Do audits often make you panic? Especially if it’s an Internal Revenue Service audit! What if you had a guide to help you prepare for the audit? This article is exactly that. It will not only help understand all about IRS audit but it enlists all the requirements. So, let’s get started.

This article covers the following:

- What is an Internal Revenue Service audit?

- What is the scope of an IRS audit?

- What are the common reasons for IRS audits?

- Who is Subject to an IRS audit?

- How to prepare for an IRS audit?

- What to do after an IRS audit?

- How to Avoid an IRS audit?

- How long do IRS audits take?

- What are the penalties for not complying with an IRS audit?

- What records should you keep for an IRS audit?

- What are some of the tips for dealing with an IRS audit?

- How can Deskera assist you?

What is an Internal Revenue Service Audit?

An Internal Revenue Service (IRS) audit is an examination of an individual or organization's tax return to verify that the information provided is accurate and complete. The IRS may audit a taxpayer for a variety of reasons, including suspected underreporting of income, incorrect deductions, or failure to file a return.

An audit can be done in person, through the mail, or through a combination of both. The first step of an IRS audit is for the taxpayer to receive an official notification from the IRS. This notification will include details about the audit, including the type of audit being conducted and what documents or information will be needed to complete the audit.

After the notification is received, the taxpayer will typically have 30 days to respond and provide the necessary documents and information. The next step of an IRS audit is for the taxpayer to provide the auditor with the requested documents and information. This may include tax returns, bank statements, investment account statements, and any other related documentation.

The auditor will then review the documentation and compare it to the information reported on the tax return. If discrepancies are found, the taxpayer may be asked to provide additional documentation or explanations. Once the auditor has completed their review, they will either issue a final report or present the taxpayer with a proposed assessment.

If a final report is issued, the taxpayer has the right to appeal the assessment within 30 days. If a proposed assessment is issued, the taxpayer has the right to dispute the assessment and request a hearing with the IRS. IRS audits can be intimidating, but taxpayers should remember that they have rights throughout the process.

Taxpayers should make sure to provide the auditor with complete and accurate information and keep all documents and records related to the audit. It is also important to remember that taxpayers may be able to negotiate with the auditor to reduce or eliminate any proposed assessment. Lastly, taxpayers should consider consulting with a tax professional if they have any questions or concerns throughout the audit process.

What is the Scope of IRS Audit?

The Internal Revenue Service (IRS) is the federal agency responsible for collecting taxes. It is also charged with enforcing tax laws and ensuring that all taxpayers comply with their obligations. As such, the IRS has the power to conduct audits of taxpayers to make sure they have reported all their income and paid all the taxes they owe.

The scope of an IRS audit depends on the type of audit being conducted. The most common type of audit is the “correspondence audit,” which is typically used for minor discrepancies and errors in a taxpayer’s return. In this type of audit, the IRS will send a letter to the taxpayer asking for more information or documentation regarding certain items.

The next type of audit is the “office audit,” which is conducted by an IRS auditor at the taxpayer’s home or business. During this type of audit, the auditor will review the taxpayer’s financial information, such as bank statements, income and expense records, and other documents.

The auditor may ask additional questions, as well as request additional information and documents. The most extensive type of audit is the “field audit.” This type of audit is conducted by an IRS auditor at the taxpayer’s home or business, but the scope of the audit is much broader.

The auditor will review all of the taxpayer’s financial information, including business records, bank statements, income and expense records, and other documents. The auditor may also ask for additional information and documents, as well as make inquiries about the taxpayer’s activities.

The IRS also has the authority to conduct criminal investigations, which are typically conducted when there is evidence of fraud or other criminal activity. This type of audit is much more extensive than the other types, as the auditor will look at all of the taxpayer’s financial information and activities, as well as any records or documents related to the alleged illegal activity.

No matter what type of audit the IRS conducts, the scope of the audit is always determined by the auditor. The IRS has the authority to look into any aspect of a taxpayer’s finances and activities, and the scope of the audit will depend on the specific situation.

