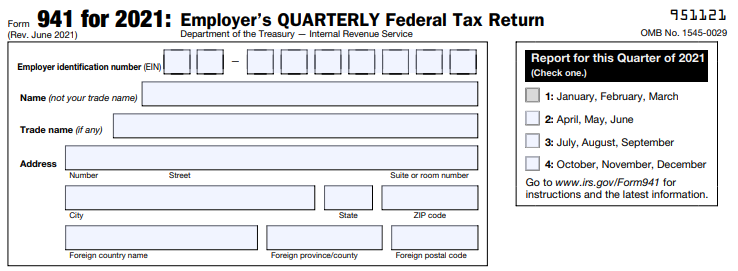

IRS Form 941, or Employer’s Quarterly Federal Tax Return is a form used by employers to report payroll taxes and employee wages. Every quarter, employees’ federal income and FICA taxes have to be reported.

IRS form 941 helps in reporting the wages paid to employees, federal income taxes that are withheld, and FICA taxes. It also helps to report tips and additional taxes that are withheld.

Who Needs to File Quarterly Form 941?

Business owners or employers who provide wages to an employee are required to file IRS Tax Form 941 every quarter. However, there are some exceptions in such cases. If you are seasonal business employers, employers of household employees, or employers of farm employees, then you do not have to file form 941.

Instructions for Filing the Form

Let’s take a look at instructions that you need to follow while filing IRS form 941.

Complete Information

First, you need to complete your basic details by entering employee details and choosing the quarter for which IRS has to be filed.

