When the businesses pay taxes to the government, they can claim the credit of GST paid for their daily operations. These included purchases of raw materials or services used for manufacturing or at the time of sale of the particular product.

This whole concept is known as Input Tax Credit (ITC).

To simplify the term, Input Tax Credit means claiming the credit of the GST paid on the purchase of goods or services used for the furtherance of the business.

The concept of ITC reversal under GST rises when the taxpayer wrongly claims the Input Tax Credit. In this case, the credit should be reversed by making the payment to that extent for the next month.

In this article, we will dive into the meaning, purpose, and calculation of ITC reversal under specified rules along with the following:

• What is ITC Reversal under GST?

• What are specific conditions for ITC Reversal?

• Calculation of ITC Reversal under Rule 42

• Calculation of ITC Reversal under rule 43

• Calculation of ITC Reversal under rule 44A

• Reporting of ITC under GST Returns

• How can Deskera help businesses?

What is ITC Reversal under GST?

We know that every registered person is entitled to take credit for the ITC.

But pertaining to specific situations, the ITC claims are reversed under GST. ITC reversal is a concept where the taxpayer entitled to claim the credit benefit before is now entitled to pay the output tax liability. The taxpayer is no longer able to claim the credit offered by taking him back to the reverse gear. The taxpayer is also entitled to pay the interest fees depending upon the level of reversal.

What are specific conditions for ITC Reversal?

The reversal of ITC is a result of certain situations and scenarios defined under the GST Act.

On the occurrence of such circumstances, the reversal of ITC is required within a specified period as stated below:

Calculation of ITC Reversal under Rule 42

The calculation of ITC reversal covers the input or input services. The entire process is based on three steps that are discussed below:

Step 1: At first, the businesses should segregate the specific credits that will not be applicable for the claim from the total amount of ITC.

To get the final amount, there are certain variables used during the process helpful for the calculation.

The same can be discussed as follows:

1. T

T is the total input tax paid credit on inputs and input services

2. T1

T1 is the specific credit attributed to inputs intended to use for non-business purposes

3. T2

T2 is the amount of input tax attributed to inputs intended to use for offending exempt supplies

4. T3

T3 is the amount of input tax deemed as 'blocked credits' under section 75

Step 2: The next step is to reduce T1, T2, and T3 the total amount of ITC and derive the common credit as below:

After that, term T4 will be coming to the picture specifying specific credit on inputs attributed exclusively for taxable supplies.

And at the end, taking differences of C1 and T4 together, you will end up under Common Credit denoted as C2, assuming that the inputs have been partly used in taxable supplies and partly used for non-business purposes.

Step 3: Finally, compute the amount of ITC to be reversed out of common credit discussed above as follows:

The ITC attributable towards exempt supplies coming out of the common credit is calculated as below.

Here E stands for an aggregate value of exempt supplies during tax period &

F stands for total turnover in the state of the registered person during the tax period.

Next, you will end up under D2, attributable for non-business purposes, out of the carbon Credit that is 5% of C2.

Finally, you will arrive at C3 that is the eligible ITC coming out of the common credit denoted as

Based on the calculations of D1 and D2, you will arrive at the ITC that needs to be reversed.

Let us understand the calculation based on the following illustration for better clarity:

Calculation of ITC Reversal under rule 43

The calculation of ITC reversal under rule 43 concerns capital goods.

But before proceeding with the steps, the first step is to find out that if the ITC falls under the following criteria:

- ITC is in relation to capital goods having used for non-business purposes or for making exempt outward supply

- ITC in relation to capital goods used for making supplies other than exempt supplies

Keep in mind that the useful life of capital goods is taken as five years, but for the filing period, the period is related to the supplies made in a particular month.

So to carry out the operations, the first thing is to find the ITC attributable to 1 month by dividing the credit by 60.

Here, common credit is noted as ‘Tc’, divided with 60, which gives Tm denoting the amount of ITC attributable to the tax period.

‘Tr’ is the aggregate Tm of the capital goods.

‘Te’ is the common credit attributable towards exempt supplies calculated as below.

Where E stands for an aggregate value of exempt supplies,

F stands for total turnover, the state of the registered person.

Hence, Te is the amount of ITC reversal calculated concerning capital goods.

Let us understand the calculation based on the following illustration for better clarity:

Calculation of ITC Reversal under rule 44A

The calculation of ITC reversal under rule 44 A is subjected to gold dore bars. Here the stock of such gold dore bars or the gold jewelry lying with the taxpayer will be restricted to 1/6th of the credit availed concerning the gold door bar. As a result, 5/6th of the credit will be reversed and the time of supply.

Reporting of ITC Reversal under GST Returns

The Reporting of ITC reversal needs to be calculated under GST returns only in GSTR- 3B and GSTR-9.

Let's discuss the reporting under both cases:

Reporting of ITC reversal in GSTR-3B

Under this, the amount of ITC reversal needs to be calculated by the taxpayer and filled up in table 4B under GSTR- 3B form.

The reporting of ITC can be done as follows:

- As per the rule of 42 and 43 of CGST/SGST rules

- Others, where ITC reversal is due to other circumstances

Reporting of ITC reversal under GSTR-9

GSTR-9 is based on the annual return, and here the taxpayer will need to fill in the details regarding the ITC reversed for the whole year. In this form, table 7 contains the details of ITC reversed and ineligible ITC for the financial year. The taxpayer can fill the amount accordingly.

