Have you ever wondered whether the products sitting in your warehouse or the raw materials waiting to be used in production count as a business asset? The answer is yes — inventory is indeed a current asset. It represents one of the most crucial resources for any business, directly influencing cash flow, profitability, and overall financial health. Whether you’re a manufacturer, retailer, or wholesaler, understanding where inventory fits in your balance sheet is essential for smart financial decision-making.

But why is inventory sold within a year? Are there any exceptions to the rule?

That’s exactly what we will be answering in this guide, along with the accounting basics of inventory and current assets.

In accounting terms, inventory is classified as a current asset because it’s expected to be sold, consumed, or converted into cash within a single operating cycle — typically a year. This classification helps businesses gauge their short-term liquidity and operational efficiency. Simply put, the faster inventory moves, the healthier a company’s cash flow and working capital position tend to be.

However, not all inventory behaves the same way. Some goods may sit on shelves longer than anticipated, become obsolete, or even lose value — which can impact their status as a current asset. That’s why it’s vital to manage and value inventory accurately to reflect a true picture of your company’s financial position. Proper tracking and categorization can prevent overstatement of assets and ensure compliance with accounting standards.

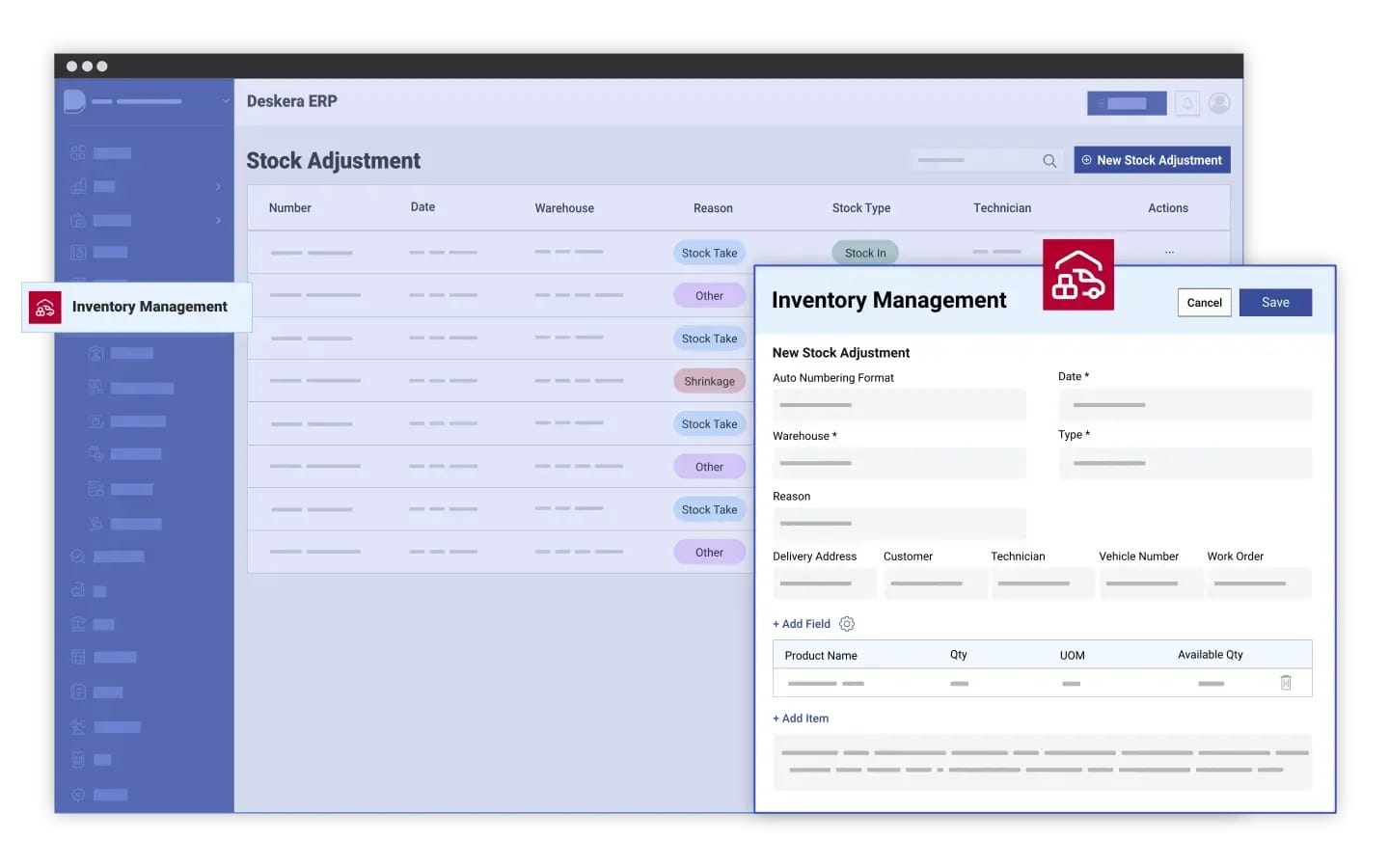

This is where Deskera ERP comes into play. Designed for modern businesses, Deskera ERP provides real-time inventory tracking, automated valuation, and seamless integration with accounting and sales functions. Its AI assistant, David, delivers actionable insights into stock movement, valuation trends, and demand forecasting — helping businesses maintain accurate financial records and optimize cash flow. With Deskera ERP, managing your inventory as a current asset becomes effortless, transparent, and data-driven.

What Are Current Assets?

In financial accounting, current assets refer to all the assets a company owns that can be converted into cash within one year or during one operating cycle—whichever is longer. They are vital indicators of a company’s short-term liquidity, revealing its ability to meet immediate obligations and manage day-to-day operations effectively.

On a balance sheet, current assets represent what a company immediately controls and can readily use. They differ from non-current (long-term) assets, such as property, buildings, equipment, or machinery, which cannot be liquidated quickly. While the value of current assets depends on their current fair market value, long-term assets are usually recorded at their historical cost or purchase price.

