In this article, we hope to provide you the solutions to all your tax queries related to the ITR 3 Form. This post is a part of our series - Income Tax Returns which includes detailed information about all the ITR forms - ITR 1, ITR 2, ITR 4, ITR 5, ITR 6, and ITR 7.

We endeavor to furnish comprehensive information about all the income tax forms through these articles.

Based on which bracket of income you fall in, you need to pay taxes to the government. This post shall throw light on the following topics:

- What is the ITR3 form?

- Structure of ITR3

- Eligibility criteria to file the ITR3

- Points indicating ineligibility

- Process of filing the ITR3

- Important changes in the ITR 3 for the year 2021-22

What is ITR 3 Form?

Individuals and HUFs with profits and gains from their businesses or professions are eligible to file ITR 3.

The persons having income from the following sources are eligible to file ITR 3:

- Business or profession (both audited and non-audited cases)

- Income from individual properties, pensions, salaries, capital gains, and other sources of income may be included in your tax return.

Here are some essential points to note:

- As for taxpayers subject to an audit under the AY 2020-21 (FY 2019-20), the deadline to file ITR-3 has been extended from 31 January 2021 to 15 February 2021. The deadline for submitting the tax audit report has been extended to 15th January 2021 from 31st December 2020.

- With effect from AY 2020-21 (FY 2019-20), the threshold for a tax audit to be conducted will be raised from Rs 1 crore to Rs 5 crore if the taxpayer's cash receipts are limited to 5% of gross receipts and 5% of the aggregate payments.

Structure of ITR 3 Form- The year 2021-22?

ITR 3 is composed of the following:

Apart from this, the other schedules included are as mentioned in the following table:

Eligibility Criteria to File ITR Form 3

ITR form 3 can be used by people who belong to the following categories

- An inherited business or profession.

- Other sources of income, such as property, salary, or pension.

The income of individuals and Hindu undivided families can be reported with ITR form 3 if it includes:

- Property income from a single or multiple properties

- Holdings of short- and long-term capital gains

- Businesses or professions run by a sole proprietorship owned by the individual or the HUF

- Lotteries, races, gambling, and other legal forms of gambling.

- An individual's foreign asset income.

Individuals Ineligible to File ITR Form 3

The income of individuals or HUF derived from partnerships, business partnerships, or professions or businesses is not eligible to be reported on Form 3 of the ITR. In such a case, the involved individuals or Hindu Undivided Family should file returns through the ITR 2.

How to File ITR 3 Form?

Online filing of ITR-3 is mandatory for all taxpayers and you can file it in both ways: Online/Electronically as well as Offline.

Online:

If you wish to file an e, you can do so as follows:

- By submitting the return online under digital signature

- By furnishing data online and then filing the verification of the return in Form ITR-V

When you submit your ITR-3 Form electronically using a digital signature, an acknowledgment will be emailed to the e-mail address you have registered.

Offline:

The income tax website also allows you to download it manually. A signed copy of the document must be submitted to the Income Tax Department's Central Processing Center in Bangalore within 120 days following e-filing.

When sending ITR-3, we must remember that it's an annexure-less form, which means we don't have to attach any documents.

Best way to send your ITR-V to the CPC Office

The ITR-V can only be opened with a password if you've downloaded it from the Income Tax Department's website. The ITR-V, known as acknowledgment, that you receive after e-filing your tax return must be sent to the Central Processing Center, Bangalore, within 120 days.

The Department of Post has assigned PINCODE 560500 to the Centralized Processing Centre (CPC), Income Tax Department, located in Bengaluru. You will now be able to submit ITR-V forms and other documents that require physical transmission to "Centralized Processing Center, Income Tax Department, Bengaluru 560500."

What are Important Changes in ITR 3 Form- The year 2021-22?

Here is a list of the major changes incorporates in the ITR 3 form for the year 2021-22:

- Dividend recipients will have to pay tax from 1st April 2020. A number of relevant sections in the Act have been amended, including 10(34), 10(35), and 115-O. In order to accommodate these changes, ITR forms are amended accordingly.

- In the event that the dividend is not received, the taxpayers are relieved from paying advance taxes. As a result, we can compute interest under section 234C for defaults in advance tax payment via the ITR form in which details of dividend income are entered quarterly.

- In the ITR form of AY 2021-22, the Schedule DI that was inserted for the AY 2020-21 for purposes of claiming deductions for expenditures made during the extended period (1st April to 30th June 2020) has been removed.