Ultimately, the scope of an Internal Revenue Service audit will depend on the type of audit being conducted and the situation. However, it is important to note that the IRS has the authority to look into any aspect of a taxpayer’s finances and activities, and the scope of the audit will be determined by the auditor.

Taxpayers should be aware of the potential risks associated with an IRS audit and should be prepared to provide the necessary information and documentation requested by the auditor.

What are the Common Reasons for IRS Audits?

The IRS typically audits taxpayers based on a variety of factors, including income level, the number of deductions taken, and any discrepancies between information reported on tax returns and information reported to the IRS.

Generally, the more complex the tax return and the greater the discrepancy between the tax return and other information reported to the IRS, the greater the likelihood of an audit. Common reasons for IRS audits include:

Unreported Income

If you fail to report income on your tax return, the IRS will generally initiate an audit. This is especially true if the amount of income not reported is significant.

Suspicious Deductions

Taking excessive deductions can also trigger an audit. The IRS is particularly concerned about deductions for business expenses, such as office supplies and travel expenses, that are not backed up by proper documentation.

Math Errors

Making simple math errors on a tax return can also trigger an audit. The IRS will generally catch these errors and will want to make sure that the entire return is accurate.

Home Office Deduction

Taking a home office deduction can be a red flag for the IRS. If you do take this deduction, make sure that you are correctly calculating the deduction.

Charitable Contributions

If you take a large deduction for charitable contributions, the IRS may want to ensure that the contributions were actually made and were valid.

High Net Worth Individuals

Individuals who have high net worth are more likely to be audited, as the IRS may want to ensure that they are paying the correct amount of taxes.

Foreign Bank Accounts

Failing to report foreign bank accounts can trigger an audit, as the IRS wants to make sure that taxpayers are not hiding income overseas.

Unusual Transactions

If you have any unusual transactions, such as large deposits or withdrawals, the IRS may want to take a closer look at your tax return.

Schedule C Losses

Taking excessive losses on Schedule C, which is for self-employment income, can also trigger an audit. The IRS wants to make sure that these losses are legitimate.

Business Expense Deductions

The IRS may also audit taxpayers who take excessive deductions for business expenses, such as entertainment and travel.

These are just a few of the common reasons for IRS audits. It is important to remember that the IRS may audit any taxpayer at any time, even if there are no obvious discrepancies or errors on the tax return.

Who is Subject to IRS Audit?

Anyone who files a federal income tax return (including those who file Form 1040, 1040A, 1040EZ, or 1040-SR) can be subject to an IRS audit. The IRS may audit taxpayers for a variety of reasons, including discrepancies in income, unreported income, incorrect deductions, or failure to report all income sources.

The IRS also has certain criteria that it uses to identify returns that are potentially more likely to be audited. These include

Income: The more money you make, the more likely you are to be audited.

Charitable giving: Donating a large percentage of income to charities or other non-profit organizations can make you more likely to be audited;

Business activity: If you are self-employed or own a business, the IRS may take a closer look at your return;

Unusual deductions: If you take deductions that are out of the ordinary for your income level, you may be more likely to be audited;

Investment income: If you have a lot of investment income, the IRS may want to make sure you are reporting it accurately;

Multiple sources of income: If you have multiple sources of income, the IRS may want to make sure you are reporting all of it accurately;

High itemized deductions: If you take a lot of itemized deductions, the IRS may want to make sure you are not taking too many;

Tax shelters or off-shore accounts: If you use tax shelters or have an off-shore account, the IRS may want to make sure you are reporting the income correctly.

Alimony payments: If you are receiving or paying alimony, the IRS may want to make sure you are reporting it correctly;

Social Security income: If you are receiving Social Security income, the IRS may want to make sure you are reporting it correctly;

Home office deductions: If you are claiming a home office deduction, the IRS may want to make sure you are not claiming too much. The IRS also may look at your return if you are randomly picked for an audit. If you have been selected for an audit, it is important to remember that the IRS is only looking to make sure you are accurately reporting your income.

