Have you ever wondered whether depreciation—the gradual reduction in the value of assets like machinery, vehicles, or buildings—counts as an operating expense? The short answer is yes, it often does, but the explanation isn’t as straightforward as it seems. Understanding where depreciation fits in financial statements can significantly change how businesses evaluate their costs, profits, and long-term growth.

Depreciation is not just an accounting concept—it’s a critical factor that influences how companies measure their performance and make strategic decisions. Unlike typical cash expenses such as rent or salaries, depreciation doesn’t involve any direct outflow of money. Instead, it spreads the cost of an asset across its useful life, ensuring that businesses match expenses with the revenue generated from using those assets.

Classifying depreciation as an operating expense matters because it directly impacts operating income, margins, and even how investors perceive a company’s efficiency. While most businesses list it under operating expenses, certain situations may categorize it differently, depending on whether the assets are tied to core operations or not. Getting this classification right is vital for accurate financial reporting and smarter decision-making.

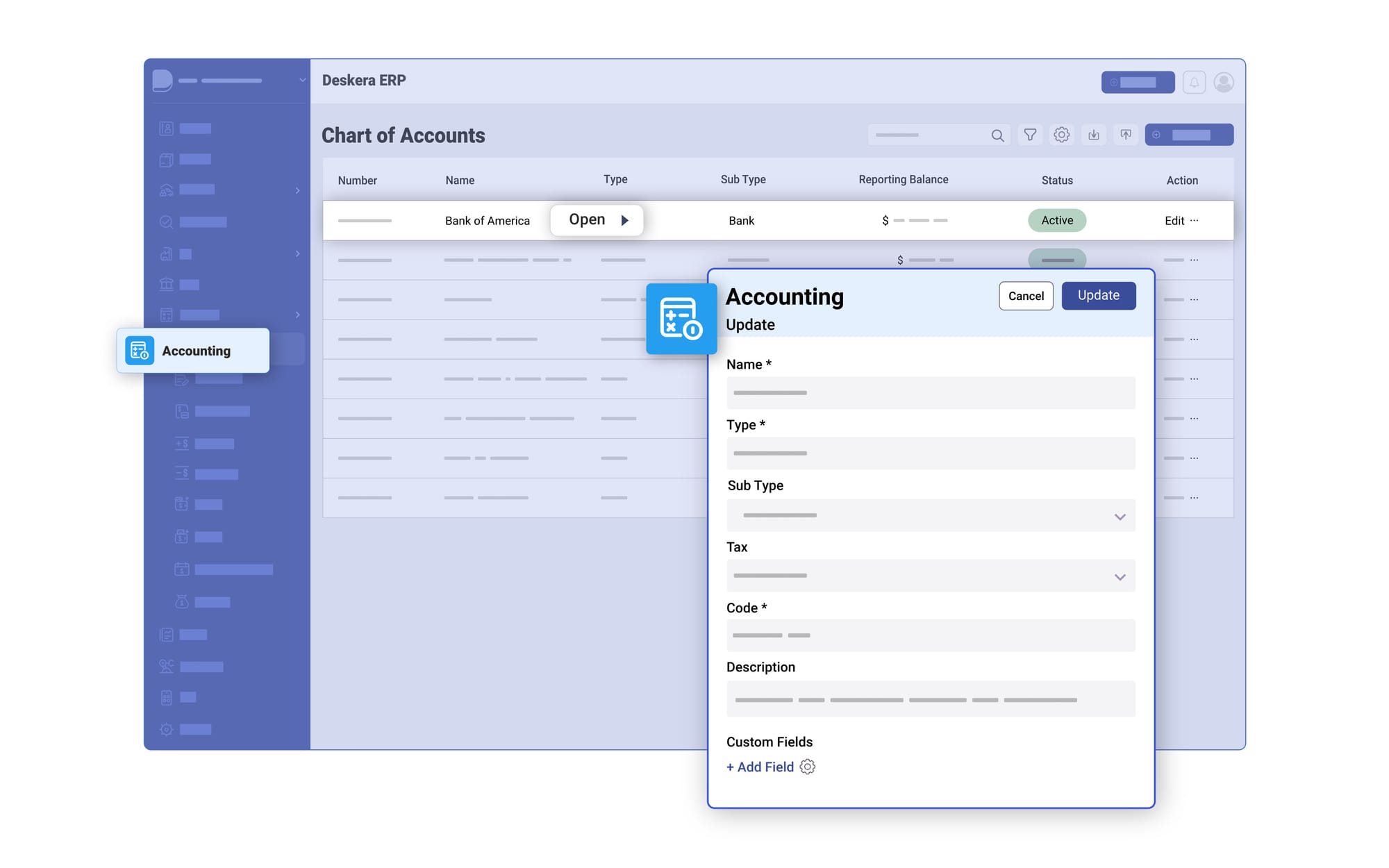

This is where modern business tools like Deskera ERP come in. Deskera ERP simplifies financial management by automating expense tracking, asset depreciation schedules, and reporting in real time. With features like built-in accounting, inventory, and compliance management, Deskera helps businesses not only record depreciation correctly but also gain actionable insights into overall operational efficiency.

What is Depreciation?

To understand whether depreciation qualifies as an operating expense, it’s important to first understand the concept itself. Depreciation is a non-cash expense, meaning it doesn’t involve any actual outflow of money. Unlike operating expenses such as wages, rent, or utilities that immediately impact cash flow, depreciation is simply an accounting method used to allocate the cost of a long-term asset over its useful life.

When a business acquires assets like machinery, vehicles, furniture, or office equipment, it incurs a large one-time cost. Deducting this entire amount in the first year would distort financial performance. Instead, accounting standards require spreading that cost across the asset’s useful life. This ensures the expense of using the asset aligns with the revenue it helps generate—commonly known as the matching principle in accounting. For instance, if a company buys a machine worth $50,000 expected to last 10 years, it might record $5,000 annually as depreciation, rather than charging the full $50,000 in year one.

