Yes, cash indeed is an asset. That is the straightforward answer.

Understanding it in depth requires you to dive into the basic principles of accounting, which brings you to understand the balance sheet and the various components in it. If the concept of accounting is new to you, do not fret. Let us consider this simple assumption.

Assume you borrowed a small amount of money from your friend yesterday and intend to return it two days later. So, you write it down on a sticky note and place it on your desk so that you remember to repay it.

Today, tools like ERP.AI are transforming how businesses manage their cash flow and accounting by automating entries, tracking assets in real-time, and ensuring greater financial accuracy with AI-powered insights.

Well, what you did is a part of accounting. This post hopes to clarify a lot of things related to accounting, its principles, and of course, cash.

Is Cash an Asset?

Cash is the most liquid asset and may be used to buy other assets quickly.

The readiness with which an asset can be turned into cash is known as liquidity. Cash is the standard metric for determining liquidity. It is the most straightforward way to exchange money for other goods, services, or assets.

Other assets are more difficult to convert into cash. A piece of machinery, property, or supplies are examples of illiquid assets. Regardless of the value, these assets hold, they must be first sold and transformed into cash before being transferred to other assets.

Breakdown of the Structure of the Balance Sheet

Balance sheets portray the status of the financial ecology of a company and have a vertical flow. From listing down the things owned by the company to adding the stuff it owes to other financial entities are all a part of the balance sheet. They are a chart of the following elements:

- Three categories – Assets, Liabilities, and Equity

- Five account entries – Current Assets, Fixed Assets, Long-term liabilities, Short-term liabilities, Shareholder’s equity

Businesses, in general, follow a vertical format of the balance sheet. The balance sheet is separated into five categories, with the most liquid assets at the top of the list.

The contents of the balance sheet can be depicted through the equation as follows:

What are Assets in Accounting?

Assets are resources or entities owned by the company, which can be further utilized to generate more value for the organization. Cash as an asset implies the handy cash, the cash lying in the bank accounts, cash equivalent liquid assets, or readily marketable securities.

The assets are on one side of the balance sheet. Considering the example of a bank, everything it owns or owes is included in the assets. This consists of the cash in its vaults to bank branch buildings, government bonds, and various financial instruments. The majority of a bank's assets are usually comprised of loan programs sold by the bank.

This is how the balance sheet with assets of a bank may look like:

Sometimes, there may be confusion regarding a loan being considered an asset as the money is no more with the bank. However, the legal bond between the bank and the borrower states that the borrower will return or repay the amount with interest to the bank later; this makes the loan amount an asset.

Classification of Assets

We have already learned what assets are. Now, let’s see the various categories of assets. The assets can be broadly classified on the basis of three factors:

- Convertibility

Sub-types: Current Assets and Fixed Assets

- Physical Assets

Sub-types: Tangible Assets and Intangible Assets

- Usage

Sub-types: Operating Assets and Non-operating Assets

Convertibility

When the assets are evaluated on the basis of their convertibility to cash, they are categorized as Fixed or Current assets.

Physical Assets

When the assets are categorized on the basis of their physical existence, we have tangible ad non-tangible assets.

Classification based on Usage

Operating assets and non-operating assets are the two sub-types when the assets are classified based on their usage.

Now, we have understood the concept of assets, let’s grasp the other two, which are liabilities and equity.

Liabilities

As the name goes, the balance sheet becomes balanced because of accurate entries for liabilities and equity.

In a nutshell, liabilities are what a firm owes, whereas shareholder equity is what it would owe to owners if all assets were totally liquidated and debts were completely paid off. We may also refer to them as the cost or price of operating/running the business.

Liabilities can be long-term or short-term. The short-term liabilities are also referred to as the current liabilities. These are paid in a short span, say, within a year. On the other hand, the long-term liabilities or the non-current liabilities are the ones that need not be cleared anytime soon; the companies have more than a year’s time to pay them off.

Examples of liabilities:

- Accounts payable

- Long-term debt

- Loans payable

- Income taxes payable

- Accrued wages

Shareholder’s Equity

When a company has investors who have stakes in the company, the money invested is called shareholder’s equity.

It means that if this company was to be dissolved and liquidated completely, then the amount that would go to the investors is called shareholder’s equity. The following line-items can be commonly noticed in a balance sheet under the equity section:

- Common stock

- Treasury stock

- Retained earnings

- Preferred stock

We will discuss assets in more detail to get a grip on the concept of cash as a current asset.

Current Assets and Fixed Assets

Speaking of cash as an asset, we must also understand which class of assets it fits into.

Fixed assets are more grounded and cannot be immediately sold for cash, whereas current assets can be convertible to cash more readily. Current assets are thus more liquid than fixed assets.

A basic guideline is that a current asset may be utilized within one year, while a fixed asset cannot or will not be converted to cash within one year. The balance sheet starts with current assets and then moves on to fixed assets.

First, let's look at current assets.

Current Assets

The assets that will be used, spent, or expended within a year are known as current assets. They are the tools that a firm utilizes to run its operations and carry out daily tasks.

- Cash: Money in its simplest sense, which may be used to buy anything to help the company grow.

- Equivalents of cash (Cash equivalents): Treasury bills, commercial paper, marketable securities, money market funds, and short-term government bonds are examples of short-term investments that are similar to cash.

- Inventory: Raw materials and completed products meant for immediate sale

- Accounts Receivable: These are the goods and services that are owed to the business but have not been paid for yet.

In the case where you do not have any fixed assets, then you may put all your assets in this section. However, if your business owns fixed assets, they will be placed under the fixed assets section.

Fixed Assets

These are physical assets that can also be referred to as tangible assets, long-term assets, or capital assets. Fixed assets are more tangible objects that a corporation keeps for a long time. Fixed assets aren't meant to be converted into cash in a year's time.

Here are some instances of what constitutes fixed assets.

- Real estate or business property: A company's property is land or real estate that it owns.

- Manufacturing plants, offices, restaurants, and other structures

- Equipment includes office furniture, machinery, trucks, computers, and other items used to provide goods and services.

Equipment and machinery, for example, will depreciate in value over time. Companies will depreciate the value of certain fixed assets over time to compensate for this loss of value.

How AI Optimizes Cost Management

With real-time data integration, AI-powered systems analyze cash flow trends—fundamental to understanding and managing costs—by forecasting liquidity and highlighting spending outliers. By simulating "what-if" scenarios—like cost fluctuations, payment delays, or supplier changes—businesses can proactively mitigate risk and optimize budgets .

When embedded within an ERP system, AI transforms cost management into a strategic tool, delivering clarity, financial control, and smarter decision-making while ensuring operational efficiency and improved profitability.

FAQs

Q: Why should I know Accounting Concepts?

A: Accounting concepts are crucial because they serve as the foundation for all financial reports and statements. It would be tough to evaluate past records or make future estimates using present methodologies if a business unit did not have a balanced economic unit. Similarly, the unit cannot calculate interest, depreciation, and inventory using the same balance sheet.

Q: Why are Accounting Principles significant?

A: Accounting Principles are a crucial component of a company's overall financial reporting process. They've been established gradually over time by accountants and other financial statement experts to aid in the preparation of financial statements.

Q: Why should I classify assets?

A: Understanding which assets are current assets and which are fixed assets, for example, is critical in determining a company's net operational capital. Understanding which assets are tangible and intangible helps to analyze a company's solvency and risk in a high-risk industry.

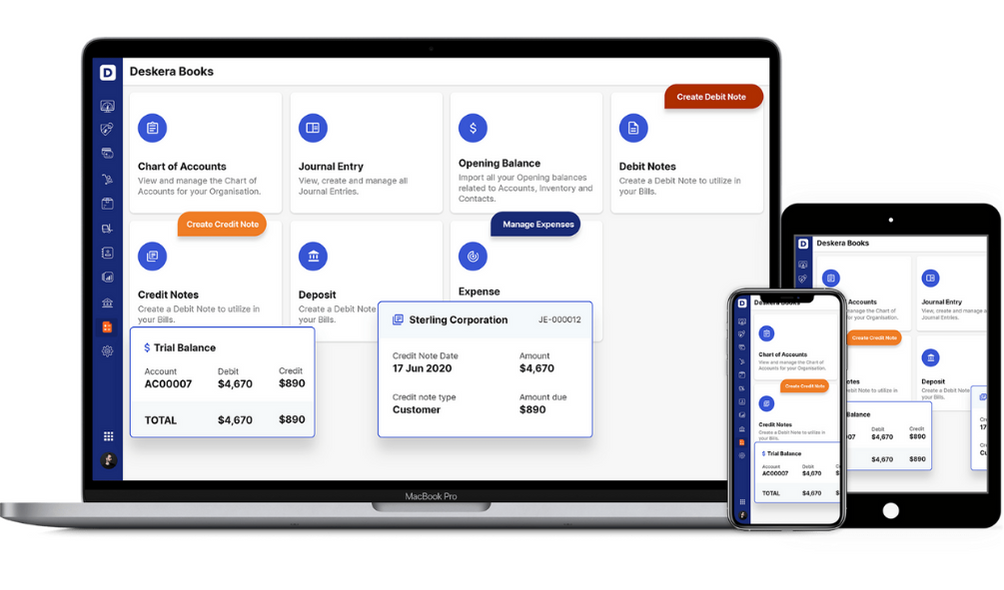

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Cash is the most liquid asset and may be used to buy other assets quickly

- The readiness with which an asset can be turned into cash is known as liquidity

- Cash is the common metric for determining liquidity. It's the most straightforward way to exchange money for other goods, services, or assets

- Maintaining the health of your business operations is no easy task. Even if yours is a small business, you will need to acquire a lot of awareness and knowledge of accounting standards and financial statements. You should be familiar with the fundamentals of accounting, which include handling and recording income statements, break-even analysis, and of course, your balance sheet.

- We have understood that the balance sheet is an important financial document that comprises information on all the aspects pertaining to a business’s financial ecosystem.

- It gives you a high-level overview of your assets, liabilities, and equity. You'll need a solid understanding of assets, liabilities, and shareholder's equity to complete your balance sheet.

- The article has helped us understand which category cash belongs to. Cash belongs to the asset section of the balance sheet because of its liquidity. Cash is, therefore, the parameter to measure liquidity, and it offers the most convenience in purchasing other assets or products.

- Balance sheets portray the financial ecology of a company and have a vertical flow

- A balance sheet includes three categories namely the Assets, Liabilities, and Equity and five accounting entries which are Current Assets, Fixed Assets, Long-term liabilities, Short-term liabilities, Shareholder’s equity

- Assets are resources owned by the company, which can be further utilized to generate more value for the organization

- Cash as an asset implies the handy cash, the cash lying in the bank accounts, cash equivalent liquid assets, or readily marketable securities

- he assets can be broadly classified on the basis of three factors: Convertibility, Physical Assets, and Usage

- When the assets are evaluated on the basis of their convertibility to cash, they are categorized as Fixed or Current assets

- When the assets are categorized on the basis of their physical existence, we have tangible ad non-tangible assets

- Operating assets and non-operating assets are the two sub-types when the assets are classified on the basis of their usage

- Balance sheet, as the name goes, becomes balanced because of accurate entries for liabilities and equity

- Liabilities are what a firm owes, whereas shareholder equity is what it would owe to owners if all assets were totally liquidated and debts were completely paid off

- When a company has investors who have stakes in the company, the money invested is called shareholder’s equity

- Fixed assets are more grounded and cannot be immediately sold for cash, whereas current assets can be convertible to cash more readily

- Current assets are thus more liquid than fixed assets

- Cash is money in its simplest sense, which may be used to buy anything to help the company grow

- Cash belongs to the asset section of the balance sheet because of its liquidity. Cash is, therefore, the parameter to measure liquidity and it offers the most convenience in purchasing other assets or products

Related Articles