It is not out to penalize you for any mistakes. In most cases, an audit will simply result in a change to your tax return and additional taxes owed, so it is important to stay calm and cooperate with the IRS auditor.

How to Prepare for an IRS Audit?

Preparing for an IRS audit can be a daunting task, but it doesn’t have to be. By having the right information, understanding the process, and being organized, you can be prepared for an audit.

Gather Records

The first step in preparing for an audit is to gather all of the necessary records that the IRS is requesting. This includes tax returns, bank statements, investment records, real estate documents, payment records, and any other documents that could be relevant to the audit. Your tax preparer may also have copies of these documents on hand, which can save you a lot of time.

Understand the Audit Process

It is important to understand the audit process so that you can prepare accordingly. Generally, the IRS will send a letter notifying you of the audit and then follow up with a phone call or in-person meeting. During the meeting, the auditor will review your records and ask questions to verify the accuracy of the information.

Be Organized

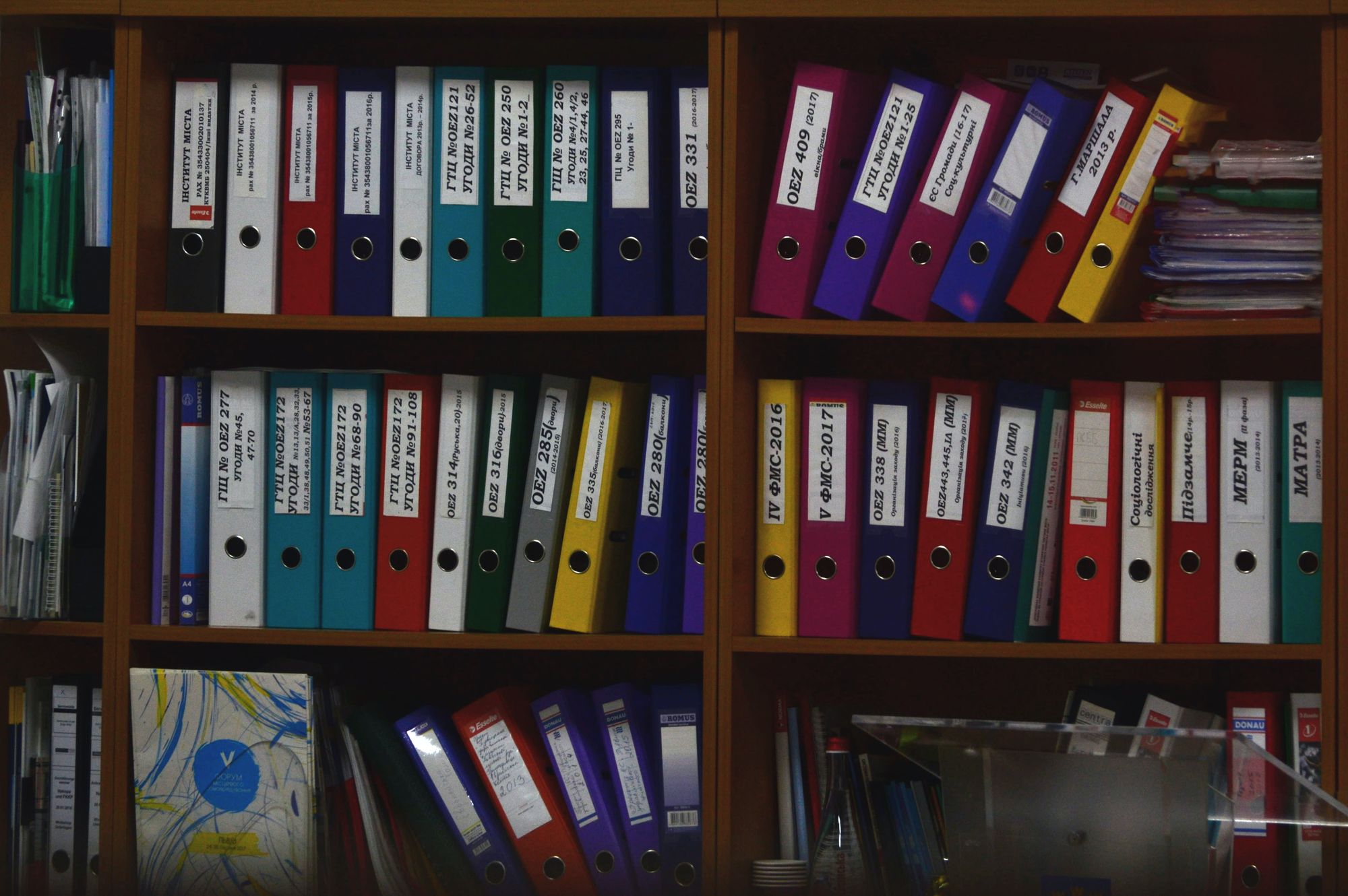

Being organized is key when preparing for an audit. Put all of your documents in a folder or binder so that you can easily access them. Make sure to keep track of any correspondence from the IRS, such as letters and phone calls.

Consider Professional Help

If you are feeling overwhelmed or uncertain about the process, you may want to consider hiring a professional. A tax attorney, accountant, or enrolled agent can help you navigate the audit process and make sure that you are prepared.

Stay Calm

The IRS audit process can be intimidating, but it is important to stay calm and remember that the auditor is just doing their job. If you are respectful and provide accurate information, the audit process should go smoothly.

By following these steps, you can be prepared for an IRS audit. Having the right information, understanding the process, and staying organized will help to ensure that it goes as smoothly as possible.

What to do After an IRS Audit?

Here is what you must do after completion of an IRS audit:

Review the results of the audit

When you receive the results of the audit, read through it carefully. Make sure that you understand the findings and the recommendations of the IRS.

Respond to any issues identified during the audit