Depreciation also has a balance sheet impact. Each time depreciation expense is recorded, it reduces the asset’s book value through an account called accumulated depreciation, which is a contra asset account. This account shows how much of the asset’s original cost has been depreciated to date. For example, if machinery worth $60,000 has $20,000 in accumulated depreciation, its net book value would be reported as $40,000 on the balance sheet.

From a tax perspective, depreciation provides a significant advantage. The IRS allows businesses to deduct depreciation as an expense, reducing taxable income. Companies can either expense an entire cost in one year (under certain conditions) or spread the deduction over the asset’s expected life. This makes depreciation a powerful tool for managing both financial reporting and tax liabilities.

In short, depreciation reflects the gradual wear and tear, obsolescence, or aging of fixed assets. While it doesn’t involve any cash payments, it plays a crucial role in showing the true financial position of a business by aligning expenses with the revenue those assets help produce.

What Counts as an Operating Expense?

Operating expenses, often referred to as OPEX, are the day-to-day costs a business must pay to keep running smoothly. These are the recurring expenses that support the core operations of a company and are essential for generating revenue. In simple terms, if the expense is required to keep your business functioning, it likely qualifies as an operating expense.

Some common examples include:

- Rent and utilities – Costs of maintaining office or factory space, electricity, water, and internet.

- Wages and salaries – Payments made to employees for their services.

- Insurance – Coverage for property, liability, or health insurance.

- Inventory costs – Purchasing, storing, and managing inventory for resale or production.

- Administrative expenses – Office supplies, software subscriptions, and professional services.

- Marketing and sales expenses – Advertising, promotions, and commissions tied to generating revenue.

Operating expenses can take two main forms:

- Fixed operating expenses – Costs that remain consistent regardless of business activity, such as rent or insurance.

- Variable operating expenses – Costs that fluctuate with business activity, such as packaging, shipping, or sales commissions.

On the income statement, operating expenses are deducted from gross profit to calculate operating profit (or operating income). This makes them an important measure of efficiency, as they reflect how effectively a company manages its resources to generate revenue.