- A new column is added in Schedules 112A and 115AD(1)(b)(iii) to indicate the nature of securities transferred for the resultant capital gains tax under sections 112A or 115AD(1)(b)(iii) of the Income Tax Act. To make the schedules more useful to taxpayers, they have been modified to enable the taxpayer to give information about the sale price, fair market value, and cost of acquisition of the security.

- The Finance Bill 2021 amends section 44AB to increase the threshold limit of tax audits to Rs.10 crores from Rs.5 crores if cash payments are less than 5 percent of total sales or turnover. ITR form contains the corresponding amendment.

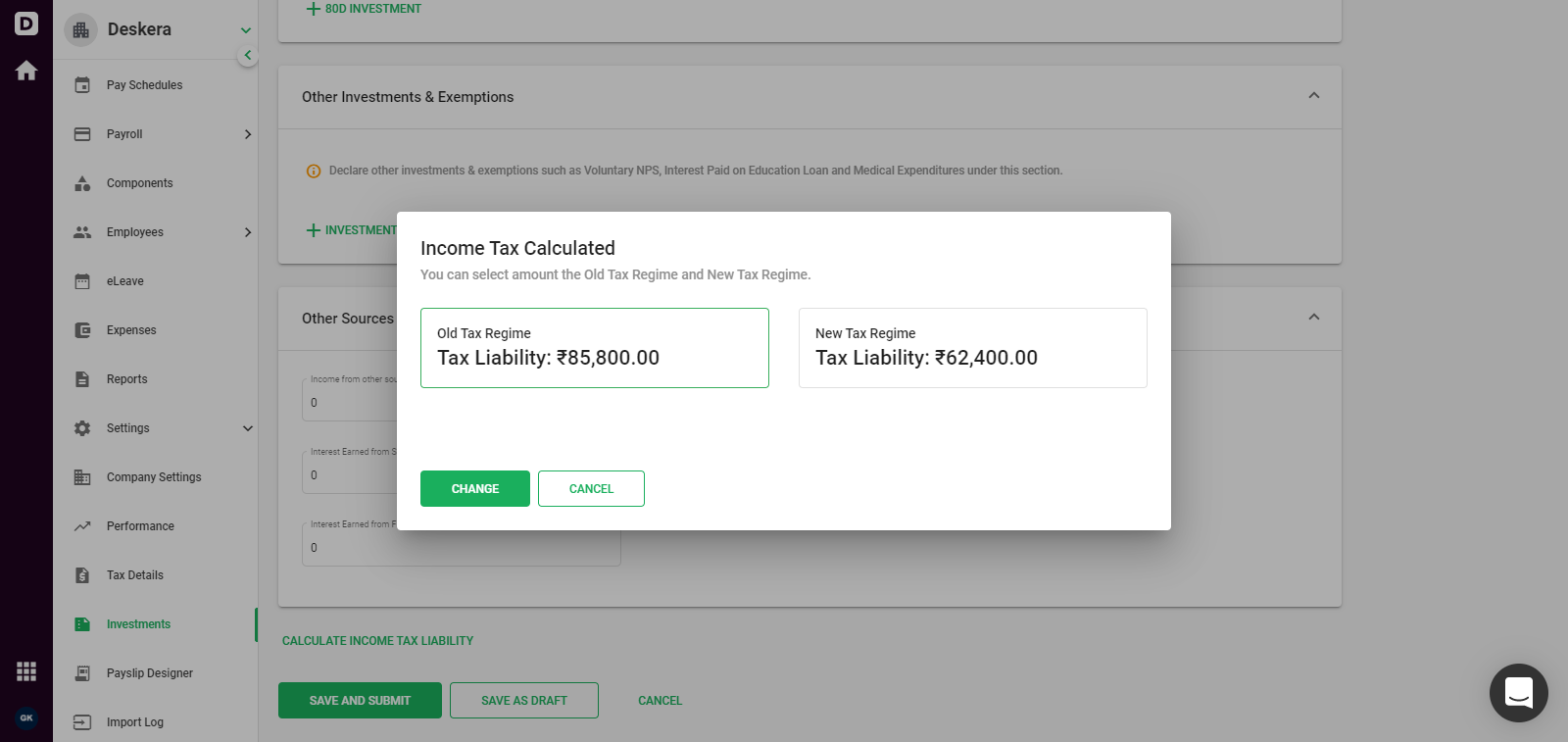

- The taxpayer is given an alternative option of a new tax regime under section 115BAC as part of Part-A General Information

- The taxpayer who has business or professional income and has opted for an alternative tax regime is needed to mention the date of filing Form no.10-IE and its acknowledgment number.