If the audit identified any issues, such as errors in your tax return or discrepancies in the information you provided, you should respond to the IRS with an explanation of why the issue occurred.

Pay any taxes or penalties that are due

If you owe taxes or penalties as a result of the audit, make sure to pay them in a timely manner.

Make necessary changes to your tax return

If the audit identified any errors in your tax return, make sure to make the necessary changes to ensure that your tax return is accurate going forward.

Keep records of the audit

It is important to keep all records related to the audit, including the audit report, any correspondence with the IRS, and any records of payments made.

Contact a tax professional

If you need help understanding the results of the audit or responding to the IRS, you may want to consider working with a tax professional. A tax professional can help you understand the audit process and ensure that you are filing accurate and complete tax returns going forward.

How to Avoid an IRS Audit?

Avoiding an Internal Revenue Service audit is not an easy task. However, there are some steps you can take to help minimize your chances of being audited.

File Your Tax Returns on Time

One of the most common reasons for an audit is failure to file a tax return on time. Make sure to file your taxes on time to avoid unnecessary attention from the IRS.

Accurately Report Your Income

The IRS can use a variety of methods to verify your reported income. Make sure to accurately report all of your income, including wages and investments, to avoid an audit.

Report All Deductions

The IRS may assess an audit if you take large deductions for which you are not eligible. Make sure to only take deductions that you are eligible for and accurately report them on your tax return.

Avoid Claiming a Home Office Deduction

Claiming a home office deduction is a red flag for the IRS. Make sure you have the necessary documents to prove that you have a legitimate home office before claiming this deduction.

Avoid Claiming Losses for Multiple Years

If you are claiming losses for multiple years, the IRS may assess an audit. Make sure to only claim losses for the current year and avoid taking losses for multiple years.

Avoid Making Large Charitable Donations

The IRS may assess an audit if you make large charitable donations. Make sure to accurately report all of your charitable donations and only claim donations that are legitimate.