In short, operating expenses are all the ongoing costs associated with running your business—excluding the direct cost of goods sold (COGS) and non-operating items like interest or taxes. Properly tracking and controlling OPEX is critical for profitability and long-term growth.

Is Depreciation an Operating Expense?

When analyzing a company’s financial statements, it’s common to wonder whether depreciation counts as an operating expense. The answer is mostly yes, but it depends on the nature of the asset being depreciated. Understanding this distinction is important because it affects operating profit, financial ratios, and business decision-making.

Depreciation is a non-cash expense—it reduces the book value of assets over time without impacting cash flow. Since many assets are directly used in business operations, depreciation is generally included in operating expenses. However, there are cases where depreciation relates to non-operating assets, which are treated differently in financial reporting.

Depreciation on the Income Statement

Depreciation is typically recorded under operating expenses in the income statement, often included in Selling, General, and Administrative (SG&A) expenses or as a separate line item. By allocating the cost of long-term assets over their useful lives, companies match the expense with the revenue generated from those assets, in accordance with the matching principle.

For example, a manufacturing company depreciating its machinery will report this expense as part of operating costs because the machinery is essential to daily production. This treatment ensures that operating profit reflects the true cost of running the business.

Operating vs. Non-Operating Depreciation

Not all depreciation is considered an operating expense. Depreciation tied to assets not used in core operations, such as investment properties or idle equipment, may be classified as non-operating. These are reported separately on the income statement and do not affect operating profit, though they still reduce taxable income.

This distinction helps investors and management evaluate operational efficiency versus costs associated with non-core investments.

Impact on Cash Flow and Taxes

Although depreciation is a non-cash expense, it indirectly affects cash flow by reducing taxable income. Businesses can use depreciation deductions to lower income taxes, which improves cash availability for operations.

Modern accounting tools like Deskera ERP can automate depreciation calculations, track accumulated depreciation, and integrate it with overall financial reporting. This ensures that businesses classify and report depreciation accurately, saving time and reducing errors.

Depreciation is generally considered an operating expense when it relates to assets used in regular business activities. Correctly categorizing depreciation ensures accurate financial statements, better profitability analysis, and smarter business decisions.

When Depreciation Is Considered an Operating Expense

Depreciation is generally classified as an operating expense when it is directly related to assets used in a company’s core operations. This means that if the asset is essential to generating revenue and supporting day-to-day business functions, its depreciation is treated as part of operating costs. Different industries provide clear examples of how and when depreciation qualifies as an operating expense.

1. Manufacturing Businesses

Manufacturing companies rely heavily on machinery and equipment to produce goods. Since these assets gradually wear out over time, their depreciation is recognized as an operating expense.

For example, a car manufacturing company purchases automated assembly line robots for $5 million with an estimated useful life of 10 years. Using the straight-line depreciation method, the company records an annual depreciation expense of $500,000 ($5M ÷ 10 years). This depreciation is considered an operating expense because the equipment is directly involved in production.

Recording depreciation as an operating expense allows the company to allocate production costs accurately over the equipment’s lifespan and reflect these costs on the income statement, impacting gross profit margins.

2. Retail Businesses

Retail businesses invest in physical assets like display shelves, checkout counters, lighting systems, and refrigeration units. These assets lose value over time, so depreciation is necessary to account for their declining worth.

For instance, a supermarket installs refrigeration units worth $1 million with a useful life of 8 years. Using the declining balance method, higher depreciation expenses are recognized in the early years. Since refrigeration is crucial for preserving perishable goods, the depreciation is treated as an operating expense.

Including this depreciation in operating expenses helps retail businesses maintain store functionality, plan for asset replacements, and manage profitability effectively.

3. Transportation and Logistics

Transportation and logistics companies depend on vehicles, aircraft, or ships to deliver goods and services. Depreciation of these assets is recorded as an operating expense because they are essential for business operations.

For example, a delivery company buys 100 trucks for $10 million with a 7-year estimated useful life. Using the units-of-production depreciation method, depreciation is allocated based on mileage driven per truck. Since transportation services are the company’s primary activity, vehicle depreciation is classified as an operating expense.