How can Deskera Help You with Filing Tax Easily?

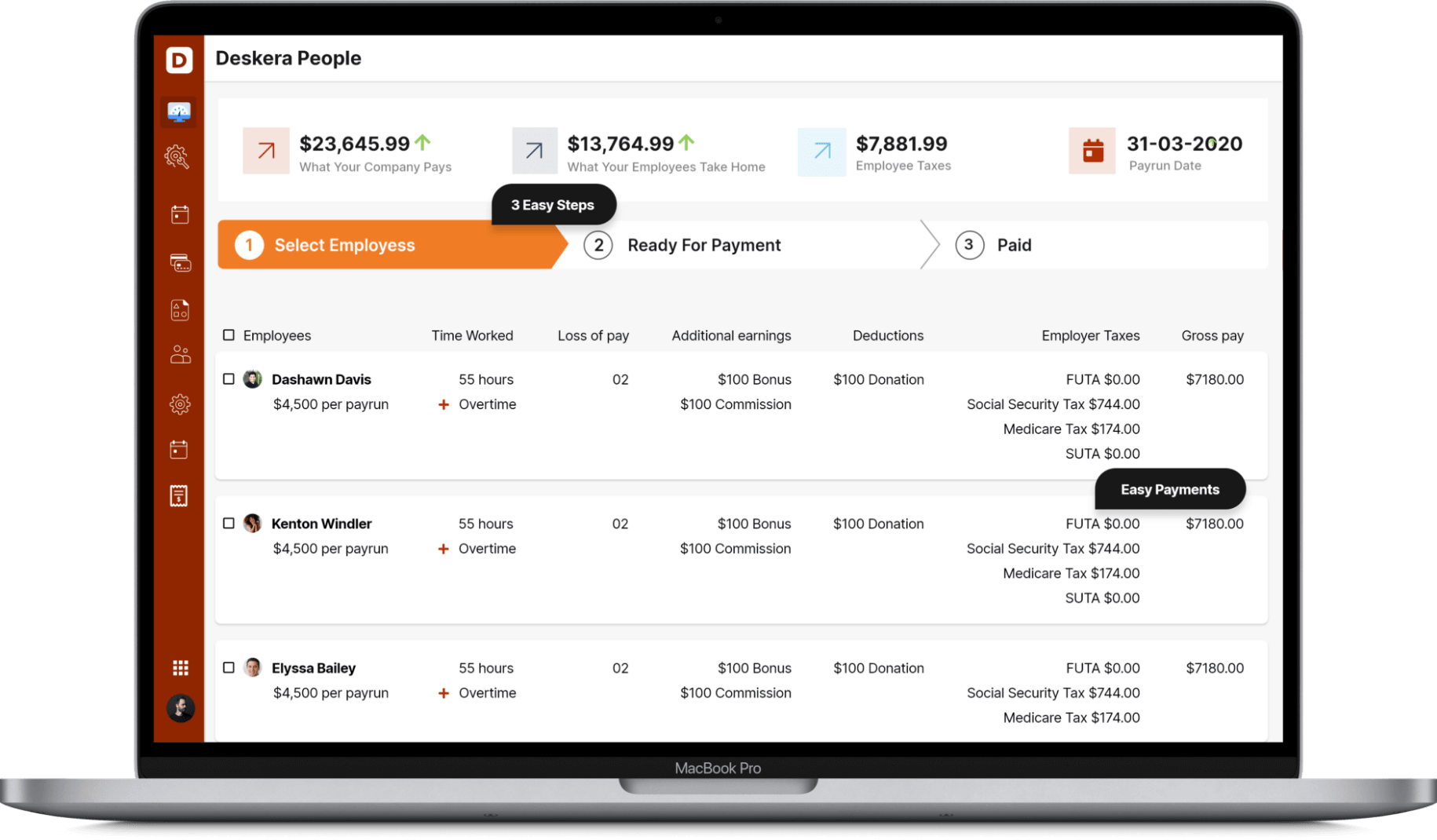

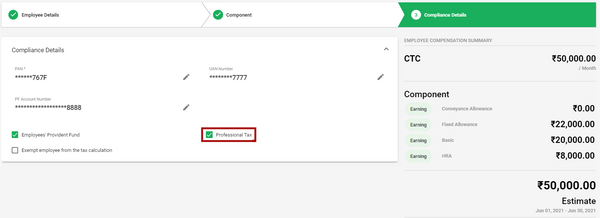

You can generate payroll and payslips in minutes using Deskera People. You can also file and manage your taxes using Deskera People. Deskera is an online cloud platform that can helps you organize your business, your employees and with handling your tax filings. Apart from helping you process your monthly payruns, Deskera People also handles your employees’ Income Tax saving investments.