Keep Good Records

The IRS may assess an audit if you do not have good records of your expenses. Make sure to keep good records of your expenses, including receipts and invoices, to avoid an audit.

Be Careful With Business Expenses

The IRS may assess an audit if you are claiming business expenses that are not legitimate. Make sure to only claim business expenses that are necessary and accurate to avoid an audit.

Taking these steps will help you avoid an Internal Revenue Service audit. It is important to remember that the IRS can assess an audit for any reason, so it is important to remain compliant with the tax laws to ensure you do not get audited.

How Long Does Internal Revenue Service Audit Take?

An IRS audit is a thorough examination of an individual or business’s tax return to ensure accuracy and compliance with tax laws. The length of time an audit takes depends on the complexity of the return and the amount of information an auditor needs to review.

The length of an audit can vary greatly and may take anywhere from a few weeks to a few months. The complexity of the return and the amount of information the IRS auditor needs to review are the two major determinants of how long an audit will take.

The Internal Revenue Service (IRS) generally begins an audit by sending a letter to the taxpayer. This letter will ask for additional information and documents about the taxpayer’s financial situation.

This is known as the “Information Document Request” (IDR). The IDR will usually require the taxpayer to provide the IRS with copies of financial documents such as bank statements, W-2 forms, and other tax-related documents.

Once the IRS receives the requested documents, the audit process can begin in earnest. During the audit, the IRS auditor will review the taxpayer’s documents to ensure that all income has been properly reported and that all deductions have been claimed accurately.

The auditor may also ask questions to verify the accuracy of the information provided. The length of an audit will vary depending on how complicated the return is and how much information is being reviewed.

For example, an audit of a business with multiple sources of income and multiple deductions can take longer than an audit of an individual with a straightforward return. In addition, if the auditor finds discrepancies or potential violations of tax law, the audit can take even longer.

In addition to the length of the audit, the taxpayer may be required to provide additional information or documents to the IRS during the course of the audit. This can also extend the amount of time required to complete the audit.

Overall, the length of an IRS audit can range from a few weeks to a few months, depending on the complexity of the return and the amount of information the auditor needs to review. The best way to ensure that an audit is completed in a timely manner is to respond promptly to requests for additional information and documents from the IRS.

What are the Penalties for not Complying with an IRS Audit?

An IRS audit is an examination of an individual or business’s financial records to determine if taxes were reported and paid correctly. The IRS may choose to audit a person or business for various reasons, including suspicion of underreporting or underpaying taxes or as part of a random audit.

Depending on the type of audit, the IRS may review tax returns, books, records, bank account information, and other financial documents. If an individual or business is audited by the IRS and it is found that there was an underpayment or underreporting of taxes, the taxpayer may be liable for additional taxes, penalties, and interest.

The amount of additional taxes and penalties will depend on a number of factors, including the amount of taxes under-reported or underpaid, the taxpayer's filing status, and whether the underpayment or underreporting was intentional or not.

Penalties for not complying with an IRS audit can include failure-to-file penalties, failure-to-pay penalties, accuracy-related penalties, and fraud penalties. Failure-to-file penalties are assessed if a taxpayer does not file a required tax return by the due date (including extensions).

The penalty is 5% of the unpaid tax per month, up to a maximum of 25% of the unpaid tax. Failure-to-pay penalties are assessed if a taxpayer does not pay the full amount of taxes due by the due date (including extensions).

The penalty is 0.5% of the unpaid tax per month, up to a maximum of 25% of the unpaid tax. Accuracy-related penalties are assessed if an individual or business underpays or underreports their taxes due to negligence, substantial understatement of income, substantial overstatement of deductions, or a substantial valuation misstatement.

The penalty is 20% of the underpayment or underreported tax. Fraud penalties are assessed if an individual or business intentionally attempts to evade taxes by underpaying or underreporting their taxes.

The penalty is 75% of the underpayment or underreported tax. In addition to the above penalties, a person or business that fails to comply with an IRS audit may also be subject to criminal charges and additional civil penalties.

