A businessman has to handle a lot more than just employees and contractors. While he has different payment methods for employees and contractual workers, it is necessary to follow certain government set methods for income tax. When an entrepreneur pays independent contractors or non-employees, he does need to worry about withholding federal income tax.

Every employee is given a salary slip along with his monthly payments. These pay stubs are proof of the said income deposited in the worker’s account and also denote the total amount withheld by the employer as a part of taxes. However, there are certain times when small business owners need to withhold payments given to non-employees. The reason may be backup withholding or any other purposes.

What is non-employee labor? In the world of a contingent workforce, it is very common for businesses to make use of non-employee labor with a fixed compensation.

IRS Form 945 - What is this form in the US?

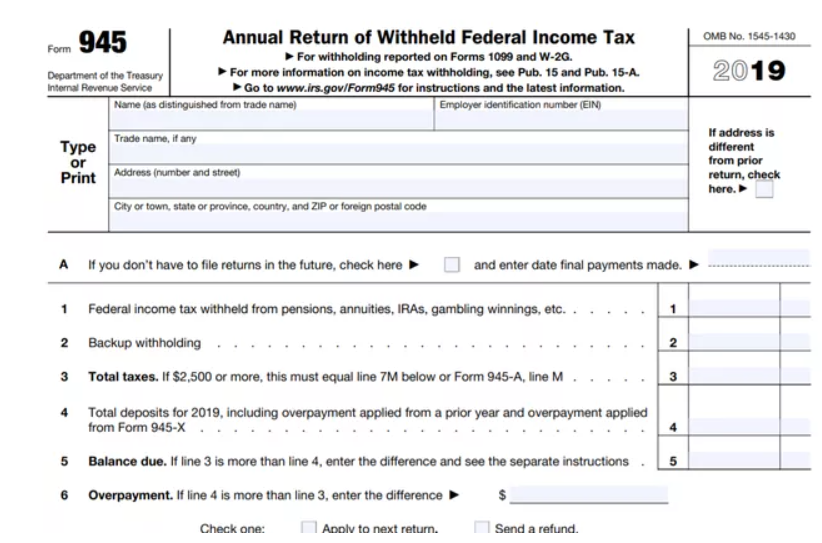

When a businessman hires non-employees on a contractual basis, he does not have to withhold taxable amounts from their compensation. However, in special circumstances, the employer can withhold a specific amount from these non-employees. The IRS form 945 is the form in the United States of America to report federal income taxes that are withheld from the contractual employees.

The IRS form 945 is known as the Annual Return of Withheld Federal Income Tax. The business head must use this form to report withheld tax from non-payroll payments which include distributions from qualified retirement plans.

By filling this IRS form 945, the employer informs the IRS about the withheld backup if they deduct this tax from the individuals’ payment.

Who files form 945?

An employer or a small business owner files this IRS form 945 to report the federal income tax held from several different kinds of payment. This withholding can be done from -

- Annuities

- Voluntary withholding is done on the certain US government payments

- Pensions

- Individual retirement plans - IRAs

This form can be also used to report non-payroll payments such as military retirements, gambling winnings, Indian gaming profits and even backup withholdings. Furthermore, you need to keep in mind a major exception for this form. If the employer has withheld taxes from the income of a person who does not have an American nationality, then he needs to file that amount on form 1042.

Classification of your workers

When you are filing the annual tax for the concerned year, the employer must pay attention to the classification of his employees. Proper classification of employees and non-employees assists in filling the form 945. The Department of Labor in America has listed the following conditions to classify the worker as an employee and non-employee :

- Does he play a crucial and integral part in the business?

- Is the worker employed permanently or as a part of a contract

- How long has the worker been associated with your company?

- Does the laborer carry his equipment and tools?

- Whether the worker has an independent company and advertising?

- Who has decided the worker’s per hour rate and working hours?

- Does he get more profit for an efficient job done?

Once you have segregated the workers on a permanent and contractual basis, you would find it much easier to fill out the federal form.

Instructions to fill IRS Form 945 - When to file it?

