Income Tax Return (ITR) is a form in which the taxpayers file information about his income earned and tax applicable to the income tax department.

The department has notified 7 diverse forms which are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7.

Using a variety of factors to ensure easy compliance with income taxes, the income-tax department categorizes taxpayers based on their income and source of income; and subsequently, lets them file their Income Tax Returns (ITR). Since taxpayers have different income categories, they have to fill out different forms of Income Tax Returns. A person or HUF without any business or profession is required to file the ITR-2 Form.

Citizens of India and non-resident Indians use ITR-2 forms to file their income tax returns with the Income Tax Department of India. According to the category an assesses falls into, an assessment must be filled out and submitted in a variety of ways. Based on your eligibility and in accordance with the guidelines set by the income tax department, the ITR-2 is one form that must be completed during the filing of taxes.

This article will guide you to file your ITR2 in a step-by-step format.

Here is the list of the points we cover in this article:

- What is ITR-2 Form?

- What is the Structure of ITR 2?

- How to file ITR 2 Form?

- URL for Downloading the ITR 2 Form for AY 2021-22

- Eligibility Criteria to file ITR 2 for AY 2020-21 and AY 2021-22?

- Individuals ineligible to file ITR 2 for AY 2020-21 and AY 2021-22?

- Prominent modifications in ITR 2 for AY 2021-22

- Prominent modifications in ITR 2 for AY 2020-21

What is ITR-2 Form?

ITR2 form is to be filed by the people who do not have income from the profits and gains of their business or profession, and who cannot file an ITR-1.

The ITR-2 is filed by the people or Hindu Undivided Families who do not have income from profit or gains of business or profession and to whom ITR-1 is not applicable. Included in this category are capital gains, foreign income, and agricultural income greater than Rs. 5,000.

What is the Structure of ITR 2?

ITR-2 consists of the following elements:

How to file ITR 2 Form?

You can choose to file your ITR-2 Form either online or offline. We shall see both methods in this section.

OFFLINE

ITR can only be filed offline by the following individuals:

- Citizens over the age of 80 or beyond.

You can file your return offline:

- In a physical form (paper-form)

- by providing a bar-coded return

When you submit a physical paper return, the Department of Income Tax will issue an acknowledgment of receipt.

ONLINE/ELECTRONICALLY

- Submit the return online or electronically under a digital signature.

- Transmit the data electronically and submit the verification in Return Form ITR-V

Your ITR-2 Form will be acknowledged when you submit it electronically under digital signature. The acknowledgment will be sent to your mail-id.

Alternatively, you can manually download it from the income tax website. It must then be signed and sent to the Income Tax Department's CPC office in Bangalore within 120 days of e-filing.

Please keep in mind that the ITR-2 is an annexure-free form, which means that no documents are to be attached when submitting it.

Download ITR2 Form for AY 2021-22

Eligibility Criteria to File ITR 2 for AY 2020-21 and AY 2021-22

The ITR Form 2 is to be filed by individuals and HUFs who receive income other than profits from business or profession ('Profits and Gains from Business or Profession’). Here is the detailed description of the individuals who are eligible to file Form ITR 2:

- More than Rs. 5000 of agricultural income.

- House Property Income (Including Income from more than one house property).

- Pension/Salary Income.

- Capital Gains/Losses on the Sale of Investments/Property (long-term and short-term).

- Other Sources of Income (including winnings from lotteries, bets on racehorses, and other forms of legal gambling).

- Non-residents or non-ordinary residents.

- Assets in foreign countries, income from foreign sources.

An individual who owns unlisted equity shares of a company or is a Director of a company will be required to file their returns in ITR-2.

Individuals Ineligible to file ITR 2 for AY 2020-21 and AY 2021-22?

Let’s learn who cannot file or is ineligible to file the ITR 2:

- Any individual or HUF who has an income from their business or profession.

