No, service revenue is not an asset.

Assets are defined as resources with economic value that a business owns.

Whereas service revenue is a business’ earnings from providing goods and services to its customers.

So, service revenue is considered a revenue (or income) account and not an asset.

In this guide, we will go through the details of what service revenue and assets represent in accounting, and why service revenue can’t be an asset.

Read on to learn more about:

- What is Service Revenue?

- What Are Assets?

- Is Service Revenue an Asset?

- Automate Accounting with Online Software

What Is Service Revenue?

Service revenue is a revenue account that records the income a business earns from providing goods and services to customers. It’s part of the income statement along with other types of revenue and business expenses.

Service revenue is recognized under the accrual basis of accounting.

In accrual accounting, cash gets recorded when the transaction occurs, not when money exchanges hands. That means completed services to which the charges haven’t been collected yet, are still considered as service revenue.

So, for example, a bill for an unpaid service is part of the income statement as service revenue, even if the client hasn’t yet paid the invoice.

But how exactly is this revenue recognition done?

Let’s check out the journal entries necessary in order to record service revenue into the accounting books.

Journal Entries for Service Revenue

In double-entry bookkeeping, transactions simultaneously affect two accounts.

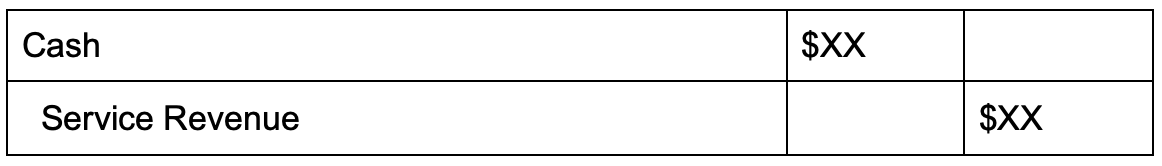

When a customer pays for their services in cash right away, there is a debit to Cash and a credit to Service Revenue.

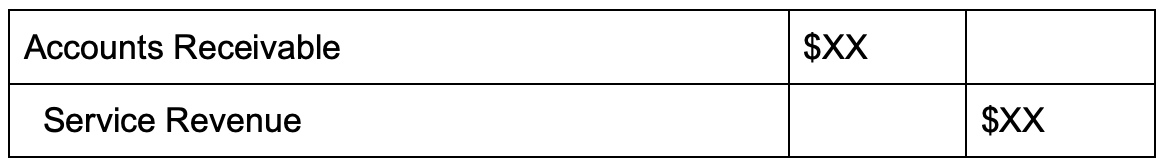

The journal entry for services rendered on account includes a debit to the asset Accounts Receivable and a credit to Service Revenue.

If you want to learn more about making journal entries for your small business accounting, head over to our guide on journalizing transactions.

What Are Assets?

Assets are resources a business owns that carry an economic value and/or will provide a future economic benefit. They can either be current or fixed.

Current assets are assets that can be converted into money within a year, such as cash, cash equivalents, accounts receivable, and inventory. While fixed assets are long-term assets businesses use for over a year and include buildings, machinery, land, etc.

Assets are included in the balance sheet along with liabilities.

Is Service Revenue an Asset?

Service revenue is a revenue account, part of the income statement.

Assets, on the other hand, are the resources that businesses use to generate this service revenue and other types of profit. They are included in the business’ balance sheet.

That’s why the answer is no: service revenue is not an asset account.

If you want to learn more about the types of accounts and how they differ, check out our guide on the chart of accounts for beginners.

Automate Accounting with Online Software

Use cloud accounting software like Deskera to streamline your finances from any device with an internet connection.

Deskera’s intuitive dashboard allows you to directly integrate with your bank accounts, automate receivables and payables, track inventory and pipelines using an advanced CRM, issue credit notes, generate financial reports, set up recurring payments, and so much more!

In addition to all of the accounting features the program also provides you with payroll functionality and a Human Resource Information System, all in one place.

Give Deskera a try with our free trial. No credit card details necessary.

Related Articles