Penalties for criminal offenses can include fines, imprisonment, or both. Civil penalties can include further fines, repayment of taxes owed, and/or the revocation of business licenses or professional certifications.

It is important to note that the IRS also has the authority to waive penalties in certain cases. If you have been audited by the IRS and believe that you may be liable for penalties, it is important to speak with a tax professional to discuss potential penalties and possible waiver options.

What Records Should You Keep for an IRS Audit?

An IRS audit is an in-depth examination of your financial records and activities. In order to prepare for an audit, you should keep all of your financial documents organized manner and be prepared to prove the accuracy of your reported income, deductions, and other information. Here are some of the documents you should have ready for an IRS audit:

Tax Returns

Prepare copies of the last three years of tax returns and any additional documents that you may have filed with the IRS.

Receipts

Have all relevant receipts on hand to prove the accuracy of your reported income, deductions, and other information. This can include receipts for any charitable donations, business expenses, medical expenses, or other deductible expenses.

Bank Statements

Have copies of your bank statements available to prove the accuracy of any deposits or withdrawals reported on your tax returns.

Investment records

Have records of all investments on hand, including any stocks, bonds, mutual funds, or other investments.

Financial documents

If you own a business, have records of business income and expenses, as well as any invoices and contracts related to the business.

Pay stubs

Have copies of all pay stubs for the years under audit.

Records of charitable contributions

Have any records of donations to charities, such as donation receipts or acknowledgments from the charity.

Other documents

Have any other documents that may be relevant to the audit, such as records of expenses related to a home office or vehicle. Be sure to keep all documents in organized manner and be prepared to explain any discrepancies between what you reported on your tax returns and what the IRS has discovered in its audit.

Having all the necessary documents on hand will help the process go more smoothly and ensure that you are prepared for any questions the auditor may have.

What are Some of the Tips for Dealing with an IRS Audit?

Here are some of the tips to help you with IRS audit:

Gather Necessary Documents

Gather all relevant documents and financial information before the audit. This will help you prepare for the audit and answer any questions the IRS may have.

Stay Organized

Keep all of your records organized and in one place. It will be easier for you to answer the IRS's questions if you have your documents organized.

Be Courteous

Be polite and courteous to the IRS auditor. This will help ensure a smoother audit process.

Keep Tax Returns Accurate

Make sure that the information on your tax return is accurate and up-to-date. This will help you avoid any potential issues during the audit.

Take Notes

During the audit, make notes of the questions the IRS asks and any other relevant information.

Ask Questions

If you do not understand something, do not be afraid to ask questions. The auditor is there to help you understand the audit process.

Get Professional Help

If you have any doubts or concerns, it is a good idea to consult a tax professional or accountant. They can provide you with the necessary guidance and advice.

Understand the Process

Make sure you understand the audit process. This will help you prepare for the audit and make sure you are following the correct procedures.

Respond Timely

If the IRS sends you a request for information, make sure you respond as soon as possible. This will ensure a smooth audit process.

Pay Attention to Detail

Pay close attention to detail when responding to the IRS. Any errors or inconsistencies can lead to additional questions or further investigation.