- Those who are eligible to complete the ITR-1 form

Prominent Modifications in ITR 2 for AY 2021-22

Here is a list of the changes introduced in the ITR 2 for AY 2021-22:

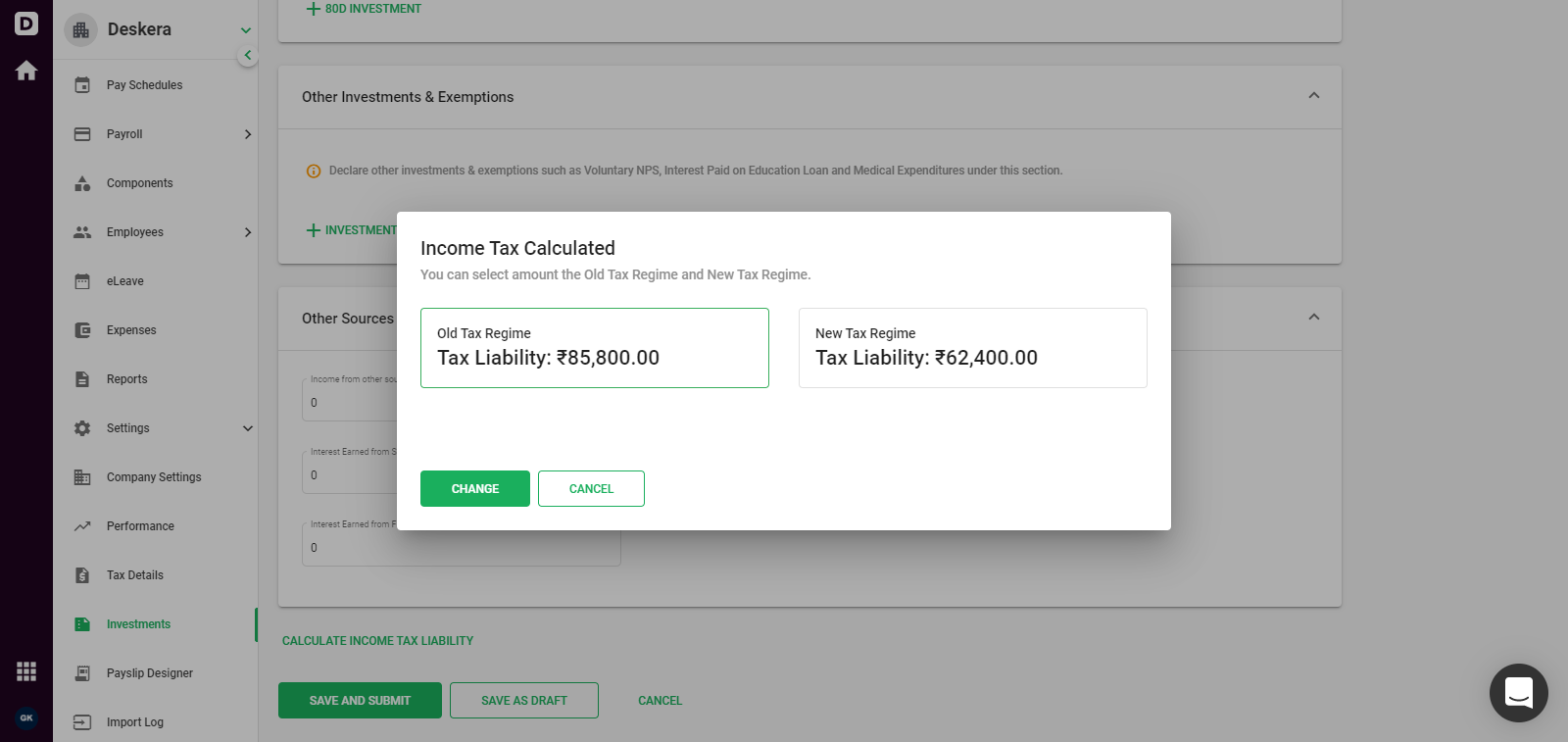

- Section 115BAC of the Finance Act 2020 introduced a choice between the old and new tax regimes for the ITR forms. Assessee who chooses to pay tax in accordance with the new tax regime needs to submit Form 10IE to the ITR department before filing their ITRs. Also, if the assessee chooses the new tax regime, a Form 10IE acknowledgment number is required.