A typical breakdown of current assets on a company’s balance sheet includes:

- Cash: The most liquid asset — funds readily available for business use or to settle obligations.

- Cash Equivalents: Highly liquid investments that can be quickly converted into cash without significant loss of value, such as:

- Treasury bills

- Short-term government bonds

- Certificates of deposit

- Money market funds

- Accounts Receivable: Money owed to the company by customers for goods or services already delivered but not yet paid for. It reflects expected short-term inflows of cash.

- Prepaid Liabilities (Prepaid Expenses): Advance payments made for future goods or services — for example, insurance premiums or service contracts. Although not directly convertible to cash, they qualify as current assets because they reduce future cash outflows.

- Marketable Securities: Liquid investments that can be sold quickly without affecting their market price. These may include publicly traded stocks or bonds that can be converted into cash on short notice.

- Other Liquid Assets: Additional short-term investments or securities that can be easily accessed if required, such as temporary deposits or short-term notes receivable.

In essence, current assets form the foundation of a company’s working capital and are critical in determining its operational efficiency. Businesses that effectively manage their current assets—especially inventory, receivables, and cash—maintain stronger liquidity positions and financial flexibility.

Is Inventory a Current Asset?

Yes, inventory is considered a current asset because it is generally intended to be sold within the normal business cycle, usually within a year. For most businesses, inventory is a cornerstone of short-term assets and is crucial for maintaining liquidity, managing working capital, and ensuring smooth operations.

How Inventory Contributes to Liquidity and Working Capital:

- Inventory represents resources that can be converted into cash through sales, directly impacting a company’s working capital.

- While inventory is less liquid than cash or cash equivalents, it is more liquid than long-term assets such as property, equipment, or patents.

- Well-managed inventory allows businesses to avoid stockouts, meet customer demand promptly, and reduce the risk of holding obsolete or excess stock.

- Inventory turnover—how quickly inventory is sold and replaced—is a key metric for assessing operational efficiency and short-term financial health.

Inventory on the Balance Sheet:

- On the balance sheet, inventory is listed under current assets, alongside cash, receivables, and other short-term resources.

- Its value depends on the accounting method used—FIFO (First-In-First-Out), LIFO (Last-In-First-Out), or weighted average cost.

- Accurate inventory valuation ensures that the balance sheet reflects a true picture of the company’s liquidity and financial position.