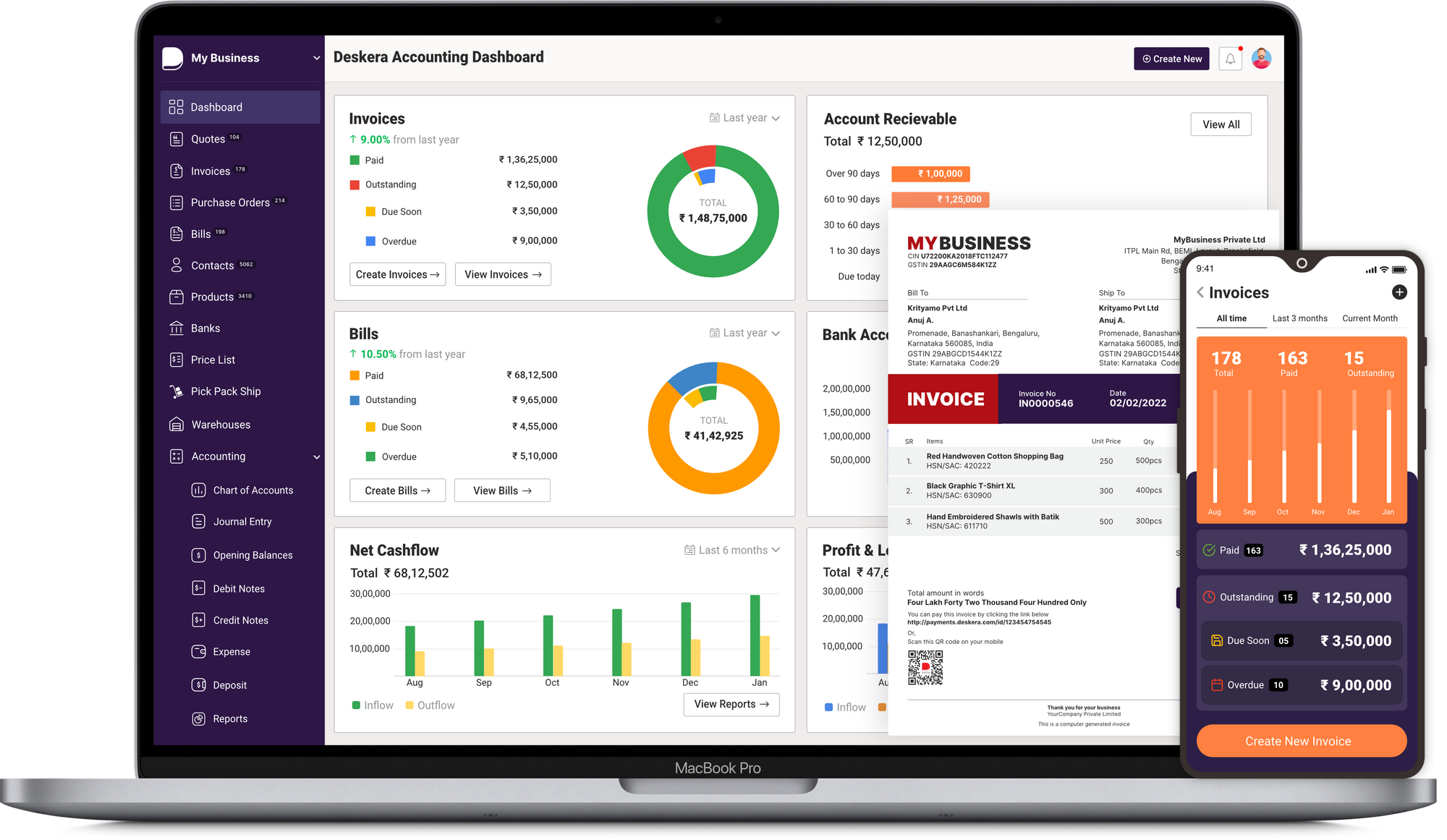

How Can Deskera Assist You?

Whatever the scope of your business, whether large or small, Deskera Books is committed to providing accounting solutions. It allows you to handle all your financial documents, such as invoices, expenses, and all your contacts, in one place, in addition to enabling easy handling of online accounting and invoicing applications.

Key Takeaways

- An Internal Revenue Service (IRS) audit is an examination of an individual or organization's tax return to verify that the information provided is accurate and complete.

- Prepare copies of the last three years of tax returns and any additional documents that you may have filed with the IRS.

- Anyone who files a federal income tax return (including those who file Form 1040, 1040A, 1040EZ, or 1040-SR) can be subject to an IRS audit.

- Gather all relevant documents and financial information before the audit. This will help you prepare for the audit and answer any questions the IRS may have.

- If you need help understanding the results of the audit or responding to the IRS, you may want to consider working with a tax professional.

Related Articles: