Filing returns is presumed as a tedious and time-consuming task for most people. The amount of effort required to gather up all the documents, identifying the right form, eligibility, and ineligibility to file a particular form, are all the steps that instill a lot of anxiousness in minds of the taxpayers.

However, as it is a mandatory process, one must abide by it, and the sooner we understand the process, the better. This article aims at presenting the steps in a clear format so that any doubts or queries that you may have had about filing the ITR, get pulled away; leaving you with a much clearer stance on the entire filing process.

This article is a part of our series on ITR and ITR forms which also includes all the other forms.

At the end of this article, you will have the following information at your finger-tip:

- What is ITR1?

- Who can file it?

- Who cannot file ITR1?

- What is the Structure of ITR1?

- How to file ITR1?

- Prominent modifications in ITR1 for the year 2021-22

- How to fill out the ITR1 form?

So, let’s dive in.

Quick Look at ITR

ITR or the Income Tax Return is a form that is needed to be filed by all the eligible individuals and submitted to the Income Tax Department of India. It comprises all the information about your income and earnings for a particular fiscal year, i.e. from 1st April of the current year to 31st March of the next year.

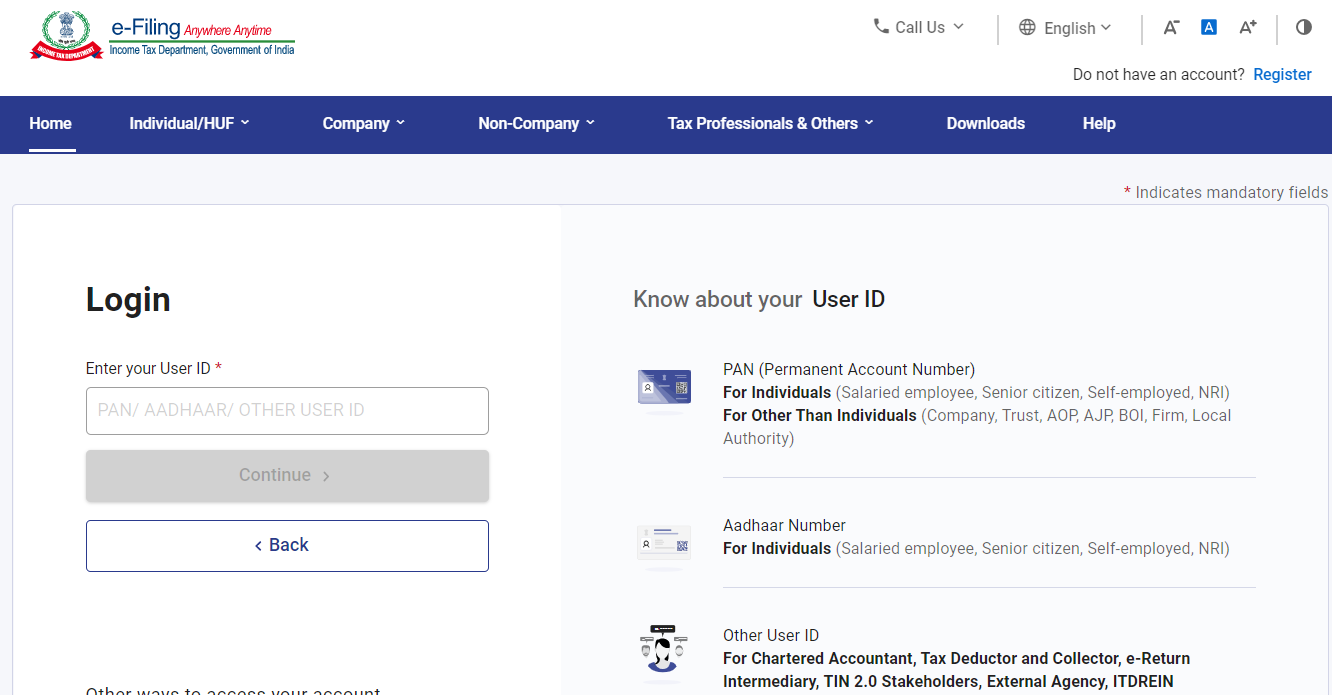

You can log in to the income tax website through the following link:

https://eportal.incometax.gov.in/iec/foservices/#/login

Per the prescription of the Income Tax Department, there are 7 types of ITR forms: ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7. Based on the type of income, people are required to file the applicable ITR form. There could be various sources of income including:

- Salary

- Income from business and profession

- House property income

- Capital gains

- Other sources like interest on deposits, royalty earning, dividends, earnings from lotteries, and so on.