It is due till 31st January each year to report the withholding done for the previous year. The maximum duration to file and submit IRS form 945 for the previous financial year is February 1st or until 10th February if the employer has made timely deposits for full payment of the concerned year’s taxes. For instance, if the employer is willing to submit this form for 2021, then he must have filed it by 1 February 2022 or max 10th February 2022.

As per the rules, a businessman/ employer should not file more than one form per year.

Where and how to file it?

The employer can fill out this form on the IRS website - Form 945.

When the employer begins to fill out this form he must include these details -

1.Enter the business name, Employer Identification Number (EIN), if applicable write the trade name and company address.

2.If this is the employer’s last year of business and he plans to close it, he must check the box in IRS form 945. In this case, he is expected to give the deposit date of the final non-payroll payment. Furthermore, the employer must attach a statement that names a person who is given the duty for maintaining payment records and his/ her address.

An important point to note here is if the business owner has decided to sell or transfer his company to a new owner then, both of them should file IRS form 945 in the year in which the transfer was done. In this case, only the taxes withheld and deposited are to be reported.

Furthermore, if you have made changes in your business, it is still considered a transfer.

Let us understand this form with more details -

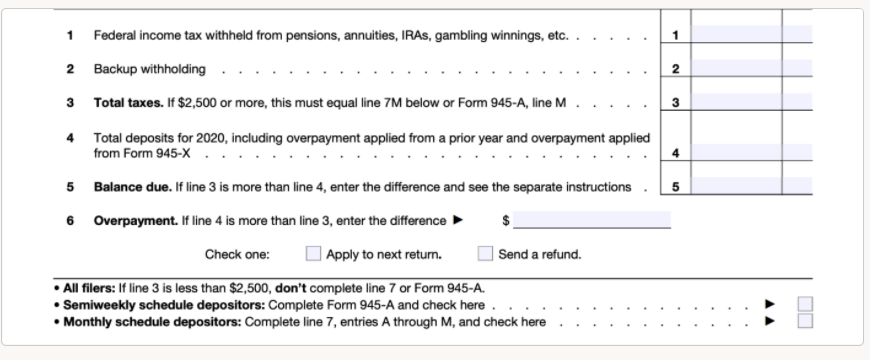

- Federal Income tax: Enter the amount of federal income tax amount you have withheld or have been compelled to withhold due to pensions, IRAs, government payments, annuities or other distributions.

- Withheld: Write the number of backup withholdings you have done or are required to do

- Total Tax: Make a summation of the above two entries. If it exceeds 2,500 dollars it should equal the employer’s total liability reported of form 945-A line M

- Deposits: Enter appropriate details of the total deposit made for the concerned year. This will also have overpayments done

- Balance due: Subtract Line 4 - Line 3. It represents the balance due. According to the rule, if this due amount turns out to be just a single dollar or even less than that, it can be exempted. However, the due amount must be cleared when the total taxes for the year (Line 3) are less than 2,500 dollars.

- Overpayment: If the amount in deposits is greater than tax, it is termed as an overpayment. An owner can request a refund for the excess amount paid or can adjust it with the next return by proper selection of the checkbox in the form. A point here to know is if the owner has just deposited a single dollar or even less, then the department would adjust it with his next return or refund only when the application for the same is given in writing.

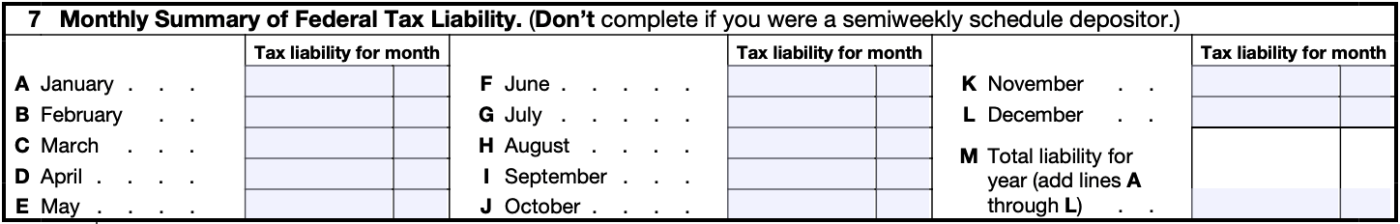

- A businessman should fill the next line related to the monthly summary of federal tax liability only if he has been a monthly depositor for more than 12 months and his amount for tax is 2,500 dollars or more.