Properly accounting for vehicle depreciation ensures accurate cost management and operational efficiency.

4. Real Estate Companies

Real estate firms that lease or manage commercial properties record property depreciation as part of operating expenses. Buildings and improvements such as HVAC systems, elevators, and structural components gradually lose value.

For example, a commercial property owner constructs an office building for $50 million with a 30-year useful life. Using the straight-line method, annual depreciation of $1.67 million ($50M ÷ 30 years) is recorded. Since leasing office spaces is the primary revenue activity, depreciation is categorized as an operating expense.

Tracking depreciation in real estate ensures accurate financial reporting, tax compliance, and proper management of operating costs for property maintenance.

When Depreciation Is Not Considered an Operating Expense

While depreciation is often classified as an operating expense, there are situations where it is treated as a non-operating expense. This occurs when the depreciated asset is not directly involved in core business operations or revenue generation. Non-operating depreciation is reported separately in financial statements under “other expenses,” so it does not affect operating profit.

1. Investment Properties

If a company owns office buildings, rental properties, or other investments that generate passive income, the depreciation on these assets is considered non-operating. For example, a tech company that owns a rental property apart from its main software business will record the property’s depreciation under non-operating expenses.

This classification ensures that the operating profit accurately reflects the performance of the company’s core business activities, separate from income generated through investments.

2. Idle or Non-Operational Assets

Depreciation on machinery, equipment, or vehicles that are not currently in use may also be classified as non-operating. For instance, a factory may have machinery that has been temporarily mothballed due to reduced production demand.

Even though these assets continue to lose value, their depreciation does not reflect ongoing operational costs, so it is excluded from operating expenses.

3. Corporate Office Buildings and Administrative Assets

Depreciation on corporate headquarters, administrative buildings, or other assets not directly tied to revenue generation may be treated as non-operating. While these assets support the business, they are not part of the core revenue-generating processes, so their expense is separated from operational costs.

4. Depreciation from Discontinued Operations

When a company shuts down or sells a division, the depreciation on assets belonging to that segment is recorded as a non-operating expense. For example, if a manufacturing company sells a production line, the depreciation on the equipment before the sale is reported separately from operating expenses.

This classification ensures clarity in financial reporting and allows stakeholders to distinguish ongoing operational costs from those related to discontinued or non-core activities.

Impact of Depreciation on Financial Statements

Depreciation may not involve cash payments, but it significantly affects a company’s financial reporting. Understanding how it interacts with the income statement, balance sheet, and cash flow statement is crucial for evaluating business performance and making informed decisions.

1. Income Statement: Reducing Operating Profit

Depreciation is recorded as an expense on the income statement. When included in operating expenses, it reduces operating income, giving a more accurate picture of the company’s profitability.

For example, if a company reports $500,000 in revenue and $100,000 in operating expenses including $20,000 depreciation, the operating profit reflects the true cost of using assets to generate that revenue. Even though no cash is spent, depreciation ensures the income statement reflects the gradual cost of asset usage.

2. Balance Sheet: Adjusting Asset Values

On the balance sheet, depreciation lowers the book value of fixed assets through an account called accumulated depreciation (a contra asset account). This shows how much of an asset’s original cost has been used up over time.

For instance, machinery purchased for $60,000 with $15,000 accumulated depreciation will be reported at a net book value of $45,000. This provides investors and management with a realistic view of asset worth and long-term investment value.

3. Cash Flow Statement: No Direct Cash Impact

Since depreciation is a non-cash expense, it doesn’t reduce cash flow directly. In the cash flow statement, depreciation is added back to net income under operating activities to reconcile accounting profit with actual cash flow.

This is why companies with significant depreciation often have strong cash flow despite lower reported profits. Proper tracking ensures that cash management, budgeting, and investment decisions remain accurate.

4. Tax Implications

Depreciation also reduces taxable income, allowing businesses to save on taxes while reflecting asset usage accurately. For long-term planning, this deduction can improve overall liquidity and free up funds for operational needs.

Modern tools like Deskera ERP simplify these processes by automating depreciation schedules, updating accumulated depreciation in real time, and integrating these figures across financial statements. This ensures accuracy and reduces manual errors in reporting.

Operating vs. Non-Operating Depreciation

Depreciation can be classified as either operating or non-operating, depending on whether the asset being depreciated is part of a company’s core revenue-generating activities. Understanding this distinction is essential for accurate financial reporting, performance evaluation, and decision-making.

1. Operating Depreciation

Operating depreciation occurs when assets are directly involved in the company’s primary business operations. These are expenses associated with machinery, vehicles, equipment, or buildings that support day-to-day activities and revenue generation.

Examples:

- Manufacturing machinery in a production plant.

- Delivery trucks used by a logistics company.

- Refrigeration units in retail stores.

- Office spaces or equipment essential for service delivery.

Recording depreciation as operating ensures it is included in operating expenses, reducing operating income and providing a realistic view of profitability from core business functions.

2. Non-Operating Depreciation

Non-operating depreciation occurs when assets do not directly contribute to core business activities or are part of non-core divisions. These expenses are recorded separately under “other expenses” in the income statement.

Examples:

- Depreciation of investment properties or rental buildings not tied to main operations.

- Machinery that is idle or temporarily not in use.

- Depreciation of administrative headquarters or corporate offices not generating direct revenue.

- Assets belonging to discontinued operations or sold divisions.

Non-operating depreciation does not affect operating profit, but it still impacts net income and taxable income, providing an accurate picture of overall financial performance.

3. Why the Distinction Matters

Understanding whether depreciation is operating or non-operating helps:

- Assess operational efficiency by focusing on expenses directly tied to core activities.

- Evaluate profitability accurately, especially when comparing businesses or divisions.

- Ensure correct tax treatment and financial reporting compliance.

Modern tools like Deskera ERP can help businesses automatically classify and track both operating and non-operating depreciation, simplifying reporting and reducing errors in financial statements.

Why Depreciation Classification Matters for Businesses

Properly classifying depreciation as either operating or non-operating is more than just an accounting formality—it has a significant impact on financial analysis, decision-making, and business strategy. Misclassifying depreciation can distort key metrics, making a company’s profitability and operational efficiency appear misleading.

1. Accurate Measurement of Operating Profit

Operating depreciation is included in operating expenses, which directly reduces operating profit. If depreciation on core assets is incorrectly categorized as non-operating, operating profit will appear higher than it truly is, giving management and investors an inaccurate view of business efficiency.

2. Better Financial Analysis

Investors, analysts, and internal stakeholders rely on accurate financial statements to assess performance. Clear separation between operating and non-operating depreciation allows for meaningful comparisons of core business profitability, asset utilization, and operational efficiency across periods and competitors.

3. Tax Planning and Cash Flow Management

Since depreciation is a non-cash expense, its classification affects reported operating profit but not cash flow directly. Correct categorization ensures proper tax planning, compliance, and better management of cash resources, helping businesses allocate funds for investments, debt repayment, or growth initiatives.

4. Strategic Business Decisions

Understanding which depreciation impacts operations allows management to make informed decisions about asset replacements, capital budgeting, and resource allocation. It also helps identify which parts of the business are more asset-intensive and where cost-saving measures may be effective.

Using tools like Deskera ERP can simplify this process by automatically classifying depreciation based on asset type and usage, ensuring consistent, accurate reporting while reducing manual errors.

Common Misconceptions About Depreciation

Depreciation is a critical accounting concept, but many business owners and even some finance professionals misunderstand its purpose and impact. Clarifying these misconceptions helps ensure accurate financial reporting and better decision-making.

1. Depreciation Reduces Cash Flow

Many people assume that depreciation reduces cash, similar to paying rent or salaries. In reality, depreciation is a non-cash expense. While it lowers taxable income and affects reported profits, it does not involve any actual cash outflow. This is why depreciation is added back to net income in the cash flow statement.

2. Depreciation Can Be Avoided

Some think depreciation is optional or can be skipped to inflate profits. In fact, depreciation is mandatory under accounting standards for tangible fixed assets. It systematically allocates the cost of assets over their useful life, ensuring financial statements reflect the true cost of using business assets.

3. Depreciation Only Applies to Large Companies

Another misconception is that only large corporations need to record depreciation. In reality, any business with long-term assets, from small retail stores to manufacturing startups, must account for depreciation to comply with accounting principles and report accurate profits.

4. Depreciation Always Uses the Straight-Line Method

While straight-line depreciation is common, it’s not the only method. Businesses can use declining balance, units-of-production, or other methods depending on how an asset loses value over time. Choosing the right method ensures expenses match asset usage accurately.

5. Depreciation Does Not Affect Taxes

Some think depreciation has no tax benefit. In fact, depreciation is tax-deductible, reducing taxable income and improving cash flow. Properly recording depreciation is essential for tax planning and long-term financial strategy.

How Deskera ERP Can Simplify Depreciation Management

Managing depreciation accurately is essential for businesses of all sizes, but it can become complex when dealing with multiple assets, methods, and reporting requirements. Deskera ERP offers a comprehensive solution to streamline depreciation management and ensure financial accuracy.

1. Automated Depreciation Calculations

Deskera ERP automatically calculates depreciation for all fixed assets based on the selected method—straight-line, declining balance, or units-of-production. This eliminates manual errors, saves time, and ensures compliance with accounting standards.

2. Real-Time Asset Tracking

The platform provides a centralized view of all assets, including acquisition costs, useful life, accumulated depreciation, and current book value. Businesses can monitor asset performance and plan replacements efficiently.

3. Accurate Financial Reporting

Deskera ERP integrates depreciation data directly into income statements, balance sheets, and cash flow statements, distinguishing between operating and non-operating expenses. This ensures management and investors receive a clear, accurate picture of profitability.

4. Tax Compliance and Planning

With automated depreciation schedules, Deskera ERP ensures tax-deductible depreciation is accurately recorded, helping businesses optimize tax benefits while maintaining compliance with regulatory standards.

5. Enhanced Decision-Making

By providing insights into asset utilization, depreciation trends, and operating costs, Deskera ERP empowers businesses to make strategic decisions about asset investments, capital budgeting, and cost management.

Deskera ERP simplifies the entire depreciation process, reduces manual work, and ensures businesses maintain accurate, compliant financial records—allowing management to focus on growth and operational efficiency.

Key Takeaways

- Depreciation is a non-cash expense that plays a crucial role in financial reporting, and understanding its classification is essential for accurately assessing business profitability and operational efficiency.

- Depreciation systematically allocates the cost of tangible fixed assets over their useful life, reflecting wear and tear, obsolescence, or aging, without affecting cash flow.

- Operating expenses are the costs necessary to run core business operations, including rent, utilities, wages, insurance, and other recurring expenses required to generate revenue.

- Depreciation is generally considered an operating expense when it relates to assets used in core business activities, directly impacting operating profit and financial analysis.

- Depreciation reduces operating profit on the income statement, lowers the book value of assets on the balance sheet, and is added back in the cash flow statement since it is a non-cash expense.

- Depreciation qualifies as an operating expense when assets—like machinery, vehicles, refrigeration units, or buildings—are essential to generating revenue in industries such as manufacturing, retail, logistics, or real estate.

- Depreciation is non-operating when it relates to assets not directly involved in core operations, such as investment properties, idle equipment, corporate offices, or discontinued operations.

- Understanding the distinction between operating and non-operating depreciation helps businesses evaluate operational efficiency, profitability, and financial performance accurately.

- Correctly classifying depreciation ensures accurate operating profit measurement, better financial analysis, optimized tax planning, and informed strategic business decisions.

- Correctly classifying depreciation ensures accurate operating profit measurement, better financial analysis, optimized tax planning, and informed strategic business decisions.

- Deskera ERP automates depreciation calculations, tracks asset values in real time, ensures accurate financial reporting, supports tax compliance, and provides insights for smarter operational and strategic decisions.

Related Articles