A 15-day free trial will enable you to become familiar with the enterprise features. Deskera People provides you with an amazing HRMS system that helps you manage your employees from end to end. From managing payroll, employee onboarding, leave and attendance management, deskera also helps you with salary management. Using Deskera People, you can file your Income Tax or IT declaration and Proof of Investment(POI) using the platform.

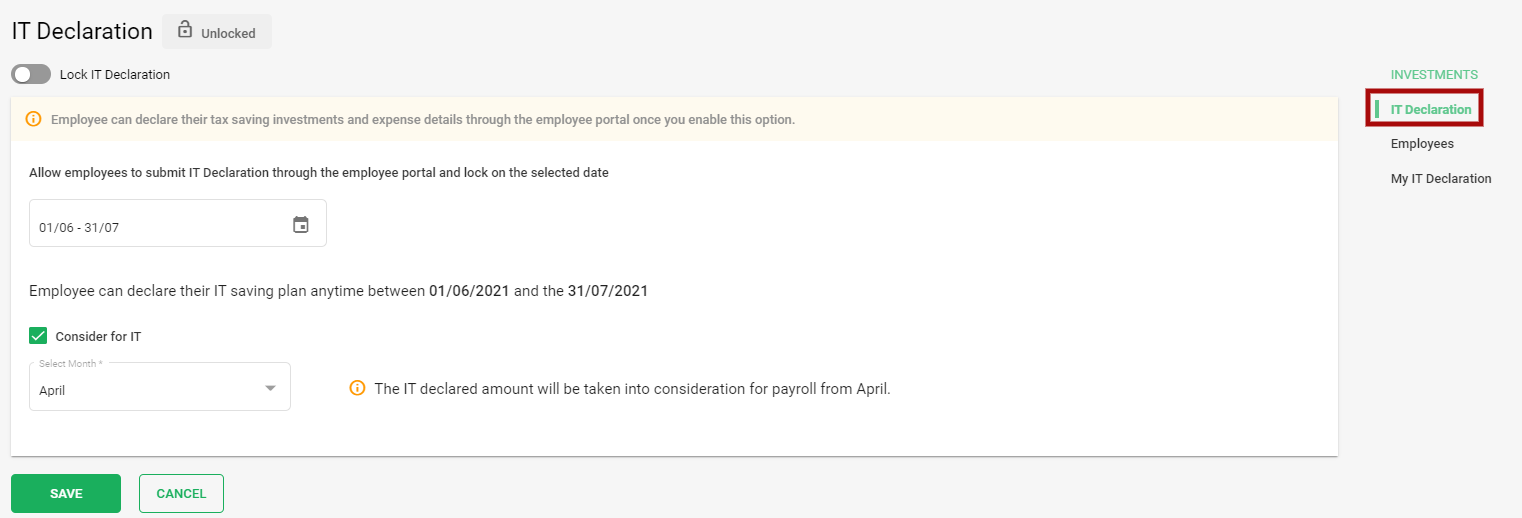

Deskera People simplifies the process of filing an ITR. Your organization's needs can be met with a customized plan designed by Deskera. Easy-to-use Deskera's tax software can help you file your taxes in no time. Business owners with any type of tax filing requirement can rely on the system. Employees can declare their proposed investments and anticipated expenses through the IT declaration.

Employees can declare the investments that they have made and submit proofs for the same, and Deskera People will auto - calculate the Income Tax based on the type and amount of each investment. The main incentive for employees’ to declare their investments is that it reduces their net taxable income, thereby decreasing the amount they need to pay as Income Tax.