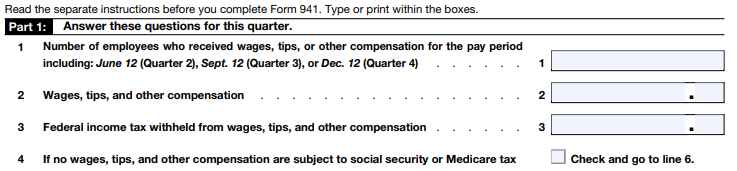

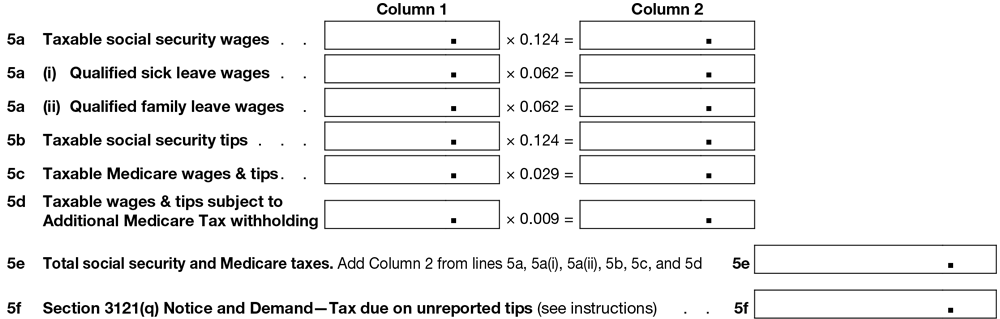

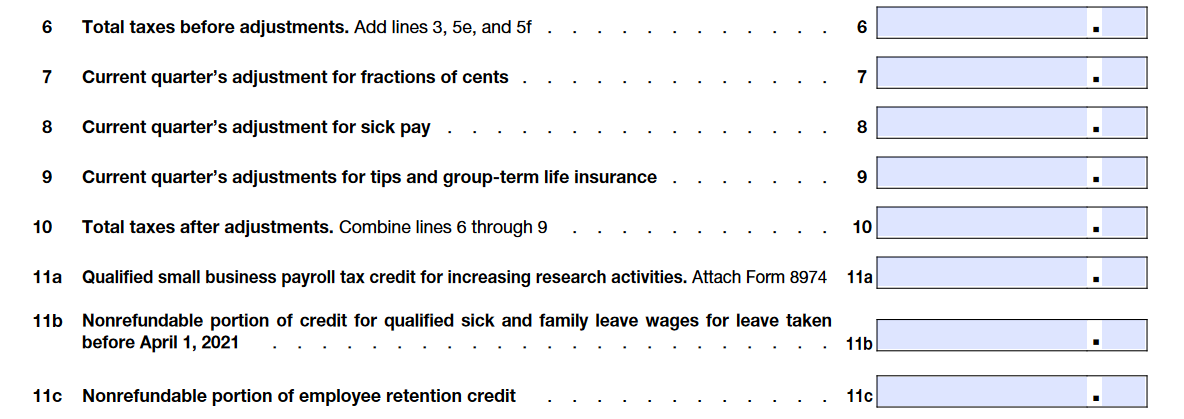

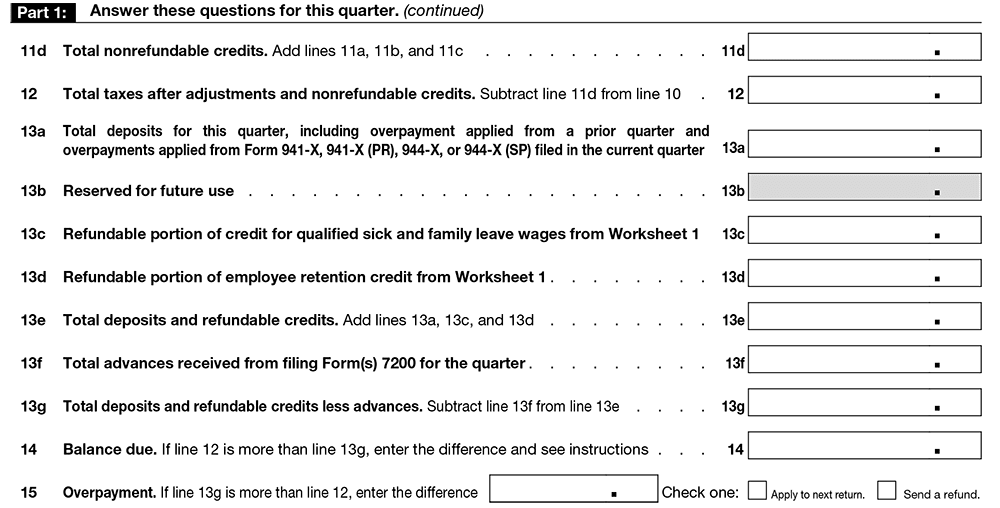

Part 1 contains the questions for the quarter:

There are 15 lines that have to be completed by entering the requested information:

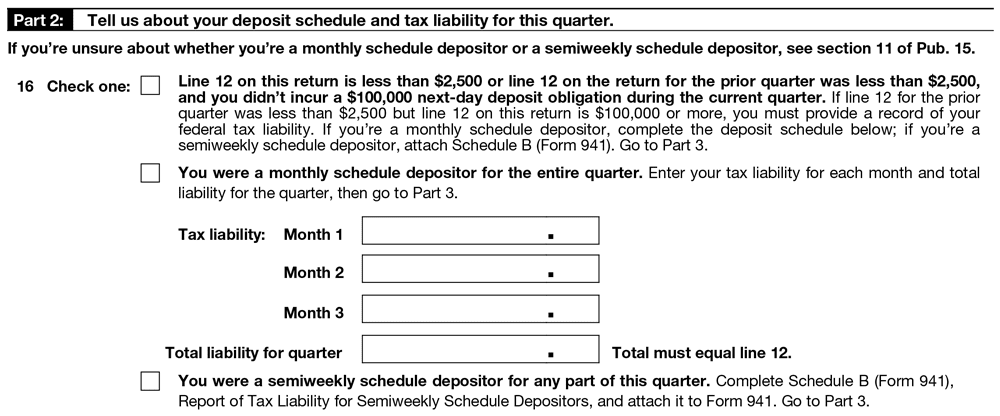

Part 2: Deposit Schedule and Tax Liability for the Quarter

Whether you are a semi-weekly or monthly depositor, Part 2 requires you to enter information about tax liability for the quarter.

In line 16, you will have to choose from the options based on your tax liability:

You will have to check box 1, if your line 12 on form 941 was less than $2,500, your previous quarterly return was less than $2,500, you didn’t adhere to the $100,000 next-day deposit rule in the current quarter.

You will have to check box 2 if you were a monthly schedule depositor for the entire quarter. You need to enter your tax liability for each month of the quarter (month 1, month 2, and month 3)

Your total liability for the quarter must be equal to line 12 on your form 941.

You need to check box 3 if you were a semi-weekly depositor during any part of the quarter. Then you need to enter the tax liability on Schedule B (Form 941), Report of tax liability for semi-weekly, schedule depositors. Then you will need to attach it with form 941 in case you were a semi-weekly depositor.

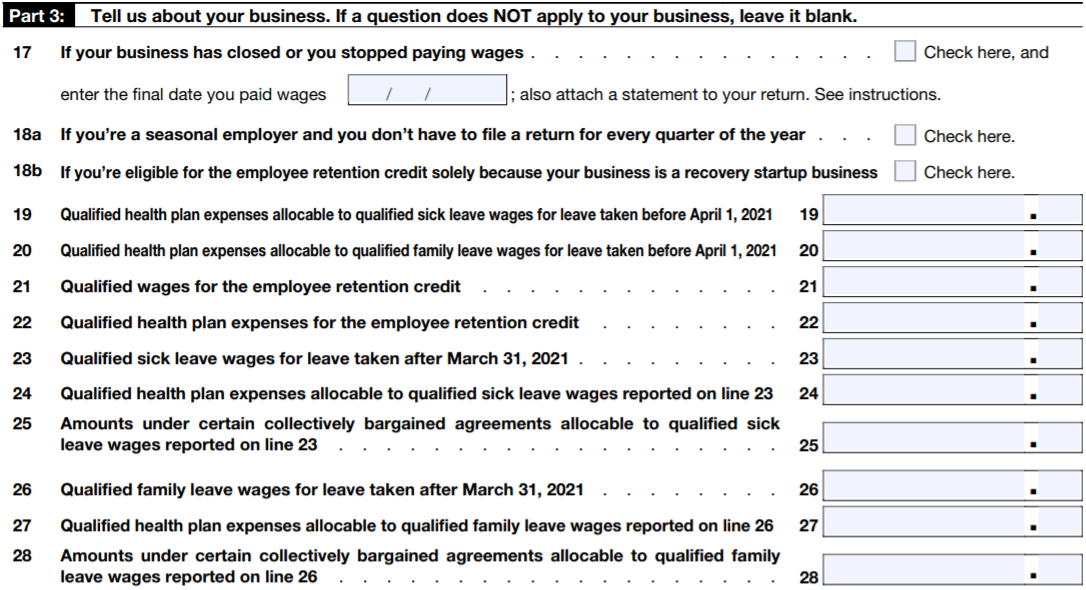

Part 3: About your Business

The third part of the form collects information about your business. You need to mention whether your business is closing or whether you are a seasonal employer. In case, the question does not pertain to your business, then you can leave the field empty:

You need to answer the questions according to the relevance of your business.

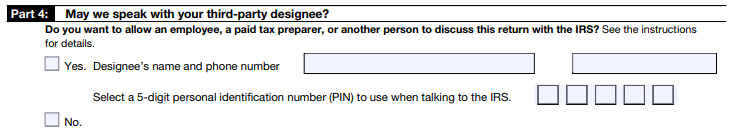

Part-4 Third Party Designee

Part 4 is related to the third-party designee that the employer authorizes to discuss with the IRS.

Tick “Yes”, If you want to discuss this return with the IRS and then you need to provide the designee’s name and phone number. Also, you are required to enter the 5-digit pin while talking with the IRS.

Tick “No” in case you don’t want to discuss.

Part-5 Signature

Once all the details are filled in, you will have to sign Form 941. Only the following people are authorized to do their signature on the return for every business entity:

Sole proprietorship: Individual who is the owner of the company

Corporation or an LLC treated as a corporation: President, vice president, or any other principal officer

Partnership or an LLC treated as a partnership: Partner, member, or an officer

Single-member LLC: Owner of the LLC or a principal officer

Trust or estate: The fiduciary

A paid preparer is an individual who completes your Form 941 filing. He is also responsible for preparing payroll tax forms on your behalf.

In case your Form 941 has been filed by a paid preparer, then you are required to enter their information on part 5.

Paid Preparers using only Form 941 should be:

Form 941 has to be signed by a duly authorized agent of the taxpayer if a valid power of attorney has been filed.

In case the form is prepared by the paid preparer, then you need to enter the information such as name, address, signature, PTIN, and contact number.

What is the deadline to file Form 941 return?

941 quarterly form is due on the last day of the end of the quarter:

- April 30 for the first-quarter

- July 31 for the second quarter

- October 31 for the third quarter

- January 31 for the fourth quarter

In case the due date is on a federal holiday, then the deadline will be the next business day.

How to fill the form 941?

You can either fill the form offline or online depending on your personal preferences. While traditional paper filing involves a lot of time and effort, e-filing is the easiest way to fill out the form. In the traditional filing, you will have to bear the additional cost of printing, envelopes, postal mailing charges, etc. Even tracking the status of such forms becomes quite difficult. While it is easier to track the form online, thus saving a lot of time.

Are there any penalties?

When you don’t file your Form 941 on time, then it can result in a penalty of 5% of the tax due with that return for each month or partial month. The maximum penalty can reach out to be 25%. There are separate penalties for those who make late tax payments or pay less than they owe. You will be charged 2% to 15% of underpayment, depending upon the number of days you are late in paying the right amount.

Always remember that the total amount that you report at the end of the year, should be equal to the total amount you report on the W-2 forms that are distributed to the employees and the Form W-3 you send to the government.

So, in order to avoid penalties, you should fill your IRS 941 form on time.

What needs to be done if you have a Form 941 error?

There can be chances of error while filing Form 941. In case, you face this situation then instead of panicking, you can use Form 941-X. This form is used to make corrections. It can help to correct wages, tips, and other compensation. Income tax withheld, taxable security and Medicare wages and tips, taxable wages and tips subject to additional Medicare tax can also be corrected using the form 941 X.

Form 941 X can be used to correct both underreported or overreported taxes. Overreported taxes can be corrected within the three years from the date you file the incorrect form 941 X or two years from the date you submitted the tax reported on Form 941. You can correct underreported tax on the previous form within three years of the date you filed inaccurate Form 941. When you discovered the mistake, you will have to clear the tax by the due date of that particular quarter.

Key Takeaways

- IRS Form 941 is a form that is used by employers in order to report payroll taxes and employee wages

- This form has to be filed quarterly by the employers

- Business owners or employers who provide wages to an employee are required to file IRS Tax Form 941 every quarter

- There are some instructions that you need to follow while filing the IRS Form 941

- IRS 941 form contains 5 parts that need to be filled carefully

- Part 1 contains the questions for the quarter, Part 2 requires you to enter the information related to the tax liability for the quarter, Part 3 requires you to enter the information related to your business, Part 4 is related to the third-party designee that the employer authorizes to discuss with the IRS, and Part 5 requires you to sign the form

- 941 quarterly form is due on the last day of the end of the quarter

- You can either fill the form offline or online depending on your personal preferences. While traditional paper filing is difficult, e-filing is quite an easy process

- When you don’t file IRS 941 form on time, then it can result in penalties varying from 5% to 25%, depending on the delay. That is why it is important to file IRS 941 form on time, in order to avoid any penalties

- In case, you file incorrect Form 941, then you can rectify your mistake by filing Form 941 X

Related Articles