- In accordance with the Finance Act 2020, the dividend income taxability has now been shifted from the company’s hands to the investor’s hands. This is brought about by amendment of Sections 10(34), 10 (35), 115-O, 115-R, 115BBDA. To allow expenses like interest to be deducted from dividend income, Schedule OS has been amended. Furthermore, schedule OS has been updated with a new row that includes information on dividend income being taxable in the hands of the unitholders of business trusts.

- As part of the Finance Act 2020, eligible start-up companies that qualify for Section 80-IAC can defer payments or deductions of tax on ESOPs. As noted under Section 80-IAC, if an employee receives ESOPs from an eligible start-up that has deferred the tax, the employee will have to disclose this deferred tax on Schedule TTI (Computation of tax liability on total income).

- According to section 234C of the ITR, all return filers must provide a quarterly breakdown of dividend income.

- As a result of the modification, the ITR forms now show "surcharges calculated before marginal relief" as well as "after marginal relief". Before this change, ITR Forms did not have to show separate effects.

- Earlier the Schedule DI was included in the previous ITR forms for any investment made for the extended period allowed, i.e. 1st April 20 to 31st July 20. This has been removed from all the ITR Forms now.

- ITR Forms must include information about cash donations made under schedule 80GGA, including the date.

- Land and buildings are governed by Section 50C, which determines the value of the consideration at the time of sale. In the case of sale considerations that are less than stamp duty values, stamp duty will be considered the full consideration except for 5% difference. Now, the ITR has been updated to reflect the change from 5% to 10% due to Finance 2020.

- A new column under schedule 112A and 115AD (1)(b)(iii) of the ITR form has been added to allow details to be provided about the nature of securities transferred. Further, both schedules have been updated with 'grandfathering clauses' that allow the mention of the sale prices, the fair market value and the certificates of ownership of the securities.

Prominent Modifications in ITR 2 for AY 2020-21

Here is a list of the changes introduced in the ITR 2 for AY 2021-22:

- There is now a column for pensioners under nature of employment.

- The column for deductions has been updated with the addition of 80TTB (which is a new deduction).

- Assesses are required to provide information about their ownership of Unlisted Companies, including all information about purchases and sales of shares made throughout the financial year.

- The assessee must now disclose his Directorship in any unlisted company he may be a Director of. A company's name, its PAN, and a director's identification number are required from Assess.

- Those over the age of 80 will be the only ones capable of filing paper returns.

- In the case of taxpayers with agricultural income, additional information will have to be provided. Land measurements will include acres, a district name, and Pin code where the land is located, and whether it is irrigated or rain-fed, as well as whether the land is owned or leased.

- A person holding foreign assets must divulge details such as foreign depository account information, foreign custodian account information, equity, and debt interests, and details of foreign annuities or cash value insurance policies.

- The income received from residential properties must include tenant information such as tenant name, PAN number, and TAN number.