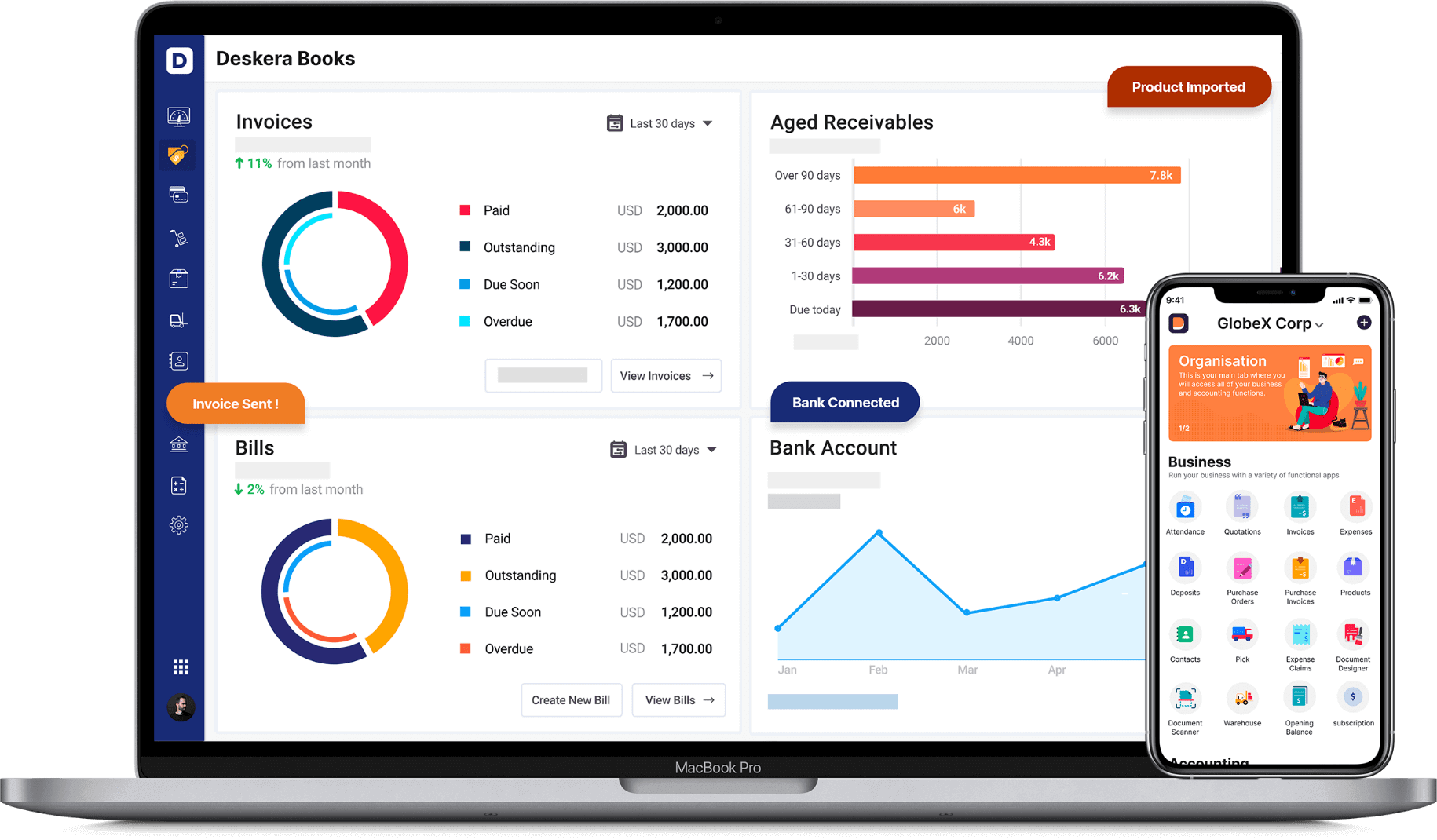

How can Deskera help businesses?

Discover how you can combine accounting, finances, inventory, and much more under one roof with Deskera Books. It's now easier than ever to manage your Journal entries and billings with Deskera. The remarkable features, such as adding products, services, and inventory, will all be available to you from one place.

Deskera is an all-in-one software through which you can combine accounting, financial management, inventory management and many more such features using Deskera Books.

While the taxation regimes followed by most countries tend to be intimidating and nerve-wracking, the key to understanding them is by starting to understand each of their nitty-gritty. In the case of GST in India, this involves understanding the Forms GSTR-1, GSTR-2A, GSTR-2B, GSTR-3B, the difference between GSTR-9 and GSTR-9C, reverse charge mechanism under GST and many more such details.

While this all seems a lot to take in, what the businesses can be relieved about is that their accounting is handled by Deskera Books. Be it tracking of financial KPIs, marketing KPIs, journal entries, financial statements, invoices, account receivables and accounts payable, Deskera Books will do it all for them- including making it easier to comply with the taxation regime of the base country.

To learn about how to manage and set up India GST in Deskera, go through this video:

Deskera Books is a time-saving strategy for managing your work contacts, invoicing, bills and expenses. In addition, opening balances can be imported, and chart accounts can be created through it.

Deskera Books can handle every aspect of the organization, including inviting colleagues and accountants.

Key Takeaways

In this article, we have covered everything about ITC reversal under GST.

Take a look at the key takeaways:

- ITC reversal is a concept with the taxpayer who is entitled to claim the credit before is now it entitled to pay the liability

- There are ten specific conditions and scenarios defined under the GST act regarding the reversal of ITC.

- Calculation of ITC reversal under rule 42 covers the input or input services.

- Calculation of ITC reversal under rule 43 covers the capital goods.

- Calculation of ITC reversal under rule 44 A is subjected to gold door bars.

- The reporting of ITC reversal under GST return of GSTR-3B and GSTR-9 are done separately.

Related Articles