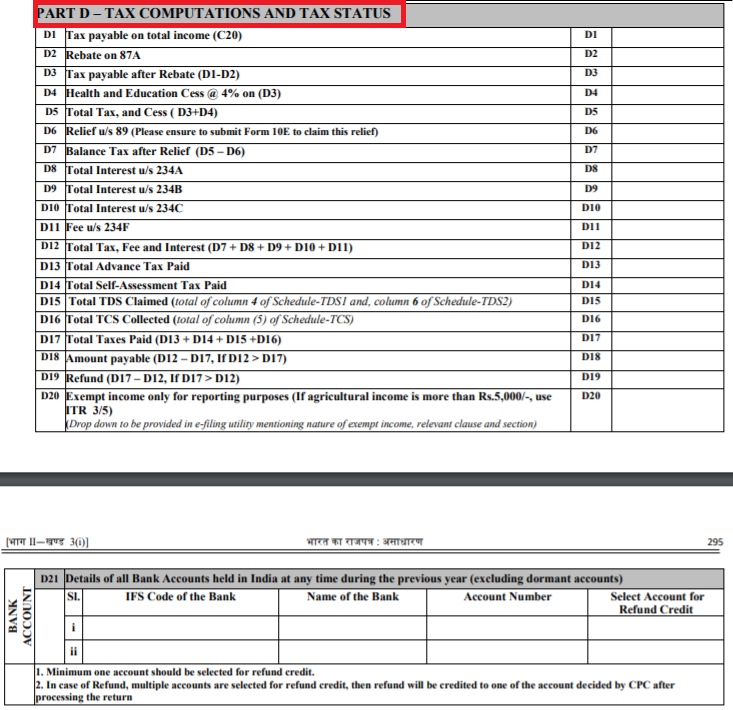

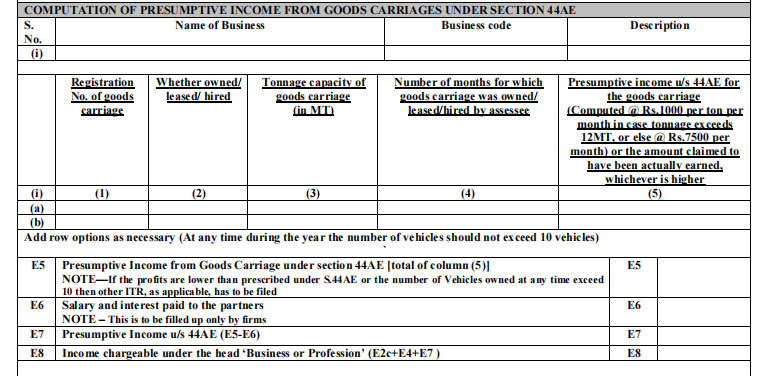

Schedule BP:

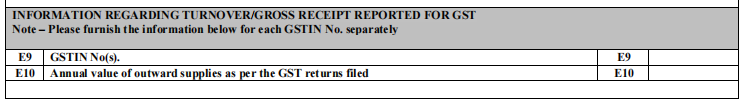

Information related to turnover/Gross receipts reported for GST

Financial Particulars of the Business

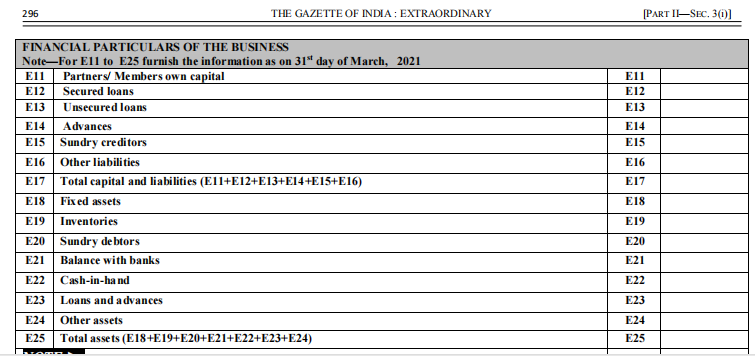

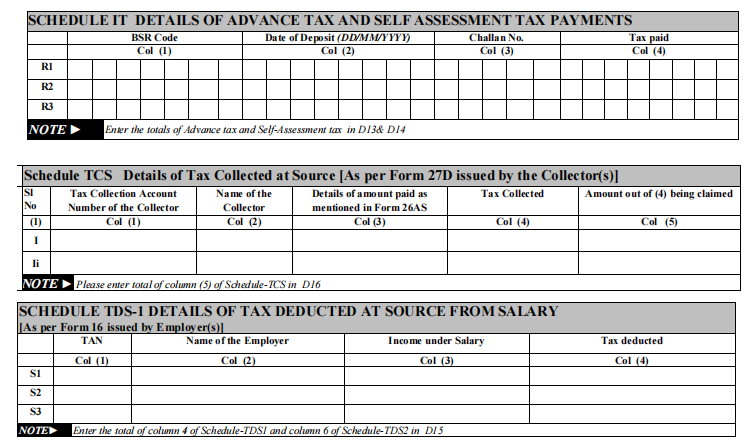

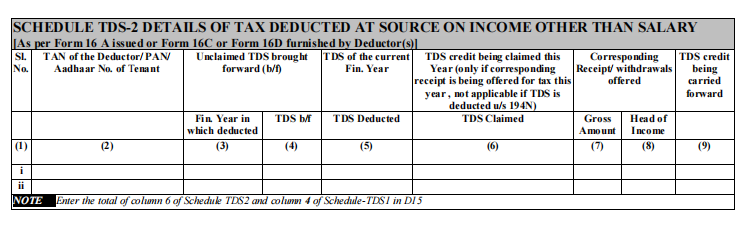

Schedule IT, TCS and TDS 1: Statement of payment of advance tax and tax on self-assessment, tax collected at source and TDS from salary

Schedule TDS2: Statement of tax deducted at source on income other than salary.

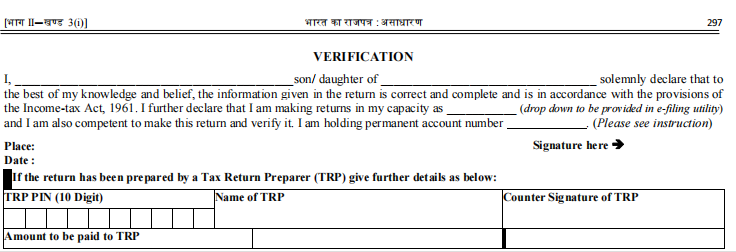

Verification

How to File ITR4?

ITR4 can be filed either online or offline. Here are the two ways explained:

OFFLINE

The income tax department allows the offline filing of the ITR only in one of the following cases:

- If an individual’s income does not exceed INR 5 lakhs and who are not claiming a refund on the income tax return

- People at the age of 80 years or above.

Here are the ways in which the return can be filed offline:

- By providing a return in a physical paper format

- By filing return in a bar-coded format

In case the individual has submitted a physical paper return, the Income Tax Department provides them with an acknowledgment.

ONLINE/ELECTRONICALLY

- You may provide the return electronically with a digital signature. If you choose to submit your ITR-4 Form this way, then you shall receive an acknowledgment on your email id registered with the department. Alternatively, you may also opt to manually download it from the income tax website.

- You may also furnish all your information electronically and then submit the verification of the return. For this, you need to utilize the Return Form, which is the ITR-V form. For this, you are required to sign and send it to the CPC office of the Income Tax Department in Bengaluru, within 120 days of e-filing.

Prominent Modifications in ITR4 - the Year 2021-22

While there are no prominent changes from the previous year’s version of the ITR4 form, let us glance through the following points pertaining to the form:

- There is a declaration added for choosing between old and new tax regimes in ITR 4 for AY 2021-22. It is under Section 115BAC (Yes or No) of Part A- general information under 'Are you opting for the new tax regime'. If the answer is Yes, then you must provide the date of filing of Form 10IE along with the acknowledgment number.

- Under Part B, there is a drop-down for interest from savings accounts, deposits, and so on in the e-filing utility to specify the source of income.

- The case that involves the dividend income, should be broken down quarterly to offer some relief from interest charges for failure to pay advance tax under Section 234C.

- Another change includes the removal of schedule DI, which was earlier present for AY 2020-21.

How can Deskera make Filing Easy for You?

By automating HR processes like hiring, payroll, leave, attendance, and expenses, Deskera People provides you with a simple and convenient way to work.

Deskera People helps digitalize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

Do not forget to check out our articles on running payroll for India and best practices in HR.

Key Takeaways

Let us recap the key information discussed in the article:

- Form ITR 4 is to be filed by the individuals who have chosen the Presumptive Taxation Scheme in accordance with Section 44D, 44DA, 44AE of the Income Tax Act,1961.

- The ITR4 form comprises 4 parts that need to be filled out by the taxpayer.

- ITR4 can be filed either online or offline.

- The offline filing is allowed only for people: Who are at or over the age of 80 years OR Who have income less than INR 5 lakhs and are not claiming a return on the income tax.

Related Articles