Easy Tax Filing With Deskera

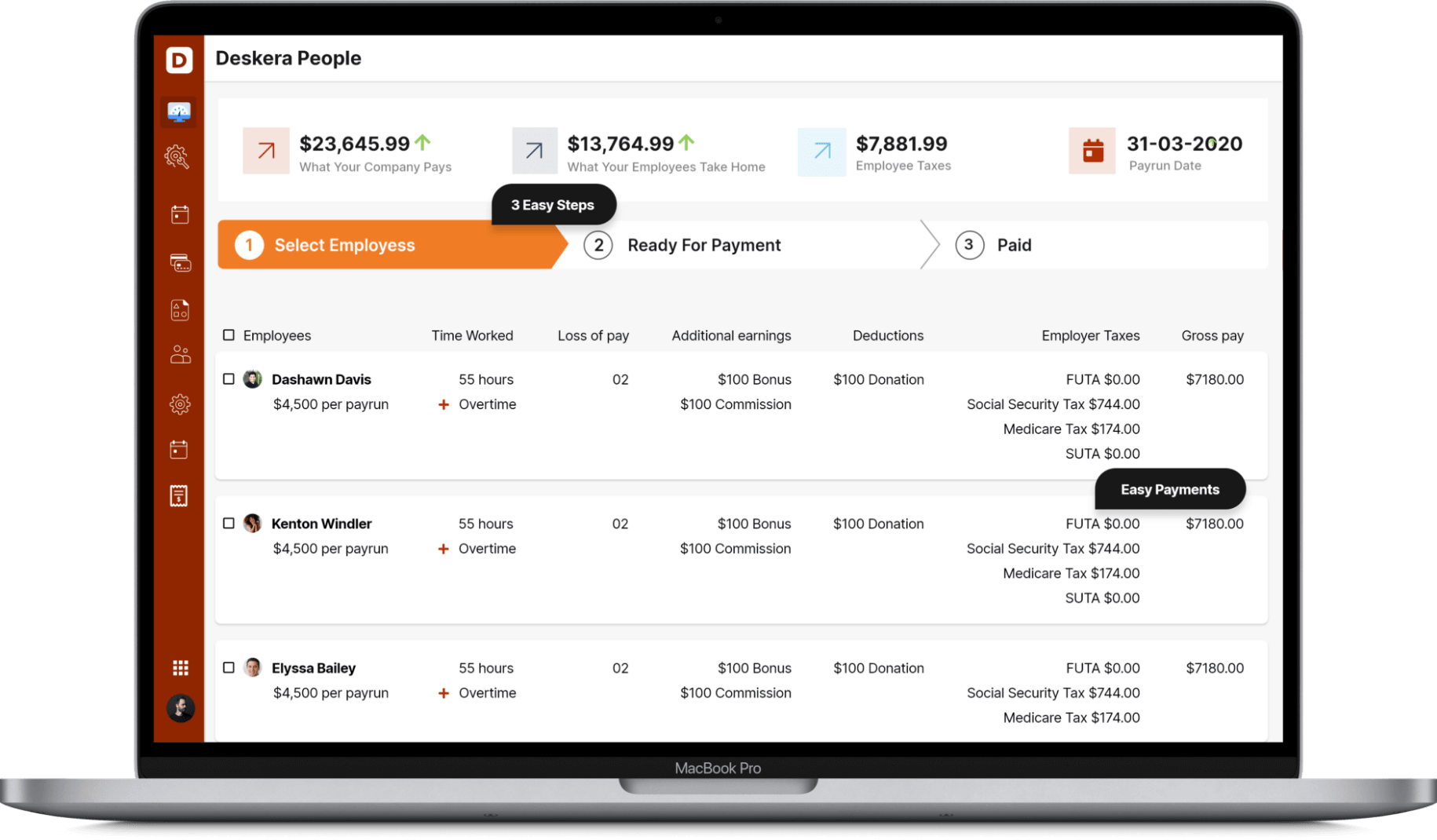

You can generate payroll and payslips in minutes using Deskera People. You can also file and manage your taxes using Deskera People. Deskera is an online cloud platform that can helps you organize your business, your employees and with handling your tax filings. Apart from helping you process your monthly payruns, Deskera People also handles your employees’ Income Tax saving investments.

A 15-day free trial will enable you to become familiar with the enterprise features. Deskera People provides you with an amazing HRMS system that helps you manage your employees from end to end. From managing payroll, employee onboarding, leave and attendance management, deskera also helps you with salary management. Using Deskera People, you can file your Income Tax or IT declaration and Proof of Investment(POI) using the platform.