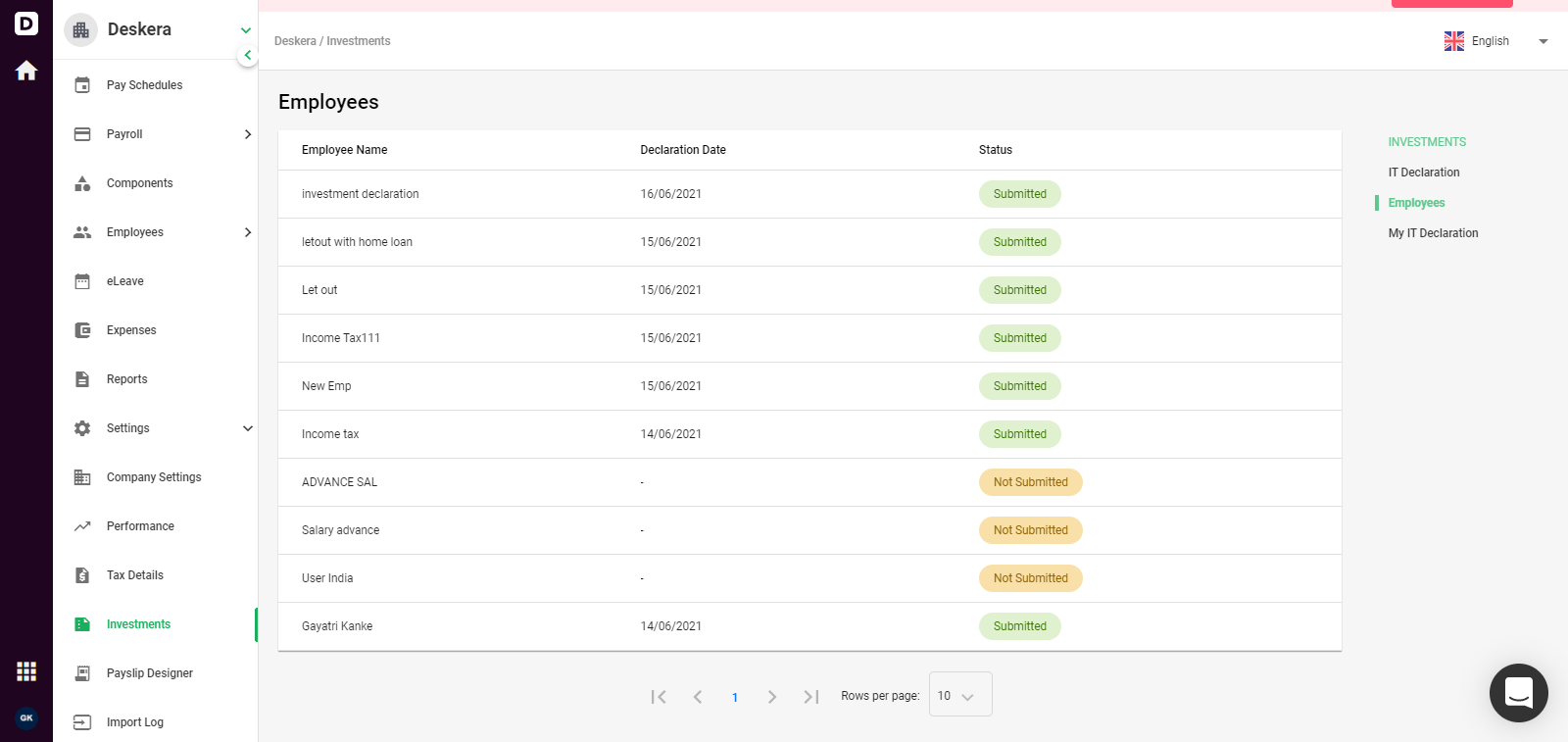

Once the IT Declarations are submitted by all the employees, the employers can view the status of these submission. Other than payroll management, Employee Provident Fund (EPF) and EPS contribution are also calculated in Deskera People

Key Takeaways

Here are the key points to learn from this post:

- Individuals and HUFs with profits and gains from their businesses or professions are eligible to file ITR 3.

- An inherited business or profession or people with other sources of income, such as property, salary, or pension are the ones who need to file the ITR 3 form. The list also includes the individuals and HUFs with certain criteria who need to file the ITR 3.

- The income of individuals or HUF derived from partnerships, business partnerships, or professions or businesses is not eligible to be reported on the Form 3 of the ITR. In such a case, individuals or HUF need to file returns through the ITR 2.

- You can choose to file ITR 3 through online or offline means.

- The ITR-V can only be opened with a password if you've downloaded it from the Income Tax Department's website.

- The ITR-V, known as acknowledgment, that you receive after e-filing your tax return must be sent to the Central Processing Center, Bangalore, within 120 days.

Related Articles