Examples Across Industries:

- Retail: Finished goods ready for sale are counted as current assets.

- Manufacturing: Includes raw materials, components, and work-in-progress (WIP), all treated as current assets.

- Wholesale and Distribution: Bulk stock intended for resale within a year qualifies as a current asset.

Additional Factors Affecting Inventory Classification:

- Industry Type: Industries with faster-moving products, like electronics or fashion, can liquidate inventory more quickly than heavy machinery or aerospace manufacturers.

- Market Conditions: Economic downturns, seasonal slowdowns, or market saturation can reduce inventory liquidity temporarily.

- Demand Fluctuations: Changes in consumer demand or product popularity can affect whether inventory is realistically convertible to cash within a year.

- Obsolescence and Expiry: Perishable goods, seasonal products, or rapidly outdated technology may lose their classification as current assets if they cannot be sold in the short term.

- Strategic Stockpiling: Companies may maintain excess stock for anticipated demand or raw material shortages. While still current assets, this can impact liquidity ratios.

Inventory occupies a middle ground in liquidity—not as readily accessible as cash, but far easier to convert into cash than long-term assets. Proper inventory management, accurate valuation, and understanding market dynamics are essential to maintain its role as a current asset and support healthy working capital.

Types of Inventory and Their Accounting Treatment

Inventory is not a single, uniform category—it consists of several types, each serving a different purpose in the production and sales process. Understanding these types and how they are accounted for is crucial for accurate financial reporting and effective inventory management.

1. Raw Materials

- Definition: Basic materials and components purchased from suppliers to be used in production.

- Examples: Steel for car manufacturing, fabric for clothing production, or electronic components for gadgets.

- Accounting Treatment:

- Recorded at purchase cost, including taxes, shipping, and handling fees.

- Considered a current asset because they are expected to be used in production within a year.

- Cost of raw materials becomes part of work-in-progress (WIP) as they are consumed in production.

2. Work-in-Progress (WIP)

- Definition: Partially completed products that are still in the production process.

- Examples: A half-assembled smartphone or machinery component.

- Accounting Treatment:

- Valued at direct material cost + direct labor cost + allocated overheads.

- Recorded as a current asset because WIP will typically be completed and sold within the operating cycle.

- Proper valuation ensures that the balance sheet and income statement accurately reflect production costs.

3. Finished Goods

- Definition: Products that have completed the production process and are ready for sale.

- Examples: Packaged consumer electronics, furniture, or clothing items in retail stores.

- Accounting Treatment:

- Valued at total production cost, including materials, labor, and overheads.

- Recorded under current assets on the balance sheet.

- When sold, the cost of finished goods moves to Cost of Goods Sold (COGS) on the income statement.

4. Maintenance, Repair, and Operations (MRO) Inventory

- Definition: Items used for production support but not part of the final product.

- Examples: Lubricants, cleaning supplies, and tools.

- Accounting Treatment:

- Considered a current asset if expected to be used within one year.

- Expensed as they are consumed in the production process or maintenance activities.

5. Goods for Resale (Merchandise Inventory)

- Definition: Products purchased by a company specifically for resale without any further processing.

- Examples: Retail clothing, electronics in stores, or wholesale goods.

- Accounting Treatment:

- Recorded at purchase cost including shipping, handling, and import duties.

- Valued as current assets, reflecting the company’s investment in inventory that will generate revenue within a year.

Accounting Methods for Inventory Valuation

To ensure accurate financial reporting, businesses use standardized methods to value inventory:

- FIFO (First-In, First-Out): Assumes the oldest inventory is sold first; ending inventory reflects the most recent purchases.

- LIFO (Last-In, First-Out): Assumes the newest inventory is sold first; ending inventory consists of older purchases.

- Weighted Average Cost: Averages the cost of all inventory available during the period, assigning this average cost to both COGS and ending inventory.

Different types of inventory—raw materials, WIP, finished goods, MRO, and merchandise—serve unique purposes in the supply chain. Proper classification and valuation are essential for accurate balance sheets, cost tracking, and effective working capital management.

When Inventory Is Not Considered a Current Asset

While inventory is typically classified as a current asset, there are certain circumstances where it may be considered a non-current (long-term) asset. This usually happens when the inventory is not expected to be sold, consumed, or converted into cash within one year or one operating cycle. Proper classification ensures accurate financial reporting and helps businesses maintain realistic liquidity assessments.

1. Long-Term Projects or Specialized Inventory

- Inventory intended for projects or contracts that extend beyond one year may be classified as a long-term asset.

- Examples:

- Construction materials for multi-year infrastructure projects

- Specialized machinery components for custom industrial equipment

- These items are tied to long-term revenue recognition and are not part of immediate working capital.

2. Slow-Moving or Obsolete Inventory

- Inventory that is unlikely to be sold within the year due to low demand, product obsolescence, or seasonal cycles may be reclassified.

- Examples:

- Outdated electronic gadgets or software versions

- Seasonal merchandise (e.g., winter clothing in summer)

- Discontinued product lines

- Businesses often need to write down the value of such inventory to reflect its net realizable value.

3. Strategic Stockpiling

- Companies may hold inventory for long-term strategic purposes, such as hedging against raw material price fluctuations or supply shortages.

- Examples:

- Commodity reserves in manufacturing

- Rare raw materials in mining or chemical industries

- While intended for future use, these inventories may exceed one year in holding period and are thus considered non-current.

4. Industry-Specific Factors

- Some industries naturally require longer production or sales cycles, affecting inventory classification.

- Examples:

- Aerospace or shipbuilding components

- Heavy machinery parts

- Large-scale construction materials

- Such inventory may remain in storage for over a year before reaching customers, making it less liquid than typical current assets.

5. Market and Demand Considerations

- Economic conditions or fluctuating demand can impact inventory liquidity:

- Recessions or downturns may delay sales, turning what was expected to be a current asset into a long-term holding.

- Market saturation or changing consumer preferences can slow inventory turnover.

- Example: An automotive company holding unsold vehicles due to falling demand in a particular region.

6. Perishables and Special Handling Requirements

- Some inventory may be current in intent but require special conditions that extend its life or delay its conversion to cash.

- Examples:

- Wine or whiskey aging inventories

- Industrial chemicals requiring long curing or processing times

- These may sometimes be reclassified if their sale or use extends beyond one operating cycle.

7. Implications of Misclassification

- Incorrectly classifying long-term inventory as current can:

- Overstate liquidity and mislead stakeholders

- Affect working capital calculations and financial ratios

- Lead to non-compliance with accounting standards (IFRS/GAAP)

- Regular review and monitoring of inventory ensures proper valuation and classification.

While inventory is generally a current asset, long-term projects, slow-moving or obsolete items, strategic stockpiling, industry-specific cycles, and market conditions may require reclassification as non-current. Accurate classification supports reliable financial reporting, better liquidity assessment, and informed business decisions.

Importance of Proper Inventory Valuation

Accurate inventory valuation is crucial for both financial reporting and operational efficiency. It not only affects the balance sheet but also directly impacts profitability, tax calculations, and decision-making regarding production, purchasing, and sales strategies. Misvaluation can lead to misleading financial statements, poor cash flow management, and compliance issues.

1. Ensures Accurate Financial Statements

- Inventory is a major component of current assets; incorrect valuation can distort the balance sheet.

- Overstated inventory may inflate assets and net income, while understated inventory can undermine profitability and working capital calculations.

- Accurate inventory valuation ensures stakeholders and investors get a true picture of the company’s financial health.

2. Determines Cost of Goods Sold (COGS)

- Inventory valuation directly affects COGS, which impacts gross profit.

- Example: Using FIFO, older (cheaper) inventory is sold first, reducing COGS and increasing profits in times of rising prices. Conversely, LIFO may increase COGS and reduce taxable income.

- Correct valuation helps businesses plan pricing, profitability, and tax obligations effectively.

3. Supports Effective Working Capital Management

- Inventory is a key part of current assets, influencing working capital.

- Proper valuation ensures businesses maintain optimal stock levels, avoiding overstocking or stockouts.

- Helps monitor inventory turnover ratios, ensuring liquidity and operational efficiency.

4. Facilitates Strategic Decision-Making

- Accurate inventory data enables better purchasing, production, and sales decisions.