If the business owner is a semiweekly or a monthly depositor but changed your payment schedule to semiweekly, then it is expected that he reports his liabilities on line 7 of Form 945-A which can be seen in the above image.

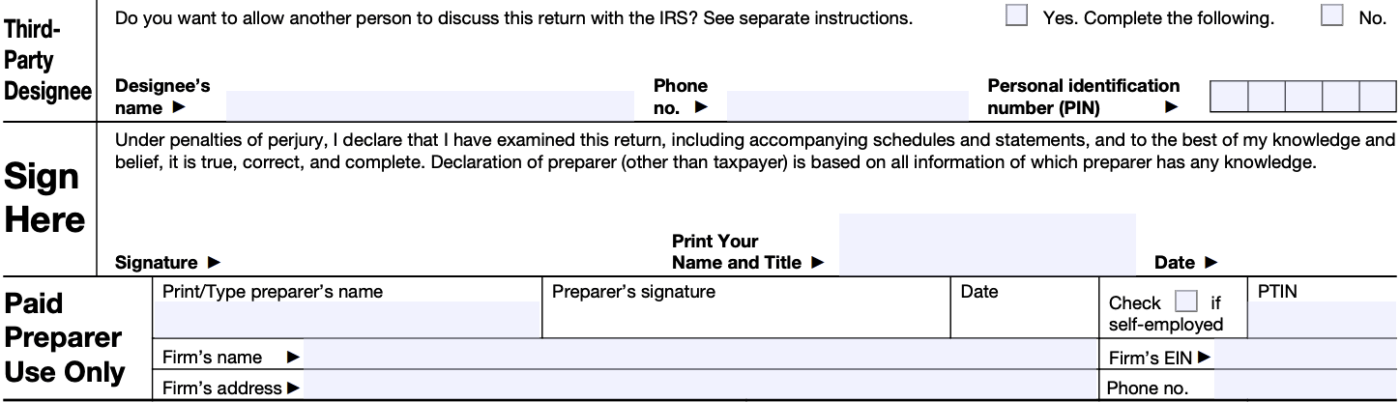

Third Party Designee

The federal government of America permits the third party to fill this form for the employer. IF he wants his employee or another party to file and discuss IRS form 945 on his behalf, you can check the Yes box in the form. The employer must provide third party details such as his name, contact number and 5-digit personal identification number(PIN).

As per the law, this designee shall provide all the missing information to the IRS as per the requests. He also can make queries and calls to know about the processing and status of the owner's return. He is also eligible to respond to IRS notices shared by the owner.

This third party designee assigned by the employer has no right to bind you over monetary means apart from the agreed ones or just represent you in front of the IRS in case of some issue that can be voluntarily solved by both the parties. This authorization is valid only for a year and expires one year since the due date of return.

Conclusion

The United States of America is very particular when it comes to reporting federal income tax withholdings and hence, has designed the IRS form 945 for the employer's/ business owners. This helps the government know about how employers withheld a specific amount from contractual workers in the country due to a variety of reasons. This withheld amount can be for a backup plan by the employer during a financial crisis of the company or in case it suddenly shuts down.

How Deskera Can Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Keynotes

- An employer or business owner must file IRS form 945 to report the withholdings done from annuities, pensions, retirement plans or voluntarily for US government payments. This withheld amount can also be a part of the owner’s backup plans

- Form 945 is usually used to report the salaries given on a contractual basis for part-time workers who have signed a specific duration bond with the employer

- Only laborers who reside in America can be employed on a contractual basis by the owner for reporting in this federal form. In this, the contractual worker must have his tools, equipment, independent company and advertising platform. The per-hour rate is agreed as per the government rules or mutually between the both.

- Form 945 can be filled only once a year by the employer. He must fill in the necessary details properly along with correct mathematical calculations. In case of an overpayment, the owner can request a return from the IRS or adjust it with the next return. The return request has to be done in writing to the IRS.

- An owner can assign a third party designee to file form 945 on his behalf. This designee has all the authority to file the form, examine status, check about returns and respond to IRS notices in place of the owner for a year from the date of return.

Related Articles