What is ITR1 Form or Sahaj Form?

We have learned about the ITR and now we shall understand about the ITR1 form which is also called the Sahaj Form. This applies to people who have an income of up to 50 lakhs.

Let’s look at it closely.

Eligibility for filing ITR1 form:

ITR1 form is called Sahaj form as it is easy and simple to fill out and applies to individuals with income up to INR 50 Lakhs. The sources of income of the individuals are:

- Salary income

- Pension

- House property income (except in cases that carry forward a loss from the previous year).

- Other sources of income (except lotteries and horse racing winning)

Another important point is that if there are clubbed incomes such as an included minor or spouse, the income is to be filed only if it meets the above specifications.

Individuals Ineligible to file ITR1

The filing of ITR1 does not apply to individuals with the following specifications:

- An individual with an income over INR 50 Lakhs

- An individual who holds the post of director in a firm or has unlisted equity anytime during the financial year.

- Residents not ordinarily resident- RNOR

- Non-residents also cannot file ITR1

- Also, if the individual has earned an income from the following sources:

- If the individual has house properties more than one.

- Has income from lotteries, horse racing, or any other form of legal gambling

- Short-term or Long-term capital gains income that is taxable

- If the person has an agricultural income of more than INR 5,000

- Income from business or profession

- A person who has foreign assets outside India

- Individuals claiming double taxation relief under sections 90/90A/91 or relief of foreign taxes paid.

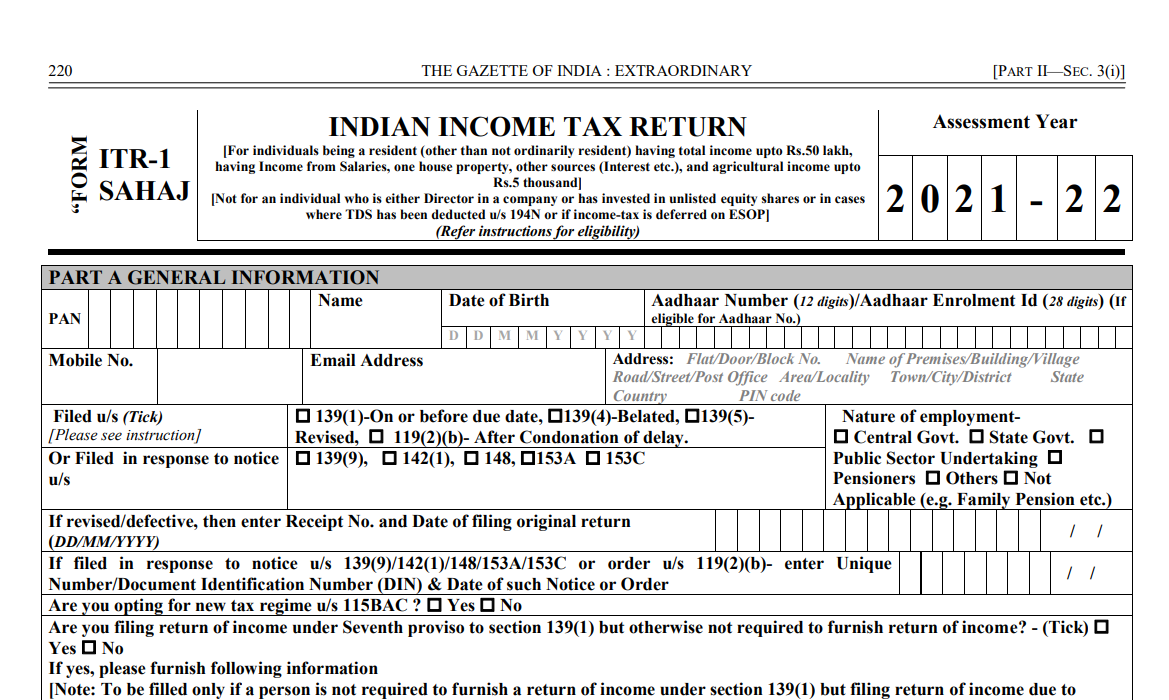

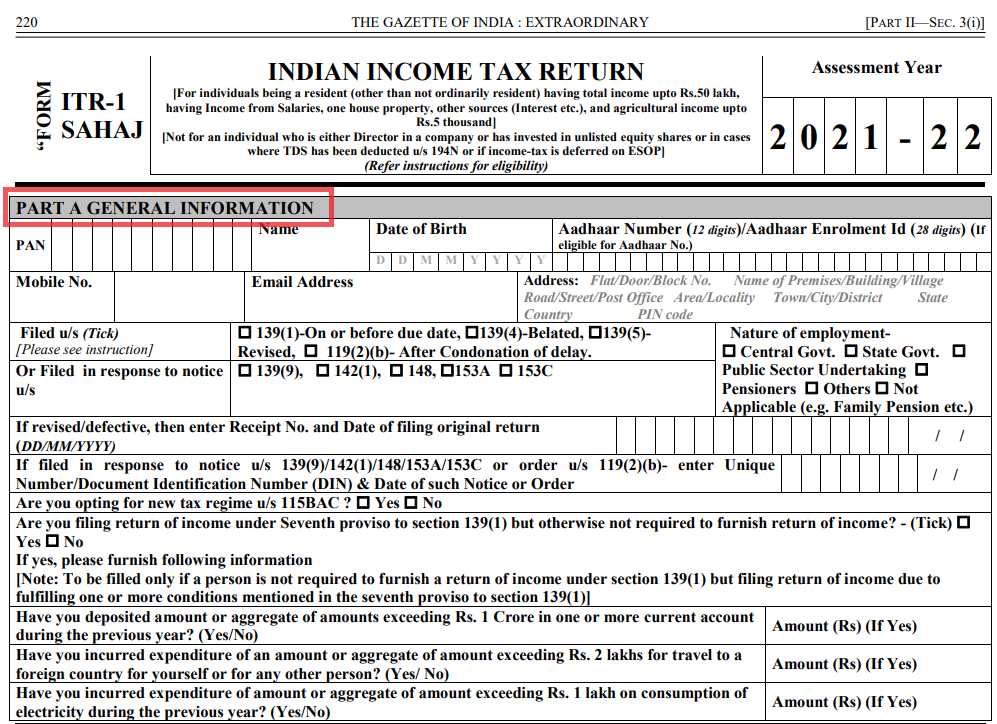

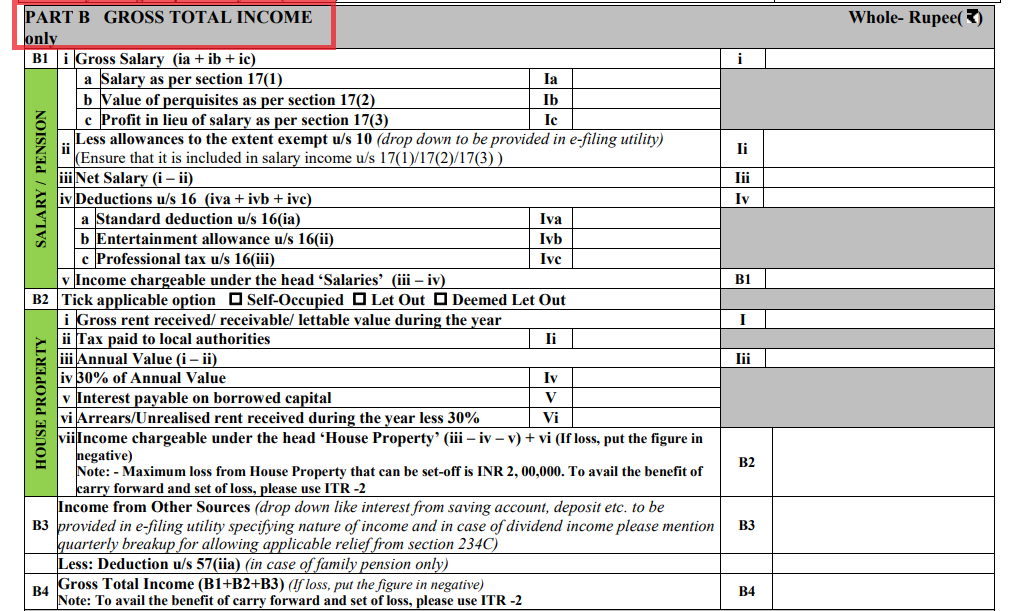

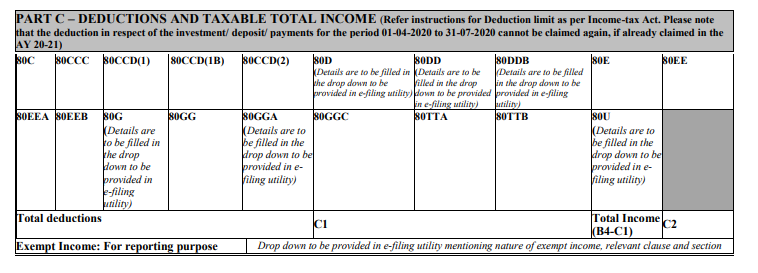

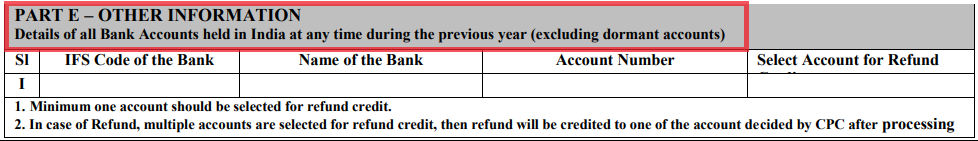

Structure of ITR1

The structure of the ITR1 form comprises the following sections:

Part A: General Information

Part B: Gross Total Income

Part C: Deductions and Taxable Total Income

Part E: Other Information

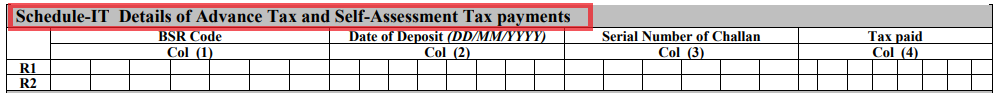

Schedule-IT

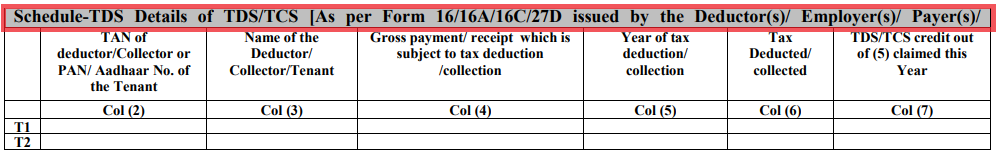

Schedule- TDS

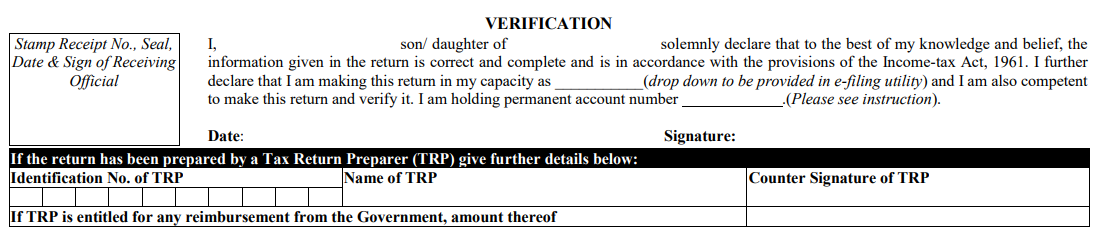

Verification

How to File ITR1?

ITR1 form can be filed electronically (online) or offline.

OFFLINE

The offline method refers to the method of filing in a paper format. The department allows only those individuals to file the ITR1 offline who fulfill this criterion:

- An individual or a HUF having an income of not more than INR 5 Lakhs and the one who hasn’t claimed a refund for income tax purposes.

- An individual at or over the age of 80 years.

ONLINE

The process of online filing involves one of the two methods mentioned here:

- By furnishing the information electronically and then submitting the ITR-V form which indicates the verification of the return. This is submitted to the CPC, Bengaluru.

- By filing the return online, which is followed by e-verification of the ITR-V form through the net-banking or Aadhar OTP or EVC.

In case of the electronic submission of your ITR1, you shall receive an acknowledgment through mail on your e-mail id. Alternatively, you can also download it manually from the income tax website. The next step after downloading is to sign it and send it to the CPC (Centralised Processing Center).

Prominent Modifications in ITR1- the Year 2021-22

In the form for the year 2021-22, we’ll be witnessing the following changes in the ITR1:

- If individuals have their TDS deducted under section 194N, then they cannot file ITR1. In accordance with section 194N, if the individual withdraws a cash amount of more than INR 20 Lakhs, then the tax will be deducted at the source. On the other hand, the tax is deducted at source when the individual withdraws cash more than INR 1 Crore within a fiscal year.

- There will be no alternative provided to carry forward the TDS as per section 194. According to section 194N, tax deductions may only be claimed during the same tax year in which they were deducted.

- A person or a HUF can choose either the old tax regime or the new tax regime. In case they choose to go with the new tax regime as per section 115BAC, they will have to additionally file Form 10IE before filing the ITR as per section 139(1).

- The ITR1 forms for the year 2020-21 included the new schedule DI. This enabled the taxpayers to avail deductions that were made in the extended duration of 2020-21. This schedule DI now stands removed in the ITR1 form-2021-22.

How to Fill-out the ITR1?

For filling out the ITR1, you shall require the following documents:

Form 16: This is generally provided by the employer to their employees for the given year.

Form 26AS: The verification of the TDS you mention in Form 16 must match the TDS you mention in Part A of Form 26AS.

Receipts: You can claim you deductions directly by providing the proof of these deductions and exemptions at the time of filing your ITR1. Keep the receipts ready before you sit down to file the returns. The exemptions or dedication could include the HRA allowance/ Section 80C or 80D deductions).

PAN: Keep your PAN card handy.

Investment certificates from your bank: certificates such as the FD certificate or entire financial information in the form of a bank passbook must be kept ready before filing returns.

How can Deskera make Filing Easy for You?

Deskera People helps digitalize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Simplify payroll management and generate pay slips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

Do not forget to check out our articles on running payroll for India and best practices in HR.

Key Takeaways

To help you get away from the anxiousness of filing the ITR, we have presented the details step-by-step for an easy understanding. Let us recap the important points mentioned in the article:

- We have learned what ITR is: ITR or the Income Tax Return is a form that is needed to be filed by all the eligible individuals and submitted to the Income Tax Department of India.

- The income tax department has introduced 7 different types of ITR forms to make the process simpler for the taxpayers: ITR forms, ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7.

- ITR1 form is called Sahaj form as it is easy and simple to fill out and applies to individuals with income up to INR 50 Lakhs.

- While the ITR1 can be filed both online as well as offline, the offline mode is reserved for people above the age of 80 years and/or an individual or a HUF having an income of not more than INR 5 Lakhs.

You shall require to keep certain documents handy before you begin with the process of filing your ITR1. These include your Form16, Form 26AS, deduction receipts (if any), PAN, and bank passbooks & other investment certificates (FD, and so on.)

Related Articles