- Helps identify slow-moving, obsolete, or excess inventory to reduce holding costs.

- Supports demand forecasting, ensuring businesses meet customer demand without over-investing in stock.

5. Compliance with Accounting Standards

- Proper valuation ensures adherence to IFRS and GAAP standards.

- Businesses must value inventory at lower cost or net realizable value (NRV) to comply with accounting principles.

- Misvaluation may result in audit issues, penalties, or misrepresentation of financial statements.

6. Enhances Financial Analysis and Investor Confidence

- Reliable inventory valuation improves the accuracy of liquidity ratios, such as the current ratio and quick ratio.

- Investors and creditors can make informed decisions based on realistic asset values and profitability.

- Helps maintain trust and credibility in the market.

Proper inventory valuation is essential for accurate financial reporting, effective working capital management, strategic decision-making, and regulatory compliance. Leveraging technology like Deskera ERP ensures businesses maintain precise inventory records, improve liquidity, and enhance operational efficiency.

How Deskera ERP Can Help Manage Inventory as a Current Asset

Managing inventory effectively is crucial for maintaining it as a current asset and ensuring strong working capital. Deskera ERP offers a comprehensive suite of tools to help businesses track, manage, and optimize inventory in real time, providing both financial clarity and operational efficiency.

1. Real-Time Inventory Tracking

- Deskera ERP allows businesses to monitor stock levels across multiple locations in real time.

- Tracks raw materials, work-in-progress, and finished goods, ensuring accurate classification as current assets.

- Helps prevent stockouts or overstocking, which can impact cash flow and working capital.

2. Automated Inventory Valuation

- Supports multiple valuation methods: FIFO, LIFO, and weighted average, ensuring accurate recording on the balance sheet.

- Automatically calculates Cost of Goods Sold (COGS) when inventory is sold or consumed.

- Ensures inventory is valued correctly for financial reporting and compliance with IFRS and GAAP standards.

3. Enhanced Demand Forecasting

- Deskera’s AI-powered tools, including the assistant David, provide insights into demand trends and stock movement.

- Predicts which products are likely to move faster, helping businesses maintain optimal inventory levels.

- Supports strategic decisions about purchasing, production, and sales to maximize liquidity and profitability.

4. Integration with Accounting and Finance

- Inventory data is seamlessly integrated with accounting, sales, and procurement modules.

- Real-time updates ensure that current assets are accurately reflected in the balance sheet.

- Helps generate automated financial reports for auditors, investors, and internal stakeholders.

5. Reducing Obsolete or Excess Inventory

- Deskera ERP identifies slow-moving or surplus stock, enabling timely action such as discounts, promotions, or write-offs.

- Ensures that inventory continues to contribute to liquidity rather than tying up capital unnecessarily.

6. Streamlined Compliance

- Automated tracking and valuation help businesses adhere to accounting standards and regulatory requirements.

- Reduces errors and ensures transparency, building trust with investors, auditors, and management.

With Deskera ERP, businesses can effectively manage inventory as a current asset, ensuring accurate valuation, real-time tracking, and strategic decision-making. By leveraging AI insights, integrated accounting, and automated processes, Deskera helps optimize working capital, maintain liquidity, and enhance overall financial health.

Key Takeaways

- Inventory is a vital component of a business’s assets, typically classified as a current asset because it can be converted into cash within the operating cycle.

- Current assets are resources that a company expects to convert into cash or use within a year, reflecting short-term liquidity and the ability to meet immediate obligations.

- Inventory is generally a current asset, contributing to working capital and short-term liquidity, and its value appears under current assets on the balance sheet.

- Inventory includes raw materials, work-in-progress, finished goods, MRO items, and merchandise for resale, each with specific valuation methods to ensure accurate financial reporting.

- Inventory may be classified as non-current when it is slow-moving, obsolete, part of long-term projects, or held for strategic purposes beyond one year or operating cycle.

- Accurate valuation of inventory ensures correct reporting of COGS, working capital, profitability, and compliance with accounting standards, while supporting strategic decision-making.

Deskera ERP provides real-time tracking, automated valuation, AI-powered insights, and integrated accounting, helping businesses maintain inventory as a current asset and optimize liquidity.

Related Articles