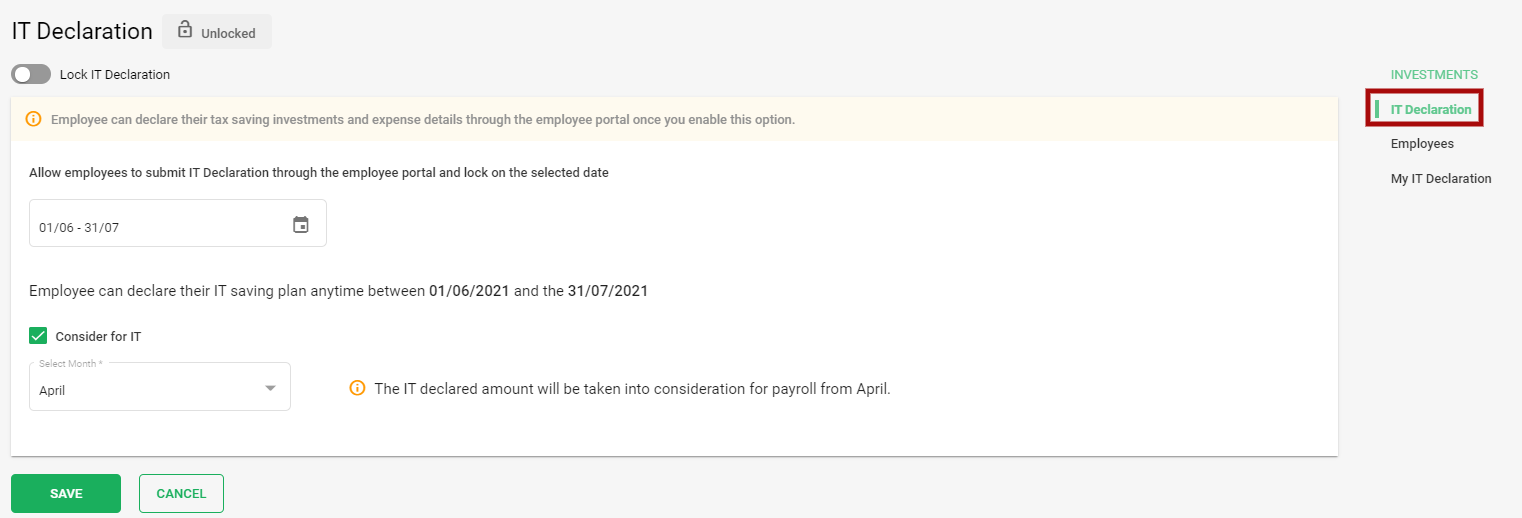

Deskera People simplifies the process of filing an ITR. Your organization's needs can be met with a customized plan designed by Deskera. Easy-to-use Deskera's tax software can help you file your taxes in no time. Business owners with any type of tax filing requirement can rely on the system. Employees can declare their proposed investments and anticipated expenses through the IT declaration.

Employees can declare the investments that they have made and submit proofs for the same, and Deskera People will auto - calculate the Income Tax based on the type and amount of each investment. The main incentive for employees’ to declare their investments is that it reduces their net taxable income, thereby decreasing the amount they need to pay as Income Tax.

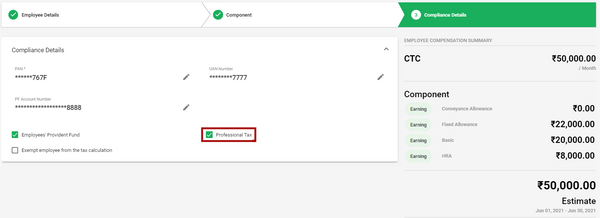

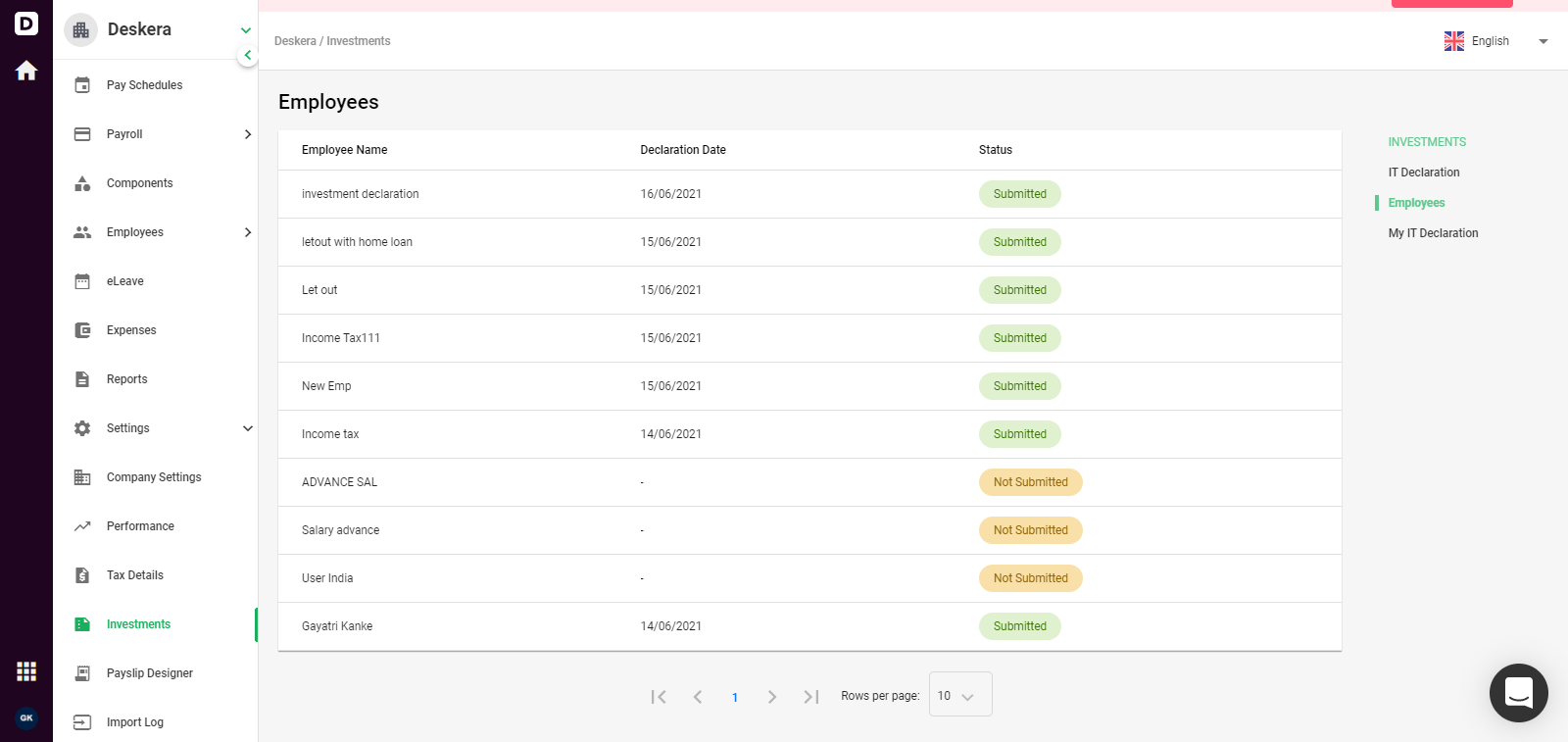

Once the IT Declarations are submitted by all the employees, the employers can view the status of these submission. Other than payroll management, Employee Provident Fund (EPF) and EPS contribution are also calculated in Deskera People

Key Takeaways

Our key learning from the article are:

- ITR2 form is to be filed by the people who do not have income from the profits and gains of their business or profession, and who cannot file an ITR-1.

- While the structure of the form is very elaborate, you can choose to file it online or offline.

- Any individual or HUF who has an income from their business or profession and those who are eligible to complete the ITR-1 form, are the individuals who are considered ineligible for filing the ITR 2 form.

Related Articles